Global Solar Powered Trains Market By Train Type(Passenger Trains, Freight Trains), By Integration(Solar Panels on Train Roof, Ground-Based), By Operational Speed(Below 100 km/h, 100-200 km/h, Above 200 km/h), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122990

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

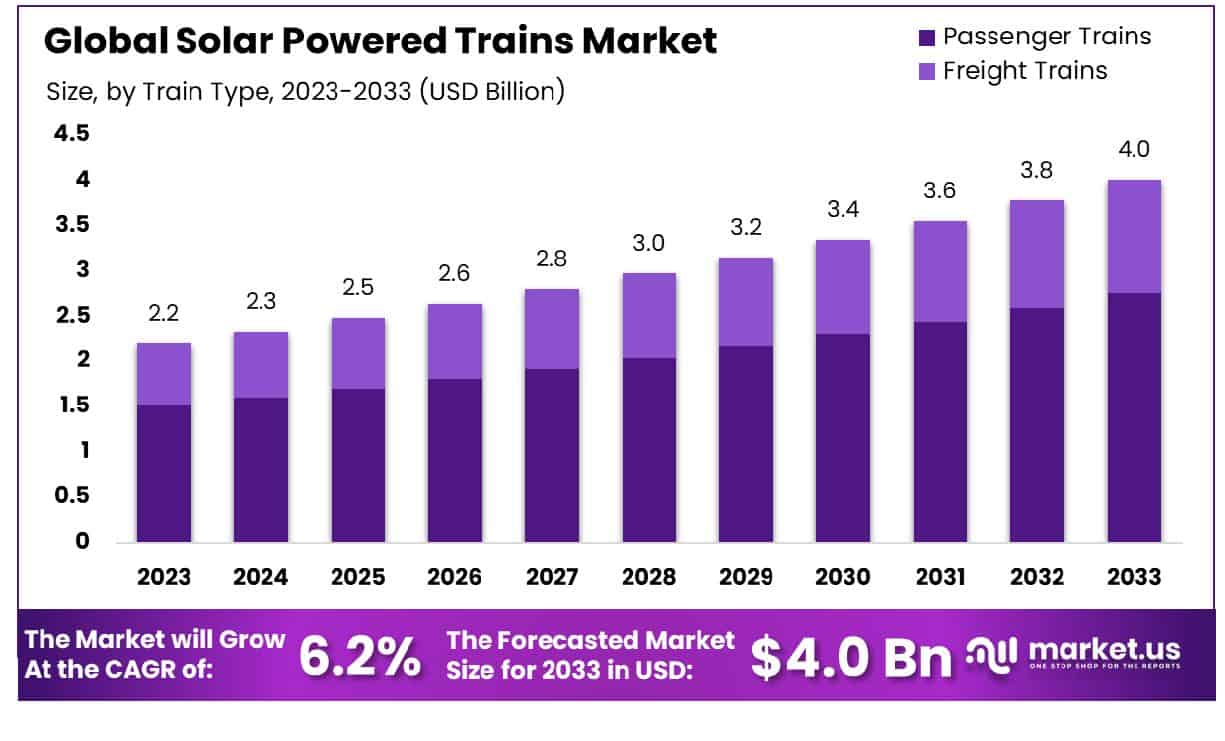

The Global Solar Powered Trains Market size is expected to be worth around USD 4.0 Billion by 2033, From USD 2.2 Billion by 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

The Solar Powered Trains Market encompasses the development, manufacturing, and deployment of railway systems powered primarily by photovoltaic cells. This market is driven by the increasing demand for sustainable transportation solutions and the global push towards reducing carbon emissions.

Key components include smart solar panels, energy storage systems, and hybrid propulsion technologies that integrate solar power with conventional energy sources. As governments and transportation authorities invest in eco-friendly infrastructure, the market for solar-powered trains presents significant growth opportunities.

The global market for solar-powered trains is poised at a critical juncture, characterized by increasing investments and the strategic deployment of renewable energy technologies within the rail sector. The integration of solar energy into railway systems presents a sustainable pathway, aligning with broader environmental objectives and fueling market growth.

Data from the past year underscores this trend, with Indian Railways reporting a 3% increase in passenger train kilometers, totaling 461 million for the year ending March 2023. This reflects a growing capacity and willingness to enhance operational efficiencies and adopt cleaner technologies.

In Great Britain, the landscape of electric rail transport also provides significant insights. As of March 2023, out of 24 passenger train operators, seven boasted fully electric fleets, demonstrating a commitment to electrification. The incremental decrease in the average age of rolling stock by 0.2 years since March 2022 further indicates ongoing investments in modernizing fleet assets, which is critical for integrating advanced technologies such as solar power.

Moreover, the global rail industry’s momentum towards sustainability is evident, with over 10,000 electric trains operational as of 2022 and substantial financial backing from the European Investment Bank—amounting to 39 billion euros aimed at halving emissions by 2030.

Key Takeaways

- The Global Solar Powered Trains Market is projected to expand from USD 2.2 billion in 2023 to USD 4.0 billion by 2033, growing at a CAGR of 6.2%.

- Europe leads the Solar Powered Trains Market with 40.6%, USD 0.9 billion.

- Passenger trains dominate the market, holding a 68.7% share in 2023.

- Solar panels are primarily integrated into train roofs for energy capture.

- Operational speeds of 100-200 km/h constitute 43.5% of the market segment.

Driving Factors

Increasing Global Focus on Sustainable Transport Solutions

The growing emphasis on sustainable transport solutions is a pivotal driver for the expansion of the solar-powered trains market. As governments and organizations worldwide intensify their efforts to reduce carbon emissions and combat climate change, solar-powered trains represent a strategic innovation in public transportation. These initiatives often align with broader commitments to sustainability, such as the Paris Agreement targets.

The integration of solar power into railway management systems not only diminishes reliance on fossil fuels but also enhances energy security and stability in transport infrastructures. Consequently, the market for solar-powered trains is anticipated to expand as the global agenda increasingly prioritizes eco-friendly and sustainable transport options.

Government Incentives and Subsidies for Renewable Energy Projects

Governmental policies play a crucial role in accelerating the adoption of solar-powered trains. Incentives such as grants, tax rebates, and subsidies are instrumental in lowering the capital and operational costs associated with renewable energy projects. These financial supports make solar installations more accessible and financially viable for public transport systems, including railways.

For instance, regions with strong supportive frameworks for renewable energy see more significant investment and quicker development in solar-powered infrastructure. By reducing the economic barriers to entry, these incentives and subsidies not only foster a conducive environment for growth in the solar-powered trains market but also ensure that such projects achieve long-term sustainability and profitability.

Advancements in Photovoltaic Technology Enhancing Efficiency

Technological advancements in photovoltaic (PV) cells have dramatically enhanced the efficiency and viability of solar energy systems, including those used in train operations. Improvements in PV technology mean that solar panels now convert more sunlight into electricity at a lower cost, making solar energy a more competitive and appealing option for powering trains.

Enhanced efficiency can lead to reduced operational costs and smaller solar array footprints, thereby broadening the potential for integrating solar power into existing train infrastructures. As PV technology continues to advance, the potential for solar-powered trains to become a standard aspect of the railway industry grows, underpinning the market’s expansion.

Restraining Factors

High Initial Investment and Installation Costs

High initial costs for installation and investment significantly challenge the expansion of the solar-powered trains market. The deployment of solar panels, along with necessary modifications to train systems and infrastructure to accommodate solar technology, requires substantial upfront capital. This can deter railway operators and public transportation authorities from adopting solar power, especially in regions where budgets are constrained or where the return on investment is unclear.

The high cost of photovoltaic panels and associated technology, despite declining trends in solar equipment prices, remains a formidable barrier. This factor limits market growth by restricting the accessibility of solar-powered train technology to only the most well-funded or subsidized projects.

Limited Solar Power Efficiency in Less Sunny Regions

The efficiency of solar power generation is heavily dependent on geographical and meteorological conditions. In regions with less sunlight, such as those at higher latitudes or with frequent overcast conditions, the efficacy of solar panels diminishes significantly. This limitation restricts the practicality of solar-powered trains in such areas, where consistent and reliable energy yield from solar panels cannot be guaranteed.

The variability of solar energy in these less sunny regions means that solar-powered trains may not always provide a steady or sufficient power supply, necessitating backup systems that can complicate and increase the cost of operations.

By Train Type Analysis

Passenger trains dominate the market, holding a 68.7% share in the solar-powered trains sector.

In 2023, Passenger Trains held a dominant market position in the “By Train Type” segment of the Solar Powered Trains Market, capturing more than a 68.7% share. This significant market penetration can be attributed to increasing investments in sustainable mass transportation solutions. Governments and private entities are prioritizing solar-powered passenger trains due to their efficiency and reduced environmental impact.

Freight Trains, while holding a smaller share of the market, also saw considerable adoption, driven by the need for greener cargo transport solutions. The integration of solar power technology in freight operations reflects a growing commitment to reducing carbon footprints in industrial supply chains. However, the adoption rates in this segment lag behind those of passenger trains, largely due to higher initial implementation costs and the complex logistics involved in freight operations.

The expansion of the solar powered trains market is supported by technological advancements and governmental incentives aimed at promoting renewable energy sources. These factors are expected to continue driving the growth of the market, particularly in regions actively investing in eco-friendly transport infrastructures. The rise in urbanization and heightened awareness of environmental issues are also critical in propelling the demand for solar-powered trains.

Moreover, the industry is witnessing a surge in R&D activities focused on enhancing the efficiency and storage capacity of solar panels, which could significantly improve the operational capabilities of both passenger and freight solar trains. As these technologies mature, the market is anticipated to offer more robust growth opportunities, with passenger trains likely maintaining their lead due to broader consumer acceptance and governmental support for public transport systems.

By Integration Analysis

Solar panels are commonly integrated on train roofs, optimizing space and harnessing solar energy efficiently.

In 2023, the Solar Powered Trains Market witnessed significant segmentation by integration, primarily categorized into Solar Panels on Train Roof and Ground-Based installations. Among these, Solar Panels on Train Roof held a dominant market position. This method’s prevalence is primarily due to its direct integration with train operations, offering a seamless energy supply directly where it is needed. By harnessing solar energy atop moving vehicles, this setup eliminates the need for extensive ground infrastructure, thereby reducing initial setup costs and land use concerns.

The integration of solar panels on train roofs not only enhances the sustainability of train operations but also serves as a visible commitment to renewable energy, potentially increasing public and investor interest in rail transport companies. This setup is particularly advantageous in regions with high solar irradiance, where the efficiency of solar panels is maximized.

On the other hand, the Ground-Based segment involves the installation of solar panels along tracks or nearby land areas. Although this method covers a smaller market share, it is instrumental in generating supplementary power for train stations and support facilities. This approach can also be scaled up more easily, offering the potential for larger solar farms that contribute power back to the grid, thus supporting a broader transition towards renewable energy within the community.

Overall, the market’s inclination towards Solar Panels on Train Roof underscores a strategic move towards integrating renewable energy solutions directly with mobile assets, thereby enhancing operational efficiency and sustainability. As technology advances, both segments are expected to evolve, potentially increasing their capacity to meet the growing demands of eco-friendly public transportation solutions.

By Operational Speed Analysis

Trains operating between 100-200 km/h represent 43.5% of the market, highlighting their widespread adoption.

In 2023, the Solar Powered Trains Market was segmented by operational speed into three main categories: Below 100 km/h, 100-200 km/h, and Above 200 km/h. Among these, the 100-200 km/h segment held a dominant market position, capturing more than a 43.5% share. This segment’s prominence can be attributed to its optimal balance between speed and energy efficiency, which makes it particularly suitable for inter-city travel while still benefiting from solar power technology.

The Below 100 km/h segment, typically used for urban and suburban routes, accounted for a significant portion of the market as well. These trains are favored in regions where shorter routes and frequent stops are common, and where the integration of solar power helps to reduce urban air pollution and operational costs.

Conversely, the Above 200 km/h segment, although smaller in market share, represents a critical area of technological innovation and development. Trains operating at these higher speeds are less common but are gaining interest as technology advances allow for higher speeds without compromising the efficiency and sustainability benefits of solar power.

Overall, the market dynamics of solar-powered trains are influenced by factors such as technological advancements, governmental support for green transportation solutions, and increasing public and corporate interest in sustainable practices. The growth of the market in the 100-200 km/h segment underscores the increasing viability of solar technologies in supporting relatively high-speed rail operations without the environmental burden of traditional fossil fuels. This trend is expected to continue, driven by enhancements in photovoltaic cell efficiency and battery storage solutions.

Key Market Segments

By Train Type

- Passenger Trains

- Freight Trains

By Integration

- Solar Panels on Train Roof

- Ground-Based

By Operational Speed

- Below 100 km/h

- 100-200 km/h

- Above 200 km/h

Growth Opportunities

Expansion into Emerging Markets with High Solar Insolation

The global solar-powered trains market is poised for substantial growth in 2023, particularly through strategic expansion into emerging markets that boast high solar insolation. Countries in regions such as Africa, Southeast Asia, and South America present significant opportunities due to their abundant sunlight and increasing demand for sustainable transport solutions.

These markets offer a dual benefit: they are ripe for economic development and have the natural resources necessary to support solar-powered infrastructure efficiently. By tapping into these emerging markets, companies can not only leverage the geographic advantages but also contribute to local economic growth, creating a symbiotic relationship that propels the global spread and adoption of solar-powered trains.

Integration of Solar Technology with Existing Rail Infrastructure

Another considerable growth opportunity for the solar-powered trains market in 2023 lies in the integration of solar technology with existing rail infrastructure. This approach minimizes the need for extensive new constructions and leverages the current assets of railway networks. By retrofitting existing railway systems with solar technology, the industry can reduce initial costs and accelerate the deployment process.

Moreover, integrating solar power with existing infrastructure promotes a smoother transition to renewable energy sources within the transport sector, making it a practical and appealing option for many regions. The ability to retrofit helps mitigate some of the financial and logistical barriers associated with newer, standalone solar rail projects, thus enhancing market growth potential.

Latest Trends

Development of Lightweight and High-Capacity Solar Panels

A significant trend in the 2023 global solar-powered trains market is the development of lightweight and high-capacity solar panels. This advancement is crucial as it addresses one of the core challenges in solar applications for mobility: the need for efficient energy generation without adding substantial weight to the vehicle. The latest solar panels are not only more efficient in converting sunlight into electricity but are also designed to be lighter, which is particularly important for the dynamic requirements of train systems.

These innovations enhance the viability of solar-powered trains by improving their operational efficiency and extending their range, making them more practical and attractive for wider adoption. Manufacturers and research institutions are increasingly focusing on integrating materials like advanced polymers and thin-film technologies, which contribute to the reduced weight and improved performance of these panels.

Increasing Adoption of Energy Storage Systems to Enhance Train Operation

Another trend shaping the solar-powered trains market in 2023 is the increasing adoption of energy storage systems. These systems are critical for stabilizing the power supply and extending the operational capabilities of solar-powered trains, especially during periods of low sunlight. By integrating advanced battery technologies, solar-powered trains can store excess energy generated during peak sun hours and utilize it as needed, thereby ensuring consistent and reliable train operations.

This capability is particularly important for maintaining service regularity and efficiency in less sunny regions or during unfavorable weather conditions. The adoption of these energy storage systems demonstrates a shift towards more resilient and dependable solar-powered rail solutions, reflecting broader efforts to make renewable energy more practical for mass transit.

Regional Analysis

In Europe, the Solar Powered Trains Market represents 40.6% dominance, valued at USD 0.9 billion.

The Solar Powered Trains Market demonstrates significant regional segmentation, reflecting varying degrees of adoption and infrastructure development across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Europe is the dominating region in the solar-powered trains market, commanding a substantial 40.6% market share, valued at USD 0.9 billion. This prominence is supported by robust governmental commitments to decarbonization and substantial investments in renewable technologies, including Germany and the UK’s aggressive expansions in solar rail infrastructure. Europe’s leadership in environmental policies further accelerates the integration of solar technologies into its transport sectors.

Asia Pacific is identified as a rapidly growing segment in the market due to high solar insolation and increasing environmental awareness. Countries like India and China are investing heavily in sustainable transport solutions, leveraging their vast solar potential and governmental support to reduce urban pollution and enhance energy security.

North America, though a smaller segment compared to Europe and Asia Pacific, is steadily advancing with the adoption of solar-powered trains, driven by increasing environmental concerns and technological innovations in solar and energy storage solutions. The United States and Canada are exploring solar applications in public transport to meet their climate goals.

Middle East & Africa show promising growth potential, largely untapped but supported by abundant solar resources. Investments in renewable energy infrastructure are beginning to take shape, with countries like the UAE and Saudi Arabia leading regional developments.

Latin America, with its vast natural resources and increasing focus on sustainable development, remains a nascent but potentially significant market. Regional efforts are concentrated on leveraging solar energy to improve transportation infrastructures, though at a slower pace compared to other regions.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the global solar-powered trains market is influenced by the strategic movements and innovations of several key companies, each contributing uniquely to the sector’s development.

Trina Solar and Hanwha S&C are leading the charge with advanced photovoltaic technology that enhances the efficiency and integration capability of solar panels specifically designed for rail transport systems. These companies are pivotal in driving down the cost of solar technologies, making solar-powered trains more economically viable.

Riding Sunbeams stands out for its focus on directly powering railway lines through nearby solar farms, demonstrating innovative approaches to harnessing solar energy within the railway sector. This method showcases a scalable model that could be adopted in various regions with similar geographic and solar conditions.

Canadian Solar and SunPower Corporation are crucial for their robust, high-efficiency solar cells that are ideal for the fluctuating needs of train operations. Their continuous advancements in solar efficiency play a critical role in the market by reducing the footprint and weight of solar solutions on trains.

Byron Bay Railroad Company illustrates the practical application of solar-powered train technology. As one of the few companies to have successfully implemented and operated a solar-powered train, their model provides valuable insights and proof of concept to the industry.

LG Electronics and Kyocera Corporation are enhancing the durability and adaptability of solar technologies in diverse environmental conditions, which is critical for the global expansion of solar-powered trains.

Greenrail and Jakson Engineers Limited are notable for their efforts in integrating solar power with sustainable materials and innovative engineering designs, pushing the boundaries of what’s possible in rail infrastructure.

Bankset Energy, Axitec LLC, and SolarWorld contribute through their specialized solar modules that are tailored to the unique demands of the transport sector, focusing on maximizing energy capture and storage.

Market Key Players

- Trina Solar

- Riding Sunbeams

- Hanwha S&C

- Central Electronics Limited (CEL)

- SolarWorld

- Canadian Solar

- Byron Bay Railroad Company

- LG Electronics

- Bankset Energy

- Axitec LLC

- Kyocera Corporation

- Greenrail

- Jakson Engineers Limited

- SunPower Corporation

Recent Development

- In January 2024, significant developments in related technologies were noted in Gujarat, India, with major initiatives such as the hybrid renewable energy park and the Dholera Solar Park, which is set to become India’s largest solar project with a 5,000 MW capacity.

- In October 2023, Jackson Green has a strong portfolio, having managed over 4 GW of solar EPC contracts and 1.3 GW in solar operations and maintenance

Report Scope

Report Features Description Market Value (2023) USD 2.2 Billion Forecast Revenue (2033) USD 4.0 Billion CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Train Type(Passenger Trains, Freight Trains), By Integration(Solar Panels on Train Roof, Ground-Based), By Operational Speed(Below 100 km/h, 100-200 km/h, Above 200 km/h) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Trina Solar, Riding Sunbeams, Hanwha S&C, Central Electronics Limited (CEL), SolarWorld, Canadian Solar, Byron Bay Railroad Company, LG Electronics, Bankset Energy, Axitec LLC, Kyocera Corporation, Greenrail, Jakson Engineers Limited, SunPower Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Solar Powered Trains Market Size in 2023?The Global Solar Powered Trains Market Size is USD 2.2 Billion in 2023.

What is the projected CAGR at which the Global Solar Powered Trains Market is expected to grow at?The Global Solar Powered Trains Market is expected to grow at a CAGR of 6.2% (2024-2033).

List the segments encompassed in this report on the Global Solar Powered Trains Market?Market.US has segmented the Global Solar Powered Trains Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Train Type(Passenger Trains, Freight Trains), By Integration(Solar Panels on Train Roof, Ground-Based), By Operational Speed(Below 100 km/h, 100-200 km/h, Above 200 km/h)

List the key industry players of the Global Solar Powered Trains Market?Trina Solar, Riding Sunbeams, Hanwha S&C, Central Electronics Limited (CEL), SolarWorld, Canadian Solar, Byron Bay Railroad Company, LG Electronics, Bankset Energy, Axitec LLC, Kyocera Corporation, Greenrail, Jakson Engineers Limited, SunPower Corporation

Name the key areas of business for Global Solar Powered Trains Market?The Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe are leading key areas of operation for Global Solar Powered Trains Market.

Solar Powered Trains MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Solar Powered Trains MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Trina Solar

- Riding Sunbeams

- Hanwha S&C

- Central Electronics Limited (CEL)

- SolarWorld

- Canadian Solar

- Byron Bay Railroad Company

- LG Electronics

- Bankset Energy

- Axitec LLC

- Kyocera Corporation

- Greenrail

- Jakson Engineers Limited

- SunPower Corporation