Global Software-Defined Data Center Market Size, Share, Statistics Analysis Report By Component (Solution, Services), By Type (Software-Defined Computing, Software-Defined Storage, Software-Defined Networking, Other Types), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Healthcare, Retail, Manufacturing, Government, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134266

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Type Analysis

- Organization Size Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

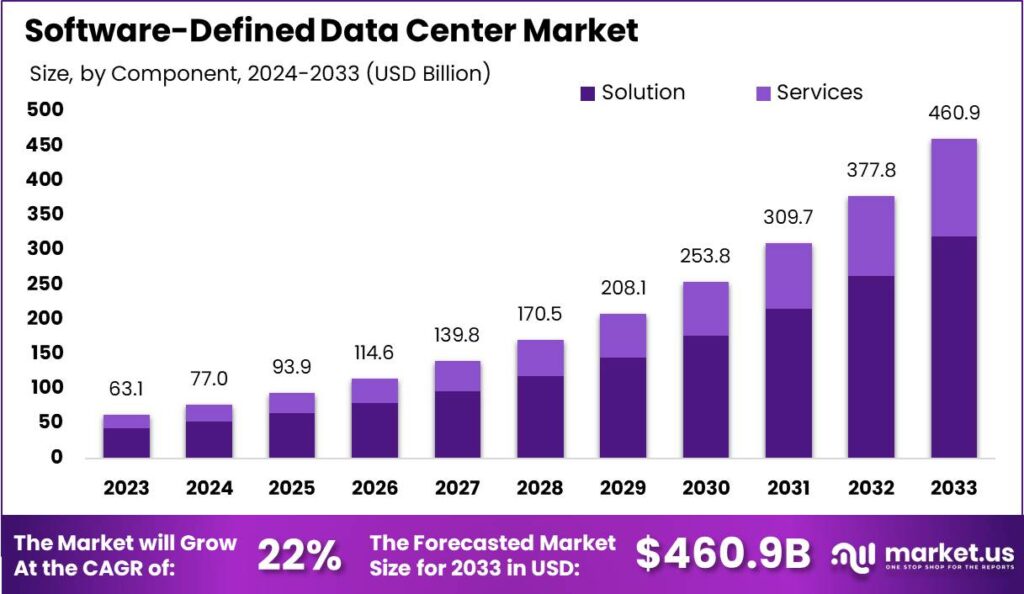

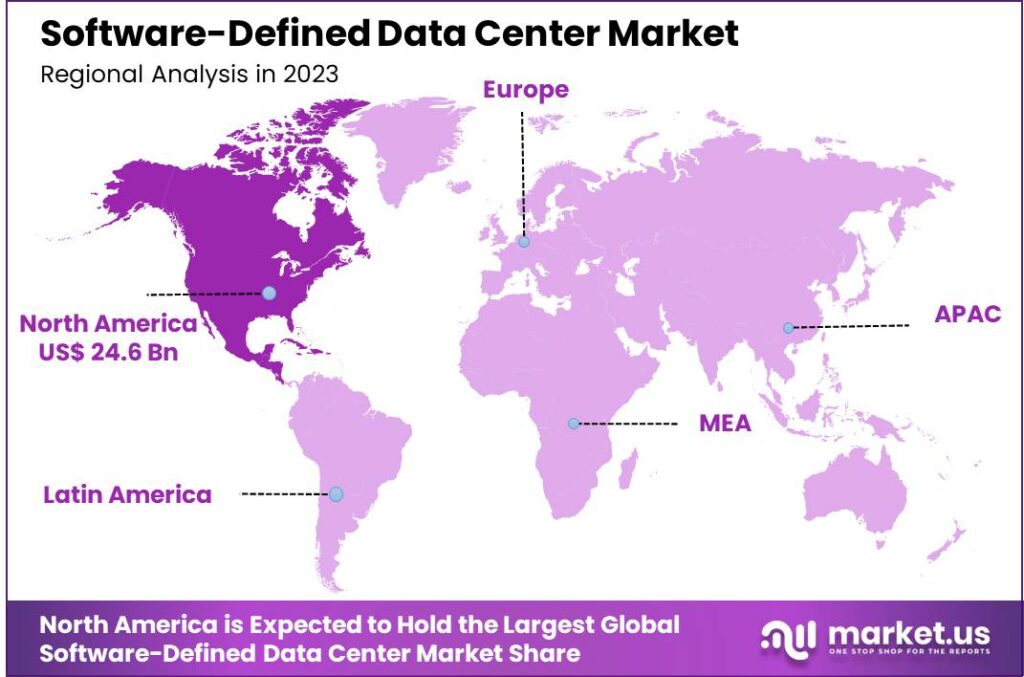

The Global Software-Defined Data Center Market size is expected to be worth around USD 460.9 Billion By 2033, from USD 63.1 Billion in 2023, growing at a CAGR of 22.00% during the forecast period from 2024 to 2033. In 2023, North America led the Software-Defined Data Center (SDDC) market, capturing over 39.0% of the share and generating revenues of USD 24.6 billion.

A Software-Defined Data Center (SDDC) is an advanced data center infrastructure where all elements, including networking, storage, CPU, and security, are virtualized and delivered as a service. Control of the data center is fully automated by software, meaning hardware configuration is maintained through intelligent software systems. This approach allows organizations to create a highly scalable, flexible, and efficient infrastructure that can dynamically adapt to the changing needs of the business.

The growth of the Software-Defined Data Center market is driven by several key factors such as there is a growing demand for agile, scalable, and efficient IT infrastructure, especially in the face of increasing data volumes and computational needs. Businesses are seeking solutions that reduce operational costs and improve the speed of deployment of IT services, which SDDCs facilitate through their virtualization and automation features.

Additionally, the rise of cloud computing and the need for advanced data center management and maintenance solutions have spurred the adoption of SDDC technologies. SDDC architectures enable disaster recovery and data center consolidation by allowing businesses to manage multiple data centers on a single software platform, eliminating the need for reliance on physical hardware.

The popularity of SDDCs can be attributed to their alignment with contemporary IT trends, including cloud computing, artificial intelligence, and machine learning. These technologies require robust and flexible infrastructure solutions that can only be effectively supported by software-defined environments. The shift to remote work has increased the popularity of SDDCs, as they provide the tools to efficiently manage and secure distributed IT resources.

For instance, In October 2023, Microsoft announced a bold step forward by unveiling its plan to create a dedicated team focused on data center automation and robotics research. This move underscores a significant shift in how technology leaders are addressing the growing demands of the digital world.

The SDDC market presents immense opportunities, especially in data-driven industries like healthcare, finance, and retail. With the ability to quickly deploy, manage, and scale IT resources, SDDCs are a game-changer for businesses aiming to innovate and maintain a competitive edge.

Market expansion for SDDCs is expected to continue as technology evolves and businesses seek more sophisticated IT solutions. Emerging markets and developing regions are particularly promising, as their growing IT sectors provide fertile ground for SDDC adoption. Additionally, the ongoing development of cybersecurity solutions within SDDC frameworks addresses one of the primary concerns of businesses, thereby enhancing trust and accelerating the adoption of SDDC solutions worldwide.

Key Takeaways

- The Global Software-Defined Data Center Market is projected to reach approximately USD 460.9 Billion by 2033, up from USD 63.1 Billion in 2023, growing at a CAGR of 22.00% during the forecast period from 2024 to 2033.

- In 2023, the Solution segment dominated the Software-Defined Data Center (SDDC) market, capturing over 69.5% of the market share.

- The Software-Defined Computing (SDC) segment held a leading position in the market in 2023, accounting for more than 38.1% of the market share.

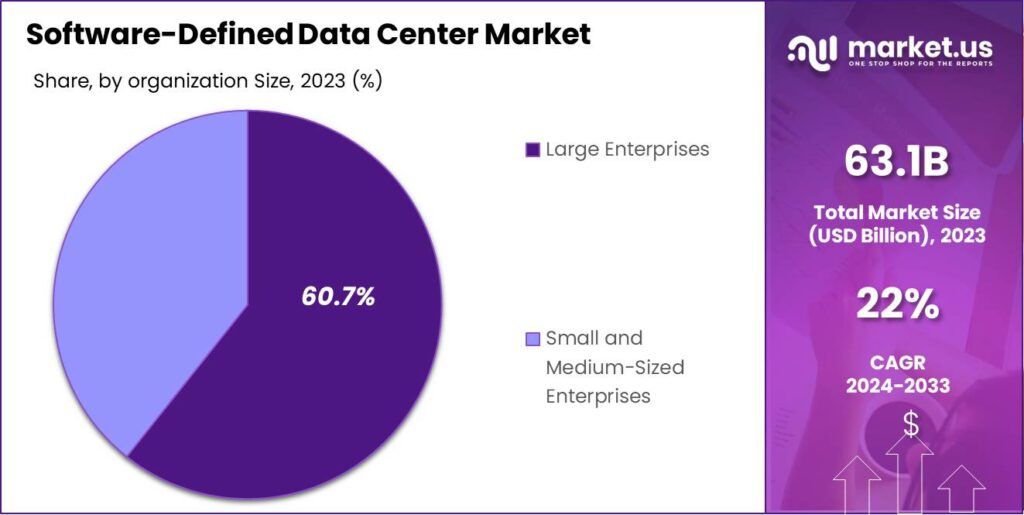

- The Large Enterprises segment dominated the SDDC market in 2023, capturing more than 60.7% of the market share.

- The IT and Telecommunications segment was the leading market driver in 2023, with a share of more than 27.6%.

- North America held the largest market share in 2023, accounting for over 39.0%, with revenues reaching USD 24.6 billion.

Component Analysis

In 2023, the Solution segment held a dominant position within the Software-Defined Data Center (SDDC) market, capturing more than 69.5% of the market share. This significant dominance can be attributed primarily to the increasing adoption of SDDC solutions across various industries seeking to modernize their IT infrastructure.

Solutions in this segment include software-defined computing, software-defined networking (SDN), and software-defined storage, each of which offers substantial improvements over traditional hardware-centric data center management. Organizations are leveraging these solutions to achieve greater flexibility, scalability, and cost efficiency in their data center operations.

The primary driver behind the leading position of the Solution segment is the pressing need for businesses to enhance their operational agility in response to rapidly changing market conditions. Software-defined solutions facilitate quicker deployment of new applications and services, enabling businesses to respond more swiftly to opportunities and challenges. This ability to scale resources on demand, allows companies to optimize their computing environment according to real-time needs without substantial capital expenditure.

Type Analysis

In 2023, the Software-Defined Computing (SDC) segment held a dominant position in the Software-Defined Data Center (SDDC) market, capturing more than 38.1% of the market share. This leading status can be attributed to the increasing demand for agile computing services and the widespread adoption of cloud-based solutions in various industries.

Organizations are leveraging SDC to enhance their operational flexibility and scalability, which is crucial in managing large volumes of data and complex workloads. The ability of SDC to dynamically configure and reconfigure server loads based on application requirements has made it a critical component for businesses aiming to optimize their IT infrastructure.

The predominance of the Software-Defined Computing segment is also bolstered by the integration of artificial intelligence and machine learning technologies. These integrations allow for smarter automation and predictive analytics within IT operations, streamlining processes and reducing the need for manual intervention.

As businesses continue to emphasize cost efficiency and improved performance, SDC provides a compelling solution by enabling virtualization and more efficient resource management. This shift towards virtual environments is expected to persist, further driving the growth of the SDC segment.

Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant market position within the software-defined data center (SDDC) market, capturing more than a 60.7% share. This segment’s leadership can be attributed to the significant financial resources and IT infrastructure demands characteristic of large enterprises.

These organizations typically require robust, scalable solutions to manage vast amounts of data and ensure high availability and reliability across multiple global locations. The complexity and scale of operations in large enterprises necessitate the efficiency, agility, and advanced functionality that SDDCs provide.

Large enterprises also lead the SDDC market due to their higher readiness to adopt new technologies that promise enhanced operational efficiency and reduced costs. With larger IT budgets, these organizations are more equipped to invest in the initial setup and ongoing management of SDDCs.

Another reason for the dominance of large enterprises in the SDDC market is their need for stringent security measures and compliance with various regulatory standards. SDDCs offer enhanced security features and better control over data flows, which are critical for large enterprises dealing with sensitive information and regulatory compliance issues.

Industry Vertical Analysis

In 2023, the IT and Telecommunications segment held a dominant market position within the software-defined data center (SDDC) market, capturing more than a 27.6% share. This leadership is primarily due to the inherent nature of IT and telecommunications firms, which require high levels of data processing capabilities and network resilience to manage and deliver services effectively.

Moreover, IT and telecommunications companies are at the forefront of digital transformation, continually seeking to enhance their service offerings and improve customer experience through innovative technologies. The adoption of SDDCs allows these companies to deploy, manage, and automate complex data center operations more efficiently and with reduced operational costs.

Additionally, the IT and telecommunications sector often leads in adopting new technologies that can drive further efficiencies and competitive advantages. The integration of SDDCs facilitates advanced virtualization, improved disaster recovery solutions, and streamlined management of computing resources. This ensures high uptime and agility, enabling rapid service launches and quick responses to market changes, solidifying the IT and Telecommunications sector’s leadership in the SDDC market.

Key Market Segments

By Component

- Solution

- Services

By Type

- Software-Defined Computing

- Software-Defined Storage

- Software-Defined Networking

- Other Types

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- BFSI

- Healthcare

- Retail

- Manufacturing

- Government

- Other Industry Verticals

Driver

Adoption of Multi-Cloud Environments

In today’s digital landscape, businesses are increasingly adopting multi-cloud strategies to leverage the unique advantages of various cloud service providers. This trend necessitates a unified and efficient management system across diverse cloud platforms. SDDCs address this need by providing a centralized framework that integrates resources from multiple clouds, enabling seamless management and optimization.

The agility offered by SDDCs empowers businesses to respond swiftly to market changes and evolving customer demands. For instance, deploying new applications or scaling existing ones becomes more straightforward and faster, providing a competitive edge in rapidly changing markets. Additionally, the automation capabilities of SDDCs minimize manual interventions, reducing the likelihood of human errors and enhancing overall system reliability.

Restraint

Absence of Unified Standards

The rapid evolution of SDDC technologies has led to a diverse array of solutions from various vendors, each with its own set of protocols and interfaces. This diversity can result in compatibility issues when integrating different software and hardware components. Organizations may face challenges in ensuring seamless interoperability, which can lead to inefficiencies and higher operational costs.

Moreover, the absence of universally accepted standards can hinder scalability. As businesses grow and their infrastructure needs expand, the lack of standardization can complicate the integration of new components, potentially affecting performance and reliability. Security is another concern as inconsistent security measures across various components can create vulnerabilities.

Opportunity

Boosting Durability and System Reliability

SDDCs offer advanced solutions to maintain high availability through features like automated failover and rapid disaster recovery. These capabilities enable systems to swiftly respond to issues, minimizing downtime and ensuring uninterrupted service delivery.

The automation inherent in SDDC architectures allows for proactive monitoring and management of resources. Potential issues can be identified and addressed before they escalate into significant problems, thereby enhancing system resilience.

Industries where downtime can lead to substantial financial losses or safety concerns, such as finance, healthcare, and manufacturing, particularly benefit from the resilience offered by SDDCs. By ensuring continuous operations and system reliability, SDDCs help maintain business continuity and protect revenue streams.

Challenge

Lack of Skilled Workforce

The sophisticated nature of SDDC technologies necessitates a workforce proficient in areas like virtualization, automation, and network management. However, there is a notable shortage of professionals with the requisite skills to effectively design, implement, and manage SDDC environments.

This skills gap can impede the successful deployment and operation of SDDCs, potentially leading to suboptimal performance and increased vulnerability to security threats. Organizations may find themselves investing heavily in training programs to upskill existing employees or competing in a limited talent pool to recruit qualified professionals.

Emerging Trends

One significant trend is the integration of server virtualization, which allows multiple operating systems to run on a single physical server. This optimizes resource utilization and reduces hardware costs. Edge computing is also gaining prominence. By processing data closer to its source, edge computing reduces latency and enhances the performance of Internet of Things (IoT) devices.

Hybrid cloud environments are becoming more common, enabling businesses to distribute workloads across public and private clouds. This approach offers greater flexibility and scalability.

The adoption of software-defined storage (SDS) is another notable trend. SDS decouples storage resources from hardware, allowing for more efficient data management and scalability. Artificial intelligence (AI) and machine learning are being integrated into data center operations to enhance efficiency and performance.

Business Benefits

Implementing an SDDC can lead to significant cost savings for business. By pooling infrastructure resources and standardizing management tools, businesses can reduce hardware expenditures and improve system utilization.

SDDCs enhance agility by enabling rapid provisioning of IT resources. Policy-driven automation allows for quick responses to new requests, facilitating faster delivery of services.

Centralized management in SDDCs simplifies operations, allowing IT teams to configure, monitor, and maintain systems from a single interface. This reduces the need for manual interventions and minimizes errors. The flexibility of SDDCs supports the integration of emerging technologies, ensuring that businesses remain competitive and can adapt to evolving market demands.

Regional Analysis

In 2023, North America held a dominant position in the Software-Defined Data Center (SDDC) market, capturing more than a 39.0% share with revenues amounting to USD 24.6 billion. This leadership is largely driven by the region’s robust technological infrastructure and the rapid adoption of cloud services across enterprises.

North America, particularly the United States, is home to some of the world’s largest technology companies and innovators in IT infrastructure, which has fostered a conducive environment for the growth of SDDC solutions. The region’s market dominance is also supported by substantial investments in research and development, enabling constant technological advancements.

The presence of a large number of data centers and the increasing need for data center modernization have further propelled the adoption of SDDC in North America. Businesses in this region are keen on optimizing their data center operations to enhance efficiency and reduce operational costs. This has led to a heightened demand for software-defined solutions that promise improved scalability and flexibility compared to traditional data centers.

Moreover, regulatory compliance and data privacy concerns in North America have played a critical role in the adoption of SDDC solutions. Companies are increasingly investing in these solutions to ensure they meet stringent data protection standards and regulatory requirements efficiently. The advanced security features allow organizations to maintain high levels of data integrity and security, further boosting their adoption in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the competitive landscape of the Software-Defined Data Center (SDDC) market, IBM Corporation stands out as a key player. IBM has leveraged its extensive experience in IT and network technology to develop advanced SDDC solutions that prioritize scalability and security. The company’s offerings are valued for their ability to integrate with existing IT infrastructure, enabling smooth transitions to software-defined environments.

Cisco Systems, Inc. is another significant contributor to the SDDC market. Known for its robust networking hardware, Cisco has successfully transitioned into the SDDC space by offering a range of solutions that include software-defined networking (SDN) and security features. Cisco’s SDDC solutions are designed to support complex, multi-cloud environments, providing flexibility and enhanced control over data center resources.

Microsoft Corporation also plays a pivotal role in the SDDC market with its Azure-based offerings. Microsoft’s approach integrates various components of SDDC, such as SDN, storage, and computing, under its Azure platform, offering a cohesive and scalable environment that supports both hybrid and cloud-native applications.

Top Opportunities Awaiting for Players

The Software-Defined Data Center (SDDC) market is evolving rapidly, presenting several key opportunities for industry players.

- Integration of Advanced Technologies: Incorporating artificial intelligence (AI) and machine learning (ML) into SDDC solutions can enhance automation and predictive analytics, leading to more efficient data center operations. This integration allows for proactive management and optimization of resources, aligning with the growing demand for intelligent infrastructure.

- Expansion into Emerging Markets: Regions such as the Asia-Pacific are experiencing significant digital transformation, increasing the demand for flexible and scalable data center solutions. SDDC providers can capitalize on this trend by offering tailored solutions that meet the specific needs of these markets, thereby expanding their global footprint.

- Development of Hybrid Cloud Solutions: As organizations adopt multi-cloud strategies, there is a growing need for seamless integration between on-premises and cloud environments. SDDC vendors can develop hybrid cloud solutions that provide unified management and orchestration across diverse infrastructures, offering businesses the flexibility they require.

- Focus on Security Enhancements: With increasing cyber threats, robust security measures within SDDC offerings are crucial. By integrating advanced security protocols and compliance features, providers can address customer concerns and differentiate their products in the market.

- Investment in Edge Computing: The rise of Internet of Things (IoT) devices necessitates processing data closer to its source. SDDC vendors can develop edge computing capabilities to reduce latency and improve performance, catering to industries that rely on real-time data processing.

Top Key Players in the Market

- IBM Corporation

- Cisco Systems, Inc.

- Microsoft Corporation

- Broadcom Inc.

- Oracle Corporation

- Hewlett Packard Enterprise (HPE)

- Dell Inc.

- Nutanix

- Rackspace Technology

- Other Key Players

Recent Developments

- In November 2023, Broadcom completed its $69 billion acquisition of VMware, a leader in virtualization and cloud infrastructure. This strategic move aims to enhance Broadcom’s software portfolio and solidify its position in the SDDC market.

- In November 2024, Nutanix, a leader in hyper-converged infrastructure (HCI), plays a key role in the SDDC space. Its Nutanix Cloud Platform integrates compute, storage, and networking into a single software-defined architecture, helping businesses optimize IT environments with automation and simplicity. Nutanix generated $1.8 billion in revenue for FY 2023, reflecting an 18% growth.

Report Scope

Report Features Description Market Value (2023) USD 63.1 Bn Forecast Revenue (2033) USD 460.9 Bn CAGR (2024-2033) 22% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Type (Software-Defined Computing, Software-Defined Storage, Software-Defined Networking, Other Types), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Healthcare, Retail, Manufacturing, Government, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Cisco Systems, Inc., Microsoft Corporation, Broadcom Inc., Oracle Corporation, Hewlett Packard Enterprise (HPE), Dell Inc., Nutanix, Rackspace Technology, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Software-Defined Data Center MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Software-Defined Data Center MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Cisco Systems, Inc.

- Microsoft Corporation

- Broadcom Inc.

- Oracle Corporation

- Hewlett Packard Enterprise (HPE)

- Dell Inc.

- Nutanix

- Rackspace Technology

- Other Key Players