Global Sports & Event Cancellation Insurance Market Size, Share, Industry Analysis Report By Policy Duration (Single Event Policies, Annual Multi-Event Policies, Others), By End-User (Event Organizers, Sports Teams & Leagues, Venue Owners, Others), By Distribution Channel (Insurance Brokers, Specialty Insurers, Direct Sales), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167605

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- U.S. Market Size

- Policy Duration Analysis

- End-User Analysis

- Distribution Channel Analysis

- Emerging Trends

- Growth Factors

- Investment and Business Benefits

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

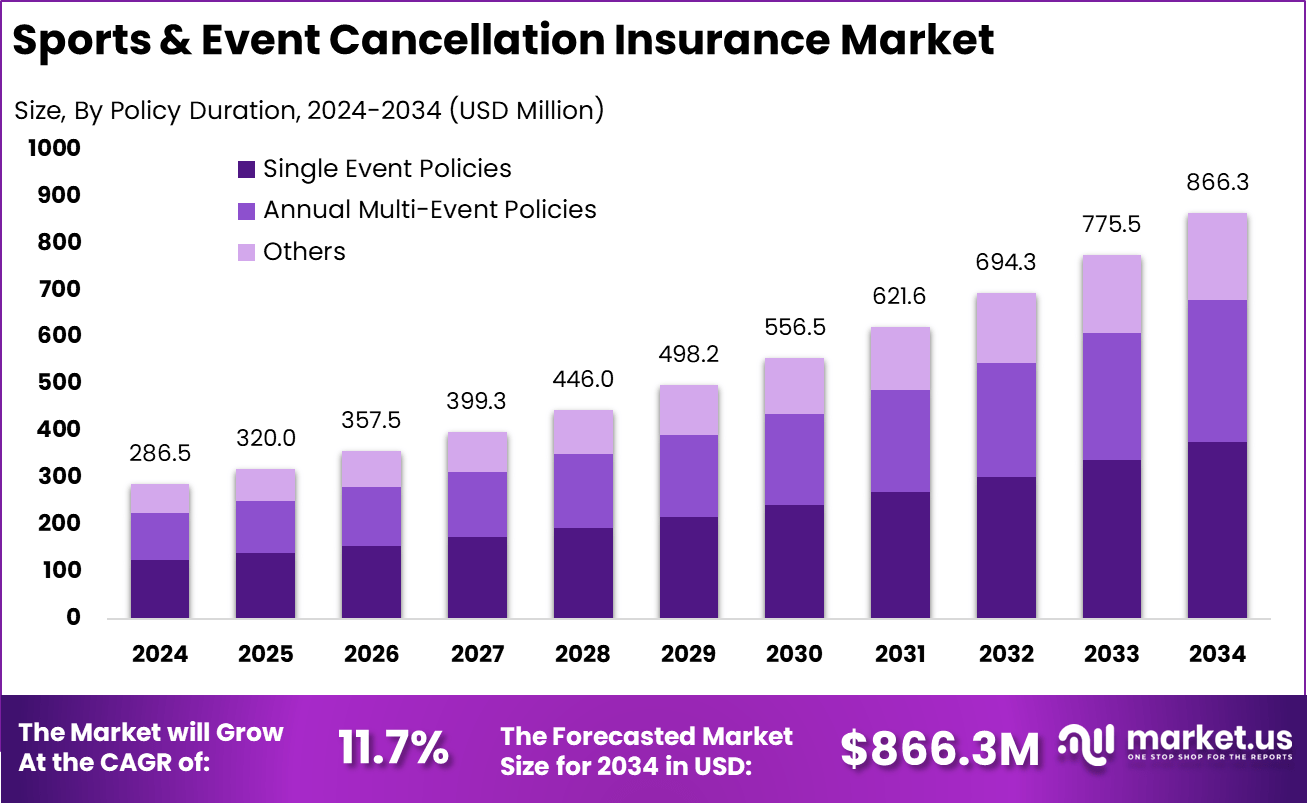

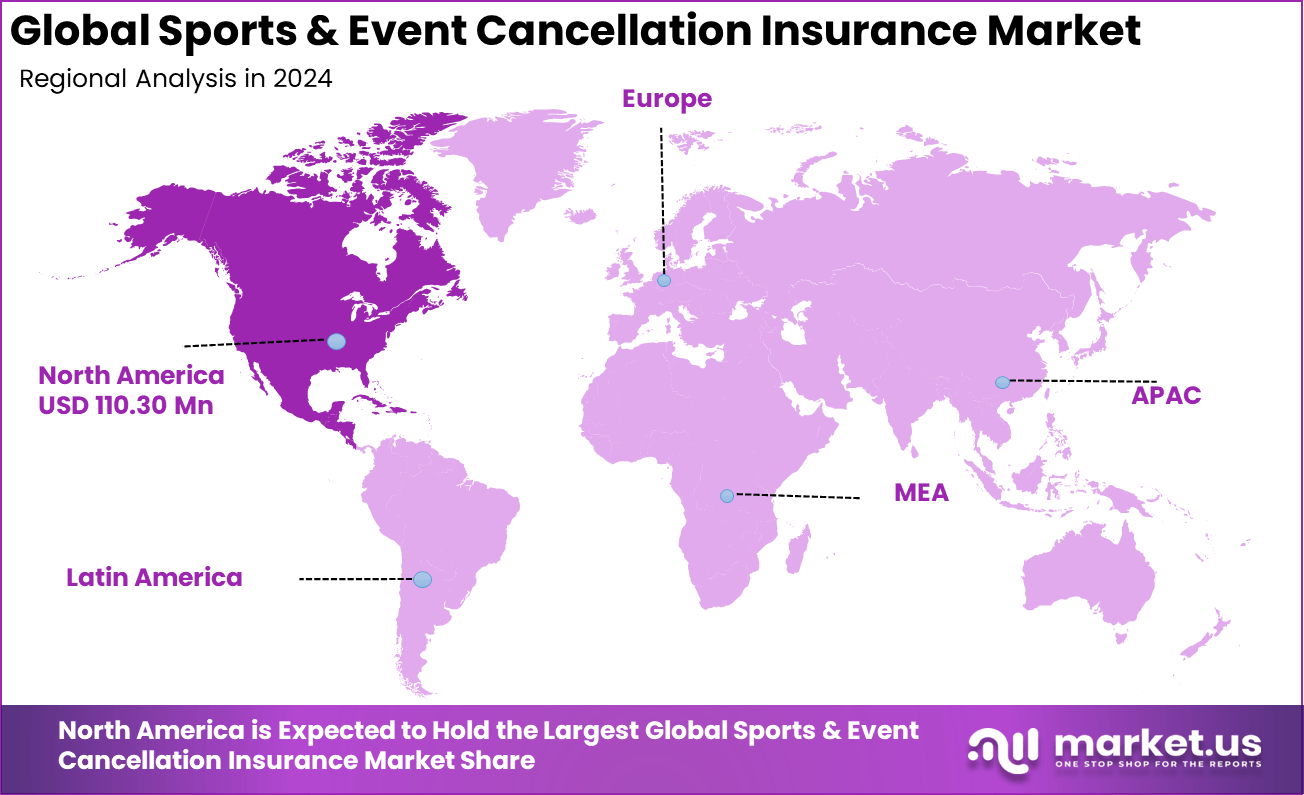

The Global Sports & Event Cancellation Insurance Market size is expected to be worth around USD 866.3 million by 2034, from USD 286.5 million in 2024, growing at a CAGR of 11.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.5% share, holding USD 110.30 million in revenue.

The sports and event cancellation insurance market has expanded as organisers face increasing financial exposure from interruptions caused by weather, safety concerns, logistics issues and unforeseen external events. Growth reflects rising operational costs, higher audience expectations and the need for financial protection when events cannot proceed as planned. The market covers a range of activities, including sports tournaments, cultural festivals, concerts, trade shows and community events.

Top Driving Factors for this insurance include the rising frequency of unpredictable events like extreme weather and pandemics, which create significant risks for live events. Increasing awareness about the financial impacts of cancellations encourages event organizers to seek protection proactively. Another driver is the growing number and scale of large-scale events worldwide, especially corporate events, concerts, and sports tournaments, which involve substantial investments and complex logistics requiring risk management.

The Sports and Event Cancellation Insurance market is driven by rising uncertainty from extreme weather, pandemics, and political disruptions that create financial risks for organizers. As cancellations and postponements become more common, demand for insurance protection has increased. Growth in large global sporting events has also raised awareness and encouraged insurers to provide more tailored and flexible coverage to match changing risk conditions.

For instance, in June 2025, Tokio Marine introduced flexible event cancellation insurance policies with extensive coverage for sporting events and other large gatherings, including extensions for adverse weather and non-appearance of key individuals.

Key Takeaway

- In 2024, the Single Event Policies segment led the Global Sports and Event Cancellation Insurance Market with a 43.6% share.

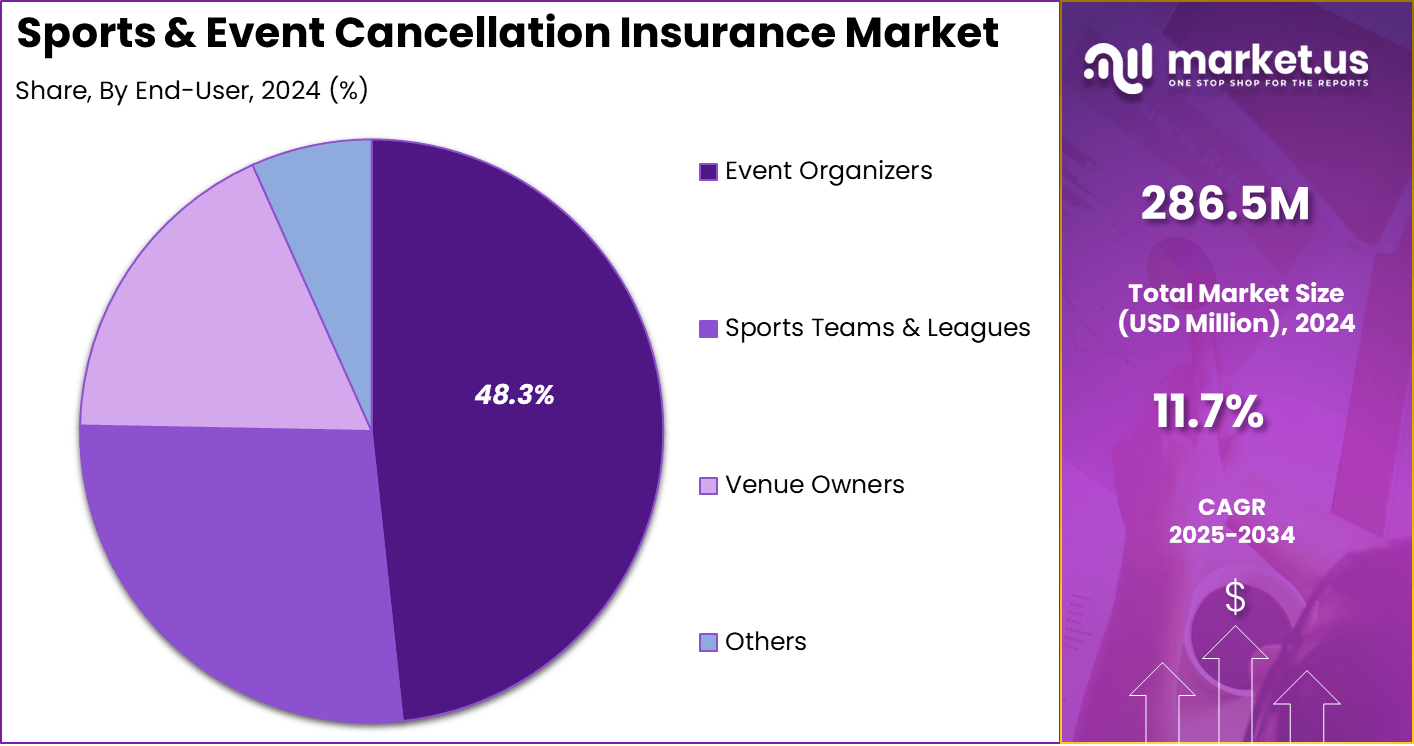

- Event Organizers dominated the same year with a 48.3% share.

- Direct Sales accounted for the largest distribution share in 2024 at 61.8%.

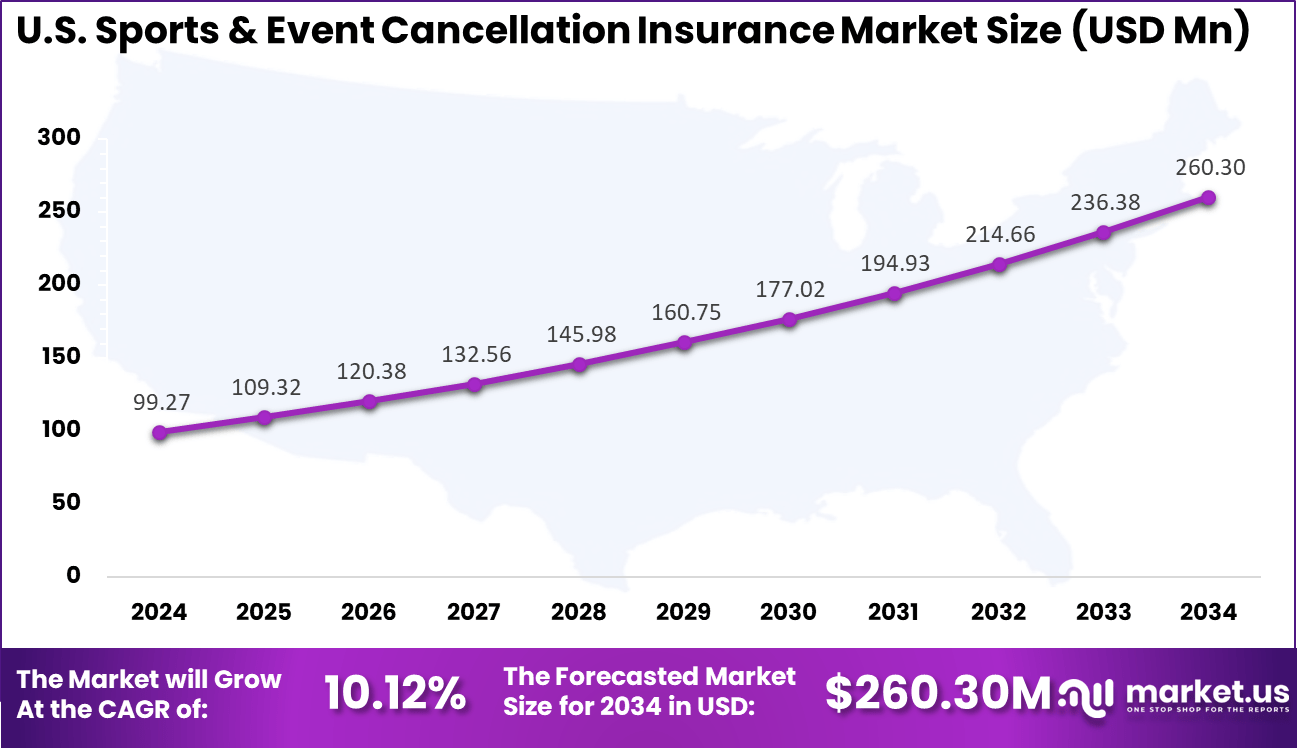

- The U.S. market reached USD 99.27 Million in 2024 with a 10.12% CAGR.

- North America maintained leadership in 2024 with a 38.5% share.

Role of Generative AI

Generative AI is transforming how sports and event cancellation insurance operates by automating data processing and speeding up claim evaluations. AI can quickly analyze event data, weather reports, and participant information to assess risks and validate claims with minimal human intervention.

Around 72% of industry leaders recognize generative AI’s ability to improve efficiency and accuracy in insurance workflows. This technology also helps detect fraud by identifying unusual claim patterns that may go unnoticed by manual processes, protecting insurers and clients alike.

AI’s role extends beyond claims to personalizing insurance offers based on large sets of historical and live data. By tailoring policies to the unique risks of each event, insurers can price coverage more fairly and manage risk more effectively. Additionally, generative AI automates customer service interactions and the creation of insurance documents, making the buying experience faster and more responsive.

U.S. Market Size

The market for Sports & Event Cancellation Insurance within the U.S. is growing tremendously and is currently valued at USD 99.27 million, the market has a projected CAGR of 10.12%. The market is growing due to the increasing awareness of financial risks tied to event disruptions. Organizers face challenges such as unpredictable weather, venue issues, and unforeseen incidents that can cause cancellations or postponements.

Insurance offers crucial protection against these losses, encouraging more event planners to adopt coverage. The rise in large-scale sporting and entertainment events further fuels demand, as stakeholders seek stability and risk management. This growth reflects a broader trend of professionalizing event planning with financial safeguards in place.

For instance, in May 2025, Liberty Mutual’s event cancellation coverage protects against lost deposits and rescheduling costs when events, including sports competitions, cannot proceed as planned due to covered risks like severe weather or vendor issues. They emphasize early policy purchase to secure extensive protection for event organizers.

In 2024, North America held a dominant market position in the Global Sports & Event Cancellation Insurance Market, capturing more than a 38.5% share, holding USD 110.30 million in revenue. This dominance arises from a well-established sports industry featuring frequent large-scale professional and amateur events, which drives consistent demand for insurance coverage.

North America’s mature insurance sector and robust regulatory framework further encourage widespread adoption of event cancellation insurance among organizers, sponsors, and sports clubs. Additionally, the region’s advanced risk management practices and high awareness of financial vulnerability related to event disruptions contribute significantly to market strength.

For instance, in November 2025, Starr International became an official sponsor of St. John’s Athletics, signaling its strong involvement and commitment to the sports insurance market with a focus on specialty coverages, including accident and liability insurance for sports events.

Policy Duration Analysis

In 2024, The Single Event Policies segment held a dominant market position, capturing a 43.6% share of the Global Sports & Event Cancellation Insurance Market. These policies are crafted to cover one-time events, providing organizers with financial protection specifically for that event alone.

This segment benefits from simplicity and straightforward coverage terms, appealing to organizers who manage unique or irregular events and want targeted security without long-term commitments. The focus on single-event policies reflects the demand for flexible and immediate risk coverage tailored to individual event needs.

This segment’s relevance grows with the diversity and frequency of one-off sports and entertainment events worldwide, where cancellation risks like weather or unforeseen disruptions are always present. The market’s inclination toward single-event policies highlights the value placed on minimizing event-specific financial losses while keeping insurance flexible and affordable.

For Instance, in October 2023, Allianz Partners launched ticket cancellation insurance for the Paris 2024 Olympic and Paralympic Games, allowing fans to protect single event ticket purchases against sudden unforeseen events such as illness or travel issues, a strong example of tailored single event coverage.

End-User Analysis

In 2024, the Event Organizers segment held a dominant market position, capturing a 48.3% share of the Global Sports & Event Cancellation Insurance Market. These professionals and companies secure insurance to mitigate financial risks related to event postponements, cancellations, or interruptions.

The insurance offers critical safeguards that enable organizers to manage uncertainties, such as weather issues, venue problems, or other disruptions that could otherwise cause significant monetary losses. The strong market share of event organizers underscores their proactive approach to risk management and commitment to ensuring event success despite potential setbacks.

For instance, in September 2025, Zurich Insurance extended its sponsorship of the Zurich Classic of New Orleans PGA Tour, a high-profile sports event, demonstrating its commitment to event organizers by supporting major events and offering related insurance solutions.

Distribution Channel Analysis

In 2024, The Direct Sales segment held a dominant market position, capturing a 61.8% share of the Global Sports & Event Cancellation Insurance Market. This channel allows insurance providers to interact directly with clients, building trust and offering tailored service. Direct sales are particularly effective for larger events or repeat insurance purchasers, where customization and relationship management are critical.

The preference for direct sales reflects the complex nature of cancellation insurance, where clients often need expert advice and personalized policy terms. It also points to the importance of direct support in navigating claims and coverage details. While online platforms and brokers grow in influence, direct sales remain a key channel for substantial and complex insurance needs in this market segment.

For Instance, in October 2025, AXA XL highlighted its direct sales approach in contingency insurance, including event cancellation and non-appearance policies across a wide variety of events, emphasizing flexibility and personalized service to direct clients.

Emerging Trends

A key emerging trend in sports and event cancellation insurance is the use of real-time data for dynamic pricing. Insurers now factor in live conditions like weather and ticket sales to adjust coverage costs immediately, offering more precise risk management.

About 25% of fans are willing to pay extra for insurance products and services enhanced by AI and data insights, showing market acceptance. Parametric insurance is also gaining attention, where policies pay out automatically when measurable triggers such as rainfall or wind speed reach certain levels, cutting delays in claims.

Sustainability concerns are reshaping insurance demands as climate events become more frequent. There is a rising interest in policies that support environmentally responsible event planning and cover environmental risks. The market is also expanding to cover virtual and eSports events, which face unique threats like streaming failures or cyberattacks.

Growth Factors

The growth in sports and event cancellation insurance is mainly fueled by the increasing number and scale of organized sports events worldwide. Greater professionalization and higher stakes in sports lead to larger financial risks, prompting organizers to secure adequate protection.

Escalating medical expenses and a stronger focus on athlete safety further drive the demand for specialized insurance solutions. Advances in AI and data analytics also contribute by enabling insurers to design customized policies, making coverage more accessible and attractive.

Commercialization of sports through media rights and sponsorship deals adds significant financial exposure, increasing the need for cancellation insurance to protect investments. The diversity of events, including virtual sports and amateur competitions, widens the market base. As event complexity grows, so does the priority given by organizers to risk management, helping insurance providers tap into a broader, more sophisticated customer segment.

Investment and Business Benefits

Investment Opportunities in this sector are driven by technological innovation in risk assessment and coverage models. Investment in AI and big data analytics enhances underwriting capabilities, enabling more tailored and cost-effective policies.

Furthermore, parametric insurance products, offering automatic payouts based on predefined triggers, open up new avenues for expansion. Growth prospects also lie in emerging markets where even economies are rapidly developing.

Business Benefits of adopting this insurance include improved risk management, reduced financial unpredictability, and enhanced credibility with stakeholders. Event organizers can focus more confidently on planning and operations, knowing that cancellations or disruptions will not cause devastating losses.

Key Market Segments

By Policy Duration

- Single Event Policies

- Annual Multi-Event Policies

- Others

By End-User

- Event Organizers

- Sports Teams & Leagues

- Venue Owners

- Others

By Distribution Channel

- Insurance Brokers

- Specialty Insurers

- Direct Sales

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand Due to Unpredictable Events

The growing number of unpredictable events like extreme weather, pandemics, and political unrest has pushed event organizers to seek protection. This rising frequency of risks makes cancellation insurance essential for sports events. Organizers want to avoid huge financial losses caused by last-minute cancellations or postponements.

With more large-scale sports events happening worldwide, the awareness of cancellation insurance as a safeguard has increased. This growing demand supports steady market growth and encourages insurers to develop more tailored and flexible insurance solutions.

For instance, in March 2024, Allianz highlighted the increasing insured values for large sports events due to rising costs in ticketing, travel, and accommodation following the pandemic. The company emphasized that global sports events demand robust insurance solutions to cover these unpredictabilities, driving insurance coverage growth.

Restraint

Economic Uncertainty Impacting Investment

Economic fluctuations and downturns pose a restraint on the sports and event cancellation insurance market. When the economy weakens, event organizers may become hesitant to spend on additional insurance coverage. The premium costs can sometimes be seen as an avoidable expense, especially for smaller-scale sporting events or those with tight budgets.

The uncertainty in economic conditions can reduce the willingness of organizers to buy comprehensive insurance policies. Furthermore, the complexity of these insurance products and the challenge of accurately evaluating risk for each event may discourage uptake.

Event organizers may find the policies difficult to understand or feel that the coverage does not justify the cost. These economic and perception barriers can constrain market growth despite increasing risk awareness.

For instance, in August 2025, Zurich launched EventGuard, a new event cancellation product with pandemic-related coverage improvements. Despite product innovation, economic caution among organizers affects uptake. Higher premium sensitivity during uncertain economic times limits new policy sales, particularly for smaller or less lucrative events.

Opportunities

Expansion of Corporate and Large-Scale Sporting Events

The global rise in corporate-sponsored and large sporting events creates a huge opportunity for the event cancellation insurance market. Corporations are hosting more branded tournaments, sponsorships, and sporting spectacles to engage audiences, which means bigger financial stakes and higher insurance needs.

As these events get more expensive to organize, the demand for protecting these investments from cancellation losses grows. This opportunity also extends to emerging markets, where rising disposable incomes fuel more sports participation and viewership.

Insurance providers have a chance to offer tailored products that fit specific event scales and regional risks. With better risk assessment technology, insurers can design coverage that appeals to a broader customer base, maximizing growth potential.

For instance, in August 2025, Chubb acquired EventPro Insurance Services to strengthen its global event cancellation offerings. This move expands its capacity to underwrite large conferences and live sports events, capturing growth potential in corporate and high-value sports markets.

Challenges

Increasing Insurance Costs and Coverage Limits

The new generative AI has been creating more advanced threats, namely prompt injection attacks. By exploiting the AI models incorporated in the APIs, the hackers manipulate the input to the model to cause malicious actions.

By writing certain prompts, intruders will determine the AI behavior to retrieve sensitive, confidential data, respectively modify the output, or ultimately affect the weaknesses of the organization. Potential risks include data breaches and intellectual property theft. With more integration into company activities, securing AI-centric APIs against these threats would save business assets and credibility.

For instance, in September 2024, Tokio Marine launched a new malicious cyber event coverage extension for its event cancellation insurance as a response to growing cyber risks, reflecting increased complexity and costs in underwriting modern events. This addition indicates challenges insurers face in managing evolving risks while trying to keep premiums competitive.

Key Players Analysis

Allianz, Zurich Insurance Group, Chubb, AIG, and AXA XL lead the sports and event cancellation insurance market with strong underwriting expertise and global coverage capabilities. Their policies protect organizers from financial losses caused by unforeseen disruptions such as severe weather, venue issues, and public safety concerns. These companies focus on accurate risk modeling, customized coverage structures, and rapid claim management.

Liberty Mutual, Tokio Marine, Munich Re, Swiss Re, and Berkshire Hathaway strengthen the competitive landscape through reinsurance capacity and specialized event-risk solutions. Their offerings support major tournaments, concerts, trade shows, and international competitions. These providers emphasize scenario analysis, risk diversification, and high-limit coverage to address complex cancellation exposures.

Hiscox, Markel, Beazley, Starr International, and other participants add depth to the market with flexible policies for mid-sized events, festivals, and regional sports competitions. Their solutions focus on affordability, tailored endorsement options, and coverage for emerging risks such as equipment failure or key-person unavailability. Increasing frequency of weather disruptions and operational uncertainties drives adoption of these products across entertainment, sports, and corporate event segments.

Top Key Players in the Market

- Allianz

- Zurich Insurance Group

- Chubb

- AIG

- AXA XL

- Liberty Mutual

- Tokio Marine

- Munich Re

- Swiss Re

- Berkshire Hathaway

- Hiscox

- Markel

- Beazley

- Starr International

- Others

Recent Developments

- In November 2025, Zurich Insurance Group held an Investor Update in mid-November highlighting ongoing strategic initiatives and market positioning, reflecting a strong focus on sustaining growth in niche insurance areas, including event cancellation coverage.

- In November 2025, AIG reported excellent third-quarter results early November with new investments indicating an expansion of their insurance offerings, including enhanced event cancellation solutions aimed at large-scale sports and entertainment events.

- In May 2025, Liberty Mutual emphasized advanced event cancellation coverage in its portfolio guide, highlighting the importance of timely policy purchase (at least two weeks in advance) to protect against lost deposits and rescheduling costs, particularly for weather-vulnerable outdoor events.

Report Scope

Report Features Description Market Value (2024) USD 286.5 Mn Forecast Revenue (2034) USD 866.3 Mn CAGR(2025-2034) 11.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Policy Duration (Single Event Policies, Annual Multi-Event Policies, Others), By End-User (Event Organizers, Sports Teams & Leagues, Venue Owners, Others), By Distribution Channel (Insurance Brokers, Specialty Insurers, Direct Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz, Zurich Insurance Group, Chubb, AIG, AXA XL, Liberty Mutual, Tokio Marine, Munich Re, Swiss Re, Berkshire Hathaway, Hiscox, Markel, Beazley, Starr International, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sports & Event Cancellation Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Sports & Event Cancellation Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz

- Zurich Insurance Group

- Chubb

- AIG

- AXA XL

- Liberty Mutual

- Tokio Marine

- Munich Re

- Swiss Re

- Berkshire Hathaway

- Hiscox

- Markel

- Beazley

- Starr International

- Others