Global Sustainable Insurance Market Size, Share Analysis By Product Type (Green Insurance Products, Socially Responsible Insurance, Climate Risk Insurance, Others), By Distribution Channel (Direct Sales, Brokers and Agents), By End-User Industry (Individual, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155480

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

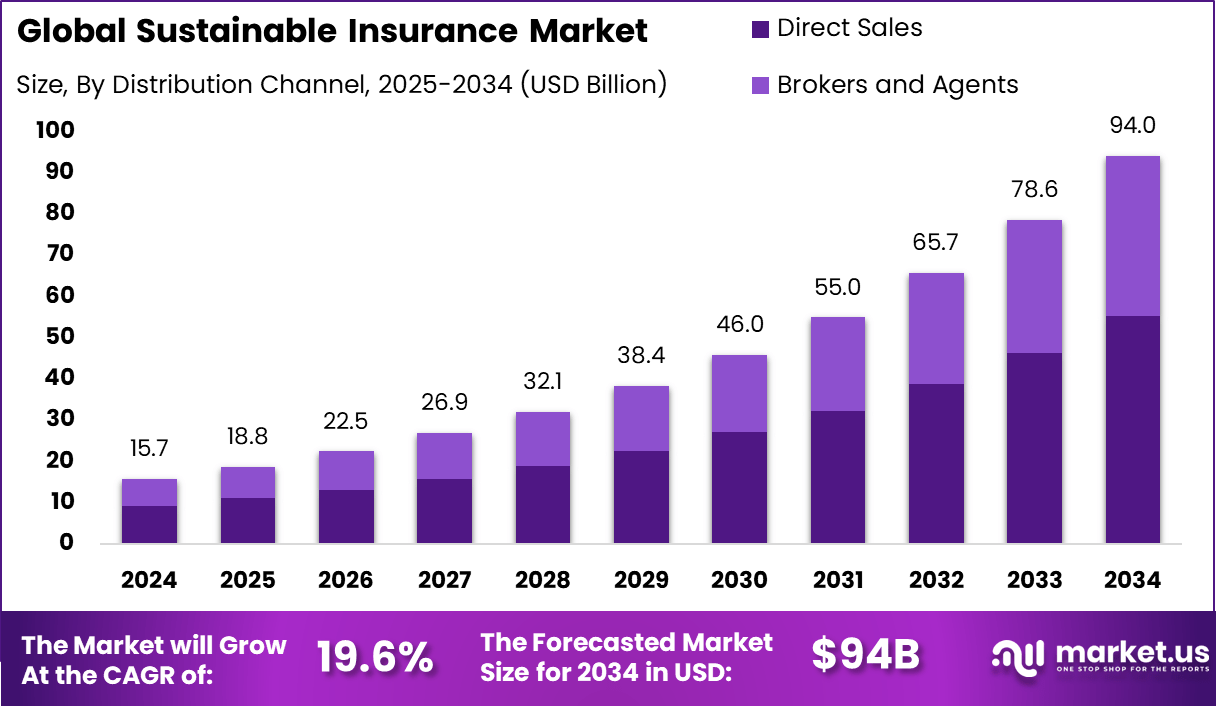

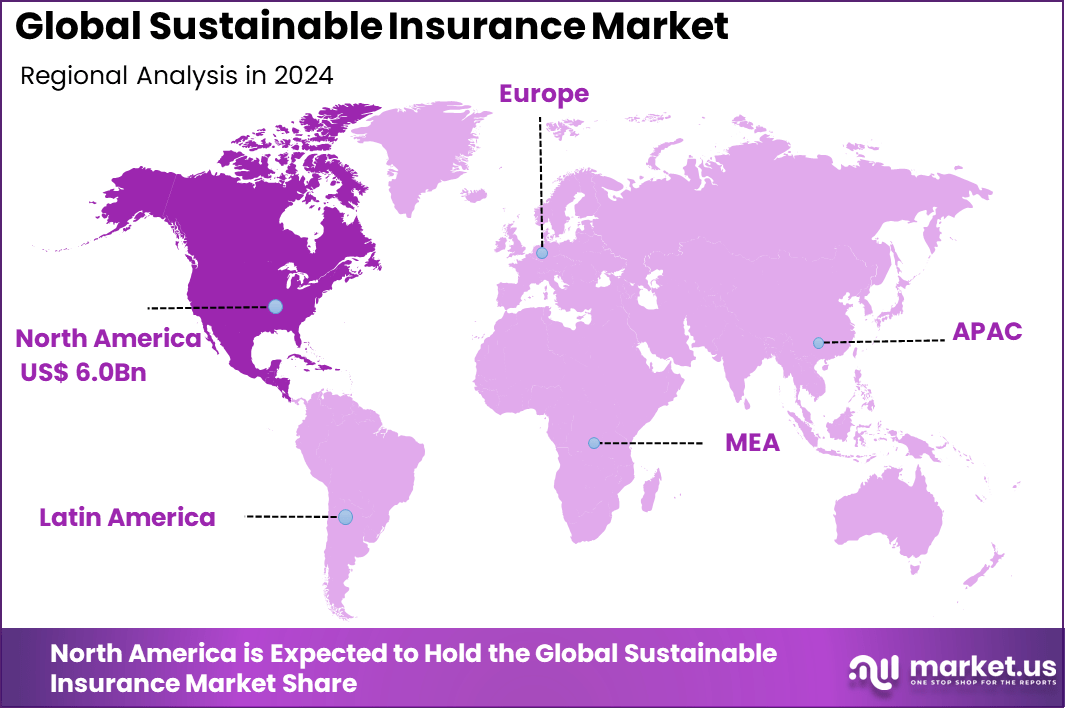

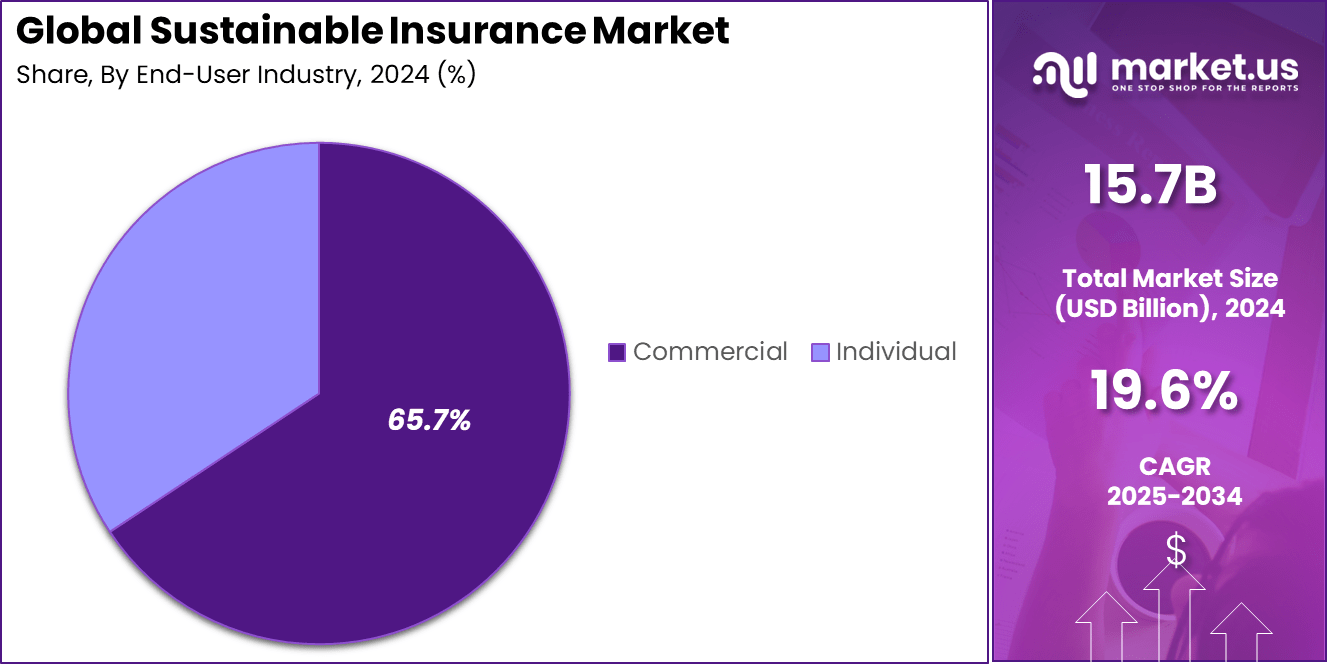

The Global Sustainable Insurance Market size is expected to be worth around USD 94 Billion By 2034, from USD 15.7 billion in 2024, growing at a CAGR of 19.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.3% share, holding USD 6.0 Billion revenue.

Key Insight Summary

- By product type, Green Insurance Products led the Global Sustainable Insurance Market in 2024, capturing 45.8% of the total share.

- Direct Sales was the leading distribution channel, holding 58.9% of the market share, indicating strong adoption through direct insurer-client relationships.

- The Commercial segment was the top end-user industry, commanding 65.7% of the market, driven by sustainability-focused corporate risk management strategies.

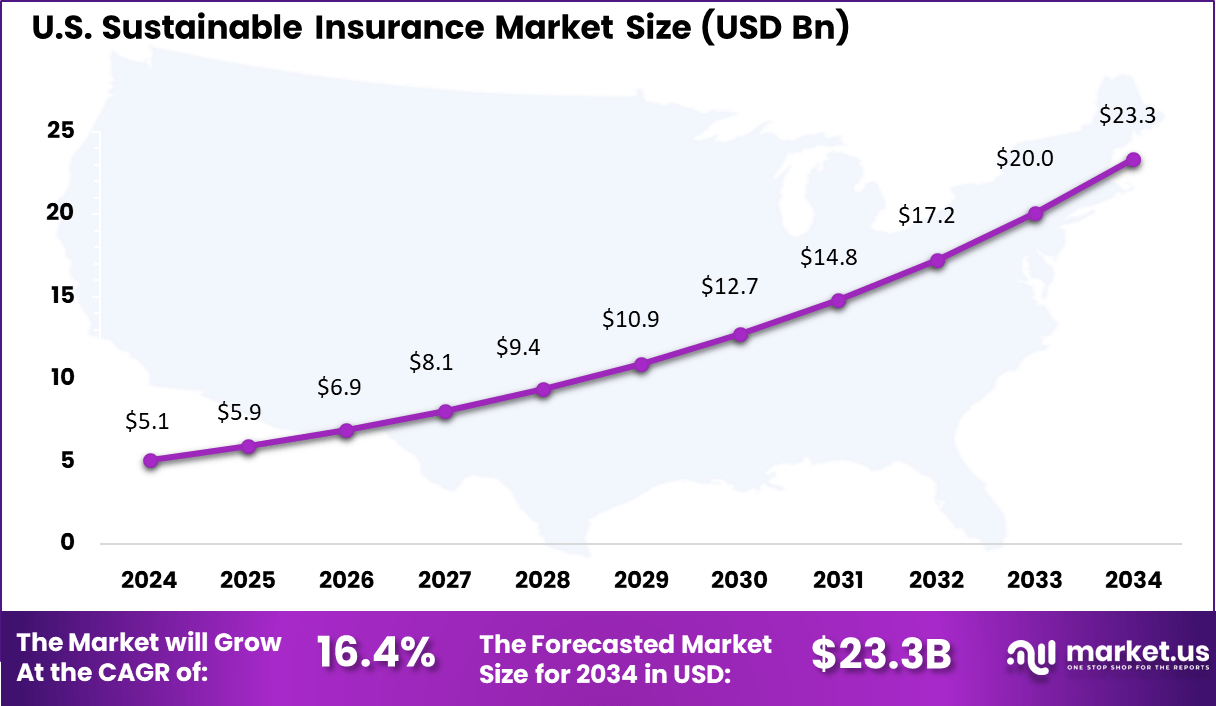

- The U.S. market reached USD 5.11 billion in 2024, with a notable CAGR of 16.4%, reflecting accelerated adoption of eco-conscious insurance solutions.

The Sustainable Insurance Market embodies a strategic approach where insurance activities across the entire value chain integrate ESG considerations. This market focuses on providing insurance solutions that not only manage traditional risks but also address emerging sustainability challenges such as climate change and social inequalities.

Sustainable insurance supports a low-carbon and resilient economy by aligning decisions with sustainability principles to deliver long-term societal and environmental benefits. Top driving factors behind the growth of the sustainable insurance market include increasing regulatory pressure, rising awareness of climate-related risks, and heightened stakeholder demand for responsible business practices.

Insurers face growing expectations from regulators, clients, and investors to disclose and manage ESG risks transparently. Demand for sustainable insurance reflects both client needs and investor interest. Businesses and individuals seek coverage that supports climate adaptation, green transitions, and resilient assets. Insurers are expected to be strategic partners in managing emerging sustainability risks.

According to capgemini, India hosts 55 insurance companies, comprising 31 general insurers and 24 life insurers. As reported by the Insurance Regulatory and Development Authority of India, the nation ranked eleventh globally in 2020 by premium volume, holding a 1.72% share of the global insurance market with premiums worth $107.9 billion.

Climate resilience remains a critical challenge for the sector. In the Climate Economics Index, India ranked 45th out of 48 major economies, reflecting its vulnerability to climate change impacts. Agriculture and tourism, contributing 18% and 9% of GDP respectively in 2020, are especially exposed to environmental risks.

Based on data from gitnux, 85% of companies have embedded sustainability into their core strategies as of 2023, while 70% incorporate climate risk assessments into underwriting. ESG-driven investment approaches have been adopted by 60% of large insurers, achieving an average 25% reduction in carbon footprint through green investments.

US Market Size

The U.S. Sustainable Insurance Market was valued at USD 5.1 Billion in 2024 and is anticipated to reach approximately USD 23.3 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 16.4% during the forecast period from 2025 to 2034.

The United States leads the Sustainable Insurance Market due to a combination of regulatory momentum, strong financial capacity, and high market awareness. Federal and state-level policies have increasingly encouraged insurers to integrate climate risk assessment, ESG reporting, and responsible investment strategies. This regulatory clarity has created a favorable environment for the adoption of sustainable insurance frameworks.

In 2024, North America held a dominant market position, capturing more than 38.3% of the Sustainable Insurance Market and generating approximately USD 6.0 billion in revenue. The region’s leadership is largely attributed to its advanced insurance infrastructure, high regulatory compliance, and the proactive integration of environmental, social, and governance (ESG) principles into underwriting and investment strategies.

Strong collaboration between insurers, government bodies, and sustainability-focused organizations has accelerated the adoption of green insurance products, enabling better risk management for climate-related events and sustainable asset portfolios. Additionally, heightened consumer awareness regarding climate change and corporate responsibility has driven significant demand for insurance offerings aligned with sustainability goals.

Emerging Trends

One significant emerging trend in sustainable insurance is the rise of innovative green insurance products that address climate risks directly. These include coverage for renewable energy projects, green building insurance, and climate-resilient policies tailored to support eco-friendly practices.

Advanced technologies like data analytics, artificial intelligence, and Internet of Things sensors are enabling insurers to more accurately assess environmental risks, offer parametric insurance products with faster claim settlements, and encourage sustainable behaviors among policyholders.

By Product Type Analysis

In 2024, Green insurance products, holding a 45.8% share of the sustainable insurance market, are rapidly gaining recognition as insurers respond to increasing environmental concerns and tightening regulatory frameworks. These products cover areas such as renewable energy projects, energy-efficient real estate, and environmentally conscious transportation.

Their growing adoption is driven by heightened awareness among individuals and businesses about climate change risks and the tangible benefits of eco‑friendly insurance solutions. By rewarding policyholders who embrace sustainable practices, green insurance plays an active role in integrating environmental stewardship into risk management strategies.

By Distribution Channel

In 2024, Direct sales account for 58.9% of the sustainable insurance market, reflecting a strong shift toward convenience, transparency, and digital engagement. Insurers are using online platforms, mobile apps, and self-service tools to connect directly with customers, bypassing intermediaries.

This approach resonates particularly well with tech-savvy, environmentally conscious buyers who prefer to evaluate and purchase products on their own terms. By streamlining processes and lowering costs, direct sales not only improve customer experience but also allow insurers to tailor offerings more effectively to the needs of sustainability-focused clients.

By End-User Industry

With a 65.7% share, the commercial sector stands as the largest end-user of sustainable insurance products. Businesses are increasingly prioritizing resilience against climate change, regulatory compliance, and sustainability commitments as part of their corporate strategies.

Commercial insurance tailored toward sustainability helps companies safeguard green assets, such as renewable energy infrastructure or energy-efficient real estate, while also promoting responsible resource management. For many firms, adopting such products is not only a risk management measure but also a key step toward enhancing their ESG (Environmental, Social, and Governance) profile.

This high market share reflects that sustainable insurance in the commercial domain goes beyond policy coverage – it acts as a strategic business enabler. Firms leveraging these solutions can secure a competitive advantage, meet stakeholder expectations, and mitigate reputational risks related to environmental issues.

Key Market Segments

By Product Type

- Green Insurance Products

- Socially Responsible Insurance

- Climate Risk Insurance

- Others

By Distribution Channel

- Direct Sales

- Brokers and Agents

By End-User Industry

- Individual

- Commercial

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A key driver propelling sustainable insurance growth is increasing consumer demand for environmentally responsible products. As awareness of climate change impacts grows, many consumers actively seek insurance policies that promote sustainability, such as discounts for electric vehicle owners or coverage for green construction materials. Regulatory requirements and industry mandates for transparency in climate risk disclosures also push insurers to integrate sustainability into their offerings, enhancing their market appeal.

Restraint Analysis

One constraining factor is the lack of standardized ESG (Environmental, Social, and Governance) metrics and reliable data to accurately quantify sustainability risks. This deficiency complicates risk assessment and pricing, making it challenging for insurers to create consistent and trustworthy green insurance products. Moreover, regulatory frameworks across different regions can be fragmented and unclear, imposing an additional compliance burden on insurers and hindering the uniform adoption of sustainable practices.

Opportunity Analysis

An attractive opportunity lies in the development of new insurance solutions that support the transition to a low-carbon economy. Insurers can expand coverage for emerging clean technologies, renewable energy infrastructure, and climate adaptation projects. By investing capital and offering risk financing in these sectors, the insurance industry can play a pivotal role in fostering environmental innovation while unlocking new revenue streams.

Challenge Analysis

A major challenge for sustainable insurance is balancing sustainability goals with financial viability amid increasing climate-related risks. Rising natural disasters elevate claims costs, leading to higher premiums that may reduce affordability and accessibility for some customers, especially in high-risk areas. Furthermore, insurers must navigate reputational risks associated with prior investments or policies linked to fossil fuels, all while aligning their products with evolving customer and stakeholder expectations.

Competitive Analysis

Everest Global, Inc., Capgemini, and CGAP are contributing to the advancement of sustainable insurance through research, consulting, and strategy development. Their initiatives focus on integrating environmental, social, and governance (ESG) factors into risk assessment and underwriting frameworks. Oliver Wyman, LLC. and Lloyd’s are leveraging data-driven models to manage climate-related risks and create resilient insurance portfolios.

Allianz is actively implementing sustainability-focused investment strategies, aligning with global climate goals while promoting innovative insurance products designed to address emerging environmental and societal risks. Solvy Tech Solutions Pvt Ltd and NTT DATA Corporation are driving technology integration in sustainable insurance by offering digital platforms that enhance risk analytics and reporting.

Cognizant are providing advanced data intelligence and AI-powered tools to improve decision-making processes. SKD Türkiye and SAP SE are supporting insurers with customized software solutions for compliance, sustainability tracking, and operational efficiency. Their combined efforts are enabling insurers to meet regulatory demands and customer expectations for transparent, eco-conscious services.

Milliman, Inc. is focusing on actuarial consulting to model long-term climate impacts, helping insurers adapt pricing and capital strategies. Other players in the market are innovating in policy design, microinsurance models, and community-based risk-sharing mechanisms to expand coverage in underserved areas.

Top Key Players in the Market

- Everest Global, Inc.

- Capgemini

- CGAP

- Oliver Wyman, LLC.

- Lloyd’s

- Allianz

- Solvy Tech Solutions Pvt Ltd

- NTT DATA Corporation

- Cognizant

- SKD Türkiye

- SAP SE

- Milliman, Inc.

- Others

Recent Developments

- In 2024, Everest wrote over $5 billion in gross premiums and emphasized environmental conservation along with social responsibility initiatives. The firm has supported renewable energy insurance solutions and climate risk mitigation through risk engineering services, marking its commitment to a net-zero economy.

- Oliver Wyman hosted the Sustainable Insurance Summit 2024, which brought together over 300 leaders to discuss operational actions supporting a low-carbon world. The firm advises insurers on integrating net-zero goals, climate resilience, and ESG data into underwriting and claims management.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Green Insurance Products, Socially Responsible Insurance, Climate Risk Insurance, Others), By Distribution Channel (Direct Sales, Brokers and Agents), By End-User Industry (Individual, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Everest Global, Inc., Capgemini, CGAP, Oliver Wyman, LLC., Lloyd’s, Allianz, Solvy Tech Solutions Pvt Ltd, NTT DATA Corporation, S&P Global, Cognizant, SKD Türkiye, SAP SE, Milliman, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sustainable Insurance MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Sustainable Insurance MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Everest Global, Inc.

- Capgemini

- CGAP

- Oliver Wyman, LLC.

- Lloyd’s

- Allianz

- Solvy Tech Solutions Pvt Ltd

- NTT DATA Corporation

- S&P Global

- Cognizant

- SKD Türkiye

- SAP SE

- Milliman, Inc.

- Others