Global Sustainable Data Center Market Size, Share Analysis Report By Component (Solution (Power System, Monitoring & Management System, Cooling/HVAC System, Networking System), Services (Professional, Managed), By Datacenter Size (Large Data Centers, Small and Medium-sized Data Centers), By Industry Vertical (BFSI, IT & Telecom, Media & Telecom, Healthcare, Government & Defence, Retail, Manufacturing, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149843

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

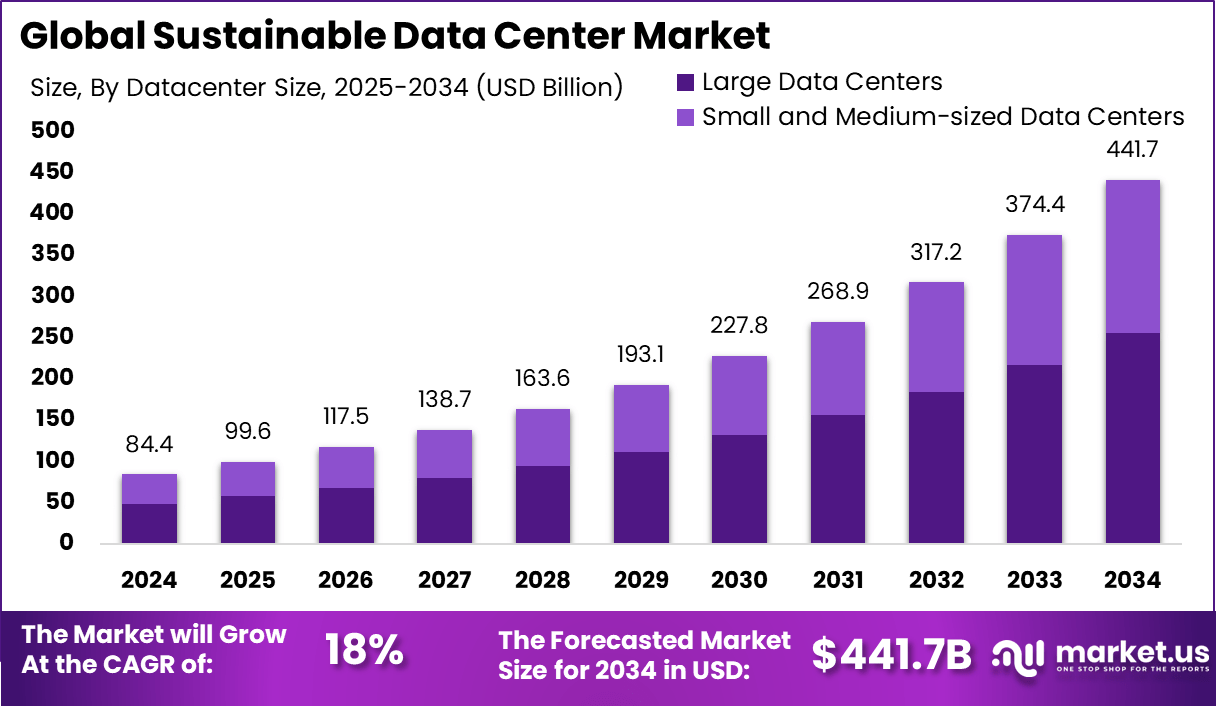

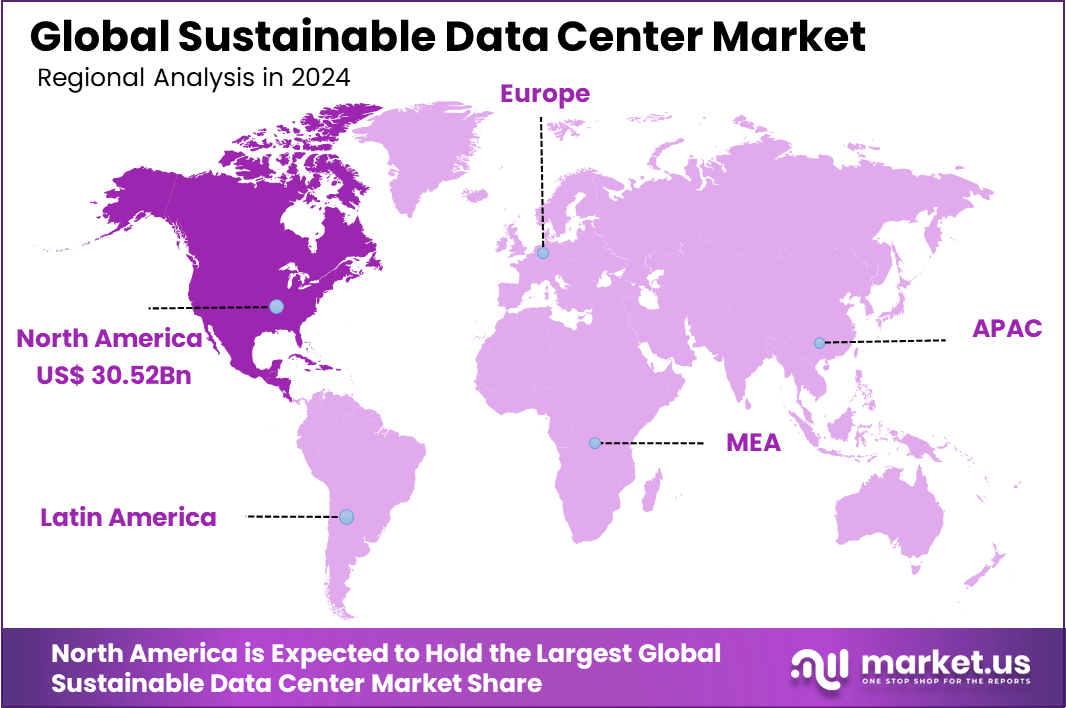

The Global Sustainable Data Center Market size is expected to be worth around USD 441.7 Billion By 2034, from USD 84.4 billion in 2024, growing at a CAGR of 18% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36% share, holding USD 30.52 Billion revenue.

A Sustainable Data Center is a facility designed to minimize environmental impact while maintaining optimal performance. These centers employ energy-efficient technologies, utilize renewable energy sources, and implement advanced cooling systems to reduce carbon emissions and resource consumption. By integrating green building practices and intelligent energy management, sustainable data centers aim to achieve operational efficiency and environmental responsibility.

The Sustainable Data Center Market is experiencing significant growth, driven by increasing demand for eco-friendly data storage solutions. Top Driving Factors include the exponential growth of data generation, rising energy costs, and stringent environmental regulations. Organizations are increasingly prioritizing sustainability to meet corporate social responsibility goals and comply with governmental policies aimed at reducing carbon footprints.

Increasing Adoption Technologies such as AI-driven energy management systems, advanced cooling techniques, and renewable energy integration are being implemented to enhance the efficiency and sustainability of data centers. These technologies not only reduce operational costs but also contribute to environmental conservation efforts.

The business benefits of adopting sustainable data centers are multifaceted. Organizations can achieve cost savings through reduced energy consumption and operational efficiencies. Additionally, sustainable practices enhance corporate reputation, meet regulatory compliance, and attract environmentally conscious customers and stakeholders. The transition to green data centers also positions companies as leaders in innovation and sustainability.

Key Takeaways

- The Global Sustainable Data Center Market is projected to grow from USD 84.4 billion in 2024 to USD 441.7 billion by 2034, advancing at a robust CAGR of 18% between 2025 and 2034.

- In 2024, North America led globally, contributing USD 30.52 billion, which accounted for more than 36% of the overall revenue.

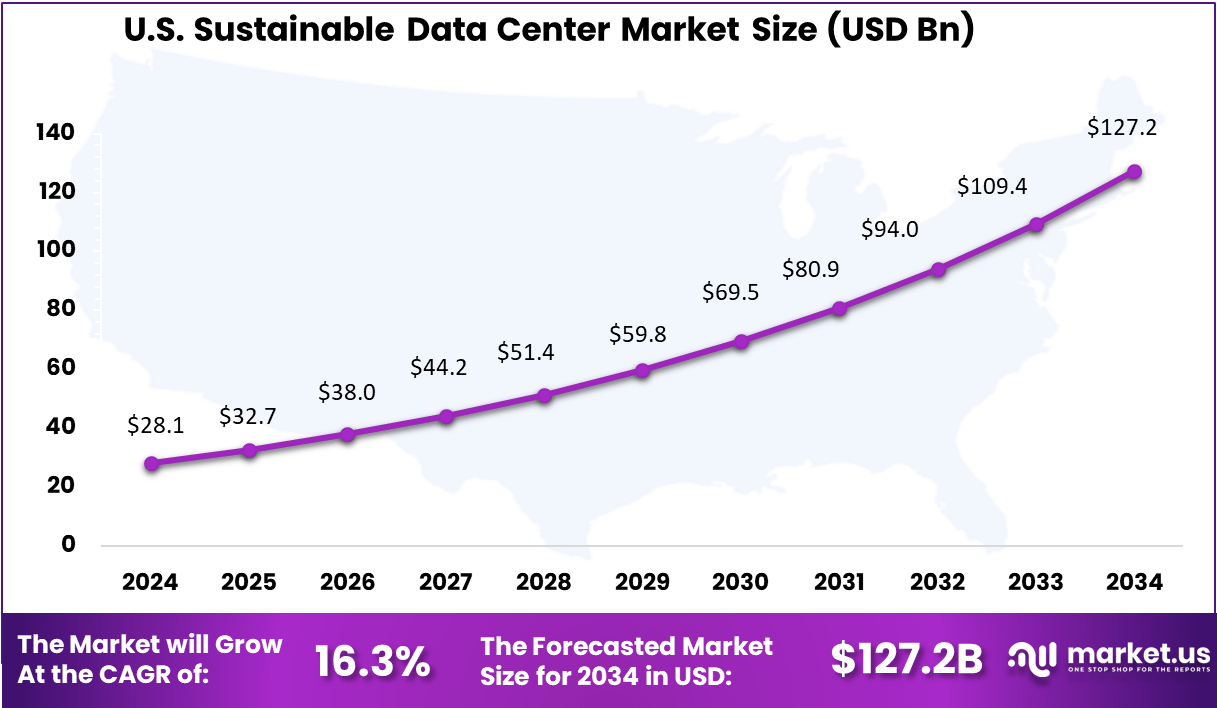

- The U.S. market is projected to grow from USD 28.1 billion in 2024 to USD 127.2 billion by 2034, expanding at a CAGR of 16.3%.

- The Solution segment dominated the global market in 2024, accounting for over 70% share, driven by demand for energy-efficient technologies and green IT frameworks.

- Large data centers captured more than 58% of the market share in 2024, reflecting their higher capacity and investment scalability in sustainable infrastructure.

- The IT & Telecom sector remained the largest end-use vertical, holding over 25% share, supported by increasing hyperscale deployments and network infrastructure upgrades.

Impact of AI

The integration of Artificial Intelligence (AI) into data center operations has significantly influenced their sustainability profiles. While AI has enhanced operational efficiencies, it has concurrently escalated energy consumption and environmental concerns.

Data centers currently account for approximately 1-2% of global electricity consumption, a figure projected to rise to 4% by 2030 due to AI-driven demands. Notably, AI-focused data centers can consume electricity comparable to that of energy-intensive industries like aluminum smelting, yet are more geographically concentrated, intensifying local grid pressures.

The environmental impact extends beyond electricity usage. Cooling AI servers necessitates substantial water resources, with projections indicating that AI-related data centers could consume up to 6.6 billion cubic meters of water by 2027, surpassing the annual water usage of countries like Denmark.

Companies like GridFree AI are developing modular, off-grid power systems that integrate gas power, battery storage, and advanced cooling, achieving 90% energy conversion efficiency and reducing operational costs by one-third. Similarly, Skeleton Technologies’ GrapheneGPU system utilizes supercapacitors to smooth out power fluctuations, enhancing GPU performance by up to 40% and reducing energy waste.

US Market Expansion

The US Sustainable Data Center Market is valued at approximately USD 28.1 Billion in 2024 and is predicted to increase from USD 59.8 Billion in 2029 to approximately USD 127.2 Billion by 2034, projected at a CAGR of 16.3% from 2025 to 2034.

North America Growth

In 2024, North America held a dominant position in the sustainable data center market, capturing over 36% of the global share and generating approximately USD 30.52 billion in revenue. This leadership is primarily attributed to the region’s substantial investments in green technologies, stringent environmental regulations, and the presence of major technology firms committed to sustainability.

Companies such as Amazon Web Services, Microsoft, and Google have been at the forefront, integrating renewable energy sources and energy-efficient infrastructure into their data center operations. Additionally, government incentives and policies promoting energy efficiency have further propelled the growth of sustainable data centers in North America.

Component Insights

In 2024, the Solution segment held a dominant market position in the sustainable data center market, capturing more than a 70% share. This dominance is primarily attributed to the escalating demand for advanced infrastructure components essential for energy efficiency and operational reliability. Key elements such as power systems, cooling/HVAC systems, monitoring and management systems, and networking systems have become integral to data center operations.

The surge in high-density computing workloads, driven by artificial intelligence and cloud services, necessitates robust solutions to manage increased power consumption and heat generation effectively. Consequently, data center operators are investing heavily in innovative solutions to ensure optimal performance and sustainability.

The prominence of the Solution segment is further reinforced by the critical role these components play in achieving sustainability goals. Advanced cooling technologies, including liquid cooling systems, have gained traction due to their superior energy efficiency compared to traditional air-based methods. Additionally, sophisticated monitoring and management systems enable real-time tracking of energy usage and system health, facilitating proactive maintenance and energy optimization.

Networking systems have also evolved to support seamless communication with minimal energy usage. Collectively, these solutions not only enhance the operational efficiency of data centers but also contribute significantly to reducing their environmental footprint, thereby solidifying the Solution segment’s leading position in the market.

Datacenter Size Insights

In 2024, the Large Data Centers segment held a dominant position in the sustainable data center market, capturing more than a 58% share. This dominance is primarily attributed to the escalating demand for hyperscale and colocation facilities driven by the proliferation of artificial intelligence (AI), cloud computing, and big data analytics.

These large-scale data centers are essential for supporting high-density computing workloads and ensuring operational efficiency. Their ability to leverage economies of scale allows for significant investments in sustainable technologies, such as advanced cooling systems and renewable energy integration, which are crucial for meeting stringent environmental regulations and corporate sustainability goals.

Furthermore, large data centers often benefit from strategic partnerships with utility providers and governments, facilitating access to cleaner energy sources and infrastructure incentives. For instance, major operators have been investing in on-site renewable energy generation and energy-efficient designs to reduce their carbon footprint.

These initiatives not only enhance the sustainability of large data centers but also set industry benchmarks for environmental responsibility. Consequently, their leadership in adopting and implementing sustainable practices reinforces their dominant market position in 2024.

Industry Vertical Insights

In 2024, the IT & Telecom segment held a dominant position in the sustainable data center market, capturing more than a 25% share. This prominence is primarily attributed to the sector’s escalating demand for scalable, energy-efficient infrastructure to support the rapid growth of data-intensive applications.

The proliferation of cloud computing, 5G networks, and artificial intelligence (AI) technologies necessitates robust data center solutions that can handle increased workloads while minimizing environmental impact. Consequently, IT and telecom companies are investing heavily in sustainable data centers that offer enhanced energy efficiency, reduced carbon footprints, and compliance with stringent environmental regulations.

Moreover, the IT & Telecom sector’s leadership in the sustainable data center market is reinforced by its commitment to corporate sustainability goals and the adoption of green technologies. Companies within this segment are increasingly leveraging renewable energy sources, advanced cooling systems, and intelligent energy management solutions to optimize data center operations.

Key Market Segments

By Component

- Solution

- Power System

- Monitoring & Management System

- Cooling/HVAC System

- Networking System

- Services

- Professional

- Managed

By Datacenter Size

- Large Data Centers

- Small and Medium-sized Data Centers

By Industry Vertical

- BFSI

- IT & Telecom

- Media & Telecom

- Healthcare

- Government & Defence

- Retail

- Manufacturing

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

The data center industry is undergoing a significant transformation, driven by the imperative to balance escalating digital demands with environmental sustainability. A prominent trend is the integration of renewable energy sources, such as solar, wind, and hydroelectric power, to reduce reliance on fossil fuels.

Major technology companies are investing in clean energy initiatives; for instance, Google has entered a $20 billion partnership to develop data centers powered by co-located solar and wind energy, coupled with battery storage systems. These efforts aim to meet net-zero carbon emission targets while ensuring energy reliability.

Another emerging trend is the adoption of advanced cooling technologies to enhance energy efficiency. Traditional cooling methods are being supplemented or replaced by innovative solutions like liquid cooling and immersion cooling, which are more effective at dissipating heat and consume less energy.

Business Benefits

Investing in sustainable data centers offers substantial financial advantages for businesses. Energy-efficient practices lead to reduced operational costs by lowering electricity consumption. Implementing energy-efficient servers, advanced cooling techniques, and renewable energy sources can result in significant cost savings over time.

Moreover, companies may benefit from potential tax incentives and rebates associated with sustainable practices. Beyond cost savings, sustainable data centers enhance corporate reputation and stakeholder trust. Demonstrating a commitment to environmental responsibility can strengthen brand image and appeal to environmentally conscious consumers and investors.

Driver

Renewable Energy Integration

The shift toward renewable energy is a primary driver for sustainable data centers. Operators are increasingly adopting solar, wind, and hydroelectric power to reduce carbon emissions and align with global sustainability goals.

For instance, Google’s partnership with Intersect Power and TPG Rise Climate aims to construct data centers adjacent to renewable energy sources, facilitating direct access to clean power and minimizing dependence on fossil fuels. This initiative not only supports environmental objectives but also enhances energy reliability and cost predictability for data center operations.

Furthermore, companies like AirTrunk are implementing large-scale renewable projects, such as a 1MW rooftop solar system at their Johor Bahru data center in Malaysia. These efforts contribute to achieving net-zero emissions targets and demonstrate the industry’s commitment to sustainable practices. By integrating renewable energy, data centers can significantly reduce their environmental impact while meeting the growing demand for digital services.

Restraint

High Capital Expenditure

The substantial initial investment required for sustainable infrastructure poses a significant restraint. Implementing advanced cooling systems, renewable energy sources, and energy-efficient technologies involves considerable capital expenditure. This financial barrier can deter small and medium-sized enterprises from transitioning to sustainable data center models, limiting widespread adoption.

Additionally, the complexity of retrofitting existing facilities to accommodate sustainable technologies can further escalate costs. Challenges include upgrading power distribution systems, enhancing structural components, and ensuring compliance with environmental regulations. These factors collectively contribute to the financial burden, making it imperative for stakeholders to evaluate cost-benefit scenarios carefully.

Opportunity

AI-Driven Energy Optimization

Artificial Intelligence (AI) presents a significant opportunity for enhancing energy efficiency in data centers. AI algorithms can analyze vast datasets to optimize power usage, predict maintenance needs, and manage workloads effectively. By leveraging AI, data centers can achieve real-time energy optimization, reducing operational costs and environmental impact.

Moreover, AI can facilitate the integration of renewable energy by forecasting energy production and adjusting consumption patterns accordingly. This dynamic approach ensures a balanced energy supply-demand equation, promoting sustainability. The adoption of AI-driven solutions is poised to revolutionize data center operations, aligning technological advancement with environmental stewardship.

Challenge

Cooling Technology Limitations

Efficient cooling remains a critical challenge in sustainable data center operations. Traditional air cooling methods are often insufficient for high-density computing environments, leading to increased energy consumption and operational costs. Innovative solutions like liquid and immersion cooling offer improved efficiency but come with their own set of challenges, including higher initial costs and maintenance complexities.

Furthermore, the implementation of advanced cooling technologies requires careful consideration of environmental factors, such as water usage and potential ecological impacts. Balancing the need for effective cooling with sustainability goals necessitates ongoing research and development. Addressing these challenges is essential for the evolution of eco-friendly data center infrastructures.

Key Player Analysis

In 2025, Dell Technologies introduced several innovations to enhance data center sustainability and efficiency. Key developments include the Dell PowerProtect All Flash Appliance, set for release in August 2025, and the PowerStore Advanced Ransomware Detection, expected in the second half of 2025. These solutions aim to improve data protection and operational resilience.

Fujitsu has focused on enhancing data center energy efficiency through strategic collaborations. In partnership with Supermicro and Nidec, Fujitsu is developing a liquid-cooling solution that could improve data center energy efficiency by up to 40% compared to traditional air-cooling methods.

In 2025, Cisco Systems redefined data center architecture by introducing Smart Switches that integrate services directly into the data center fabric. These switches, combining Cisco’s networking capabilities with AMD DPUs, aim to simplify operations and reduce power consumption.

Top Key Players Covered

- Dell EMC Inc.

- Fujitsu Ltd

- Cisco Systems Inc.

- HP Inc.

- Hitachi Ltd

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation

- Vertiv Corporation

- Green Revolution Cooling, Inc.

- ABB Ltd.

- Asetek, Inc.

- Delta Electronics, Inc.

- Digital Realty Trust

- Equinix, Inc.

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- Siemens AG

- Other Key Players

Recent Developments

- In March 2025, Eaton completed the acquisition of Fibrebond, a designer and builder of modular power enclosures, for $1.4 billion. This move is expected to expand Eaton’s modular power solutions for data centers.

- In October 2024, Schneider Electric announced plans to acquire a 75% stake in Motivair Corp, a U.S.-based specialist in liquid cooling for high-performance computing, for $850 million. This acquisition aims to bolster Schneider’s capabilities in data center cooling.

Report Scope

Report Features Description Market Value (2024) USD 84.4 Bn Forecast Revenue (2034) USD 441.7 Bn CAGR (2025-2034) 18% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution (Power System, Monitoring & Management System, Cooling/HVAC System, Networking System), Services (Professional, Managed), By Datacenter Size (Large Data Centers, Small and Medium-sized Data Centers), By Industry Vertical (BFSI, IT & Telecom, Media & Telecom, Healthcare, Government & Defence, Retail, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dell EMC Inc., Fujitsu Ltd, Cisco Systems Inc., HP Inc., Hitachi Ltd, Schneider Electric SE, IBM Corporation, Eaton Corporation, Vertiv Corporation, Green Revolution Cooling, Inc., ABB Ltd., Asetek, Inc., Delta Electronics, Inc., Digital Realty Trust, Equinix, Inc., Hewlett Packard Enterprise Company, Huawei Technologies Co., Ltd., Siemens AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sustainable Data Center MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Sustainable Data Center MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dell EMC Inc.

- Fujitsu Ltd

- Cisco Systems Inc.

- HP Inc.

- Hitachi Ltd

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation

- Vertiv Corporation

- Green Revolution Cooling, Inc.

- ABB Ltd.

- Asetek, Inc.

- Delta Electronics, Inc.

- Digital Realty Trust

- Equinix, Inc.

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- Siemens AG

- Other Key Players