Global Solar Roof Tiles Market Size, Share Analysis Report By Product Type (Monocrystalline, Polycrystalline, Thin-Film), By Application (Residential, Commercial, Industrial), By Installation Type (New Installation, Retrofit) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161142

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

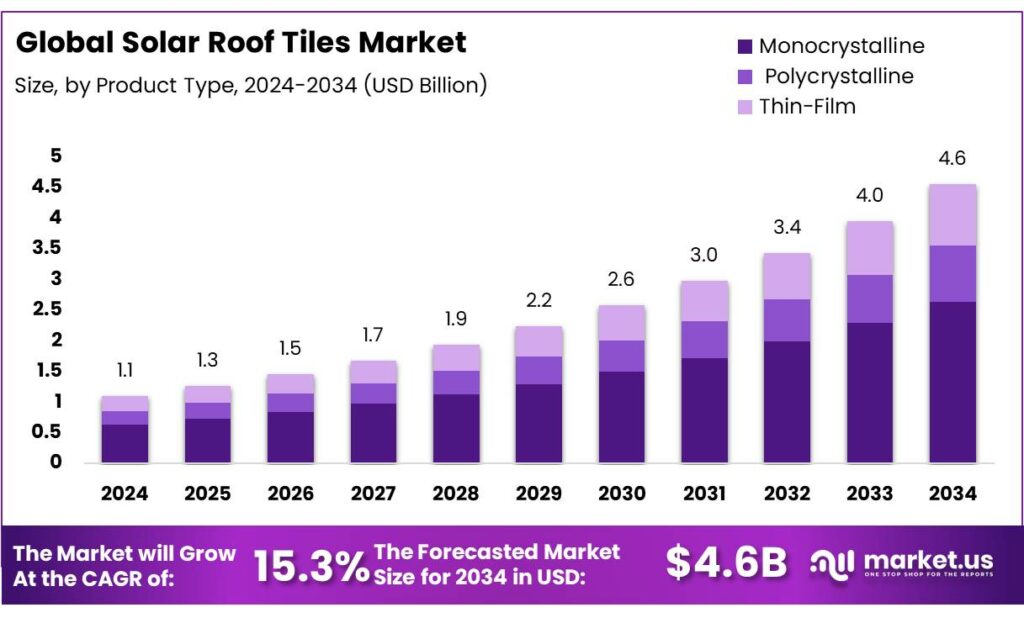

The Global Solar Roof Tiles Market size is expected to be worth around USD 4.6 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 15.3% during the forecast period from 2025 to 2034. Strong industrial growth and rising Energy production supported North America 35.90% leading regional market position.

The solar roof tile industry occupies a niche yet fast-growing segment at the intersection of photovoltaic (PV) generation and building materials. Unlike traditional rack-mounted solar panels, solar roof tiles integrate directly into the roof structure, offering aesthetic appeal while generating electricity. The technology typically involves glass, silicon, or thin-film PV elements embedded in tiles that replace conventional roofing materials. Leading commercial offerings, such as Tesla’s Solar Roof, offer integrated solar plus storage solutions with long warranties.

From an solar roof tiles are still in an emergent stage relative to conventional rooftop solar panels. While conventional panels dominate installations due to lower cost and ease of retrofit, solar tiles compete on added value in aesthetics, architectural integration, and premium residential / commercial new builds. The broader context supports growth: solar PV is expected to account for 80% of new renewable capacity additions globally between 2024 and 2030, making it the fastest growing renewable source. According to REN21, renewables comprised 13.5% of total final energy consumption (TFEC) in 2023.

Key driving factors for growth of solar roof tiles include aesthetic appeal, rising energy costs, greater awareness of sustainability goals, and favorable government policies and incentives. In many jurisdictions, incentives, tax rebates, or subsidies for rooftop solar spur demand for more integrated solutions. For instance, under India’s PM Surya Ghar: Muft Bijli Yojana, central financial assistance is provided to residential consumers, with subsidy levels of ₹ 30,000 per kW for the first 1 kW, ₹ 60,000 for 2 kW, and up to ₹ 78,000 for 3 kW systems.

Government initiatives play a crucial role in promoting the adoption of solar roof tiles. In India, the Ministry of New and Renewable Energy (MNRE) has set an ambitious target to install 30 gigawatts (GW) of rooftop solar capacity by fiscal year 2027, as part of the country’s broader goal to achieve 500 GW of non-fossil fuel capacity by 2030. Additionally, state-level programs such as Maharashtra’s SMART Solar Scheme provide financial incentives to residential consumers, further encouraging the adoption of solar technologies.

Key Takeaways

- Solar Roof Tiles Market size is expected to be worth around USD 4.6 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 15.3%.

- Monocrystalline held a dominant market position, capturing more than a 57.9% share of the global solar roof tiles market.

- Residential segment held a dominant market position, capturing more than a 53.2% share of the global solar roof tiles market.

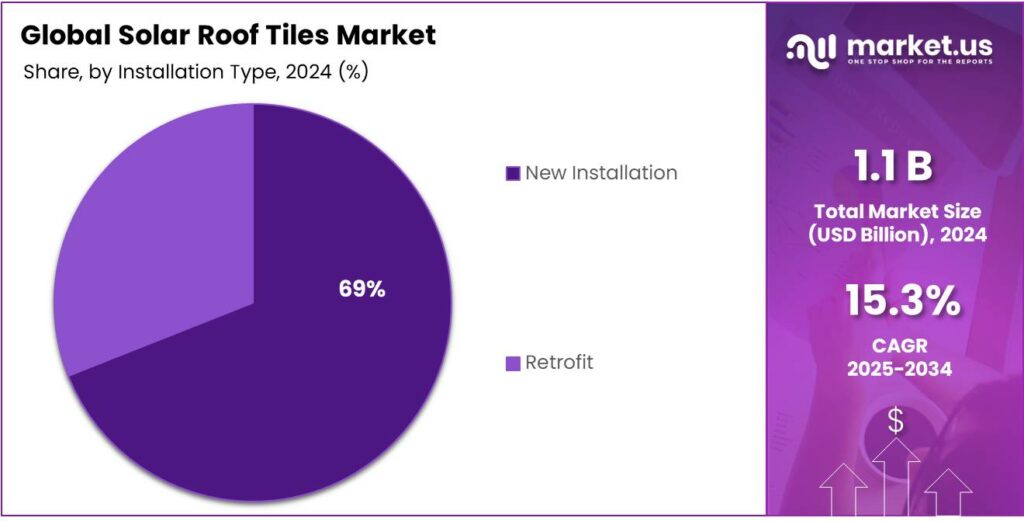

- New installation segment held a dominant market position, capturing more than a 69.5% share of the global solar roof tiles market.

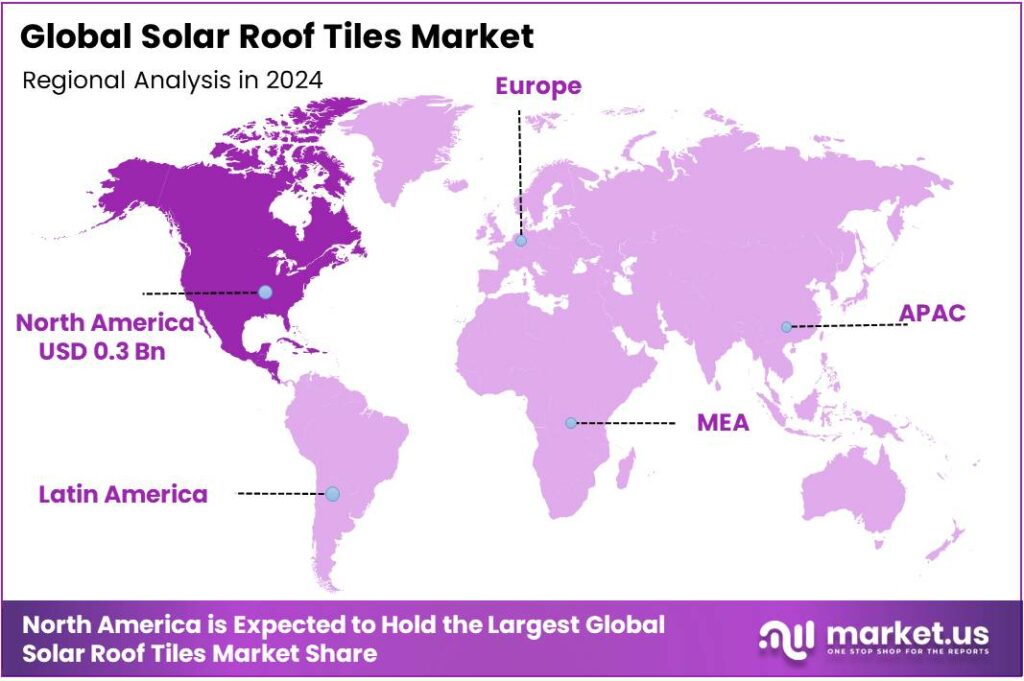

- North America emerged as a dominant region in the global solar roof tiles market, capturing a significant 35.90% share, equating to an estimated market value of USD 0.3 billion.

By Product Type Analysis

Monocrystalline Solar Roof Tiles dominate with 57.9% market share in 2024 due to high efficiency and reliability.

In 2024, Monocrystalline held a dominant market position, capturing more than a 57.9% share of the global solar roof tiles market. This segment’s leadership can be attributed to its superior energy conversion efficiency compared to other types of solar roof tiles, making it highly attractive for both residential and commercial installations. Monocrystalline tiles are known for their long lifespan, durability, and consistent performance even under low-light conditions, which further strengthens their adoption in regions with varying sunlight intensity.

The industrial scenario indicates a steady preference for monocrystalline technology among homeowners and builders who prioritize energy efficiency and long-term savings. In addition, falling production costs and improvements in material quality have enhanced the cost-effectiveness of monocrystalline solar roof tiles, making them accessible to a wider audience. Government incentives promoting renewable energy adoption, including subsidies for rooftop solar installations, have also accelerated the uptake of monocrystalline tiles.

By Application Analysis

Residential applications dominate with 53.2% market share in 2024 driven by increasing household adoption of renewable energy.

In 2024, the residential segment held a dominant market position, capturing more than a 53.2% share of the global solar roof tiles market. The strong adoption in homes is driven by rising awareness of sustainable energy solutions and the desire to reduce electricity costs. Residential users increasingly prefer solar roof tiles for their dual advantage of generating clean energy and enhancing the aesthetic appeal of rooftops, making them an attractive alternative to conventional solar panels.

The industrial scenario reflects growing acceptance among homeowners, particularly in urban and suburban regions where energy efficiency and sustainability are prioritized. Government programs and subsidies promoting rooftop solar installation have further encouraged residential adoption, making it financially viable for a larger number of households. Technological improvements in tile efficiency, durability, and ease of installation have also played a critical role in consolidating the residential segment as the market leader.

By Installation Type Analysis

New installations dominate with 69.5% market share in 2024 driven by rising construction of energy-efficient buildings.

In 2024, the new installation segment held a dominant market position, capturing more than a 69.5% share of the global solar roof tiles market. This strong preference is largely due to the growing trend of integrating renewable energy solutions during the construction of new residential and commercial buildings. Installing solar roof tiles during the initial construction phase ensures seamless integration, higher efficiency, and reduced additional costs compared to retrofitting existing structures.

The industrial scenario indicates that developers and builders increasingly prioritize energy-efficient designs to comply with evolving building codes and sustainability standards. Financial incentives and government policies supporting new solar installations further reinforce this segment’s dominance, encouraging the adoption of clean energy solutions from the outset. Technological advancements in solar roof tile design and improved durability have made new installations more cost-effective and appealing, strengthening market growth.

Key Market Segments

By Product Type

- Monocrystalline

- Polycrystalline

- Thin-Film

By Application

- Residential

- Commercial

- Industrial

By Installation Type

- New Installation

- Retrofit

Emerging Trends

Surge in Global Solar Capacity + Oversupply Driving Innovation

One of the defining trends now influencing solar roof tiles is the explosive growth in global solar capacity, creating both market momentum and pressure for innovation. In 2024, global solar PV installations jumped by roughly 30% year-on-year, adding about 553 GW of new capacity, making solar PV the top power generation technology in that year. The total cumulative installed solar capacity climbed from ~1.6 TW to ~2.2 TW in 2024 — a ~37.5 % increase. With such rapid build-out, many regions now have saturated standard rooftop PV deployment paths, pushing interest toward integrated solutions like solar roof tiles (BIPV).

At the same time, the solar supply chain is seeing oversupply and steep cost declines, which opens space for roof-tile manufacturers to compete. By end of 2024, global solar manufacturing capacity was projected to exceed 1,100 GW, more than double the expected demand, putting pressure on margins. Module prices have fallen sharply due to intense competition and overcapacity. This means that the “premium” cost buffer that solar roof tiles used to carry is being squeezed—and manufacturers are forced to innovate in materials, installation methods, and designs to stay viable.

- For example, global renewable capacity additions are expected to rise from 666 GW in 2024 to nearly 935 GW by 2030, with solar PV and wind making up 95% of those additions. As rooftop solar becomes more central to energy planning, integrated solutions receive more attention. In many jurisdictions, incentives originally for rooftop solar are being extended to BIPV systems, encouraging experimentation in tile-based systems.

Drivers

Falling Cost of Solar Components and Improved Economics

One of the biggest driving forces pushing solar roof tiles into broader adoption is the sharp drop in cost of solar components over recent years, which makes integrated solar roofing more financially viable. In 2023, global power generation from solar PV grew by 320 TWh, a 25% increase over 2022, and solar PV accounted for 5.4% of total electricity globally, reflecting scale growth and cost pressure in the industry. Also, module spot prices declined by more than 50% between December 2022 and December 2023, thanks to oversupply in manufacturing capacity and intense competition.

Governments help reinforce this trend. For example, under India’s Pradhan Mantri Surya Ghar Muft Bijli Yojana, the Indian government allocated ₹75,021 crore to help 1 crore households install rooftop solar and receive 300 units of free electricity monthly. That kind of support improves project economics, especially for residential solar systems. Also, India’s solar PV module manufacturing capacity rose from 2.3 GW to 88 GW between 2014 to 2025, and cell capacity from 1.2 GW to 25 GW, boosting domestic supply and reducing reliance on expensive imports.

To put this in perspective: India’s solar capacity has grown dramatically. As of November 2024, total installed solar power capacity reached 94.16 GW, up from about 2.5 GW in 2014—a ~30× increase. This scale helps bring down costs for all solar applications, including integrated tiles. Also globally, solar PV manufacturing capacity is expected to exceed 1,100 GW by the end of 2024—more than double the projected demand—leading to oversupply and further price compression.

In everyday terms: when the bricks and steel you use in a house get cheaper, you might be more willing to try that fancy new tile roof. Similarly, as solar modules and cells get cheaper, people and developers become more open to paying a little extra for something that looks nicer (solar roof tiles) rather than just ugly panels.

Restraints

High Upfront Cost and Cost Premium

One major restraining factor in the solar roof tile sector is the significantly higher upfront cost compared to conventional solar panel systems, which makes adoption harder for many homeowners, builders, and small businesses. Because solar roof tiles must combine structural roofing materials with functional photovoltaic elements, the manufacturing complexity, integration, and installation demands are greater.

For example, in the U.S., solar roof shingles often cost between USD 21 and USD 25 per square foot installed (equivalent to about USD 2,100 to USD 2,600 for a roof area) according to Angi estimates. A typical full installation of solar roof shingles may reach USD 55,000 on average for a residential property.

Another layer of the cost issue is that solar roof tile systems often have lower efficiency per square foot than high-efficiency standalone panels. Solar roof tiles or BIPV (building-integrated photovoltaics) modules typically operate around 15% to 17% efficiency, whereas high-end crystalline silicon panels frequently reach close to 20% or more. This efficiency gap means one needs more area for the same output when using integrated roofing, raising costs further.

Additionally, integrated roof tiles may suffer from higher operating temperatures due to poorer heat dissipation, which can depress performance by 0.4–0.5% per degree Celsius rise in module temperature.

Governments incentivize solar installations, relatively few specifically offer extra support for BIPV or solar roof tile systems. In some countries, solar incentives treat BIPV as equivalent to standard PV, without recognizing the extra cost of integration. Without dedicated subsidies or tax breaks, the cost premium remains a drag. Moreover, permitting and building code compliance for integrated solar roofing can add regulatory hurdles and associated costs, as many jurisdictions lack experience or standard rules for these systems.

Opportunity

Expansion in Distributed & Residential Solar Demand

One of the clearest growth opportunities for solar roof tiles lies in the rapidly rising demand for distributed, small-scale solar installations, especially on residential and commercial buildings where space is limited and aesthetics matter. In 2023, global solar PV power generation jumped by 320 TWh, a 25% increase over 2022, and solar accounted for 5.4% of global electricity generation. In 2024, solar generation surged again by 30%, adding about 475 TWh and moving past the 2,000 TWh mark globally.

Governments around the world are increasingly supporting rooftop and distributed solar to meet climate and energy goals. Under the “Renewables 2024” forecast, solar PV (including utility and distributed) is projected to account for almost 80% of all new renewable electricity capacity additions worldwide over 2024–2030. Also, global solar manufacturing capacity was expected to surpass 1,100 GW by end-2024 — more than double projected demand — which helps push down module costs and fosters adoption in smaller systems.

For solar roof tiles, which combine aesthetics and functionality, the rising acceptance of rooftop solar in residential and commercial sectors provides a large addressable market. Homeowners who want neat, integrated designs rather than bulky panels are prime adopters, especially in urban areas with strict building codes or design aesthetics. As module and balance-of-system costs fall, the cost premium for integrated roofing becomes more manageable.

Regional Insights

North America holds a 35.90% share in the global solar roof tiles market in 2024, valued at approximately USD 0.3 billion.

In 2024, North America emerged as a dominant region in the global solar roof tiles market, capturing a significant 35.90% share, equating to an estimated market value of USD 0.3 billion. This leadership is primarily attributed to the region’s robust adoption of renewable energy solutions, driven by escalating electricity costs and a growing emphasis on sustainable construction practices.

The United States, in particular, has been at the forefront of this trend. The implementation of favorable policies, such as the Investment Tax Credit (ITC) and various state-level incentives, has significantly reduced the financial barriers for both residential and commercial property owners to invest in solar technologies. These incentives, coupled with increasing consumer awareness of environmental issues, have spurred the demand for solar roof tiles as an aesthetically pleasing and efficient alternative to traditional solar panels.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

CertainTeed offers the Apollo II solar roofing system, which combines traditional roofing materials with integrated solar technology. The company has been proactive in promoting solar solutions, with surveys indicating that 47% of residential builders and contractors are very likely to consider solar roofing systems.

SunTegra provides solar roof shingles that blend seamlessly with traditional roofing materials. Their products are designed for easy integration and are suitable for both new constructions and roof replacements. SunTegra emphasizes aesthetics and efficiency, catering to homeowners seeking sustainable energy solutions without compromising on design.

Tesla’s Solar Roof integrates photovoltaic cells directly into roof tiles, offering both energy generation and aesthetic appeal. Despite facing challenges such as a class-action lawsuit over price hikes and installation complexities, Tesla has continued to innovate in the solar roofing sector. The company reported a 40% year-over-year increase in solar equipment deployment in 2023.

Top Key Players Outlook

- Tesla, Inc.

- SunTegra Solar Roof Systems

- CertainTeed Corporation

- Hanergy Holding Group Ltd.

- SolteQ

- RGS Energy

- Sunflare Solar

- Luma Solar

- GB-Sol

- SunPower Corporation

Recent Industry Developments

In 2024, Tesla’s solar energy deployments experienced a 40% year-over-year increase, reflecting a growing consumer interest in sustainable energy solutions. The company reported $23.3 billion in revenue in the first quarter of 2023, with a notable portion attributed to its solar and energy storage divisions.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 4.6 Bn CAGR (2025-2034) 15.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Monocrystalline, Polycrystalline, Thin-Film), By Application (Residential, Commercial, Industrial), By Installation Type (New Installation, Retrofit) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tesla, Inc., SunTegra Solar Roof Systems, CertainTeed Corporation, Hanergy Holding Group Ltd., SolteQ, RGS Energy, Sunflare Solar, Luma Solar, GB-Sol, SunPower Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tesla, Inc.

- SunTegra Solar Roof Systems

- CertainTeed Corporation

- Hanergy Holding Group Ltd.

- SolteQ

- RGS Energy

- Sunflare Solar

- Luma Solar

- GB-Sol

- SunPower Corporation