Global Surgical Snare Market By Usability (Single use and Reusable), By Application (GI Endoscope, Laparoscopy, Urology Endoscopy, Gynecology Endoscopy, Arthroscopy, Bronchoscopy, Mediastinoscopy, Laryngoscopy and Others), By End Use (Hospitals and Clinics and Ambulatory Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2034

- Published date: Feb 2025

- Report ID: 139862

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

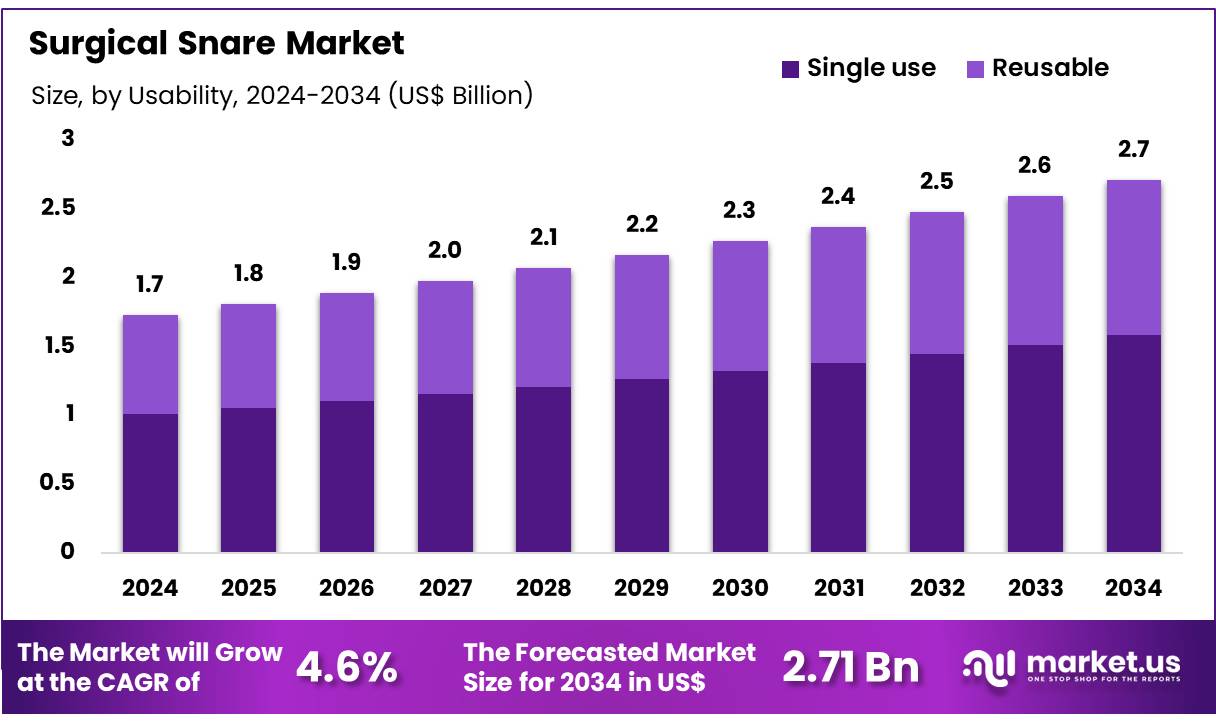

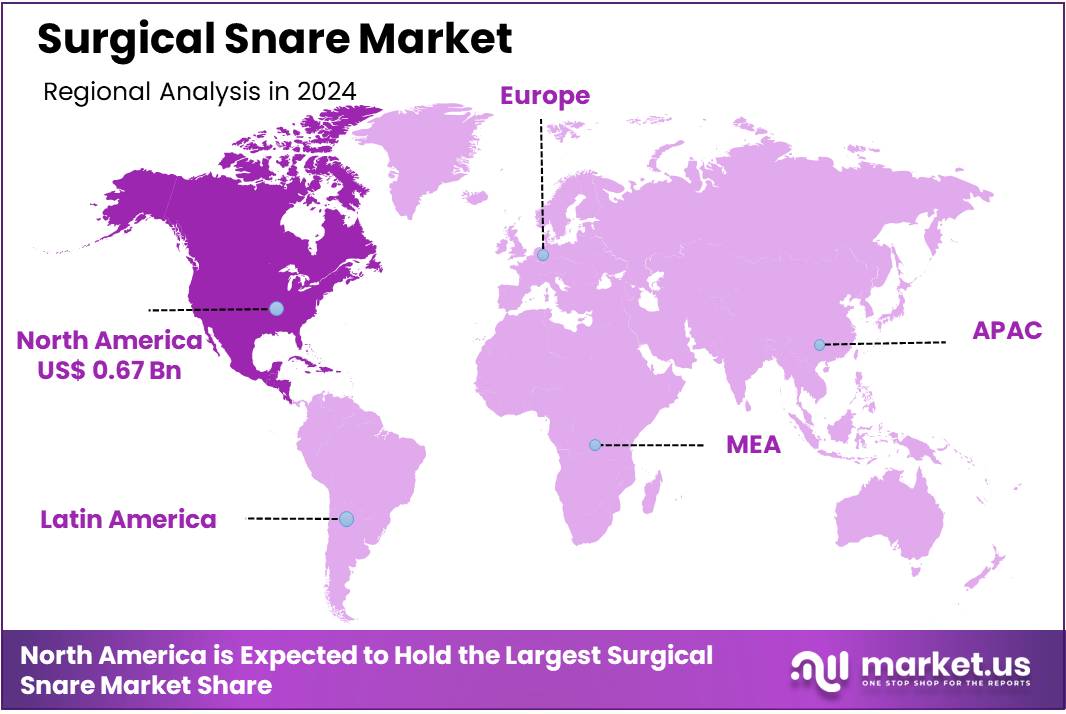

Global Surgical Snare Market size is expected to be worth around US$ 2.71 billion by 2034 from US$ 1.73 billion in 2024, growing at a CAGR of 4.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.7% share with a revenue of US$ 0.67 billion.

The Surgical Snare Market is a segment of the broader medical devices industry, focusing on devices used in various surgical procedures to excise or remove tissue. Surgical snares are commonly employed in minimally invasive surgeries, such as polypectomies, biopsy procedures, tumor removal, and endoscopic surgeries. They consist of a wire loop that can be tightened around tissue to facilitate removal.

The market is primarily driven by increasing demand for minimally invasive surgeries, which offer benefits like shorter recovery times, lower risk of infection, and reduced scarring. Moreover, advancements in technology, such as disposable snares, bioresorbable materials, and improved ergonomics, are enhancing the safety and effectiveness of these devices.

Additionally, the rising prevalence of chronic conditions like colorectal cancer, gastrointestinal disorders, and obesity is further propelling market growth. The market is also influenced by growing healthcare access, particularly in emerging economies, as well as expanding awareness around early disease detection and surgical interventions.

Key Takeaways

- In 2024, the market for Surgical Snare generated a revenue of US$ 73 billion, with a CAGR of 4.6%, and is expected to reach US$ 2.71 billion by the year 2034.

- The type segment is divided into Single use, Reusable, Kallikrein Inhibitors and Others with Single use taking the lead in 2024 with a market share of 58.3%.

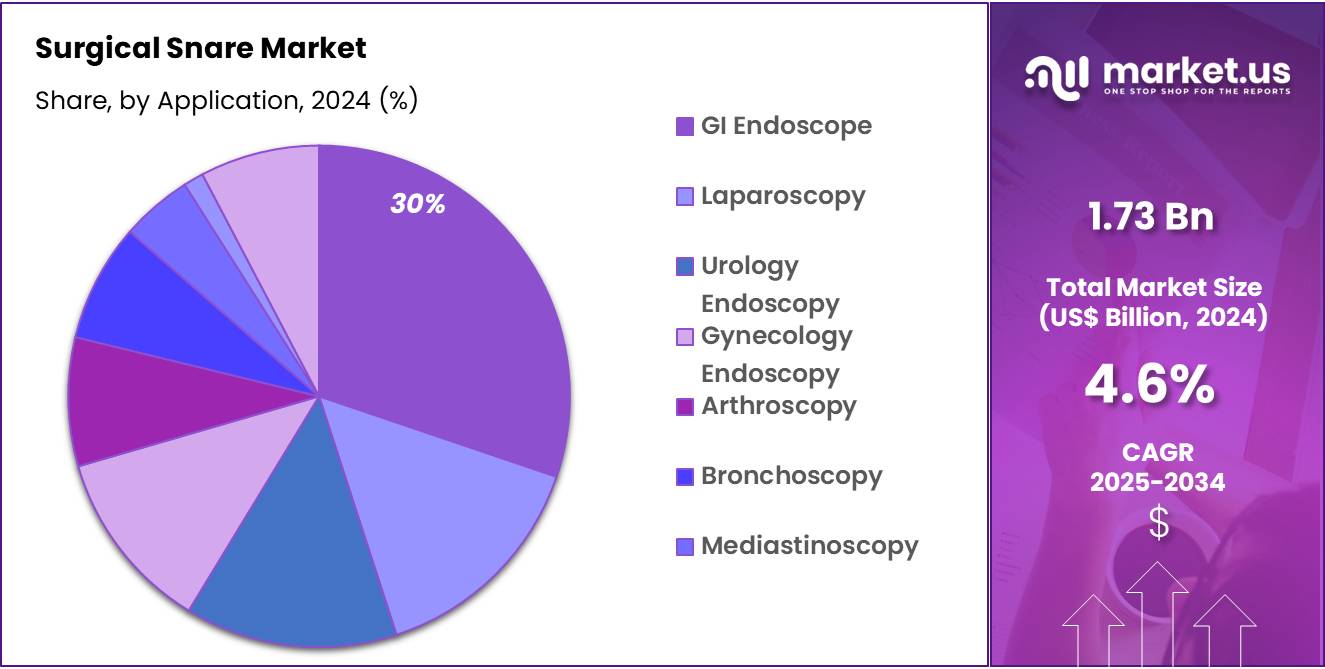

- Considering active Application, the market is divided into GI Endoscope, Laparoscopy, Urology Endoscopy, Gynecology Endoscopy, Arthroscopy, Bronchoscopy, Mediastinoscopy, Laryngoscopy and Others. Among these, GI Endoscope held a significant share of 30.2%.

- Furthermore, concerning the End Use, the market is segregated into Hospitals and Clinics. The Hospitals and Clinics stands out as the dominant segment, holding the largest revenue share of 65.0% in the Surgical Snare market.

- North America led the market by securing a market share of 38.7% in 2024.

Usability Analysis

On the basis of Usability, single-use snare segment dominated the market in 2024 with a market share olf 58.3% due to growing concerns about infection control and safety in medical procedures. The convenience and reduced risk of cross-contamination associated with single-use snares have made them the preferred choice in many clinical settings. Single-use surgical snares are designed for one-time use and are discarded after the procedure.

These snares are gaining popularity due to their enhanced safety features, as they eliminate the risk of cross-contamination between patients. Additionally, they offer convenience in terms of sterilization, requiring no maintenance or reprocessing, which is particularly valuable in high-turnover environments like hospitals and ambulatory surgical centers.

Application Analysis

By Application, the GI endoscope segment is the dominant segment withy 30.2% market share due to the high number of endoscopic procedures performed worldwide, driven by the growing awareness of gastrointestinal diseases and cancer prevention efforts. Surgical snares for gastrointestinal (GI) endoscopy are widely used for polyp removal, biopsy collection, and other procedures.

This segment is dominant due to the high frequency of GI procedures such as colonoscopy, which is frequently performed for early cancer detection. For instance, according to the data by National Endoscopic Database (NED) which was published in 2021, it is estimated that more than 20 million GI endoscopies are performed yearly in the United States.

By End Use Analysis

Based on end use analysis, the hospitals and clinics segment dominated the market with 65.0% market share due to the higher volume and complexity of surgeries conducted in these settings, including those requiring advanced surgical snares.

However, ASCs are experiencing rapid growth, and their demand for snares is increasing as more surgeries transition to outpatient care. These settings perform a wide range of surgeries, including complex and emergency procedures, often requiring specialized surgical tools like snares. Hospitals tend to have higher surgical volumes and offer diverse specialties such as GI, urology, and gynecology, driving significant demand for surgical snares.

Key Market Segments

By Usability

- Single use

- Reusable

- Kallikrein Inhibitors

- Others

By Application

- GI Endoscope

- Laparoscopy

- Urology Endoscopy

- Gynecology Endoscopy

- Arthroscopy

- Bronchoscopy

- Mediastinoscopy

- Laryngoscopy

- Others

By End Use

- Hospitals and Clinics

- Ambulatory Surgical Centers

Drivers

Increasing Demand for Minimally Invasive Surgeries

The rising preference for minimally invasive procedures is a significant driver for the surgical snare market. These surgeries offer several benefits, including shorter recovery times, reduced risk of infection, and smaller incisions, which contribute to faster patient recovery. Surgical snares, being crucial tools for tissue excision during such procedures, are increasingly in demand as healthcare providers adopt these advanced techniques for various surgeries, including endoscopy and laparoscopy.

According to a data provided by Procedural Stat Release 2022, the total number of minimally invasive cosmetic surgery procedures accounted for 23,672,269 in 2022 and 25,442,640 in 2023 representing a 7.5% increase from 2022 to 2023.

Restraints

High Cost of Advanced Devices

Despite their growing demand, one significant restraint in the surgical snare market is the high cost associated with advanced devices. Many surgical snares incorporate complex features, such as electrosurgical or robotic-assisted capabilities, that increase their production costs. These advanced devices require ongoing research, quality control, and compliance with regulatory standards, all of which contribute to their premium prices.

Hospitals, particularly in developing economies or those with limited budgets, may find it challenging to afford these advanced surgical tools, limiting their adoption. Furthermore, even in developed markets, hospitals may hesitate to invest in costly devices due to the overall financial pressure of maintaining high-quality care.

This price barrier can make it difficult for some healthcare institutions to fully transition to cutting-edge surgical techniques that rely on specialized tools like advanced snares. As a result, manufacturers and healthcare providers must balance innovation with cost-effectiveness to meet the demands of both high-tech and budget-conscious segments of the market.

Opportunities

Technological Advancements in Surgical Snare Design

Technological advancements are continuously reshaping the surgical snare market. Modern snares are incorporating innovations such as enhanced precision, better biocompatibility, and the integration of electrosurgical features to improve surgical outcomes. For example, some snares are now equipped with advanced materials like nitinol, which offers superior flexibility and strength.

Others integrate digital technologies, including real-time imaging and feedback systems, that enhance the surgeon’s ability to perform delicate tissue removal. Moreover, the design of surgical snares has evolved to improve maneuverability and ease of use in minimally invasive procedures, allowing for safer and more effective surgeries.

The use of robotic-assisted platforms has also spurred demand for snares that are compatible with these systems, providing greater precision and reducing the likelihood of complications. As these technological advancements continue, surgical snares will play an even more critical role in complex surgeries, further driving market growth.

Manufacturers are investing in R&D to push the boundaries of surgical snare design, meeting the increasing demand for highly efficient and accurate surgical tools. For instance, in September 2024, a team from the University of Tennessee, in collaboration with the Department of Mechanical, Aerospace, and Biomedical Engineering, is involved in a groundbreaking multi-institution surgical robot project that has received up to $12 million in funding from the Advanced Research Projects Agency for Health (ARPA-H).

The project’s aim is to develop a surgical robot that can perform an entire surgery autonomously. This advancement is made possible by a new breakthrough in robotic technology known as concentric tube robots.

Impact of Macroeconomic / Geopolitical Factors

Economic conditions such as GDP growth, healthcare budgets, and disposable income levels directly impact the demand for surgical snares. In regions with robust economic growth, healthcare spending tends to rise, which facilitates the purchase of advanced surgical tools, including snares.

Conversely, during economic downturns or in countries facing economic challenges, hospitals and healthcare providers may delay or scale down investments in new technologies, including surgical snares. Moreover, inflation and fluctuating raw material costs can affect the pricing and availability of these devices, impacting market growth.

Geopolitical instability, such as trade wars, political unrest, and regional conflicts, can disrupt global supply chains and the availability of materials required for manufacturing surgical snares. Regulatory changes and tariffs may also impact international trade and the distribution of medical devices.

For example, changing healthcare policies in major markets like the U.S. or Europe can influence reimbursement rates for surgeries, thereby affecting demand for surgical snares. On the other hand, global medical tourism and cross-border healthcare collaboration may drive growth in emerging markets, offering new opportunities for manufacturers.

Latest Trends

Personalized Medicine

Rising Healthcare Investments is a key trend in the surgical snare market, driving growth and innovation. Governments and private entities worldwide are increasingly investing in healthcare infrastructure, particularly in emerging economies, to meet the rising demand for quality medical services.

This trend is particularly evident in the construction of new hospitals, expansion of ambulatory surgical centers (ASCs), and the adoption of advanced medical technologies. As healthcare systems evolve, there is a growing emphasis on providing modern, minimally invasive treatments, leading to higher demand for specialized tools such as surgical snares.

With the increased investments, there is also a focus on improving patient care, enhancing surgical precision, and reducing recovery times, which aligns with the rising popularity of minimally invasive procedures. This shift boosts the demand for innovative surgical snares that enable safer, faster surgeries with minimal patient discomfort. Additionally, more healthcare funding facilitates research and development, leading to the introduction of advanced snare designs, further stimulating market growth.

Regional Analysis

North America is leading the Surgical Snare Market

The North American surgical snare market is a significant market globally with 38.7% of market share, driven by a combination of cutting-edge healthcare infrastructure, high healthcare expenditure, and an increasing preference for minimally invasive surgeries. The U.S. and Canada dominate the region, where hospitals, outpatient clinics, and ambulatory surgical centers (ASCs) perform a high volume of procedures requiring surgical snares, including endoscopy, laparoscopy, and urology surgeries.

The rising incidence of chronic diseases such as gastrointestinal disorders, cancers, and urological conditions, coupled with the aging population, further fuels the demand for surgical snares. Technological advancements in snare designs, including electrosurgical and robotic-assisted options, also contribute to the market’s growth. Additionally, favorable reimbursement policies and the increasing adoption of minimally invasive techniques in the region are expected to drive further demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Medtronic, Boston Scientific Corporation, Johnson & Johnson (Ethicon), Stryker Corporation, Smith & Nephew, ConMed Corporation, Cook Medical, Olympus Corporation, Hoya Corporation (Pentax Medical), Cook Medical, B. Braun Melsungen AG, Teleflex Incorporated, KARL STORZ GmbH & Co. KG, Micro-Tech (Nanjing) Co., Ltd., Abbott Laboratories, MedeAnalytics, Richard Wolf GmbH, Medline Industries, Inc., Fujifilm Holdings Corporation, Nihon Kohden Corporation, and Other Prominent Players.

Medtronic is a global leader in medical devices, offering a wide range of products, including surgical snares. Known for its innovation, Medtronic provides advanced snares for minimally invasive procedures such as endoscopy and laparoscopy, focusing on safety, precision, and ease of use. The company continues to expand its offerings through technological advancements like electrosurgical snares.

Boston Scientific Corporation is another key player, renowned for its broad portfolio in the surgical snare market. The company develops highly specialized snares for use in gastrointestinal, urological, and respiratory procedures. Johnson & Johnson (Ethicon) offers a comprehensive range of surgical snares, particularly through its Ethicon brand.

Top Key Players

- Medtronic

- Boston Scientific Corporation

- Johnson & Johnson (Ethicon)

- Stryker Corporation

- Smith & Nephew

- ConMed Corporation

- Cook Medical

- Olympus Corporation

- Hoya Corporation (Pentax Medical)

- Cook Medical

- Braun Melsungen AG

- Teleflex Incorporated

- KARL STORZ GmbH & Co. KG

- Micro-Tech (Nanjing) Co., Ltd.

- Abbott Laboratories

- MedeAnalytics

- Richard Wolf GmbH

- Medline Industries, Inc.

- Fujifilm Holdings Corporation

- Nihon Kohden Corporation

- Other Prominent Players

Recent Developments

- In November 2023, Virtuoso Surgical, Inc., a medical device company, secured a US$1.8 million grant from the Small Business Innovation Research (SBIR) program under the NIH. The funding, which will be distributed over the next two years, will support the development of Virtuoso’s robotic surgery system including surgical snare devices. This innovative system introduces advanced robotic tools and techniques for endoscopic surgery, offering capabilities that current instruments cannot achieve.

- In may 2021, Olympus Corporation completed its acquisition of Israeli medical device company Medi-Tate Ltd., following its decision to exercise the call option in February 2021. This acquisition allows Olympus to broaden its portfolio by offering in-office treatments for benign prostatic hyperplasia (BPH), further strengthening its leadership in the urological device including surgical snare.

Report Scope

Report Features Description Market Value (2024) US$ 1.73 billion Forecast Revenue (2034) US$ 2.71 billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Usability (Single use and Reusable), By Application (GI Endoscope, Laparoscopy, Urology Endoscopy, Gynecology Endoscopy, Arthroscopy, Bronchoscopy, Mediastinoscopy, Laryngoscopy and Others), By End Use (Hospitals and Clinics and Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Medtronic, Boston Scientific Corporation, Johnson & Johnson (Ethicon), Stryker Corporation, Smith & Nephew, ConMed Corporation, Cook Medical, Olympus Corporation, Hoya Corporation (Pentax Medical), Cook Medical, B. Braun Melsungen AG, Teleflex Incorporated, KARL STORZ GmbH & Co. KG, Micro-Tech (Nanjing) Co., Ltd., Abbott Laboratories, MedeAnalytics, Richard Wolf GmbH, Medline Industries, Inc., Fujifilm Holdings Corporation, Nihon Kohden Corporation, and Other Prominent Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Medtronic

- Boston Scientific Corporation

- Johnson & Johnson (Ethicon)

- Stryker Corporation

- Smith & Nephew

- ConMed Corporation

- Cook Medical

- Olympus Corporation

- Hoya Corporation (Pentax Medical)

- Cook Medical

- Braun Melsungen AG

- Teleflex Incorporated

- KARL STORZ GmbH & Co. KG

- Micro-Tech (Nanjing) Co., Ltd.

- Abbott Laboratories

- MedeAnalytics

- Richard Wolf GmbH

- Medline Industries, Inc.

- Fujifilm Holdings Corporation

- Nihon Kohden Corporation

- Other Prominent Players