Global Spiral Membrane Market Size, Share, And Business Benefits By Polymer Type (Polyamide, PS and PES, Fluoropolymers, Others), By Technology (Reverse Osmosis, Microfiltration, Ultrafiltration, Nanofiltration), By End-use (Water and Wastewater Treatment, Industry Processing, Food and Beverage Processing, Pharmaceutical and Medical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153429

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

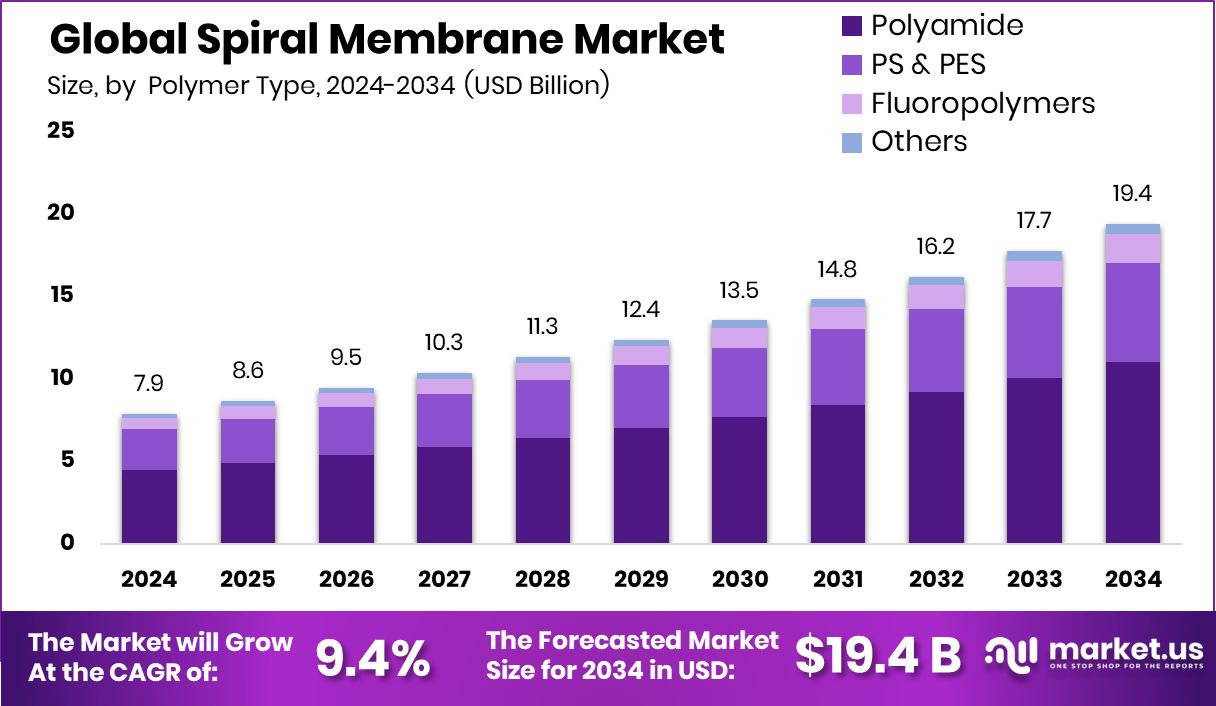

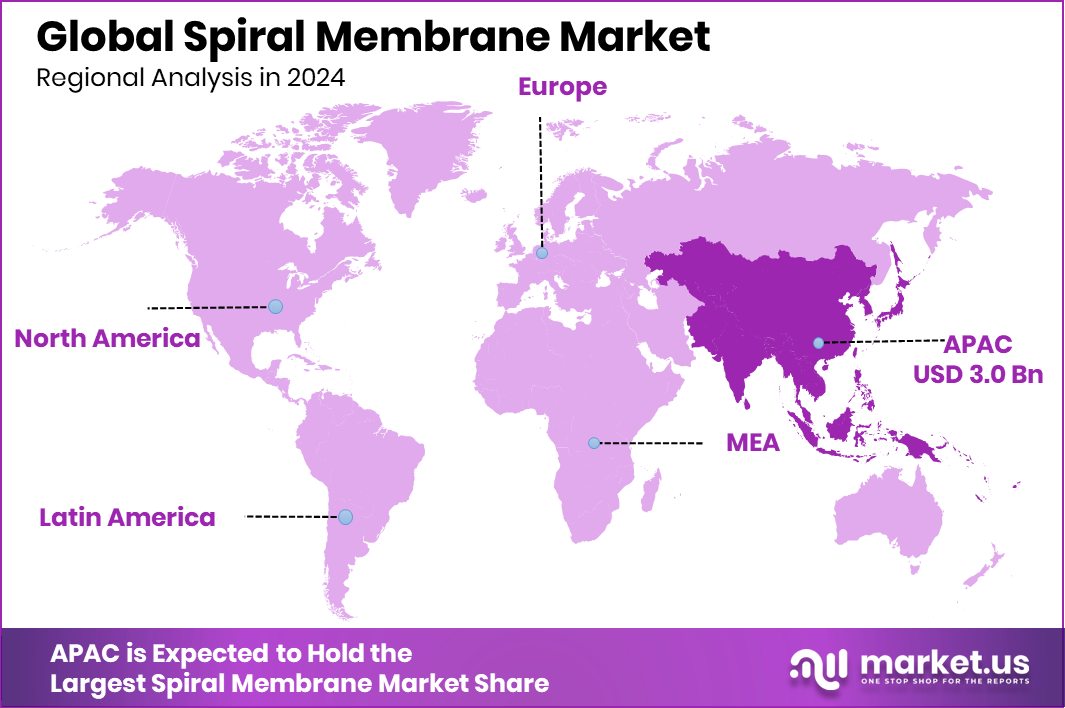

The Global Spiral Membrane Market is expected to be worth around USD 19.4 billion by 2034, up from USD 7.9 billion in 2024, and is projected to grow at a CAGR of 9.4% from 2025 to 2034. The USD 3.0 Bn value highlights Asia-Pacific’s dominance in membrane system demand.

Spiral membrane is a type of filtration technology widely used in water treatment and separation processes. It is composed of multiple layers of flat membrane sheets wound around a central tube, creating a compact and high-surface-area structure. Water or process fluids pass through the membrane under pressure, allowing selective separation of substances based on molecular size.

The spiral membrane market refers to the global trade and utilization of these membranes across various sectors such as water treatment, food and beverage, pharmaceuticals, and chemicals. It encompasses the manufacturing, deployment, and maintenance of spiral-wound membrane modules, which are integrated into systems for desalination, effluent recycling, concentration, and purification. Recent financial support within the sector highlights its growing importance; for instance, SepPure Technologies secured $12 million through its Series A funding round, while NALA Membranes received $1.5 million to advance commercialization of its innovative membrane technology.

Growth factors for the spiral membrane market include the rising global population, urbanization, and industrial activities that have increased pressure on freshwater resources. As a result, municipalities and industries are investing in advanced membrane filtration systems for sustainable water use and recovery, boosting market expansion.

Demand for spiral membranes is also escalating due to the push for high-performance and energy-efficient filtration systems. These membranes offer high flux rates and reduced operational footprints, making them ideal for both small- and large-scale installations. The need for compliance with environmental standards further accelerates adoption.

Key Takeaways

- The Global Spiral Membrane Market is expected to be worth around USD 19.4 billion by 2034, up from USD 7.9 billion in 2024, and is projected to grow at a CAGR of 9.4% from 2025 to 2034.

- In the Spiral Membrane Market, polyamide dominates with a 56.8% share due to its durability.

- Reverse osmosis technology leads the Spiral Membrane Market, capturing 49.5% owing to high purification efficiency.

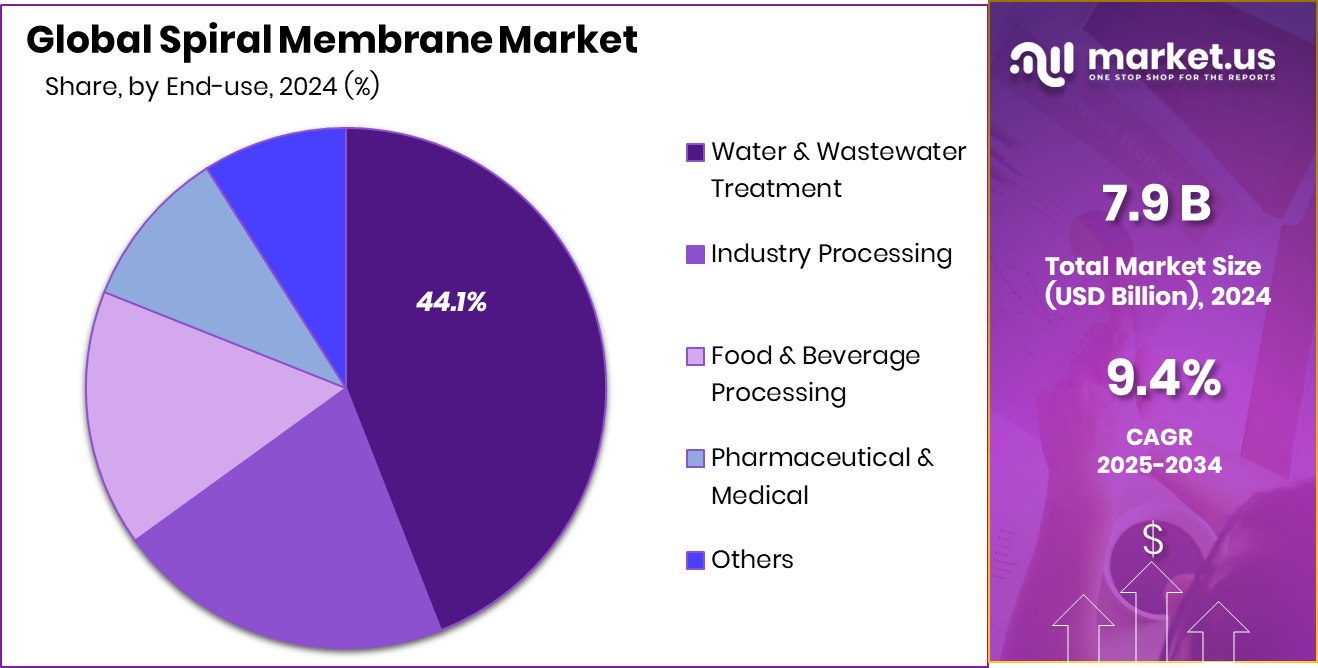

- Water and wastewater treatment holds 44.1% share in the Spiral Membrane Market, driven by rising environmental concerns.

- Asia-Pacific held a strong 38.2% share in global Spiral Membrane Market growth.

By Polymer Type Analysis

Polyamide dominates Spiral Membrane Market with 56.8% due to durability.

In 2024, Polyamide held a dominant market position in By Polymer Type of the Spiral Membrane Market, with a 56.8% share. This significant lead can be attributed to polyamide’s superior separation efficiency, excellent chemical resistance, and wide compatibility with both brackish and seawater applications. Its high permeability and selective barrier properties make it particularly suitable for reverse osmosis and nanofiltration processes, which are extensively used in municipal water treatment and industrial separation systems.

The dominance of polyamide membranes reflects the growing preference for reliable and high-performance materials capable of meeting stringent filtration standards, especially in sectors requiring consistent water quality and operational efficiency. Additionally, the material’s adaptability across pressure ranges and its cost-effective production support its continued uptake in existing and emerging membrane installations.

The 56.8% share held by polyamide in 2024 indicates strong and sustained demand across diverse end-use environments, reinforcing its role as a preferred polymer in spiral membrane configurations. As global concerns over water scarcity and industrial wastewater discharge continue to rise, polyamide membranes are expected to maintain their dominance, driven by their balance of performance, durability, and affordability in advanced filtration applications.

By Technology Analysis

Reverse osmosis holds 49.5% share, leading the filtration technology segment.

In 2024, Reverse Osmosis held a dominant market position in the By Technology segment of the Spiral Membrane Market, with a 49.5% share. This leadership is largely driven by the increasing use of reverse osmosis systems in desalination, wastewater treatment, and purification of drinking water. The technology’s ability to remove a wide range of dissolved salts, organic contaminants, and microscopic particles with high precision has made it the preferred choice for both municipal and industrial applications.

Its compatibility with spiral-wound membrane structures enhances overall system efficiency, offering high recovery rates and consistent performance even under varying pressure conditions. The 49.5% market share highlights the growing reliance on reverse osmosis as a robust and scalable filtration solution, particularly in regions facing acute water scarcity and rising demand for treated water.

The continued investment in infrastructure for clean water access and environmental compliance further supports the dominance of this segment. The adoption of reverse osmosis spiral membranes is also encouraged by their longer service life and reduced maintenance requirements, making them economically attractive over the long term.

By End-use Analysis

Water and wastewater treatment accounts for 44.1% of total demand.

In 2024, Water and Wastewater Treatment held a dominant market position in By End-use segment of the Spiral Membrane Market, with a 44.1% share. This dominance reflects the growing global focus on water quality, reuse, and sustainable resource management. The water and wastewater treatment sector relies heavily on spiral membrane technology for removing dissolved solids, organic compounds, and pathogens from municipal and industrial water streams.

The 44.1% share demonstrates the increasing deployment of spiral membranes in treatment plants aiming to meet stricter environmental discharge standards and optimize water recovery processes. Their compact design, high surface area, and efficiency in handling large volumes of water contribute to their widespread adoption in both urban utilities and decentralized treatment systems. Governments and municipalities are increasingly investing in advanced membrane technologies to address issues of water scarcity, aging infrastructure, and pollution control, further reinforcing the segment’s lead.

Additionally, industries generating significant wastewater volumes—such as food processing, textiles, and chemicals—are prioritizing the integration of spiral membranes to meet compliance norms and minimize environmental impact. The consistent and reliable performance of spiral membranes under varying operating conditions makes them an essential component in the treatment and reuse of water, securing their position as the preferred solution in this segment.

Key Market Segments

By Polymer Type

- Polyamide

- PS and PES

- Fluoropolymers

- Others

By Technology

- Reverse Osmosis

- Microfiltration

- Ultrafiltration

- Nanofiltration

By End-use

- Water and Wastewater Treatment

- Industry Processing

- Food and Beverage Processing

- Pharmaceutical and Medical

- Others

Driving Factors

Rising Need for Clean Water Worldwide

One of the main driving factors for the spiral membrane market is the growing global demand for clean and safe water. With rising population, urbanization, and industrialization, more freshwater is being used than ever before. At the same time, many regions are facing water scarcity due to limited natural resources and changing climate conditions.

This situation has increased the need for efficient water purification and wastewater treatment technologies. Spiral membranes are widely used because they can remove harmful impurities like bacteria, chemicals, and salts from water.

Their compact size, high filtration capacity, and energy efficiency make them ideal for both drinking water systems and industrial wastewater treatment. As governments invest more in water infrastructure, the demand for spiral membranes is expected to grow steadily.

Restraining Factors

High Maintenance and Replacement Costs Limit Adoption

One major restraining factor in the spiral membrane market is the high cost associated with maintenance and membrane replacement. Although spiral membranes offer efficient filtration, they are sensitive to fouling, scaling, and chemical damage over time. Regular cleaning is needed to maintain performance, which adds to operational costs.

In industrial or remote setups, replacing damaged membranes or maintaining the system can become costly and time-consuming. These ongoing expenses can discourage small or cost-sensitive users from adopting the technology.

Additionally, specialized knowledge is often required to operate and maintain spiral membrane systems properly. This cost barrier limits broader implementation, especially in developing regions or sectors with limited budgets for water treatment infrastructure and technology upgrades.

Growth Opportunity

Expanding Decentralized Water Treatment Solutions

A significant growth opportunity for the spiral membrane market lies in decentralized water treatment systems. Rural communities, small towns, and industries often lack access to large-scale treatment plants, making compact and modular solutions essential. Spiral membranes excel in this setting due to their small footprint, high filtration efficiency, and ease of installation.

These systems can be deployed near the point of use—such as remote villages, construction sites, and temporary facilities—to provide clean water without extensive infrastructure. Additionally, decentralized units can be tailored to specific water quality issues, such as salinity, chemical contamination, or microbial pathogens.

As governments and NGOs promote local water security and resilience, demand for these adaptable membrane systems is likely to rise steadily. This presents a clear avenue for market expansion in diverse, underserved locations.

Latest Trends

Smart Integration with Real‑Time Monitoring Systems

A key latest trend in the spiral membrane market is the integration of smart monitoring systems that offer real-time performance tracking. These systems use sensors to monitor pressure, flow rate, water quality, and energy consumption continuously. Through online dashboards, operators can quickly detect declines in efficiency or early signs of fouling and scaling.

Early alerts allow timely interventions, reducing downtime and extending membrane life. Smart systems also support automated cleaning and adaptive controls that adjust operational parameters for optimal performance. This trend enables data-driven decision-making, leading to significant savings in energy and maintenance costs.

In industrial, municipal, and decentralized treatment facilities, smart integration is increasingly seen as a valuable upgrade. It boosts operational reliability and helps meet tight environmental and safety standards more efficiently.

Regional Analysis

In Asia-Pacific, Spiral Membrane Market reached USD 3.0 billion in 2024.

In 2024, the Asia-Pacific region held a dominant position in the global Spiral Membrane Market, accounting for a substantial 38.2% share, with a market value reaching USD 3.0 billion. This leadership can be attributed to the growing industrialization, rising urban populations, and increasing investments in water and wastewater treatment infrastructure across countries such as China, India, and Southeast Asia.

The need for clean water sources and stricter environmental norms are further driving membrane adoption in this region. North America also represents a significant market, supported by advanced treatment technologies and strong regulatory compliance in sectors such as food processing and municipal water treatment.

Europe continues to show steady growth, backed by sustainability initiatives and technological upgrades in industrial filtration systems. Meanwhile, the Middle East & Africa region is witnessing increasing adoption of spiral membranes, particularly in desalination and water reuse projects due to water scarcity challenges.

Latin America is experiencing moderate growth, driven by infrastructure development and the need to treat industrial wastewater. Across all regions, the demand for compact, energy-efficient, and high-performance membrane systems is shaping market dynamics, but Asia-Pacific remains the clear leader in terms of both value and volume, reflecting its rising focus on water sustainability and industrial efficiency.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DowDuPont Inc. further solidified its market presence by focusing on R&D efforts aimed at enhancing membrane durability and fouling resistance. The company’s spiral configurations exhibited improved chemical stability, which supported adoption within municipal and industrial water treatment applications. By aligning product development with evolving environmental regulations, DowDuPont ensured that its membrane solutions met high standards of safety and performance.

Toray Industries, Inc. continued to leverage its leadership in polymer science and production scale. Toray emphasized production efficiencies and invested in upstream process technologies, resulting in cost-effective spiral membranes. With a strong footprint across Asia and North America, Toray capitalized on its global network to streamline supply chains and support rapid deployment of its modules in regional projects.

Hydranautics sustained its reputation for engineering-centric membrane solutions. The firm prioritized application-specific performance by developing spiral membranes tailored to industries with stringent purity needs. By emphasizing energy efficiency and long service life, Hydranautics continued to secure traction within critical sectors such as pharmaceuticals and food processing, where water quality standards are exceptionally high.

LG Water Solutions marked significant progress in modular, scalable membrane systems. The company’s efforts concentrated on developing compact membrane plants incorporating spiral modules for decentralized water treatment and reuse. Their approach offered flexibility for both municipal and industrial clients. LG’s focus on system integration—combining membranes with smart monitoring and controls—positioned it well to meet demand for turnkey solutions and operational efficiency.

Top Key Players in the Market

- DowDuPont Inc.

- Toray Industries, Inc.

- Hydranautics

- LG Water Solutions

- SUEZ Water Technologies and Solutions

- Pentair plc

- Koch Membrane Systems

- Pall Corporation

- Alfa Laval

- Applied Membranes

- Axeon Water Technologies

- Fileder

- GEA Group

Recent Developments

- In May 2024, Toray introduced a new, highly durable RO membrane designed for industrial wastewater reuse and sewage treatment. This membrane offers double the resistance to cleaning chemicals compared to conventional versions—reducing degradation, extending replacement intervals, and cutting operational costs.

- In February 2024, DuPont introduced the FilmTec™ LiNE‑XD nanofiltration membrane specifically designed for lithium brine purification. Targeted at direct lithium extraction (DLE), this membrane offers improved durability and water recovery, helping to lower energy use and chemical waste during lithium processing.

Report Scope

Report Features Description Market Value (2024) USD 7.9 Billion Forecast Revenue (2034) USD 19.4 Billion CAGR (2025-2034) 9.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Polymer Type (Polyamide, PS and PES, Fluoropolymers, Others), By Technology (Reverse Osmosis, Microfiltration, Ultrafiltration, Nanofiltration), By End-use (Water and Wastewater Treatment, Industry Processing, Food and Beverage Processing, Pharmaceutical and Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DowDuPont Inc., Toray Industries, Inc., Hydranautics, LG Water Solutions, SUEZ Water Technologies and Solutions, Pentair plc, Koch Membrane Systems, Pall Corporation, Alfa Laval, Applied Membranes, Axeon Water Technologies, Fileder, GEA Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DowDuPont Inc.

- Toray Industries, Inc.

- Hydranautics

- LG Water Solutions

- SUEZ Water Technologies and Solutions

- Pentair plc

- Koch Membrane Systems

- Pall Corporation

- Alfa Laval

- Applied Membranes

- Axeon Water Technologies

- Fileder

- GEA Group