Global Starter Fertilizers Market Size, Share, And Enhanced Productivity By Form (Liquid, Dry, Micro-granulated), By Nutrient Type (Nitrogen-based Starters (Urea-based Starters, Ammoniacal-Nitrogen, Controlled-release Nitrogen), Phosphorus-based Starters (Orthophosphates, Polyphosphates, Superphosphates), Potassium-based Starters (Potassium Chloride, Potassium Sulfate, Potassium Thiosulfate, Others)), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables), By Application Method (In-furrow Placement, 2x2 Band Placement, Pop-up/Seed-placed), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174922

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

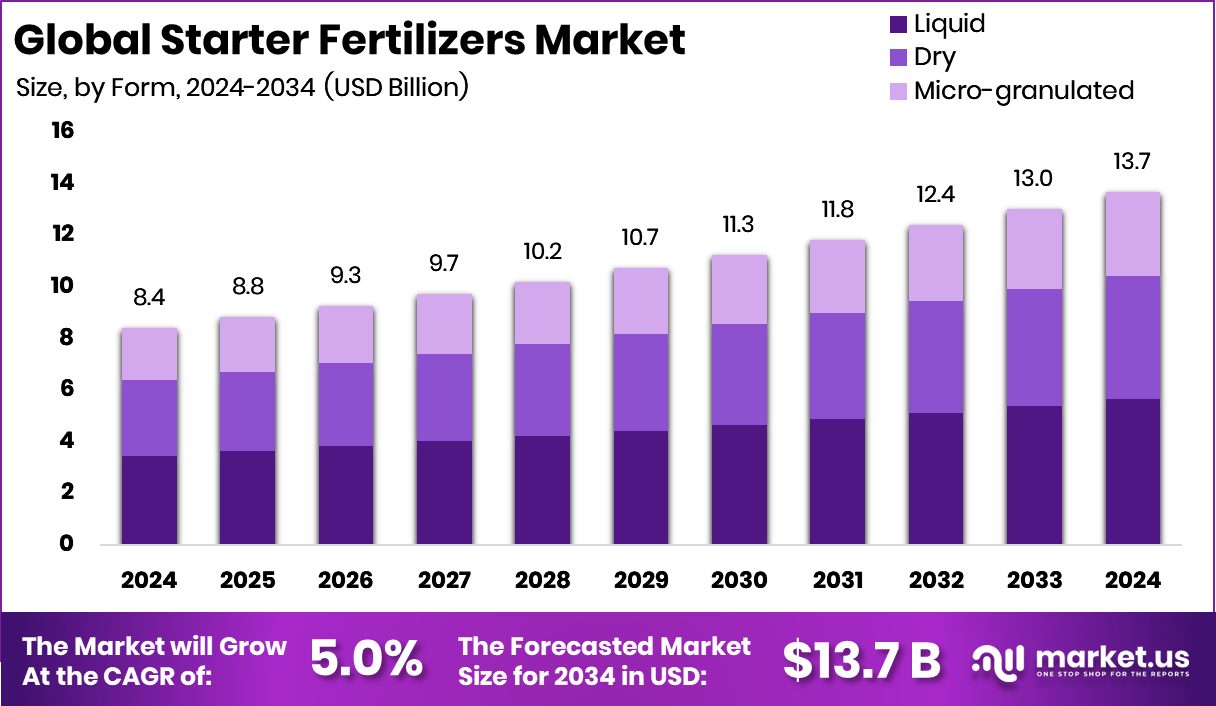

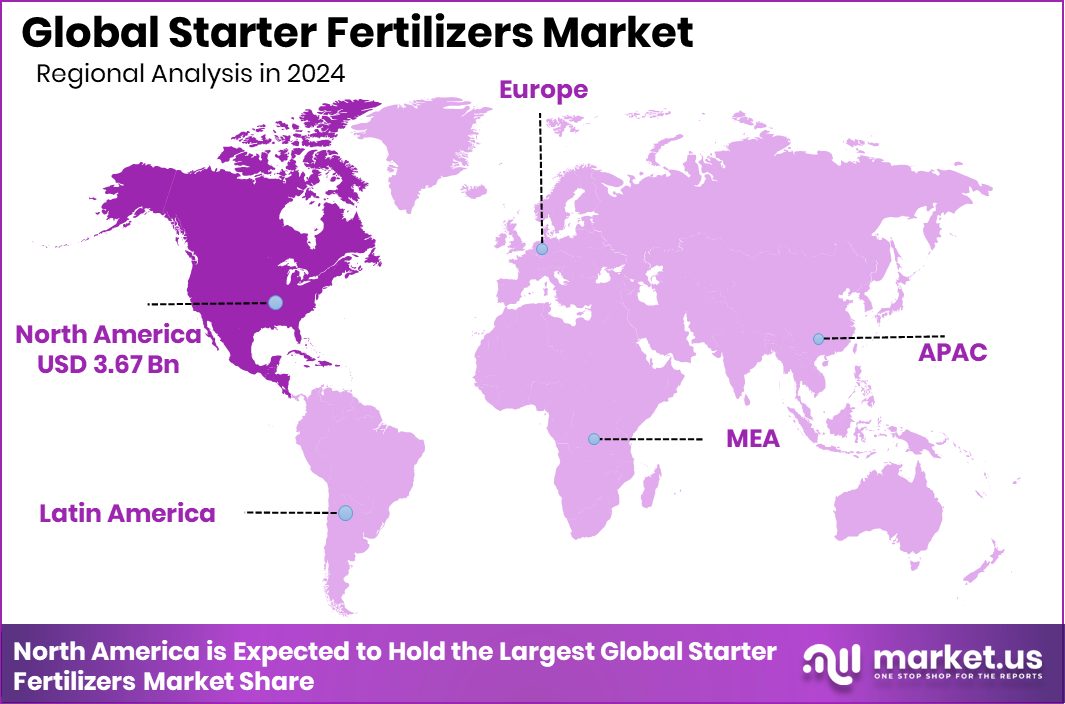

The Global Starter Fertilizers Market is expected to be worth around USD 13.7 billion by 2034, up from USD 8.4 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034. The starter fertilizers market in North America recorded 43.8%, totaling USD 3.67 Bn.

Starter fertilizers are small but highly effective doses of nutrients applied at planting to support early seed and root development. They are usually placed close to the seed so young plants can access nutrients immediately, especially phosphorus, which is critical during early growth. Starter fertilizers help crops establish faster, grow uniformly, and handle early stress from cold soils or low nutrient availability. Farmers rely on them to improve early vigor and create a strong foundation for the rest of the growing season.

The Starter Fertilizers Market refers to the production and use of these fertilizers across crops such as cereals, grains, and oilseeds. This market is closely linked to planting activity, food demand, and crop productivity goals. Governments also influence it through agricultural policies, such as India’s decision to rationalise agri schemes into two and approve a ₹10,000 crore Oilseeds Mission, strengthening nutrient use in oilseed cultivation.

Growth in the market is supported by rising food requirements and steady production outlooks. For example, the government has projected 2.4% growth in foodgrains production in 2025–26, highlighting the need for efficient early nutrition to maintain yields. Public investment is also visible globally, with Manitoba increasing its stake in a cereals research centre to $23.5 million, supporting crop science and input efficiency.

Demand is further driven by strong activity in the cereal and plant-based food industries. Companies are investing heavily in cereals and oilseed value chains, as seen in Ferrero’s $3.1 billion acquisition of Kellogg’s US cereal business, along with Magic Spoon raising $85 million and an earlier $5.5 million seed round to reinvent cereal products. These moves underline sustained demand for grains that depend on reliable crop establishment.

The market also presents opportunities through innovation and supply-chain expansion. Cano-ela raised €1.6 million to extract plant-based ingredients from oilseeds, while Keychain secured $15 million in Series A funding to strengthen food manufacturing platforms. These investments signal growing emphasis on efficient crop inputs, where starter fertilizers play a vital role in supporting consistent raw material supply.

Key Takeaways

- The Global Starter Fertilizers Market is expected to be worth around USD 13.7 billion by 2034, up from USD 8.4 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034.

- The Starter Fertilizers Market shows strong momentum as liquid formulations dominate with 49.1% share globally.

- Growing adoption of phosphorus-based starters drives the starter fertilizers market, holding 41.2% share worldwide.

- The Starter Fertilizers Market expands steadily, with cereals and grains contributing a dominant 56.7% portion.

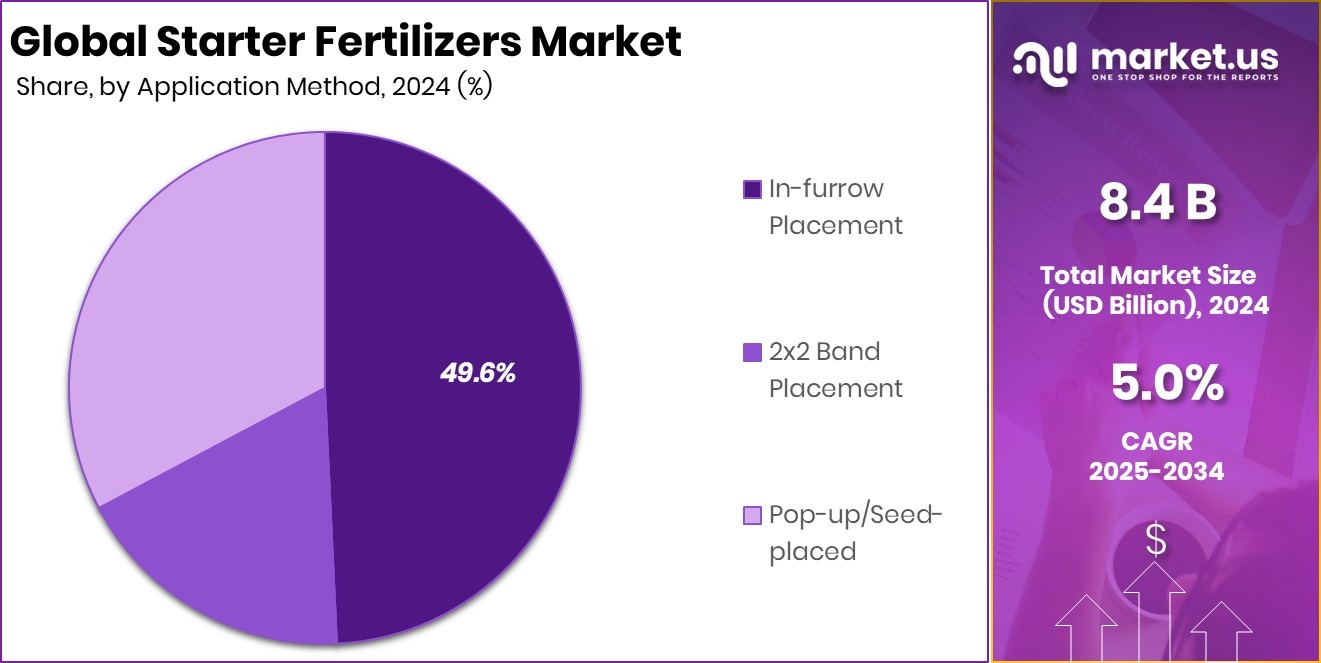

- In-furrow placement leads application preferences in the Starter Fertilizers Market, accounting for 49.6% usage.

- In North America, demand strengthened as the market achieved 43.8% and USD 3.67 Bn.

By Form Analysis

Starter Fertilizers Market grows as liquid formulations reach a strong 49.1% global share.

In 2024, the starter fertilizers market saw liquid formulations secure a dominant position, holding a 49.1% share due to their fast nutrient absorption and compatibility with precision farming tools. Farmers increasingly preferred liquid starter fertilizers because they flow easily through modern application systems and ensure uniform distribution around seeds. This form helps reduce early growth stress, especially in soils with low nutrient availability.

Liquid products also blend well with micronutrients and biological additives, making them a flexible choice for varied crop requirements. As agricultural regions adopt advanced seeding technologies, liquid starters continue to offer convenience, efficiency, and strong early root support, which drives their consistent uptake across both developed and emerging farming markets.

By Nutrient Type Analysis

Starter Fertilizers Market demand rises with phosphorus-based starters holding 41.2% segment leadership.

In 2024, phosphorus-based starter fertilizers emerged as the leading nutrient category in the Starter Fertilizers Market, capturing a 41.2% share. Phosphorus plays a pivotal role in early root formation, seedling vigor, and improved nutrient uptake during the crucial establishment stage. Farmers across major cereal- and oilseed-growing regions relied on these formulations to overcome phosphorus deficiency in cold or compacted soils.

The demand strengthened further as growers embraced high-efficiency fertilizers designed to minimize fixation losses and improve nutrient-use efficiency. Phosphorus-based starters remain popular because they provide predictable, early-season growth benefits and allow crops to better tolerate environmental stress. Their consistent performance across diverse soil conditions continues to reinforce their leadership in the nutrient type segment.

By Crop Type Analysis

Starter Fertilizers The market expands steadily as cereals and grains dominate with a 56.7% share.

In 2024, cereals and grains dominated the crop-type segment of the starter fertilizers market with a commanding 56.7% share, driven by strong global demand for wheat, maize, rice, and barley. These crops respond strongly to early nutrient availability, particularly phosphorus and nitrogen, which enhances uniform emergence and boosts yield potential. Large-scale producers increasingly adopted starter fertilizers to improve stand establishment and reduce early nutrient stress in high-density planting systems.

Countries focusing on food security and sustainable productivity also encouraged the use of starters to optimize fertilizer inputs. As cereals and grains remain central to global diets and feed industries, starter fertilizers play a vital role in supporting consistent yields and resilient crop growth across diverse farming regions.

By Application Method Analysis

The starter fertilizer market strengthens globally due to in-furrow placement, achieving a 49.6% usage rate.

In 2024, in-furrow placement held a strong 49.6% share in the application-method segment of the Starter Fertilizers Market, reflecting its accuracy and effectiveness in early nutrient delivery. This method places fertilizer directly in the seed furrow during planting, ensuring immediate nutrient access for germinating seeds. Farmers prefer in-furrow application because it enhances uniform emergence, reduces wastage, and improves nutrient-use efficiency, especially for phosphorus-dependent crops.

The technique is widely used in mechanized farming systems where precision placement contributes to improved crop vigor and higher yield stability. With expanding adoption of advanced planting equipment and increasing emphasis on efficient input management, in-furrow placement continues to be the preferred method for achieving strong early-season crop performance.

Key Market Segments

By Form

- Liquid

- Dry

- Micro-granulated

By Nutrient Type

- Nitrogen-based Starters

- Urea-based Starters

- Ammoniacal-Nitrogen

- Controlled-release Nitrogen

- Phosphorus-based Starters

- Orthophosphates

- Polyphosphates

- Superphosphates

- Potassium-based Starters

- Potassium Chloride

- Potassium Sulfate

- Potassium Thiosulfate

- Others

By Crop Type

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

By Application Method

- In-furrow Placement

- 2×2 Band Placement

- Pop-up/Seed-placed

Driving Factors

Rising Demand for Fresh Produce Supply Efficiency

Growing demand for fresh fruits and vegetables is becoming a key driver for the Starter Fertilizers Market, as farmers look for reliable ways to improve early crop growth. This demand is supported by supply-chain investments, such as Handpickd, raising $15 million to optimise fruit and vegetable delivery.

Additional support comes from Handpickd, securing INR 21.7 crore, and KisanKonnect, raising INR 72 crore, both aimed at strengthening produce distribution. These investments highlight how the farm-to-market cycle is expanding fast, making early crop nutrition more important than ever. With fresh produce markets becoming more competitive, growers increasingly rely on starter fertilizers to ensure that crops establish quickly, maintain uniform quality, and meet year-round supply expectations.

Restraining Factors

Currency Risks Increasing Input Cost Pressures

A major restraint in the Starter Fertilizers Market comes from rising financial instability and currency-related risks that affect fertilizer import costs. These concerns are linked to global financial movements, including Grain raising over $50 million to launch an FX management solution for businesses. The funding round included an $18 million seed and a $33 million Series A, which further shows how seriously firms are treating currency volatility.

Grain also secured a separate $33 million Series A to help companies hedge currency risks in real time. When exchange rates fluctuate sharply, farmers face unpredictable fertilizer pricing, making it difficult to plan purchases. This uncertainty can slow the adoption of starter fertilizers, especially in regions dependent on imported crop nutrition products.

Growth Opportunity

Expanding Whole Grain Research And Innovation

A key growth opportunity emerges from the expanding investment in grain and crop research, which strengthens demand for early nutrient support. This opportunity is highlighted by Grain securing £225 million in funding, showing strong confidence in grain-related supply chains. Additional momentum comes from the $19 million funding boost for Washington’s whole-grain research and market development, which supports innovation in crop performance and quality.

As researchers look for ways to increase yield, resilience, and nutritional value, starter fertilizers gain importance for ensuring strong early root systems and uniform plant establishment. Growing attention toward grain quality and sustainability opens the door for new starter fertilizer formulations that match modern crop science goals.

Latest Trends

Research Investments Strengthening Early Crop Technologies

One of the latest trends in the Starter Fertilizers Market is the growing emphasis on research-driven crop improvement and digital efficiency. Significant momentum comes from the Western Grains Research Foundation committing $2.71 million to new crop research projects, which support advancements in seed performance and nutrient response.

Financial innovation is also influencing agriculture, as seen in Grain receiving $50 million+ funding to transform cross-border payments with AI-powered FX tools. These digital tools help stabilize transactions for global farm input suppliers. Together, these research and financial developments show how growers are increasingly relying on improved seed genetics, nutrient strategies, and digital tools—creating a trend where starter fertilizers are integral to early crop success and modern farming systems.

Regional Analysis

North America led the starter fertilizers market with 43.8%, reaching USD 3.67 Bn.

In 2024, North America dominated the starter fertilizers market with a strong 43.8% share valued at USD 3.67 Bn, reflecting the region’s advanced crop nutrition practices and high adoption of precision seeding systems. The demand in North America remained consistent across major cereal- and corn-producing belts, where growers depend on starter fertilizers to improve early-season vigor and stand uniformity.

Europe followed with steady market participation supported by its broad acreage of cereals and oilseeds, alongside the region’s focus on efficient nutrient management. The Asia Pacific region continued to expand as rising cultivation of grains and increasing mechanization encouraged greater use of starter fertilizers to improve crop establishment.

Meanwhile, the Middle East & Africa market showed a gradual uptake due to widening agricultural activities in selected countries where improving early root growth is essential for yield stability under challenging conditions.

Latin America maintained a stable share, influenced by large-scale adoption in soybean and maize production zones, where early nutrient availability supports stronger crop emergence. Across all regions, demand grew around crops requiring efficient nutrient delivery at planting, reinforcing the importance of starter fertilizers in modern farming systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ADAMA Agricultural Solutions Limited plays a steady and influential role in the global Starter Fertilizers Market through its strong agronomic expertise and farmer-centric approach. The company is widely recognized for aligning fertilizer solutions with real field conditions, helping growers achieve uniform crop establishment during early growth stages. ADAMA’s close engagement with distributors and agronomists allows it to tailor starter fertilizer strategies to regional soil needs, supporting consistent adoption across major agricultural economies. Its emphasis on practical, easy-to-use solutions strengthens trust among farmers seeking reliable early-season performance.

AgroLiquid brings a focused and technically driven presence to the starter fertilizers landscape, particularly through liquid nutrition systems. The company’s strength lies in its precise nutrient delivery philosophy, which supports faster root development and improved nutrient uptake at planting. AgroLiquid’s direct-to-farm advisory model helps growers understand placement, timing, and formulation benefits, making starter fertilizers more effective in real-world conditions. This hands-on approach positions the company as a specialist rather than a volume-driven supplier.

Meanwhile, BASF SE contributes to the Starter Fertilizers Market through innovation, formulation science, and integration with broader crop input solutions. BASF’s strong research capabilities enable the development of starter fertilizer technologies that improve nutrient efficiency and crop resilience. Its global reach and technical support networks reinforce adoption among progressive growers seeking consistent early growth outcomes in diverse cropping systems.

Top Key Players in the Market

- ADAMA Agricultural Solutions Limited

- AgroLiquid

- BASF SE

- Bayer AG

- Compass Minerals International, Inc.

- Conklin Company Inc.

- EC Grow, Inc.

- Grassland Agro

- GROWMARK, Inc.

- Helena Agri-Enterprises, LLC

Recent Developments

- In November 2024, GROWMARK, Inc. announced a multi-year strategic partnership with Indigo Ag to bring new powder-based biological products to its FS cooperative network. This partnership will make innovative seed coating and biological solutions available to growers through more than 15 states and provinces across North America. These products support crop performance, water and nutrient use, and can complement traditional crop inputs, including fertilizer programs, by helping plants better access nutrients.

- In September 2024, Compass Minerals entered into a significant environmental agreement in Utah to support water conservation near the Great Salt Lake. While not a direct fertilizer launch, this development affects the plant nutrition business, which depends on sustainable mineral extraction. The company committed to donating 200,000 acre-feet of water annually under a state-backed program, highlighting sustainability priorities within its plant nutrients operations.

Report Scope

Report Features Description Market Value (2024) USD 8.4 Billion Forecast Revenue (2034) USD 13.7 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Dry, Micro-granulated), By Nutrient Type (Nitrogen-based Starters (Urea-based Starters, Ammoniacal-Nitrogen, Controlled-release Nitrogen), Phosphorus-based Starters (Orthophosphates, Polyphosphates, Superphosphates), Potassium-based Starters (Potassium Chloride, Potassium Sulfate, Potassium Thiosulfate, Others)), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables), By Application Method (In-furrow Placement, 2×2 Band Placement, Pop-up/Seed-placed) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADAMA Agricultural Solutions Limited, AgroLiquid, BASF SE, Bayer AG, Compass Minerals International, Inc., Conklin Company Inc., EC Grow, Inc., Grassland Agro, GROWMARK, Inc., Helena Agri-Enterprises, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Starter Fertilizers MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Starter Fertilizers MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ADAMA Agricultural Solutions Limited

- AgroLiquid

- BASF SE

- Bayer AG

- Compass Minerals International, Inc.

- Conklin Company Inc.

- EC Grow, Inc.

- Grassland Agro

- GROWMARK, Inc.

- Helena Agri-Enterprises, LLC