Global Software-Defined Wide Area Network (SD-WAN) Market Size, Share, Trends, Forecast Report By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail and E-Commerce, Healthcare, Manufacturing, Energy and Utilities, Government, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sept. 2024

- Report ID: 129642

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Segment Analysis

- Deployment Mode Segment Analysis

- Organization Size Segment Analysis

- Industry Vertical Segment Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Latest Trends

- Top Use Cases for SD-WAN

- Business Benefits of SD-WAN

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

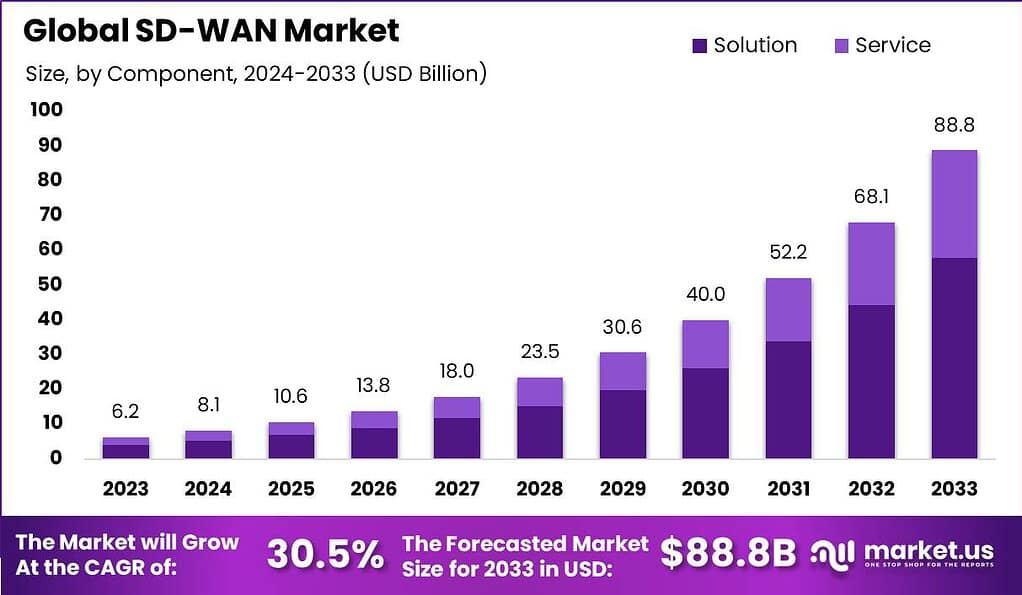

The global Software-Defined Wide Area Network (SD-WAN) Market size is expected to be worth around USD 88.8 Billion by 2033, from USD 6.2 Billion in 2023, growing at a CAGR of 30.5% during the forecast period from 2024 to 2033.

Software-Defined Wide Area Network (SD-WAN) is a technology that simplifies the management and operation of a network by separating the networking hardware from its control mechanism. This allows companies to build higher-performance WANs using lower-cost and commercially available Internet access, enabling businesses to partially or wholly replace more expensive private WAN connection technologies such as MPLS.

The Software-defined Wide Area Network (SD-WAN) market is experiencing significant growth driven by the rising demand for efficient, secure, and flexible networking solutions. Enterprises are increasingly adopting SD-WAN to improve network performance and reduce operational costs, especially in the context of cloud migration and remote work. For instance, In September 2023, Cisco announced enhancements to its SD-WAN offering, integrating advanced security features to bolster network protection for remote workers and cloud applications.

Demand for SD-WAN is driven by the need for cost-effective network management solutions that can also provide enhanced performance and reliability. As businesses expand geographically and move more services to the cloud, the necessity for efficient and reliable network operations escalates, bolstering the demand for SD-WAN technologies.

Several factors contribute to the growth of the Software-defined Wide Area Network (SD-WAN) market. The widespread adoption of cloud-based services requires more robust network infrastructure. Additionally, the increase in data traffic from video streaming and large-scale file transfers necessitates more efficient network management solutions. Regulatory and industry compliance requirements also push businesses to adopt SD-WAN to ensure secure data transmission.

Opportunities in the SD-WAN market include the ongoing digital transformation initiatives by numerous companies across various sectors seeking to innovate and improve their IT infrastructure. Additionally, as cybersecurity becomes a critical concern, Software-defined Wide Area Network (SD-WAN) offers enhanced security features that protect data across extensive networks, presenting significant growth opportunities. The expansion into emerging markets where new network infrastructures are being developed also offers lucrative prospects for the growth of SD-WAN solutions.

According to data from Secure Data, the average cost of a data breach in 2023 was approximately $4.45 million, representing a 15.3% increase since 2020. This rising trend is compounded by the scale of breaches, as incidents involving the loss of 1–10 million records can cost organizations approximately $36 million, while breaches exceeding 50 million records escalate to an average of $332 million.

In terms of ransomware attacks, the first three quarters of 2023 saw a significant increase of nearly 70% compared to the same period in 2022, reflecting an increasingly complex threat landscape for businesses.

The broader trend in data breaches reveals a troubling trajectory. Between 2013 and 2022, the number of data breaches has more than tripled. In the U.S., breaches reported during the first nine months of 2023 increased by 20% compared to all of 2022. Furthermore, approximately 29% of these breaches resulted in actual data loss, highlighting the severity of these incidents.

Cloud vulnerabilities are becoming an increasingly critical concern, with over 80% of data breaches in 2023 occurring within cloud storage systems. This underlines the importance of deploying robust cloud-based Data Loss Prevention (DLP) solutions to mitigate risks and safeguard sensitive information.

Key Takeaways

- The Global SD-WAN Market is projected to grow significantly, with its market size expected to reach USD 88.8 billion by 2033, increasing from USD 6.2 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 30.5% during the forecast period from 2024 to 2033.

- In 2023, the solution segment dominated the market, accounting for more than 65.1% of the global market share. This segment’s leadership is primarily attributed to the growing demand for efficient network management and cost-effective solutions.

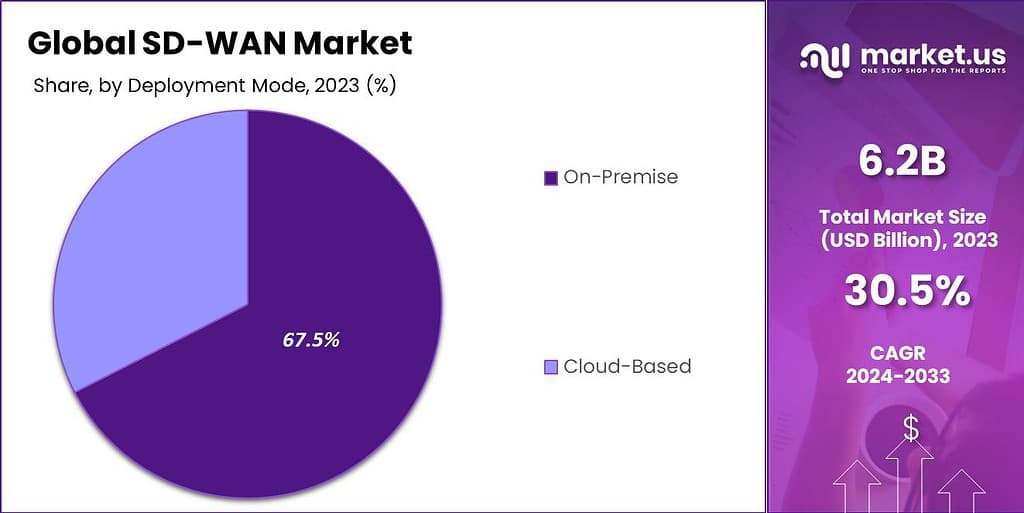

- Additionally, the on-premise segment held a commanding position, representing over 67.5% of the total market in 2023. This dominance is largely due to enterprises’ preference for deploying SD-WAN solutions within their own infrastructure for enhanced security and control.

- The large enterprise segment also captured a significant share, with more than 68.3% of the market in 2023. The growing adoption of SD-WAN by large-scale organizations, driven by the need for advanced network solutions to support complex operations, has fueled this growth.

- In terms of industry verticals, the BFSI segment emerged as a key contributor, representing over 22.1% of the market in 2023. The sector’s increasing reliance on SD-WAN for secure, high-performance connectivity solutions to manage sensitive financial data is a major factor in this trend.

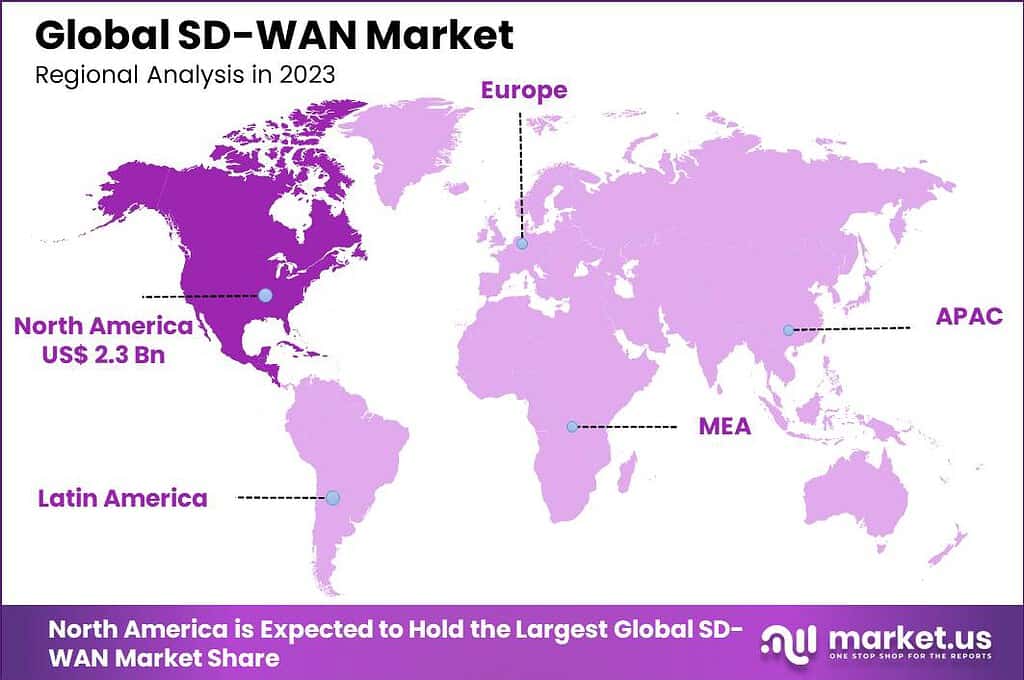

- Geographically, North America led the global SD-WAN market in 2023, accounting for more than 37.6% of the total market share. The region’s dominance is largely driven by the widespread adoption of advanced networking solutions and the presence of major industry players.

Component Segment Analysis

In 2023, the solution segment held a dominant position in the SD-WAN market, capturing more than a 65.1% share. This substantial market share can be attributed to the critical need for robust network solutions that can support the increasing demand for cloud-based applications and data services across various industries.

Organizations are actively seeking Software-defined Wide Area Network (SD-WAN) solutions to enhance their network efficiency and reduce the complexity associated with managing traditional WANs. SD-WAN solutions are leading the market segments primarily because they offer significant improvements in bandwidth utilization and provide greater flexibility in traffic management. These solutions enable businesses to prioritize critical applications and reroute traffic based on current network conditions, ensuring optimal performance.

Moreover, as the volume of data transferred across networks continues to grow due to trends like remote work and video conferencing, the importance of effective and adaptable network solutions becomes even more pronounced. Additionally, Software-defined Wide Area Network (SD-WAN) solutions are more cost-effective compared to traditional WAN architectures.

They reduce the need for expensive proprietary hardware and allow companies to leverage cheaper commodity internet connections, which can significantly lower overall IT costs. The ability to manage multiple connection types – from broadband to LTE – under a single, unified interface further simplifies the network management, making SD-WAN solutions highly attractive to enterprises looking to streamline their operations.

The leadership of the solution segment is also bolstered by the ongoing advancements in technology that enhance the capabilities of SD-WAN. Continuous improvements in areas such as artificial intelligence and machine learning are being integrated into SD-WAN solutions, providing smarter and more proactive network management tools.

These technological enhancements not only improve the reliability and security of the network but also offer businesses the analytical tools needed to optimize their network strategies, thus reinforcing the dominant position of the solution segment in the SD-WAN market.

Deployment Mode Segment Analysis

In 2023, the on-premise segment held a dominant market position in the SD-WAN market, capturing more than a 67.5% share. This leadership is primarily attributed to the high level of control and security that on-premise solutions offer to organizations.

Many businesses, particularly in sectors such as finance, government, and healthcare, continue to rely on on-premise deployments to maintain strict regulatory compliance and data sovereignty by keeping sensitive data within their own data centers.

The preference for on-premise SD-WAN solutions is further driven by their ability to provide enhanced reliability and performance customization. Companies can tailor their network operations to specific needs and conditions without depending on external cloud service providers. This capability is crucial for organizations with mission-critical applications that require consistent network performance and minimal downtime.

The control over the network infrastructure also allows for more precise security measures, a vital consideration in an era marked by increasing cybersecurity threats. Moreover, despite the growing trend toward cloud migration, the substantial existing investments in on-premise infrastructure by large enterprises support the continued dominance of this segment.

These organizations often find that integrating SD-WAN with their legacy systems offers a cost-effective way to upgrade their network capabilities without the need for a complete overhaul. This integration helps leverage existing assets while still gaining the benefits of modern SD-WAN technology.

The on-premise segment’s leading position is reinforced by the technological advancements that enhance the deployment and management of SD-WAN solutions on-site. Innovations in network automation and integration tools have simplified the management of complex network environments, making on-premise solutions not only more robust but also easier to maintain and scale as per business requirements.

Organization Size Segment Analysis

In 2023, the large enterprises segment held a dominant market position in the SD-WAN market, capturing more than a 68.3% share. This prominence is largely due to the extensive network requirements and higher volumes of data handled by large organizations, which necessitate robust, scalable network solutions like SD-WAN.

These enterprises often operate across multiple geographical locations, thereby requiring advanced network management capabilities to ensure seamless connectivity and high performance. Large enterprises are leading the adoption of SD-WAN because of their capacity to invest in advanced technologies that promise enhanced operational efficiency and reduced costs over time.

The ability of SD-WAN to optimize and securely manage network traffic across vast corporate networks is particularly appealing. This technology enables them to effectively prioritize critical business applications and dynamically route traffic based on the bandwidth requirements, ensuring better utilization of network resources.

Furthermore, the growing shift towards digital transformation in large enterprises fuels the demand for SD-WAN. As these organizations continue to adopt cloud services, IoT, and other emerging technologies, the complexity of their network infrastructure increases. SD-WAN solutions address these complexities by offering more agile and manageable networks, which can adapt to changes in traffic patterns and network loads without compromising on security or performance.

The dominance of the large enterprises segment is also supported by the fact that SD-WAN provides a significant return on investment (ROI) for these organizations. By reducing dependency on costly MPLS links and enabling the use of less expensive broadband connections, SD-WAN helps to cut down on operational expenses.

Moreover, the centralized control and visibility features of SD-WAN platforms allow these enterprises to improve their IT responsiveness and agility, which is crucial for maintaining competitive advantage in their respective industries.

Industry Vertical Segment Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the SD-WAN market, capturing more than a 22.1% share. This significant market share can be attributed to the critical need within the BFSI sector for highly secure, reliable, and efficient network infrastructure.

As financial institutions handle sensitive data and require constant, high-speed connectivity for daily operations, SD-WAN technology offers an optimal solution by enhancing network management capabilities and security measures. The leadership of the BFSI segment in the SD-WAN market is driven by the stringent regulatory requirements for data protection and transaction security in this sector.

SD-WAN technology supports compliance with these regulations by providing advanced encryption and segmentation capabilities, which safeguard data transmission across networks. Additionally, SD-WAN offers improved visibility and control over the network, enabling BFSI institutions to detect and respond to threats more swiftly, thereby enhancing overall cybersecurity.

Moreover, as BFSI companies continue to embrace digital transformation, the need for agile and scalable network solutions becomes more pronounced. SD-WAN facilitates the efficient handling of high-volume, high-speed transactions and supports the integration of cloud-based applications and services seamlessly into the banking operations.

This adaptability not only helps in managing the growing data traffic but also improves the customer experience by reducing downtime and enhancing the performance of digital services. The dominance of the BFSI segment is further bolstered by the global expansion of financial services and the increasing adoption of mobile banking, online transactions, and fintech innovations.

Key Market Segments

By Component

- Solution

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- BFSI

- Retail and E-Commerce

- Healthcare

- Manufacturing

- Energy and Utilities

- Government

- Other Industry Verticals

Driver

Increased Adoption of Cloud-Based Solutions

One major driver propelling the growth of the SD-WAN market is the increased adoption of cloud-based solutions across various industries. As businesses continue to integrate cloud technologies into their operations, the demand for efficient, scalable, and secure network infrastructure grows.

SD-WAN provides the necessary agility and performance optimization needed for cloud applications, reducing overall costs and improving bandwidth management. The capability of SD-WAN to enhance application performance, coupled with its cost efficiency, makes it an attractive option for enterprises looking to maximize their cloud investments.

Restraint

Complexity in Integration and Migration

A significant restraint facing the SD-WAN market is the complexity associated with integrating and migrating from traditional WAN to SD-WAN. This transition involves detailed configuration and testing to ensure that the new network supports all existing applications without disruption.

For organizations with entrenched legacy systems or extensive network architectures, the process can be particularly challenging, potentially hindering the adoption of SD-WAN. Addressing these complexities requires specific expertise and resources, which can be a barrier for many organizations, particularly those without robust IT departments.

Opportunity

Convergence with Edge Computing

There is a growing opportunity for SD-WAN in its integration with edge computing technologies. As more businesses deploy applications closer to the edge of the network to improve speed and reduce latency, the need for SD-WAN solutions that can provide dynamic routing and improved security at the network’s edge increases.

This convergence allows organizations to handle the growing volume of data being processed outside of traditional data centers more efficiently and securely, enabling new use cases in IoT and mobile applications, particularly in industries like manufacturing and healthcare.

Challenge

Need for Skilled Professionals

The SD-WAN market faces the challenge of a shortage of skilled professionals who can effectively implement, manage, and troubleshoot SD-WAN solutions. As the technology grows in complexity and the demand for advanced network solutions increases, the need for experienced IT professionals who understand both the technical and strategic aspects of SD-WAN becomes more critical.

This shortage can limit the speed at which companies can successfully adopt and leverage SD-WAN technology, affecting overall market growth. Organizations and vendors may need to invest in training and certification programs to build a workforce capable of supporting their SD-WAN initiatives.

Growth Factors

The growth of the SD-WAN market is driven by increasing demand for improved network performance and agility. As businesses adopt cloud based applications, SD-WAN helps optimize connectivity, reduce costs and enhance user experience by dynamically managing network traffic.

Another key factor is the rise of remote work, which has increased the need for secure, scalable, and easily deployable networking solutions. SD-WAN addresses these needs with built in security features and centralized management. Furthermore, the expansion of IoT and edge computing drives SD-WAN adoption, as it offers the necessary flexibility and control to manage complex, distributed networks efficiently.

Latest Trends

The SD-WAN market is experiencing rapid growth drives by the demand for secure, agile, and cost effective networking solutions. Key trends include the integration of artificial intelligence and machine learning for enhanced network automation and real time analytics. Security is becoming a top priority, with secure access service edge solutions gaining traction to unify networking and security.

Another trend is the increasing adoption of SD-WAN among small and medium sized enterprises, driven by its scalability and remote workforce enablement. Cloud native SD-WAN solutions are also on the rise, enabling seamless connectivity and optimization for hybrid and multi cloud environment.

Top Use Cases for SD-WAN

SD-WAN is increasingly adopted across various industries due to its ability to enhance network management and support digital transformation. Key use cases include:

- Hybrid Work: SD-WAN facilitates the hybrid work model by providing seamless connectivity across multiple locations and work environments, from office spaces to remote setups. This adaptability ensures that employees have consistent and secure access to necessary applications and resources, regardless of their location.

- Multi-cloud Deployments: With many businesses using multiple cloud services, SD-WAN efficiently manages traffic across these platforms, ensuring optimal performance and enhanced security. This setup prevents data loss and minimizes downtime by intelligently routing traffic and providing direct cloud access.

- High Availability and Resilience: For industries where uptime is critical, such as healthcare and financial services, SD-WAN offers solutions that maximize network reliability and resiliency. This is achieved by its ability to manage multiple connections and switch traffic dynamically to the best available route.

Business Benefits of SD-WAN

Adopting SD-WAN offers several significant advantages:

- Cost Efficiency: By optimizing bandwidth usage and reducing the need for expensive legacy setups like MPLS, companies can significantly lower their networking costs.

- Improved Application Performance: SD-WAN enhances the performance of business-critical applications by prioritizing and routing traffic more efficiently. This results in faster access to cloud services and improved user experiences.

- Enhanced Security: The ability to encrypt data and offer secure connections for remote employees helps in mitigating potential security threats, making SD-WAN an excellent option for organizations looking to strengthen their cybersecurity posture.

- Simplified Network Management: With its centralized control features, SD-WAN simplifies the management of network resources, reducing the complexity and operational overhead associated with traditional WANs.

Regional Analysis

In 2023, North America held a dominant market position in the SD-WAN market, capturing more than a 37.6% share with revenue of USD 2.3 billion. This leadership can be attributed to several key factors. North America, particularly the United States, has a highly developed IT infrastructure and hosts a large number of multinational corporations and technology firms that are early adopters of innovative network technologies.

The region’s market dominance is further supported by the presence of major SD-WAN vendors and startups, which drives competitive advancements and adoption. The rapid embrace of cloud-based services across industries in North America has also propelled the demand for SD-WAN solutions. These solutions facilitate more efficient data traffic management and improved security protocols necessary for cloud technology, enhancing the appeal of SD-WAN to businesses transitioning to the cloud.

Additionally, the increasing trend towards remote work and distributed enterprises in the region necessitates robust network solutions that SD-WAN provides, aiding in handling the dispersed workforce’s connectivity demands effectively. Moreover, North America’s commitment to digital transformation initiatives across its corporate sector fosters a conducive environment for SD-WAN technologies.

Companies in the region are continuously seeking to optimize their network operations to support real-time data transfer and high-quality communication solutions, aligning well with the benefits offered by SD-WAN. This alignment is evident in the substantial investments in network infrastructure upgrades to support the scaling of business operations and the integration of emerging technologies such as the Internet of Things (IoT) and artificial intelligence (AI).

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The SD-WAN market is highly competitive, with several key players making significant moves to consolidate their market positions. Among these, Cisco Systems, Inc., Hewlett Packard Enterprise (HPE), and Fortinet, Inc. stand out due to their strategic initiatives, including acquisitions, product launches, and partnerships.

Cisco Systems, Inc. is a prominent player in the SD-WAN market, renowned for its robust offerings and continuous innovation. Cisco has expanded its market reach through strategic acquisitions and the continual enhancement of its SD-WAN solutions. For instance, Cisco’s acquisition of Viptela and integration of its technology into Cisco’s networking solutions has strengthened its SD-WAN portfolio, enabling more comprehensive and secure networking options for enterprises.

Hewlett Packard Enterprise (HPE) has also been active in enhancing its SD-WAN capabilities. HPE’s focus on hybrid cloud and network transformation solutions has been complemented by strategic partnerships and acquisitions, such as the purchase of Silver Peak, a leader in the SD-WAN space. This acquisition is aimed at bolstering HPE’s Aruba Edge Services Platform, providing customers with a unified cloud management solution to manage both the WAN and LAN from a single point.

Fortinet, Inc. continues to excel in integrating security with network functionality, distinguishing its SD-WAN solutions in the market. Fortinet’s advancements in SD-WAN technology are particularly focused on embedding comprehensive security features directly into the network, thus offering an all-in-one solution that enhances performance while ensuring security.

Top Key Players in the Market

- Cisco Systems, Inc.

- Hewlett Packard Enterprise (HPE)

- Broadcom Inc.

- Fortinet, Inc.

- Oracle Corporation

- Nokia Corporation

- Juniper Networks, Inc.

- Palo Alto Networks, Inc.

- Riverbed Technology

- Aryaka Networks, Inc.

- Other Key Players

Recent Developments

- In January 2024, Zscaler launched its SD-WAN solution, as it steps into the growing and competitive single-vendor secure access service edge (SASE) market. The security services edge (SSE) leader has been working with almost all of the leading SD-WAN vendors for its multivendor SASE approach.

- In November 2023, Etisalat announced its partnership with global technology leaders Versa Networks, VeloCloud, and Fortinet, enhancing its portfolio and unveiling a transformative era in managed SDWAN (Software-Defined Wide Area Network) services.

Report Scope

Report Features Description Market Value (2023) USD 6.2 Bn Forecast Revenue (2033) USD 88.8 Bn CAGR (2024-2033) 30.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail and E-Commerce, Healthcare, Manufacturing, Energy and Utilities, Government, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Inc., Hewlett Packard Enterprise (HPE), Broadcom Inc., Fortinet, Inc., Oracle Corporation, Nokia Corporation, Juniper Networks, Inc., Palo Alto Networks, Inc., Riverbed Technology, Aryaka Networks, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Software-Defined Wide Area Network (SD-WAN) MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample

Software-Defined Wide Area Network (SD-WAN) MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- Hewlett Packard Enterprise (HPE)

- Broadcom Inc.

- Fortinet, Inc.

- Oracle Corporation

- Nokia Corporation

- Juniper Networks, Inc.

- Palo Alto Networks, Inc.

- Riverbed Technology

- Aryaka Networks, Inc.

- Other Key Players