Global Subscription Scanning Market Size, Share, Industry Analysis Report By Component (Software, Hardware, Services), By Application(Document Management, Identity Verification, Compliance Monitoring, Fraud Detection, Others), By Deployment Mode(Cloud, On-Premises), By Enterprise Size(Small and Medium Enterprises, Large Enterprises), By End-User(BFSI,Healthcare,Retail & E-commerce,Government,IT & Telecommunications,Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 168557

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- By Component

- By Application

- By Deployment Mode

- By Enterprise Size

- By End-User

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

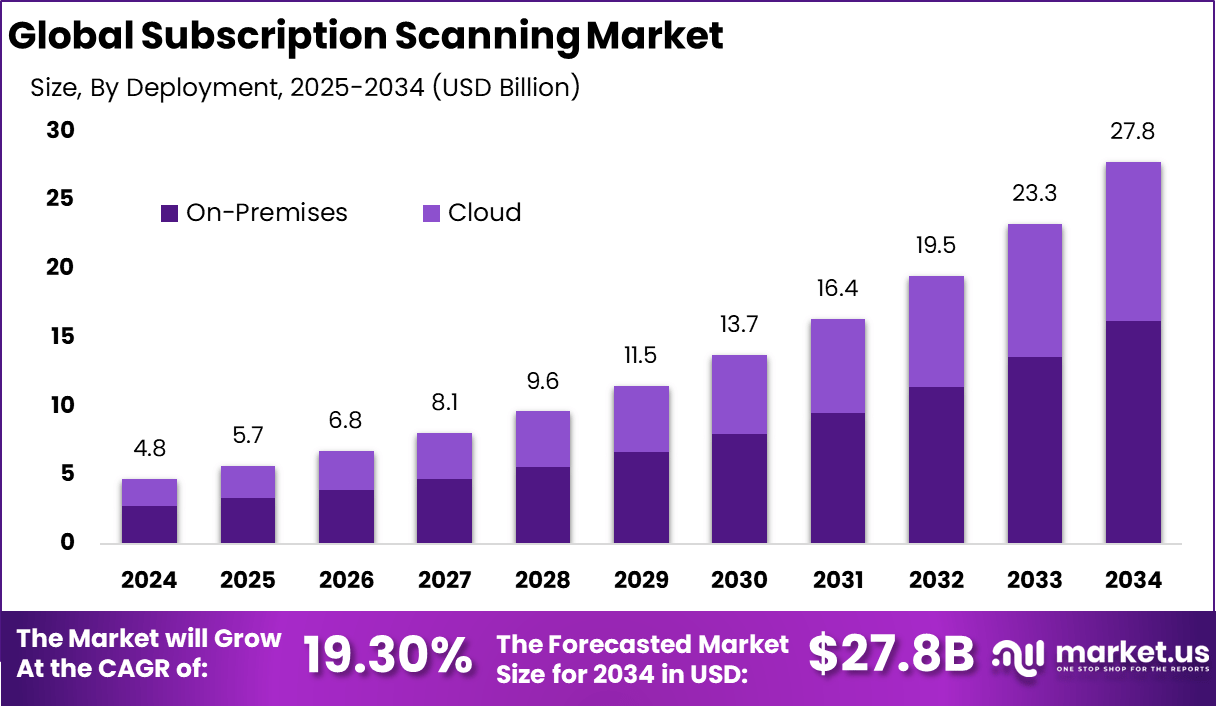

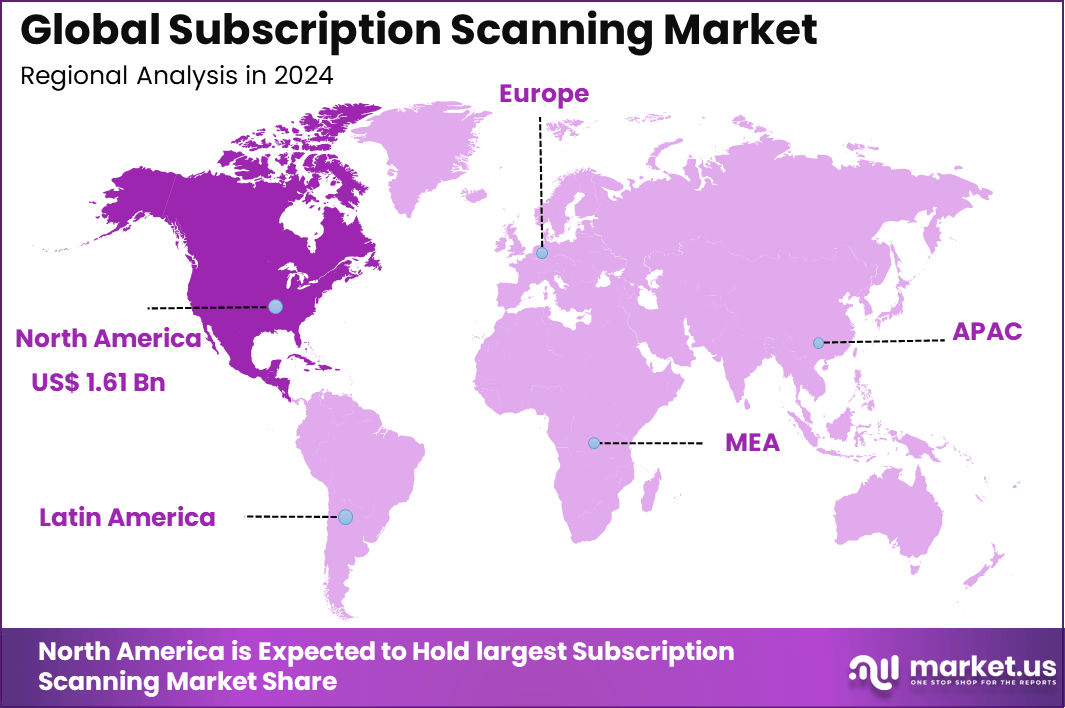

The Global Subscription Scanning Market generated USD 4.8 billion in 2024 and is predicted to register growth from USD 5.7 billion in 2025 to about USD 27.8 billion by 2034, recording a CAGR of 19.30% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 33.9% share, holding USD 1.61 Billion revenue.

The subscription scanning market has expanded as individuals and businesses rely on tools that identify, track and manage recurring payments across digital services. Growth reflects rising subscription adoption in entertainment, software, lifestyle platforms and mobile applications. These tools consolidate scattered billing information into a single view, giving users clearer financial oversight and stronger control over recurring expenses.

The growth of the market can be attributed to increasing subscription based consumption, higher digital payment activity and greater interest in financial visibility. Many users accumulate unwanted or forgotten subscriptions and seek tools that can highlight hidden costs. Businesses also face pressure to manage rising software expenses, driving adoption of scanning solutions that reduce waste and support accurate budget planning.

Demand is rising across households, freelancers, small businesses and enterprise finance teams. Consumers use subscription scanning to detect unused services, track renewal dates and avoid unexpected charges. Organisations with multiple digital tools rely on these platforms to monitor vendor contracts, eliminate duplicate licenses and standardise spending across departments. Markets with strong mobile payment usage show particularly high demand.

Key technologies supporting adoption include AI driven pattern recognition, automated billing classification, bank transaction analysis, renewal detection engines, secure account aggregation and expense dashboards. Machine learning models identify recurring patterns in payment histories and separate subscription spending from one time purchases. Real time notifications alert users before renewal, allowing proactive cancellation or adjustment.

Top Market Takeaways

- By component, hardware leads with 54.5% share, including high-speed document scanners, multifunction devices, and imaging hardware essential for high-volume subscription-based scanning services in document digitization workflows.

- By application, document management dominates with 45.6% share, driven by enterprise needs for automated capture, OCR processing, and integration with ECM systems to handle subscription contract archives, billing records, and compliance documentation.

- By deployment mode, on-premises solutions hold 58.4% share, preferred by regulated industries requiring data sovereignty, low latency processing, and integration with legacy systems despite cloud migration trends.

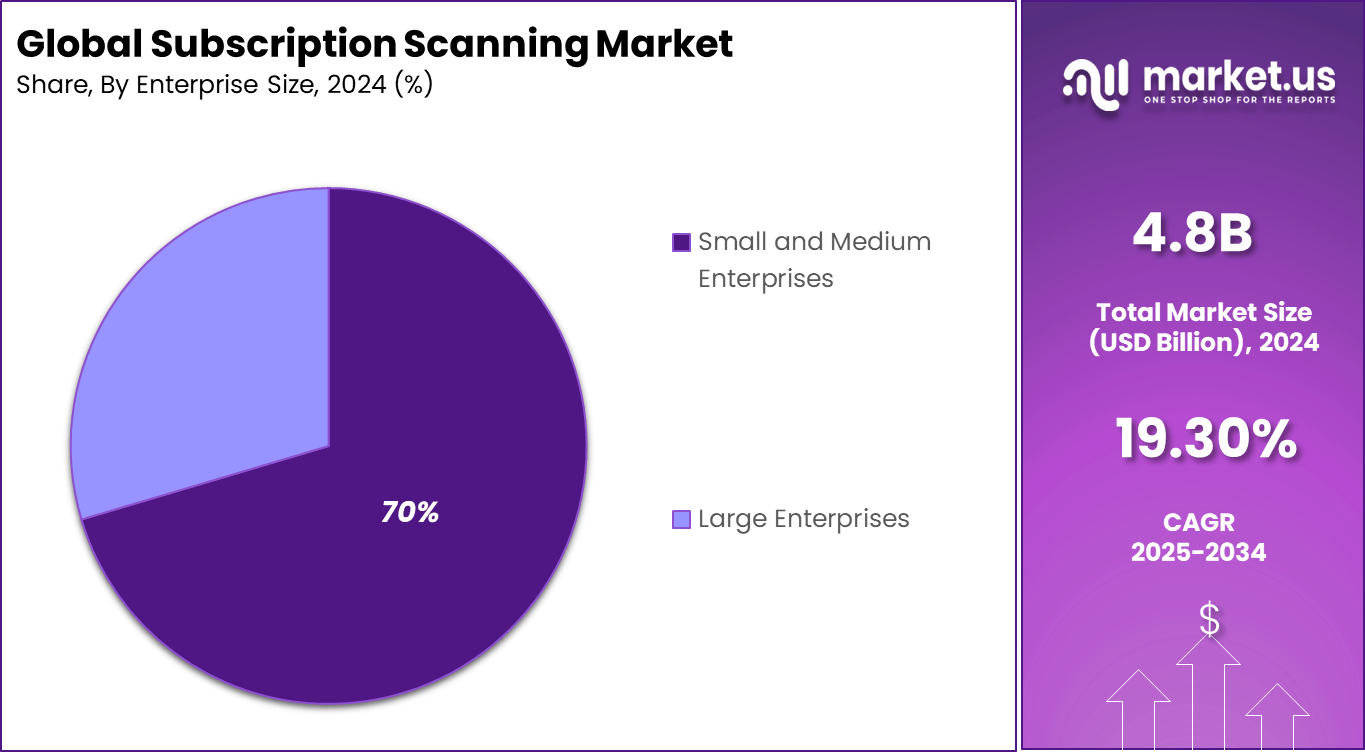

- By enterprise size, large enterprises account for 70.4% of the market, leveraging scanning hardware for massive document volumes, centralized workflows, and compliance mandates across global operations.

- By end-user, BFSI represents 36.7% share, fueled by KYC verification, loan processing, regulatory archiving, and fraud detection requiring secure, high-fidelity scanning hardware.

- Regionally, North America commands about 33.9% market share.

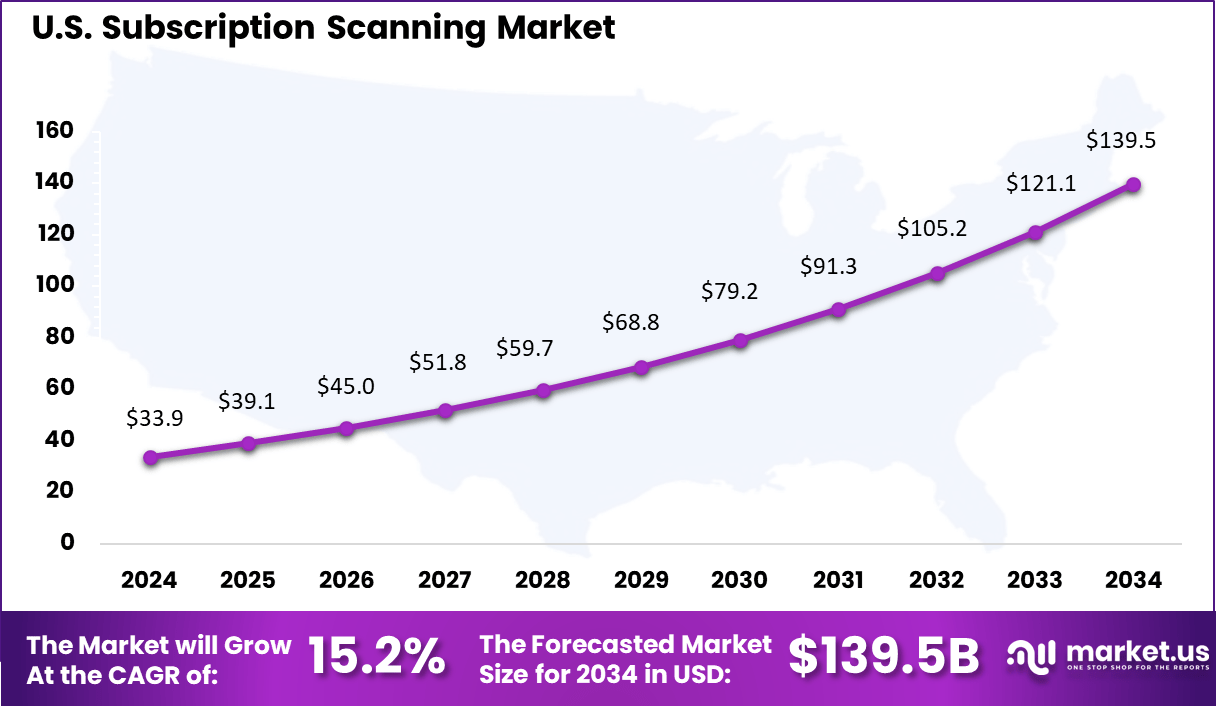

- The U.S. market size is valued at approximately USD 1.37 billion in 2025.

- The market grows at a CAGR of 15.2%, accelerated by digital transformation mandates, AI-enhanced OCR accuracy, and subscription models like scanner-as-a-service reducing capex for enterprises.

By Component

Hardware leads the subscription scanning market with a solid 54.5% share. Scanners, multifunction printers, and high-speed document feeders form the core of this segment, providing the physical foundation for capturing paper documents into digital formats essential for subscription-based services.

These devices handle bulk processing reliably, supporting industries that deal with high volumes of contracts, invoices, and forms under subscription models. Hardware durability and integration with scanning software ensure seamless workflows, making it indispensable for organizations transitioning from paper-heavy operations to digital archives.

Ongoing advancements in duplex scanning, automatic document feeders, and mobile connectivity enhance hardware’s role in modern subscription scanning. Businesses value the tactile reliability of physical devices alongside cloud upload capabilities, creating hybrid systems that balance speed with accuracy for long-term subscription management needs.

By Application

Document management captures 45.6% of the subscription scanning market, serving as the primary use case for digitizing and organizing subscription-related paperwork. This application streamlines storage, retrieval, and compliance tracking for contracts, renewals, and billing records, reducing manual filing errors and accelerating audits. Integration with workflow automation allows scanned documents to trigger subscription updates, payments, or alerts automatically, enhancing operational efficiency across departments.

The shift toward paperless offices amplifies document management’s importance, particularly for subscription-heavy sectors managing thousands of recurring agreements. Advanced OCR and indexing features turn scanned images into searchable, editable data, enabling better customer service and regulatory adherence while cutting storage costs significantly.

By Deployment Mode

On-premises deployment holds a strong 58.4% share, preferred by organizations prioritizing data control and integration with existing infrastructure. Local servers and dedicated hardware provide immediate access without internet dependency, ideal for sensitive subscription data requiring strict security protocols.

On-premises setups offer customization for high-volume scanning tailored to specific subscription workflows, ensuring uninterrupted operations even during network outages. Security-conscious enterprises favor on-premises for compliance with data sovereignty laws and reduced latency in processing.

While cloud options grow, on-premises maintains dominance through robust backup systems and seamless connectivity with legacy applications, supporting reliable scanning for mission-critical subscription processes.

By Enterprise Size

Large enterprises dominate with 70% market share, driven by their extensive document volumes and complex subscription ecosystems. These organizations deploy enterprise-grade scanners across multiple sites to handle contracts, policies, and billing at scale, integrating with ERP and CRM systems for end-to-end automation. Their substantial IT budgets enable sophisticated hardware-software combinations that support high-throughput scanning and AI-enhanced data extraction.

Large firms leverage scanning solutions to centralize document repositories, facilitating cross-departmental access and analytics for subscription lifecycle management. The need for redundancy, advanced security, and custom integrations reinforces their leadership, setting benchmarks for efficiency in document-intensive operations.

By End-User

The BFSI sector accounts for 36.7% of the subscription scanning market, reflecting its heavy reliance on digitized documents for loans, insurance policies, and recurring financial services. Banks and insurers use high-volume scanners to process membership agreements, KYC forms, and payment authorizations swiftly, ensuring compliance with strict regulatory standards.

Scanning technology accelerates customer onboarding and renewal cycles, minimizing delays in subscription activations. BFSI’s focus on fraud prevention and audit trails drives adoption of secure, traceable scanning solutions. Integration with core banking systems allows real-time data flow from scans to subscription databases, enhancing service delivery while maintaining data integrity across vast customer portfolios.

Key Reasons for Adoption

- Teams keep signing up for SaaS tools on their own, creating shadow IT that IT can’t track, so scanning helps spot these hidden subscriptions before they cause problems.

- Budgets are getting squeezed with average companies running dozens of unused licenses, and scanning uncovers waste to cut costs right away.

- Compliance rules like GDPR push firms to know every app handling data, and subscription scanning makes audits straightforward.

- Remote work exploded usage of unapproved apps, up to 85% in small businesses, forcing leaders to scan for security gaps.

- Finance wants control over spend, as decentralized buying hides renewals and duplicates across departments.

Benefits

- Full visibility into all subscriptions cuts overspend by spotting unused seats and negotiating better deals.

- Automated discovery of shadow IT reduces breach risks from risky apps employees grab without checks.

- Real-time alerts on renewals and usage drops help retain value and avoid surprise bills.

- Better license optimization frees up cash, with tools showing exactly who’s using what.

- Compliance gets easier with reports proving data controls across 80+ app attributes.

Usage

- Firms pair scanning with AI to auto-detect anomalies like new logins or odd data flows in SaaS stacks.

- Centralized dashboards track spend and risk scores, popular in 73% of orgs chasing consolidated views.

- Regular scans, often weekly, flag shadow AI tools alongside traditional apps for proactive cleanup.

- Integration with procurement tools automates approvals, cutting manual reviews by half in growing teams.

- Focus shifts to predictive churn signals from usage data, helping finance forecast MRR accurately.

Emerging Trends

Key Trends Description AI and Automation Integration Use of AI and automation to optimize subscription management, reduce churn, and personalize user experience. Sustainability Focus Increasing demand for eco-friendly packaging, circular economy practices, and sustainable fulfillment methods. Hyper-Personalization Leveraging advanced data analytics for highly customized product recommendations and subscription plans. Bundling and Aggregation Combining products and services into bundles to add value and improve customer retention. Expansion of Digital Payment Methods Adoption of diverse and secure payment solutions enhancing subscriber convenience and reducing friction. Growth Factors

Key Factors Description Growing Digital Business Models Proliferation of online subscriptions across media, retail, software, and services boosting market expansion. Rising Consumer Preference for Convenience Demand for hassle-free, predictable shopping experiences driving subscription service adoption. Technological Advancements Innovations in AI, machine learning, and cloud technologies enhancing platform scalability and analytics. Expansion into Emerging Markets Increasing internet penetration and smartphone adoption in emerging economies fueling growth opportunities. Investment and Competitive Landscape Increasing investments and new entrants intensifying innovation and market competition. Key Market Segments

By Component

- Software

- Hardware

- Services

By Application

- Document Management

- Identity Verification

- Compliance Monitoring

- Fraud Detection

- Others

By Deployment Mode

- Cloud

- On-Premises

- By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By End-User

- BFSI

- Healthcare

- Retail & E-commerce

- Government

- IT & Telecommunications

- Others

Regional Analysis

North America captured a leading 33.9% share of the global subscription scanning market, driven by widespread adoption of subscription management tools across SaaS, media, and e-commerce sectors. The region’s advanced digital infrastructure and high consumer reliance on recurring billing models accelerate demand for scanning solutions that optimize billing cycles, detect anomalies, and ensure compliance.

Enterprises leverage AI-powered scanning for real-time visibility into subscription health, churn prediction, and revenue optimization, supported by robust regulatory frameworks emphasizing data security and transparency.

The U.S. dominates within North America, valued at approximately USD 1.37 billion in 2024 and growing at a robust CAGR of 15.2%. This expansion reflects strong enterprise focus on subscription analytics amid rising SaaS proliferation and e-commerce subscription models, with providers enhancing scanning capabilities for fraud detection and usage tracking.

Leading platforms integrate seamlessly with CRM and billing systems, catering to diverse industries from streaming to software services. The U.S. market’s maturity and innovation ecosystem position it as the primary growth driver for North American subscription scanning adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rise of digital business models and expanding enterprise data

The growth of the Subscription Scanning Market is being supported by a widespread shift toward digital business models and the continuous expansion of enterprise data. As organizations increasingly migrate operations, records, and workflows to digital formats, there emerges a growing volume of data assets and digital infrastructure needing regular scanning and monitoring.

This escalation in digital assets makes subscription-based scanning solutions attractive because they enable ongoing scanning, updates, and maintenance without requiring large upfront investments. The recurring subscription model aligns well with enterprises’ need to continuously protect growing and evolving digital environments.

Restraint

Limited awareness and definition ambiguity

One restraint affecting the adoption of subscription-scanning services is uncertainty about what exactly constitutes “subscription scanning”, combined with limited awareness among potential users. Because the term does not appear widely standardized, many enterprises may hesitate to procure such services due to lack of clarity on scope, coverage, and benefits.

This ambiguity can reduce buyer confidence and slow down adoption – particularly among smaller organizations that lack dedicated IT security or compliance functions. The lack of a clearly defined market category may thus limit wider uptake in the near term.

Opportunity

Demand for regular vulnerability assessments and managed scanning services

An opportunity for the Subscription Scanning Market arises from the increasing demand for regular vulnerability assessments and managed scanning services across industries. As enterprises adopt more cloud-based applications, third-party tools, and interconnected systems, the complexity and frequency of security exposures grow.

Subscription scanning services that offer periodic, automated scanning and updates can help firms maintain security hygiene without needing in-house scanning infrastructure or expertise. This is particularly appealing to small and medium-size businesses that seek professional scanning support without heavy capital expenditure.

Challenge

Strong competition from broader security platforms

A major challenge for subscription scanning providers is strong competition from full scale vulnerability management and security platforms. Many enterprises prefer platforms that combine scanning, patching, compliance tracking and threat insights in one place.

These integrated tools reduce the need for separate scanning subscriptions, which makes it difficult for standalone scanning services to stand out. Unless subscription scanning providers offer clear differentiation in simplicity, cost or specialized focus, they may face difficulty gaining wider adoption.

Competitive Analysis

Adobe, ABBYY, Kofax, Canon, and Xerox lead the subscription scanning market with advanced cloud-enabled document capture platforms designed for continuous, high-volume digitization. Their solutions support automated OCR, classification, and secure storage for enterprise workflows. These companies focus on accuracy, scalability, and seamless integration with business applications.

Epson, Fujitsu, Brother, HP, Kodak Alaris, Ricoh, Lexmark, and Nuance strengthen the competitive landscape with reliable scanning hardware paired with subscription software for workflow automation. Their platforms offer multi-device synchronization, encrypted uploads, and AI-based extraction tools. These providers help organizations streamline information capture, reduce manual errors, and improve document accessibility.

Scanbot SDK, DocuWare, PaperScan, Hyland, IRIS, OpenText, DocuSign, and others broaden the market with specialized mobile scanning, e-signature integration, and cloud workflow solutions. Their offerings target businesses seeking lightweight, API-driven capture capabilities for apps and customer portals. These companies prioritize easy deployment, strong data security, and customizable workflows.

Top Key Players in the Market

- Adobe Inc.

- ABBYY

- Kofax Inc.

- Canon Inc.

- Xerox Corporation

- Epson America, Inc.

- Fujitsu Ltd.

- Brother Industries, Ltd.

- HP Inc.

- Kodak Alaris

- Ricoh Company, Ltd.

- Lexmark International, Inc.

- Nuance Communications, Inc.

- Scanbot SDK (doo GmbH)

- DocuWare GmbH

- PaperScan (ORPALIS)

- Hyland Software, Inc.

- IRIS S.A.

- OpenText Corporation

- DocuSign, Inc.

- Others

Future Outlook

The subscription scanning market is expected to grow steadily owing to increasing digital transformation initiatives across industries aiming to reduce paper usage, enhance data management, and improve document accessibility.

The growing emphasis on cloud-based and AI-powered scanning solutions to streamline operations in sectors such as healthcare, legal, and finance boosts demand. Additionally, the rise in remote work and the need for secure, compliant digital recordkeeping support market expansion, especially in emerging economies with increasing digitization efforts.

Opportunities lie in

- Adoption of AI and machine learning to improve scanning accuracy and automate data extraction processes.

- Growing demand for cloud-based subscription models for scalable and flexible document scanning solutions.

- Increasing need for secure digital archiving and compliance with regulations like GDPR and HIPAA.

- Expansion of remote workforce driving demand for accessible and centralized document management systems.

- Emerging markets embracing digital workflows and paperless initiatives, creating new customer segments.

Recent Developments

- November, 2025, Adobe expanded its Acrobat subscription offerings for students and teachers, providing enhanced PDF editing, e-signature, and web form capabilities with subscription flexibility and cloud integration

- March, 2025, ABBYY enhanced its FineReader PDF and Business Card Reader mobile apps with subscription-based in-app services, using advanced AI for OCR and document capture analytics to improve user experience

Report Scope

Report Features Description Market Value (2024) USD 4.8 Bn Forecast Revenue (2034) USD 27.8 Bn CAGR(2025-2034) 19.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component(Software,Hardware,Services)By Application(Document Management,Identity Verification,Compliance Monitoring,Fraud Detection,Others)By Deployment Mode(Cloud,On-Premises)By Enterprise Size(Small and Medium Enterprises,Large Enterprises)By End-User(BFSI,Healthcare,Retail & E-commerce,Government,IT & Telecommunications,Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe Inc., ABBYY, Kofax Inc., Canon Inc., Xerox Corporation, Epson America, Inc., Fujitsu Ltd., Brother Industries, Ltd., HP Inc., Kodak Alaris, Ricoh Company, Ltd., Lexmark International, Inc., Nuance Communications, Inc., Scanbot SDK (doo GmbH), DocuWare GmbH, PaperScan (ORPALIS), Hyland Software, Inc., IRIS S.A., OpenText Corporation, DocuSign, Inc., and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Subscription Scanning MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

Subscription Scanning MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe Inc.

- ABBYY

- Kofax Inc.

- Canon Inc.

- Xerox Corporation

- Epson America, Inc.

- Fujitsu Ltd.

- Brother Industries, Ltd.

- HP Inc.

- Kodak Alaris

- Ricoh Company, Ltd.

- Lexmark International, Inc.

- Nuance Communications, Inc.

- Scanbot SDK (doo GmbH)

- DocuWare GmbH

- PaperScan (ORPALIS)

- Hyland Software, Inc.

- IRIS S.A.

- OpenText Corporation

- DocuSign, Inc.

- Others