Global Specialty Polyamides Market, By Product (Long Chain Specialty Polyamide, High-Temperature Specialty Polyamide, and MXD6/PARA), By Application (Automotive & Transportation, Electrical & Electronics, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 26722

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

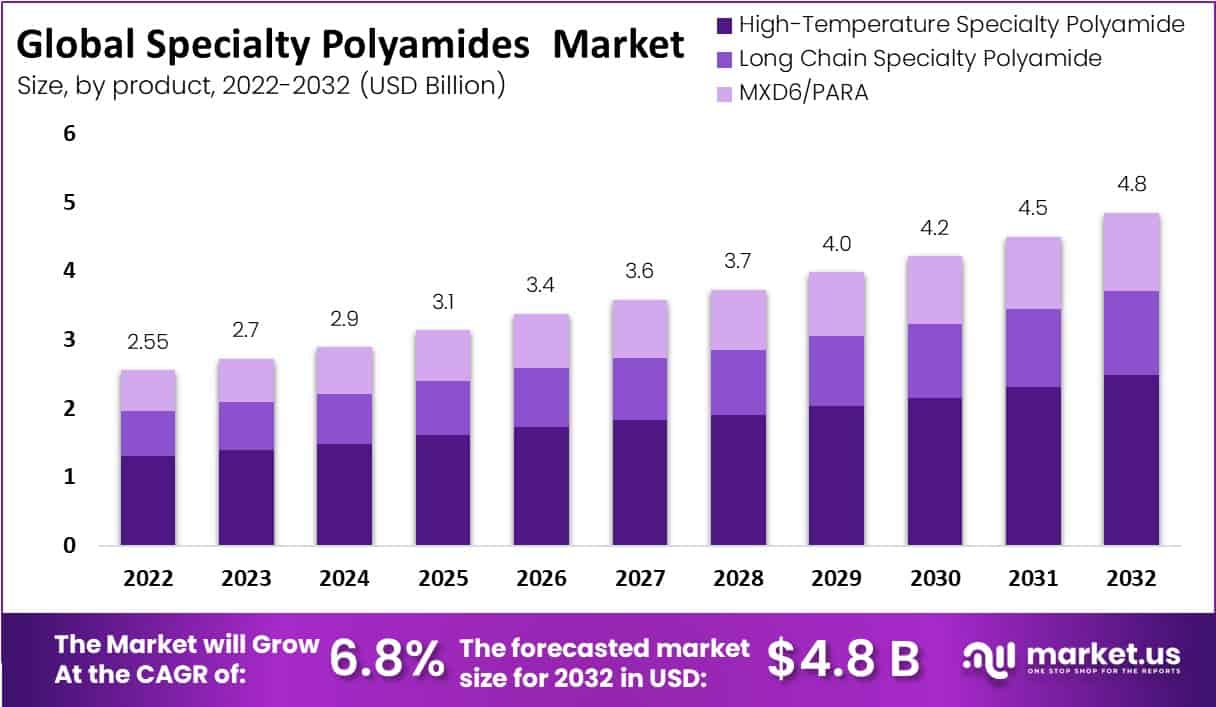

In 2022, the global specialty polyamides market was valued at USD 2.55 billion and is expected to reach around USD 4.8 billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 6.8%.

One of the major drivers of the expansion of the specialty polyamides market is the rising demand for lightweight materials with abrasion resistance and other qualities in the automotive and transportation industries.

Additionally, it is projected that rising requirements for cleaner solutions and increasing concerns over automotive fuel efficiency would increase demand for specialty polyamides.

Produced from sebacic acid, specialty polyamides like aramid and nylon, including polycaprolactam and polyphthalamides, have good lubricity, high thermal stability, high flash points, and other features. The market for specialty polyamides is being driven by the increasing demand from a variety of end-use industries, involving consumer goods, automotive, energy, and other industries.

Key Takeaways

Market Growth: The Specialty Polyamides Market is projected to reach a valuation of USD 76.9 billion by 2032, with an expected Compound Annual Growth Rate (CAGR) of 6.8%.

Rising Demand: Specialty polyamides are experiencing growing demand due to their versatile applications in various industries such as automotive, electronics, and consumer goods. Their properties like high strength, durability, and resistance to extreme conditions make them highly sought after.

Increasing Uses: Specialty polyamides have witnessed a surge in demand since their inception, finding applications in a wide range of industries. They are utilized for manufacturing automotive parts, electrical components, packaging materials, and more. The versatility of specialty polyamides allows for their adoption in diverse applications.

Rising Popularity: The growing popularity of specialty polyamides is evident from the increasing adoption of these materials across industries. Media coverage highlighting their unique properties and advantages, along with businesses incorporating them into their product lines, has significantly boosted their recognition and usage.

Drivers: The primary drivers propelling the growth of the specialty polyamides market include the increasing demand for lightweight and high-performance materials, especially in the automotive and aerospace sectors, as well as the expanding electronics and electrical industry.

Restraints: Challenges such as raw material price fluctuations and the need for advanced manufacturing technologies act as restraints for the growth of the specialty polyamides market. Additionally, environmental concerns related to production processes pose challenges to market expansion.

Opportunity: The specialty polyamides market presents a vast growth opportunity due to the continuous research and development efforts aimed at enhancing their properties and applications. Advancements in sustainable production methods and the focus on eco-friendly polyamides offer significant growth potential.

Trends: Key trends in the specialty polyamides market include a shift towards bio-based polyamides, increased recycling efforts, and the development of specialty polyamides with improved heat resistance and flame-retardant properties.

Product Analysis: The specialty polyamide market is categorized based on its products into Long Chain Specialty Polyamide, High-Temperature Specialty Polyamide, and MXD6/PARA. The dominant segment in the specialty polyamide market was the High-Temperature Specialty Polyamide segment.

Application Analysis: The Automotive and transportation segment is expected to hold the highest market share, estimated at 40%, making it the most profitable segment in the global specialty polyamides market.

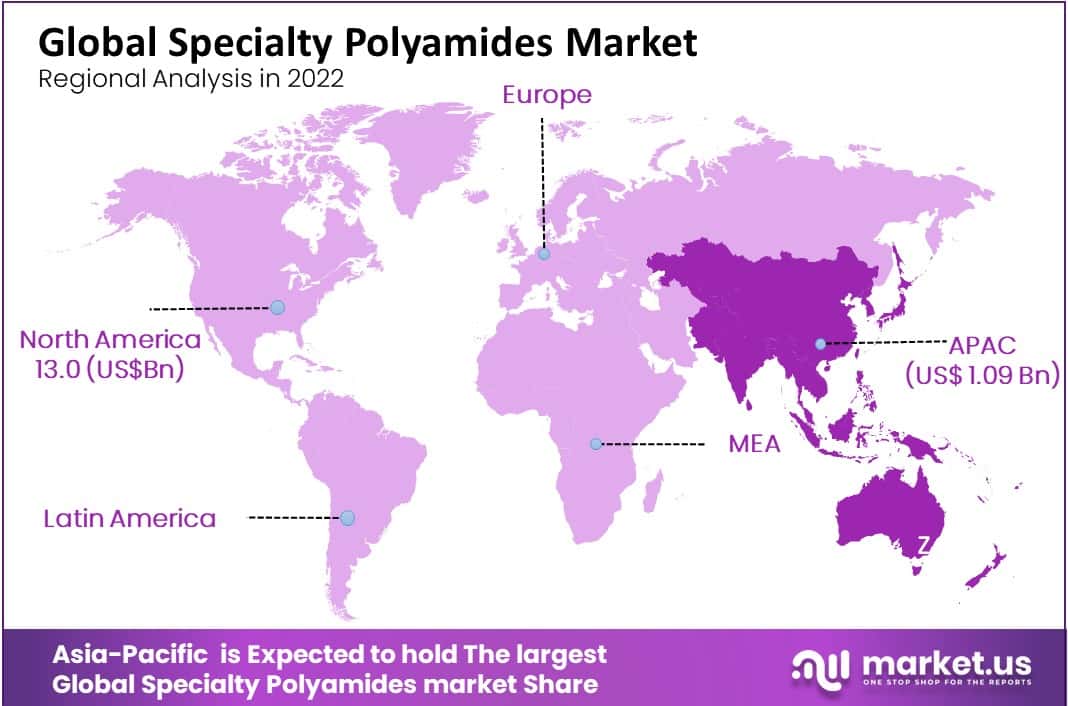

Regional Analysis: The Asia Pacific region accounted for over 43% of the total income, representing the largest share in 2022.

Key Players: Key players in the global specialty polyamides market include companies such as Evonik Industries AG, Arkema S.A, Basf SE, Dowdupont, Inc., Koninklijke DSM N.V., and Other Key Players.

Drivers

Technology improvements in manufacturing:

The market is anticipated to grow because of technological developments in the production of specialty polyamides, such as the creation of novel polymerization processes and the use of renewable raw materials. These developments have produced new specialty polyamide grades with better characteristics, which are anticipated to find new uses in various industries.

Expansion of the electrical and electronics sector:

Expansion of the electrical and electronics sector due to their high dielectric strength and heat resistance, specialty polyamides are frequently utilized in the electrical and electronics industry to produce components including connectors, switches, and cable insulation. The market for specialty polyamides is anticipated to grow as a result of the rising demand for electronic devices and the growing trend toward the shrinking of electronic components.

Restraints

High production costs:

Specialty polyamides might be more expensive to make than regular polyamides, which may prevent their widespread use in some industries. Due to the usage of specialized raw materials and the intricate manufacturing methods necessary to make them, production costs are quite high.

Limited availability of raw materials:

Specialty polyamide production and availability may be constrained by the shortage of the raw materials needed to make them, such as dodecane diamine and meta-xylylene diamine. The high cost of producing specialty polyamides may also impact a scarce supply of certain raw materials.

Product Analysis

Based on the product the market is divided into Long Chain Specialty Polyamide, High-Temperature Specialty Polyamide, and MXD6/PARA. The market for specialty polyamide was dominated by the High-Temperature Specialty Polyamide segment.

High-temperature specialty polyamides like polyphthalamides are used in a variety of applications. High-temperature specialty polyamides are used in the automotive, aerospace, medical, and electrical/electronic industries, where demanding qualities are needed. As a result, the market for specialty polyamides is experiencing increased demand from various industries, such as the automotive and electrical industries.

Application Analysis

By application analysis, the market is further divided into automotive & transportation, electrical & electronics, consumer goods & retail, energy, industrial coatings, and other applications. The Automotive & transportation segment is estimated to be the most lucrative segment in the global specialty polyamides market, with a market share of 40%.

Due to their ability to meet the demands of automotive thermal management components, specialty polyamides are frequently employed in the automobile industry. When in contact with heated automotive fluids, they maintain remarkable toughness and strength. Because of its good blend of oil resistance, design flexibility, toughness, mechanical strength, and thermal stability, it finds significant application in various domains.

The product demand in automotive & transportation applications is anticipated to be managed by its PA 11, PA 12, PA 6/12, and PA 4/6, grades. These grades are frequently used in automotive cooling systems, hoses and tubing, air intake manifolds, airbag containers, tire cords, headlamp bezels, and exterior car parts including fuel caps & lids, door & tailgate handles, wheel covers, and front-end grilles, among other things.

Key Market Segments

Based on Product

- Long Chain Specialty Polyamide

- High-Temperature Specialty Polyamide

- MXD6/PARA

Based on Application

- Automotive & Transportation

- Electrical & Electronics

- Consumer Goods & Retail

- Energy

- Industrial Coatings

- Other Applications

Growth Opportunity

The market for specialty polyamides offers a large potential for manufacturers that are offering quality, environmentally responsible substitutes for traditional crude oil-based raw materials. Specialty polyamides are more desired in a variety of applications due to their enhanced mechanical, thermal, and humidity resistance properties.

Asia Pacific has the biggest market for specialized polymers, followed by Europe and then North America. The sector does, however, encounter difficulties like the scarcity of raw materials, erratic pricing trends, shifting health regulations, and scrutinizing polyamide groups.

Major businesses including Koninklijke DSM N.V., Evonik Industries AG, BASF SE, Arkema, Radici Group, and E. I. du Pont de Nemours and Company are all actively engaged in this market despite these obstacles.

Latest Trends

The market for specialty polyamides is expanding due in part to the rising demand for lightweight materials in the automotive and transportation sectors. The most popular product category is high-temperature specialty polyamides because of their great performance and cost-effectiveness. The demand for polyamides in various automotive industries is driving the market, which is the largest application segment.

Due to the availability of cheap labor and raw resources, rising consumer demand, and pro-business government policies, the Asia-Pacific area currently represents the greatest portion of global income and is predicted to grow much more. Growing sustainability tendencies are predicted to boost sales of bio-based polyamides.

Regional Analysis

The largest share of the total income in 2022 more than 43% was accounted for by the Asia Pacific region. The Asia Pacific region is anticipated to grow at the fastest CAGR during the forecast period, led by China, India, and Japan. The primary factors influencing the growth of the market in this region are the accessibility of labor and raw materials at low costs, as well as an expansion in consumption capacity.

Also, the region is drawing international specialized polyamide producers to build up production and distribution facilities due to favorable government policies and a sizable untapped market. Compared to industrialized economies in Europe and North America, the Asia-Pacific region experiences more voltage and load fluctuations.

Power protection equipment that can reduce financial losses is more in demand as a result of power fluctuations. Manufacturers of electrical and electronic components are paying more and more attention to specialty polyamides because plastic components s more compact and easily integrated with other components, which streamlines the design process.

The regional expansion will also be supported by the expanding middle class, increased per capita income, and good living standards in emerging economies. The region’s product demand is also being supplemented by the quickly expanding automotive manufacturing sector.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Due to the existence of major competitors, the specialty polyamides market is competitive as well a growing market for specialized polyamides is being produced for a variety of uses, such as specialty fabricated goods and flexible printed circuits.

The key market players are developing new strategies for the production process and are anticipated to develop their polymer offer for North America and Asia Pacific.

Market Key Players

- Evonik Industries AG

- Arkema S.A

- Basf SE

- Dowdupont, Inc.

- Koninklijke DSM N.V.

- Asahi Kasei Corp.

- LG Chem

- INVISTA

- Solvay SA

- Radici Partecipazioni SpA

- Ems-Chemie Holding Ag

- Ube Industries Ltd.

- Kuraray Co., Ltd.

- Mitsubishi Gas Chemical Company, Inc.

- Toyobo Co., Ltd.

- Shandong Dongchen Engineering Plastic Co., Ltd.

- Eurostar Engineering Plastics

- Other Key Players

Recent Developments

- In January 2023, Evonik Industries announced the launch of a new bio-based specialty polyamide called Vestamid Terra. Vestamid Terra is made from renewable resources and is biodegradable.

- In February 2023, DSM announced the development of a new specialty polyamide called PA 6/10 HT. PA 6/10 HT is a high-temperature specialty polyamide that is designed for use in demanding applications such as automotive and aerospace applications.

- In March 2023, BASF announced the development of a new specialty polyamide for use in 3D printing. This new specialty polyamide is designed to produce high-strength and durable 3D printed parts.

Report Scope

Report Features Description Market Value (2022) USD 2.5 Bn Forecast Revenue (2032) USD 4.8 Bn CAGR (2023-2032) 6.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product (Long Chain Specialty Polyamide, High-Temperature Specialty Polyamide, MXD6/PARA) Application (Automotive & Transportation, Electrical & Electronics, Consumer Goods & Retail, Energy, Industrial Coatings, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Evonik Industries AG, Arkema S.A, Basf SE, Dowdupont, Inc., Koninklijke DSM N.V., Asahi Kasei Corp., LG Chem, Invista, Solvay SA, Radici Partecipazioni SpA, Ems-Chemie Holding Ag, Ube Industries Ltd., Kuraray Co., Ltd., Mitsubishi Gas Chemical Company, Inc., Toyobo Co., Ltd., Shandong Dongchen Engineering Plastic Co., Ltd., Eurostar Engineering Plastics, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Specialty Polyamides Market in 2022?The Specialty Polyamides Market size was estimated to be USD 2.55 billion in 2022.

What is the projected CAGR at which the Specialty Polyamides Market is expected to grow at?The Specialty Polyamides Market is expected to grow at a CAGR of 6.8% (2023-2032).

List the key industry players of the Specialty Polyamides Market?Evonik Industries AG, Arkema S.A, Basf SE, Dowdupont, Inc., Koninklijke DSM N.V., Asahi Kasei Corp., LG Chem, Invista, Solvay SA, Radici Partecipazioni SpA, Ems-Chemie Holding Ag, Ube Industries Ltd., Kuraray Co., Ltd., Mitsubishi Gas Chemical Company, Inc., Toyobo Co., Ltd., Shandong Dongchen Engineering Plastic Co., Ltd., Eurostar Engineering Plastics, Other Key Players engaged in the Specialty Polyamides Market.

Which region is more appealing for vendors employed in the Specialty Polyamides Market?The largest share of the total income in 2022 more than 43% was accounted for by the Asia Pacific region. The Asia Pacific region is anticipated to grow at the fastest CAGR during the forecast period, led by China, India, and Japan.

Specialty Polyamides MarketPublished date: Sep 2023add_shopping_cartBuy Now get_appDownload Sample

Specialty Polyamides MarketPublished date: Sep 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Evonik Industries AG

- Arkema S.A

- Basf SE

- Dowdupont, Inc.

- Koninklijke DSM N.V.

- Asahi Kasei Corp.

- LG Chem

- INVISTA

- Solvay SA

- Radici Partecipazioni SpA

- Ems-Chemie Holding Ag

- Ube Industries Ltd.

- Kuraray Co., Ltd.

- Mitsubishi Gas Chemical Company, Inc.

- Toyobo Co., Ltd.

- Shandong Dongchen Engineering Plastic Co., Ltd.

- Eurostar Engineering Plastics

- Other Key Players