Global Styrene Copolymer Market Size, Share Analysis Report By Polymer Type (Acrylonitrile-Butadiene-Styrene (ABS), Styrene-Acrylonitrile (SAN)), By End-User (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163519

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

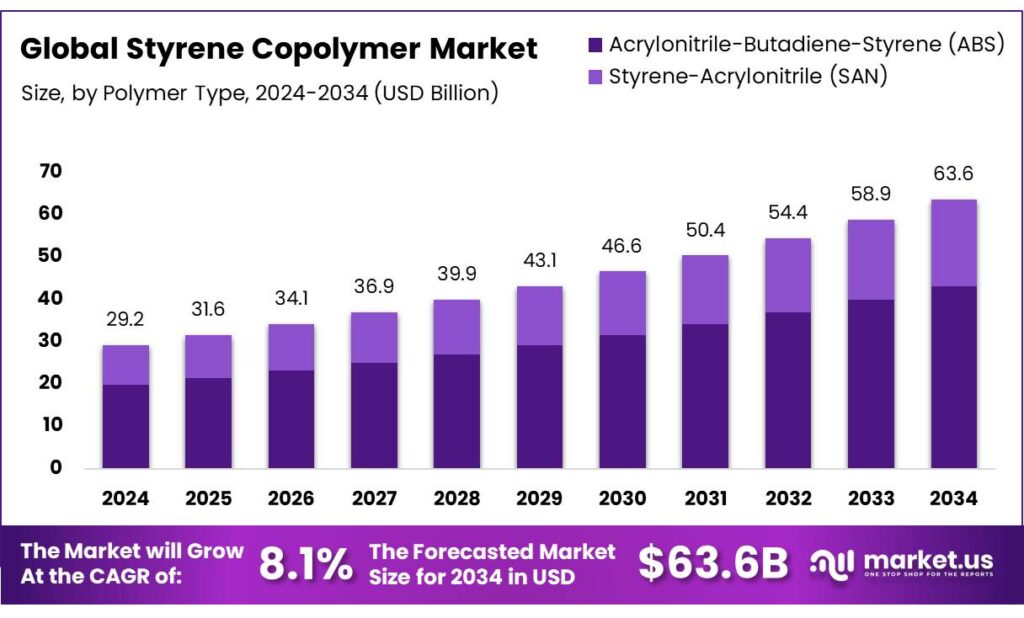

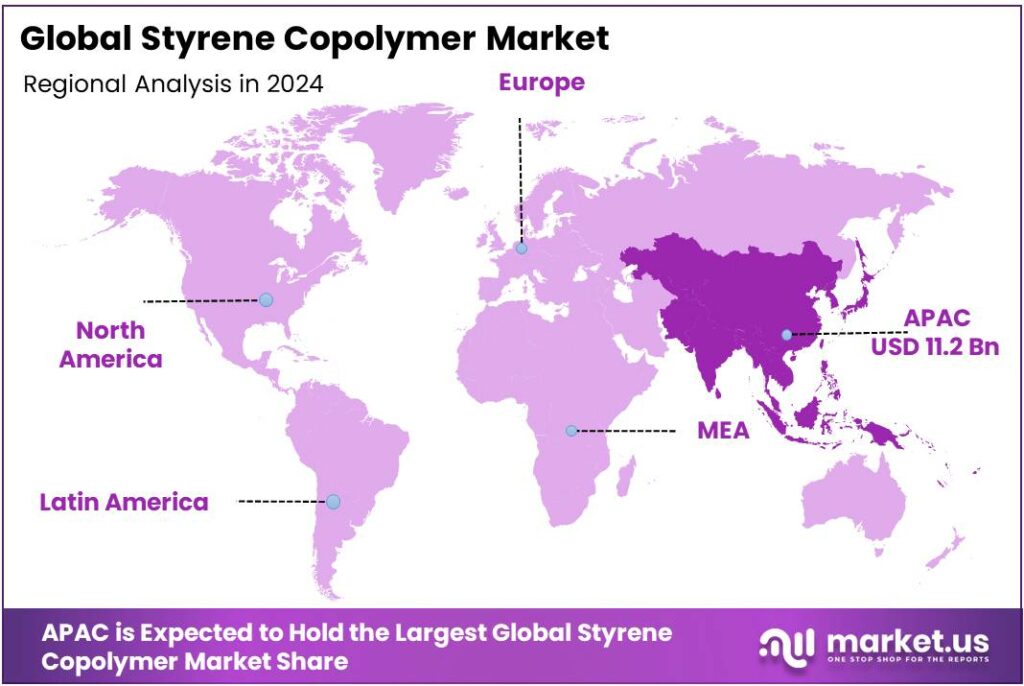

The Global Styrene Copolymer Market size is expected to be worth around USD 63.6 Billion by 2034, from USD 29.2 Billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 38.60% share, holding USD 11.2 Billion in revenue.

Styrene copolymers—principally ABS, SAN, and styrenic block copolymers (SBS/SEBS)—sit at the intersection of performance, processability, and cost, serving automotive interiors, E&E housings, medical disposables, toys, and rigid/foamed packaging. Their demand is tethered to broader plastics fundamentals and petrochemical feedstock trends. Global plastics production reached 400.3 million tonnes in 2022, underscoring the scale of polymer value chains into which styrenics are integrated.

Petrochemicals are set to account for over one-third of oil-demand growth by 2030 and nearly half by 2050, adding ~7 million barrels/day by mid-century; they are also poised to consume an additional 56 billion m³ of natural gas by 2030, reinforcing the sector’s sensitivity to oil/natural-gas balances. Within manufacturing, the chemical industries are the most feedstock-intensive and, counting both fuel and feedstock uses, account for ~29% of U.S. manufacturing energy consumption, highlighting the energy intensity that influences styrenics cost curves and plant competitiveness.

Demand pull for styrene copolymers comes from mobility and electronics. As automakers lightweight cabins and integrate ADAS displays, ABS/SAN and SEBS soft-touch blends benefit from higher content per vehicle, especially in electric cars where mass and thermal management matter. In 2023, electric-car sales neared 14 million, with China, Europe, and the United States accounting for ~95%—a structural driver for interior and exterior polymer applications compatible with high-voltage architectures and flame-retardant requirements. At the same time, the sheer scale of plastics markets frames downstream opportunity: OECD analysis reports plastics production and use at 435 million tonnes in 2020, with volumes expected to continue rising—keeping pressure on durable, high-flow engineering resins like styrenics.

Policy and sustainability vectors are increasingly material. Europe’s Packaging and Packaging Waste Regulation (PPWR) sets packaging reduction targets of 5% by 2030, 10% by 2035, and 15% by 2040, alongside design-for-recyclability and empty-space caps—nudging converters toward mono-material, easy-to-sort styrenic solutions and recycled-content integration where technically feasible. For producers, energy-efficiency and electrification initiatives matter as well: DOE/NREL footprints based on EIA’s MECS data spotlight sizable efficiency gaps across manufacturing, guiding debottlenecking and heat-integration projects that improve polymer plant margins through lower specific energy use.

Key Takeaways

- Styrene Copolymer Market size is expected to be worth around USD 63.6 Billion by 2034, from USD 29.2 Billion in 2024, growing at a CAGR of 8.1%.

- Acrylonitrile-Butadiene-Styrene (ABS) held a dominant market position, capturing more than a 67.9% share.

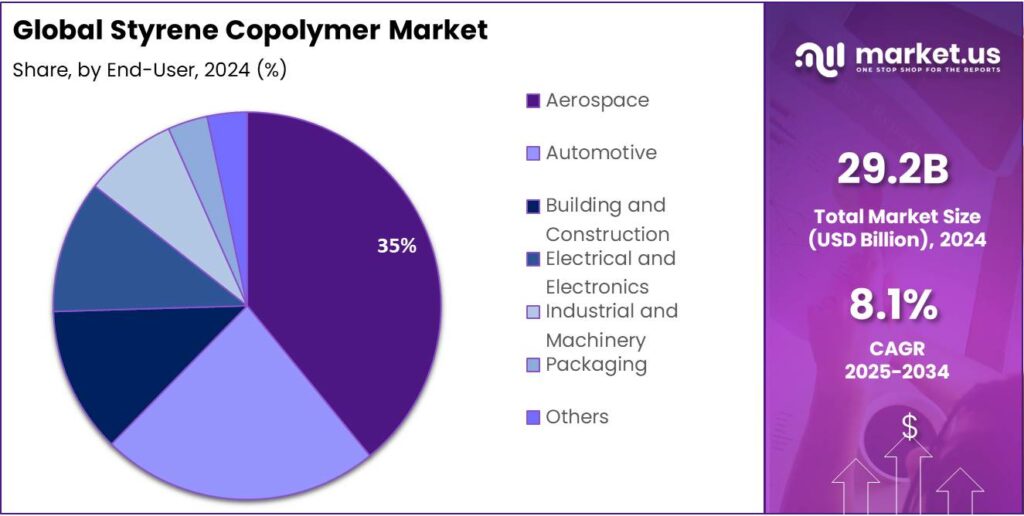

- Aerospace held a dominant market position, capturing more than a 35.3% share of the global styrene copolymer market.

- Asia-Pacific (APAC) region was the dominant regional market for styrene copolymers, accounting for 38.60% of global demand and representing an estimated USD 11.2 billion.

By Polymer Type Analysis

Acrylonitrile-Butadiene-Styrene (ABS) Leads the Segment with 67.9% Market Share in 2024

In 2024, Acrylonitrile-Butadiene-Styrene (ABS) held a dominant market position, capturing more than a 67.9% share of the global styrene copolymer market. This leadership was primarily attributed to its wide applicability across automotive, electronics, consumer goods, and construction industries. The material’s superior toughness, dimensional stability, and glossy finish have made it a preferred choice for manufacturing durable components such as dashboards, instrument panels, appliance housings, and protective casings.

In industrial terms, ABS demand witnessed consistent expansion during 2024, supported by the recovery of the global automotive industry and rising consumer electronics production. According to industry statistics, global automotive output rebounded by nearly 5% in 2024, strengthening the consumption of ABS-based interior and exterior components. Additionally, the rising shift toward lightweight and impact-resistant materials in electric vehicles further reinforced ABS utilization, as it offers an optimal balance between strength and design flexibility.

By End-User Analysis

Aerospace Dominates with 35.3% Market Share in 2024 Owing to High Demand for Lightweight Polymers

In 2024, Aerospace held a dominant market position, capturing more than a 35.3% share of the global styrene copolymer market. This strong presence was largely driven by the increasing demand for lightweight, durable, and heat-resistant materials used in aircraft manufacturing and interior design. Styrene-based copolymers, particularly Acrylonitrile-Butadiene-Styrene (ABS) and Styrene-Acrylonitrile (SAN), have become essential materials in aerospace applications such as cabin panels, seat frames, ventilation systems, and storage components, offering an ideal balance between strength, rigidity, and weight reduction.

Global aircraft production rose steadily due to rising air travel demand and fleet modernization initiatives by leading airlines. According to the International Air Transport Association (IATA), global passenger air traffic grew by nearly 16% year-on-year in 2024, reinforcing aircraft manufacturing activities and, in turn, boosting the consumption of high-performance polymers like styrene copolymers. The preference for materials that can withstand high stress, vibrations, and fluctuating temperatures without compromising safety or aesthetics further enhanced ABS and SAN adoption in the aerospace sector.

Key Market Segments

By Polymer Type

- Acrylonitrile-Butadiene-Styrene (ABS)

- Styrene-Acrylonitrile (SAN)

By End-User

- Aerospace

- Automotive

- Building and Construction

- Electrical and Electronics

- Industrial and Machinery

- Packaging

- Others

Emerging Trends

Safer-by-design, mono-material food packs are reshaping styrene-copolymer use

Food brands want safer-by-design, mono-material packaging that cuts waste and is easy to recycle, and this is pushing styrene-copolymer developers to redesign resins, additives, and pack formats for modern food systems. The pressure starts with food waste. In 2022, 1.05 billion tonnes of food were wasted across households, food service, and retail—about 19% of food available to consumers, or roughly one billion meals tossed every day. Packaging that protects freshness, allows visibility, and survives distribution is now treated as a waste-reduction tool, not just a container—raising the bar for styrenic trays, lids, and display packs.

Safety is the other driver. Every year, 600 million people fall ill and 420,000 die from unsafe food. Retailers and regulators therefore lean toward materials and formats that support tight seals, tamper evidence, and clean processing—features where styrene copolymers (e.g., HIPS/SAN/ABS blends for rigid food packs) perform well when formulated correctly and used within limits. This safety focus is no longer optional; it is central to packaging choice.

Regulation is aligning around explicit migration and recyclability expectations. In June 2025, EFSA concluded that styrene in plastic food-contact materials is not genotoxic by oral exposure and that use respecting an SML of 40 µg/kg food (40 ppb) would not be of safety concern. That clarity is shaping resin tweaks (lower residuals), converter QA (more routine migration testing), and brand specs, especially for chilled dairy, bakery, and ready-to-eat packs. In India, FSSAI requires overall migration ≤ 60 mg/kg or 10 mg/dm², which similarly pushes suppliers to tighten formulations and processing.

Scale also matters. FAO estimates that agrifood value chains used 37.3 million tonnes of plastics in food packaging in 2019. Even modest shifts within this base—say, converting mixed, hard-to-recycle laminates into rigid, mono-material trays—translate into large resin opportunities for styrenics that meet food-contact and end-of-life requirements. Material makers that pair HIPS/SAN clarity and stiffness with verified migration data, traceable supply, and recycling guidance can ride this redesign wave.

Drivers

Food safety And waste-reduction needs are driving styrene-copolymer demand

A single, powerful force is pushing demand for styrene copolymers in packaging: the urgent need to keep food safe and reduce waste. The world still throws away an astonishing amount of edible food. In 2022, 1.05 billion tonnes of food—about 19% of all food available to consumers—was wasted across households, food service, and retail. That equals roughly one billion meals binned every day. Packaging that protects freshness, resists impact in distribution, seals well, and shows product clarity helps cut this loss, and styrene-based copolymers are chosen exactly for those properties.

Food safety pressures add a second push. Each year, about 600 million people fall ill from unsafe food and 420,000 die, a burden of 33 million DALYs. Robust, hygienic packaging that limits contamination and enables tamper-evident, leak-tight formats is a frontline control—especially for chilled, ready-to-eat, and grab-and-go products where handling risk is higher. The performance mix of styrene copolymers—stiffness for stackable trays, impact strength for transport, and excellent moldability for tight-tolerance closures—helps manufacturers meet these safety expectations at scale.

- Regulators have reinforced this direction by clarifying food-contact rules and migration limits, which gives buyers confidence to specify these materials. In India, the Food Safety and Standards Authority requires overall migration ≤ 60 mg/kg or 10 mg/dm² for plastic food-contact materials, tested to IS 9845. Processors that can demonstrate compliance with such limits are better positioned to supply modern retail chains.

In Europe, EFSA’s 2025 re-assessment addressed styrene specific migration and considered use up to 40 µg/kg food (40 ppb), guiding risk-management decisions and packaging design choices. In the U.S., FDA listings under 21 CFR Parts 175–178 cover polystyrene and butadiene-styrene rubber for indirect food additives, providing clear pathways for compliant uses. Together, these regimes lower uncertainty, streamline audits, and encourage investment in high-performing styrenic formats.

Waste reduction targets now sit at the center of many national food strategies. The U.N.’s SDG 12.3 calls for halving per-capita food waste by 2030, and the UNEP Food Waste Index tracks progress. Retailers and quick-service brands, under pressure to report and improve, are shifting toward packs that extend shelf life, protect against bruising, and maintain visibility for quality checks.

Restraints

Migration And micro-plastic risks restrict styrene-copolymer adoption

Migration of substances from plastic food contact materials (FCMs) is a well-documented risk. A 2024 science review noted that global plastic demand for food packaging still allocates around 40% of all plastics to the food packaging sector, with materials such as polystyrene featured prominently. Within food packaging applications, plastics can release monomers, oligomers, additives, non-intentionally added substances (NIAS) and other migrating compounds under storage, heat, mechanical stress and contact with acidic or fatty foods.

Micro- and nanoplastic (MNP) migration is emerging as a regulatory and consumer concern. A systematic review published in 2025 found that 96% of studies on plastic food contact articles reported presence of micro-/nanoplastics in food simulants or foods linked to normal use of packaging. These particles may carry additives, sorbed contaminants, or degrade into smaller chemical species—even if the base polymer meets conventional migration limits. A 2022 review raised concerns that MPs entering food may carry both physical and chemical risks.

The European Food Safety Authority (EFSA) re-assessment for styrene in food-contact materials concluded that styrene itself is not genotoxic at low exposure levels, and proposed a specific migration limit (SML) of 40 µg/kg food (40 ppb) for styrene monomer. Although the conclusion may reassure some users, the need to monitor and demonstrate compliance adds cost and risk—especially for recycled content, multilayer constructions, high-fat foods or high-temperature use.

Sustainability and circular-economy pressures reinforce this restraining effect. While styrene copolymers deliver excellent barrier and mechanical performance, food brands and retailers are under increasing pressure via initiatives such as the Sustainable Development Goal 12.3 and broader plastic-packaging-waste targets. Choosing packaging materials perceived as “better behaved” from chemical-migration and microplastic-standpoints becomes a driver—and that works against styrenic formats unless they can demonstrate robust, future-proof safety and circularity credentials.

Opportunity

Surge in convenience foods opens new demand window

One of the biggest growth opportunities for styrene-copolymer materials (used in rigid trays, containers, lidded packs, display tubs and other food-contact formats) is the rapid shift towards convenience, ready-to-eat and on-the-go food consumption — and the packaging that must protect these processed foods while maintaining shelf-life, clarity and safety.

Consumers around the world are eating fewer home-cooked meals, living busier lives and preferring packaged solutions. For example, the Food and Agriculture Organization of the United Nations (FAO) notes that agrifood systems used 37.3 million tonnes of plastics in food-packaging in 2019 alone — an indicator of the scale of packaging demand in food value chains. The implication: materials that offer durable, hygienic, clear structural performance have a large addressable area.

- Moreover, government and regulatory initiatives are favouring improved packaging to reduce food waste and enhance food safety — both of which support material innovation. For instance, the UN’s Sustainable Development Goal 12.3 targets halving food waste per capita by 2030. Packaging that extends shelf-life or better preserves product quality directly supports that aim. Better packaging means fewer spoiled goods, less waste, and better margins for food producers and retailers.

In many emerging markets, rising urbanisation, increasing numbers of dual-income households and growth of e-grocery or food-delivery channels are further accelerating demand for packaged, ready-to-eat food formats. This creates a window of opportunity for material developers and pack-converters to offer advanced styrenic copolymer solutions that deliver the right mix of performance, cost and compliance.

Regional Insights

Asia-Pacific leads with 38.60% share and a market size of USD 11.2 billion in 2024

In 2024, the Asia-Pacific (APAC) region was the dominant regional market for styrene copolymers, accounting for 38.60% of global demand and representing an estimated USD 11.2 billion in market value; this position was supported by concentrated downstream manufacturing in China, India and Southeast Asia and by significant capacity additions in styrene and downstream resins.

The concentration of upstream styrene capacity in China was notable in 2024, with industry reporting total national styrene capacity on the order of ~21 million tonnes, a factor that sustained regional feedstock availability for ABS, SAN and other copolymers. Rapid growth in regional end-use sectors was observed in 2024–2025: automotive production rebounds and rising electronics manufacturing in APAC increased demand for ABS grades used in housings and interior components.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

CHIMEI Corporation, based in Taiwan, is recognized as one of the world’s largest ABS resin and SAN resin manufacturers, leveraging over 50 years of production and R&D experience in styrene-based resins. Their product portfolio includes ABS, SAN, PS, PC/ABS, ASA and TPE, among others. The company emphasises stable supply and service to electronics and consumer-goods industries through its broad resin offering.

INEOS Styrolution (a business within the INEOS Group) is a global leader in styrenics, offering ABS standard and specialty grades across 16 production sites in eight countries, serving automotive, electronics, healthcare and packaging markets. It reported roughly EUR 4.9 billion of sales in 2024.

Kumho Petrochemical, headquartered in South Korea, has a diversified portfolio that includes synthetic resins such as ABS, SAN and PS alongside its leading synthetic-rubber operations. With over 50 years in materials, the company is making inroads into high-value synthetic resins and electronic-materials domains.

Top Key Players Outlook

- CHIMEI

- Formosa Plastics Group

- INEOS

- Kumho Petrochemical

- LG Chem

- Lotte Chemical

- PetroChina Company Limited

- SABIC

- Techno-UMG Co., Ltd.

- Tianjin Bohai Chemical Co., Ltd

- Toray Industries Inc.

- Trinseo

- Versalis S.p.A. t

Recent Industry Developments

In 2024, FPG achieved consolidated revenue of NT$348.6 billion, up 4.8 % from the previous year. The company’s plastic-products segment—of which ABS is a substantive part—generated NT$39.2 billion in sales in 2024 and accounted for 22.4 % of the parent entity’s revenue.

In 2024 INEOS Styrolution, posted €4,749.2 million in revenue from its Styrolution segment, up from €4,511.7 million in 2023, signalling a modest increase in volumes and higher pricing. Its adjusted EBITDA in 2024 was €276.6 million, compared to €200.1 million in 2023, reflecting improved margins across ABS and advanced polymers.

Report Scope

Report Features Description Market Value (2024) USD 29.2 Bn Forecast Revenue (2034) USD 63.6 Bn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Polymer Type (Acrylonitrile-Butadiene-Styrene (ABS), Styrene-Acrylonitrile (SAN)), By End-User (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape CHIMEI, Formosa Plastics Group, INEOS, Kumho Petrochemical, LG Chem, Lotte Chemical, PetroChina Company Limited, SABIC, Techno-UMG Co., Ltd., Tianjin Bohai Chemical Co., Ltd, Toray Industries Inc., Trinseo, Versalis S.p.A. t Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CHIMEI

- Formosa Plastics Group

- INEOS

- Kumho Petrochemical

- LG Chem

- Lotte Chemical

- PetroChina Company Limited

- SABIC

- Techno-UMG Co., Ltd.

- Tianjin Bohai Chemical Co., Ltd

- Toray Industries Inc.

- Trinseo

- Versalis S.p.A. t