Global Steel and Alloy Casting Valves Market Size, Share, Growth Analysis By Type (Plug Valves, Butterfly Valves, Ball Valves, Gate Valve, Other Types), By Material (Cast Iron, Carbon Steel, Alloy Steel, Austenitic Steel, Nickel Alloy Steel, Ductile Steel, Duplex Stainless Steel), By Size (2’’ & Below, 2-6’’, 6-25’’, 25-50’’, 50’’ & Above), By End-Use Industry (Pharmaceutical, Food & Beverage, Chemical, Energy & Power, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 73266

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

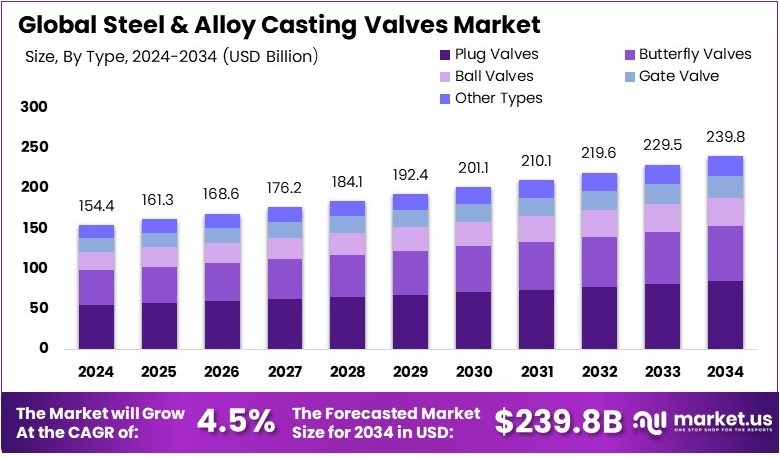

The Global Steel and Alloy Casting Valves Market size is expected to be worth around USD 239.8 Billion by 2034, from USD 154.4 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

Steel and alloy casting valves are essential components used across various industries, including oil and gas, power generation, and manufacturing, for regulating fluid flow. These valves are known for their durability and ability to withstand extreme conditions, making them crucial for efficient industrial operations.

The Steel and Alloy Casting Valves Market is driven by global industrial growth and infrastructural projects that require robust fluid management systems. The demand in this sector continues to rise with increasing industrial activities.

For instance, the import-export dynamics show significant growth, notably in India, where steel imports, including those for alloy casting valves, have increased dramatically. Between April and September 2024, India saw a 42.2% increase in steel imports, totaling 4.7 million metric tons, with 1.4 million metric tons coming from China alone.

Furthermore, this market’s dynamics are influenced by factors such as technological advancements and regulatory standards that dictate the quality and environmental impact of production. As industries seek more efficient and environmentally friendly solutions, the market for steel and alloy casting valves adapts to meet these evolving needs.

Consequently, while the market shows signs of saturation in some regions, new opportunities continue to emerge in developing areas, driven by industrialization and infrastructural investments. This ongoing development ensures the market’s vitality and its critical role in supporting global industrial infrastructure.

Key Takeaways

- The Steel and Alloy Casting Valves Market was valued at USD 154.4 Billion in 2024 and is expected to reach USD 239.8 Billion by 2034, with a CAGR of 4.5%.

- In 2024, Plug Valves led the type segment with 32.3%, attributed to their efficient flow control in industrial applications.

- In 2024, Cast Iron dominated the material segment with 32.4%, due to its durability and cost-effectiveness.

- In 2024, 2-6” size category accounted for 33.6%, driven by its widespread use in industrial systems.

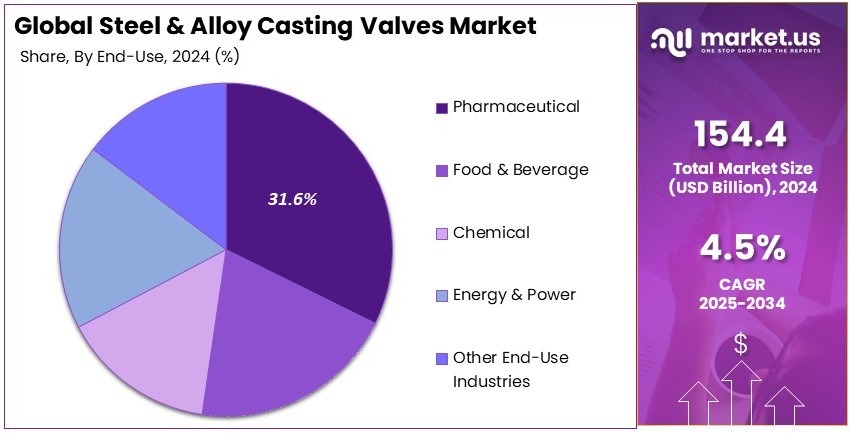

- In 2024, Pharmaceutical dominated the end-use industry segment with 31.6%, due to stringent quality requirements.

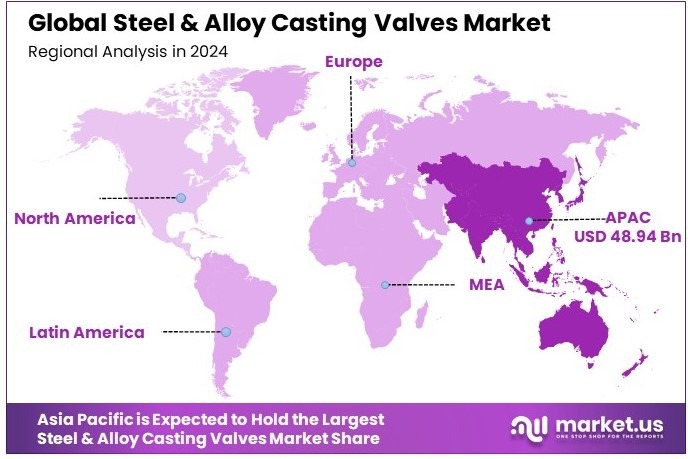

- In 2024, APAC held a 31.7% market share, valued at USD 48.94 Billion, due to rapid industrialization and infrastructure development.

Type Analysis

Plug Valves dominate with 32.3% due to their widespread use in critical industries.

In the Steel and Alloy Casting Valves market, plug valves hold the largest market share, accounting for 32.3%. These valves are highly valued for their simplicity and reliability, especially in high-pressure systems. They are commonly used in industries such as chemical processing, oil and gas, and water treatment due to their excellent flow control capabilities.

The design of plug valves allows for tight shut-off, making them an essential component in systems requiring secure, leak-proof operation. Additionally, plug valves are often preferred for their ability to handle a variety of fluids, including gases, liquids, and slurries, which adds to their versatility and demand.

Other valve types such as butterfly valves, ball valves, and gate valves have significant roles but do not match the dominance of plug valves. Butterfly valves, for instance, are popular in applications that require moderate pressure and high flow, while ball valves are more suitable for on/off control applications.

Gate valves, known for their ability to fully open or close, are widely used in larger systems but face limitations in certain pressure settings. Despite these competing valve types, plug valves continue to lead in terms of usage in industrial applications, ensuring their continued growth and importance.

Material Analysis

Cast Iron dominates with 32.4% due to its cost-effectiveness and reliability in a wide range of industries.

Cast iron accounts for 32.4% of the market share in the Steel and Alloy Casting Valves sector. This material is favored for its strength, durability, and cost-effectiveness, making it ideal for a broad range of applications in industries like water treatment, oil and gas, and chemical manufacturing.

Cast iron valves are known for their resistance to wear and tear, which ensures their longevity even under harsh conditions. This makes them a popular choice for large-scale projects and systems where cost-efficiency and performance are critical.

Other materials, such as carbon steel, alloy steel, and austenitic steel, also play important roles in the market but have more specific uses. Carbon steel is often used in high-pressure systems due to its strength but is less resistant to corrosion compared to cast iron.

Alloy steel provides enhanced resistance to wear and heat, making it suitable for high-temperature applications. Nickel alloy steel and duplex stainless steel offer exceptional resistance to corrosion and are often used in specialized industries such as pharmaceuticals or food processing. While these materials offer distinct advantages, cast iron remains the most widely used material due to its balance of cost and functionality.

Size Analysis

2-6’’ valves dominate with 33.6% due to their versatility in industrial applications.

The 2-6’’ valve size holds the largest market share in the Steel and Alloy Casting Valves market, with 33.6%. This size range is versatile and widely used across industries, making it the most common valve size in industrial systems.

Valves in the 2-6’’ range are ideal for managing moderate flows and pressures, making them suitable for use in a variety of applications, including water treatment, energy, and chemical plants. The popularity of this size can be attributed to its balance between functionality and size, allowing it to be incorporated into both large and small-scale systems.

Larger valve sizes, such as 6-25’’ and 25-50’’, are used in more specific, high-flow applications but do not have the same level of demand as the 2-6’’ size. These larger valves are crucial in industries like oil and gas or power generation, where they manage large volumes of fluid or gas.

However, due to their specialized use, their market share is smaller compared to the more commonly used 2-6’’ valves. Similarly, smaller valves (2’’ and below) are often used in more compact systems but are limited in the types of applications they can serve.

End-Use Industry Analysis

Pharmaceutical industry dominates with 31.6% due to the need for precision and high-quality materials.

The pharmaceutical industry accounts for 31.6% of the market share in the Steel and Alloy Casting Valves market. This industry demands high-quality valves to ensure precise control and safety in drug production processes. Valves used in pharmaceutical manufacturing must meet strict standards for hygiene, reliability, and performance.

Steel and alloy casting valves are used extensively in the industry for controlling the flow of ingredients and chemicals in a safe and efficient manner. The need for precise regulation in sensitive environments makes valves in this sector highly specialized and in demand.

Other industries, such as food and beverage, chemical, and energy and power, also contribute to the market but represent smaller portions of the market share. The food and beverage industry requires valves for product flow control and sanitation, while the chemical industry uses valves for handling various chemicals safely.

Energy and power industries rely on valves for regulating fluid and gas flow in power plants and refineries. While these industries are growing, the pharmaceutical industry remains the leader due to its stringent requirements for valve performance.

Key Market Segments

By Type

- Plug Valves

- Butterfly Valves

- Ball Valves

- Gate Valve

- Other Types

By Material

- Cast Iron

- Carbon Steel

- Alloy Steel

- Austenitic Steel

- Nickel Alloy Steel

- Ductile Steel

- Duplex Stainless Steel

By Size

- 2” & Below

- 2-6’’

- 6-25’’

- 25-50’’

- 50’’ & Above

By End-Use Industry

- Pharmaceutical

- Food & Beverage

- Chemical

- Energy & Power

- Other End-Use Industries

Driving Factors

Infrastructure Growth Drives Market Expansion

The Steel and Alloy Casting Valves market is being significantly influenced by increasing infrastructure development in emerging markets. As economies grow and urbanization accelerates, there is a rising demand for infrastructure projects, such as transportation, utilities, and industrial facilities. This growth drives the need for reliable, durable valves used in a variety of applications.

Additionally, the expansion of key industries like oil & gas, petrochemicals, and power generation is boosting demand for steel and alloy valves. These industries rely heavily on high-performance valves that can withstand harsh environments and extreme pressures, further increasing the need for specialized valve solutions.

Furthermore, rising demand for high-performance and corrosion-resistant materials is driving the market. As industries require materials that can endure demanding conditions, the preference for steel and alloy materials has intensified.

Advancements in manufacturing technologies and automation are also contributing to the market’s growth. New innovations have made it easier and more cost-effective to produce precision casting valves, thereby improving efficiency and reducing lead times.

Restraining Factors

High Costs and Regulatory Challenges Restrain Market Growth

Despite the market’s positive drivers, several factors are hindering growth. Volatility in raw material prices and supply chain disruptions pose significant challenges. Steel and alloy materials are subject to price fluctuations, which can affect overall production costs and make it difficult to predict pricing for finished products.

Additionally, the high initial investment costs in casting technologies can be a barrier to entry for smaller players in the market. Advanced casting technologies, though highly efficient, require significant capital investment, making it harder for companies to compete without substantial financial resources.

Stringent environmental and safety regulations also present challenges. As governments enforce stricter regulations regarding emissions and waste management, manufacturers of steel and alloy casting valves must invest in compliance measures, which can increase operational costs.

Moreover, the limited availability of skilled labor for precision casting adds another layer of difficulty. The highly specialized nature of the casting process requires skilled technicians, and the shortage of such labor can hinder production and affect overall market performance.

Growth Opportunities

Emerging Technologies and Customization Provide Growth Opportunities

The Steel and Alloy Casting Valves market offers various opportunities for growth. One key opportunity is the adoption of smart valve technologies, which enhance operational efficiency. Smart valves, integrated with sensors and digital technologies, allow for real-time monitoring and remote control, increasing system reliability and reducing maintenance costs.

The growth in renewable energy projects, particularly those in wind and solar, is also creating demand for specialized valves. As these industries expand, they require valves tailored to the unique conditions of renewable energy systems.

Additionally, there is an increased demand for custom-made steel and alloy valves. Industries are moving toward solutions that are specifically designed to meet their operational needs, driving demand for valves that are customized in terms of materials, sizes, and specifications.

The expansion of aftermarket services and maintenance solutions is another growth opportunity. As the market grows, the need for ongoing valve maintenance, repairs, and upgrades increases, creating a robust aftermarket services market that complements the production of new valves.

Emerging Trends

Technological and Sustainability Trends Shape the Market

Several key trends are shaping the Steel and Alloy Casting Valves market. Rising adoption of Industry 4.0 and the Internet of Things (IoT) in valve monitoring is significantly influencing the market. These technologies enable continuous monitoring of valve performance, improving efficiency and preventing downtime in critical applications.

Moreover, the demand for lightweight and high-strength materials in casting is growing. As industries seek to reduce the weight of their systems while maintaining performance, valves made from advanced alloys are becoming increasingly popular.

There is also an emphasis on sustainability and eco-friendly manufacturing practices. With a growing global focus on environmental responsibility, manufacturers are adopting cleaner production processes and sustainable materials to meet consumer and regulatory expectations.

Finally, the growing preference for automated control systems in valve operations is a significant trend. Automation allows for more precise control of fluid and gas flow, improving system efficiency and reliability. As industries continue to seek greater automation in their operations, the demand for advanced casting valves will likely rise.

Regional Analysis

APAC Dominates with 31.7% Market Share

Asia Pacific (APAC) leads the Steel and Alloy Casting Valves market, holding 31.7% of the market share, which amounts to USD 48.94 billion. The region’s dominance can be attributed to its large manufacturing base, high industrialization, and increasing demand for steel and alloy casting valves in sectors like oil & gas, power generation, and chemical industries. APAC countries, such as China and India, are key contributors due to their growing infrastructure and manufacturing sectors.

Key factors driving this dominance include the rapid industrialization in APAC countries, increasing investments in infrastructure, and the rising demand for efficient and durable valves. Steel and alloy casting valves are crucial components in industries like energy, petrochemicals, and construction, sectors that are booming in APAC.

Additionally, the presence of major manufacturers in China, India, and Japan helps sustain the region’s lead. Competitive pricing and advanced manufacturing techniques in these countries further strengthen APAC’s market position.

Regional Mentions:

- North America: North America, with its well-established industrial base, holds a significant share in the Steel and Alloy Casting Valves market. The presence of large-scale industries, particularly in the oil and gas sector, drives demand for high-performance valves.

- Europe: Europe’s focus on energy efficiency and infrastructure renewal continues to boost its demand for steel and alloy casting valves. Technological innovations and a shift toward sustainable industrial solutions further strengthen the region’s market position.

- Middle East & Africa: The Middle East and Africa are emerging as key markets for steel and alloy casting valves, primarily driven by large-scale oil and gas projects and infrastructure development. Increasing industrialization contributes to market growth.

- Latin America: Latin America is seeing growth in steel and alloy casting valve demand, largely due to the expansion of mining, power generation, and chemical sectors. The market is bolstered by rising investments in industrial infrastructure.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Steel and Alloy Casting Valves market is characterized by a few dominant players, each contributing to the market’s growth through innovative technologies and a strong focus on quality. The top four companies—KITZ Corporation, Alcon Industries, Aero Metals Inc, and Badger Alloys—are the main players in this sector.

KITZ Corporation is a global leader in the valve manufacturing industry. The company offers a wide range of steel and alloy casting valves used in various applications, including oil and gas, water treatment, and power generation. Their commitment to precision engineering and product reliability has made KITZ a trusted name in the industry.

Alcon Industries is known for its expertise in manufacturing valves for demanding industrial applications. The company’s high-performance steel and alloy casting valves are used in industries such as aerospace, automotive, and chemical processing. Alcon’s focus on innovation and customer satisfaction has positioned it as a key player in this market.

Aero Metals Inc specializes in the production of steel and alloy casting valves for the aerospace industry. The company’s valves are known for their durability and precision, making them ideal for critical applications in aerospace and defense. Aero Metals continues to expand its presence through technological advancements and strong industry relationships.

Badger Alloys manufactures high-quality steel and alloy casting valves for diverse industrial sectors, including construction, mining, and power generation. The company’s focus on custom valve solutions and its deep understanding of customer needs contribute to its strong market position.

These companies dominate the Steel and Alloy Casting Valves market by providing innovative, reliable products that meet the needs of various industries.

Major Companies in the Market

- KITZ Corporation

- Alcon Industries

- Aero Metals Inc.

- Badger Alloys

- Harrison Steel Castings Company

- Emerson Electric Co.

- Flowserve Corporation

- Crane Co.

- Pentair plc

- Velan Inc.

Recent Developments

- Design News and Automotive Industry: In October 2024, Design News reported that automotive manufacturers are increasingly adopting large-scale castings to reduce production costs and complexity. This trend involves replacing numerous individual parts with single, massive cast components, a process facilitated by advancements in 3D printing technology.

- Winsert and Alloy Cast Products, Inc. (ACP): In October 2022, Winsert, a global manufacturer of critical metal parts, acquired Alloy Cast Products, Inc. (ACP), a company specializing in investment casting and machining of exotic cobalt alloys. This acquisition, facilitated by Altus Capital Partners, aims to enhance Winsert’s product offerings and expand its capabilities in metal forming.

Report Scope

Report Features Description Market Value (2024) USD 154.4 Billion Forecast Revenue (2034) USD 239.8 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Plug Valves, Butterfly Valves, Ball Valves, Gate Valve, Other Types), By Material (Cast Iron, Carbon Steel, Alloy Steel, Austenitic Steel, Nickel Alloy Steel, Ductile Steel, Duplex Stainless Steel), By Size (2’’ & Below, 2-6’’, 6-25’’, 25-50’’, 50’’ & Above), By End-Use Industry (Pharmaceutical, Food & Beverage, Chemical, Energy & Power, Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape KITZ Corporation, Alcon Industries, Aero Metals Inc, Badger Alloys, Harrison Steel Castings Company, Emerson Electric Co., Flowserve Corporation, Crane Co., Pentair plc, Velan Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Steel and Alloy Casting Valves MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Steel and Alloy Casting Valves MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- KITZ Corporation

- Alcon Industries

- Aero Metals Inc.

- Badger Alloys

- Harrison Steel Castings Company

- Emerson Electric Co.

- Flowserve Corporation

- Crane Co.

- Pentair plc

- Velan Inc.