Global Sorbitol Market By Type (Sorbitol Liquid, and Sorbitol Powder), By Application (Cosmetic and Personal Care, Chemical, Food, and Others), By End-use(Chemical, Personal Care, Pharmaceuticals, Food, Other End-uses), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 29398

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

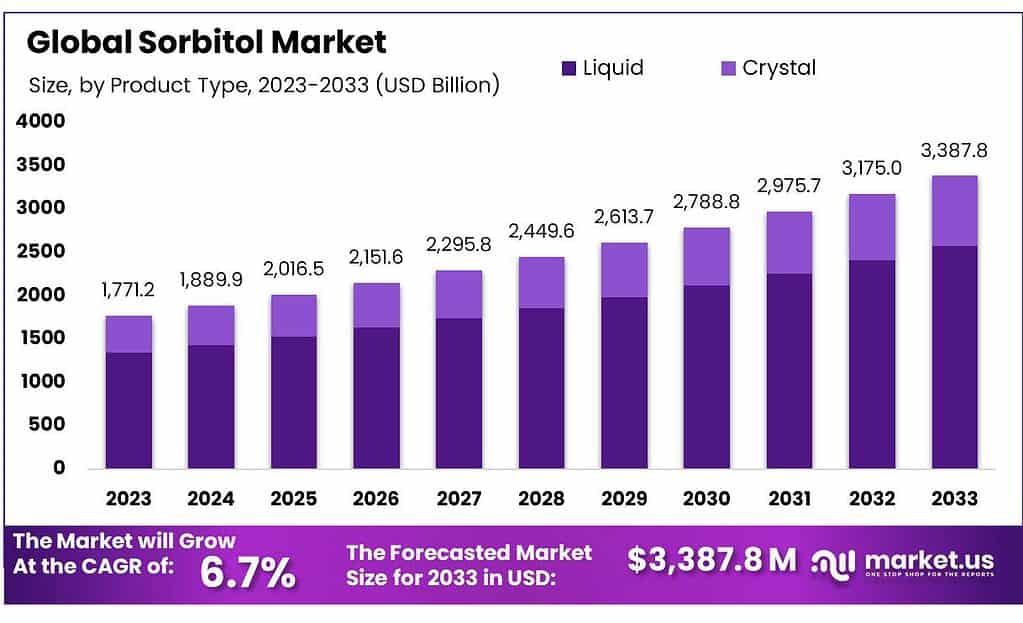

The global sorbitol market size is expected to be worth around USD 3387.8 Million by 2033, from USD 1771.2 Million in 2023, growing at a CAGR of 6.7% during the forecast period from 2023 to 2033.

Because of the increasing use of dietetic and diabetic foods and beverages, the market will experience significant growth in the forecast period. In the coming years, there will be a growing demand for the product to replace sugar in food products.

Oral care products are increasingly using sorbitol because it is more slowly metabolized than other sugar alcohols. This helps prevent dental problems like tooth decay and cavities. Over the forecast period, the industry will see the same benefits.

The trend to shift production to the Asia Pacific has also led to lower costs of sorbitol. Therefore, there is a rising demand for other non-food products.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Growth Projection: The global sorbitol market is expected to surge from USD 1771.2 Million in 2023 to about USD 3387.8 Million by 2033, marking a robust CAGR of 6.7%. This growth is attributed to increased demand for diabetic and dietetic foods and beverages.

- Usage in Various Industries: Sorbitol finds wide applications across industries like food, pharmaceuticals, and cosmetics. It’s valued for its slow metabolism compared to other sugars, making it beneficial for oral care products to prevent dental issues.

- Product Analysis: Liquid sorbitol holds a dominant market share of over 76.0% in 2023. It’s preferred in low-calorie foods and pharmaceuticals. Crystal sorbitol is extensively used in frozen food production, cosmetics, and pharmaceuticals due to its resistance to degradation.

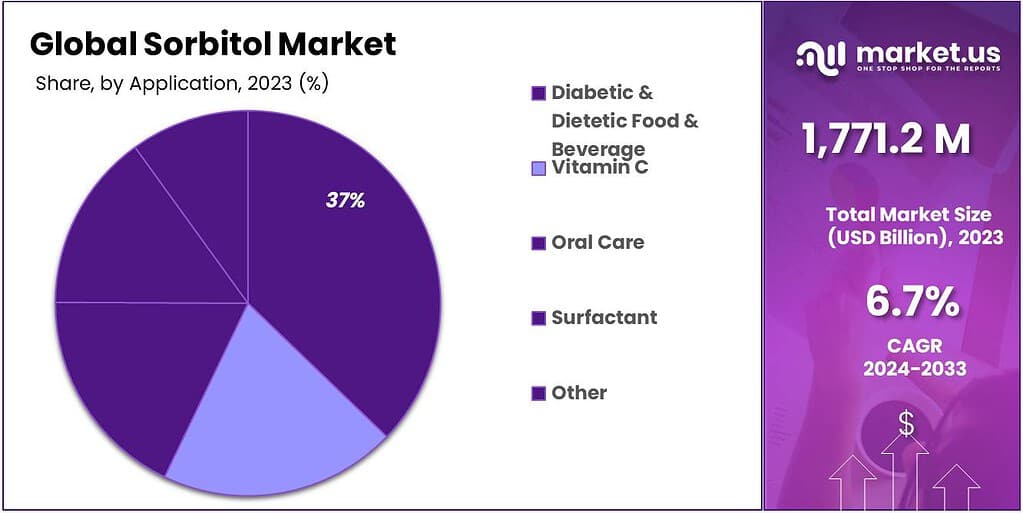

- Application Insights: Sorbitol’s use in diabetic and dietetic food & beverage holds over 37% market share. Its versatility extends to surfactants, stabilizing various foods, and aiding in the production of Vitamin C.

- End-Use Significance: Sorbitol’s addition to food not only replaces refined sugar but also acts as an anti-crystallization agent, enhancing shelf life. Its role extends to the production of bio-based Ethanol and Propylene Glycol, serving as a key building block.

- Market Segmentation: The market segments sorbitol based on product type, application, and end-use, highlighting its versatility across multiple industries.

- Drivers, Restraints, and Opportunities: Rising health consciousness and the adverse effects of sugar-based products drive the market. Adherence to international quality standards ensures safety. Emerging markets and fluctuations in sugar prices present growth opportunities.

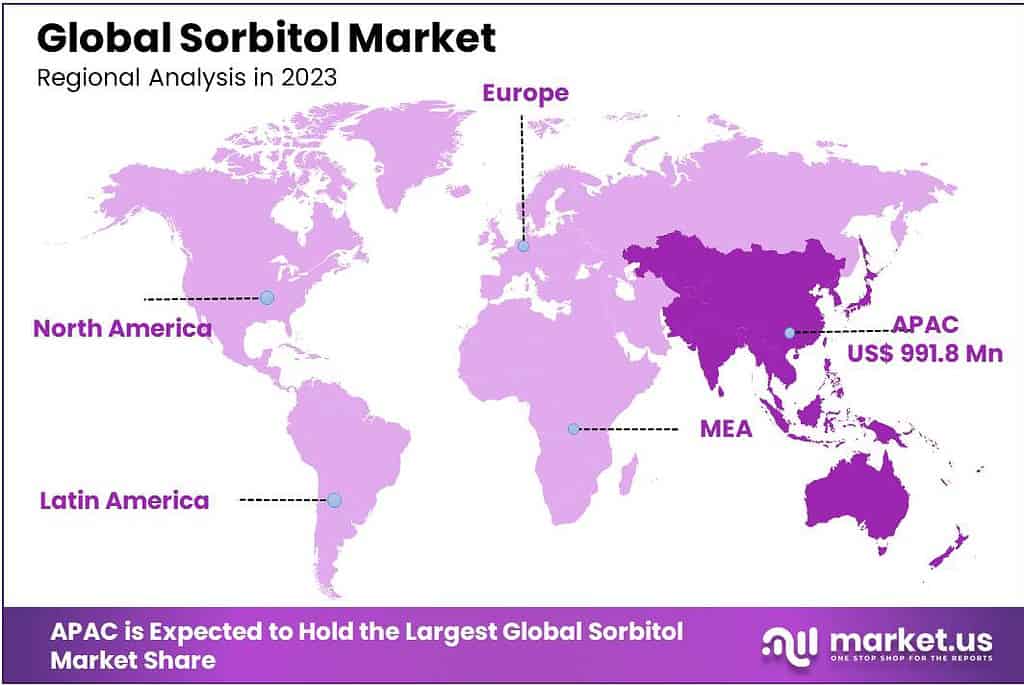

- Regional Analysis: The Asia Pacific dominates the market due to increased consumption in various applications. Europe follows suit due to its well-established food and beverage industry.

- Key Market Players: Companies like ADM, Cargill Incorporated, and DuPont are key players in the sorbitol market.

Product Analysis

In 2023, liquid accounted for over 76.0% market share. Liquid sorbitol can be used in food and beverage, as well as pharmaceutical applications. This product is expected to be used in these industries due to the growing demand for low-calorie food, as well as the rising number of patients suffering from obesity.

Crystal sorbitol has been widely used in food production for making frozen raw fish, shrimp fillets, and roasted fish pieces. It is also used to make frozen aquatic products and sugar-free foodstuffs. Over the forecast period, market growth will be supported by a high demand for application products, especially frozen food and meat products.

Due to their resistance to bacteriological degradation, crystal-based products are also useful as humectants in many cosmetic products such as moisturizers and creams.

Crystal sorbitol is also used in the manufacture of capsule outer shells and as an excipient and filler in pharmaceutical tablets. The future growth in cosmetic products will be a boon for sorbitol consumption.

Application Analysis

In 2023, foods and drinks for diabetics and diets were the top choices, making up over 37% of the Market share for dietetic and diabetic food & beverage was high, due to the economies of scale as well as the increasing consumption of functional foods, major manufacturers have experienced low manufacturing costs.

This has created new opportunities for sorbitol’s future growth. A gradual rise in demand for sweeteners such as maltitol/xylitol is expected to be a threat to this market, as they can be replaced by sorbitol.

Sorbitol can be used in surfactants like detergents, dispersants, and emulsifiers as well as wetting and foaming agents. In the food processing sector, biobased surfactants are being used more frequently.

Surfactants can be used to stabilize a wide range of foods, including bread, ice cream, cakes, and ice cream. The surfactants also help to maintain the texture and viscosity, as well as extend shelf life. As such, the demand for bio-based surfactant products is expected to grow over the forecast period.

The highest growth rate is expected for the Vitamin C segment over the forecast period.Vitamin C can be synthesized mainly using two manufacturing methods, the two-step ferment process or the Reichstein Grussner process. Both processes use sorbitol to produce vitamin C. Chinese manufacturers are the most common users of this two-step fermentation process due to its lower price.

Note: Actual Numbers Might Vary In Final Report

End-Use Analysis

The food segment contributed significantly to the global revenue for 2023. Sorbitol can be added to food to replace refined sugar and induce sweetness. Sorbitol provides sweetness and is also an anti-crystallization agent and texturizing for ice cream and bakery products.

It is used extensively to extend shelf life and preserve the freshness of different confectionery products and bakery items. It can also be used to produce canned fruit. The food sector is expected to grow rapidly, due to the increasing number of applications that will lead to market growth.

Market growth will be influenced by rising awareness of dietary supplements due to their nutritional benefits. Market growth will be supported by rising awareness about the importance of low-calorie, sugar-free products as a result of increasing diabetes prevalence in the world.

Sorbitol has been identified as a key building block in the production of bio-based Ethanol and Propylene Glycol. This biobased PG shares the same chemical composition as petroleum-based PG but is made using a much more sustainable manufacturing process. The growth rate for the chemical applications segment is expected to be 6.91%, due to the extensive use of sorbitol.

Key Market Segmentation

By Product

- Crystal

- Liquid

By Application

- Diabetic & Dietetic Food & Beverage

- Vitamin C

- Oral Care

- Surfactant

- Other applications

By End-use

- Chemical

- Personal Care

- Pharmaceuticals

- Food

- Other End-uses

Drivers

Rising consumer preference for low-calorie food

As more people become health-conscious, there’s a growing preference for low-calorie food options. Sorbitol, being a sugar substitute with fewer calories compared to sugar, is often used in various food and beverage products as a sweetening agent. Its ability to provide sweetness while reducing caloric content aligns with the demand for healthier food choices.

Increasing health problems due to the consumption of sugar-based products

Excessive consumption of sugar has been linked to various health issues like obesity, diabetes, and dental problems. As awareness about the adverse effects of sugar increases, consumers are seeking alternatives. Sorbitol serves as a viable substitute, offering sweetness without impacting blood sugar levels significantly, making it an attractive option for individuals aiming to reduce their sugar intake.

Restraints

Adherence to international quality standards and regulations

Ensuring Product Safety: Adhering to international quality standards and regulations ensures that products meet specified safety requirements. These standards often encompass aspects like purity, quality, and permissible levels of components. For sorbitol, this ensures its safety for consumption in food, pharmaceuticals, and personal care products.

Meeting Industry Requirements: Compliance with international standards enables manufacturers to meet industry-specific requirements. For sorbitol, this means adhering to regulations set by food safety authorities, pharmaceutical standards, and cosmetic safety guidelines to ensure its suitability and effectiveness in different applications.

Opportunities

Growing demand from the food & beverage industry in emerging markets

Market Expansion: Emerging markets are experiencing increased urbanization, rising disposable incomes, and changing consumer preferences. As a result, there’s a growing demand for a variety of food and beverage products. Sorbitol, as a sugar substitute, finds application in these markets due to its sweetening properties and lower caloric content, catering to the demand for healthier alternatives.

Fluctuations in the price and supply of sugar are creating opportunities for sorbitol

Price Volatility of Sugar: Fluctuations in the price and supply of sugar impact food and beverage manufacturers, leading to uncertainties in production costs. This situation creates an opportunity for sorbitol, which provides a viable alternative to sugar. Manufacturers can use sorbitol as a substitute to stabilize costs and reduce dependency on fluctuating sugar prices.

Challenges

Ambiguity related to the side effects of sorbitol

Gastrointestinal Disturbances: Sorbitol, like other sugar alcohols, can have a laxative effect and cause gastrointestinal discomfort, including bloating, gas, diarrhea, and abdominal pain when consumed in excessive quantities. This laxative effect occurs because sorbitol is not fully absorbed in the small intestine and can ferment in the colon, leading to an osmotic effect and subsequent water retention in the bowels.

Individual Sensitivity: Some individuals are more sensitive to sorbitol than others. The threshold at which these side effects manifest can vary from person to person. While some people may consume sorbitol without experiencing adverse effects, others may be more prone to gastrointestinal disturbances even with smaller amounts.

Regional Analysis

The Asia Pacific dominated this market and was responsible for more than 56.2% of global revenue in 2023. Due to its widespread use in many applications (e.g. cookies, confectionery, and bakery goods), the market for sorbitol has been driven by a growing number of health-conscious consumers.

The demand for the product has increased due to the changing lifestyles and urbanization in the developing world. End-users are adopting the product more frequently to satisfy consumer demand. The Asia Pacific region has seen a lot of Sorbitol being used in non-food uses. Japan is a major importer of the oral care market.

Sorbitol has been able to penetrate the European market at a rapid pace due to the well-established European food and beverage industry. This industry is constantly evolving and adapting to new products.

Europeans consume a large number of meat products. Most Europeans eat processed meat products.

Europe is not only the largest market for food and beverages but also one of the most tightly regulated.Europe will see high growth opportunities due to the product’s role as a substitute sugar in sugar-based beverages and foods, as well as the fact that sorbitol is able to prevent the charring of meat.

Note: Actual Numbers Might Vary In Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

In response to the growing demand for non-GMO ingredients in the food and drink, pharmaceutical, cosmetics, and cosmetics sectors, manufacturers are focusing more on the production quantities of sorbitol from non-GMO crops. To reduce transportation costs and the impact on the environment, manufacturers are now focusing their efforts on local sourcing.

Gujrat Ambuja Exports (PT Ecogreen Oleochemicals), Gujrat Ambuja Exports (GUJRAT Ambuja Exports), and Gulshan Pols are some companies that import sorbitol from their overseas manufacturing plants in Turkey and India. These companies have focused on customizing products to suit the requirements of food and industrial processing players

Key Market Players

- American International Foods, Inc.

- ADM

- Cargill Incorporated

- DuPont

- Gulshan Polyols Ltd.

- Merck KGaA

- Ecogreen Oleochemicals GmbH

- Qinhuangdao Lihua Starch Co., Ltd.

- Roquette Frères

- SPI Pharma

- Tereos

- Ingredion Incorporated

- Kasyap Sweeteners, Ltd

Recent Development

January 2020: ADM launched a new logo with a catchy tagline for their brand, Unlocking Nature, Enriching Life. Through this, ADM was able to attract and appeal to more consumers and expand its customer base.

Report Scope

Report Features Description Market Value (2023) USD 1771 Billion Forecast Revenue (2033) USD 3387 Billion CAGR (2023-2032) 6.7% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sorbitol Liquid, and Sorbitol Powder), By Application (Cosmetic and Personal Care, Chemical, Food, and Others), By End-use(Chemical, Personal Care, Pharmaceuticals, Food, Other End-uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape American International Foods, Inc., ADM, Cargill Incorporated, DuPont, Gulshan Polyols Ltd., Merck KGaA, Ecogreen Oleochemicals GmbH, Qinhuangdao Lihua Starch Co., Ltd., Roquette Frères, SPI Pharma, Tereos, Ingredion Incorporated, Kasyap Sweeteners, Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is sorbitol market?Sorbitol is a sugar alcohol derived from glucose and commonly used as a sweetening agent in various food and beverage products. It's also utilized in pharmaceuticals and personal care products.

How is sorbitol market produced?Sorbitol is typically produced by the hydrogenation of glucose and is available in both liquid and powder forms. It occurs naturally in fruits but is predominantly manufactured commercially.

What are the benefits of sorbitol in food products?Sorbitol offers sweetness similar to sugar but with fewer calories. It's often used in sugar-free and reduced-sugar products, contributing to their taste and texture without impacting blood sugar levels significantly.

-

-

- American International Foods, Inc.

- ADM

- Cargill Incorporated

- DuPont

- Gulshan Polyols Ltd.

- Merck KGaA

- Ecogreen Oleochemicals GmbH

- Qinhuangdao Lihua Starch Co., Ltd.

- Other Key Players