Global Sports Auto-Camera AI Market Size, Share, Industry Analysis Report By Deployment (Cloud-based, On-premise), By Application (Broadcast Production, Live Streaming, Instant Replay, Highlight Generation, Player Performance Analysis, Others), By End-User (Broadcast Networks, Sports Leagues & Teams, Streaming Platforms, Venue Operators, Content Creators, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166900

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Performance Statistics

- AI’s Impact on Athletic Performance

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Deployment Analysis

- Application Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

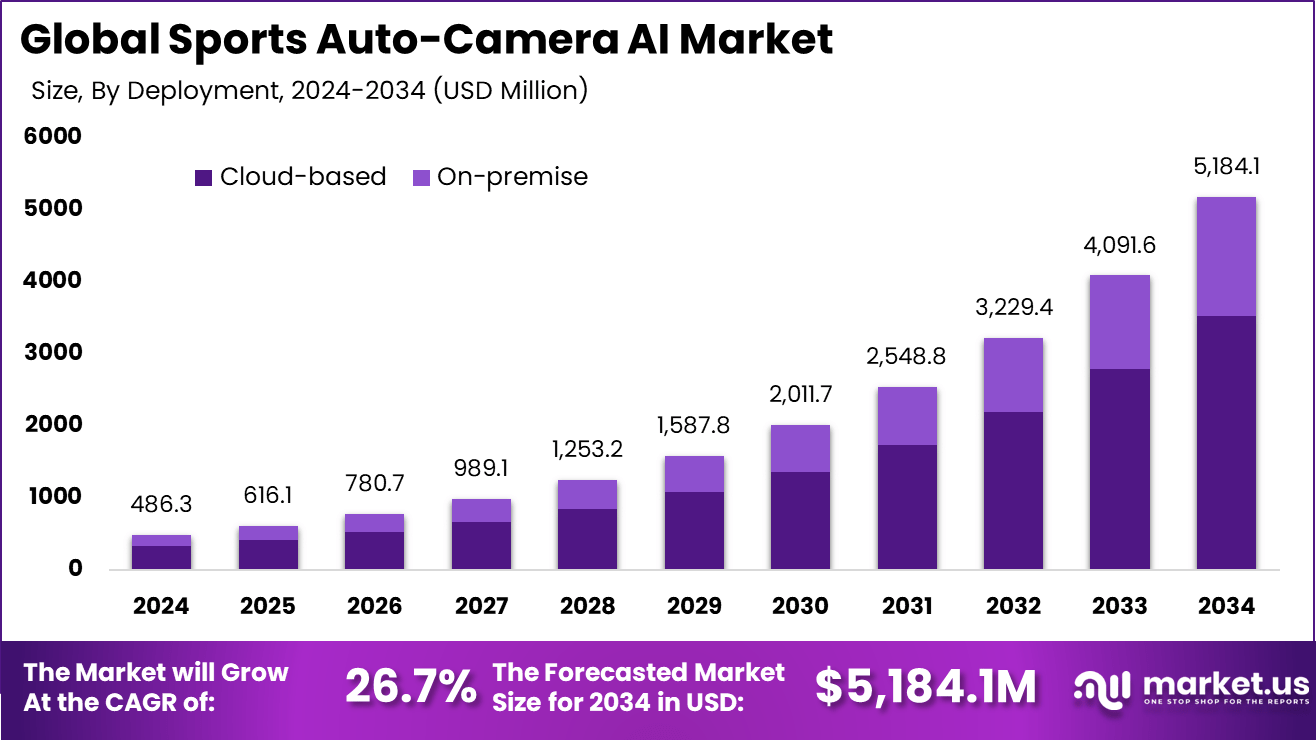

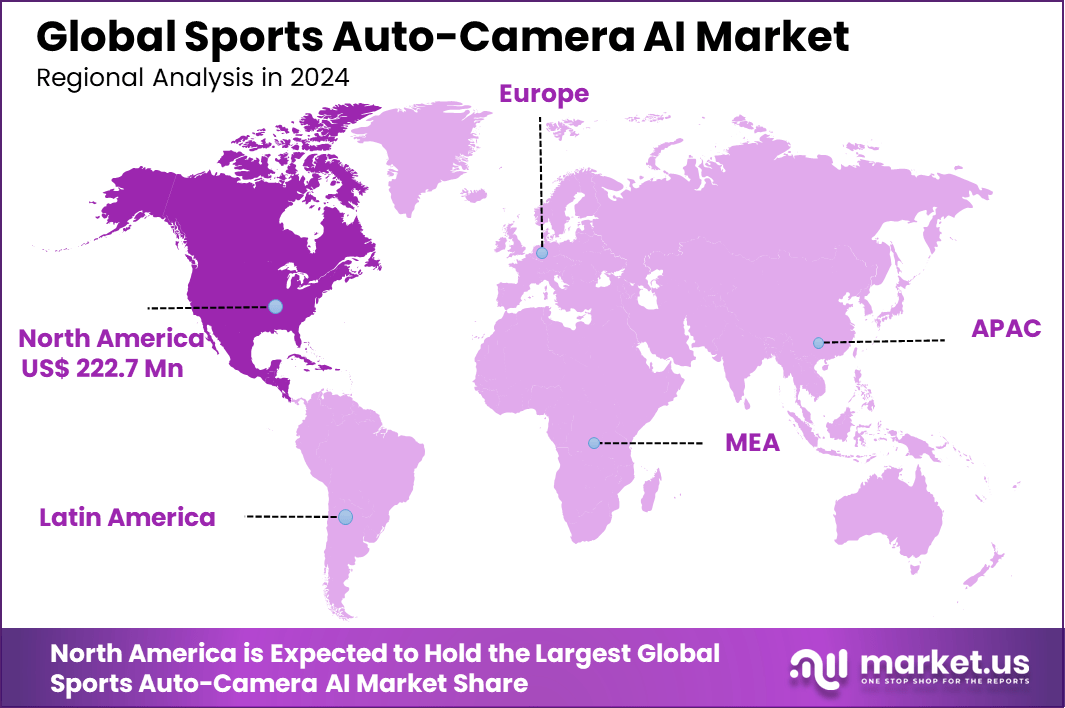

The Global Sports Auto-Camera AI Market size is expected to be worth around USD 5,184.1 million by 2034, from USD 486.3 million in 2024, growing at a CAGR of 26.7% during the forecast period from 2025 to 2034. In North America held a dominant market position, capturing more than a 45.8% share, holding USD 222.7 million in revenue.

The sports auto camera AI market has expanded as clubs, academies and broadcasters adopt intelligent camera systems capable of tracking players and capturing automated footage without human operators. Growth reflects the rising need for affordable, high quality sports recording that supports training, analytics and live streaming. The market has moved from niche automated filming tools to widely adopted AI driven systems across professional, amateur and youth sports.

Top Driving Factors for Sports Auto-Camera AI include the surge of data from wearables and sensors that demand advanced analytics, and rapid strides in machine learning and computer vision technologies. These factors allow precise monitoring of player performance, injury prediction, and tactical decisions, boosting the appeal of automated systems to teams and broadcasters.

For instance, in March 2024, Sony released two new 4K handheld professional camcorders featuring AI subject recognition, high-precision autofocus, and advanced zoom capabilities. These models optimize capture quality and provide seamless cloud streaming, supporting various professional sports production needs.

The increasing adoption of technologies like computer vision, pose estimation, and real-time tracking plays a crucial role. These AI cameras can identify and follow players continuously, analyze actions during gameplay, and even generate heat maps and speed tracking data automatically. Integration with wearable devices further enriches the quality of athlete monitoring by combining video data with physiological metrics.

Key Takeaway

- In 2024, the Cloud-based segment dominated with a 68.1% share, reflecting growing preference for scalable storage, remote access, and seamless video processing.

- The Broadcast Production segment led with a 51.7% share, driven by rising demand for automated, AI-enhanced live sports coverage.

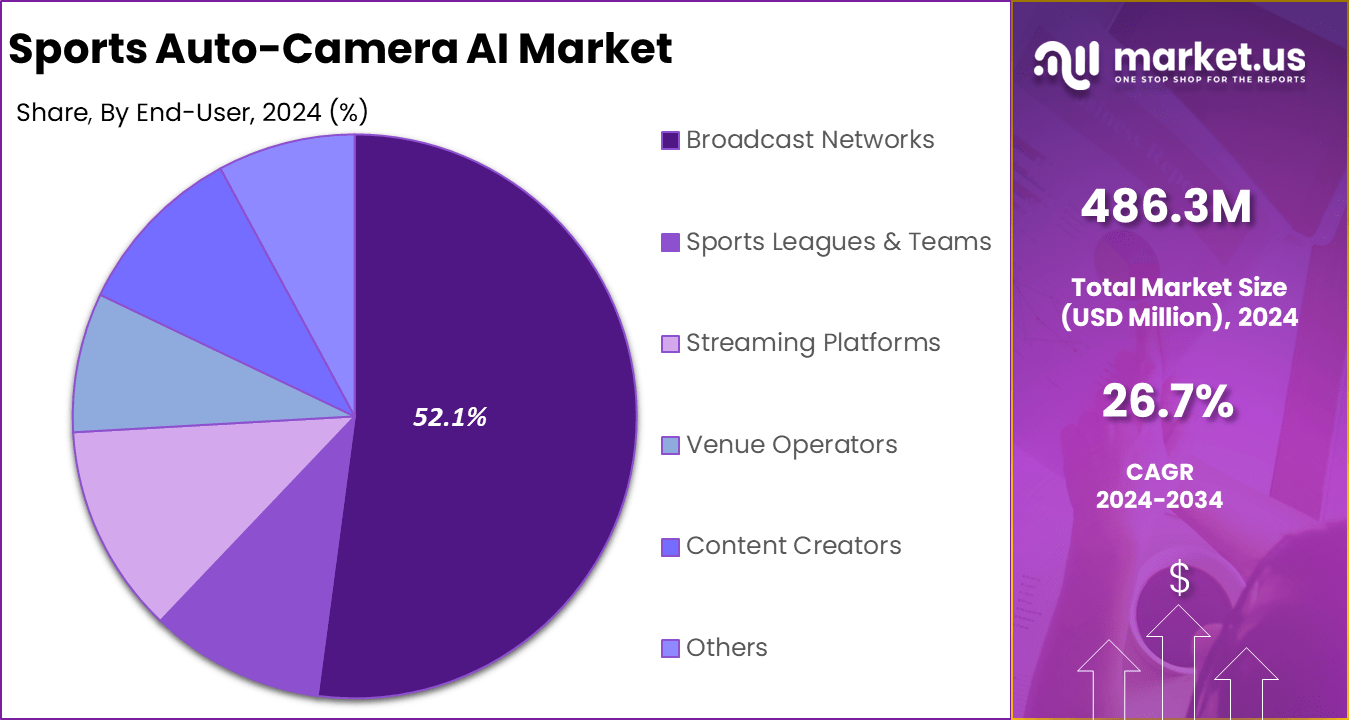

- The Broadcast Networks segment accounted for 52.1%, emphasizing adoption of AI cameras for real-time event streaming and content optimization.

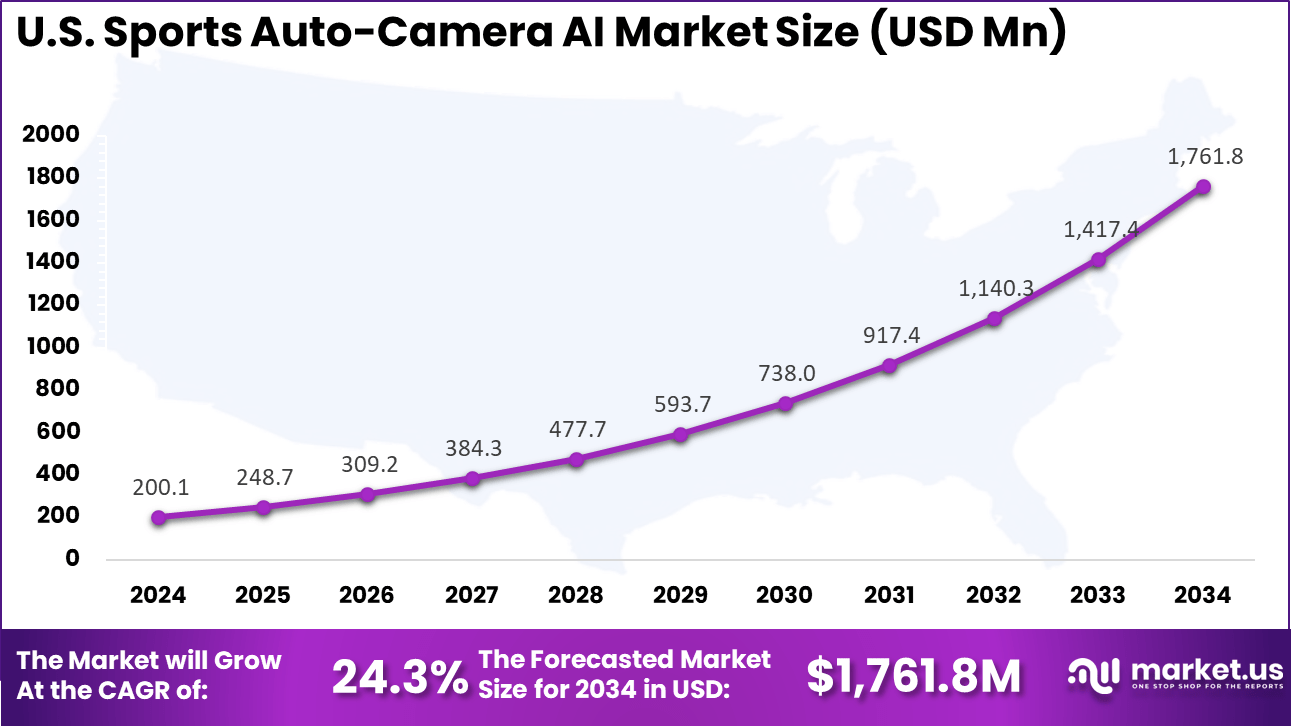

- The US market was valued at USD 200.1 million in 2024 and is expanding at a strong CAGR of 24.3%, fueled by increasing integration of AI-based analytics in sports broadcasting.

- North America captured more than 45.8%, supported by advanced media infrastructure, professional sports leagues, and early AI adoption in production technologies.

Key Performance Statistics

- Highlight generation systems reach more than 98% detection accuracy during live sports events.

- Semi automated offside technology at the 2022 World Cup delivered decisions and 3D animations in about 25 seconds, compared with the 3 to 4 minutes often required by traditional VAR reviews.

- Player tracking platforms use 12 dedicated cameras to capture 29 body points per athlete at 50 Hz, supporting precise movement analysis.

- Motion analysis models achieve over 95% accuracy in sports such as tennis and basketball.

- Consumer AI cameras typically include a 120° AI lens with 360° horizontal rotation, allowing full field coverage.

- Many AI powered action cameras record in 4K resolution at 60 FPS, ensuring high image quality.

AI’s Impact on Athletic Performance

- Professional sports teams using AI analytics have reported injury reductions of up to 30%.

- One football club recorded a 70% drop in injuries per 1,000 hours of play after adopting AI-based risk assessment systems.

- The NFL reduced total injuries from 990 in 2019 to 495 in 2023, supported by the integration of AI-driven monitoring technologies.

- AI-assisted training programs can improve strength, endurance, and coordination by up to 20% compared with traditional approaches.

- AI-supported rehabilitation processes have demonstrated a 30% decrease in recovery time, helping athletes return to training more efficiently.

Role of Generative AI

Generative AI plays a growing role in sports auto-camera AI by powering the creation of instant highlights and personalized content. Around 25% of fans are willing to pay extra for AI-enhanced experiences that generate automatic game summaries and commentary, helping to make sports more engaging to watch. This technology supports broadcasters by reducing delays in content production and providing more dynamic ways to tune into the game.

By generating video clips and real-time insights, it makes the viewing experience more interactive and accessible to casual and serious fans alike. Generative AI also enhances sports analysis by creating unique angles and replay clips without manual editing. It assists coaches and players by summarizing complex game data into digestible video insights, something that nearly half of professional teams are adopting to improve tactical planning.

This AI approach opens new paths for fan interaction, including automated social media content and tailored highlights, making it easier to follow favorite players or teams. This technology transforms traditional sports coverage by blending automation and creativity with precision.

Investment and Business Benefits

Investment Opportunities within the Sports Auto-Camera AI landscape look promising due to escalating demand for innovative, real-time sports analytics and broadcasting solutions. Funding is rapidly flowing into startups and established firms developing AI-driven camera platforms that cater to a variety of sports, including football, basketball, tennis, and emerging e-sports formats.

There is particular growth in cloud-native and SaaS models that enable scalable deployment of AI cameras at venues worldwide. Business Benefits are numerous: AI cameras increase operational efficiency by automating video capture and editing, enhance fan experience through immersive, multi-angle viewing options, and improve athlete safety by monitoring fatigue and movement anomalies closely.

These cameras also help sports organizations attract sponsors with digital scorecards and branded content integration, while enabling detailed performance insights that fine-tune athlete training and game-day tactics.

U.S. Market Size

The market for Sports Auto-Camera AI within the U.S. is growing tremendously and is currently valued at USD 200.1 million, the market has a projected CAGR of 24.3%. The market is growing due to the increasing demand for advanced broadcasting technologies and automated coverage. The growth is supported by the need for real-time insights, better viewer engagement, and cost efficiency in sports production.

Innovations from leading tech companies and broadcasters are making AI-powered cameras more accessible and efficient. This trend is expected to continue as the industry seeks smarter, more flexible solutions to enhance live sports experiences and streamline content delivery, fueling the market’s impressive growth rate.

For instance, in June 2025, the NHL accelerated its integration of Hawk-Eye technology, developed by Sony, to enhance officiating accuracy and revolutionize game viewing. This system uses high-speed cameras and AI to track player and puck movements with millimeter precision, supporting smarter replay reviews and near-instantaneous rulings on plays such as offside and goal validity.

In 2024, North America held a dominant market position in the Global Sports Auto-Camera AI Market, capturing more than a 45.8% share, holding USD 222.7 million in revenue. This dominance is driven by advanced technological infrastructure, early adoption of AI in sports broadcasting, and significant investments from major broadcasters and tech companies.

The region’s mature sports industry continually seeks innovative ways to enhance fan engagement and improve production efficiency. Combined with supportive regulations and a concentration of leading AI developers, North America remains at the forefront of advancing and deploying smart camera solutions in sports media.

For instance, in May 2025, Google demonstrated its AI Basketball Coach using Gemini 2.5 Pro combined with Pixel cameras and Vertex AI to provide biomechanical analytics and jump shot coaching, showing advanced computer vision in sports training.

Deployment Analysis

In 2024, The Cloud-based segment held a dominant market position, capturing a 68.1% share of the Global Sports Auto-Camera AI Market. This is because cloud-based systems allow sports organizations to use powerful AI tools without investing heavily in physical infrastructure. The cloud offers flexibility by enabling remote access and easy scaling, which suits events of different sizes and budgets.

Additionally, cloud deployment supports real-time data processing and instant delivery of game footage and analytics. This means broadcasters and fans receive seamless, accurate coverage powered by AI without delays. The ability to update and improve software on the cloud also keeps the system current and efficient.

For instance, In November 2025, IBM partnered with Agassi Sports Entertainment to introduce an AI-powered platform for video coaching and premium digital content in racquet sports. The initiative reflects IBM’s focus on cloud-based AI that supports real-time engagement and flexible content delivery without requiring heavy local systems. IBM’s Watson AI has also been applied at events such as Wimbledon to manage data-intensive sports analytics, underscoring the scalability of cloud AI in modern sports applications.

Application Analysis

In 2024, the Broadcast Production segment held a dominant market position, capturing a 51.7% share of the Global Sports Auto-Camera AI Market. AI-powered cameras automate filming processes by tracking players and ball movement, managing multi-angle views, and capturing key moments without the need for manual camera operation. This automation enhances broadcast quality while reducing the labor costs associated with traditional sports coverage.

Besides improving camera control, the AI capabilities enrich broadcasts with real-time stats, heat maps, and instant replays that engage viewers and provide deeper insights into the game. These technologies enable broadcasters to deliver immersive experiences that appeal to both casual fans and analysts alike. Growing investments in broadcast production technology ensure this application segment remains a dominant driver of AI adoption in sports.

For instance, in July 2024, Spiideo introduced Autocast 2.0, a suite of AI-enhanced cameras and software enabling automated multi-angle broadcasting and instant replay in sports production. Their cloud native AI cameras reduce the need for manual operators, improving efficiency in live game production across multiple sports. These advances demonstrate how AI is transforming broadcast production workflows through automation and AI-driven video analytics.

End-User Analysis

In 2024, The Broadcast Networks segment held a dominant market position, capturing a 52.1% share of the Global Sports Auto-Camera AI Market. This dominance is driven by advanced technological infrastructure, early adoption of AI in sports broadcasting, and significant investments from major broadcasters and tech companies.

The region’s mature sports industry continually seeks innovative ways to enhance fan engagement and improve production efficiency. Combined with supportive regulations and a concentration of leading AI developers, North America remains at the forefront of advancing and deploying smart camera solutions in sports media.

For Instance, in October 2025, Amazon Web Services (AWS) partnered with the NBA to launch “NBA Inside the Game,” an AI-powered analytics platform offering advanced player and play insights during broadcasts and apps. This collaboration exemplifies how broadcast networks use cloud AI to enrich live sports telecasts with detailed data and enhance viewer engagement through automated camera tracking and analysis.

Emerging Trends

Emerging trends in sports auto-camera AI show a rise in combining computer vision with smart algorithms to track players, balls, and game situations with more accuracy. Over 50% of viewers appreciate AI-powered referee aids that use camera data to reduce errors during matches.

Improvements in camera hardware, such as advanced zoom and pan abilities controlled by AI, allow for more fluid and professional live coverage, capturing every key moment. These features feed a trend where cameras can autonomously follow fast movements and complex actions without operator intervention.

Another trend is the integration of 5G technology, enabling quick uploads to cloud platforms for immediate game review and analysis worldwide. Modular camera designs also emerge, letting teams and broadcasters customize setups for various sports and environments.

These developments improve accessibility for smaller clubs and amateur leagues, which can now afford high-tech sports filming. This democratization means more sports events benefit from quality recordings and detailed data analytics, boosting the sport’s reach and engagement.

Growth Factors

Growth factors for this market include the rising demand for automated, professional-grade sports broadcasting that cuts down costs and staffing needs. AI cameras provide valuable analytics by tracking player movements and game dynamics, helping teams optimize training and strategy.

They also enhance fan experience with instant replays and personalized content delivery. The popularity of adventure and extreme sports expands opportunities for durable, mobile AI cameras suitable for different environments. Another factor is the increasing use of AI cameras for injury prevention and performance monitoring.

These cameras analyze biomechanics and highlight risk factors, offering early warnings for athletes and their trainers. This safety aspect adds value to sports programs at all levels and drives further adoption. AI also helps sponsors by delivering data-rich content that can be used for targeted advertising and fan engagement, making it a win-win for stakeholders.

Key Market Segments

By Deployment

- Cloud-based

- On-premise

By Application

- Broadcast Production

- Live Streaming

- Instant Replay

- Highlight Generation

- Player Performance Analysis

- Others

By End-User

- Broadcast Networks

- Sports Leagues & Teams

- Streaming Platforms

- Venue Operators

- Content Creators

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Real-time Performance Insights

The sports industry is witnessing a rising demand for real-time analytics that can enhance player performance and coaching decisions. AI-powered auto-cameras capture player movements, ball trajectories, and game dynamics with high precision. This technology allows coaches and analysts to get instant feedback that helps optimize training and game strategies.

Teams and broadcasters increasingly rely on these cameras to deliver detailed performance insights and immersive viewing experiences, boosting the adoption of sports auto-camera AI solutions. This growing need for accurate and actionable sports data is driven by advancements in AI algorithms and computer vision, which have become capable of processing vast amounts of visual information instantly.

For instance, in August 2025, IBM announced the rollout of AI-powered fan experiences for the 2025 US Open, featuring real-time AI commentary, match insights, and interactive chatbots that enhance both athlete performance tracking and fan engagement. IBM’s Watsonx platform uses multi-camera image recognition and pose estimation to provide detailed, live analysis during sports events, supporting teams and viewers with instant data.

Restraint

High Implementation Costs

One important factor slowing the widespread adoption of sports auto-camera AI systems is the high cost of implementation. Installing advanced AI cameras, integrating them with existing sports infrastructure, and maintaining the necessary computing resources require significant capital investment. Smaller sports teams and leagues often find these costs prohibitive, limiting the technology’s reach beyond major professional sports.

The expense includes hardware, software, and skilled personnel needed to operate and analyze camera data effectively. This financial barrier results in slower adoption rates, especially in less commercially lucrative sports or regions with limited funding, restraining market growth despite growing interest in AI-powered performance analysis.

For instance, in July 2025, Pixellot launched its Air NXT portable AI multi-sports camera, designed to cut production costs by automating recording, editing, and distribution. Despite cost reductions, the investment in such advanced AI hardware and software ecosystems remains high, especially for smaller organizations. Pixellot’s solution focuses on affordability but highlights the ongoing financial challenge of deploying sophisticated AI camera setups at scale.

Opportunities

Expansion into Fan Engagement and Personalized Experiences

Beyond athlete performance, sports auto-camera AI offers significant opportunities for enhancing fan engagement. AI-driven cameras can provide multi-angle replays, automated highlight generation, and interactive viewing features that personalize broadcast content for fans.

These advanced capabilities open new revenue streams for sports organizations by increasing fan satisfaction, boosting viewership, and attracting advertisers seeking targeted audience engagement. The growing integration of AI cameras with augmented reality and virtual reality technologies also points to creative ways to deepen fan immersion.

For instance, in September 2025, Sony introduced the FR7 full-frame PTZ camera with AI-based auto framing, enabling dynamic multi-person tracking and enhanced live sports broadcasts. Sony’s advanced AI camera technology improves viewer experience by providing cinematic angles and supports new interactive and immersive broadcast features, pointing to expanding opportunities in personalized fan engagement through AI-driven visuals.

Challenges

Shortage of Skilled Professionals

A major challenge for the growth of the sports auto-camera AI market is the shortage of skilled professionals who understand both AI technology and sports dynamics. The integration and effective use of AI cameras require expertise in machine learning, computer vision, and sports science. However, finding talent with this combined knowledge is difficult, delaying system deployment and limiting innovation.

This skills gap affects the ability of sports organizations to fully leverage AI-powered insights for training and game decisions. Bridging this gap requires focused education, training programs, and industry collaboration to develop a workforce equipped for this specialized field, which remains a critical hurdle for the sector’s expansion.

For instance, in March 2025, Microsoft highlighted how its Azure AI technologies are helping sports teams optimize race strategies and operations, but acknowledged the need for skilled AI professionals familiar with both machine learning and sports data. The specialized knowledge required to develop, deploy, and interpret AI sports cameras remains limited, slowing the full potential exploitation of these tools.

Key Players Analysis

IBM, Google, Microsoft, and Amazon lead the sports auto-camera AI market with strong capabilities in cloud computing, real-time analytics, and automated video intelligence. Their technologies support motion recognition, event tracking, and instant highlight creation. These platforms help teams analyze performance, enhance broadcast quality, and manage large video datasets efficiently.

Sony, Hawk-Eye Innovations, Pixellot, Spiideo, and Veo Technologies strengthen the market with specialized auto-camera systems built for live sports coverage. Their solutions deliver multi-angle capture, automated zooming, and high-precision ball or player tracking. These systems improve officiating accuracy, training efficiency, and fan engagement.

WSC Sports, Wicket, Trace, SwingVision, and other providers expand the landscape with AI-driven content automation and athlete-focused video tools. Their platforms create personalized clips, tactical breakdowns, and real-time performance insights. These companies prioritize ease of use, mobile accessibility, and fast clip generation for coaches and athletes.

Top Key Players in the Market

- IBM

- Microsoft

- Amazon

- Sony

- Hawk-Eye Innovations

- Pixellot

- Spiideo

- Veo Technologies

- WSC Sports

- Wicket

- Trace

- SwingVision

- Others

Recent Developments

- In May 2025, Google showcased its evolving AI ecosystem at Google I/O 2025, signaling a future where AI is not just a feature but the core system. Their advancements include AI-powered multi-camera arrays to create 3D sports viewing experiences and enhanced AI modes for sports media, promising reduced production time and richer fan engagement.

- In September 2024, Pixellot launched the Air NXT, a portable AI-driven sports camera with improved AI tracking, quadruple storage, and faster battery charging. Approved by FIBA, it supports multiple sports and integrates with Pixellot’s analytics and OTT platforms to simplify live game production.

Report Scope

Report Features Description Market Value (2024) USD 486.3 Mn Forecast Revenue (2034) USD 5,184.1 Mn CAGR(2025-2034) 26.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment (Cloud-based, On-premise), By Application (Broadcast Production, Live Streaming, Instant Replay, Highlight Generation, Player Performance Analysis, Others), By End-User (Broadcast Networks, Sports Leagues & Teams, Streaming Platforms, Venue Operators, Content Creators, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM, Google, Microsoft, Amazon, Sony, Hawk-Eye Innovations, Pixellot, Spiideo, Veo Technologies, WSC Sports, Wicket, Trace, SwingVision, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sports Auto-Camera AI MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Sports Auto-Camera AI MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM

- Microsoft

- Amazon

- Sony

- Hawk-Eye Innovations

- Pixellot

- Spiideo

- Veo Technologies

- WSC Sports

- Wicket

- Trace

- SwingVision

- Others