Global Sourdough Market Size, Share, Growth Analysis By Form (Ready-to-Use Liquid, Dry Mix / Premix), By Type (Type I, Type II, Type III), By Ingredient (Wheat, Barley, Oats, Others), By Application (Breads and Buns, Cookies, Cakes, Pizza, Others), By Distribution Channel ( Food Processing, Foodservice, Retail, Supermarkets / Hypermarkets, Online Retail Stores, Other) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158235

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

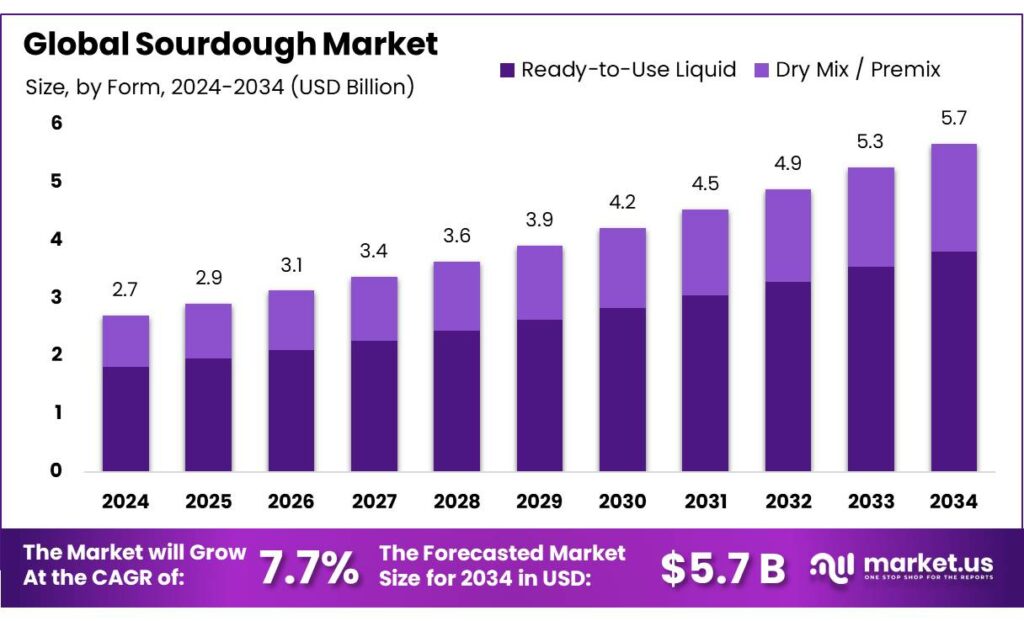

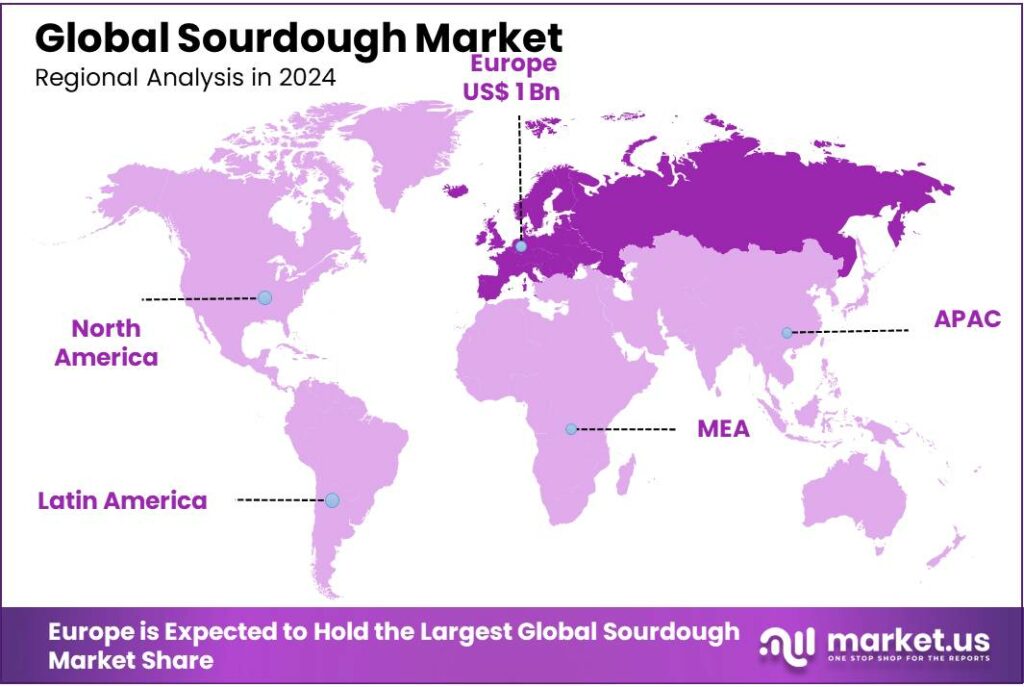

The Global Sourdough Market size is expected to be worth around USD 5.7 Billion by 2034, from USD 2.7 Billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 39.20% share, holding USD 1 Billion in revenue.

Sourdough refers to a bread or baked‐goods process involving natural fermentation by wild yeasts and lactic acid bacteria instead of solely using commercial yeast. Its attributes include distinctive flavour, improved digestibility, enhanced nutritional profile, and fewer additives.

Research such as Chemical and Nutritional Characterization of Sourdoughs shows that use of sprouted or unsprouted whole‑wheat flour fermented in a spontaneous sourdough process results in increased yeast and lactic acid bacteria counts, higher total phenolic content, antioxidant capacity, and lower phytic acid content; substitution of ~20% sprouted whole‑wheat flour improved bread volume and crumb softness.

Government initiatives like the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme are instrumental in this transformation. Launched in 2020, the PMFME scheme aims to formalize micro food processing units, providing financial, technical, and business support. Under this scheme, micro-enterprises can avail of a 35% capital subsidy on project costs up to ₹10 lakh, along with seed capital for Self-Help Groups (SHGs) and support for branding and marketing.

Government initiatives play a crucial role in supporting the growth of the sourdough industry. The Pradhan Mantri Kisan SAMPADA Yojana (PMKSY), implemented by the Ministry of Food Processing Industries, has facilitated the establishment of 28 bakery processing projects as of 2023, enhancing infrastructure and supply chains for bakery products. Additionally, the PM Formalization of Micro Food Processing Enterprises (PMFME) scheme has supported over 2,000 bakery units, promoting the formalization and modernization of the sector.

Key Takeaways

- Sourdough Market size is expected to be worth around USD 5.7 Billion by 2034, from USD 2.7 Billion in 2024, growing at a CAGR of 7.7%.

- Ready-to-Use Liquid held a dominant market position in the “By Form” segment of the Sourdough Market, capturing more than a 67.3% share.

- Type I held a dominant market position in the “By Type” segment of the Sourdough Market, capturing more than a 45.2% share.

- Wheat held a dominant market position in the “By Ingredient” segment of the Sourdough Market, capturing more than a 59.6% share.

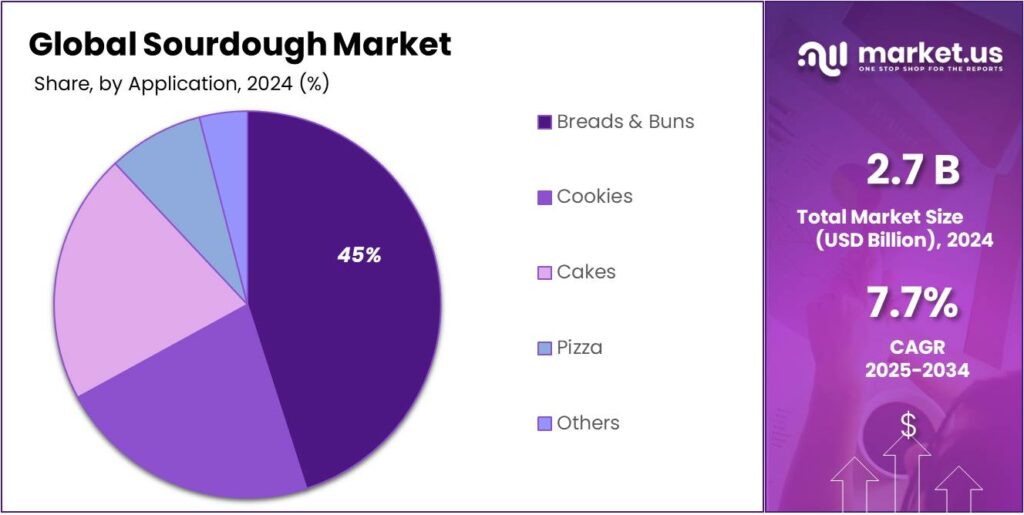

- Breads & Buns held a dominant market position in the “By Application” segment of the Sourdough Market, capturing more than a 45.1% share.

- Food Processing held a dominant market position in the “By Distribution Channel” segment of the Sourdough Market, capturing more than a 52.9% share.

- Europe dominated with 39.20% share translating to about USD 1 billion

By Form Analysis

Ready-to-Use Liquid dominates with 67.3% due to its ease of application and consistency.

In 2024, Ready-to-Use Liquid held a dominant market position in the “By Form” segment of the Sourdough Market, capturing more than a 67.3% share. This strong preference is largely due to its convenience, consistency, and time-saving nature, especially for industrial and commercial bakeries. Unlike traditional starters that require nurturing and timing, ready-to-use liquid sourdough eliminates the need for long fermentation processes, making it easier for bakers to maintain quality and flavor at scale.

It allows quicker integration into dough without compromising the tangy profile and texture that sourdough is known for. In 2025, this segment is expected to maintain its lead, supported by growing demand for uniform taste and efficient baking operations across foodservice and retail bakeries. As modern baking evolves, products that blend tradition with ease of use, like liquid sourdough, are clearly becoming a preferred choice.

By Type Analysis

Type I Sourdough leads with 45.2% thanks to its traditional fermentation and clean-label appeal.

In 2024, Type I held a dominant market position in the “By Type” segment of the Sourdough Market, capturing more than a 45.2% share. This type, known for its traditional long fermentation process at ambient temperatures, continues to attract both artisanal and health-conscious consumers. Type I sourdough uses wild yeasts and lactic acid bacteria, without the use of commercial starters or additives, aligning well with the rising demand for clean-label and minimally processed foods.

It is especially favored by small-scale and artisanal bakers who aim to deliver authentic sourdough flavor, texture, and aroma. Despite requiring longer fermentation and more handling time, its natural profile remains a strong selling point. In 2025, this segment is expected to maintain steady demand, driven by consumers seeking wholesome, gut-friendly, and naturally fermented bread options in both home and craft bakery settings.

By Ingredient Analysis

Wheat dominates with 59.6% owing to its widespread use and reliable baking performance.

In 2024, Wheat held a dominant market position in the “By Ingredient” segment of the Sourdough Market, capturing more than a 59.6% share. This leadership is driven by wheat’s long-standing role as a staple grain in baking, offering consistent structure, elasticity, and fermentation properties essential for sourdough production. Bakers, whether artisanal or industrial, prefer wheat due to its balanced gluten content and familiarity among consumers.

It allows for better loaf volume, a chewy crumb, and the classic tang that defines sourdough bread. Even with the rise of alternative flours like rye, spelt, or oats, wheat remains the go-to choice for both traditional and modern sourdough recipes. In 2025, the wheat-based sourdough segment is expected to stay in front, supported by strong global wheat supply chains and its compatibility with varied fermentation techniques.

By Application Analysis

Breads & Buns take the lead with 45.1% due to everyday consumption and rising health appeal.

In 2024, Breads & Buns held a dominant market position in the “By Application” segment of the Sourdough Market, capturing more than a 45.1% share. This growth is fueled by the increasing demand for healthier and flavorful alternatives to regular white bread. Sourdough breads and buns are now a regular part of daily diets for many consumers who are looking for better digestion, clean ingredients, and richer taste. Their appeal spans across households, cafes, and premium foodservice chains.

The fermentation process in sourdough gives breads a longer shelf life and makes them suitable for natural preservation without chemical additives. In 2025, the segment is expected to expand further as more bakeries and supermarkets introduce sourdough-based sandwich buns, rolls, and loaves to meet growing interest in gut-friendly and artisan-style baked goods.

By Distribution Channel Analysis

Food Processing leads with 52.9% as manufacturers scale sourdough use in packaged and frozen goods.

In 2024, Food Processing held a dominant market position in the “By Distribution Channel” segment of the Sourdough Market, capturing more than a 52.9% share. This strong presence is driven by the growing use of sourdough in large-scale food production, including packaged breads, frozen pizzas, and ready-to-bake products. Food manufacturers increasingly prefer sourdough due to its natural preservation qualities, flavor depth, and consumer appeal for clean-label and fermented foods.

By integrating ready-to-use sourdough starters or sourdough-based dough into processing lines, companies can maintain consistency while offering artisanal-quality products on a commercial scale. In 2025, this segment is expected to continue expanding as food brands explore more diverse applications of sourdough across snacks, wraps, and specialty baked items to meet the evolving tastes of health-conscious consumers.

Key Market Segments

By Form

- Ready-to-Use Liquid

- Dry Mix / Premix

By Type

- Type I

- Type II

- Type III

By Ingredient

- Wheat

- Barley

- Oats

- Others

By Application

- Breads & Buns

- Cookies

- Cakes

- Pizza

- Others

By Distribution Channel

- Food Processing

- Foodservice

- Retail

- Supermarkets / Hypermarkets

- Online Retail Stores

- Other

Emerging Trends

Government Initiatives Fueling Growth in the Sourdough Industry

The Indian sourdough bread sector is experiencing significant growth, largely driven by government initiatives aimed at enhancing the food processing industry. Programs like the Pradhan Mantri Kisan Sampada Yojana (PMKSY) and the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme are playing pivotal roles in this development.

In July 2025, the Union Cabinet approved an allocation of ₹6,520 crore for the expansion of PMKSY during the 15th Finance Commission cycle (2021–2026). This includes an additional ₹1,920 crore to further support the scheme’s objectives. The PMKSY aims to enhance the agricultural and food processing sectors in India, promoting value addition, infrastructure development, and reducing post-harvest losses.

As part of this expansion, the government plans to establish 50 irradiation units to improve food preservation and safety, along with 100 new food testing laboratories to ensure compliance with quality standards. These initiatives are expected to strengthen the agricultural supply chain and increase income opportunities for farmers and entrepreneurs in the food processing industry.

These government initiatives have not only facilitated the modernization of bakery units but have also encouraged the formalization of the sector, leading to improved product quality and increased competitiveness. For instance, under the PMFME scheme, micro-enterprises have received support for upgrading their production facilities, adopting modern technologies, and enhancing their marketing strategies, thereby expanding their market reach and improving profitability.

The impact of these schemes is evident in the success stories of various bakery units across the country. In Gujarat, for example, the PMFME scheme has enabled micro food processing units to scale up operations, adopt modern technology, and access new markets. Similarly, in Delhi, the establishment of incubation centers and the provision of bakery line equipment have empowered local entrepreneurs to enhance their production capabilities and product offerings.

Drivers

Government Support and Schemes

One of the most significant catalysts propelling the growth of the sourdough and broader bakery industry in India is the robust support from government schemes, particularly the Pradhan Mantri Kisan Sampada Yojana (PMKSY) and the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme.

The PMKSY, with an enhanced outlay of ₹6,520 crore (approximately USD 780 million) for the period 2021–2026, aims to modernize food processing infrastructure, reduce post-harvest losses, and promote value addition in the food processing sector. This initiative has led to the establishment of over 1,100 operational projects, collectively creating a processing and preservation capacity of 255.66 lakh metric tonnes per year, as of June 2025

Complementing this, the PMFME scheme, launched in June 2020, focuses on supporting micro food processing enterprises, including those in the bakery sector. With a financial outlay of ₹10,000 crore (approximately USD 1.2 billion) over five years, the scheme provides credit-linked subsidies, technical assistance, and support for branding and marketing. As of 2023, 2,017 bakery units have benefited from this scheme, receiving a total assistance of ₹186 crore.

These government initiatives have not only facilitated the modernization of bakery units but have also encouraged the formalization of the sector, leading to improved product quality and increased competitiveness. For instance, under the PMFME scheme, micro-enterprises have received support for upgrading their production facilities, adopting modern technologies, and enhancing their marketing strategies, thereby expanding their market reach and improving profitability.

Restraints

Labor Shortages and Skill Gaps in Artisan Baking

A significant challenge hindering the growth of the sourdough bread sector in India is the acute shortage of skilled labor and the lack of specialized training in artisanal baking techniques. This issue is particularly pronounced in non-metro regions, where traditional baking methods are less prevalent, and the demand for artisanal products is on the rise.

The Indian bakery industry is experiencing a labor shortage, and the cost of hiring skilled workers continues to rise. This is particularly challenging when bakeries need labor for tasks such as dough mixing, dividing, rounding, and packaging, which are highly time-consuming and labor-intensive. In traditional setups, these tasks are typically performed manually, leading to inefficiencies and increased risk of contamination. Manual handling of dough and finished goods introduces hygiene risks, which can lead to product recalls and damaged credibility in today’s health-conscious market.

The shortage of trained bakers who understand artisanal techniques, such as natural fermentation and sourdough starter management, further exacerbates the problem. These skills are essential for producing high-quality sourdough bread but are not widely taught in conventional culinary institutions. As a result, many aspiring bakers resort to self-learning or rely on informal training, leading to inconsistent product quality and operational inefficiencies.

This labor challenge is compounded by the increasing demand for artisanal and health-oriented bakery products. Consumers are becoming more health-conscious and are seeking products like sourdough bread, which is perceived as a healthier alternative due to its natural fermentation process and lower glycemic index. However, the inability to meet this demand due to labor shortages limits the growth potential of the sourdough sector.

Opportunity

Exploring the Growth Opportunity in Sourdough Bread

The global sourdough bread market is experiencing a significant transformation, driven by a collective shift in consumer preferences towards healthier, more natural food options. This change is not just a fleeting trend but a reflection of a deeper, more conscious approach to eating. As people become increasingly aware of the benefits of traditional fermentation methods, sourdough bread has emerged as a preferred choice for many.

One of the key factors contributing to this surge is the growing awareness of the health benefits associated with sourdough bread. Unlike conventional bread, sourdough undergoes a natural fermentation process that can enhance digestibility and reduce the glycemic index. This makes it an attractive option for individuals looking to manage their blood sugar levels and improve gut health.

Moreover, the appeal of sourdough extends beyond its health benefits. The unique flavor profile and texture of sourdough bread offer a distinctive culinary experience that resonates with consumers seeking authenticity and quality in their food choices. This has led to an increase in the popularity of artisanal bakeries and specialty bread products, further fueling the market’s growth.

Government initiatives and industry support play a crucial role in this expansion. Regulatory bodies are increasingly recognizing the value of traditional baking methods and are providing frameworks that support the production and labeling of sourdough products. These policies help ensure that consumers have access to authentic and high-quality sourdough bread, thereby fostering trust and encouraging consumption.

Regional Insights

In 2024, Europe dominated with 39.20% share translating to about USD 1 billion in the global sourdough market, making it the leading region in terms of both market size and influence. This dominance arises from Europe’s strong bakery tradition, high consumer awareness around health and artisanal quality, and well‑developed industrial bakery and food processing infrastructure.

Consumer trends in Europe strongly favour sourdough because of perceived health advantages (better digestion, cleaner ingredients), taste and flavor preferences, and growing demand for artisanal and traditional methods. Industrial and retail channels are both important: supermarkets, artisan bakeries, and foodservice are pulling many consumers into sourdough goods.

Technological improvements—such as better fermentation controls, starter cultures, and packaging to retain freshness—are enabling the market to scale. Germany, France, and the UK are especially important markets, with Germany being a leader in terms of absolute sales and traditional rye/wheat sourdough culture, and France/UK innovating in premium and clean‐label sourdough.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Puratos (Belgium) is a leader in sourdough solutions, offering a wide range of active, inactive, liquid, powder and ready‑to‑use sourdoughs under its “Sapore” and “O‑tentic” lines. The company preserves over 1,500 strains of lactic bacteria and many wild yeast strains in its Sourdough Library, supplying both artisanal and industrial bakery customers. Puratos emphasizes clean‑label, flavour consistency, and industrial scalability.

AB Mauri (UK) provides both active and inactive sourdough products to stabilize flavour, texture, colour, and volume in baked goods. Its Aromaferm™ portfolio includes pastes with malt, seeds and grains, and also offers durable liquid and powder sourdough mixes. The company focuses on ready‑to‑use solutions that save time and ensure consistent performance for both craft and industrial bakeries.

IREKS GmbH (Germany) is an established family‑owned company present in over 90 countries. It supplies sourdoughs tailored for bakeries of different scales, integrating natural leavening, starter cultures, and fermentation know‑how. IREKS’s strength lies in balancing traditional sourdough flavour with industrial requirements like shelf life, dough handling, and texture consistency.

Top Key Players Outlook

- Puratos

- AB Mauri

- IREKS GMBH

- Lallemand Inc

- Lesaffre

- GOLD COAST BAKING COMPANY

- BOUDIN BAKERY

- Goodmills

- Emst BÖCKER GmbH & Co. KG

- Bake With Brolite

Recent Industry Developments

In 2024, IREKS GmbH – a long‑standing baking ingredient company based in Germany with roughly 3,300 employees globally – leaned further into its sourdough work by highlighting “fermented” as a core theme for expansion in its product and R&D strategy.

In 2024, AB Mauri stepped up its sourdough offerings with the launch of 3 new Aromaferm™ sourdough pastes in the UK.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Bn Forecast Revenue (2034) USD 5.7 Bn CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Ready-to-Use Liquid, Dry Mix / Premix), By Type (Type I, Type II, Type III), By Ingredient (Wheat, Barley, Oats, Others), By Application (Breads and Buns, Cookies, Cakes, Pizza, Others), By Distribution Channel ( Food Processing, Foodservice, Retail, Supermarkets / Hypermarkets, Online Retail Stores, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Puratos, AB Mauri, IREKS GMBH, Lallemand Inc, Lesaffre, GOLD COAST BAKING COMPANY, BOUDIN BAKERY, Goodmills, Emst BÖCKER GmbH & Co. KG, Bake With Brolite Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Puratos

- AB Mauri

- IREKS GMBH

- Lallemand Inc

- Lesaffre

- GOLD COAST BAKING COMPANY

- BOUDIN BAKERY

- Goodmills

- Emst BÖCKER GmbH & Co. KG

- Bake With Brolite