Spain Sports Tourism Market Size, Share, Growth Analysis By Sports Type (Football/Soccer, Cricket, Motorsports, Basketball, Others), By Sports Tourism Type (Sports Event Tourism, Nostalgia Sports Tourism, Active Sports Tourism, Passive Sports Tourism), By Consumer Orientation (Men, Women, Children), By Booking Channel (Online Booking, Phone Booking, In-Person Booking), By Tourist Type (International, Domestic), By Tour Type (Independent Traveler, Tour Group, Package Traveler), By Age Group (15–25 Years, 26–35 Years, 36–45 Years, 46–55 Years, 56–65 Years, 66–75 Years), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166817

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Sports Type Analysis

- By Sports Tourism Type Analysis

- By Consumer Orientation Analysis

- By Booking Channel Analysis

- By Tourist Type Analysis

- By Tour Type Analysis

- By Age Group Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Key Spain Sports Tourism Company Insights

- Recent Developments

- Report Scope

Report Overview

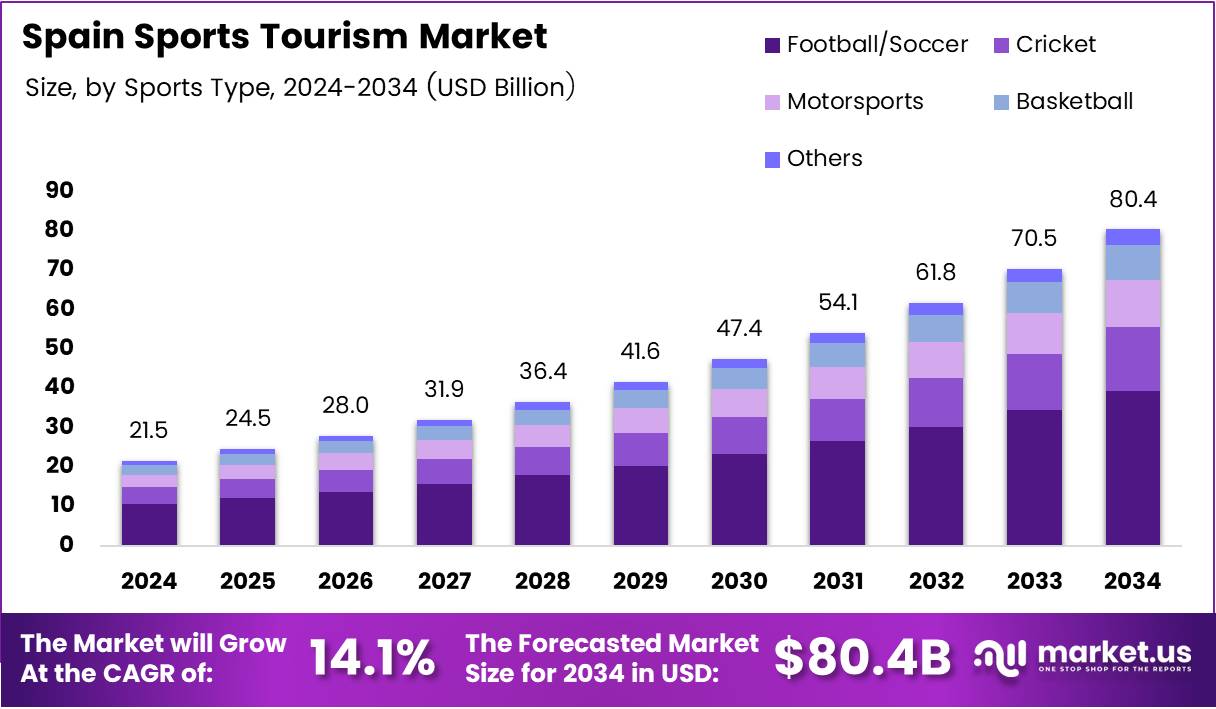

The Spain Sports Tourism Market size is expected to be worth around USD 80.4 Billion by 2034, from USD 21.5 Billion in 2024, growing at a CAGR of 14.1% during the forecast period from 2025 to 2034.

Spain’s sports tourism market represents travel driven by sporting events, active sports activities, and related leisure experiences. It includes international and domestic visitors who participate in or attend sports, supporting sectors like accommodation, mobility, and local recreation. Consequently, the Spain Sports Tourism Market functions as a strategic pillar of the national tourism economy.

Moving forward, Spain’s sports tourism landscape continues expanding as investors leverage high visitor interest, strong event hosting capabilities, and year-round sporting appeal. The market benefits from rising demand for active travel, increasing digital promotion, and improved sports infrastructure, creating a broader customer base and diversified revenue potential across regions.

Additionally, government initiatives stimulate growth by upgrading venues, improving transport links, and reinforcing regulatory clarity. Authorities consistently prioritize sustainable tourism, ensuring that sporting events comply with environmental standards. This regulatory focus encourages responsible development while attracting travelers seeking memorable and well-managed sports experiences across Spain’s coastal and urban destinations.

Furthermore, favorable policy direction, investment incentives, and enhanced destination marketing create new opportunities for local businesses. As Spain strengthens its position in global sports tourism, service providers gain room to expand offerings such as adventure sports, premium hospitality packages, and community-based sport programs, ultimately supporting long-term market competitiveness.

According to the survey, sports tourism in Spain generated €8,351.2 million in direct spending in 2024, growing 14.3% from 2023, while foreign visitors contributed 70.7% (€5,904.6 million). Moreover, according to the Anuario de Estadísticas Deportivas 2025 (CSD), 1.47 million foreign tourists visited mainly for sport in 2024, spending over €1,770 million.

Simultaneously, the CSD confirms that 3.8 million Spanish residents travelled domestically for sports, pushing total sports-motivated spending above €3,000 million. These indicators demonstrate strong international demand, rising domestic engagement, and continued support from major events such as global sailing competitions and elite tournaments, reinforcing confidence in Spain’s Sports Tourism Market outlook.

Key Takeaways

- Spain Sports Tourism Market projected to reach USD 80.4 Billion by 2034, growing from USD 21.5 Billion in 2024 at a 14.1% CAGR.

- Football/Soccer leads Sports Type share with 48.2% dominance in 2024.

- Sports Event Tourism is the top Sports Tourism Type, holding 55.9% share.

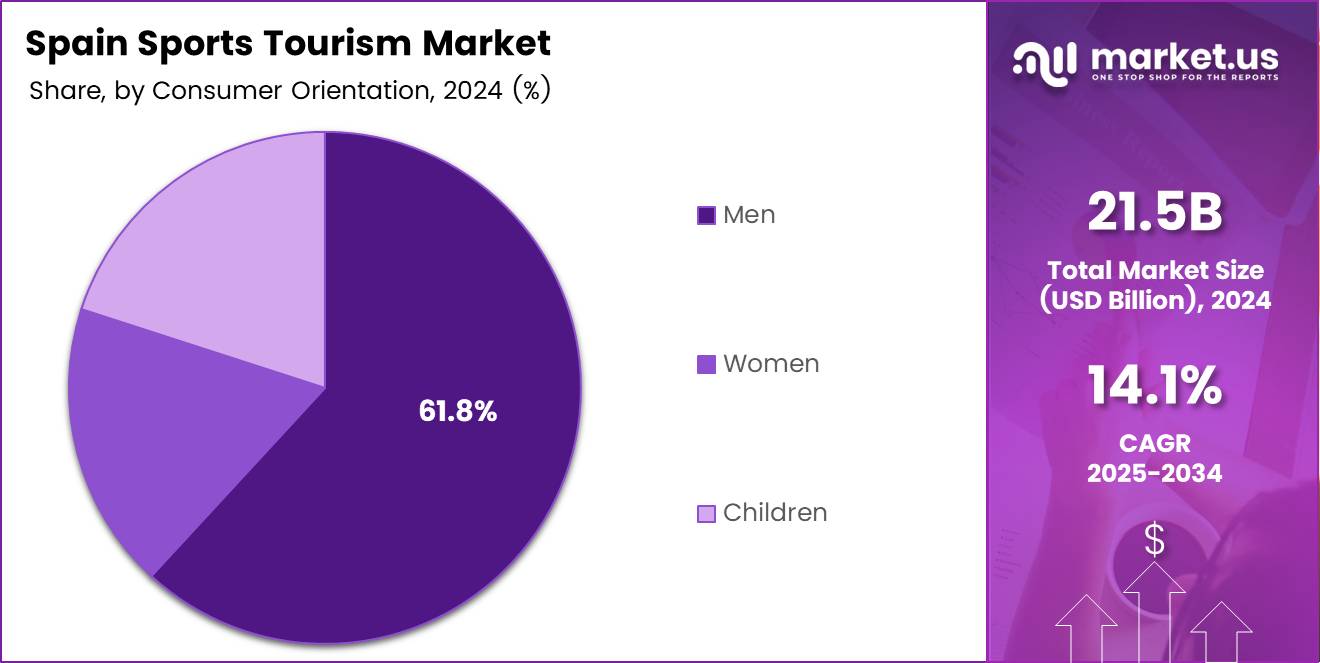

- Men dominate Consumer Orientation with a 61.8% market share.

- Online Booking leads Booking Channels with 66.3% usage.

- International tourists account for 66.1% of total sports tourism in Spain.

- Independent Travelers represent 59.4% of the Tour Type segment.

- The 26–35 Years age group leads the market with a 34.7% share.

By Sports Type Analysis

Football/Soccer dominates with 48.2% due to its massive fan culture and nationwide engagement.

In 2024, Football/Soccer held a dominant market position in the By Sports Type segment of the Spain Sports Tourism Market, with a 48.2% share. It attracts both domestic and international enthusiasts, fueling stadium visits and matchday travel. Additionally, its strong club legacy continuously boosts travel demand across Spain.

Cricket continued gaining traction as travelers explored emerging sports activities in Spain. Although less traditional, it still attracted niche audiences attending tournaments and training camps. Moreover, growing expatriate communities increased participation and viewership, slowly enhancing cricket’s tourism value.

Motorsports showcased rising appeal through major racing events held across Spain. Furthermore, iconic circuits like Barcelona-Catalunya drew passionate global fans. As a result, motorsports contributed significantly to high-spending tourism linked to premium events and brand experiences.

Basketball strengthened its position by attracting fans to domestic league games and international competitions. Similarly, Spain’s reputation for producing elite players enhanced inbound tourism. Consequently, basketball events spurred consistent traveler flows into major urban destinations.

Others encompassed varied sports tourism activities, maintaining steady participation levels. Moreover, adventure and niche sports diversified travel patterns. These offerings appealed to travelers seeking alternative, experience-driven trips across diverse regions of Spain.

By Sports Tourism Type Analysis

Sports Event Tourism dominates with 55.9% due to its strong pull for large-scale spectators.

In 2024, Sports Event Tourism held a dominant position in the By Sports Tourism Type segment of the Spain Sports Tourism Market, with a 55.9% share. Major tournaments and iconic stadium events attracted massive crowds, further boosting hotel occupancy and travel spending throughout the year.

Nostalgia Sports Tourism grew steadily as fans visited historical stadiums, museums, and legendary sports sites. Additionally, heritage-based experiences encouraged emotional engagement. This trend reinforced Spain’s appeal to travelers seeking memorable sports-related journeys.

Active Sports Tourism expanded as visitors pursued physically engaging activities. Furthermore, Spain’s natural landscapes supported cycling, hiking, and water sports participation. These adventure-focused experiences attracted fitness-driven travelers, enhancing year-round tourism.

Passive Sports Tourism also contributed meaningfully as travelers preferred observing sporting activities without direct participation. Likewise, comfortable viewing experiences at premium venues encouraged higher spending. This segment remained essential to sustaining event-related travel demand.

By Consumer Orientation Analysis

Men dominate with 61.8% owing to stronger participation and event attendance.

In 2024, Men held a dominant market position in the By Consumer Orientation segment of the Spain Sports Tourism Market, with a 61.8% share. They drove major attendance at large sporting events. Additionally, their high enthusiasm for competitive sports sustained consistent travel momentum across Spain.

Women increasingly participated in sports tourism, reflecting rising engagement in live sports and fitness activities. Moreover, evolving social trends encouraged greater involvement in sporting experiences. This shift supported more inclusive travel patterns.

Children contributed through school trips, youth tournaments, and training camps. Furthermore, family-oriented travel boosted participation in child-friendly sports events. These activities nurtured early interest in sports tourism experiences.

By Booking Channel Analysis

Online Booking dominates with 66.3% due to its convenience and rapid adoption.

In 2024, Online Booking held a dominant position in the By Booking Channel segment of the Spain Sports Tourism Market, with a 66.3% share. Digital platforms simplified ticket purchases and travel planning. Additionally, mobile accessibility led to faster decision-making and broader market reach.

Phone Booking remained relevant among travelers valuing personalized assistance for event and travel reservations. Moreover, direct support encouraged trust, especially for complex itineraries. This method continued serving traditional customer groups.

In-Person Booking appealed to travelers who preferred physical interaction at booking centers. Furthermore, local agencies assisted spontaneous bookings near event venues. This segment sustained demand within specific demographic groups.

By Tourist Type Analysis

International tourists dominate with 66.1% driven by Spain’s global sporting reputation.

In 2024, International travelers held a dominant market position in the By Tourist Type segment of the Spain Sports Tourism Market, with a 66.1% share. Their interest in elite events and iconic stadiums significantly boosted inbound travel. Additionally, international fans drove higher spending across hospitality and attractions.

Domestic tourists also engaged actively in sports tourism, attending local competitions and exploring regional sporting events. Moreover, shorter travel distances encouraged frequent participation. Domestic travelers played a key role in sustaining year-round demand.

By Tour Type Analysis

Independent Traveler dominates with 59.4% due to flexible and personalized planning preferences.

In 2024, Independent Traveler held a dominant market position in the By Tour Type segment of the Spain Sports Tourism Market, with a 59.4% share. They sought self-designed itineraries based on event schedules. Additionally, flexible planning enabled spontaneous attendance at diverse sports activities.

Tour Group travelers valued structured itineraries for major sports events. Furthermore, coordinated travel and guided experiences improved convenience. These packages appealed to fans seeking shared group environments.

Package Traveler participation remained steady as bundled deals simplified travel logistics. Moreover, inclusive services reduced planning efforts for sports tourists. This segment benefited travelers seeking cost-effective, all-in-one solutions.

By Age Group Analysis

26–35 Years dominates with 34.7% due to high mobility and active sports enthusiasm.

15–25 Years travelers showcased strong participation in sports-centered activities, encouraged by student travel and youth sports tournaments. Additionally, affordable travel options supported greater attendance at sporting experiences across Spain.

In 2024, 26–35 Years held a leading position in the By Age Group segment of the Spain Sports Tourism Market, with a 34.7% share. This group prioritized dynamic travel and major sports events. Furthermore, higher spending power strengthened their market contribution.

36–45 Years travelers maintained stable engagement in sports tourism. Additionally, family-oriented travel increased participation in events suitable for mixed age groups. Their balanced interests supported steady demand.

46–55 Years participants pursued comfortable travel experiences paired with premium event attendance. Moreover, their preference for well-planned itineraries contributed to consistent sports tourism activity.

56–65 Years tourists favored relaxed and culturally enriching sports activities. Additionally, interest in iconic stadium tours and nostalgic sports experiences grew, enhancing their tourism footprint.

66–75 Years travelers focused on leisure-friendly sports tourism. Furthermore, accessible venues and guided tours strengthened participation. Their involvement, though modest, remained impactful within mature traveler groups.

Key Market Segments

By Sports Type

- Football/Soccer

- Cricket

- Motorsports

- Basketball

- Others

By Sports Tourism Type

- Sports Event Tourism

- Nostalgia Sports Tourism

- Active Sports Tourism

- Passive Sports Tourism

By Consumer Orientation

- Men

- Women

- Children

By Booking Channel

- Online Booking

- Phone Booking

- In-Person Booking

By Tourist Type

- International

- Domestic

By Tour Type

- Independent Traveler

- Tour Group

- Package Traveler

By Age Group

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 56-65 Years

- 66-75 Years

Drivers

Rising Government Investment in Sports Infrastructure Modernization Drives Market Growth

Spain’s sports tourism market is expanding steadily as the government continues to modernize stadiums, training centers, and event facilities. These upgrades help regions host more international events and attract global travelers looking for high-quality sports experiences.

Another key driver is the expansion of year-round sports event calendars. Regions such as Catalonia, Andalusia, and the Canary Islands are adding more tournaments, marathons, and community sports festivals throughout the year. This reduces off-season gaps and keeps tourist activity stable.

International participation in adventure and outdoor sports is also growing. Spain’s landscapes—from beaches to mountains—make it an attractive hub for cycling, hiking, surfing, and water sports. This trend brings in travelers who prefer active holidays.

Additionally, collaborations between sports clubs and travel operators are increasing. Travel packages that combine tickets, accommodation, and training sessions offer tourists more value and convenience. These partnerships help streamline travel planning and enhance the overall sports tourism experience.

Restraints

High Seasonal Dependence for Certain Sports Tourism Segments Restrains Market Growth

A major restraint for Spain’s sports tourism market is the heavy dependence on seasonal activities. Sports like skiing, surfing, and certain outdoor events attract tourists only during specific months, causing fluctuations in demand. This makes it difficult for operators and destinations to maintain consistent revenue throughout the year.

Another challenge is the rising operational cost of hosting major sports events. Organizers must manage expenses related to security, logistics, technology, staffing, and facility maintenance. These costs continue to increase, making it harder for smaller regions or clubs to host large-scale tournaments.

Higher expenses can also increase ticket prices or reduce the number of events available, which may affect the overall tourist inflow. In some cases, local authorities face budget restrictions that limit their ability to support new sports infrastructure or event expansion.

These factors collectively slow down the pace of growth, especially for regions that rely heavily on seasonal sports or have limited funding for event operations.

Growth Factors

Development of Niche Sports Tourism Experiences for Specialized Travelers Creates New Opportunities

Spain has strong potential to grow by developing niche sports tourism experiences. Activities such as trail running, cycling retreats, underwater sports, and heritage-based sports events appeal to travelers seeking unique and personalized experiences. These niche segments allow regions to differentiate themselves.

Smart venue technologies also offer new opportunities. Digital ticketing, real-time crowd monitoring, and immersive experiences such as AR-guided tours can boost visitor engagement and improve operational efficiency. These technologies make events more appealing to tech-savvy tourists.

Another growth area lies in expanding cross-border sports tourism packages with EU partners. Joint tours, regional leagues, and multi-country travel passes can attract European travelers who want seamless travel and diverse sports experiences.

Sustainability-focused sports tourism is also gaining traction. Eco-friendly sporting events, green stadiums, and low-impact adventure travel resonate with modern tourists who prioritize environmental responsibility. Spain can leverage this trend to attract a new wave of environmentally conscious travelers.

Emerging Trends

Rising Demand for Wellness-Integrated Sports Travel Packages Drives Market Trends

A major trend shaping Spain’s sports tourism market is the rising demand for wellness-oriented travel. Visitors increasingly prefer packages that combine sports activities with relaxation, nutrition programs, and mindfulness experiences. This shift supports the growth of wellness resorts and multi-day sports retreats.

Esports-related tourism is another fast-growing trend. Competitive gaming events, esports festivals, and digital sports conventions are attracting younger travelers. Spain’s expanding esports infrastructure makes it an emerging hub for gaming tourism.

Data-driven personalized travel planning is also becoming popular. Travelers want customized sports itineraries based on their performance levels, interests, and health data. This trend pushes operators to adopt advanced analytics and AI-based travel tools.

Social media is further shaping micro-destination sports trips. Influencers promote hidden cycling routes, local surf spots, or community tournaments, encouraging travelers to explore lesser-known Spanish regions. This trend diversifies tourism traffic and supports regional development.

Key Spain Sports Tourism Company Insights

CN Sports Tourism is positioned as a full-service operator leveraging Spain’s diverse sporting infrastructure, from football and basketball to adventure and water sports. In 2024, its competitive edge lies in packaging multi-sport experiences with accommodation and logistics, targeting both team travel and high-spend hobbyist segments seeking performance-focused camps and tournaments.

Kaptiva Sports Travel is expected to deepen its specialization in youth and academy-focused football experiences, capitalizing on Spain’s reputation as a talent hub. The company’s growth potential hinges on partnerships with clubs and schools, offering turnkey tour programs that mix training, competition, and cultural immersion to drive repeat institutional business.

Jolly DMC is likely to focus on high-value incentive and corporate sports travel, integrating tournaments, golf, sailing, and experiential add-ons into MICE itineraries. As corporates demand more wellness and team-building content, Jolly DMC can differentiate by curating bespoke, small-group sports events that align with brand objectives and ESG-conscious venue choices.

Oentours is well placed to exploit the crossover between sports tourism and lifestyle travel, especially in cycling, hiking, and running combined with gastronomy and wine. By emphasizing slower, region-focused itineraries and secondary destinations, Oentours can tap into traveler demand for authenticity while easing pressure on saturated urban hubs, supporting sustainable growth in Spain’s sports tourism ecosystem.

Top Key Players in the Market

- CN Sports Tourism

- Kaptiva Sports Travel

- Jolly DMC

- Oentours

- Spain Essential Travel

- Agency Sports and Travel Europe

- Spain Sports Tour

- Just Explore

- Costa Excursions

- Madride Travel

- Not Just a Tourist

Recent Developments

- In May 2024: Sports Tours International (UK) acquired Destination Marathons LLC, a U.S.-based running-travel specialist. This deal, though undisclosed in value, enabled the company to broaden its global portfolio of organized running-event travel experiences.

- In October 2024: Banijay Entertainment launched Banijay Iberia Sports, a new Spain-focused sports division. Led by Gonzalo Miró, the unit was created to strengthen Banijay’s presence in sports content development and regional market influence.

- In December 2024: Gersh Sports, via parent company The Gersh Agency, announced the acquisition of Madrid-based agency You First. The move expanded its international reach, boosting its global sports-representation capabilities across multiple athletic sectors.

- In January 2025: FITUR Sports 2025 introduced an innovative programme focused on sports tourism, sustainability, and marketing in Madrid. Taking place from 22–26 January, the segment aimed to highlight emerging trends and strengthen Spain’s leadership in global sports tourism.

Report Scope

Report Features Description Market Value (2024) USD 21.5 Billion Forecast Revenue (2034) USD 80.4 Billion CAGR (2025-2034) 14.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Sports Type (Football/Soccer, Cricket, Motorsports, Basketball, Others), By Sports Tourism Type (Sports Event Tourism, Nostalgia Sports Tourism, Active Sports Tourism, Passive Sports Tourism), By Consumer Orientation (Men, Women, Children), By Booking Channel (Online Booking, Phone Booking, In-Person Booking), By Tourist Type (International, Domestic), By Tour Type (Independent Traveler, Tour Group, Package Traveler), By Age Group (15–25 Years, 26–35 Years, 36–45 Years, 46–55 Years, 56–65 Years, 66–75 Years) Competitive Landscape CN Sports Tourism, Kaptiva Sports Travel, Jolly DMC, Oentours, Spain Essential Travel, Agency Sports and Travel Europe, Spain Sports Tour, Just Explore, Costa Excursions, Madride Travel, Not Just a Tourist Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Spain Sports Tourism MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Spain Sports Tourism MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- CN Sports Tourism

- Kaptiva Sports Travel

- Jolly DMC

- Oentours

- Spain Essential Travel

- Agency Sports and Travel Europe

- Spain Sports Tour

- Just Explore

- Costa Excursions

- Madride Travel

- Not Just a Tourist