Global Somatostatin Analogs Market By Product Type (Octreotide, Pasireotide, Lanreotide and Others), By Application (Neuroendocrine Tumors, Acromegaly and Others), By End-User (Hospitals, Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174944

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

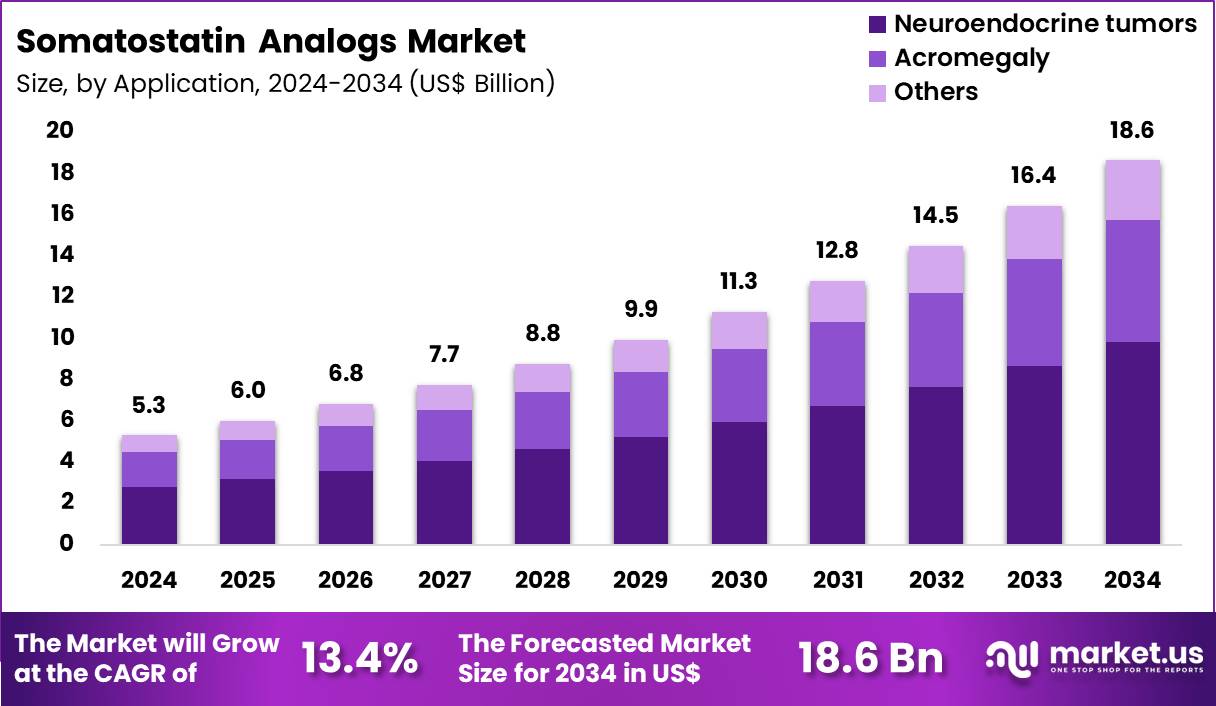

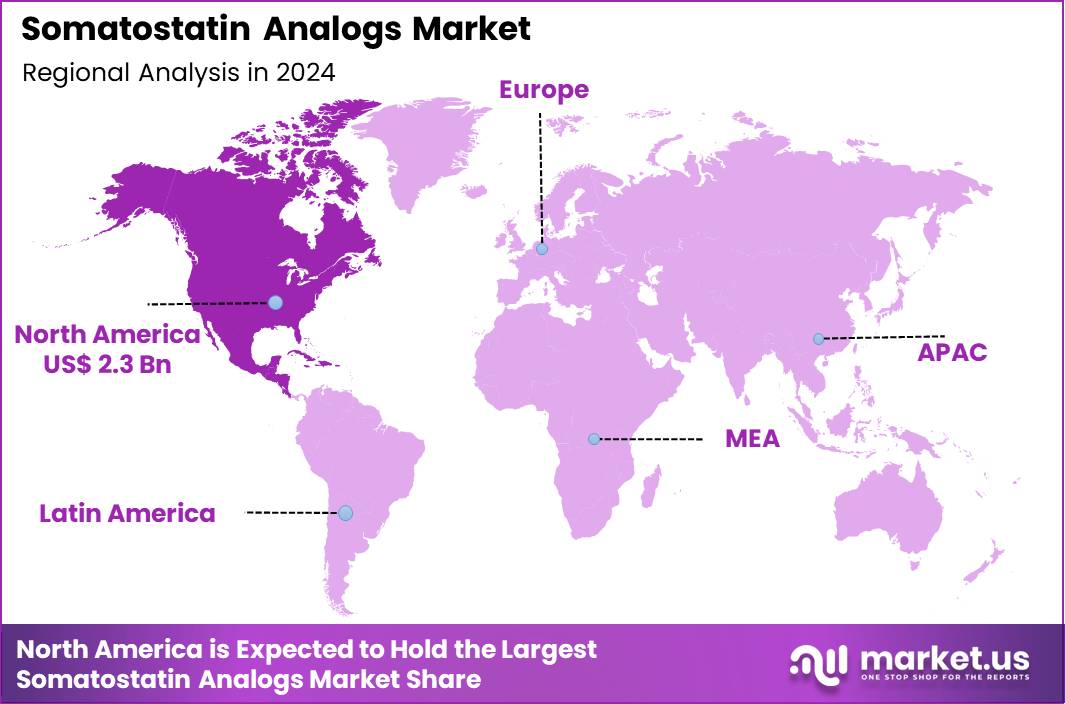

Global Somatostatin Analogs Market size is expected to be worth around US$ 18.6 Billion by 2034 from US$ 5.3 Billion in 2024, growing at a CAGR of 13.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.2% share with a revenue of US$ 2.3 Billion.

Rising incidence of neuroendocrine tumors and acromegaly accelerates demand for somatostatin analogs that effectively suppress hormone hypersecretion and tumor growth. Endocrinologists prescribe octreotide and lanreotide long-acting formulations to control symptoms in patients with functional gastroenteropancreatic neuroendocrine tumors, reducing diarrhea, flushing, and abdominal pain associated with carcinoid syndrome.

These agents inhibit growth hormone release in acromegaly, normalizing insulin-like growth factor-1 levels and alleviating headaches, joint pain, and soft tissue swelling. Clinicians utilize somatostatin analogs as first-line therapy for thyrotropin-secreting pituitary adenomas, restoring euthyroid status and preventing cardiovascular complications. These therapies support adjunctive treatment in refractory Cushing’s disease, where they decrease adrenocorticotropic hormone secretion and mitigate hypercortisolism effects.

In July 2025, Camurus reported a favorable opinion from the Committee for Medicinal Products for Human Use for Oczyesa (CAM2029), clearing the path toward European marketing authorization and a commercial rollout planned for the second half of 2025. This milestone supports growth in the somatostatin analogs market by introducing an additional long-acting therapy option in Europe, encouraging wider uptake of depot-based treatments for chronic endocrine conditions and sustaining demand for extended-release formulations.

Manufacturers pursue opportunities to develop ultra-long-acting somatostatin analogs with extended dosing intervals, improving patient adherence in acromegaly and neuroendocrine tumor management. Developers advance oral formulations that bypass injection-related discomfort, expanding applications for patients intolerant to depot injections in chronic hormone excess disorders.

These innovations facilitate combination strategies with targeted therapies, enhancing antiproliferative effects in progressive neuroendocrine tumors. Opportunities emerge in pediatric formulations that address rare growth hormone-secreting adenomas, providing precise dosing for younger patients.

Companies invest in sustained-release depots that maintain stable plasma concentrations, optimizing symptom control and tumor stabilization in long-term therapy. Firms explore novel delivery systems that improve bioavailability and reduce injection-site reactions, broadening accessibility for patients requiring lifelong treatment in pituitary and gastrointestinal endocrine diseases.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.3 Billion, with a CAGR of 13.4%, and is expected to reach US$ 18.6 Billion by the year 2034.

- The product type segment is divided into octreotide, pasireotide, lanreotide and others, with octreotide taking the lead with a market share of 44.7%.

- Considering application, the market is divided into neuroendocrine tumors, acromegaly and others. Among these, neuroendocrine tumors held a significant share of 52.8%.

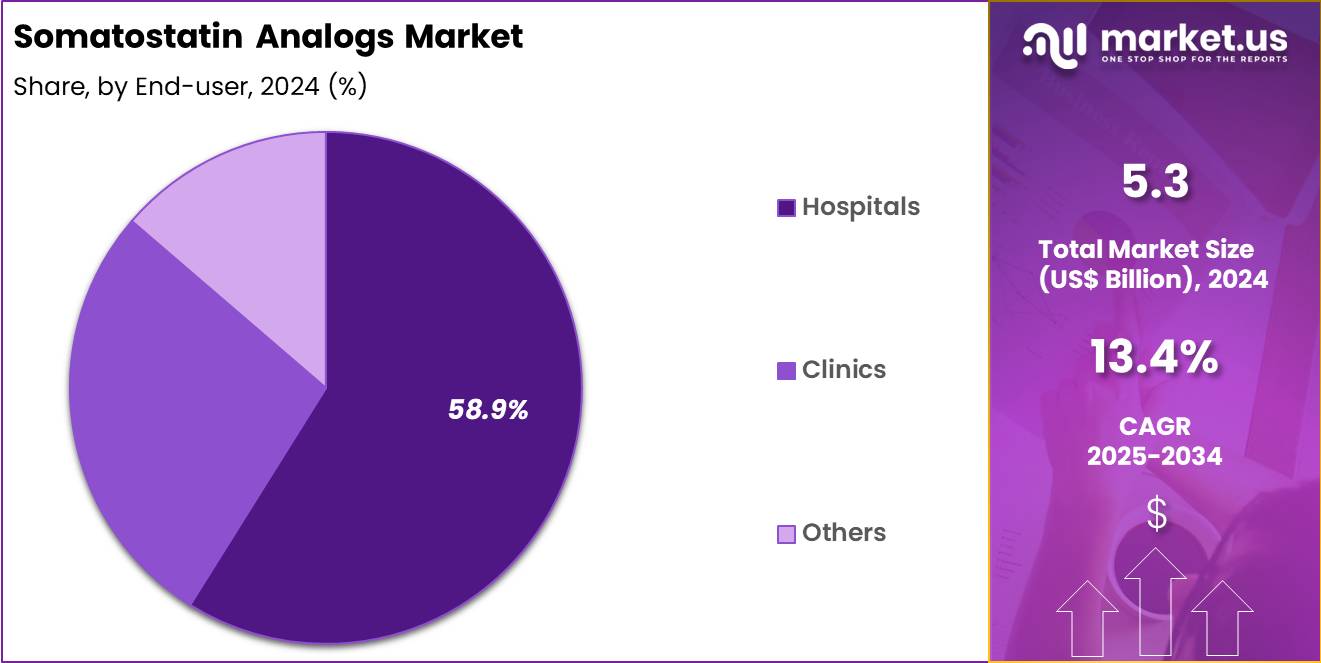

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, clinics and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 58.9% in the market.

- North America led the market by securing a market share of 43.2%.

Product Type Analysis

Octreotide accounted for 44.7% of growth within the product type category and represents the most established therapy class in the Somatostatin Analogs market. Clinicians frequently select octreotide due to strong familiarity and long-term clinical usage. Broad labeling across neuroendocrine tumor symptom control and acromegaly management supports sustained demand. Hospitals rely on octreotide for rapid control of hormone-related symptoms in acute settings. Availability of multiple formulations improves dosing flexibility across patient needs.

Long-acting depot versions support better adherence through reduced injection frequency. Physicians value predictable efficacy in controlling flushing and diarrhea in carcinoid syndrome. Increased diagnosis of hormone-secreting tumors strengthens octreotide utilization. Generic competition improves affordability and access in multiple regions. Treatment protocols often position octreotide as a first-line somatostatin analog.

Oncology and endocrinology teams prefer therapies with established safety profiles. Expansion of specialized NET clinics increases prescribing volumes. Improved imaging and biomarker testing increases patient identification rates. Hospital formularies continue to include octreotide due to cost-effectiveness and reliability. Increased use as perioperative support in endocrine surgeries contributes to demand.

Research evidence reinforces use in symptom control and disease stabilization. Supply chain maturity supports consistent availability. Patient preference supports long-acting injection schedules. The segment is projected to maintain dominance due to legacy use, broad clinical utility, and strong access economics. Overall growth reflects guideline alignment and growing NET caseloads.

Application Analysis

Neuroendocrine tumors accounted for 52.8% of growth within the application category and represent the primary demand driver for somatostatin analog therapy. Rising incidence and improved detection of NETs increase the treated patient pool. Functional NETs require symptom control, which sustains long-term treatment duration. Somatostatin analogs remain central to controlling hormone secretion-related complications. Clinicians increasingly adopt chronic therapy to manage carcinoid syndrome symptoms.

Diagnostic advances in PET imaging and biomarker monitoring improve early identification of NET cases. Longer survival rates extend the duration of medical management. Multidisciplinary tumor boards standardize somatostatin analog initiation in NET pathways. Increased patient awareness drives earlier healthcare seeking behavior. Hospital-based oncology services treat high volumes of metastatic and advanced NET patients.

Somatostatin analogs support tumor stabilization strategies in well-differentiated NETs. Use in combination with other systemic therapies increases overall therapy exposure. Long-acting depot dosing supports adherence for long-term management. Growing access to specialist centers expands treatment uptake. Treatment guidelines reinforce consistent use for symptom management.

Improved supportive care increases persistence and follow-up compliance. Payor coverage improves where NET therapy demonstrates reduced hospitalization from symptom crises. The segment is anticipated to remain dominant due to chronic symptom burden and long-term treatment requirements. Overall growth reflects increasing diagnosis rates and guideline-based NET management.

End-User Analysis

Hospitals represented 58.9% of growth within the end-user category and dominate somatostatin analog utilization due to their role in diagnosis, initiation, and ongoing monitoring. NET and acromegaly patients frequently enter care through hospital-based endocrinology and oncology departments. Hospitals provide imaging, biomarker testing, and specialist evaluation required for therapy selection. Acute symptom flares require hospital intervention and rapid octreotide administration.

Hospital pharmacies manage cold-chain storage and consistent product availability. Long-acting injections often require supervised administration in hospital outpatient settings. Multidisciplinary coordination improves treatment adherence and follow-up scheduling. Hospitals manage complex cases with comorbidities that require monitoring. Referral networks direct advanced NET patients to tertiary hospitals for ongoing treatment.

Hospitals integrate somatostatin analogs into standardized treatment protocols. Insurance authorization processes operate efficiently through hospital systems. Teaching hospitals strengthen adoption through guideline-based practice and specialist training. Monitoring of glucose metabolism and gallbladder-related safety parameters supports hospital-led care. Hospitals manage dose titration and switching decisions based on clinical response. Infusion and injection services support consistent patient access.

Expansion of oncology day-care services increases treatment volumes. Hospitals remain the main center for NET symptom control and chronic therapy oversight. The segment is expected to retain dominance due to infrastructure strength, specialist presence, and high patient concentration. Overall growth reflects centralized care delivery and increasing NET workloads.

Key Market Segments

By Product Type

- Octreotide

- Pasireotide

- Lanreotide

- Others

By Application

- Neuroendocrine tumors

- Acromegaly

- Others

By End-User

- Hospitals

- Clinics

- Others

Drivers

Increasing prevalence of neuroendocrine tumors is driving the market.

The escalating incidence of neuroendocrine tumors (NETs) worldwide serves as a primary force propelling the somatostatin analogs market forward. Enhanced diagnostic capabilities, including advanced imaging and biomarker testing, have contributed to earlier and more frequent identification of these neoplasms. This improved detection has expanded the patient pool requiring long-term management with somatostatin analogs.

Official epidemiological data from the Surveillance, Epidemiology, and End Results (SEER) program demonstrate a sustained upward trajectory in NET incidence rates over recent decades. The age-adjusted incidence rate rose notably from earlier periods, with analyses confirming continued increases into the early 2020s.

Somatostatin analogs, such as octreotide and lanreotide, remain cornerstone therapies for symptom control and antiproliferative effects in functional and non-functional NETs. Their established role in first-line and maintenance treatment reinforces demand as case numbers grow.

Healthcare systems are increasingly prioritizing multidisciplinary approaches that incorporate these agents for optimal outcomes. Public health surveillance efforts highlight the rising burden of rare cancers, including NETs, prompting greater resource allocation. This driver continues to underpin investment in research, manufacturing, and global distribution of somatostatin analogs.

Restraints

High treatment costs and limited reimbursement are restraining the market.

The substantial expense associated with somatostatin analog therapies creates a notable barrier to widespread adoption and sustained market expansion. Branded long-acting formulations require repeated administration, resulting in considerable cumulative costs over extended treatment durations.

Many healthcare payers impose strict criteria for coverage, often necessitating documented evidence of disease progression or symptom severity. In regions with constrained public health budgets, access to these medications is frequently limited to select patient subgroups.

Out-of-pocket expenses can deter patient adherence, particularly in middle- and lower-income settings. Generic versions, while emerging, have not yet achieved sufficient penetration to alleviate pricing pressure across all markets. Regulatory and manufacturing complexities further contribute to elevated production costs that are reflected in final pricing.

Providers sometimes opt for alternative management strategies when reimbursement is uncertain or inadequate. This financial restraint disproportionately affects patients in developing economies where insurance frameworks remain underdeveloped. Addressing affordability through policy reforms and expanded assistance programs remains essential to mitigate this limitation.

Opportunities

Rising healthcare infrastructure development in Asia-Pacific is creating growth opportunities.

Rapid improvements in healthcare systems across the Asia-Pacific region present significant prospects for expanded utilization of somatostatin analogs. Increased government investment in oncology services and specialized centers has enhanced diagnostic and therapeutic capabilities in multiple countries. Rising awareness of neuroendocrine tumors among physicians and patients supports earlier referral and treatment initiation.

Expanding private insurance coverage in urban areas improves affordability for premium therapies. Local manufacturing initiatives and strategic partnerships reduce supply chain vulnerabilities and import-related expenses. Training programs for endocrinologists and oncologists foster greater familiarity with somatostatin analog protocols. The large and aging population base in the region contributes to a growing pool of potential patients with hormone-related disorders.

Regulatory harmonization efforts facilitate faster product approvals and market entry. Pharmaceutical companies are establishing dedicated commercial teams to capitalize on these evolving dynamics. This opportunity enables meaningful penetration into previously underserved territories and supports long-term revenue diversification

Impact of Macroeconomic / Geopolitical Factors

Global economic progress enhances funding for endocrine disorder treatments, accelerating the somatostatin analogs market as patients gain better access to therapies like octreotide for acromegaly management. Executives target affluent demographics in expanding economies, which supports robust sales pipelines and clinical trial advancements. However, unrelenting inflation pressures raw material and logistics fees, requiring firms to streamline efficiencies in resource-scarce settings.

Geopolitical rivalries in active ingredient hubs generate supply bottlenecks, compelling international players to reassess vendor dependencies amid trade barriers. Managers adapt through strategic relocations to reliable partners, which cultivates operational strength and fresh market insights.

Current US tariffs on imported biologics from major sources add fiscal hurdles for external suppliers, altering competitive landscapes in North America. Domestic innovators respond by intensifying U.S.-based synthesis efforts, which generates specialized jobs and aligns with regulatory emphases. Ongoing refinements in long-acting formulations continually vitalize the industry, fostering enduring accessibility and value-driven expansion for healthcare providers.

Latest Trends

Shift toward combination therapies with targeted agents is a recent trend in the market.

Recent clinical practice has increasingly incorporated somatostatin analogs within multimodal regimens alongside other targeted therapies. In 2024 and continuing into 2025, combination approaches have gained prominence for managing advanced or progressive neuroendocrine tumors.

Studies and real-world evidence have explored pairing somatostatin analogs with peptide receptor radionuclide therapy or small-molecule inhibitors to achieve synergistic effects. This strategy aims to enhance progression-free survival while maintaining acceptable tolerability profiles. Guidelines updated in recent years reflect growing acceptance of such integrated treatment sequences.

Pharmaceutical development efforts now prioritize evaluating somatostatin analogs in combination settings during late-stage trials. The trend responds to the need for more durable responses in patients with refractory disease. Improved understanding of tumor biology supports rational selection of complementary mechanisms.

Healthcare providers report greater utilization of these regimens in tertiary centers equipped for complex care. This evolution broadens the therapeutic utility of somatostatin analogs beyond monotherapy applications.

Regional Analysis

North America is leading the Somatostatin Analogs Market

North America accounted for 43.2% of the overall market in 2024, and the Somatostatin Analogs market expanded as endocrinologists and oncology centers increased treatment uptake for acromegaly and neuroendocrine tumors through long-acting injectable therapies. Strong clinical demand came from earlier diagnosis and structured disease management programs that improved patient follow-up and therapy persistence.

Specialty pharmacies and hospital infusion networks strengthened distribution, supporting timely access to depot formulations and adherence-focused dosing schedules. Clinicians increasingly relied on somatostatin-based therapies to control hormone hypersecretion and manage symptom burden, especially in functional tumors.

The JAMA Network Open reported a 20-year limited-duration prevalence of 248,546 neuroendocrine neoplasm patients in the United States as of January 1, 2021, which continued to drive therapy demand in 2024 through growing survivorship and long-term disease monitoring.

Expanded awareness among primary-care providers also increased referral rates to specialist care. Formulation improvements supported better tolerability and patient convenience. These drivers collectively strengthened North America’s market growth in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to witness steady expansion during the forecast period as the Somatostatin Analogs market benefits from rising specialist capacity, improved diagnostic access, and increasing detection of neuroendocrine tumors and pituitary disorders. Hospitals expand endocrinology and oncology services in major urban centers, enabling better long-term disease management and treatment continuity.

Increased availability of long-acting formulations supports dosing convenience and improved adherence in chronic therapy settings. Government investments in cancer-care infrastructure strengthen detection and referral pathways, supporting higher therapy utilization.

The Japanese Society of Neuroendocrine Tumors reported more than 10,000 registered neuroendocrine tumor cases in Japan by 2022, indicating expanding clinical burden that supports sustained demand for somatostatin-based therapies. Local pharmaceutical production and regional distribution improvements enhance accessibility across Asia Pacific. Clinical guideline adoption further standardizes treatment practices. These factors position the market for sustained growth across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Somatostatin Analogs market drive growth by improving long-acting depot formulations that reduce injection frequency and support sustained disease control in acromegaly and neuroendocrine tumors. Companies expand adoption by strengthening specialist engagement with endocrinologists and oncologists, ensuring therapy positioning within well-defined treatment pathways and monitoring protocols.

Commercial strategies focus on market access execution, patient support services, and injection training programs that raise adherence and persistence over long treatment cycles. Innovation priorities include next-generation receptor targeting, improved tolerability profiles, and lifecycle extensions through new indications and delivery options.

Market expansion targets regions improving diagnostic rates and specialty care infrastructure for hormonal disorders and rare tumors. Novartis operates as a leading participant with deep endocrine expertise, strong global commercialization capability, and a well-established portfolio of long-acting therapies that supports sustained leadership in this category.

Top Key Players

- Novartis AG

- Ipsen S.A.

- Pfizer Inc.

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

- Gland Pharma

- Baxter International Inc.

- Ferring Pharmaceuticals

- Recordati S.p.A

- Sandoz (Novartis)

Recent Developments

- In December 2024, Crinetics Pharmaceuticals confirmed that the US FDA accepted the New Drug Application for paltusotine as a maintenance treatment for adults with acromegaly. The acceptance advances the somatostatin analogs market by moving an oral, non injectable alternative closer to approval, expanding therapeutic choice and addressing adherence challenges associated with long term injectable regimens, which may contribute to broader and more sustained market utilization.

- In October 2024, Teva introduced the first generic version of Sandostatin LAR in the United States. This entry increases competition within the somatostatin analogs market by lowering treatment costs and improving accessibility for patients requiring long term therapy. Greater affordability is expected to drive higher prescription volumes and expand overall market penetration for somatostatin analog treatments.

Report Scope

Report Features Description Market Value (2024) US$ 5.3 Billion Forecast Revenue (2034) US$ 18.6 Billion CAGR (2025-2034) 13.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Octreotide, Pasireotide, Lanreotide and Others), By Application (Neuroendocrine Tumors, Acromegaly and Others), By End-User (Hospitals, Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novartis AG, Ipsen S.A., Pfizer Inc., Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Gland Pharma, Baxter International Inc., Ferring Pharmaceuticals, Recordati S.p.A, Sandoz Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Somatostatin Analogs MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Somatostatin Analogs MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Novartis AG

- Ipsen S.A.

- Pfizer Inc.

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

- Gland Pharma

- Baxter International Inc.

- Ferring Pharmaceuticals

- Recordati S.p.A

- Sandoz (Novartis)