Global Subsea Navigation and Tracking Market By System Type (Acoustic Systems (USBL (Ultra-Short Baseline), LBL (Long Baseline), SBL (Short Baseline)), Inertial Navigation Systems (FOG (Fiber Optic Gyroscope), MEMS (Micro-Electro-Mechanical Systems), Ring Laser, Strapdown INS), Hybrid INS/Acoustic), By Application (Oil & Gas Exploration, Military Activities, Ocean Sciences & Survey, Offshore Wind & Renewables, Salvage & Others), By Platform (ROVs (Remotely Operated Vehicles), AUVs (Autonomous Underwater Vehicles), Seabed Networks & Surface/Support Vessels), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167020

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

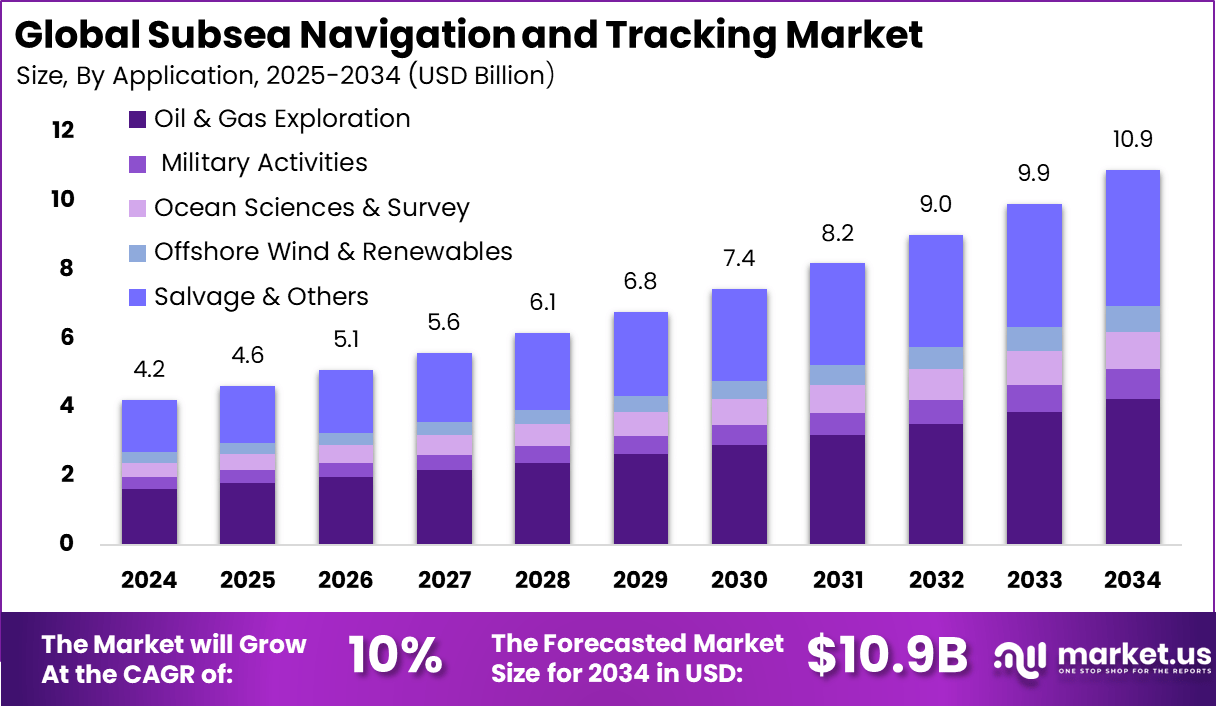

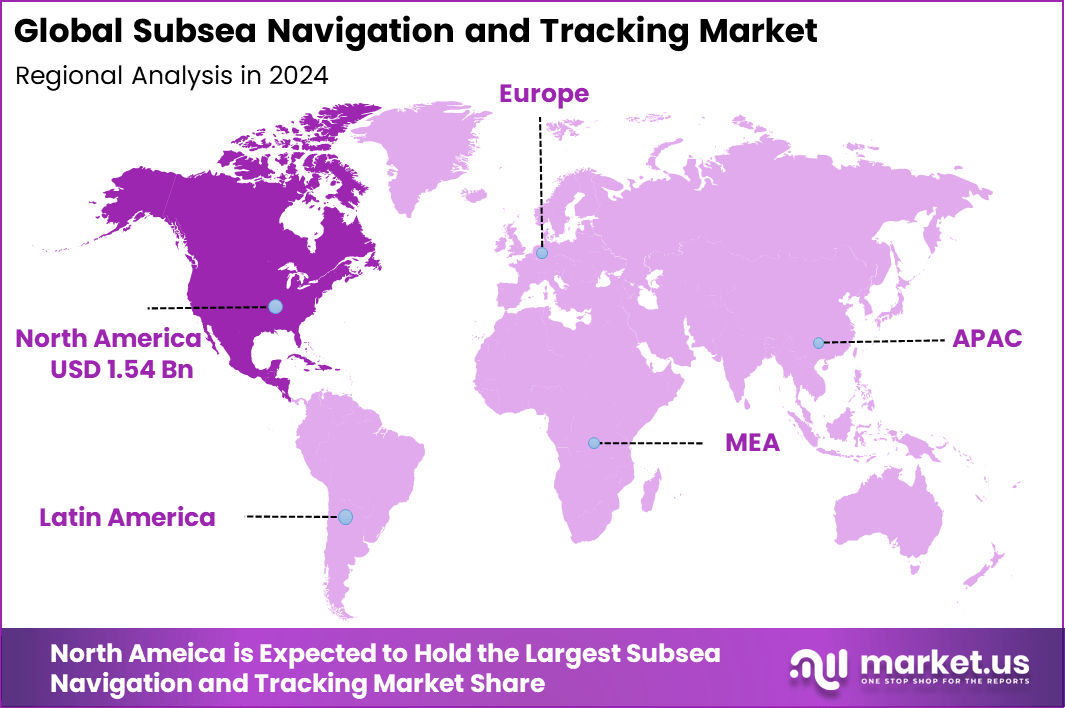

The Global Subsea Navigation and Tracking Market generated USD 4.2 billion in 2024 and is predicted to register growth from USD 4.6 billion in 2025 to about USD 10.9 billion by 2034, recording a CAGR of 10% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.8% share, holding USD 1.54 Billion revenue.

The subsea navigation and tracking market has expanded as offshore energy operators, marine researchers and defence organisations require precise underwater positioning for complex missions. Growth reflects the rise of autonomous underwater vehicles, deeper offshore exploration and increased reliance on subsea inspection and intervention systems. The market now supports a range of technologies that enable reliable tracking in environments where GPS signals cannot reach.

The growth of the market can be attributed to increasing offshore oil and gas activity, expansion of subsea renewable energy projects and rising deployment of underwater robots for inspection and repair. Strong interest in ocean mapping, environmental monitoring and maritime security also contributes to adoption. Advances in underwater acoustics and real time tracking technologies further strengthen market momentum.

Demand is rising across offshore drilling, subsea construction, pipeline inspection, oceanographic research, fisheries management and naval missions. Autonomous underwater vehicles and remotely operated vehicles rely heavily on accurate tracking to perform operations safely. Marine biologists use subsea tracking tools for studying animal movement and habitat changes.

Defence agencies require these systems for mine countermeasures, surveillance and underwater asset protection. Key technologies supporting adoption include ultra short baseline systems, long baseline systems, inertial navigation units, Doppler velocity logs, acoustic beacons and integrated subsea positioning networks. Modern systems combine acoustic tracking with inertial and optical sensors to improve accuracy. AI driven signal processing helps correct drift and noise in challenging water conditions.

Top Market Takeaways

- By system type, acoustic systems dominate with approximately 62.7% market share, favored for their reliability and accuracy in underwater positioning. Subcategories include USBL, LBL, and SBL acoustic positioning systems widely used across subsea applications.

- By application, oil & gas exploration leads with about 38.9% share. Subsea navigation and tracking are critical in offshore drilling, pipeline installation, and subsea infrastructure inspection, where precise positioning and operational safety are imperative.

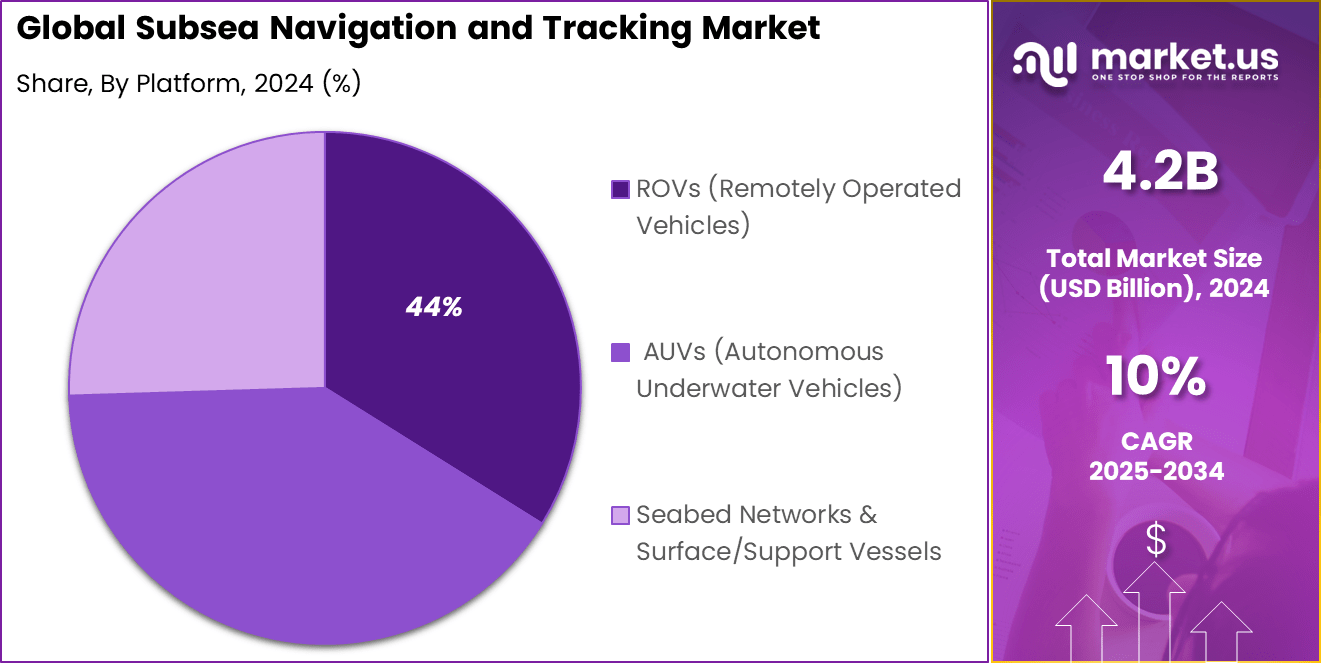

- By platform type, Remotely Operated Vehicles (ROVs) hold the largest share at approximately 43.9%, extensively utilized for subsea inspection, maintenance, repair, and construction tasks in offshore energy.

- North America commands about 36.8% of the market, driven by robust offshore oil and gas operations primarily in the Gulf of Mexico, advanced defense investments, and marine robotics adoption.

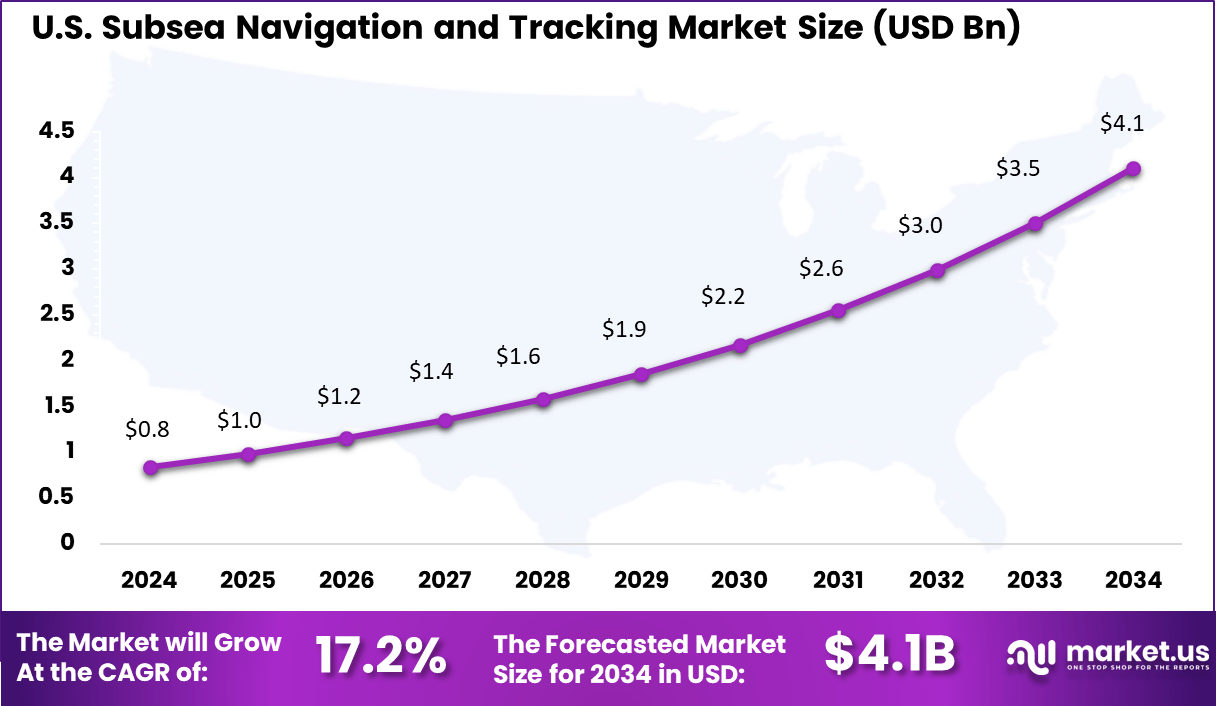

- The U.S. subsea navigation and tracking market size is estimated at around USD 0.84 billion in 2025, with growth fueled by expanding offshore exploration and infrastructure projects.

- The market is growing robustly with a CAGR of approximately 17.2%, propelled by technological advancements in acoustic and inertial navigation systems, increasing utilization of autonomous underwater vehicles (AUVs) for extended missions, and government initiatives supporting offshore energy and defense modernization.

By System Type

In 2024, Acoustic systems hold a dominant 62.7% share in the subsea navigation and tracking market. These systems are preferred because of their superior ability to transmit signals underwater, where GPS and other electromagnetic waves fail. Acoustic technologies such as Ultra-Short Baseline (USBL), Long Baseline (LBL), and Short Baseline (SBL) form the foundation of accurate underwater positioning.

Their effectiveness in providing reliable data across varied subsea depths and environmental conditions makes them essential for offshore operations. The wide adoption of acoustic systems stems from their proven reliability and versatility in precision positioning, particularly in challenging underwater environments.

By Application

In 2024, Oil and gas exploration accounts for 38.9% of subsea navigation and tracking applications, driven by the need for precise underwater positioning and operational safety during offshore drilling and infrastructure development. These systems aid in the navigation of drilling rigs, remotely operated vehicles (ROVs), and autonomous underwater vehicles (AUVs), enabling efficient monitoring, inspection, and maintenance of subsea assets.

Accurate positioning reduces operational risks and ensures compliance with stringent safety regulations. The industry’s growing push towards deep-water and ultra-deep-water exploration further heightens demand for sophisticated navigation solutions. Subsea tracking technologies not only optimize resource extraction but also support environmental monitoring and emergency response capabilities.

By Platform

In 2024, Remotely Operated Vehicles (ROVs) dominate the subsea platforms segment with a 44% share. ROVs are critical for subsea inspection, repair, and construction as they provide safe and precise operations in hazardous underwater environments. Integrated navigation systems enhance ROV functionality by enabling exact maneuvering, tool positioning, and mission execution with minimal human intervention.

ROVs’ versatility across offshore energy, marine research, and defense sectors drives their market prominence. Their ability to navigate complex underwater topographies while transmitting real-time data ensures operational success and cost-effectiveness, reinforcing their leading role in subsea operations.

Emerging Trends

Key Trends Description Agentic AI Automation AI hiring software is moving beyond recommendations to agentic AI that takes autonomous actions like posting jobs, sourcing candidates, scheduling interviews, and refining processes automatically. This shift helps recruiters focus on strategy over manual tasks. Skills-Based Hiring There is growing emphasis on evaluating skills and competencies rather than only credentials. AI tools now simulate tasks and soft-skill scenarios to assess candidates more accurately, helping companies hire the best fit for roles. Ethical and Transparent AI With rising regulatory scrutiny, AI hiring systems are incorporating bias auditing, transparency, and explainability to ensure fair hiring practices and comply with regional laws across the US, EU, and APAC. Predictive Analytics AI software uses predictive models to forecast workforce needs, retention risks, and candidate success, allowing recruiters to plan hiring strategically and retain talent more effectively. Hybrid Human-AI Collaboration Recruiters increasingly work alongside AI tools that automate routine functions while humans handle decision-making, diversity, and ethics, creating a balanced and effective recruitment process. Growth Factors

Key Factor Description Advanced Hybrid Navigation Systems Combining acoustic and inertial technologies for enhanced accuracy and reliability in underwater positioning. Autonomous Underwater Vehicle Adoption Increased use of AUVs for ocean mapping, inspection, and subsea infrastructure monitoring. AI and Machine Learning Integration AI-driven sensor fusion and data analytics improve navigation precision and operational efficiency. Growth in Offshore Renewable Energy Expansion of offshore wind farm installations drives demand for precise subsea navigation and tracking systems. Cloud-Based Mission Playback and Analytics Real-time data access and analytics support operational decision-making and remote monitoring. Key Market Segments

By System Type

- Acoustic Systems

- USBL (Ultra-Short Baseline)

- LBL (Long Baseline)

- SBL (Short Baseline)

- Inertial Navigation Systems

- FOG (Fiber Optic Gyroscope)

- MEMS (Micro-Electro-Mechanical Systems)

- Ring Laser

- Strapdown INS

- Hybrid INS/Acoustic

By Application

- Oil & Gas Exploration

- Military Activities

- Ocean Sciences & Survey

- Offshore Wind & Renewables

- Salvage & Others

By Platform

- ROVs (Remotely Operated Vehicles)

- AUVs (Autonomous Underwater Vehicles)

- Seabed Networks & Surface/Support Vessels

Regional Analysis

North America accounted for a significant share of around 36.8% in the subsea navigation and tracking market, valued at approximately USD 0.84 billion. The region’s growth is driven by extensive investments in offshore energy exploration, defense infrastructure, and maritime security, particularly in the United States.

North American companies are at the forefront of adopting advanced autonomous underwater vehicles (AUVs), remote-operated vehicles (ROVs), and integrated navigation systems utilizing AI, cloud computing, and sensor fusion technologies.

The region’s focus on deep-water exploration, oil & gas projects, and maritime research fuels continuous innovation and demand for high-precision subsea positioning and tracking solutions, making North America a pivotal player in this market.

The United States emerges as a dominant market with a valuation estimated at USD 0.84 billion and exhibiting a high CAGR of 17.2%. The U.S. market is propelled by a combination of strategic investments in offshore oil & gas, military subsea operations, and scientific research initiatives. Strong defense spending on Naval modernization, coupled with a robust offshore energy sector in the Gulf of Mexico, significantly boosts demand for sophisticated subsea navigation and tracking solutions.

Additionally, ongoing developments in autonomous underwater systems, real-time telemetry, and AI-powered analytics bolster the U.S. market’s leadership role, shaping regional and global industry standards in subsea navigation technology.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Offshore Oil and Gas Exploration

The subsea navigation and tracking market is driven by the rising offshore oil and gas exploration activities fueled by the demand for energy security and declining shallow-water reserves. Accurate positioning and navigation are crucial in deep-water exploration, subsea pipeline installation, and infrastructure monitoring. These advanced subsea systems enhance operational safety, precision, and efficiency, making them indispensable for modern offshore projects.

Furthermore, advancements in autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) that rely on precise navigation bolster demand for reliable subsea tracking technologies. The growing complexity of subsea operations requires continuous innovation in hybrid navigation systems combining acoustic and inertial sensors.

Restraint

High Capital Costs and Complex Deployment

One of the major restraints in the subsea navigation and tracking market is the high capital expenditure and complex system deployment requirements. Advanced navigation systems, particularly those integrating fiber optic gyroscopes and ultra-short baseline (USBL) positioning, involve substantial upfront investments. This limits accessibility for small contractors and research organizations without significant funding.

Deployment challenges arise from the need to operate in harsh underwater conditions characterized by high pressure, low temperature, and corrosive environments. These factors complicate maintenance and reliability, increasing the total cost of ownership and slowing adoption in cost-sensitive applications.

Opportunity

Growth in Offshore Renewable Energy Sector

The expanding offshore renewable energy sector represents a significant opportunity for subsea navigation and tracking solutions. Offshore wind farm development, tidal technologies, and wave energy projects require precise subsea positioning to ensure efficient installation, inspection, and maintenance of underwater infrastructure.

The demand for advanced navigation capabilities that can work reliably amidst strong currents and complex underwater terrains stimulates continuous innovation. Integration with AI-powered real-time monitoring and cloud-based dashboards also creates opportunities for comprehensive asset management platforms, expanding subsea navigation use cases beyond oil and gas to renewable energy and scientific research.

Challenge

Environmental Conditions and Technological Complexity

The subsea navigation and tracking market faces critical challenges from extreme underwater environmental conditions that affect system performance and durability. Saltwater corrosion, biofouling, and variable acoustic propagation conditions reduce sensor accuracy and system longevity, requiring robust design and frequent maintenance.

Technological complexity involving multi-sensor fusion, real-time data processing, and secure communication in underwater environments adds to operational difficulties. The scarcity of skilled professionals capable of managing such advanced systems further complicates wide-scale deployment and efficient operation. Managing these challenges is essential for market players aiming to maintain reliability in mission-critical subsea applications.

Competitive Analysis

Kongsberg Gruppen, Teledyne Technologies, and Sonardyne International lead the subsea navigation and tracking market with high-precision acoustic positioning and inertial navigation systems. Their technologies support offshore energy, scientific research, and naval missions where accurate underwater navigation is essential. Strong reliability, long-range capability, and real-time tracking reinforce their dominance as subsea operations become more complex and data-driven.

Exail (iXblue), EdgeTech, EvoLogics, L3Harris Technologies (Nautronix), and Ultra Maritime expand the competitive landscape with advanced tools for AUV and ROV navigation. Their solutions combine acoustic beacons, Doppler velocity logs, and hybrid tracking methods to improve performance in challenging marine environments. Rising adoption of autonomous subsea systems continues to strengthen demand for their specialized technologies.

Saab Seaeye, Fugro, and other participants contribute with integrated survey systems, underwater tracking tools, and efficient deployment solutions for offshore construction, inspection, and environmental monitoring. Their platforms emphasize multi-sensor integration and operational efficiency. Growing investment in subsea infrastructure, offshore wind, and deep-water exploration drives consistent adoption of reliable navigation and tracking systems.

Top Key Players in the Market

- Kongsberg Gruppen

- Teledyne Technologies

- Sonardyne International

- Exail (iXblue)

- EdgeTech

- EvoLogics

- L3Harris Tech nologies (Nautronix)

- Ultra Maritime

- Saab Seaeye Ltd.

- Fugro N.V.

- Others

Recent Developments

- November, 2025, Kongsberg reported a 20% revenue increase in Q2 2025 compared to the previous year. Growth was driven by defense contracts, including unmanned turret production for the U.S. Marines

- May, 2025, Teledyne Marine participated in SeaSEC Challenge 2025, showcasing integrated subsea acoustics, sonar, and autonomous vehicle communications for maritime security

Report Scope

Report Features Description Market Value (2024) USD 4.2 Bn Forecast Revenue (2034) USD 10.9 Bn CAGR(2025-2034) 10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By System Type (Acoustic Systems (USBL (Ultra-Short Baseline), LBL (Long Baseline), SBL (Short Baseline)), Inertial Navigation Systems (FOG (Fiber Optic Gyroscope), MEMS (Micro-Electro-Mechanical Systems), Ring Laser, Strapdown INS), Hybrid INS/Acoustic), By Application (Oil & Gas Exploration, Military Activities, Ocean Sciences & Survey, Offshore Wind & Renewables, Salvage & Others), By Platform (ROVs (Remotely Operated Vehicles), AUVs (Autonomous Underwater Vehicles), Seabed Networks & Surface/Support Vessels) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kongsberg Gruppen, Teledyne Technologies, Sonardyne International, Exail (iXblue), EdgeTech, EvoLogics, L3Harris Technologies (Nautronix), Ultra Maritime, Saab Seaeye Ltd., Fugro N.V., and other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Subsea Navigation and Tracking MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Subsea Navigation and Tracking MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kongsberg Gruppen

- Teledyne Technologies

- Sonardyne International

- Exail (iXblue)

- EdgeTech

- EvoLogics

- L3Harris Tech nologies (Nautronix)

- Ultra Maritime

- Saab Seaeye Ltd.

- Fugro N.V.

- Others