Global Suture Market By Product Type (Absorbable sutures and Non-absorbable sutures) By Material Type (Natural Fibers and Synthetic Fibers) By Filament (Monofilament and Multifilament) By Application (Cardiovascular Surgery, Orthopedic Surgery, Ophthalmic Surgery, Gynecological Surgery, Neurological Surgery, General Surgery and Others) andBy Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 18108

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

The Global Suture Market size is expected to be worth around USD 8.3 Billion by 2033, from USD 4.7 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

A surgical suture, also known as a stitch, is a medical device used to hold body tissues together and approximate wound edges after an injury or surgery. It involves using a needle with an attached length of thread, and there are numerous types of sutures which differ by needle shape and size as well as thread material and characteristics.

Sutures can be classified as absorbable or non-absorbable, and they can be made from a variety of materials, including natural and synthetic options such as nylon, polypropylene, silk, and polyester. The selection of surgical suture should be determined by the characteristics and location of the wound or the specific body tissues being approximated.

Over the last few years, significant progress has been made in developing sutures, such as developing different materials for sutures. Non-absorbable sutures with high biocompatibility, such as PTFE sutures, are usually easygoing and smooth and help prevent profound wound micro-damage and bacterial migration. Surgical knots made with PTFE sutures are strong and do not lose easily.

Key Takeaways

- Market Size: Suture Market size is expected to be worth around USD 8.3 Billion by 2033, from USD 4.7 Billion in 2023.

- Market Growth: The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.9% from 2024 to 2033.

- Product Type Analysis: Absorbable sutures, which dissolve in the body, held a significant market share of over 55.5% in 2023.

- Material Type Analysis: Synthetic fibers were the preferred material type for sutures in 2023, accounting for the largest market share.

- Filament Analysis: Multifilament sutures, which are flexible and easy to tie, captured more than 59% of the market in 2023.

- The “Others” category in the suture market, including various surgeries not falling into common categories, held a share of over 35.2% in 2023.

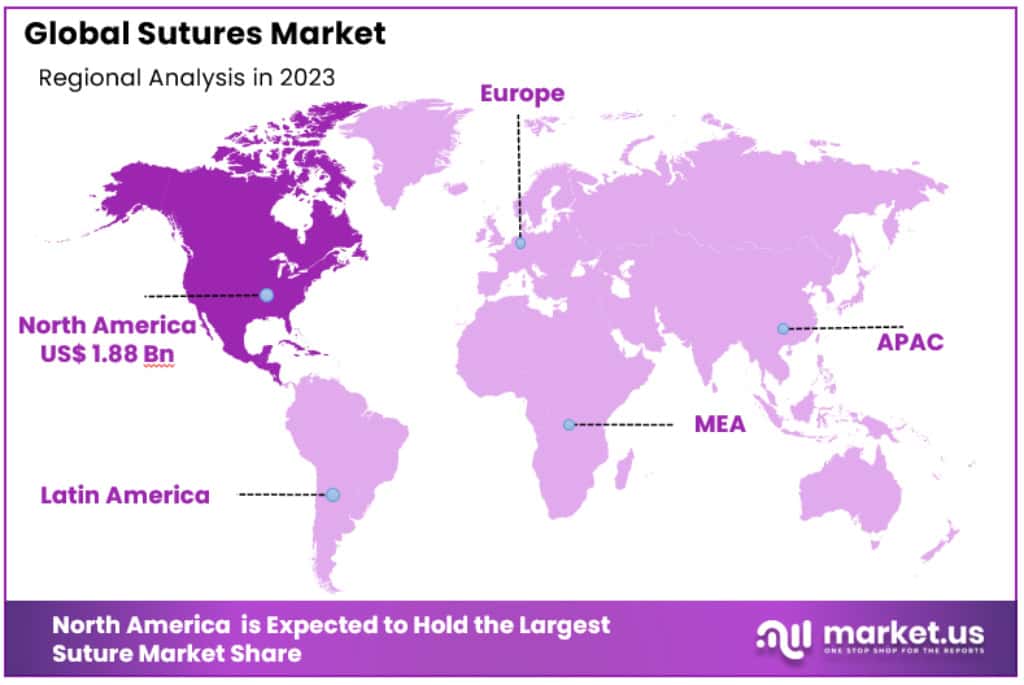

- Regional Analysis: North America dominates Suture Market, with share 40.1%, worth USD 1.88 billion in 2023.

Product Type Analysis

In 2023, Absorbable sutures had a big share of the market, holding more than 55.5%. They’re popular because they dissolve in the body, so patients don’t need to go back to the doctor to get them removed. They’re great for inside the body where it’s hard to reach for stitch removal. These sutures are made of materials like animal tissues or special man-made stuff that the body can safely break down.

Non-absorbable sutures, on the other hand, don’t dissolve. They are used for wounds that need longer healing time or for parts of the body where stronger support is needed. They’re often made from materials like nylon or silk. These sutures might need to be taken out by a doctor once the wound is healed, especially if they’re on the outside of the body. They’re less popular than absorbable sutures but still important for certain types of surgeries or injuries.

Material Type Analysis

Synthetic Fibers were the top choice in the suture market, grabbing the highest market share in 2023. These fibers, made in labs, include materials like nylon, polyester, and polypropylene. They are loved for their strength, flexibility, and lower chance of causing infections. Since they’re man-made, they can be tailored for different kinds of surgeries, making them super versatile.

Natural Fibers, on the other hand, come from natural sources like silk or animal tissues. They’ve been used for a long time and are good at tying knots securely. They’re biocompatible, meaning they work well with the body, but they have a higher chance of causing reactions or infections compared to synthetic fibers. They’re still used, especially in cases where synthetic fibers aren’t the best fit, but they don’t dominate the market like synthetic fibers do.

Filament Analysis

In 2023, Multifilament sutures were a big hit in the market, capturing more than a 59% share. They are made by twisting together several small threads, which makes them really flexible and easy to tie. They’re great for surgeries where precise stitching is key. Multifilament sutures are chosen often because they are gentle on delicate tissues and provide a smooth passage through tissues.

Monofilament sutures, on the other hand, are made of a single strand. They are simpler and less likely to cause infections. They’re a bit stiffer and harder to handle than multifilament, but they’re great for surgeries where minimizing infection risk is really important. Even though they have their benefits, they’re less popular than multifilament sutures.

Application Analysis

In 2023, the “Others” category in the suture market was really strong, taking up more than a 35.2% share. This group includes all those surgeries that don’t fall into the common categories, like plastic surgery, urological surgery, or surgeries for the digestive system. The variety in this group means lots of different sutures are used, fitting each unique surgery’s needs.

Cardiovascular Surgery, where doctors work on the heart and blood vessels, also uses a lot of sutures. They need very reliable and precise sutures because the heart is such a vital organ.

Orthopedic Surgery, which deals with bones, joints, and muscles, often uses sturdy, non-absorbable sutures. They need to hold things together firmly as the body heals.

Ophthalmic Surgery, for the eyes, requires very fine and delicate sutures. They’re super tiny to avoid damaging sensitive eye tissues.

Gynecological Surgery, which includes surgeries on the female reproductive system, and Neurological Surgery, which is all about the brain and nerves, also have their specific suture needs depending on the delicacy and complexity of the surgeries.

General Surgery covers a wide range of common surgeries in various parts of the body. It uses a mix of both absorbable and non-absorbable sutures, depending on the specific procedure.

Key Market Segments

Product Type

- Absorbable sutures

- Non-absorbable sutures

Material Type

- Natural Fibers

- Synthetic Fibers

Filament

- Monofilament

- Multifilament

Application

- Cardiovascular Surgery

- Orthopedic Surgery

- Ophthalmic Surgery

- Gynecological Surgery

- Neurological Surgery

- General Surgery

- Others

Driver

The main factor that is driving this market is the rising number of surgeries around the world. This has led to increased and thus demand for surgeries in health system due to prevalence of chronic diseases, traumatic injuries and aging population. WHO estimates that over 5o million people undergo surgery every year globally with over 7o million surgical operations being conducted annually.

As the number of surgeries increases the need to close wounds and promote healing makes use of sutures essential. Thirdly, there is an increasing interest in minimally invasive surgical procedures that utilize sutures in highly accurate ways within the bodies of patients, thus driving the need and development of better suture materials and methods.

Trend

One significant trend identified in the suture market is the emergence of bioresorbable sutures and technologies. These sutures are dissolvable and therefore do not require removal and the risks of infection related with the sutures are greatly minimized. Absorbable sutures, including polyglycolic acid sutures and polylactic acid sutures, also have several benefits like low levels of discomfort to patients and enhanced tissue recovery.

Another trend is the use of antimicrobial coatings and the drug eluting capability of sutures to prevent post operation infections and facilitate quick healing period. These innovations are the driving forces towards efficiency and patient friendly market.

Restraint

A significant factor threatening the suture market is the presence of substitute closures for wounds, including staples, adhesives, and advanced wound care solutions. In some circumstances, these alternatives afford faster application and less likelihood of complications than a standard and comprehensive flap, making them more suitable for particular surgeries.

On the same note, expensive innovation in suture materials and methods also pose a challenge for health care since only the elite can afford these costly techniques, more so in the developing world where budgets are tightly controlled. Onerous regulation and high barriers to entry because of approval procedures for new suture products are challenges for industry players as well.

Opportunity

The sutures Market has attractive prospects in growing economies as the necessary healthcare requirements are being upgraded and healthcare spending is rising. In Asia-Pacific, Latin America, and African regions, industries such as hospitals and surgical centres are on the rise and, this has created a large market for sutures.

In addition, increasing attention to individualized treatment, surgical approaches as well as specialties provides manufactures with niches for value-added and innovative suture products. Investment on relevant training programs with local healthcare providers and expansion of marketing campaigns may help create a broader market penetration and further conquer these regions.

Regional Analysis

Key Regions Covered

North America

- The US

- Canada

- Mexico

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global suture market is dominated by a few key players, with Johnson & Johnson Medical, Medtronic, and Peters Surgical holding significant market shares. Ethicon, a subsidiary of Johnson & Johnson Medical, is the leading player in the market, with a share of over 30%. Medtronic is the second-largest player, with a share of around 20%. Peters Surgical, a subsidiary of B. Braun, is the third-largest player, with a share of around 15%. Other major players in the market include Internacional Farmacéutica, DemeTech, Kono Seisakusho, Surgical Specialties Corporation, Mani, Samyang Biopharmaceuticals, AD Surgical, Dolphin, Usiol, Assut Medical Sarl, Teleflex, Lotus Surgicals, CONMED, and W.L. Gore & Associates.

Key Market Players

- Johnson & Johnson Medical

- Medtronic

- Peters Surgical

- B.Braun

- Internacional Farmacéutica

- DemeTech

- Kono Seisakusho

- Surgical Specialties Corporation

- Mani

- Samyang Biopharmaceuticals

- AD Surgical

- Dolphin

- Usiol

- Assut Medical Sarl

- Teleflex

- Lotus Surgicals

- CONMED

- W.L. Gore & Associates

Recent Developments

- (February 2024): Johnson & Johnson Medical acquired SutureTech Innovations, expanding its portfolio with advanced suture technologies. This acquisition aims to integrate SutureTech’s innovative products into Johnson & Johnson’s existing offerings, enhancing its market position in the global suture market.

- (April 2024): Medtronic launched the BioSecure Suture, a bioresorbable suture with antimicrobial properties designed to reduce infection rates and improve healing. This innovative product aims to meet the growing demand for advanced, patient-friendly wound closure solutions in surgical procedures.

- (January 2024): Peters Surgical merged with MedStitch Solutions to strengthen its product range and market reach. The merger aims to combine their expertise and resources to develop innovative suture products and expand their presence in the global market.

- (March 2024): B. Braun acquired SutureMed Inc., enhancing its suture product line with cutting-edge technologies. This strategic move aims to integrate SutureMed’s advanced solutions into B. Braun’s portfolio, expanding its market footprint in surgical wound management.

- (May 2024): Internacional Farmacéutica introduced the FlexiSuture, a high-flexibility suture designed for optimal performance in complex surgeries. This product launch aims to provide surgeons with more reliable and versatile suturing options, improving patient outcomes.

- (June 2024): DemeTech acquired Precision Sutures, a company known for its high-quality suture materials. This acquisition aims to enhance DemeTech’s product offerings and strengthen its position in the global suture market by leveraging Precision Sutures’ expertise and technology.

Report Scope

Report Features Description Market Value (2023) USD 4.7 Billion Forecast Revenue (2033) USD 8.3 Billion CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Absorbable sutures and Non-absorbable sutures) By Material Type (Natural Fibers and Synthetic Fibers) By Filament (Monofilament and Multifilament) By Application (Cardiovascular Surgery, Orthopedic Surgery, Ophthalmic Surgery, Gynecological Surgery, Neurological Surgery, General Surgery and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Johnson & Johnson Medical, Medtronic, Peters Surgical, B.Braun, Internacional Farmacéutica, DemeTech, Kono Seisakusho, Surgical Specialties Corporation, Mani, Samyang Biopharmaceuticals, AD Surgical, Dolphin, Usiol, Assut Medical Sarl, Teleflex, Lotus Surgicals, CONMED and W.L. Gore & Associates and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are sutures?Sutures are medical devices used to close wounds or surgical incisions. They are typically made from materials like silk, polyester, or bioresorbable polymers and are essential for promoting healing and reducing the risk of infection.

How big is the Suture Market?The global Suture Market size was estimated at USD 4.7 Billion in 2023 and is expected to reach USD 8.3 Billion in 2033.

What is the Suture Market growth?The global Suture Market is expected to grow at a compound annual growth rate of 5.9%. From 2024 To 2033.

Who are the key companies/players in the Suture Market?Some of the key players in the Suture Markets are Johnson & Johnson Medical, Medtronic, Peters Surgical, B.Braun, Internacional Farmacéutica, DemeTech, Kono Seisakusho, Surgical Specialties Corporation, Mani, Samyang Biopharmaceuticals, AD Surgical, Dolphin, Usiol, Assut Medical Sarl, Teleflex, Lotus Surgicals, CONMED and W.L. Gore & Associates and Other Key Players.

What drives the suture market?The market is driven by the increasing number of surgical procedures worldwide, advancements in suture technology, and the rising prevalence of chronic diseases and traumatic injuries that require surgical intervention.

What are bioresorbable sutures?Bioresorbable sutures are made from materials that can be absorbed by the body over time, eliminating the need for removal and reducing the risk of infection and complications.

What are some recent trends in the suture market?Recent trends include the development of bioresorbable sutures, antimicrobial sutures, and the integration of advanced materials and technologies like 3D printing for customized suture solutions.

What challenges does the suture market face?Challenges include the high cost of advanced suture technologies, the availability of alternative wound closure methods (such as staples and adhesives), and stringent regulatory requirements.

-

-

- Johnson & Johnson Medical

- Medtronic

- Peters Surgical

- B.Braun

- Internacional Farmacéutica

- DemeTech

- Kono Seisakusho

- Surgical Specialties Corporation

- Mani

- Samyang Biopharmaceuticals

- AD Surgical

- Dolphin

- Usiol

- Assut Medical Sarl

- Teleflex

- Lotus Surgicals

- CONMED

- W.L. Gore & Associates