Global Specialty Silicone Market By Product Type (Silicone Elastomers, Antifoam/Defoaming Agents, Silicone Greases, Silicone Surfactants, Silicone Polish/Shining Agent, Silicone Textile Softeners, Others), By Form(Fluids, Greases, Others), By Application(Molded Parts, Automobile Parts, Medical Solutions, Rubbers, Cosmetics, Others), By End-User Industry(Textiles, Healthcare, Electronics, Agriculture, Construction, Beauty and Personal Care, Chemical Manufacturing (Resins and Coatings), Automotive, Food Processing Industries, Energy, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 126323

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

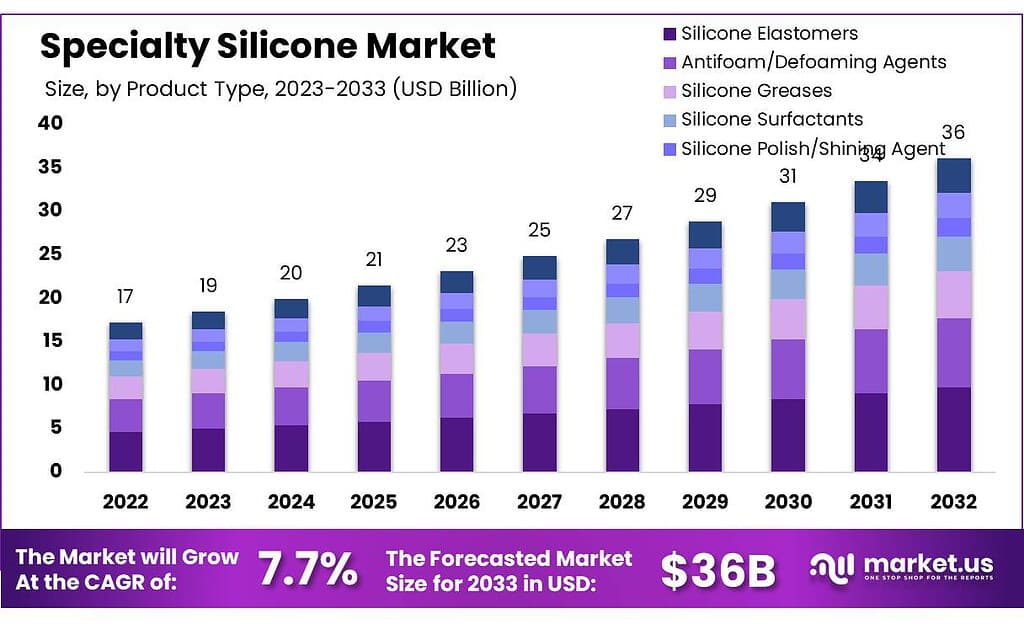

The global Specialty Silicone market size is expected to be worth around USD 36 billion by 2033, from USD 17 billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2023 to 2033.

The specialty silicone market is a distinct segment within the broader silicone industry, characterized by products that offer superior and specific properties to meet the demands of various high-tech industries. These silicones are engineered for applications where standard silicones fall short, providing enhanced thermal stability, chemical resistance, mechanical properties, and electrical conductivity. This makes them indispensable in sectors such as automotive, electronics, medical devices, construction, and personal care.

In the automotive sector, for example, specialty silicones are utilized for parts like gaskets and seals which must endure extreme temperatures and harsh chemical environments. Similarly, in the electronics industry, these materials are pivotal for manufacturing components that require high levels of dielectric strength and thermal conductivity, essential for ensuring safety and efficiency.

In terms of global trade, the United States played a significant role in the specialty silicone market in 2022. It stood as the third-largest exporter of silicone, with exports amounting to $1.55 billion. The main destinations for these exports were Mexico, China, and Canada, highlighting the global reliance on U.S.-produced specialty silicones.

Conversely, the U.S. also led as the largest importer of silicone, with significant imports coming from Germany, China, and Japan, totaling $1.2 billion for the year. This robust trade activity underscores the critical role of specialty silicones in supporting various industries globally.

The demand for specialty silicones is driven by their unique properties which make them suitable for a wide array of applications across different industries. The ongoing developments and innovations in silicone production are shaped by the increasing needs of sectors like healthcare, electronics, and construction, which require materials that can perform under extreme conditions while ensuring reliability and durability.

This ongoing innovation not only drives market growth but also ensures that new applications for specialty silicones continue to emerge, further expanding their impact and utility in the market.

Key Takeaways

- The global specialty silicone market is projected to grow from USD 17 billion in 2023 to USD 36 billion by 2033, at a CAGR of 7.7%.

- In 2023, silicone elastomers led with a 27.4% market share, used extensively in automotive, aerospace, and healthcare applications.

- Silicone fluids dominated with a 44.3% share in 2023, valued for their versatility in lubrication and thermal management.

- Molded parts held a 25.3% market share in 2023, crucial for customized components in healthcare and other industries.

- Asia Pacific accounted for 39.5% of the market in 2023, valued at USD 6.7 billion, driven by industrial and construction demand.

- Specialty silicones captured a 21.4% market share in 2023, valued for their durability and heat resistance in-vehicle components.

By Product Type

In 2023, Silicone Elastomers held a dominant market position, capturing more than a 27.4% share. This segment’s prominence is due to its extensive applications in the automotive, aerospace, and healthcare industries where high durability and flexibility are essential.

Antifoam/Defoaming Agents also play a critical role in the market, particularly in industrial processes such as chemical manufacturing and water treatment, where they prevent foam formation and improve operational efficiency.

Silicone Greases are valued for their excellent thermal and electrical insulation properties, making them ideal for use in electrical applications and high-temperature environments.

Silicone Surfactants have seen significant use in personal care and home care products, thanks to their ability to enhance the texture and efficacy of formulations, thus improving product performance.

Silicone Polish/Shining Agents are increasingly popular in automotive and furniture applications for their ability to provide a high-gloss finish while offering protection against environmental damage.

Silicone Textile Softeners are utilized in the textile industry to impart a soft, smooth finish to fabrics, enhancing the feel and comfort of the final products.

By Form

In 2023, Fluids held a dominant market position, capturing more than a 44.3% share in the specialty silicone market. This segment is favored for its versatility and broad applicability across various industries, including automotive, electronics, and personal care, where silicone fluids are used for lubrication, heat transfer, and as dielectric fluids.

Silicone Greases also command a significant portion of the market, appreciated for their exceptional performance in providing durable lubrication and sealing properties under extreme conditions. These are commonly used in electrical applications and automotive components, ensuring long-lasting protection and smooth operation.

By Application

By End-User Industry

In 2023, the Automotive sector held a dominant market position in the specialty silicone market, capturing more than a 21.4% share. This industry values specialty silicones for their durability and resistance to extreme temperatures and chemicals, essential for under-hood applications and seals.

The Healthcare industry also heavily utilizes specialty silicones due to their biocompatibility, making them ideal for a wide range of medical devices and implants. These silicones ensure safety and functionality in critical medical applications.

In the Electronics sector, specialty silicones are prized for their excellent insulating properties and thermal stability. They are used in components where superior electrical insulation and heat resistance are crucial for device reliability and safety.

The Construction industry uses specialty silicones for sealants and adhesives that offer enhanced durability and weather resistance, critical for building applications that must withstand various environmental stressors.

Beauty and Personal Care is another significant end-user, employing silicone to improve the texture, spreadability, and long-lasting properties of skin and hair care products.

In Chemical Manufacturing, specifically for resin and Coatings, silicones provide benefits like improved adhesion, gloss, and weather resistance, enhancing the quality and durability of finishes.

The Textile industry incorporates silicones to give fabrics a softer feel and provide water repellency, while in Agriculture, they are used to enhance the efficacy and application of agrochemicals.

Automotive applications continue to expand, utilizing specialty silicones in vehicle assembly to enhance performance and safety.

Food Processing Industries benefit from silicone’s non-toxic and stable properties, using them in applications that require direct contact with food.

Key Market Segments

By Product Type

- Silicone Elastomers

- Antifoam/Defoaming Agents

- Silicone Greases

- Silicone Surfactants

- Silicone Polish/Shining Agent

- Silicone Textile Softeners

- Others

By Form

- Fluids

- Greases

- Others

By Application

- Molded Parts

- Automobile Parts

- Medical Solutions

- Rubbers

- Cosmetics

- Others

By End-User Industry

- Textiles

- Healthcare

- Electronics

- Agriculture

- Construction

- Beauty and Personal Care

- Chemical Manufacturing (Resins and Coatings)

- Automotive

- Food Processing Industries

- Energy

- Others

Drivers

Growing Demand in Diverse Industries: The specialty silicone market is seeing significant growth driven by its extensive applications across multiple industries. For instance, its use in healthcare for medical implants and devices, in automotive for various parts, and electronics for insulation and protection, demonstrates its broad utility and the ongoing demand. This diverse application base is crucial for its steady market expansion.

Technological Innovations and Advancements: Technological advancements in silicone products, especially in specialty silicones, are pivotal. Innovations that improve performance, such as enhanced heat resistance and electrical insulation properties, cater to the evolving needs of high-tech industries. These advancements are not only enhancing product qualities but also opening new markets for specialty silicones.

Expansion in Medical and Healthcare Applications: With the rising healthcare expenditure, especially in regions like China, there is an increased demand for medical-grade silicones. These materials are critical in developing medical devices and implants that require biocompatibility, flexibility, and durability. The aging global population and the expanding medical sector are significant contributors to the growth of this segment.

Environmental Sustainability and Regulatory Compliance: The shift towards more sustainable and environmentally friendly products is also a notable driver. The development of bio-based and recyclable silicone materials is becoming increasingly important. Regulatory bodies in regions like Europe are pushing for these developments through REACH regulations, which ensure the safe use of chemicals and promote sustainability.

Increased Use in Consumer Goods and Electronics: Consumer preferences for high-quality, durable, and efficient products are leading to an increased use of specialty silicones in consumer goods and electronics. The unique properties of silicones, such as their thermal stability and insulation capabilities, make them ideal for modern consumer electronics and other personal care products.

Infrastructure Development and Urbanization: Global trends towards urbanization and infrastructure development, particularly in emerging markets, are fostering the demand for construction-related silicone products. Silicone sealants and adhesives are extensively used in construction due to their durability and resistance properties.

Economic Development and Industrial Growth: As regions develop economically, industries expand, increasing the demand for materials that can enhance product performance and longevity. Silicone’s role in industrial processes and its contributions to improving industrial efficiency are crucial factors driving its market growth.

Restraints

Fluctuating Raw Material and Energy Costs

One of the major restraining factors affecting the growth of the specialty silicone market is the fluctuation in raw material and energy prices. Specialty silicone production heavily relies on raw materials like silicon metal, methyl chloride, and siloxanes, whose prices have been highly volatile in recent years.

For instance, between 2016 and 2018, there was a substantial increase in the prices of silicon metal and methyl chloride, both of which are crucial in the manufacturing of silicone-based products. These cost spikes have directly impacted the production costs for specialty silicones, reducing profit margins for manufacturers.

The energy-intensive nature of silicone production exacerbates this issue. The manufacturing process for specialty silicones, particularly the synthesis of silicone elastomers and silicone fluids, requires significant amounts of energy. Therefore, fluctuations in energy prices—whether caused by geopolitical instability, such as the ongoing Russia-Ukraine conflict, or general market volatility—can dramatically increase production costs.

The effects of fluctuating raw material and energy prices are not limited to cost increases alone. Manufacturers often respond by passing these additional costs on to consumers, which makes specialty silicones more expensive. For instance, companies like Wacker Chemie AG and Elkem ASA have adjusted the prices of their silicone products in response to rising production costs. This price escalation can deter potential buyers and reduce the competitiveness of silicone products in the market, particularly in price-sensitive regions.

Moreover, energy price fluctuations are influenced by global events and policies. For instance, the shift towards green energy and decarbonization efforts has led to increased costs for traditional energy sources, further pressuring silicone manufacturers. Additionally, regulatory measures that aim to reduce the environmental impact of energy-intensive industries could increase operational costs for silicone producers. This is particularly significant in regions like Europe, where stringent environmental regulations, such as REACH, are in place to control the use and production of chemicals, including silicones.

The Russia-Ukraine war has also disrupted the supply of essential raw materials like silica and silicon metal, leading to shortages and price hikes. Both countries are key global suppliers of these materials, and the conflict has resulted in interruptions to their production and export. These disruptions further exacerbate the volatility in raw material pricing, making it difficult for manufacturers to maintain stable production costs.

The cumulative impact of these factors poses a significant challenge to the specialty silicone market. To cope with the fluctuating costs, manufacturers may need to adopt more efficient energy usage methods or switch to alternative raw materials, though these options often require substantial investment and innovation. Additionally, government initiatives to stabilize energy markets, encourage the use of renewable energy, and regulate the price volatility of key raw materials can provide some relief to the industry in the long term. However, the immediate challenge of fluctuating raw material and energy prices remains a key constraint for the specialty silicone market’s growth and profitability.

Opportunity

Expanding Demand in Renewable Energy Applications

The specialty silicone market holds significant growth potential due to the expanding demand for silicone-based materials in renewable energy applications. As countries and industries push towards sustainability and decarbonization, specialty silicones are becoming essential in technologies like solar panels, wind turbines, and energy storage systems. This trend is largely driven by silicone’s unique properties, such as its thermal stability, weather resistance, and electrical insulation, which make it ideal for the harsh conditions often encountered in renewable energy environments.

In solar energy systems, specialty silicones are used extensively for encapsulating solar cells and providing seals and adhesives that ensure long-term durability in outdoor conditions. According to industry reports, the global renewable energy sector is projected to grow at a 7.9% CAGR from 2022 to 2030, with much of this expansion happening in regions like Asia-Pacific, North America, and Europe. As this market grows, the demand for specialty silicones will increase, given that silicone materials enhance the efficiency and longevity of solar panels by protecting them from UV radiation and temperature fluctuations.

Similarly, the wind energy sector offers another major growth opportunity for specialty silicone products. Silicones are used in wind turbine components, such as gaskets, seals, and electrical insulation, all of which are critical to ensuring the operational efficiency and durability of turbines in extreme weather conditions. The global wind power market is expected to continue expanding, with annual installations of wind capacity projected to reach 120 GW by 2030. This expansion creates a direct demand for silicone materials that can withstand the mechanical stress and environmental exposure faced by wind turbines.

Governments are playing an active role in accelerating the growth of renewable energy and, by extension, the specialty silicone market. The European Green Deal, for example, sets ambitious targets for carbon neutrality by 2050, driving the need for advanced materials like specialty silicones that can support sustainable energy technologies. In the U.S., federal and state incentives for renewable energy adoption, such as tax credits for solar and wind installations, are further stimulating demand for these high-performance materials.

In addition to solar and wind energy, energy storage technologies also present a significant opportunity for the specialty silicone market. With the global focus on stabilizing renewable energy supplies through efficient storage solutions, silicones are increasingly being used in thermal management systems for batteries and other energy storage devices. Their ability to handle high temperatures and provide electrical insulation makes them an essential component in improving the performance and safety of energy storage systems.

Trends

Increased Use of Specialty Silicones in Electric Vehicles (EVs)

One of the most significant trends in the specialty silicone market is the increased adoption of specialty silicones in electric vehicles (EVs). As the global push for clean energy and sustainable transportation gains momentum, the electric vehicle market is experiencing rapid growth. According to the International Energy Agency (IEA), electric vehicle sales reached 10 million units globally in 2022, with expectations that the figure could double by 2030. This rapid growth is driving demand for advanced materials like specialty silicones, which play critical roles in improving the safety, efficiency, and performance of EVs.

Silicones are used in various parts of EVs, including battery components, thermal management systems, and sealing applications. For example, specialty silicone-based adhesives and sealants are essential for battery packs, where they provide thermal stability, electrical insulation, and protection from environmental factors such as heat and moisture. Silicones can withstand extreme temperatures, which is crucial for ensuring the safety and longevity of EV batteries, particularly as lithium-ion battery systems are sensitive to overheating.

The trend toward electrification is particularly strong in markets like China, where government policies and incentives are encouraging the adoption of EVs. China aims to have 50% of new car sales be electric by 2035, driving a surge in demand for advanced silicone materials used in automotive manufacturing. Similarly, the European Union and the United States are offering tax credits and subsidies for EV purchases, further accelerating market growth.

Specialty silicones are also being integrated into thermal management systems within EVs. Efficient thermal management is crucial for preventing battery degradation and maintaining the performance of electric drivetrains. Silicone thermal interface materials (TIMs) help dissipate heat generated by high-performance batteries, ensuring the vehicle’s safety and extending its operating life.

Automotive manufacturers such as Tesla, Volkswagen, and General Motors are increasingly focusing on improving battery technology and overall vehicle efficiency, and silicones are playing a pivotal role in this innovation. Specialty silicone elastomers are used to create seals and gaskets that ensure high performance in harsh operating environments, such as extreme temperatures or exposure to chemicals and UV radiation. These materials are critical for maintaining the durability and longevity of electric vehicle components.

Regional Analysis

The Asia Pacific (APAC) region held the largest share of the global specialty silicone market in 2023, accounting for 39.5% of the total market, valued at USD 6.7 billion. This dominance is driven by rapid industrialization, strong growth in the electronics, automotive, and construction sectors, and a rising demand for high-performance materials across countries like China, India, and Japan. China, in particular, is a key player due to its large-scale manufacturing activities and robust renewable energy projects, which are heavily reliant on silicone materials.

North America is another significant region, primarily driven by its advanced healthcare, electronics, and automotive industries. The United States leads the market with extensive demand for specialty silicones used in medical devices, automotive components, and construction. The region’s innovation in sustainable technologies and increasing investments in electric vehicles also fuel the specialty silicone market.

In Europe, demand is supported by the region’s stringent environmental regulations and a strong focus on sustainability. Specialty silicones are widely used in the automotive, construction, and renewable energy sectors, with Germany, France, and the UK being major contributors.

The Middle East & Africa (MEA) and Latin America are smaller markets but are experiencing gradual growth due to increasing construction activities and investments in renewable energy projects. In these regions, silicones are gaining traction as essential materials for infrastructure development and energy applications.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The specialty silicone market is highly competitive, with several key players driving innovation and growth across various industries. AB Specialty Silicones, Bellofram Group of Companies, and Chemsil Silicones Inc. are notable for their niche applications and product offerings, particularly in areas like industrial lubricants and sealants. CHT Germany GmbH and Dow are global leaders known for their extensive portfolios in silicone products, catering to sectors such as automotive, healthcare, and electronics. Elkay Chemicals Pvt Ltd and Elkem ASA have established strong presences in the Asia-Pacific region, leveraging local demand for specialty silicones in the construction and energy sectors.

Major players such as Evonik Industries AG, Innospec, and Momentive are heavily involved in research and development, driving innovation in sustainable and high-performance silicone materials. Shin-Etsu Chemical Co. Ltd and Wacker Chemie AG are dominant in the global market, particularly in Europe and North America, offering advanced solutions for the automotive, aerospace, and healthcare industries. Companies like Supreme Silicones and Siltech Corporation are also making significant contributions to the market through specialized applications in personal care, electronics, and renewable energy sectors.

The presence of diverse players like KCC Corporation, Milliken & Company, and NUSIL further enhances the competitive landscape, with each focusing on distinct applications such as medical devices, coatings, and industrial applications. This broad range of players ensures continuous innovation and product development, meeting the evolving needs of various end-user industries globally.

Market Key Players

- AB Specialty Silicones

- Bellofram Group of Companies

- Chemsil Silicones Inc.

- CHT Germany GmbH

- Dow

- Elkay Chemicals Pvt Ltd

- Elkem ASA

- Evonik Industries AG

- Innospec

- K. K. Chempro India Private Limited

- KCC Corporation

- MESGO SpA

- Milliken & Company

- Momentive

- NUSIL

- Reiss Manufacturing Inc.

- Shin-Etsu Chemical Co. Ltd

- Siltech Corporation

- Specialty Silicone Products Inc.

- Supreme Silicones

- The Lubrizol Corporation

- Wacker Chemie AG

Recent Development

AB Specialty Silicones is a prominent U.S.-based manufacturer and distributor of specialty silicone chemicals. Their product portfolio includes emulsions, catalysts, antifoams, defoamers, and specialty silicones designed for various applications such as personal care, medical devices, adhesives, and coatings.

Bellofram Group of Companies indicates a solid performance with a revenue increase of approximately 8% year-over-year, driven by enhanced product offerings and strategic market expansions.

Report Scope

Report Features Description Market Value (2023) USD 17 Bn Forecast Revenue (2033) USD 36 Bn CAGR (2024-2033) 7.7% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Silicone Elastomers, Antifoam/Defoaming Agents, Silicone Greases, Silicone Surfactants, Silicone Polish/Shining Agent, Silicone Textile Softeners, Others), By Form(Fluids, Greases, Others), By Application(Molded Parts, Automobile Parts, Medical Solutions, Rubbers, Cosmetics, Others), By End-User Industry(Textiles, Healthcare, Electronics, Agriculture, Construction, Beauty and Personal Care, Chemical Manufacturing (Resins and Coatings), Automotive, Food Processing Industries, Energy, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape AB Specialty Silicones, Bellofram Group of Companies, Chemsil Silicones Inc., CHT Germany GmbH, Dow, Elkay Chemicals Pvt Ltd, Elkem ASA, Evonik Industries AG, Innospec, K. K. Chempro India Private Limited, KCC Corporation, MESGO SpA, Milliken & Company, Momentive, NUSIL, Reiss Manufacturing Inc., Shin-Etsu Chemical Co. Ltd, Siltech Corporation, Specialty Silicone Products Inc., Supreme Silicones, The Lubrizol Corporation, Wacker Chemie AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Specialty Silicone Market?Specialty Silicone market size is expected to be worth around USD 36 billion by 2033, from USD 17 billion in 2023

What is the CAGR of Specialty Silicone Market?The Specialty Silicone Market is growing at a CAGR of 7.7% during the forecast period 2023 to 2033.Who are the major players operating in the Specialty Silicone Market?AB Specialty Silicones, Bellofram Group of Companies, Chemsil Silicones Inc., CHT Germany GmbH, Dow, Elkay Chemicals Pvt Ltd, Elkem ASA, Evonik Industries AG, Innospec, K. K. Chempro India Private Limited, KCC Corporation, MESGO SpA, Milliken & Company, Momentive, NUSIL, Reiss Manufacturing Inc., Shin-Etsu Chemical Co. Ltd, Siltech Corporation, Specialty Silicone Products Inc., Supreme Silicones, The Lubrizol Corporation, Wacker Chemie AG

-

-

- AB Specialty Silicones

- Bellofram Group of Companies

- Chemsil Silicones Inc.

- CHT Germany GmbH

- Dow

- Elkay Chemicals Pvt Ltd

- Elkem ASA

- Evonik Industries AG

- Innospec

- K. K. Chempro India Private Limited

- KCC Corporation

- MESGO SpA

- Milliken & Company

- Momentive

- NUSIL

- Reiss Manufacturing Inc.

- Shin-Etsu Chemical Co. Ltd

- Siltech Corporation

- Specialty Silicone Products Inc.

- Supreme Silicones

- The Lubrizol Corporation

- Wacker Chemie AG