Global Subscription E-Commerce Market Size, Share Analysis Report By Subscription Type (Product Subscription, Service Subscription, Digital Subscription, Membership Subscription), By Industry (Retail, Entertainment, Food and Beverage, Health and Wellness, Others), By Payment Frequency (Monthly, Quarterly, Annually), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153198

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

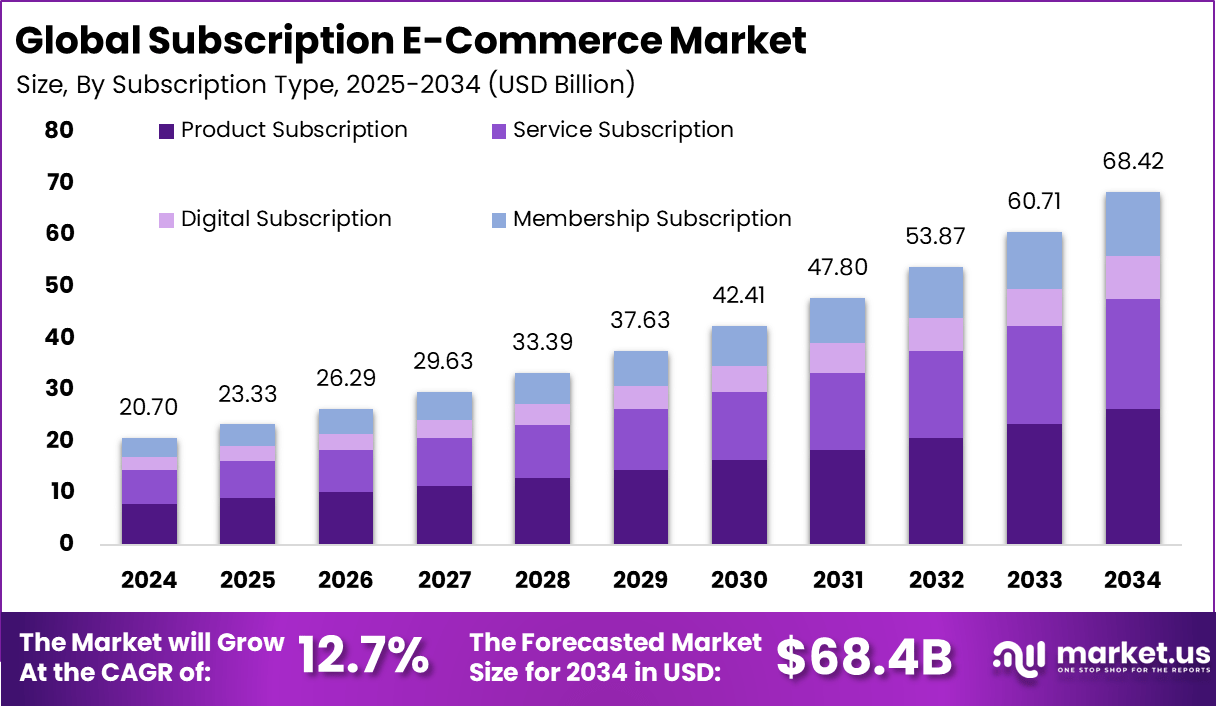

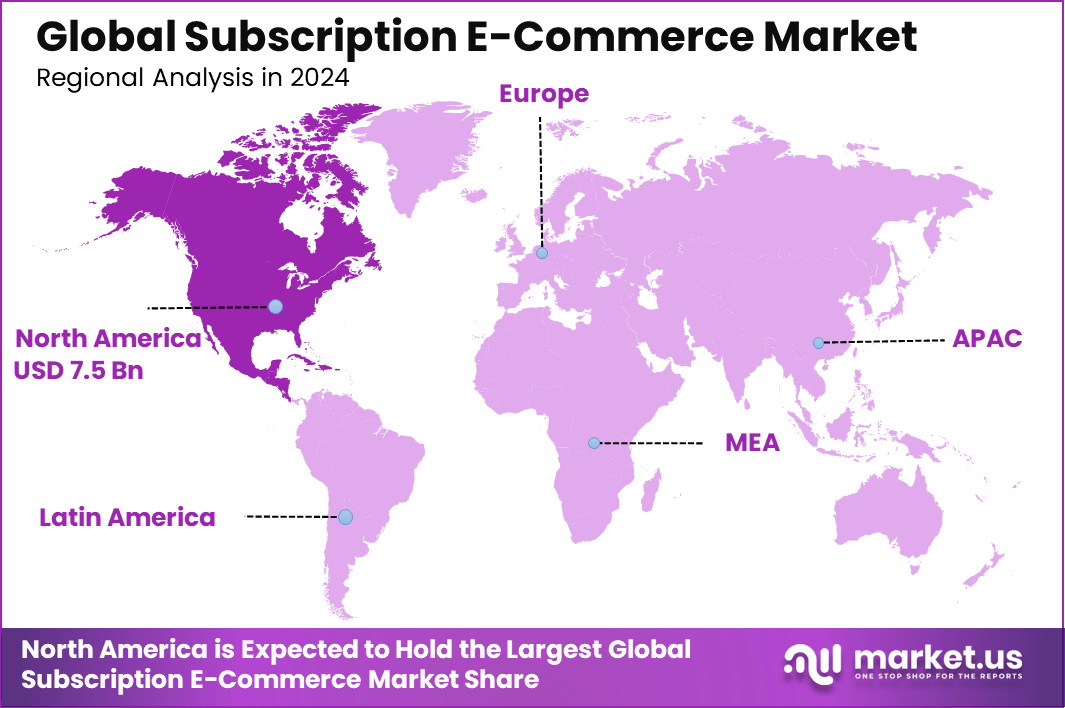

The Global Subscription E-Commerce Market size is expected to be worth around USD 68.42 Billion By 2034, from USD 20.7 billion in 2024, growing at a CAGR of 12.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.5% share, holding USD 7.5 Billion revenue.

Subscription e-commerce is a digital business model where customers sign up to receive products or services on a recurring basis, often monthly or quarterly. This approach emphasizes consistent, convenient delivery tailored to individual preferences. Users benefit from seamless service, often with personalized selections and the comfort of automatic renewals. The system suits both tangible goods and digital content, supporting everything from groceries and cosmetics to streaming content and learning platforms.

One of the top driving factors behind the growth of this market is consumer preference for convenience. Automated deliveries reduce the need for repeated ordering, saving both time and effort. Additionally, advancements in personalization technologies help providers tailor offerings based on customer behavior, which enhances satisfaction and loyalty. Economic factors such as competitive pricing and exclusive subscriber discounts also support growth.

According to Market.us, According to Market.us, the Global E-commerce Market is projected to reach USD 151.5 Trillion by 2034, rising from USD 28.29 Trillion in 2024, expanding at a CAGR of 18.29% during the forecast period from 2025 to 2034. Meanwhile, the AI in E-commerce Market is anticipated to attain a value of USD 50.98 Billion by 2033, up from USD 5.79 Billion in 2023, progressing at a CAGR of 24.3% between 2024 and 2033.

For instance, In February 2025, Amazon introduced an AI-powered predictive subscription model, designed to enhance user convenience by analyzing individual consumption patterns. This system enables users to adjust delivery schedules dynamically, based on real-time usage data and behavioral trends. The model applies machine learning to predict when a product will run out, reducing waste and ensuring timely replenishment.

Scope and Forecast

Report Features Description Market Value (2024) USD 20.7 Bn Forecast Revenue (2034) USD 68.42 Bn CAGR (2025-2034) 12.7% Largest market in 2024 North America [36.5% market share] Key Insight Summary

- The global subscription e-commerce market is projected to grow from USD 20.7 billion in 2024 to approximately USD 68.42 billion by 2034, registering a healthy CAGR of 12.7% during 2025–2034, supported by rising consumer preference for convenience and personalized shopping experiences.

- In 2024, North America held a leading position with over 36.5% market share, generating about USD 7.5 billion, driven by widespread digital adoption and mature e-commerce infrastructure.

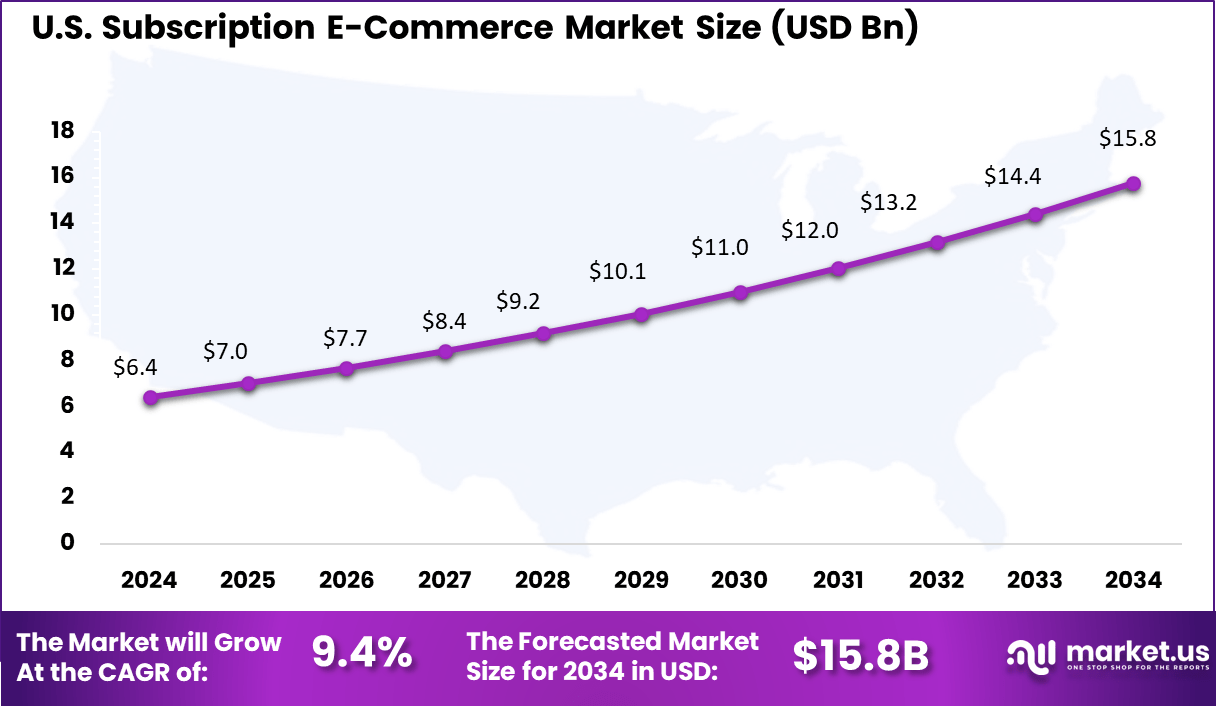

- Within North America, the U.S. contributed USD 6.42 billion in 2024, with an expected CAGR of 9.4%, reflecting strong demand for curated and recurring delivery services.

- By subscription type, product subscriptions accounted for 38.6% share, fueled by consumer interest in regular delivery of goods such as food, personal care, and household items.

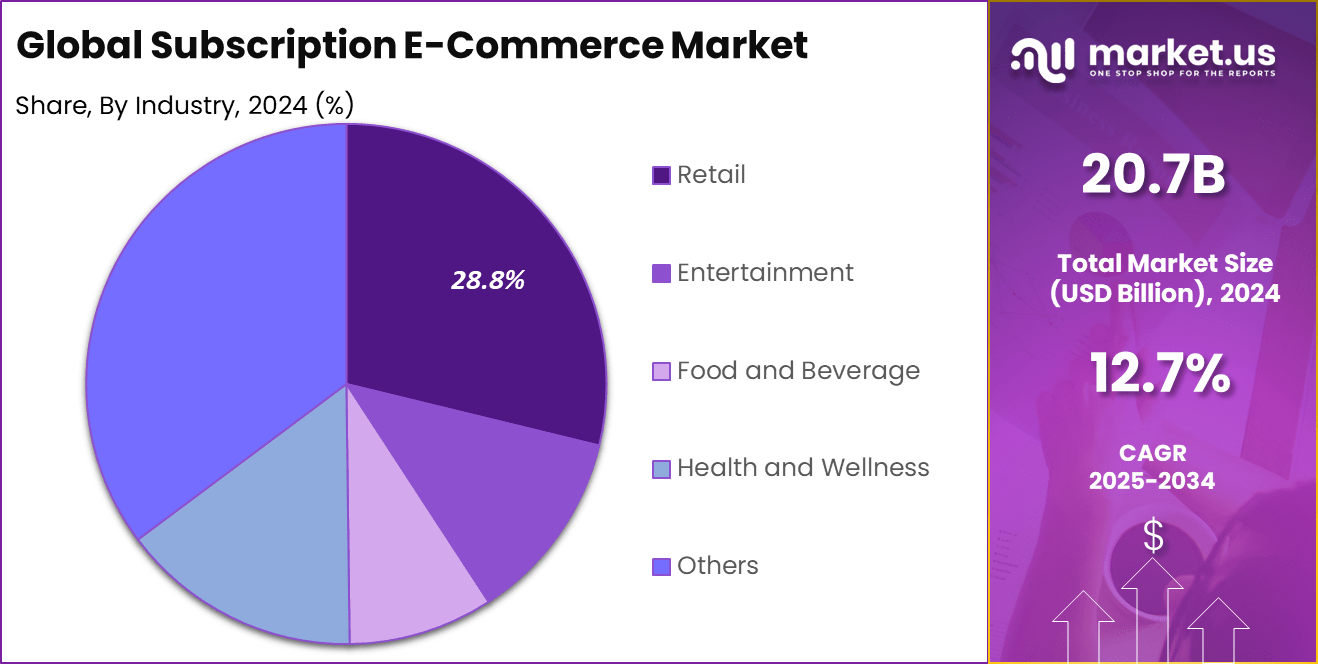

- By industry, retail led the market with 28.8% share, as brands increasingly leverage subscriptions to build customer loyalty and predictability in revenue.

- By payment frequency, monthly subscriptions dominated with a 48.7% share, indicating consumer preference for flexible, short-term commitments over longer billing cycles.

US Market Size

The U.S. Subscription E-Commerce Market was valued at USD 6.4 Billion in 2024 and is anticipated to reach approximately USD 15.8 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 9.4% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 36.5% share, holding USD 7.5 billion revenue in the subscription e-commerce market. This leadership can be attributed to the region’s early digital adoption, advanced payment infrastructure, and well-established e-commerce ecosystem.

The presence of tech-savvy consumers with high disposable income has supported widespread acceptance of recurring service models across a variety of sectors, including food, fashion, health, and entertainment. Moreover, North American companies have heavily invested in AI-driven personalization tools, which have enhanced customer satisfaction and reduced churn, reinforcing platform loyalty.

By Subscription Type

In 2024, the Product Subscription segment held a significant position in the global subscription e-commerce market, capturing approximately 38.6% of the total share. This strong foothold can be attributed to evolving consumer preferences for convenience and recurring deliveries of frequently used products – ranging from personal care and grooming items to food kits and household essentials.

Product subscriptions simplify shopping by automating repeat purchases, which appeals to busy lifestyles and provides a sense of reliability. The popularity of product subscriptions is further bolstered by advancements in technology and data analytics, enabling companies to deliver highly personalized experiences.

As a result, customers are more likely to stay engaged with brands that predict their needs and offer tailored recommendations, supporting both retention and recurring revenue models. With platforms increasingly adopting automated curation and flexible options, the product subscription model continues to thrive as a cornerstone of the subscription e-commerce landscape.

By Industry

In 2024, the Retail industry emerged as a dominant sector in the subscription e-commerce market, accounting for 28.8% of the market share. Retailers are leveraging subscription models to build stronger, ongoing relationships with customers while ensuring steady cash flow and enhanced inventory management.

Through subscription services – such as curated fashion boxes, pet supplies, and wellness kits – retailers can differentiate themselves in a crowded market and drive repeat purchases. The rise of the retail segment is closely tied to its ability to offer customized product selections, exclusive member discounts, and convenience for consumers looking for regular access to their favorite items.

With leading market players like Amazon and Walmart expanding their subscription offerings, retail subscriptions are increasingly seen as a strategic avenue to foster brand loyalty and sustain business growth in a competitive e-commerce arena.

By Payment Frequency

Monthly payment frequencies held the largest share in 2024, comprising 48.7% of all subscriptions in the market. This prevalence reflects consumer comfort with predictable expenses and the psychological ease of making smaller, recurrent payments rather than larger lump sums.

The monthly payment model lowers the barrier to entry for new subscribers, enabling them to try services without a significant upfront commitment. For businesses, monthly billing supports frequent customer engagement and offers greater flexibility to introduce new features, promotions, or product updates.

This structure is well-suited to a digital-savvy audience seeking convenience, and it facilitates adaptive pricing strategies that cater to varying budgets. As a result, the monthly subscription model remains a preferred choice for both providers and consumers, fueling the ongoing expansion of the subscription e-commerce marketplace.

Key Market Segments

By Subscription Type

- Product Subscription

- Service Subscription

- Digital Subscription

- Membership Subscription

By Industry

- Retail

- Entertainment

- Food and Beverage

- Health and Wellness

- Others

By Payment Frequency

- Monthly

- Quarterly

- Annually

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

An emerging trend in the subscription e-commerce market is the increasing use of artificial intelligence to personalize customer experiences. Subscription platforms are leveraging AI-driven algorithms to analyze consumer behavior, purchase history, and preferences to deliver highly tailored product recommendations and dynamic pricing models. This trend is enhancing customer satisfaction and retention by creating a more engaging and relevant shopping experience that aligns with individual needs and lifestyles.

Driver

The growth of subscription e-commerce is primarily driven by the rising consumer preference for convenience and curated experiences. Customers are increasingly attracted to the ease of automated deliveries, predictable costs, and the element of discovery that subscription boxes often offer. This shift in buying behavior reflects a broader move toward services that save time and reduce decision fatigue, making subscription models an appealing alternative to traditional retail shopping.

Restraint

One of the key restraints facing the subscription e-commerce sector is high churn rates due to customer fatigue and lack of perceived value over time. Many consumers cancel subscriptions after a few cycles if the products fail to meet expectations or if they no longer see the benefit in continued payments. This challenge puts pressure on businesses to continuously innovate, refresh their offerings, and maintain high engagement levels to retain customers.

Opportunity

Significant opportunities exist in expanding subscription e-commerce into underserved product categories and emerging markets. Areas such as eco-friendly products, locally sourced goods, and wellness services present untapped potential for differentiation.

Additionally, increasing internet penetration in developing regions provides a growing customer base for businesses willing to adapt their offerings to local tastes and preferences, opening new revenue streams and fostering brand loyalty.

Challenge

A critical challenge in subscription e-commerce is managing supply chain complexities and ensuring timely, consistent deliveries. Fluctuations in demand, inventory shortages, and logistical constraints can lead to customer dissatisfaction and reputational damage. Companies are under pressure to invest in robust supply chain management and transparent communication strategies to mitigate disruptions and maintain service quality in a highly competitive environment.

Key Player Analysis

Amazon.com Inc., Netflix Inc., and Hulu, LLC lead the subscription e-commerce market by offering bundled services, exclusive content, and seamless user experiences. Their strong digital platforms and personalization features help retain users and drive recurring revenue.

Dollar Shave Club, BarkBox, and Stitch Fix, Inc. focus on lifestyle and grooming with curated boxes and personalized plans. They attract niche audiences by offering convenience, product variety, and regular doorstep delivery that fits modern consumer routines.

Blue Apron, Scribd Inc., Cratejoy, and others strengthen the market through food kits, digital reading, and specialized boxes. Their tech-driven models and flexible subscriptions boost engagement and long-term brand loyalty.

Top Key Players Covered

- Amazon.com Inc.

- Blue Apron Holdings

- Dollar Shave Club

- Farmhouse Delivery

- Netflix Inc.

- Personalized Beauty Discovery Inc.

- Stitch Fix, Inc.

- BarkBox

- Blue Apron Holdings, Inc.

- Hulu, LLC

- Scribd Inc.

- Cratejoy

- Other Major Players

Recent Developments

- In May 2025, Naver Corp. moved to add Spotify to its shopping membership, following its earlier tie-up with Netflix in November 2024. This expansion signals a clear push to strengthen content offerings and challenge e-commerce rival Coupang through global partnerships.

- In September 2024, YouTube and Shopee launched a new shopping feature in Indonesia, allowing users to buy products seen in videos directly through Shopee links. This marks a strategic move to compete with TikTok in Southeast Asia’s fast-growing social commerce market.

- In June 2024, Amazon introduced a USD 5/month pharmacy subscription for Medicare users, aiming to simplify access to medications and boost its role in U.S. healthcare services.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Subscription Type (Product Subscription, Service Subscription, Digital Subscription, Membership Subscription), By Industry (Retail, Entertainment, Food and Beverage, Health and Wellness, Others), By Payment Frequency (Monthly, Quarterly, Annually) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon.com Inc., Blue Apron Holdings, Dollar Shave Club, Farmhouse Delivery, Netflix Inc., Personalized Beauty Discovery Inc., Stitch Fix, Inc., BarkBox, Blue Apron Holdings, Inc., Hulu, LLC, Scribd Inc., Cratejoy, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Subscription E-Commerce MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Subscription E-Commerce MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon.com Inc.

- Blue Apron Holdings

- Dollar Shave Club

- Farmhouse Delivery

- Netflix Inc.

- Personalized Beauty Discovery Inc.

- Stitch Fix, Inc.

- BarkBox

- Blue Apron Holdings, Inc.

- Hulu, LLC

- Scribd Inc.

- Cratejoy

- Other Major Players