Global Superfoods Market By Type (Fruits, Vegetables, Grains and Seeds, Herbs and Roots, Others), By Function (Antioxidant-rich, Immune-boosting, Digestive Health, Energy-enhancing, Brain-boosting, Weight Management), By Application (Snacks, Beverages, Bakery and Confectionery, Others), By Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Convenience Stores, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133081

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

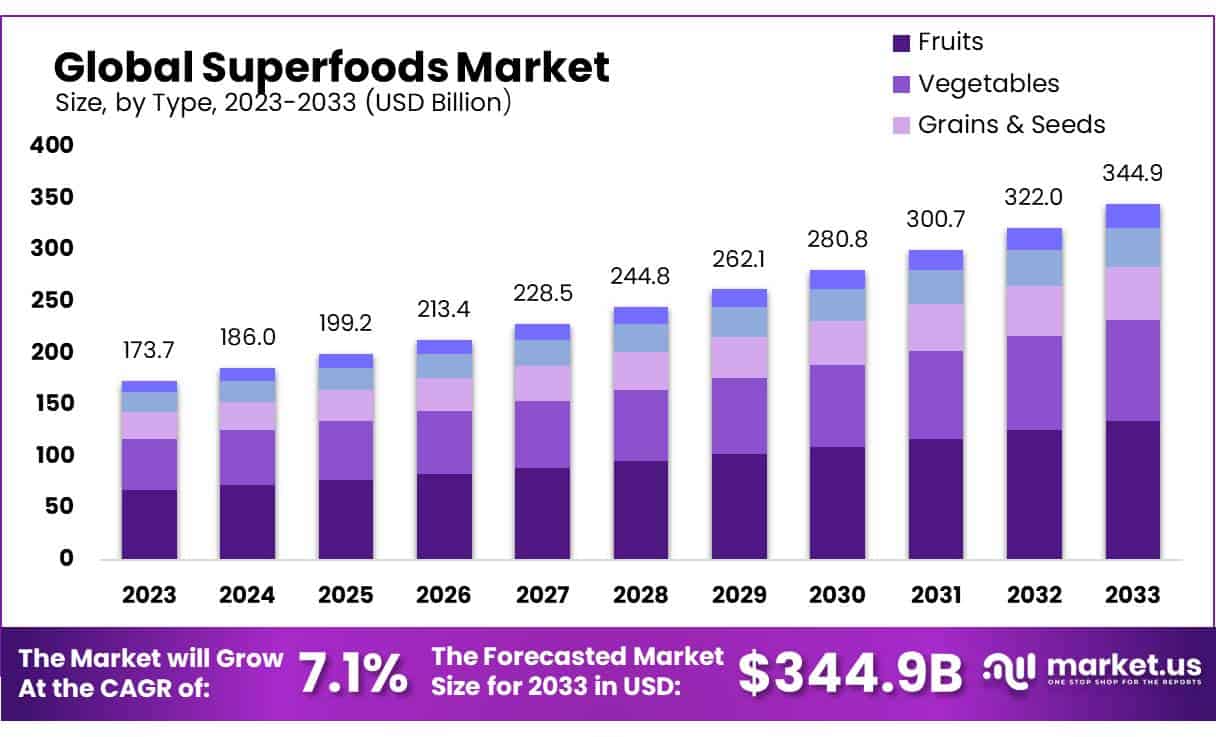

The Global Superfoods Market size is expected to be worth around USD 344.9 Bn by 2033, from USD 173.7 Bn in 2023, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033.

The superfoods market, recognized for its nutrient-dense foods, continues to experience robust growth, driven by increasing health awareness and consumer demand for nutritious dietary options. Superfoods, which include items like blueberries, salmon, and kale, are celebrated for their rich content in vitamins, minerals, and antioxidants, offering substantial health benefits and supporting immune function.

Import and Export Dynamics The global trade dynamics for superfoods are noteworthy, with significant activity in both imports and exports. For instance, in 2023, Bolivia observed a 15% increase in quinoa exports, totaling approximately 8,000 metric tons, predominantly fueled by demand from Europe and North America. Similarly, New Zealand’s kiwifruit exports saw a 20% increase, generating revenue close to $1.9 billion, underscoring its prominence as a sought-after superfood in international markets.

Market Investments and Support The superfoods sector has attracted considerable investment, reflecting confidence in its growth potential. The Canadian government’s 2023 initiative to invest $2 million in promoting chia and hemp seeds is a testament to the public sector’s commitment. Simultaneously, private investments have surged, with $120 million invested in various superfood-related startups, emphasizing a shift towards sustainable and health-focused food solutions.

Innovative Industry Movements Innovation remains a key driver in the superfoods market, with significant corporate activities including acquisitions and strategic partnerships. A notable development in early 2024 involved a major US food company acquiring a superfood snack manufacturer for $250 million, aiming to diversify and enhance its health-oriented product range.

Moreover, collaborations between global food corporations and local superfood producers are increasingly common, aiming to combine global reach with local agricultural expertise.

Collaborative Efforts The sector also benefits from collaboration between the government and private sectors, aimed at fostering innovation and expanding market reach. An example of such collaboration is the European Union’s €10 million project initiated in 2024 with private entities. This project focuses on developing new superfood products that adhere to European dietary and health standards, reflecting a strategic approach to integrating superfoods into mainstream consumer markets.

Key Takeaways

- Superfoods Market size is expected to be worth around USD 344.9 Bn by 2033, from USD 173.7 Bn in 2023, growing at a CAGR of 7.1%.

- Fruits held a dominant market position in the superfoods market, capturing more than a 39.2% share.

- Antioxidant-rich superfoods held a dominant market position, capturing more than a 36.1% share.

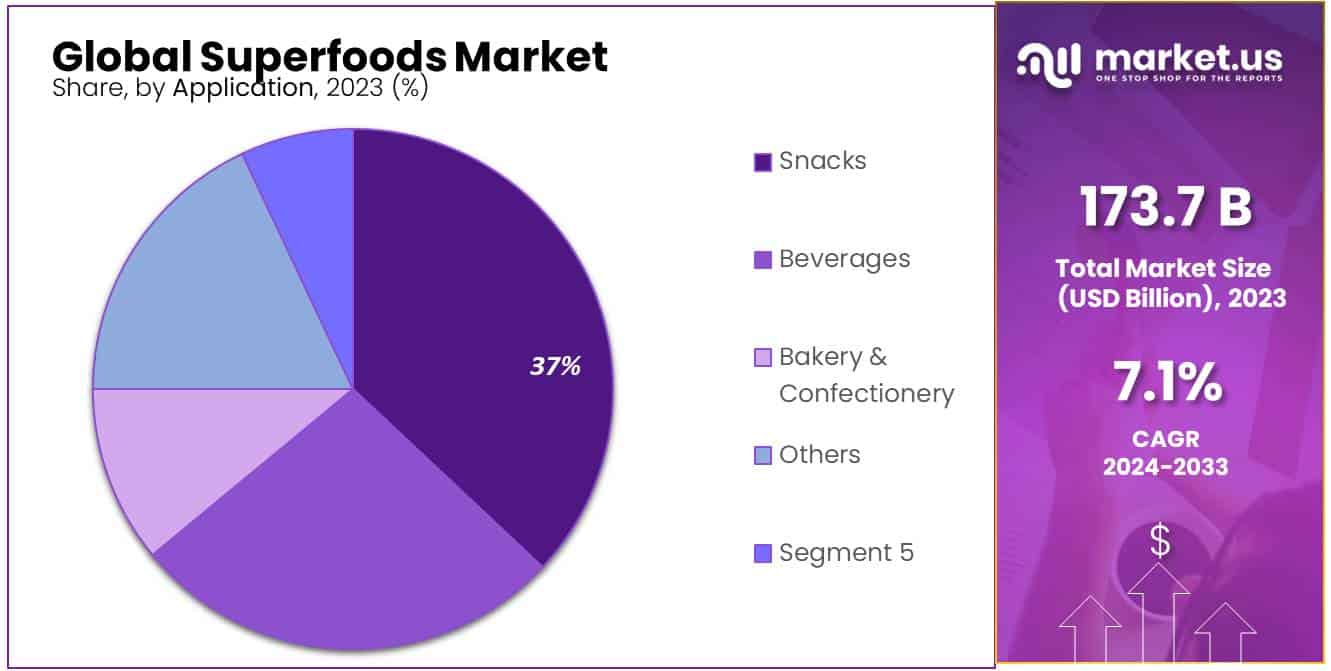

- Snacks held a dominant market position in the superfoods market, capturing more than a 37.2% share.

- Supermarkets/Hypermarkets held a dominant market position in the superfoods market, capturing more than a 49.1% share.

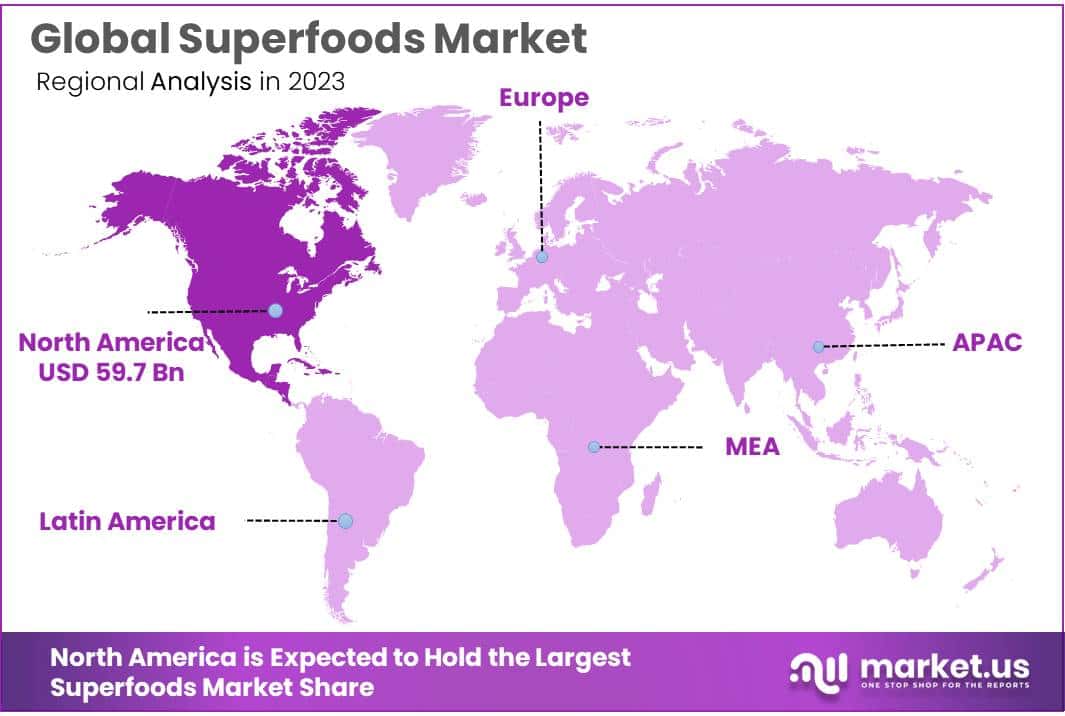

- North America held the dominant market position, accounting for 34.4% of the global superfood market, valued at approximately USD 59.7 billion.

By Type

In 2023, Fruits held a dominant market position in the superfoods market, capturing more than a 39.2% share. This segment’s popularity can be attributed to the growing demand for antioxidant-rich fruits like acai berries, blueberries, and goji berries, which are known for their health benefits such as boosting immunity and promoting skin health. Additionally, fruits are versatile and widely consumed in various forms, including fresh, dried, and powdered, making them accessible to a broad range of consumers.

The Vegetables segment followed closely behind, holding a substantial share of the market in 2023. Vegetables like kale, spinach, and broccoli are highly valued for their rich nutrient content, including vitamins, minerals, and fiber. These vegetables are increasingly being used in smoothies, salads, and other health-conscious food products.

Grains & Seeds also contributed significantly to the market, with products like quinoa, chia seeds, and flaxseeds gaining traction due to their high protein and omega-3 content. These superfoods cater to the growing demand for plant-based nutrition and are widely used in snacks, cereals, and energy bars.

The Herbs & Roots segment, which includes superfoods like turmeric, ginger, and ashwagandha, is witnessing strong growth as consumers seek natural remedies for inflammation, stress relief, and overall wellness. These products are commonly available in powder, capsule, and liquid extract forms.

By Function

In 2023, Antioxidant-rich superfoods held a dominant market position, capturing more than a 36.1% share. This category remains the largest due to increasing consumer awareness about the importance of antioxidants in combating oxidative stress and preventing chronic diseases. Superfoods such as acai berries, blueberries, and pomegranate are particularly popular for their high antioxidant content, which helps neutralize free radicals in the body and support overall health. These products are commonly used in smoothies, juices, and snack bars.

The Immune-boosting segment also saw significant growth, capturing a notable share of the market in 2023. Consumers are increasingly seeking natural ways to strengthen their immune system, especially in the wake of the COVID-19 pandemic. Superfoods like elderberries, mushrooms (such as reishi and shiitake), and vitamin C-rich fruits like oranges and kiwi are widely incorporated into daily diets to support immune function and reduce the risk of infections.

In terms of digestive health, Digestive Health superfoods have become increasingly popular. This segment, driven by the rising demand for gut health solutions, includes probiotic-rich foods like yogurt, kimchi, and kombucha, along with fiber-rich foods like chia seeds and flaxseeds. These products are associated with promoting gut flora balance, improving digestion, and supporting overall gastrointestinal health.

The Energy-enhancing segment, which includes superfoods like matcha, spirulina, and maca root, is gaining momentum among health-conscious consumers. These foods are known for their ability to boost stamina, enhance mental focus, and reduce fatigue, making them popular among athletes and individuals with active lifestyles.

Brain-boosting superfoods, including omega-3-rich foods like walnuts and flaxseeds, are also seeing growing demand. These superfoods are often linked to cognitive function and mental clarity, appealing to aging populations and professionals seeking to improve brain health and focus.

By Application

In 2023, Snacks held a dominant market position in the superfoods market, capturing more than a 37.2% share. This segment has gained significant traction as consumers increasingly look for healthier alternatives to traditional snack options.

Superfoods such as chia seeds, quinoa, and almonds are often incorporated into snack products like granola bars, trail mixes, and energy balls, offering a convenient, on-the-go option with added health benefits. The demand for nutrient-dense, low-calorie snacks has driven growth in this segment, particularly among health-conscious consumers and millennials.

The Beverages segment followed closely, driven by the growing popularity of smoothies, protein shakes, and functional drinks infused with superfoods. Ingredients like matcha, acai, and turmeric are commonly used in beverages for their antioxidant, anti-inflammatory, and energy-boosting properties. With consumers becoming more focused on hydration and wellness, the functional beverage market, which includes superfood-based juices, herbal teas, and water enhancers, continues to expand rapidly.

The Bakery & Confectionery segment has also seen notable growth, as consumers seek to incorporate superfoods into their everyday indulgences. Products such as superfood muffins, cookies, and cakes that feature ingredients like cacao, blueberries, and almonds are gaining popularity. These bakery items offer a healthier alternative to traditional sweet treats by providing functional benefits like added fiber, vitamins, and minerals while still satisfying consumer cravings for taste and texture.

By Distribution Channel

In 2023, Supermarkets/Hypermarkets held a dominant market position in the superfoods market, capturing more than a 49.1% share. These retail outlets remain the primary destination for consumers seeking a wide variety of superfood products. Supermarkets offer convenient access to both mainstream and niche superfood brands, with dedicated aisles for health-conscious products like organic snacks, nutritional drinks, and superfood-packed cereals. Their broad product range, competitive pricing, and frequent promotional activities continue to drive consumer preference in this channel.

Online Retail followed as another key distribution channel, experiencing strong growth as e-commerce has become increasingly popular. Consumers are increasingly turning to online platforms for purchasing superfoods due to the convenience, variety, and the ability to compare prices. Websites and apps like Amazon, iHerb, and Whole Foods Market offer a broad selection of superfoods that can be delivered directly to consumers’ homes. The increasing reliance on online shopping, coupled with the ease of ordering from home, has boosted sales in this segment, especially during the pandemic and in regions with high internet penetration.

Convenience Stores also contribute to the growing superfoods market, though they hold a smaller share compared to supermarkets and online retail. These stores cater to consumers seeking quick, on-the-go solutions. Superfoods like protein bars, pre-packed smoothies, and trail mixes are commonly found in convenience stores, targeting busy individuals who prioritize healthy eating but need quick, convenient options. As consumer demand for healthy, portable food options continues to rise, this segment is expected to grow, especially in urban areas.

Specialty Stores such as health food stores, organic shops, and fitness-focused retailers have seen steady demand as well. These stores cater to niche markets, offering curated selections of premium, organic, and sustainable superfoods. While the share of this segment is smaller compared to larger retail outlets, it continues to attract loyal customers who are willing to pay a premium for high-quality, ethically sourced products.

Key Market Segments

By Type

- Fruits

- Vegetables

- Grains & Seeds

- Herbs & Roots

- Others

By Function

- Antioxidant-rich

- Immune-boosting

- Digestive Health

- Energy-enhancing

- Brain-boosting

- Weight Management

By Application

- Snacks

- Beverages

- Bakery & Confectionery

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Online Retail

- Convenience Stores

- Specialty Stores

- Others

Drivers

Increasing Health Consciousness and Growing Demand for Nutrient-Dense Foods

One of the primary drivers of the superfoods market is the increasing consumer awareness about health and wellness. As the global population becomes more health-conscious, there has been a significant shift toward healthier eating habits, with a growing preference for nutrient-dense foods like superfoods. The rising awareness of the importance of diet in preventing chronic diseases such as obesity, diabetes, and cardiovascular conditions has led to a surge in demand for natural, whole foods that provide multiple health benefits.

Health Trends and Lifestyle Changes

According to a report by the World Health Organization (WHO), non-communicable diseases (NCDs) are responsible for 71% of global deaths, highlighting the urgent need for better health management through nutrition. In response to this, consumers are increasingly seeking foods that can help boost immunity, improve mental clarity, promote digestive health, and support overall well-being.

Superfoods, such as chia seeds, quinoa, and kale, which are high in antioxidants, fiber, and essential nutrients, are becoming integral to the modern diet. This has been supported by various government health initiatives that emphasize the consumption of healthier food choices. For instance, initiatives like the Eat Well Guide in the UK and MyPlate in the U.S. encourage people to incorporate more plant-based, nutrient-rich foods into their daily diets.

Rising Awareness of Functional Foods

The demand for functional foods, which offer additional health benefits beyond basic nutrition, is also on the rise. According to a 2022 study by the Food and Agriculture Organization (FAO), the global functional foods market, including superfoods, is projected to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030.

This growth is driven by an increasing consumer preference for foods that offer specific health benefits, such as boosting immunity or aiding digestion. Superfoods, which are rich in bioactive compounds like polyphenols, vitamins, and minerals, are gaining popularity as part of this trend.

Shift Toward Plant-Based Diets and Sustainability

Another significant factor is the growing trend toward plant-based diets and sustainability. Consumers are becoming more concerned about the environmental impact of their food choices, leading to a rise in the popularity of plant-based, eco-friendly superfoods.

The United Nations Environment Programme (UNEP) has highlighted that plant-based foods generally have a lower environmental footprint than animal-based foods. As a result, many consumers are turning to superfoods like spirulina, matcha, and hemp as part of their transition to more sustainable eating habits.

A 2019 study by the Journal of Cleaner Production found that switching to plant-based diets could reduce global food-related greenhouse gas emissions by 49%. This growing concern for the planet’s health is contributing to the increasing demand for nutrient-rich, plant-based superfoods that offer both personal health benefits and lower environmental impact.

Technological Innovations in Superfood Production

Technological advancements in agriculture and food production are also driving the growth of the superfoods market. Innovations in farming practices, such as vertical farming and hydroponics, are making it easier to cultivate nutrient-dense superfoods in urban environments, which is increasing their availability and reducing the cost of production. These innovations, combined with growing consumer demand, are expected to drive the market even further.

Restraints

High Cost and Affordability Challenges

One of the major restraining factors for the superfoods market is the high cost of production and affordability issues for consumers. While superfoods offer numerous health benefits, the price of these nutrient-dense foods can be a significant barrier for many individuals, especially in emerging markets. The relatively high cost of production, coupled with the premium price tag of many superfood products, limits their widespread adoption, particularly among lower-income consumers.

Production and Supply Chain Challenges

The high cost of superfoods is largely due to the challenges associated with their production. Many superfoods, such as acai berries, goji berries, and moringa, require specialized growing conditions or long-distance transportation from regions where they are cultivated.

For example, acai is primarily grown in the Amazon rainforest, and its import costs contribute to its high retail price in regions outside South America. According to the Food and Agriculture Organization (FAO), global food prices have increased by 9.6% in 2023, which includes raw materials used for producing superfoods. This price increase, driven by supply chain disruptions and rising fuel costs, impacts the overall affordability of superfoods.

Additionally, the lack of local production for certain superfoods in many countries means they must be imported, often leading to inflated retail prices due to import duties, logistics, and middlemen costs. For instance, matcha, a powdered form of green tea, is grown primarily in Japan, and its transportation costs result in high prices for end consumers.

Impact on Consumer Access

According to a 2022 study by the World Bank, the global cost of healthy diets is about 60% higher than the cost of unhealthy diets. In countries where average disposable income is lower, the high price of superfoods may make them an unattainable option for many consumers. This price disparity limits the widespread consumption of superfoods in lower-income populations, where consumers are often forced to prioritize cheaper, less nutritious options.

Government initiatives have also been aimed at improving food accessibility and affordability. For instance, the U.S. Department of Agriculture (USDA) supports initiatives like the Supplemental Nutrition Assistance Program (SNAP), which provides food assistance to low-income individuals and families.

However, these programs generally do not cover higher-priced superfoods, making it difficult for economically disadvantaged communities to benefit from their health properties. Similarly, in countries like India, where the affordability of food is a major concern, efforts to include more superfoods in mainstream diets are still in the nascent stage.

Lack of Awareness and Education

Another challenge that compounds the affordability issue is the lack of awareness and education about the health benefits of superfoods. Many consumers may not be aware of the nutritional value or potential health benefits of superfoods, which can lead to reluctance in purchasing them, especially if they are perceived as expensive.

According to the World Health Organization (WHO), lack of nutrition awareness is a barrier to adopting healthy eating habits in many developing regions, where the focus is often on low-cost, calorie-dense foods rather than nutrient-dense options.

Economic Constraints in Developing Markets

In emerging economies, the price sensitivity of consumers further restricts the growth of the superfoods market. While superfoods may be gaining popularity in developed markets like the U.S. and Europe, their uptake in developing regions such as Africa, Latin America, and parts of Asia remains limited.

UNICEF reports that in low-income countries, more than 40% of the population lacks access to a diverse, healthy diet, largely due to the high cost of nutritious foods, including superfoods. As a result, unless the cost of production is reduced through more sustainable farming practices or local production initiatives, superfoods will remain out of reach for many consumers in these regions.

Opportunity

Increasing Demand for Plant-Based and Functional Foods

One of the most prominent growth opportunities for the superfoods market lies in the increasing demand for plant-based and functional foods. As consumers worldwide become more health-conscious, there is a significant shift towards foods that offer additional health benefits beyond basic nutrition. This trend is largely driven by growing awareness about the importance of a balanced diet, the impact of nutrition on long-term health, and the rise of chronic diseases. Superfoods, which are rich in vitamins, minerals, and antioxidants, are well-positioned to capitalize on this trend, especially as plant-based diets gain momentum.

Rising Health Consciousness and Demand for Nutrient-Dense Foods

According to the World Health Organization (WHO), non-communicable diseases (NCDs), such as heart disease, diabetes, and obesity, account for over 70% of deaths globally, making health a major focus for governments and consumers alike. This has led to an increasing demand for foods that not only meet basic caloric needs but also offer additional health benefits. Superfoods like spirulina, chia seeds, goji berries, and moringa are particularly appealing to consumers who are looking for ways to prevent illness, boost immunity, and improve overall well-being.

For example, the global plant-based food market is projected to reach USD 74.2 billion by 2027, growing at a compound annual growth rate (CAGR) of 11.9% from 2020 to 2027 (source: FAO). This rapid expansion of plant-based diets is linked to the increasing awareness of the health and environmental benefits associated with plant-based eating. As consumers adopt plant-based diets, the demand for plant-based superfoods is expected to grow accordingly.

Government Initiatives Promoting Healthier Diets

Governments worldwide are taking proactive steps to promote healthier diets, which further enhances the growth prospects for the superfoods market. For example, the U.S. Department of Agriculture (USDA) and other health organizations are continuously promoting the MyPlate initiative, which emphasizes the importance of eating a variety of nutrient-dense foods, including fruits, vegetables, and whole grains. Such campaigns encourage the consumption of foods rich in antioxidants and other nutrients, many of which are found in superfoods.

In addition, the United Nations (UN) Sustainable Development Goal (SDG) 3 aims to ensure healthy lives and promote well-being for all at all ages. This goal has spurred initiatives focused on improving nutrition, with a particular emphasis on reducing malnutrition and promoting nutrient-dense foods like superfoods. Many countries are working to integrate superfoods into public nutrition programs, which could help boost their adoption across different demographics.

The Popularity of Functional Foods

The growing interest in functional foods is another factor driving the growth of the superfoods market. Functional foods are those that provide health benefits beyond basic nutrition, such as improving gut health, enhancing immunity, and supporting heart health. Superfoods, by definition, fit into this category, making them a prime candidate for consumers seeking foods that can support specific health goals. According to a 2023 report from the Food and Agriculture Organization (FAO), the global functional food market is expected to grow from USD 275.4 billion in 2023 to USD 419.3 billion by 2027, expanding at a CAGR of 10.9%.

For instance, products made from turmeric (known for its anti-inflammatory properties), ginger (which aids digestion), and matcha (which provides a natural energy boost) are increasingly popular in functional food categories. As more consumers seek foods that serve multiple purposes—such as improving digestion, supporting mental clarity, and boosting immunity—the demand for superfoods in functional food products is expected to rise.

Innovation and Product Development

Innovation in the superfoods sector, including the development of new product formats, is also expected to drive market growth. Companies are increasingly introducing superfood-infused products, such as snacks, beverages, supplements, and baked goods, making it easier for consumers to incorporate these nutrient-dense ingredients into their daily diets.

For example, plant-based protein bars, superfood smoothies, and energy shots containing ingredients like acai and blueberries are becoming more common in stores. According to Euromonitor, the global market for functional beverages alone is set to grow by 7.1% annually, and superfood-enhanced beverages will make up an increasingly larger share of this market.

Trends

Rise in Plant-Based Superfoods and Sustainable Sourcing

One of the most prominent latest trends in the superfoods market is the increasing demand for plant-based superfoods, driven by a growing awareness of the environmental and health benefits of plant-based eating. This trend is being fueled by a combination of consumer preferences for healthier diets and an increasing focus on sustainability in food production.

According to the Food and Agriculture Organization (FAO), plant-based foods are gaining ground globally due to their lower environmental impact compared to animal-based products. As a result, plant-based superfoods like moringa, spirulina, and chia seeds are becoming increasingly popular.

Growth of Plant-Based Food Consumption

This growth is driven by consumer interest in plant-based foods’ potential to reduce the risk of chronic diseases, including heart disease, diabetes, and obesity. As more consumers shift toward plant-based eating, the demand for plant-based superfoods that offer nutritional benefits—such as antioxidants, omega-3 fatty acids, and fiber—is expected to increase significantly.

In particular, the growing popularity of vegan and vegetarian lifestyles has contributed to the market’s expansion. Data from the Plant Based Foods Association (PBFA) shows that the U.S. plant-based food sales alone reached USD 7 billion in 2023, marking an increase of 27% over the past three years. This trend indicates a significant shift in consumer behavior and presents a substantial opportunity for companies producing plant-based superfoods to expand their market reach.

Focus on Sustainable Sourcing and Ethical Production

Sustainability is another significant trend influencing the superfoods market. Sustainable sourcing and ethical production practices are becoming increasingly important to consumers, particularly as environmental concerns grow. Superfoods like hemp, quinoa, and acai are sourced from regions where agricultural practices are undergoing significant changes to reduce environmental impact. For instance, many companies are now ensuring that their superfoods are organically grown and certified by third-party organizations like Fair Trade and Rainforest Alliance, which guarantee sustainable and ethical farming methods.

The growing focus on sustainability is reflected in consumer spending behavior, with a report by Euromonitor International showing that 45% of global consumers actively seek out brands and products that demonstrate environmental responsibility. Furthermore, 58% of U.S. consumers in 2023 indicated that they would pay a premium for food products with a transparent and ethical supply chain, emphasizing the market’s preference for sustainability.

Functional Benefits and Personalization

Another key trend in the superfoods market is the growing interest in functional benefits, where consumers are increasingly seeking foods that offer specific health benefits such as improved digestion, better sleep, and enhanced immunity.

Superfoods like turmeric, ginger, and matcha are particularly popular due to their potential to address specific health concerns. The rise of personalized nutrition is also playing a role, with consumers looking for superfoods tailored to their unique health needs.

For example, the demand for immune-boosting superfoods has surged following the COVID-19 pandemic. Vitamin C-rich foods like acai and goji berries are increasingly popular due to their ability to support immune function. According to the Global Wellness Institute (GWI), the global immune health market was valued at USD 17.7 billion in 2022, and it is expected to grow by 8.2% annually, reflecting the rising demand for foods that support immunity.

Additionally, with the increasing interest in gut health, superfoods that support digestive health, such as fermented foods like kimchi and kombucha, are gaining traction. The global market for gut health products is estimated to reach USD 10.4 billion by 2025, growing at a CAGR of 8.5% (source: WHO).

Innovative Product Formats and Functional Superfoods

Lastly, innovation in product formats has been another key trend in the superfoods market. Consumers are looking for more convenient and ready-to-consume options, leading to the development of superfood-based snacks, beverages, supplements, and fortified products. The market for functional beverages, which often include superfoods such as green tea, turmeric lattes, and smoothies enriched with chia seeds or acai, is expanding rapidly.

For instance, the global functional beverage market is expected to grow from USD 100 billion in 2023 to USD 200 billion by 2030, expanding at a CAGR of 9.7%. This growth is attributed to the increasing demand for products that provide health benefits such as energy-boosting, digestive health, and cognitive enhancement. Superfood-infused beverages are expected to capture a significant portion of this market due to their perceived health benefits and convenience.

Regional Analysis

In 2023, North America held the dominant market position, accounting for 34.4% of the global superfood market, valued at approximately USD 59.7 billion. The market in this region is driven by a strong consumer demand for health and wellness products, with an increasing focus on functional foods and organic ingredients.

According to the Food Marketing Institute (FMI), nearly 40% of U.S. consumers are actively seeking out superfoods like blueberries, acai berries, and avocados for their perceived health benefits. The U.S. market, in particular, is witnessing a surge in plant-based superfoods, fortified products, and functional beverages, such as smoothies and energy drinks, due to rising awareness of healthy living. Additionally, the growing prevalence of chronic diseases like obesity and diabetes has further fueled the demand for nutrient-dense superfoods in North America.

Europe represents a significant share in the global superfood market, with steady growth expected over the coming years. European consumers are increasingly prioritizing clean labels and sustainable, ethically sourced superfoods. The market in Europe is projected to grow at a CAGR of 6.2% from 2023 to 2028, with countries like the UK, Germany, and France leading the demand. The increasing focus on plant-based diets and the rise of veganism have further accelerated the market for plant-based superfoods such as spirulina and chia seeds.

The Asia Pacific (APAC) region, accounting for 28.5% of the global market, is experiencing rapid growth in the superfood sector, driven by an expanding middle class and rising health consciousness. APAC’s market size is expected to reach USD 50 billion by 2027. The demand for ancient grains, herbal teas, and moringa is especially strong in countries like India, China, and Japan, where traditional superfoods are being integrated into modern diets.

Latin America has witnessed increased demand for superfoods due to the rising awareness of their health benefits. Countries like Brazil and Mexico are emerging as key producers and consumers of superfoods like acai berries and guarana.

The superfood market in the Middle East and Africa (MEA) is relatively smaller compared to other regions but is gradually expanding due to an increase in health-conscious consumers. The growing demand for nutrient-dense, plant-based foods is expected to drive growth in the region, particularly in countries like UAE and South Africa, where affluent consumers are looking for natural and organic food options.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The superfood market is highly competitive, with several prominent players driving innovation and market expansion across various regions. Companies such as Sunfood, Nature Superfoods LLP, and OMG! Organic Meets Good are key contributors to the market’s growth, offering a broad range of organic, nutrient-dense superfoods. Sunfood, a leader in organic superfoods, is renowned for its extensive product portfolio, which includes popular ingredients like acai powder, spirulina, and goji berries.

These products cater to the increasing demand for health and wellness products, with consumers seeking natural, plant-based solutions to enhance their nutrition. Nature Superfoods LLP has also carved a significant niche in the market by providing high-quality, organic superfoods, particularly in Indian and Middle Eastern markets, focusing on moringa, turmeric, and baobab.

In addition, Suncore Foods Inc., Superlife Co. Pte Ltd, and Raw Nutrition continue to expand their reach globally, capitalizing on the growing trend of functional foods. Suncore Foods is a well-known player in the global superfood market, offering a variety of products, including spirulina, beetroot powder, and pomegranate seeds. Superlife Co. Pte Ltd focuses on plant-based products and health supplements, while Raw Nutrition emphasizes clean, natural ingredients in its superfood offerings, appealing to a fitness-oriented demographic.

Barlean’s and ADUNA Ltd. have also emerged as significant players, offering high-quality oils, powders, and supplements that provide essential fatty acids, vitamins, and minerals. The Green Labs LLC and Del Monte Pacific Group are focusing on expanding their portfolios with products like maca root and acai to cater to the increasing demand for plant-based nutrition.

Companies like Mannatech Incorporated, Nevitas Organics, and Impact Foods International Ltd. are capitalizing on the health-conscious consumer shift toward clean, sustainable, and organic food sources. The growth of these key players is further supported by increasing consumer awareness, dietary shifts, and strategic partnerships in emerging markets.

Top Key Players

- Sunfood

- Nature Superfoods LLP

- Organic Meets Good

- Suncore Foods Inc.

- Superlife Co. Pte Ltd

- Raw Nutrition.

- Barlean’s

- ADUNA Ltd.

- The Green Labs LLC

- Del Monte Pacific Group

- Impact Foods International Ltd

- Naturya Bath

- Mannatech Incorporated

- Nevitas Organics

Recent Developments

In 2023, Sunfood’s revenues are estimated to have reached USD 120 million, driven by an increased consumer preference for plant-based, nutrient-rich foods.

In 2023, Nature Superfoods LLP the company’s revenue was estimated to be around USD 60 million, with significant growth attributed to the rising consumer demand for nutrient-dense superfoods.

Report Scope

Report Features Description Market Value (2023) USD 173.7 Bn Forecast Revenue (2033) USD 344.9 Bn CAGR (2024-2033) 19% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fruits, Vegetables, Grains and Seeds, Herbs and Roots, Others), By Function ( Antioxidant-rich, Immune-boosting, Digestive Health, Energy-enhancing, Brain-boosting, Weight Management), By Application (Snacks, Beverages, Bakery and Confectionery, Others), By Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Convenience Stores, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sunfood, Nature Superfoods LLP, Organic Meets Good, Suncore Foods Inc., Superlife Co. Pte Ltd, Raw Nutrition., Barlean’s, ADUNA Ltd., The Green Labs LLC, Del Monte Pacific Group, Impact Foods International Ltd, Naturya Bath, Mannatech Incorporated, Nevitas Organics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sunfood

- Nature Superfoods LLP

- Organic Meets Good

- Suncore Foods Inc.

- Superlife Co. Pte Ltd

- Raw Nutrition.

- Barlean’s

- ADUNA Ltd.

- The Green Labs LLC

- Del Monte Pacific Group

- Impact Foods International Ltd

- Naturya Bath

- Mannatech Incorporated

- Nevitas Organics