Global Solar Panel Coatings Market By Type(Anti-reflective, Hydrophobic, Self-cleaning, Anti-soiling, Anti-abrasion, Others), By Application(Photovoltaic Cells (PV), Concentrated Solar Power (CSP), Solar Thermal Panels, Solar Roof Tiles, Others), By Material(Silica-Based Coatings, Titanium Dioxide (TiO2) Coatings, Fluoropolymer Coatings, Ceramic Coatings), By End-use(Residential, Commercial, Energy, Agriculture, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 126477

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

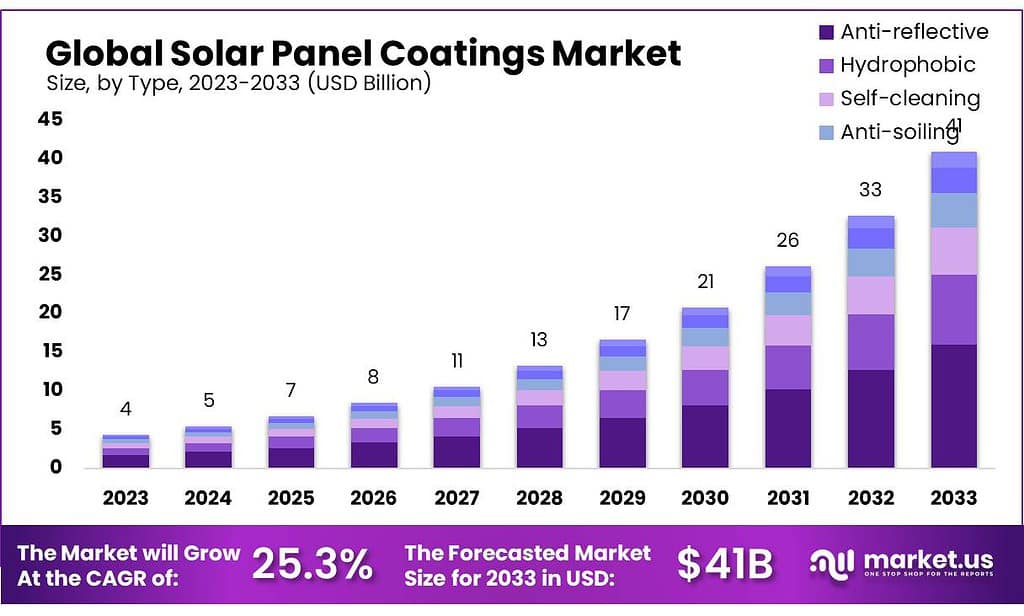

The global Solar Panel Coatings Market size is expected to be worth around USD 41 billion by 2033, from USD 4 billion in 2023, growing at a CAGR of 25.3% during the forecast period from 2023 to 2033.

The solar panel coatings market is experiencing rapid growth, driven primarily by the need to enhance the efficiency and durability of solar panels. This sector focuses on the development of specialized coatings that protect solar panels from environmental factors while improving their ability to absorb light. Key innovations in this area include the use of nanotechnology to formulate coatings with superior light absorption and longevity. Such advancements are crucial for maximizing the performance of solar panels in diverse environmental conditions.

Asia-Pacific leads this market, thanks to the high energy demands and rapid industrial development in countries like China and India. These regions continue to dominate the market due to substantial investments in solar energy coupled with strong government support through policies and subsidies. For instance, the Indian government has implemented subsidies for solar panel coatings to help achieve significant solar power capacity, which encourages the adoption of these technologies.

In addition to Asia-Pacific, the United States and Europe also actively support the solar panel coatings market through various regulatory incentives. These incentives aim to boost the use of renewable energy sources, thereby driving investments in solar technology. The market benefits from broad applications across residential, commercial, automotive, and agricultural sectors, underscoring a widespread trend of solar integration.

Key Takeaways

- The solar panel coatings market is expected to grow from USD 4 billion in 2023 to USD 41 billion by 2033, at a 25.3% CAGR.

- Anti-reflective coatings lead with over 39.5% market share in 2023, optimizing light absorption and boosting solar panel efficiency.

- Photovoltaic Cells (PV) hold a 54.4% share in 2023, reflecting their widespread use in solar energy generation.

- Silica-based coatings lead with over 38.5% share due to their effective anti-reflective properties enhancing solar panel performance.

- The commercial sector holds more than 35.4% of the market share, driven by increased adoption of solar technologies in commercial buildings.

- Asia Pacific (APAC) dominates the global market, accounting for a substantial 49.5% share.

By Type

In 2023, Anti-reflective coatings held a dominant position in the solar panel coatings market, capturing more than a 39.5% share. This type of coating is highly sought after for its ability to reduce light reflection and increase the amount of light absorbed by solar panels, thus enhancing overall energy efficiency.

Hydrophobic coatings also play a crucial role in the market. These coatings repel water, reducing moisture accumulation and the potential for dirt build-up which can degrade the panel’s performance over time. This feature makes them ideal for regions with high rainfall.

Self-cleaning coatings are appreciated for their ability to maintain panel efficiency without the need for frequent manual cleaning. By enabling dirt and other residues to wash away with rainfall, these coatings are particularly useful in dusty environments.

Anti-soiling coatings are similar to self-cleaning types but are specifically formulated to prevent the adherence of dirt and dust particles in the first place. They are valuable in arid regions where dust is prevalent and water for cleaning is scarce.

Anti-abrasion coatings protect solar panels from physical damage caused by debris, ensuring durability and sustained performance. This type is essential for maintaining the integrity of panels in harsh environmental conditions.

By Application

In 2023, Photovoltaic Cells (PV) held a dominant market position in the solar panel coatings market, capturing more than a 54.4% share. This large share reflects the widespread use of PV cells in generating electricity from sunlight, where advanced coatings improve their efficiency by reducing reflection and enhancing light absorption.

Concentrated Solar Power (CSP) applications also significantly utilize coatings, particularly to protect mirrors and lenses used to focus sunlight for power generation. These coatings are essential for maintaining performance and durability under intense sunlight exposure.

Solar Thermal Panels benefit from coatings that enhance heat absorption and provide protection from environmental elements. These coatings are key to improving thermal efficiency and reducing maintenance costs.

Solar Roof Tiles, an emerging technology, use specialized coatings to enhance durability and efficiency. As this segment grows, coatings that balance aesthetics and performance will become increasingly important.

By Material

In 2023, Silica-Based Coatings held a dominant market position in the solar panel coatings market, capturing more than a 38.5% share. These coatings are highly valued for their anti-reflective properties, which significantly enhance the efficiency of solar panels by reducing light reflection and increasing light absorption.

Titanium Dioxide (TiO2) Coatings are also widely used due to their durability and self-cleaning properties. These coatings help in breaking down organic dirt through photocatalytic reactions when exposed to UV light, keeping solar panels clean and efficient.

Fluoropolymer Coatings are favored for their exceptional weather resistance and ability to protect solar panels from harsh environmental conditions. This makes them ideal for applications in regions with extreme weather, ensuring long-term performance and durability.

Ceramic Coatings are noted for their thermal resistance and protective capabilities. These coatings are used to shield solar panels from high temperatures and physical damage, thus prolonging their operational lifespan.

By End-use

In 2023, the Commercial sector held a dominant market position in the solar panel coatings market, capturing more than a 35.4% share. This substantial market share reflects the widespread adoption of solar technologies in commercial buildings, where energy efficiency and sustainability are increasingly prioritized. Commercial applications benefit greatly from solar panel coatings as they enhance the durability and efficiency of solar installations, contributing to reduced energy costs and lower carbon footprints.

The Residential sector also shows significant uptake, utilizing solar panel coatings to maximize energy generation from rooftop installations. These coatings help homeowners increase the effectiveness of their solar systems while protecting the panels from environmental wear and tear.

In the Energy sector, solar panel coatings are crucial for large-scale solar farms where the longevity and efficiency of solar panels directly impact the viability and profitability of renewable energy projects. Coatings in this segment are tailored to resist harsh environmental conditions and maximize output.

Agriculture and Automotive sectors are emerging areas of application. In agriculture, coatings are used on solar installations that power water pumps and lighting, enhancing the resilience of panels used in often rugged, outdoor environments. The automotive industry is incorporating solar panels into the design of vehicles, where coatings are essential for protecting these panels from road wear and improving their energy absorption capabilities.

Key Market Segments

By Type

- Anti-reflective

- Hydrophobic

- Self-cleaning

- Anti-soiling

- Anti-abrasion

- Others

By Application

- Photovoltaic Cells (PV)

- Concentrated Solar Power (CSP)

- Solar Thermal Panels

- Solar Roof Tiles

- Others

By Material

- Silica-Based Coatings

- Titanium Dioxide (TiO2) Coatings

- Fluoropolymer Coatings

- Ceramic Coatings

By End-use

- Residential

- Commercial

- Energy

- Agriculture

- Automotive

- Others

Drivers

Technological Advancements in Coating Applications

One of the primary driving factors for the solar panel coatings market is the technological advancements in coating applications that enhance solar panel efficiency and longevity. Innovations such as the development of anti-reflective, hydrophobic, self-cleaning, and anti-soiling coatings are pivotal. These coatings improve the light absorption capacity of solar panels and protect them against environmental factors, thereby extending their operational life and boosting efficiency.

The anti-reflective coatings segment is particularly significant, offering ways to reduce the light reflection and increase the amount of light absorbed by the panels. Hydrophobic and self-cleaning coatings further contribute by maintaining cleanliness and optimal function despite adverse weather conditions. The growing importance of these technologies is supported by substantial investments from both the public and private sectors aimed at enhancing renewable energy technologies.

Moreover, the market’s expansion is supported by increasing global energy demands and a shift towards renewable energy sources. Governments worldwide are promoting these advancements through subsidies, grants, and regulatory support, fostering a conducive environment for market growth. This trend is expected to continue, driving the demand for advanced solar panel coatings that meet the efficiency needs of modern solar power systems.

Restraints

High Cost and Technological Complexity

A significant restraining factor in the solar panel coatings market is the high cost and technological complexity associated with these advanced coatings. The development and application of specialized coatings like anti-reflective, hydrophobic, and self-cleaning types involve sophisticated materials and processes that elevate production costs. These costs are often passed down to consumers, making the initial investment in coated solar panels substantially higher compared to standard options.

Moreover, the integration of advanced technologies such as nanotechnology and specialized chemical compounds in the coatings can pose scalability challenges. While these technologies greatly enhance the efficiency and functionality of solar panels, they require precise manufacturing environments and high-quality control standards, which can be difficult to maintain at larger scales.

The high cost not only affects the affordability for end consumers but also limits the rapid adoption of solar technologies in less developed regions where cost constraints are significant. Despite the long-term savings and environmental benefits provided by enhanced solar panels, the initial expense and complexity of technology remain substantial hurdles for widespread market penetration.

Opportunity

Anti-Reflective Solar Panel Coatings

The solar panel coatings market is poised for significant growth, particularly driven by the increasing adoption of anti-reflective coatings. These coatings are essential for enhancing the energy efficiency of solar panels by reducing the reflectivity of the glass used in solar panels, thereby increasing the amount of light absorbed. This technological enhancement is pivotal as it directly contributes to the performance and efficiency of solar power systems.

This growth trajectory underscores the robust demand and expanding applications of these coatings in both residential and commercial sectors, where energy efficiency is becoming increasingly critical.

The anti-reflective coatings segment, in particular, is witnessing substantial demand due to its capability to improve light absorption and reduce losses, which is critical for maximizing the output of solar installations. This segment benefits not only from advancements in coating technologies but also from heightened environmental awareness and a shift toward sustainable energy practices across the globe.

Moreover, government incentives and regulatory support for renewable energy technologies further fuel the adoption of advanced solar panel coatings. For instance, regions like North America and Europe are increasingly integrating solar energy solutions encouraged by governmental policies aimed at reducing carbon footprints and promoting renewable energy sources.

These initiatives are expected to sustain the demand for solar panel coatings that enhance the durability and performance of solar panels.

In summary, the expanding market for anti-reflective solar panel coatings represents a compelling growth opportunity. This is supported by technological advancements, increasing environmental awareness, and supportive government policies that are collectively driving the market forward. The continuous development in this area not only promises improved solar panel performance but also aligns with global sustainability goals, making it a key area for investment and development in the renewable energy sector.

Trends

Rise of Self-Cleaning Solar Panel Coatings

A significant trend in the solar panel coatings market is the increasing adoption of self-cleaning coatings. These coatings are engineered to reduce maintenance needs and enhance the performance of solar panels by keeping them clean and free from dust and debris, which can significantly obstruct their efficiency.

The growth of the self-cleaning coatings segment is underpinned by technological advancements that enable these coatings to effectively minimize the accumulation of dirt and dust.

This is particularly crucial in arid and semi-arid regions where dust accumulation is rapid and can drastically reduce the solar panel’s output if not regularly cleaned. By improving the light absorption efficiency and reducing the frequency of manual cleaning, self-cleaning coatings extend the life and efficiency of solar panels.

The expansion of this market segment is driven not only by the demand for greater efficiency in solar energy systems but also by environmental considerations, as these coatings help reduce water usage and labor associated with the maintenance of solar panels.

Moreover, the adoption of these coatings is supported by various government incentives aimed at enhancing the sustainability of solar energy systems. Such policies are instrumental in fostering the growth of renewable energy technologies, further stimulating the market for advanced coatings that contribute to the overall efficiency and sustainability of solar power installations.

Regional Analysis

The solar panel coatings market is witnessing significant growth across various regions, with distinct trends and dynamics shaping regional performance. Asia Pacific (APAC) dominates the global market, accounting for a substantial 49.5% share in 2023, driven by the region’s increasing investments in renewable energy and rapid industrialization. APAC’s market is projected to reach USD 2.1 billion, underpinned by government incentives in countries like China, India, and Japan, which continue to prioritize solar energy adoption as a solution to escalating energy demands and environmental concerns.

North America follows as a key region due to the rising demand for clean energy and favorable regulatory frameworks. The United States, as the largest contributor within the region, benefits from federal tax credits and state-specific solar mandates. As a result, North America exhibits steady growth, with an emphasis on high-performance coatings to enhance the energy efficiency and durability of solar panels, particularly in arid regions such as the southwestern U.S.

Europe remains a prominent player in the market, driven by ambitious decarbonization goals and supportive policies like the European Green Deal. Countries such as Germany, Spain, and Italy lead solar capacity installations, boosting demand for advanced solar panel coatings to improve efficiency in diverse climates.

The Middle East & Africa (MEA) region is witnessing gradual growth due to large-scale solar projects in countries like the UAE and Saudi Arabia, aimed at reducing reliance on fossil fuels. Meanwhile, Latin America shows moderate expansion, with Brazil and Chile spearheading solar investments, further supporting market growth. However, these regions currently trail behind APAC and North America in overall market share.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Frequently Asked Questions (FAQ)

What is the size of Solar Panel Coatings Market?Solar Panel Coatings Market size is expected to be worth around USD 41 billion by 2033, from USD 4 billion in 2023

What is the CAGR for the Solar Panel Coatings Market?The Solar Panel Coatings Market is expected to grow at a CAGR of 25.3% during 2023-2032.List the key industry players of the Global Solar Panel Coatings Market?3M, Advanced Nanotech Lab, Arkema Group Fenzi SpA, Diamon-Fusion International Inc., DSM, Element 119, FENZI S.p.A., Koninklijke DSM N.V., NanoTech Types Pty. Ltd., Optitune Oy, PPG Industries Inc., Sinovoltaics Group, Solar Sharc, Unelko Corporation, ZSD

Solar Panel Coatings MarketPublished date: Aug 2024add_shopping_cartBuy Now get_appDownload Sample

Solar Panel Coatings MarketPublished date: Aug 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- Advanced Nanotech Lab

- Arkema Group Fenzi SpA

- Diamon-Fusion International Inc.

- DSM

- Element 119

- FENZI S.p.A.

- Koninklijke DSM N.V.

- NanoTech Types Pty. Ltd.

- Optitune Oy

- PPG Industries Inc.

- Sinovoltaics Group

- Solar Sharc

- Unelko Corporation

- ZSD