Global Sports Supplement Market Size, Share Analysis Report By Product (Capsules/Tablet, Powder, Liquid, Bar), By Source (Animal-based, Plant-based), By Distribution Channel (Hypermarkets And Supermarkets, Convenience Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162026

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

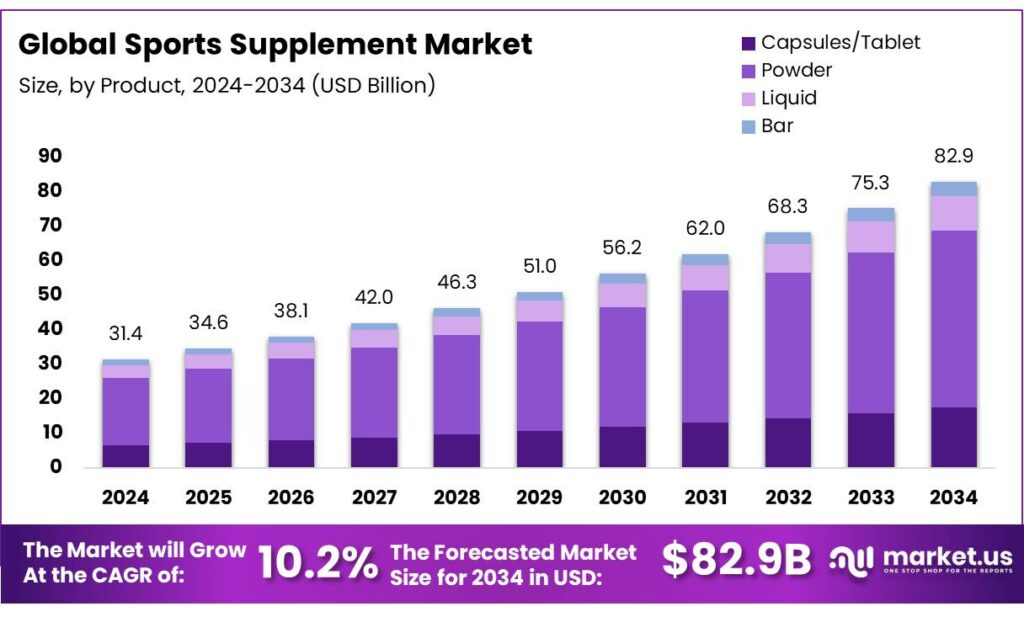

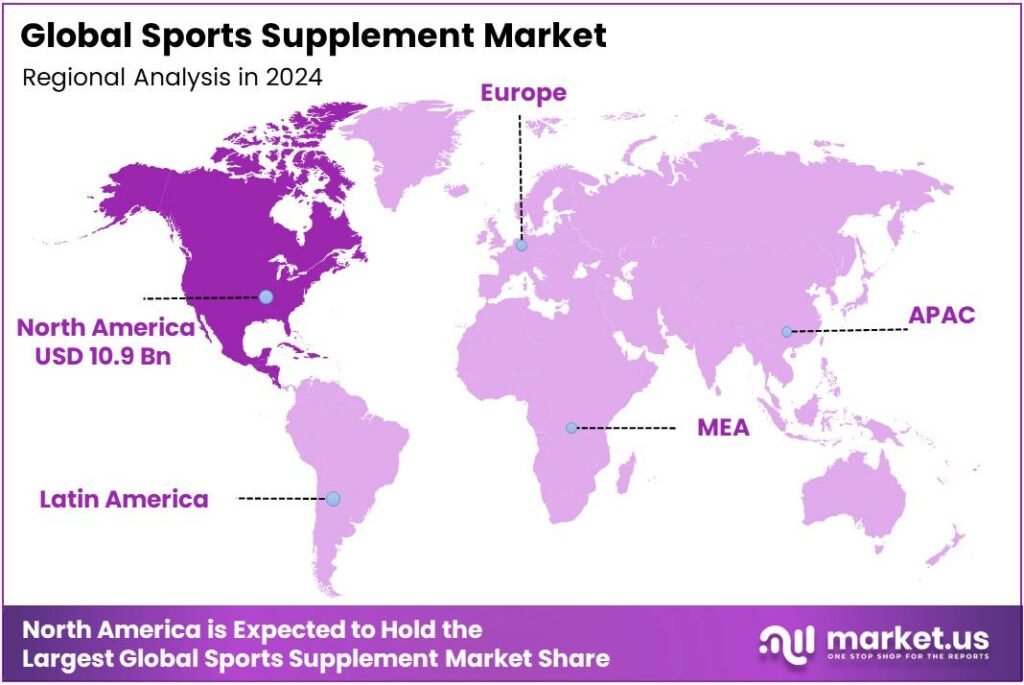

The Global Sports Supplement Market size is expected to be worth around USD 82.9 Billion by 2034, from USD 31.4 Billion in 2024, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 34.9% share, holding USD 10.9 Billion in revenue.

Sports supplements sit at the intersection of nutrition, performance science, and regulation. The category spans protein powders, amino acids, creatine, electrolytes, and ergogenic blends formulated for endurance, strength, and recovery.

The European Food Safety Authority (EFSA) similarly concludes that single doses up to 200 mg—roughly 3 mg/kg body weight—do not raise safety concerns and are acceptable even when consumed within <2 hours of intense exercise under normal conditions, guiding dose design for EU-marketed products.

The industrial scenario is shaped by rising compliance expectations and anti-doping risk management across elite and mass-participation sport. The World Anti-Doping Agency’s 2025 Prohibited List entered into force on 1 January 2025, reinforcing scrutiny of stimulants, hormone modulators, and masking agents; brands supplying tested athletes must maintain rigorous raw-material controls and batch testing to avoid inadvertent positives.

U.S. authorities also highlight hazards from highly concentrated caffeine sold in bulk: FDA guidance warns that packages can contain hundreds of potentially lethal doses and often instruct consumers to measure 50–200 mg portions—serving sizes as small as 1/64 teaspoon—underscoring why mainstream sports formulations favor pre-metered, consumer-safe formats.

Demand drivers are firmly tied to public-health and fitness trends. The World Health Organization reports that 31% of adults (about 1.8 billion people) did not meet recommended physical-activity levels in 2022, with 80% of adolescents also inactive—figures that push governments, clubs, and gyms to promote activity, in turn lifting interest in hydration, recovery, and protein products around training.

- In the United States, obesity remains widespread; CDC data show adult obesity prevalence at 40.3% during Aug 2021–Aug 2023, reinforcing consumer focus on weight management, lean mass preservation, and metabolic health within sports-nutrition routines.

Growth opportunities cluster around safer stimulation, clean-label performance, and evidence-first positioning. EFSA’s threshold—200 mg caffeine single dose or ~3 mg/kg—and FDA’s 400 mg/day benchmark create room for tiered pre-workout portfolios aligned to clear on-label guidance and athlete education.

Key Takeaways

- Sports Supplement Market size is expected to be worth around USD 82.9 Billion by 2034, from USD 31.4 Billion in 2024, growing at a CAGR of 10.2%.

- Powder held a dominant market position, capturing more than a 62.9% share in the global sports supplement market.

- Animal-based held a dominant market position, capturing more than a 67.4% share in the global sports supplement market.

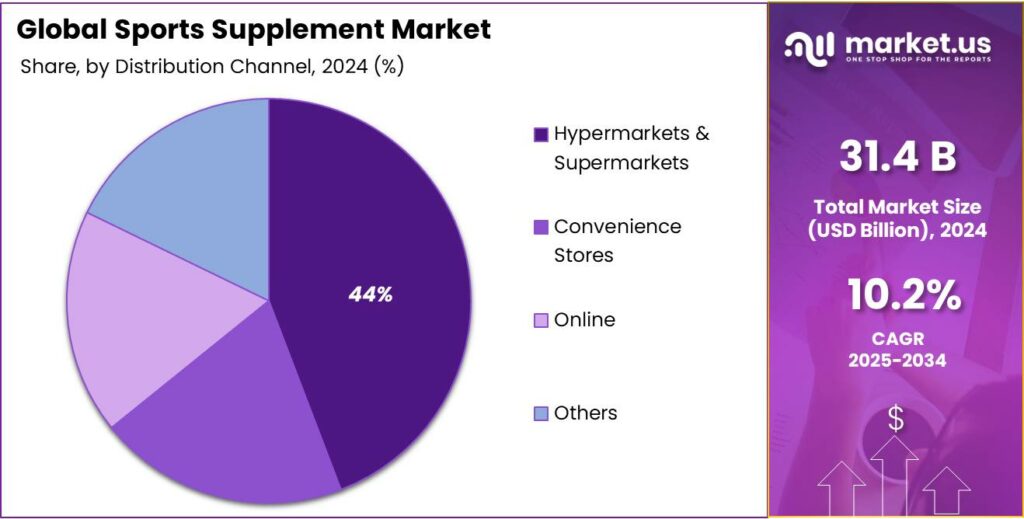

- Hypermarkets & Supermarkets held a dominant market position, capturing more than a 44.2% share in the global sports supplement market.

- North America region accounted for approximately 34.90% of the global sports supplement market, representing an estimated USD 10.9 billion.

By Product Analysis

Powder dominates with 62.9% share driven by its versatility and high consumer preference

In 2024, Powder held a dominant market position, capturing more than a 62.9% share in the global sports supplement market. The strong performance of this segment was primarily supported by its easy solubility, wide product variety, and suitability for diverse fitness goals such as muscle gain, weight management, and recovery. Powder formulations are favored by both professional athletes and fitness enthusiasts due to their customizable dosage and faster nutrient absorption compared to tablets or capsules. The availability of various protein bases such as whey, soy, and plant-based proteins further strengthened consumer adoption in 2024.

The segment is expected to maintain its leadership position, supported by growing consumer awareness of protein intake and the expansion of online distribution channels. The convenience of mixing powders with water or milk, along with a growing preference for clean-label, low-sugar, and plant-derived formulations, is projected to reinforce market growth. Continuous innovation in flavor enhancement and digestibility improvements has also made powdered supplements the preferred choice among new consumers entering the fitness market.

By Source Analysis

Animal-based dominates with 67.4% share owing to its high protein quality and strong consumer trust

In 2024, Animal-based held a dominant market position, capturing more than a 67.4% share in the global sports supplement market. The segment’s leadership was driven by the superior amino acid profile and high biological value of animal-derived proteins such as whey, casein, and collagen. These sources are widely recognized for promoting faster muscle recovery, improved strength, and better overall performance outcomes, which continue to attract both professional athletes and everyday fitness consumers. The consistent availability of raw materials from dairy and meat industries further supported large-scale production, ensuring stability in product supply throughout 2024.

The animal-based segment is expected to retain its dominance, supported by ongoing consumer preference for scientifically validated and performance-tested ingredients. Increasing demand for whey isolate and hydrolyzed protein formulations, known for rapid absorption, will continue to propel growth. Additionally, advancements in dairy processing technologies and the introduction of lactose-free and low-fat options are expanding the appeal of animal-based supplements among health-conscious users.

By Distribution Channel Analysis

Hypermarkets & Supermarkets dominate with 44.2% share due to strong consumer accessibility and product visibility

In 2024, Hypermarkets & Supermarkets held a dominant market position, capturing more than a 44.2% share in the global sports supplement market. This leadership was largely driven by their broad consumer reach, strong product availability, and the convenience of one-stop shopping. These retail formats provide customers with the advantage of comparing brands, verifying authenticity, and accessing promotional discounts, which significantly influenced purchase decisions in 2024. The wide shelf space allocated to sports nutrition and supplement products in large retail outlets also enhanced brand visibility and consumer awareness.

The dominance of hypermarkets and supermarkets is expected to continue as more consumers prefer physical stores for purchasing health and fitness products, particularly first-time buyers seeking quality assurance and professional guidance. Retailers are increasingly partnering with leading supplement manufacturers to introduce exclusive in-store promotions and loyalty programs, further boosting sales. The growing number of fitness-conscious consumers visiting supermarkets for their daily nutrition needs is also expected to support sustained growth in this segment.

Key Market Segments

By Product

- Capsules/Tablet

- Powder

- Liquid

- Bar

By Source

- Animal-based

- Plant-based

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Online

- Others

Emerging Trends

Safer-Stim” And Stimulant-Transparent Formulations in Sports Supplements

A major trend reshaping sports supplements is the shift to “safer-stim” and stimulant-transparent formulas. Brands are dialing in caffeine amounts, offering low-stim and stimulant-free options, and stating totals clearly on labels. Two widely cited guardrails are guiding this shift. First, the U.S. FDA notes that 400 mg/day of caffeine is an amount “not generally associated with dangerous, negative effects” for most healthy adults—important context for pre-workouts often taken alongside coffee or tea. Second, EFSA concludes that single doses up to 200 mg—about 3 mg/kg body weight—do not raise safety concerns for healthy adults, even when taken < 2 hours before intense exercise under normal conditions. These numbers have become anchor points for formulating tiered products.

This movement isn’t just label housekeeping; it’s risk management. Highly concentrated caffeine in bulk powders has been singled out by FDA as a public-health threat because containers can hold hundreds of potentially lethal doses, and serving sizes may be as tiny as 1/64 teaspoon—a measurement consumers can easily misjudge. That warning has nudged mainstream brands toward pre-measured servings and clearer “total caffeine per scoop” disclosures.

At the same time, performance-nutrition teams serving tested athletes are responding to anti-doping vigilance. The World Anti-Doping Agency’s 2025 Prohibited List entered into force on 1 January 2025, intensifying scrutiny of stimulants, hormone modulators, and masking agents and accelerating demand for “certified-for-sport” lines with rigorous batch testing.

The trend also reflects how consumers actually train. Many exercisers combine coffee with a pre-workout or use energy drinks throughout the day; transparent totals help them keep daily intake under the ~400 mg FDA benchmark, while single-serve products make it easier to respect EFSA’s 200 mg per-occasion guidance (or ~3 mg/kg) before a session. For coaches and sports dietitians, those numbers translate into practical advice: lighter users and smaller athletes can perform well near 2–3 mg/kg, while heavy habitual users can plan their day to remain within ~400 mg overall—reducing sleep disruption and jitters that undermine training quality.

public-health dynamics are amplifying the opportunity for these transparent, right-sized formulas. The World Health Organization reported in June 2024 that 31% of adults—about 1.8 billion people—were insufficiently active in 2022. As governments push activity campaigns through 2030, more “everyday athletes” are entering gyms, classes, and home-workout apps—many wanting energy and focus but not the side-effects of aggressive stimulant stacks. Products that clearly disclose caffeine totals—and provide stimulant-free alternatives paired with electrolytes, creatine, or protein—fit that moment.

Drivers

The Global Sedentary Lifestyle and Inactivity Crisis

One of the most significant drivers behind the growing demand for sports supplements is the global surge in physical inactivity—and with it, a heightened focus on performance, recovery, and wellness. According to the World Health Organization (WHO), more than 80% of adolescents worldwide do not meet the recommended levels of physical activity. Among adults, around one-quarter are insufficiently active, meaning they are missing out on the health benefits of even moderate exercise.

- For example, in the United States, only 46.9% of adults aged 18 and older met the guidelines for aerobic physical activity. Similarly, the U.S. government’s Healthy People 2030 initiative states that only about 25.3% of adults met both aerobic and muscle-strengthening guidelines in 2020.

This widespread inactivity means that many individuals enter workouts with less training adaptation, reduced baseline fitness, and greater need for support—whether that be through enhanced recovery, muscle-maintenance, or boosted energy. In short: when people exercise less, the margin between workout and injury or fatigue narrows, and the attractiveness of “supplement support” rises.

On the institutional side, governments and health organisations are alarmed. WHO’s Global Status Report on Physical Activity 2022 notes that less than 50% of countries have a national physical activity policy, and fewer than 40% have operational programmes to promote active living. That gap indicates a real structural challenge—and creates an opportunity for the sports nutrition industry to partner, educate, and grow.

Restraints

Safety and Regulatory Uncertainty in the Sports Supplement Industry

One of the most significant barriers holding back the sports supplement market is the issue of safety concerns combined with regulatory ambiguity. Consumers today are understandably wary: while supplements promise performance gains, they often come with unanswered questions about product purity, labeling accuracy, and long-term effects. According to the Food and Drug Administration (FDA), dietary supplements are regulated under a different standard from conventional foods and drugs — manufacturers must “ensure that. products are safe and labels are truthful” but they are not required to prove efficacy or safety before marketing.

- For example, one meta-analysis reported that among users of sports nutrition supplements, adverse events ranged from gastrointestinal issues to more severe problems like jaundice or renal strain. More concretely, in a U.S. survey of 106,698 military personnel in 2007–08, 22.8% of men and 5.3% of women reported using bodybuilding supplements, and a larger share—40.5% of men and 35.5% of women—used energy supplements that might contain caffeine or other stimulants.

Further compounding the problem, the research shows that between 10% and 15% of sports or performance-oriented dietary supplements may include substances prohibited by performance-governing bodies, unbeknownst to the users. For competitors in sporting events, this leads to significant risk—any inadvertent doping violation can mean loss of eligibility, reputational damage, and health repercussions. Such reports dampen confidence not just among elite athletes, but also among smaller brands and everyday consumers who may fear “what if” scenarios and decide to avoid the category altogether.

Opportunity

Expanding Demand Due to Global Inactivity and Health-Awareness

One very clear growth opportunity for the sports supplement industry lies in the fact that a large proportion of the global population is not getting enough physical activity, which opens the door for supplements that support training, recovery and overall wellness. According to the World Health Organization (WHO), about 31% of adults worldwide—that is roughly 1.8 billion people—did not meet recommended levels of physical activity in 2022.

What this means, in human terms, is that while people may have good intentions—wanting to be stronger, fitter or more resilient—they often lack the time, the routine, or the consistency of structured workouts. When someone does manage to squeeze in a session, whether it’s strength training, cardio, a HIIT class or simply a shorter-than-ideal gym visit, their nutritional demands shift: they may need better recovery, improved muscle support, enhanced hydration, or more energy to perform well relative to their baseline. That’s a fertile ground for sports supplements designed for everyday fitness-seekers, not only elite athletes.

Another number that underscores the opportunity: in the United States, data from the Centers for Disease Control and Prevention (CDC) show that only 24.2% of adults in 2020 met both the aerobic and muscle-strengthening guidelines. That means the vast majority of adults fall short of optimal guidelines, so even moderate improvements in diet, training and supplementation become meaningful.

From a policy perspective, governments and international organisations are making this a priority, which indirectly supports growth for the sports supplement sector. The WHO’s Global Action Plan on Physical Activity 2018–2030 (GAPPA) sets the goal of a 15% relative reduction in the global prevalence of physical inactivity among adults and adolescents by 2030. This kind of initiative signals rising awareness, more programs to encourage participation in sport and fitness, and increased consumption of nutrition-supporting products by users as they become more active.

Regional Insights

North America Leads Global Sports Supplement Market with 34.9% Share

In 2024, the North America region accounted for approximately 34.90% of the global sports supplement market, representing an estimated USD 10.9 billion in revenue for that year. The region’s dominance can be attributed to several inter-linked factors: high consumer disposable incomes, a well-established fitness culture, and strong institutional frameworks supporting sports nutrition. The United States, in particular, drives the regional market share through both lifestyle and performance users.

Within North America, the prevalence of gym-memberships, collegiate sports programmes, and health-conscious consumer segments has raised demand for protein-based supplements, recovery formulations and performance enhancers. The region benefits from advanced retail infrastructure and regulatory oversight that enhances consumer confidence in product quality and claims. The size of the market at USD 10.9 billion in 2024 highlights the mature nature of demand and the willingness of consumers to invest in sports nutrition.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Creative Edge Nutrition is a U.S.-based holding company active in the sports nutrition sector, emphasising both organic growth and strategic acquisitions. For example, it acquired the Sci-Fit and Nature’s Science brands to expand its range of over 600 products aimed at athletes across levels. The company focuses on high-quality supplements and brand development to support its growth strategy in the performance-nutrition space.

GSK, a global healthcare company, entered the sports-nutrition market through its acquisition of Maxinutrition (including the Maximuscle brand) in the UK for approximately £162 million. This move augmented its consumer-healthcare franchise and provided a strong foothold in the protein-based sports-supplement segment, extending its reach into international markets with science-backed formulations.

Established in 1977 and headquartered in New Jersey, Universal Nutrition has cultivated a reputation in bodybuilding and strength-athlete segments, distributing to more than 90 countries. Its product lines emphasise authenticity (“what is on the label is in the bottle”) and include both hardcore training formulas and “Naturals” wellness variants, making it a specialist in performance-oriented supplements.

Top Key Players Outlook

- Creative Edge Nutrition Inc.

- GlaxoSmithKline PLC

- Universal Nutrition.

- Nature’s Bounty

- GNC Holdings, LLC

- Glanbia PLC

- Herbalife International of America, Inc.

- SciTec, Inc.

- Atlantic Grupa d.d.

- Enervit

Recent Industry Developments

In 2024 GSK reported a total group turnover of £31.4 billion and a core operating profit of £9.15 billion.

In 2024 GNC Holdings, LLC reported a revenue of approximately $1.81 billion, reflecting a 5.57% decline from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 31.4 Bn Forecast Revenue (2034) USD 82.9 Bn CAGR (2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Capsules/Tablet, Powder, Liquid, Bar), By Source (Animal-based, Plant-based), By Distribution Channel (Hypermarkets And Supermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Creative Edge Nutrition Inc., GlaxoSmithKline PLC, Universal Nutrition., Nature’s Bounty, GNC Holdings, LLC, Glanbia PLC, Herbalife International of America, Inc., SciTec, Inc., Atlantic Grupa d.d., Enervit Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Creative Edge Nutrition Inc.

- GlaxoSmithKline PLC

- Universal Nutrition.

- Nature's Bounty

- GNC Holdings, LLC

- Glanbia PLC

- Herbalife International of America, Inc.

- SciTec, Inc.

- Atlantic Grupa d.d.

- Enervit