Global Sodium-Sulfur Battery Market By Product(Private Portable, Industrial), By Power(Up To 10 MW, 11 MW-25 MW, 2 /6 MW-50 MW, 2Above 50 MW), By Application(Ancillary Services, Load Leveling, Renewable Energy Stabilization, Others), By End-Use(Grid and Standalone Systems, Space, Transport & Heavy Machinery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 16595

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

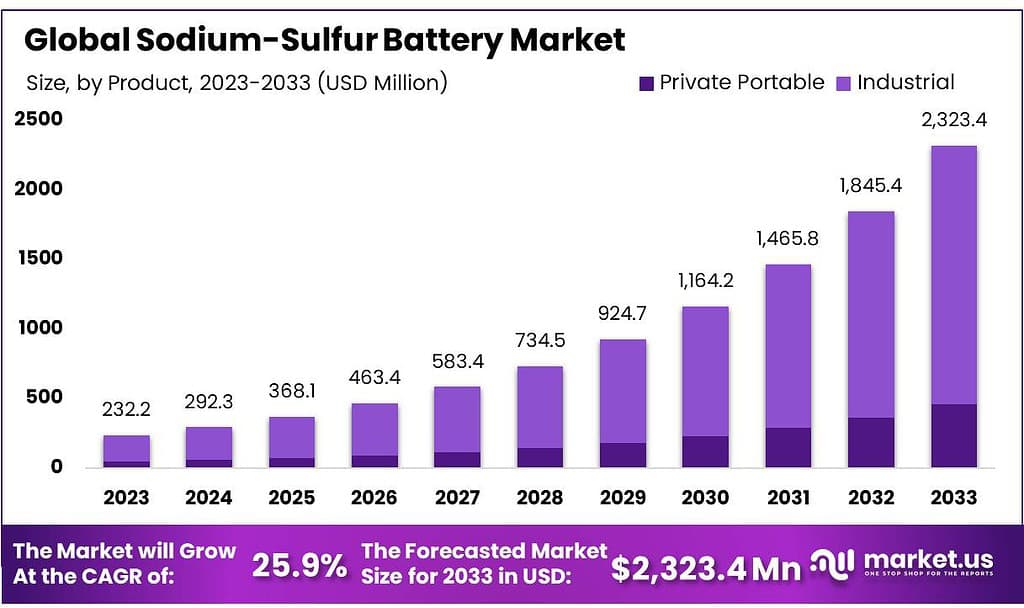

The Sodium-Sulfur Battery Market size is expected to be worth around USD 2323.4 Mn by 2033, from USD 232.2 Mn in 2023, growing at a CAGR of 25.9% during the forecast period from 2023 to 2033.

The Sodium-Sulfur Battery Market refers to the sector involving the production, distribution, and utilization of sodium-sulfur batteries. Sodium-sulfur batteries are advanced energy storage systems that use liquid sodium as the negative electrode, sulfur as the positive electrode, and a solid ceramic electrolyte.

These high-temperature batteries are known for their efficiency, long cycle life, and ability to store and deliver large amounts of energy. The market encompasses manufacturers, suppliers, and other stakeholders contributing to the development and deployment of sodium-sulfur battery technology. Factors such as renewable energy integration, grid stabilization, and advancements in energy storage drive the growth and dynamics of the Sodium-Sulfur Battery Market.

As the power is not required to be exchanged right after generation, sodium-sulfur batteries can defer transmission up-gradation. The power can also easily be discharged at will. Also, the sodium-sulfur battery is used to maintain an urgent power supply and supply power for industrial and off-grid customers. The availability of alternate battery technologies like Lead-Acid batteries has resulted in a low adoption rate.

Key Takeaways

- Impressive Growth Projection: The Sodium-Sulfur Battery Market aims to reach USD 2323.4 Mn by 2033, showcasing a robust 25.9% CAGR from 2023 to 2033.

- Dominant Industrial Segment: In 2023, the Industrial segment led with an 80.3% market share, emphasizing its critical role in large-scale applications.

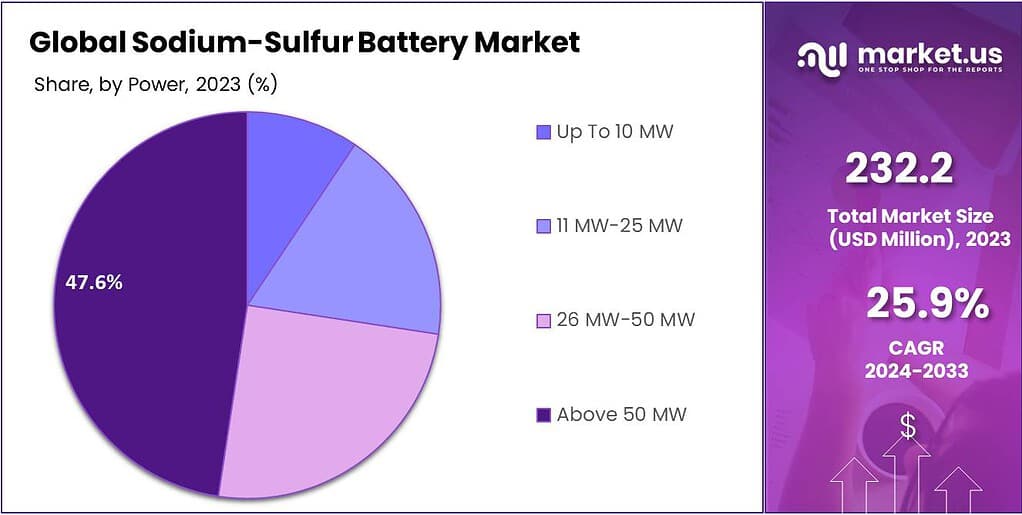

- Power Segment Leadership: The “Above 50 MW” power category secured a significant 36.4% market share in 2023, tailored for substantial energy demands.

- Key Application – Ancillary Services: Ancillary Services claimed a notable 35.6% market share in 2023, highlighting the essential role of sodium-sulfur batteries in grid stability.

- End-Use Dominance – Grid and Standalone Systems: Grid and Standalone Systems dominated in 2023, capturing over 52.6% share, crucial for stable energy supply.

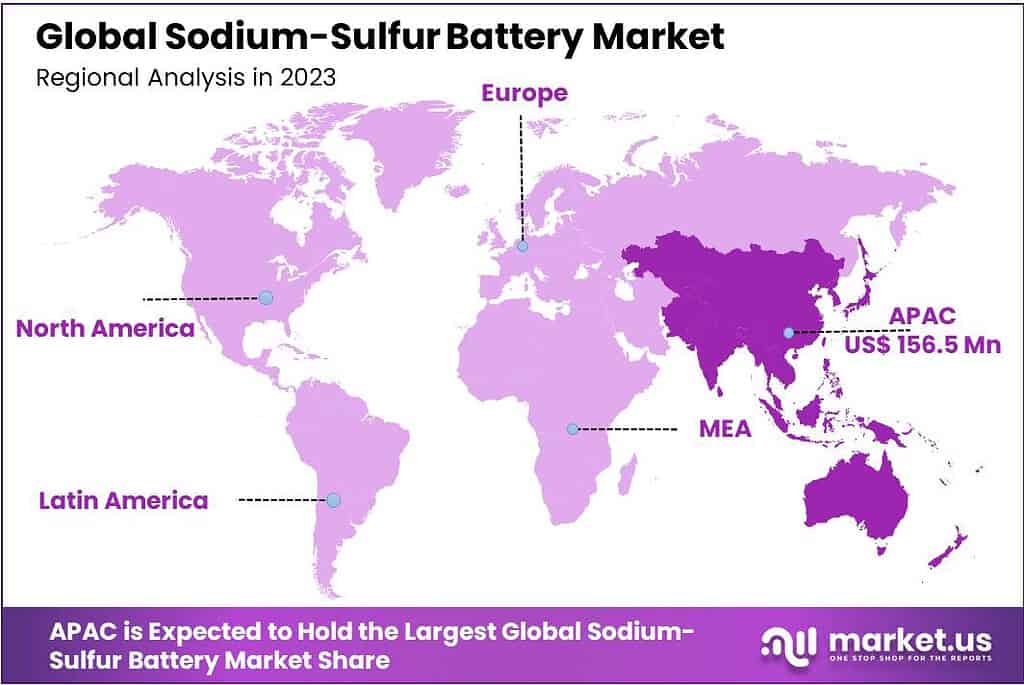

- Asia Pacific’s Commanding Position: Asia Pacific led with a substantial 67.4% revenue share in 2023, driven by Japan’s industrialization and reliable electricity generation focus.

Product Analysis

The Sodium-Sulfur Battery Market in 2023 witnessed a dominant position held by the Industrial segment, capturing a substantial 80.3% share. These batteries proved instrumental in powering large-scale applications across various industrial settings.

Their utilization in sectors such as energy storage, utilities, and expansive power plants showcased their reliability and high energy capacity, ensuring uninterrupted operations. The sodium-sulfur batteries’ robustness and ability to cater to heavy-duty demands solidified their preference in industrial applications, contributing significantly to their market dominance.

In contrast, the Private Portable segment, although occupying a smaller market share, catered to niche uses. These batteries were designed for portable applications, offering mobility and convenience for individual or private use.

Despite a lower market share, the Private Portable segment found its niche in personal electronics, small-scale energy storage systems, or mobile devices, providing reliable power solutions for more personalized needs. However, their market presence remained overshadowed by the widespread and essential role played by sodium-sulfur batteries in industrial operations.

By Power

The Sodium-Sulfur Battery Market in 2023 demonstrated the remarkable dominance of the “Above 50 MW” power segment, securing a substantial market share of more than 36.4%. These batteries were specifically tailored for large-scale applications requiring significant power capacities.

Industries and utility-scale power plants heavily depended on these high-capacity sodium-sulfur batteries, drawn to their robustness and capability to handle immense energy demands beyond 50 MW. This dominance reflected their crucial role in supporting operations where substantial power reserves and reliability were paramount, solidifying their leading position in this particular market segment.

Contrastingly, the lower power segments, such as the “Up to 10 MW” and “11 MW-25 MW” categories, catered to applications with comparatively lower energy needs. While they served various industries and smaller utility setups, their market presence was overshadowed by the substantial demand and critical role played by the above 50 MW segment.

These lower power segments found application in smaller-scale energy storage needs, but their market share remained modest compared to the extensive use and importance of high-capacity sodium-sulfur batteries in powering larger-scale operations.

Application Analysis

In 2023, the Sodium-Sulfur Battery Market was notably led by the Ancillary Services application segment, capturing a substantial 35.6% market share. These batteries held a crucial role in ancillary services within the energy sector, functioning as essential components for stabilizing and managing the grid.

Their primary function encompassed ensuring consistent and reliable power supply, along with maintaining control over voltage and frequency regulation. Na-sulfur batteries stand out due to their rapid and responsive energy support capabilities, making them essential in maintaining grid stability. Their prominence within Ancillary Services reinforced their crucial role in safeguarding power system operational integrity – further cementing their status in this market segment.

Meanwhile, other application segments, such as Load Leveling and Renewable Energy Stabilization, although important, held a comparatively lower market share. Load Leveling involves balancing electricity supply and demand, and Renewable Energy Stabilization aimed at enhancing the stability of renewable power sources.

While these segments utilized sodium-sulfur batteries for specific energy management purposes, their market presence remained overshadowed by the critical role played by these batteries in ensuring the stability and efficiency of ancillary services within the broader energy sector.

By End-Use

In 2023, Grid and Standalone Systems held a dominant market position, capturing more than a 52.6% share. These systems are crucial for storing and delivering energy to power grids, ensuring a stable and reliable energy supply. The robust demand is fueled by the increasing focus on renewable energy integration and the need for efficient grid stabilization.

The Space segment exhibited notable growth, showcasing advancements in sodium-sulfur battery technology for aerospace applications. These batteries are valued for their lightweight and high energy density properties, contributing to the reliable power supply needed in space exploration missions.

Transport & Heavy Machinery emerged as a significant segment in the Sodium-Sulfur Battery Market. The transportation sector, including electric vehicles and heavy machinery, saw a rising adoption of sodium-sulfur batteries due to their ability to provide high energy density, enhancing the efficiency and sustainability of these vehicles.

Key Market Segments:

By Product

- Private Portable

- Industrial

By Power

- Up To 10 MW

- 11 MW-25 MW

- 2 /6 MW-50 MW

- 2Above 50 MW

By Application

- Ancillary Services

- Load Leveling

- Renewable Energy Stabilization

- Others

By End-Use

- Grid and Standalone Systems

- Space

- Transport & Heavy Machinery

- Others

Drivers

The Sodium-Sulfur Battery Market experiences robust growth due to several driving forces that shape its expansion. More and more renewable energy, like solar and wind power, is joining the power grids. This makes us need good ways to store that energy. Sodium-sulfur batteries help a lot by storing this energy well.

Making sure the power grid stays stable is really important. We need things that can store energy fast and have lots of power. Sodium-sulfur batteries are great at this. They help with keeping the grid stable by managing how much power is used and keeping everything balanced.

Industries with substantial energy demands are drawn towards sodium-sulfur batteries. These batteries’ robustness and high energy capacity cater perfectly to the energy-intensive needs of heavy industries, utilities, and large-scale power plants, making them a preferred choice in industrial applications.

More and more, people want big solutions to store energy. This helps when lots of power is needed suddenly or when there’s too much or too little energy. Sodium-sulfur batteries are getting more popular for this. They’re good at handling big amounts of power, so they’re used a lot for storing a bunch of energy in one go. Governments support using batteries to store energy. They give rewards and start projects to encourage using these technologies.

The rules also say it’s good to make the power grid stable and use more renewable energy. This helps more people choose sodium-sulfur batteries for different uses. Scientists keep working to make batteries better. They want them to work well, last long, and not cost too much. This makes sodium-sulfur batteries more appealing for many uses in different areas. So, because of these things happening together, more and more people and industries are choosing and using sodium-sulfur batteries.

Restraints

Temperature Dependency, Sodium-sulfur batteries rely heavily on high operating temperatures for optimal performance, yet this reliance can present challenges when operating in environments with colder climates or regions where maintaining consistent temperature ranges becomes challenging. Fluctuations in temperature can greatly impact its efficiency, negatively affecting its overall reliability and performance.

Safety Considerations, The materials utilized within sodium-sulfur batteries – particularly sodium and sulfur possess reactive properties that require careful handling and management to avoid potential safety risks such as fire risks or leakage of dangerous substances. Mishandling or improper storage could result in mishaps that require stringent protocols and special handling to manage properly, adding complexity to their use.

Limited Adaptability, While sodium-sulfur batteries are ideal for large-scale utility applications due to their high power capabilities, their adaptability in smaller-scale uses or portable devices is limited due to specific size, weight and operating condition requirements which restrict them and make them less suitable.

Lifespan Restrictions, Sodium-sulfur batteries have limited charge and discharge cycles when compared with other battery types, limiting their durability over time and diminishing cost-effectiveness over time. Periodic replacement or refurbishments due to decreased cycle life can increase overall maintenance costs significantly.

Cost and Infrastructure Challenges, To ensure consistent high temperatures for sodium-sulfur batteries requires special infrastructure and significant initial investments, with costs associated with setting up and operating them making them less economically viable – especially for smaller-scale applications.

These limitations collectively hinder the widespread adoption of sodium-sulfur batteries, impacting their feasibility and applicability across industries and applications. Addressing these challenges remains essential to improving accessibility and expanding usage across various sectors.

Opportunities

Modernizing Grids Globally, The push towards modernizing global power grids presents an excellent opportunity for energy storage technologies such as sodium-sulfur batteries. These batteries offer an attractive solution for grid stabilization by helping manage fluctuations between supply and demand, improving reliability, and supporting renewable integration initiatives.

Renewable Energy Integration As the adoption of renewable energy sources such as solar and wind power grows, excess power generated during peak production times must be stored effectively to keep these resources operational. Sodium-sulfur batteries offer an efficient means for efficiently storing this surplus energy as we work towards optimizing use of renewable sources like these batteries more effectively.

Electric Vehicle Development, The expanding electric vehicle market requires advanced and high-performing battery technologies. Sodium-sulfur batteries, known for their high energy density and rapid charging potential, offer promising potential solutions for integration into electric vehicles. Their capacity to store significant energy as well as provide quicker charging solutions positions them as viable options within this emerging industry.

Industrial & Utility Scale Applications, Industries that depend on heavy machinery or utilities require reliable energy storage solutions that can effectively meet their power demands. Sodium-sulfur batteries offer the possibility to meet this industrial-scale energy storage need with their high power capabilities, providing reliable energy storage for heavy machinery as well as meeting large utility demands.

Research & Development, Research and development efforts drive continuous advances and innovations that enhance battery technology. Ongoing R&D that seeks to increase the performance, durability, and cost-effectiveness of sodium-sulfur batteries presents opportunities for further market penetration while innovations in materials or manufacturing processes could make these batteries even more cost-efficient and competitive across various applications.

These opportunities demonstrate the promise of sodium-sulfur batteries to expand their presence across diverse sectors and applications, provided efforts address existing obstacles while prioritizing technological development and market integration.

Challenges

Temperature Sensitivity. Sodium-sulfur batteries function best at higher temperatures, which may present difficulties depending on their environment. Maintaining consistent high temperatures impacts their performance negatively in colder climates requiring additional heating systems that add complexity and cost.

Safety Issues, The materials found in sodium-sulfur batteries – such as sodium and sulfur – pose significant safety hazards if not managed appropriately. Issues such as reactivity, potential leakage or overheating could pose imminent threats that require stringent safety protocols, special handling practices and extensive precautionary measures for their safe handling and use.

Sodium-sulfur batteries excel at utility-scale applications due to their high power capabilities but are less suitable for smaller-scale or portable device use due to specific operating conditions, size and weight constraints that restrict their versatility across applications limiting widespread adoption.

Lifespan Limitations, Sodium-sulfur batteries have a limited number of charge-discharge cycles compared to other battery types, limiting their overall durability. As a result, periodic replacement or refurbishment will likely become necessary, increasing maintenance costs over time and decreasing cost-effectiveness over time.

Cost and Infrastructure Requirements: Maintaining high temperatures required by sodium-sulfur batteries requires significant initial investments and infrastructure investments, along with ongoing costs of maintaining these operating conditions. As these costs add to overall expenses, making smaller-scale applications less economically feasible.

Overcoming these hurdles is key to expanding the usability and market penetration of sodium-sulfur batteries across a variety of industries and applications. Aiming at improving safety, decreasing temperature dependence, lengthening lifespan and cutting costs are among the primary means for surmounting them.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 67.4% in 2023. The region is expected to see substantial growth over the next period. As the Asia Pacific region grows in its investment in power generation, and rural electrification, there will be greater demand for storage batteries.

Japan is the leading country in sodium-sulfur battery use, with more than 170MW installed capacity. The continued industrialization in major economies of the region has meant that there is a growing emphasis on reliable electricity generation and grid stability.

Sodium sulfur batteries are uniformly being used to provide ancillary and frequency-regulated services. The market growth will also be supported by increasing efforts to reduce our carbon footprint by developing renewable energy infrastructure.

Europe is set to see notable growth over the next decade due to the increasing demand for NAS batteries. Technological innovations in terms of cost-effectiveness as well as improved efficiency and product innovation are expected to drive regional market growth. The market is expected to grow due to strict emission regulations by the governments in advanced countries like the U.K. and U.S. as well as increasing focus on fuel efficiency.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Due to the presence and size of major companies, there has been intense competition in the market for sodium-sulfur batteries. This market is mainly focused on business growth.

Market players are now focusing more on developing nations to meet the rising demand for NAS-battery batteries. To expand and consolidate their market share within the industry, market participants are also investing in product design. In 2019, NGK (Basf) announced an expansion of their existing partnership and a joint agreement (JDA), which will allow them to develop next-generation sodium-sulfur batteries. The major players in this sodium-sulfur battery market are

Маrkеt Кеу Рlауеrѕ

- NGK INSULATORS, LTD.

- BASF SE

- Tokyo Electric Power Company Holdings, Inc.

- EaglePicher Technologies

- GE Energy

- FIAMM Group

- KEMET Corporation

- POSCO

- Sieyuan Electric Co., Ltd.

- Other Key Players

Recent Developments

May 2022, Lifespan from GE Electric provides users with an innovative renewable energy digital suite designed to improve performance and operations of renewable assets across their area, while providing critical insight needed to take immediate action within their company.

Report Scope

Report Features Description Market Value (2022) USD 232.2 Mn Forecast Revenue (2032) USD 2323.4 Mn CAGR (2023-2032) 25.9% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Private Portable, Industrial), By Power(Up To 10 MW, 11 MW-25 MW, 2 /6 MW-50 MW, 2Above 50 MW), By Application(Ancillary Services, Load Leveling, Renewable Energy Stabilization, Others), By End-Use(Grid and Standalone Systems, Space, Transport & Heavy Machinery, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape NGK INSULATORS, LTD., BASF SE, Tokyo Electric Power Company Holdings, Inc., EaglePicher Technologies, GE Energy, FIAMM Group, KEMET Corporation, POSCO, Sieyuan Electric Co., Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Sodium-Sulfur Battery Market?Sodium-Sulfur Battery Market size is expected to be worth around USD 2323.4 Mn by 2033, from USD 232.2 Mn in 2023

What is the CAGR for the Sodium-Sulfur Battery Market?The Sodium-Sulfur Battery Market is expected to grow at a CAGR of 25.9% during 2023-2033.Who are the key players in the Sodium-Sulfur Battery Market?NGK INSULATORS, LTD., BASF SE, Tokyo Electric Power Company Holdings, Inc., EaglePicher Technologies, GE Energy, FIAMM Group, KEMET Corporation, POSCO, Sieyuan Electric Co., Ltd., Other Key Players

Sodium-Sulfur Battery MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Sodium-Sulfur Battery MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- NGK INSULATORS, LTD.

- BASF SE

- Tokyo Electric Power Company Holdings, Inc.

- EaglePicher Technologies

- GE Energy

- FIAMM Group

- KEMET Corporation

- POSCO

- Sieyuan Electric Co., Ltd.

- Other Key Players