Global Sports Nutrition Market By Product Type (Sports Supplements, Protein Powders, Ready-to-Drink (RTD) Protein Beverages, Energy Bars, Sports Drinks, Meal Replacement Products, Other Product Types), By Ingredient (Proteins & Amino Acids, Vitamins & Minerals, Carbohydrates, Probiotics and Others), By Application (Energy Supplements, Hydration Products, Pre‑Workout, Post‑Workout and Others), By Formulation (Tablets, Capsules, Powder, Soft gels, Other Formulations), By Distribution (Online, Brick‑and‑Mortar Retail), By Consumer Group (Adults, Children, and Geriatric), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 104589

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Ingredient Analysis

- Application Analysis

- Formulation Analysis

- Distribution Analysis

- Consumer Group Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

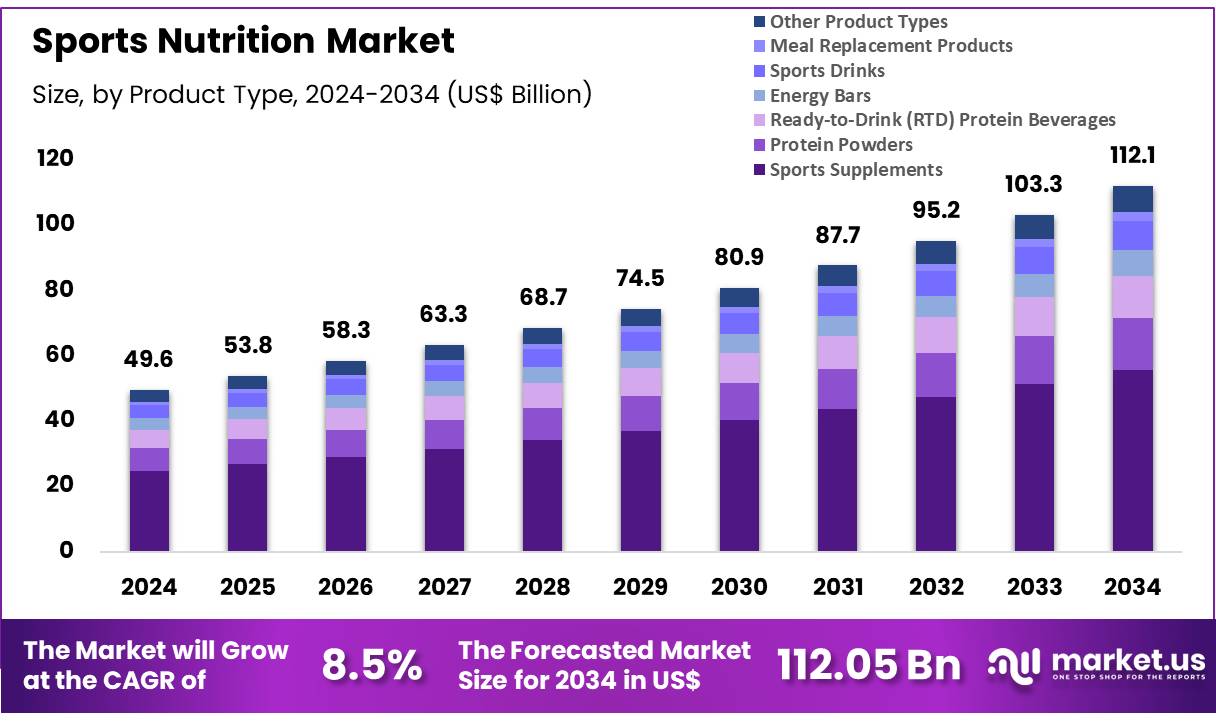

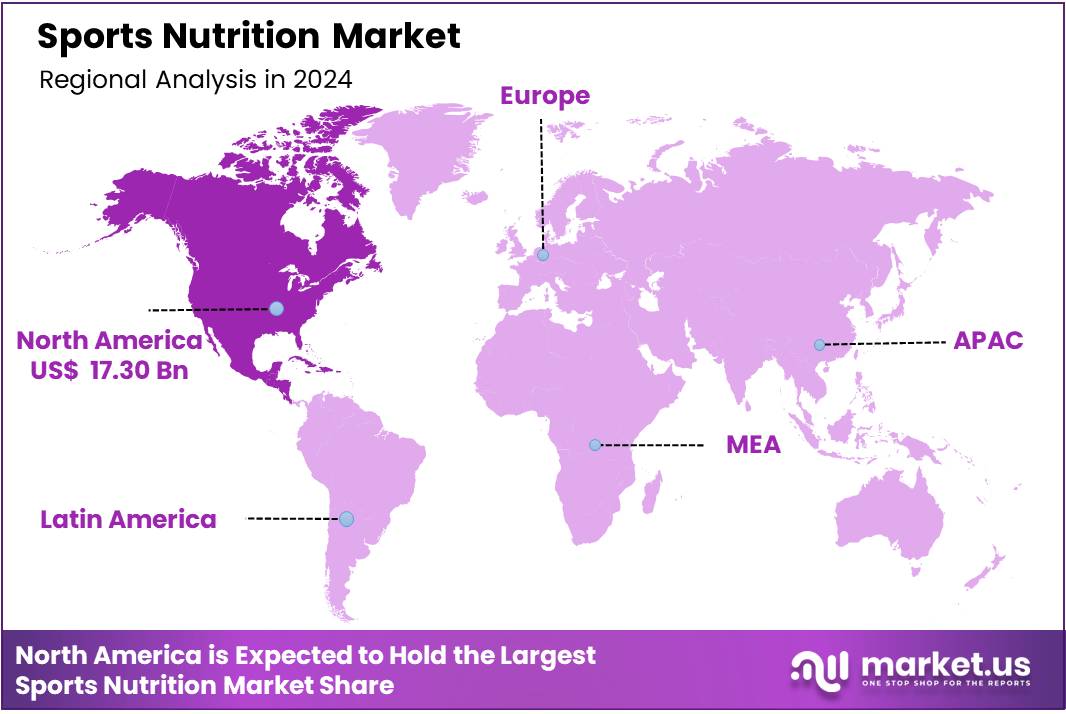

Global Sports Nutrition Market size is expected to be worth around US$ 112.05 Billion by 2034 from US$ 49.56 Billion in 2024, growing at a CAGR of 8.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 34.9% share with a revenue of US$ 17.30 Billion.

Sports nutrition is gradually shifting from niche channels such as gyms and health food stores to mainstream retail outlets. With the rise of innovative ingredients, modern packaging formats, and evolving consumer preferences, these products are increasingly available in supermarkets and convenience stores to meet the growing demand for healthy, on-the-go lifestyle solutions.

Despite this expansion, authenticity and proven effectiveness remain key challenges, as many consumers remain skeptical about product claims. Traditionally catering to bodybuilders and professional athletes, the market is now broadening to include recreational sports participants and lifestyle users, opening fresh opportunities for food manufacturers.

The global sports nutrition market has grown into a mainstream segment of the broader health and wellness industry, driven by increasing fitness awareness, the expansion of gym and health club memberships, and the rising popularity of recreational sports. Once primarily targeted at professional athletes and bodybuilders, sports nutrition has transitioned into a lifestyle category embraced by general consumers seeking energy, recovery, weight management, and overall wellness solutions.

In 2024, sports drinks remained the dominant category, supported by established brands such as Gatorade (PepsiCo) and Powerade (Coca-Cola), which continue to expand product portfolios with low-sugar and functional hydration options. Protein powders, led by brands like Optimum Nutrition and MyProtein, represent another critical segment, widely used for muscle growth and post-workout recovery. Energy bars, exemplified by Clif Bar and Quest Nutrition, are increasingly popular among on-the-go consumers and outdoor enthusiasts.

The rise of plant-based proteins, probiotics, and clean-label formulations highlights evolving consumer preferences for natural, sustainable, and health-conscious ingredients. E-commerce platforms have further expanded accessibility, with brands leveraging direct-to-consumer strategies to build strong communities.

Key Takeaways

- In 2024, the market for Sports Nutrition generated a revenue of US$ 49.56 Billion, with a CAGR of 8.5%, and is expected to reach US$ 112.05 Billion by the year 2034.

- By Product Type, the market is bifurcated into Sports Supplements, Protein Powders, Ready-to-Drink (RTD) Protein Beverages, Energy Bars, Sports Drinks, Meal Replacement Products, and Other Product Types with Sports Supplements taking the lead in 2024 with 49.8% market share.

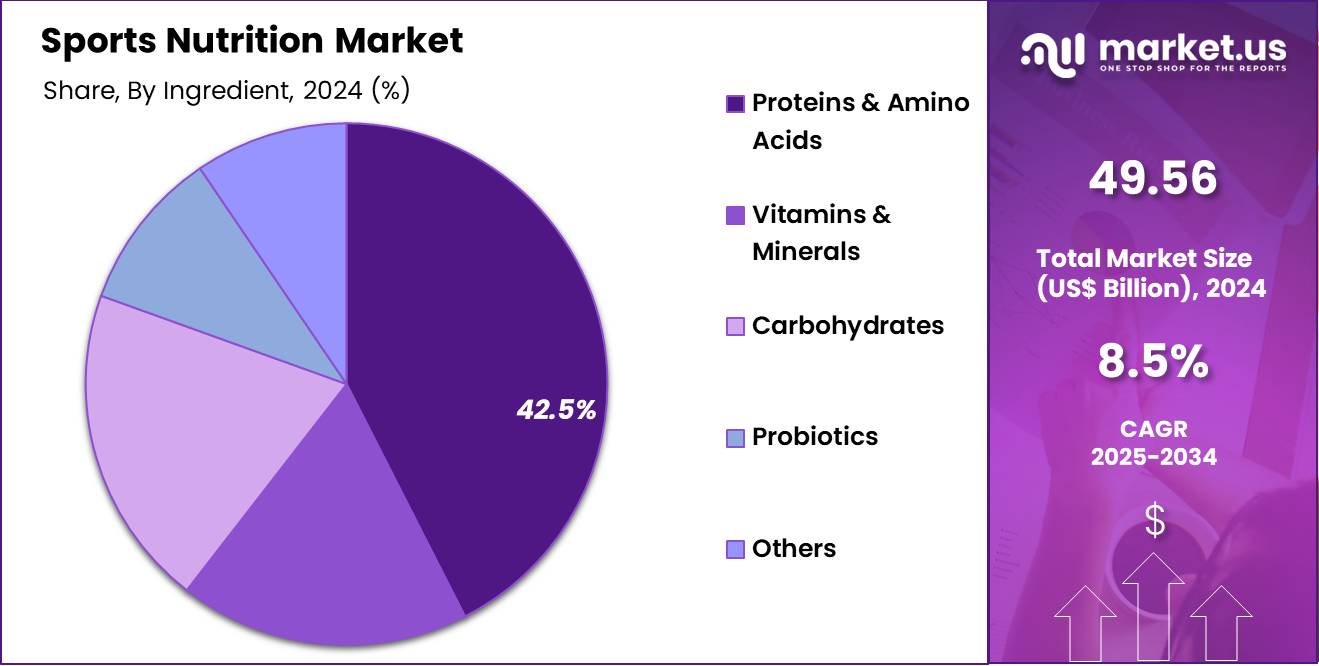

- By Ingredient, the market is bifurcated into Proteins & Amino Acids, Vitamins & Minerals, Carbohydrates, Probiotics, and Others with Proteins & Amino Acids taking the lead in 2024 with 42.5% market share.

- By Application, the market is bifurcated into Energy Supplements, Hydration Products, Pre‑Workout, Post‑Workout, and Others with Energy Supplements taking the lead in 2024 with 31.7% market share.

- By Formulation, the market is bifurcated into Tablets, Capsules, Powder, Soft gels, and Other Formulations with Powder taking the lead in 2024 with 41.7% market share.

- By Distribution, the market is bifurcated into Online and Brick‑and‑Mortar Retail, with Online taking the lead in 2024 with 66.5% market share.

- By Consumer Group, the market is classified into Adults, Children, and Geriatric, with Adults dominated the market with 65.6% market share.

- North America led the market by securing a market share of 34.9% in 2024.

Product Type Analysis

In the sports nutrition market, sports drinks represent the dominating segment with 49.8% market share, holding the largest share due to their widespread consumption and strong brand presence. Sports drinks are designed to provide quick hydration, replenish electrolytes, and restore energy during and after physical activities, making them a staple among both professional athletes and casual fitness enthusiasts. The dominance of this segment is strongly supported by globally recognized brands such as Gatorade from PepsiCo and Powerade from The Coca-Cola Company, which have established robust distribution networks and strong brand loyalty.

In May 2025, PepsiCo announced a landmark global partnership with Formula 1®, set to begin in 2025 under a multi-year agreement. The collaboration brings together the sport’s high-octane energy with three of PepsiCo’s flagship brands: Sting Energy, Gatorade, and Doritos. Through this partnership, PepsiCo aims to merge the thrill of Formula 1 with its commitment to delivering dynamic fan experiences worldwide. With Formula 1 attracting a cumulative global audience of 1.6 billion viewers and boasting an active fan base of 826 million, the alliance offers PepsiCo a powerful platform to connect with consumers across 21 host countries and more than 200 broadcast territories.

These companies continue to innovate by offering low-sugar, zero-calorie, and functional hydration options enriched with added vitamins and minerals to cater to health-conscious consumers. Additionally, lifestyle-driven demand has expanded beyond gyms and sports arenas, with sports drinks now positioned as everyday beverages for energy and wellness. Convenience packaging and marketing strategies targeting younger demographics further reinforce this segment’s leadership.

Ingredient Analysis

In the sports nutrition market, proteins and amino acids form the dominating ingredient segment, accounting for the highest share of 42.5% due to their critical role in muscle building, repair, and performance enhancement. Consumers increasingly rely on whey protein, casein, soy protein, and branched-chain amino acids (BCAAs) to support strength training, endurance, and post-exercise recovery.

For example, brands such as Optimum Nutrition’s Gold Standard Whey and MyProtein’s Impact Whey have become globally recognized choices for athletes and fitness enthusiasts. The rise of plant-based proteins like pea and rice protein from companies such as Garden of Life and Vega further strengthens the segment by addressing vegan and lactose-intolerant populations.

Beyond traditional powders, proteins are now integrated into RTD shakes, snack bars, and fortified foods, expanding accessibility and convenience. The segment benefits from increasing awareness of high-protein diets and their role in weight management and healthy lifestyles. While vitamins, minerals, and probiotics are growing in importance for holistic wellness, proteins and amino acids remain the cornerstone of sports nutrition formulations, ensuring their continued dominance as the essential building blocks for performance-focused and lifestyle-driven consumers.

In February 2024, Nestlé India introduced Resource Activ, a multi-benefit high-protein supplement tailored to the wellness aspirations of active millennials. Built on its distinctive ‘New Edge Formula’, the product combines high-quality proteins to support muscle health, calcium and vitamin D to strengthen bones, and hyaluronate to promote skin vitality. Additionally, it is fortified with fiber and immunonutrients, offering a comprehensive solution for holistic well-being.

Application Analysis

In the sports nutrition market, energy supplements represent the dominating application segment, capturing the largest share of 31.7% due to their broad consumer appeal and immediate performance benefits. These products are designed to enhance stamina, endurance, and focus, making them highly relevant for both athletes and everyday fitness users. Popular examples include C4 Pre-Workout by Cellucor, Red Bull energy formulations, and GU Energy Gels, which are widely used by endurance athletes. Energy supplements span across powders, capsules, drinks, and gels, offering flexibility in consumption and convenience for on-the-go lifestyles.

Their dominance is supported by the growing demand for quick energy boosts in professional sports, recreational fitness, and even busy work schedules, extending their use beyond athletic contexts. The increasing incorporation of natural caffeine sources, green tea extracts, and adaptogens reflects shifting consumer preferences toward clean-label and sustainable energy solutions. In April 2025, GORGIE, a wellness-focused energy drink brand redefining the $20B+ energy market, announced the completion of its $24.5 million Series A funding round. The round was led by Notable Capital, an existing seed investor, raising the company’s total funding to $37 million since its launch.

Formulation Analysis

In the sports nutrition market, powder formulations dominate the segment, holding the largest share of 41.7% due to their versatility, high absorption rates, and wide consumer acceptance. Powders are the preferred format for protein supplements, amino acids, and pre-workout blends, as they can be easily mixed with water, milk, or smoothies. Leading examples include Optimum Nutrition’s Gold Standard Whey, MyProtein powders, and MuscleTech performance blends, which remain best-sellers across gyms, e-commerce, and specialty nutrition stores.

The dominance of powders is reinforced by their ability to deliver precise dosages, faster digestion, and customizable servings compared to tablets or capsules. Furthermore, innovation in flavors, plant-based options, and functional blends enriched with probiotics or electrolytes has broadened their appeal beyond professional athletes to lifestyle users.

In December 2024, ProQuest Nutrition, a prominent player in health and wellness, introduced its latest innovations aimed at supporting athletes and fitness enthusiasts across India. Under the leadership of Sunil Sharma, Business Head, and the strategic direction of Akansha Nagar, Managing Director, the company launched BCAA 5000 along with a new Pre-Workout range, reinforcing its commitment to advancing sports nutrition.

Distribution Analysis

Online distribution is the dominating segment, capturing the largest share of 66.5% due to rising consumer preference for convenience, accessibility, and product variety. E-commerce platforms such as Amazon, Bodybuilding.com, and brand-owned websites like MyProtein and Optimum Nutrition have expanded global reach, allowing consumers to compare products, access discounts, and explore reviews before purchasing.

Online channels are especially popular among younger demographics and urban consumers who value digital shopping experiences, subscription models, and doorstep delivery. The segment is further strengthened by social media marketing and influencer-driven promotions that create strong brand engagement.

Companies are increasingly leveraging direct-to-consumer strategies, offering personalized nutrition recommendations and bundling options through digital platforms. While brick-and-mortar retail, including supermarkets, gyms, and specialty nutrition stores, remains significant for in-person product experience and impulse buying, its growth is comparatively slower.

For instance, in July 2025, sports nutrition brand BeastLife adopted Unicommerce’s technology suite to strengthen and scale its e-commerce operations across India. Founded in 2024 by Gaurav Taneja and Raj Vikram Gupta, BeastLife functions as an online platform offering a wide range of sports nutrition and bodybuilding products, including protein supplements, BCAA, and multi-vitamins.

Consumer Group Analysis

In the sports nutrition market, adults form the dominating consumer group accounting for 65.6% market share, accounting for the highest share due to their widespread participation in fitness, gym activities, and endurance sports. This group increasingly prioritizes performance enhancement, muscle recovery, and energy management, driving demand for protein powders, sports drinks, and energy supplements.

Popular brands such as Optimum Nutrition, Gatorade, and MyProtein target this demographic through gyms, retail stores, and digital platforms, reinforcing its leadership. Adults also represent the largest base for lifestyle-oriented products, with busy professionals and health-conscious individuals integrating sports nutrition into their daily routines beyond athletic use.

Key Market Segments

By Product Type

- Sports Supplements

- Protein Powders

- Ready-to-Drink (RTD) Protein Beverages

- Energy Bars

- Sports Drinks

- Meal Replacement Products

- Other Product Types

By Ingredient

- Proteins & Amino Acids

- Vitamins & Minerals

- Carbohydrates

- Probiotics

- Others

By Application

- Energy Supplements

- Hydration Products

- Pre‑Workout

- Post‑Workout

- Others

By Formulation

- Tablets

- Capsules

- Powder

- Soft gels

- Other Formulations

By Distribution

- Online

- Brick‑and‑Mortar Retail

By Consumer Group

- Adults

- Children

- Geriatric

Drivers

Rising Fitness Awareness and Lifestyle Shifts

One of the strongest drivers of the sports nutrition market is the rising global awareness of fitness, health, and preventive wellness. A growing number of consumers are incorporating gym workouts, running, cycling, and yoga into their daily routines, creating consistent demand for sports nutrition products. For instance, the International Health, Racquet & Sportsclub Association (IHRSA) reported that gym memberships have surged worldwide, particularly in regions such as North America, Europe, and Asia-Pacific.

Sports nutrition brands are capitalizing on this shift by launching mainstream products for casual fitness users, not just athletes. PepsiCo expanded its Gatorade brand with Gatorade Fit, a low-sugar, functional hydration drink targeting health-conscious consumers. Similarly, Clif Bar’s protein and energy bars are widely marketed to outdoor enthusiasts and lifestyle users.

Social media fitness influencers and global campaigns promoting active lifestyles are further strengthening this trend. As health and wellness transitions from niche to mainstream, sports nutrition has become a daily consumption choice, driving steady market growth across demographics, including millennials and Gen Z.

Restraints

Regulatory Challenges and Product Safety Concerns

A significant restraint in the sports nutrition market is the complex regulatory environment and concerns around product safety. Sports nutrition products often face scrutiny regarding ingredient claims, labeling standards, and compliance with food and drug safety regulations. For example, in the U.S., the Food and Drug Administration (FDA) closely monitors dietary supplements, while the European Food Safety Authority (EFSA) sets strict guidelines on health claims. Non-compliance can lead to recalls, reputational damage, and financial losses.

In recent years, some sports supplements were found to contain undeclared stimulants or banned substances, raising consumer concerns about authenticity and safety. Athletes, in particular, are highly sensitive to such risks due to anti-doping regulations set by the World Anti-Doping Agency (WADA). This has pushed companies like Kinetica Sports and Informed-Sport-certified brands to emphasize third-party testing and transparent labeling. Despite growing consumer demand, navigating regulatory hurdles and ensuring safe, tested products remain a critical challenge, potentially slowing market expansion if not addressed with strict quality control and compliance measures.

Opportunities

Growth of Plant-Based and Clean Label Products

The rising popularity of plant-based diets and clean-label nutrition presents a major growth opportunity for the sports nutrition market. Increasing numbers of consumers are seeking natural, sustainable, and allergen-free alternatives to traditional whey and casein protein. This has led to a surge in demand for pea, rice, hemp, and soy protein products.

For example, Vega and Garden of Life have developed strong market presence with their plant-based protein powders, shakes, and bars, catering to vegans and lactose-intolerant consumers. In addition, brands are reformulating products to exclude artificial sweeteners, synthetic additives, and genetically modified ingredients, aligning with clean-label preferences. Companies like Orgain have successfully marketed their organic, non-GMO sports nutrition lines, attracting health-conscious millennials. The trend is further accelerated by sustainability concerns, as plant-based protein production has a lower environmental footprint compared to animal-based sources.

In June 2022, Roquette, a global leader in plant-based ingredients and pioneer in plant proteins, introduced two rice proteins, marking the addition of a new botanical origin to its portfolio. Under the NUTRALYS® brand, the company offers consumers a safe, nutritious, and high-quality alternative protein option. The launch was showcased for the first time at the IFT FIRST event held July 10–13 in Chicago, reinforcing Roquette’s commitment to advancing plant-based cuisine and supporting healthier lifestyles.

With governments and advocacy groups encouraging sustainable food systems, this opportunity is likely to expand rapidly, creating space for both established players and startups to innovate within the plant-based sports nutrition category.

Impact of Macroeconomic / Geopolitical Factors

The sports nutrition market is closely influenced by macroeconomic and geopolitical factors, which shape consumer behavior, supply chains, and overall industry growth. Global inflationary pressures have pushed up the cost of raw materials such as whey protein, soy, and packaging materials, leading companies to adjust pricing strategies. For instance, protein powder prices in North America rose in 2023 as dairy costs surged due to feed and energy inflation.

Geopolitical tensions, including the Russia-Ukraine conflict, have disrupted supply chains for agricultural commodities, raising the cost of ingredients like sunflower oil and impacting energy bar production in Europe. Similarly, trade restrictions and tariffs have altered export-import flows, particularly in Asia-Pacific markets, where companies depend on cross-border ingredient sourcing. Currency fluctuations also affect profitability for global players like Glanbia and Abbott Laboratories, which operate across multiple regions.

On the positive side, government initiatives to promote health and fitness, such as China’s Healthy China 2030 policy, are stimulating demand despite these challenges. Moreover, the post-pandemic focus on immunity and preventive health continues to favor functional sports nutrition products. Overall, while macroeconomic instability and geopolitical risks create cost and supply uncertainties, strategic localization and product innovation are helping brands maintain growth momentum.

Latest Trends

Expansion of Functional and Hybrid Products

Sports nutrition is merging with functional foods and beverages. For example, Coca-Cola’s Powerade now includes vitamin-enhanced hydration products, while protein-infused coffee and snacks are blurring the line between everyday foods and performance products. This trend expands the consumer base by embedding sports nutrition into daily routines.

In July 2023, Unico Nutrition unveiled the reinvention of its flagship Apollo protein powder in collaboration with precision fermentation leader Perfect Day, Inc. The result of extensive innovation efforts, the new formula blends sustainable whey produced through fermentation with grass-fed, animal-based protein, delivering a more ecofriendly and performance-driven option. Marking an industry first, Unico Nutrition became the pioneer in launching a hybrid product that fuses conventional dairy with Perfect Day’s animal-free whey protein.

Moreover, in August 2025, Fixx Nutrition, a leading Australian sports nutrition brand, launched the Fixx Protein X Recovery Shake, a market-leading recovery drink created to help athletes rebuild, refuel, and repeat. With this new hybrid addition, the company advances its mission to support athletes worldwide in recovering smarter and enhancing performance longevity.

Regional Analysis

North America is leading the Sports Nutrition Market

North America is by far the largest regional market for sports nutrition accounting for over 34.9% of global sales in 2024. Growth projections vary, with more conservative estimates pointing to 4.6–6.1% CAGR through the decade, while some forecast a doubled expansion by 2032. Supplement-based formats (powders, bars) dominate revenue, while sports foods show rapid growth. Canada emerges as a high-growth sub-region. Leading companies driving this market include PepsiCo (Gatorade), Glanbia (Optimum Nutrition, thinkThin), Coca-Cola, Abbott Nutrition, and Mondelēz.

A salient example of strategic investment in the sector: Celsius Holdings’ USD 1.8 billion acquisition of Alani Nutrition, targeting broader consumer segments and functional drink demand. Overall, North America’s robust infrastructure, brand innovation, and active consumer base continues to fuel its sports nutrition leadership globally.

Recently, Abbott’s EAS Sports Nutrition introduced nine redesigned Myoplex products aimed at helping athletes train harder and recover better. The updated line delivers tailored nutrition to support performance before, during, and after workouts. Now available on Amazon.com and Bodybuilding.com, the products are designed to enhance power, sustain endurance, build muscle, and strengthen recovery, enabling athletes to achieve their peak performance.

In Europe, supplements dominated consumption, but the fastest momentum is in processed sports foods. India, in particular, is emerging as the fastest-growing national market. Region-wide, leading global brands are strengthening their foothold, with active launches and localized innovations catering to rising health awareness.

In April 2025, Rubicon Bridge expanded the scope of its pioneering Reg Tech Tool™, which has transformed regulatory compliance in food supplements and vitamins, to now support sports nutrition brands in navigating complex international market entry barriers. Currently enabling e-commerce access across nine European countries, the tool is set to extend its reach further in the coming months.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Sports Nutrition market includes Glanbia plc, Abbott Laboratories, PepsiCo, Inc., The Coca-Cola Company, Post Holdings, Nestlé S.A., Optimum Nutrition, MYPROTEIN, Quest Nutrition LLC, MusclePharm, Clif Bar & Company, The Bountiful Company, GNC Holdings, LLC, MuscleTech, GU Energy Labs, and Other key players.

Glanbia plc is a global leader in performance and lifestyle nutrition, recognized for its flagship brands such as Optimum Nutrition, BSN, and Isopure. Optimum Nutrition’s Gold Standard Whey remains one of the world’s best-selling protein powders, appealing to both athletes and general fitness consumers. Glanbia has also expanded into functional foods and ready-to-drink (RTD) formats, enhancing accessibility and convenience. Abbott Laboratories plays a vital role in clinical and sports nutrition with its Ensure and EAS brand heritage. Its products are widely used for muscle recovery, endurance, and overall health support, targeting both professional athletes and individuals seeking balanced nutrition. PepsiCo dominated the sports drinks category through its Gatorade brand, which remains synonymous with hydration and electrolyte replenishment.

Leaders Key Opinion Dr. Elaine Morris, Sports Nutrition Scientist- Nestlé S.A. “Nestlé’s entry into sports nutrition has reshaped the conversation around mainstream wellness. By leveraging its global presence and R&D strength, the company is successfully integrating sports performance with everyday health. Their reformulation of products with plant proteins and micronutrient blends shows a clear alignment with consumer demand for sustainable and holistic nutrition. Nestlé is proving that sports nutrition is no longer just for elite athletes but for anyone seeking daily vitality.” Optimum Nutrition (Glanbia)- Coach Daniel Hayes, Strength & Conditioning Specialist “Optimum Nutrition continues to be the gold standard in performance nutrition. Their flagship whey protein has become a staple not just for bodybuilders but also for casual gym-goers worldwide. What sets them apart is consistency—flavor innovation, transparent labeling, and quality assurance have built trust across generations of athletes. Optimum is now innovating with plant-based ranges and RTD solutions, showing adaptability while maintaining its credibility in the performance segment.” MyProtein- Lara Bennett, Fitness & Lifestyle Influencer “MyProtein has democratized access to sports nutrition. Their direct-to-consumer model and wide product portfolio resonate strongly with millennials and Gen Z. By offering affordable, customizable supplements and leveraging influencer partnerships, they’ve turned sports nutrition into a lifestyle category. The brand’s push into vegan proteins, functional snacks, and limited-edition flavors keeps it highly relevant in an industry that thrives on innovation and consumer engagement.” Sports Nutrition Market

- Glanbia plc

- Abbott Laboratories

- PepsiCo, Inc.

- The Coca-Cola Company

- Post Holdings

- Nestlé S.A.

- Optimum Nutrition

- MYPROTEIN

- Quest Nutrition LLC

- MusclePharm

- Clif Bar & Company

- The Bountiful Company

- GNC Holdings, LLC

- MuscleTech

- GU Energy Labs

- Other key players

Recent Developments

- In July 2025, Cizzle Brands Corporation announced the official launch of Rocket Berry Blast, a new flavor of its flagship sports drink, CWENCH Hydration. The new variant delivers a sweet and juicy taste profile, crafted to capture the refreshing spirit of the summer season.

- In April 2025, RAW Nutrition, a rapidly expanding sports nutrition brand known for premium quality and advanced formulations, announced a strategic partnership with The Quality Group, Europe’s leading performance nutrition company. Recognized in 2024 by Inc. 5000 as the fastest-growing consumer packaged goods company, RAW Nutrition continues to strengthen its global presence. This collaboration leverages The Quality Group’s expertise in state-of-the-art product development and strict quality standards, enabling RAW Nutrition to accelerate its growth and deliver even greater innovation to athletes worldwide.

- In January 2025, Cizzle Brands Corporation, a sports nutrition company focused on advancing health and wellness, announced the launch of its premium nutraceutical line, Spoken Nutrition™. NSF Certified for Sport®, the range has been developed in collaboration with leading performance coaches, dieticians, nutritionists, and functional medicine experts to address the specific needs of professional athletes.

- In March 2025, Vitacost.com, a prominent online retailer of health and wellness products, announced three new collaborations reinforcing its dedication to clean sports and athlete well-being. Central to this initiative is Vitacost’s Sport Certified website experience, an exclusive e-commerce platform that brings together a wide range of NSF Certified for Sport® and Informed Sport® certified products in one accessible online destination.

Report Scope

Report Features Description Market Value (2024) US$ 49.56 Billion Forecast Revenue (2034) US$ 112.05 Billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sports Supplements, Protein Powders, Ready-to-Drink (RTD) Protein Beverages, Energy Bars, Sports Drinks, Meal Replacement Products, Other Product Types), By Ingredient (Proteins & Amino Acids, Vitamins & Minerals, Carbohydrates, Probiotics and Others), By Application (Energy Supplements, Hydration Products, Pre‑Workout, Post‑Workout and Others), By Formulation (Tablets, Capsules, Powder, Soft gels, Other Formulations), By Distribution (Online, Brick‑and‑Mortar Retail), By Consumer Group (Adults, Children, and Geriatric) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Glanbia plc, Abbott Laboratories, PepsiCo, Inc., The Coca-Cola Company, Post Holdings, Nestlé S.A., Optimum Nutrition, MYPROTEIN, Quest Nutrition LLC, MusclePharm, Clif Bar & Company, The Bountiful Company, GNC Holdings, LLC, MuscleTech, GU Energy Labs, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Glanbia plc

- Abbott Laboratories

- PepsiCo, Inc.

- The Coca-Cola Company

- Post Holdings

- Nestlé S.A.

- Optimum Nutrition

- MYPROTEIN

- Quest Nutrition LLC

- MusclePharm

- Clif Bar & Company

- The Bountiful Company

- GNC Holdings, LLC

- MuscleTech

- GU Energy Labs

- Other key players