Global Snack Packaging Machine Market Size, Share, Growth Analysis By Type (Form-Fill-Seal Machines, Flow Wrapping Machines, Vacuum Packaging Machines, Cartoning Machines, Others), By Packaging Type (Flexible, Rigid), By Operation (Automatic, Semi-automatic), By Packaging Material (Plastic, Paper & Paperboard, Metal, Others), By Application (Bakery Products, Confectionery, Savory Snacks, Nuts & Dried Fruits, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156106

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

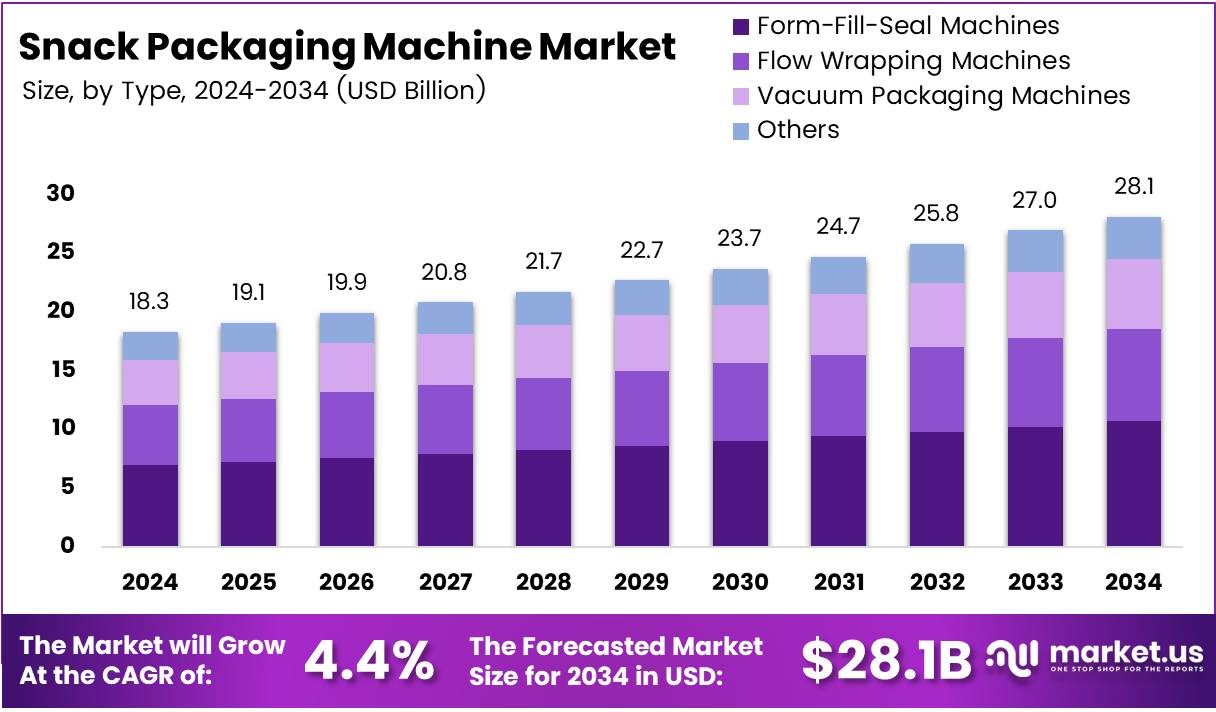

The Global Snack Packaging Machine Market size is expected to be worth around USD 28.1 Billion by 2034, from USD 18.3 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

The snack packaging machine market is a rapidly evolving sector driven by the increasing demand for efficiency and automation in the food industry. As consumer preferences shift toward convenience and variety, snack manufacturers are adopting advanced packaging technologies to enhance production speed and ensure product quality. This trend is especially prominent in the snack segment, which requires efficient, high-speed packaging systems.

Growth in the snack packaging machine market can be attributed to technological advancements in automation. Automation allows snack manufacturers to meet the growing demand for consistent, high-quality products while reducing labor costs. Packaging machinery that integrates automation also minimizes human error, thereby boosting the production process. Moreover, these machines can handle a wide range of products, including chips, popcorn, and nuts, which further supports market growth.

Furthermore, the market presents significant opportunities for both established and emerging players. As the industry faces labor shortages, automated packaging machines are becoming more essential in maintaining production continuity. The increased demand for packaged snacks globally offers an excellent opportunity for manufacturers to invest in innovative packaging solutions. Companies are focusing on introducing machines with versatile functions to cater to the diverse needs of the snack industry.

Government investment in automation technology and food safety standards plays a crucial role in market growth. Governments are increasingly focusing on policies to streamline manufacturing processes and improve packaging standards. Regulations that ensure the safety and quality of packaged food products contribute to market expansion, creating a favorable environment for manufacturers.

According to a recent survey, most automated packaging machines can produce anywhere from 20 to 200 bags per minute. This capability allows manufacturers to scale production to meet consumer demands more efficiently. Additionally, by 2025, more than 70% of packaging units are expected to shift to some form of automation due to factors like labor shortages and the increasing need for faster, consistent packaging. These statistics highlight the industry’s shift towards automation and its potential for continued growth.

Key Takeaways

- The Global Snack Packaging Machine Market is expected to reach USD 28.1 Billion by 2034, growing at a CAGR of 4.4% from 2025 to 2034.

- Form-Fill-Seal (FFS) Machines lead the By Type Analysis segment with a 38.2% market share in 2024.

- Flexible packaging holds a dominant position in the By Packaging Type segment, capturing 78.1% of the market in 2024.

- Automatic operation dominates the By Operation Analysis segment with a 72.9% share in 2024.

- Plastic is the leading material in the By Packaging Material segment, holding 63.3% of the market share in 2024.

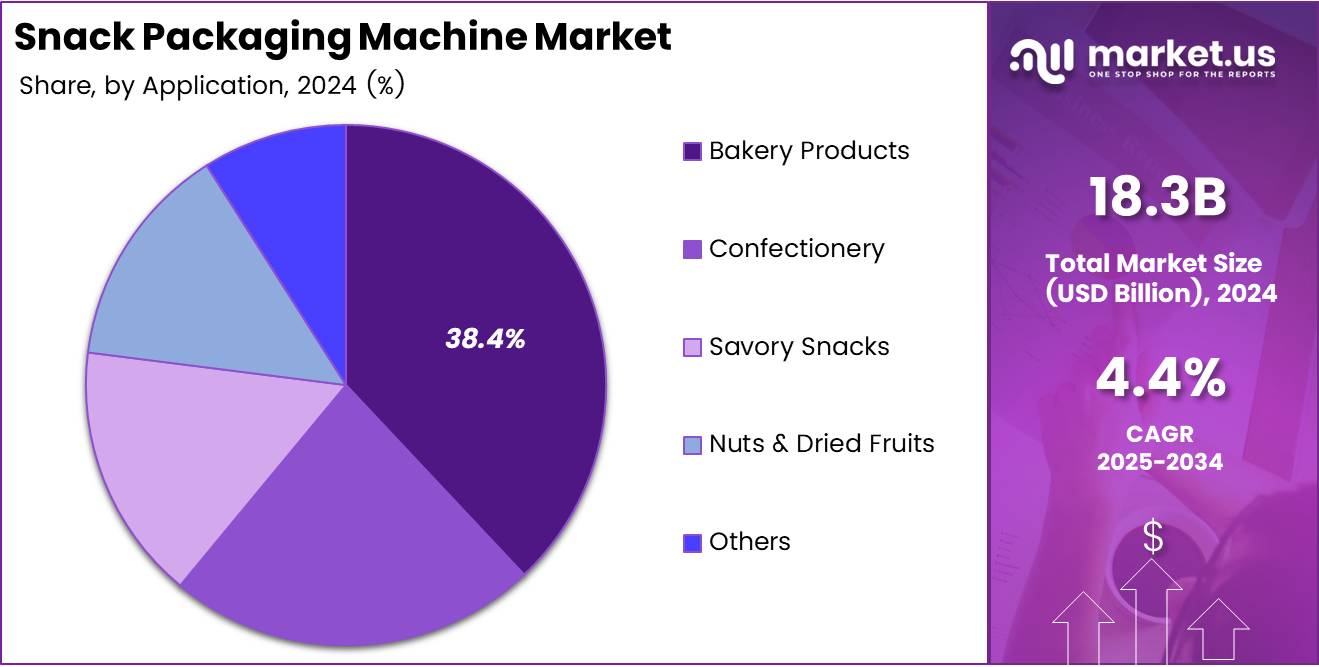

- Bakery Products account for the largest share in the By Application Analysis segment, with a 38.4% market share in 2024.

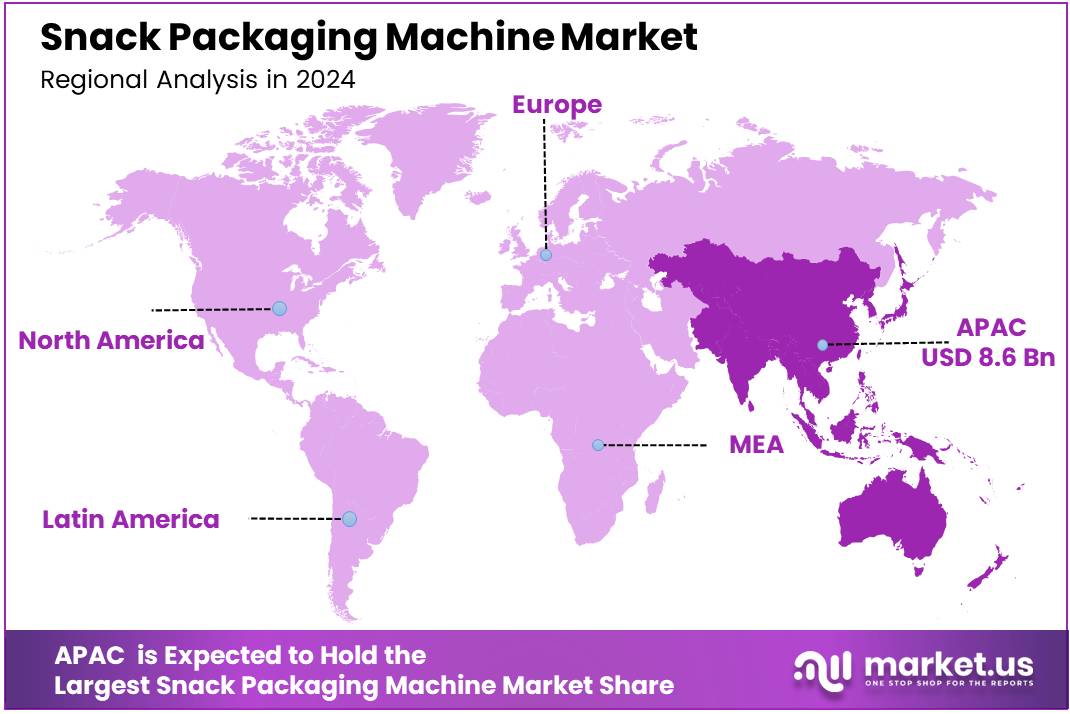

- Asia Pacific dominates the Snack Packaging Machine Market, holding 47.2% of the market, valued at USD 8.6 Billion in 2024.

Type Analysis

Form-Fill-Seal (FFS) Machines dominate with 38.2% due to their versatility and efficiency in high-volume production.

In 2024, Form-Fill-Seal (FFS) Machines held a dominant market position in By Type Analysis segment of Snack Packaging Machine Market, with a 38.2% share. This leadership position stems from their ability to create packages from roll stock material while simultaneously filling and sealing them in one continuous operation.

Flow Wrapping Machines represent a significant portion of the market, offering excellent barrier properties and visual appeal for snack products. These machines are particularly favored for individually wrapped items like granola bars and cookies.

Vacuum Packaging Machines serve specialized segments requiring extended shelf life and premium presentation. Their adoption is growing among manufacturers focusing on premium snack categories.

Cartoning Machines maintain steady demand for secondary packaging applications, particularly in retail-ready formats. The Others category encompasses specialized equipment for niche applications and emerging packaging technologies that continue to evolve with changing consumer preferences.

Packaging Type Analysis

Flexible packaging dominates with 78.1% due to its cost-effectiveness and consumer convenience.

In 2024, Flexible held a dominant market position in By Packaging Type Analysis segment of Snack Packaging Machine Market, with a 78.1% share. This overwhelming preference reflects the fundamental advantages of flexible packaging in the snack industry.

Flexible packaging offers superior cost efficiency compared to rigid alternatives, requiring less material and storage space while providing excellent barrier properties. The lightweight nature of flexible materials reduces transportation costs and environmental impact, aligning with sustainability trends.

Consumer convenience drives much of this preference, as flexible packages are easier to open, reseal, and dispose of. The format allows for innovative features like resealable zippers and portion control designs that enhance user experience.

Rigid packaging maintains a significant presence in premium segments and specific product categories that require structural protection. However, the market increasingly favors flexible solutions due to their adaptability, cost advantages, and alignment with modern consumer lifestyle demands in the rapidly evolving snack market.

Operation Analysis

Automatic systems dominate with 72.9% due to their superior efficiency and reduced labor costs.

In 2024, Automatic held a dominant market position in By Operation Analysis segment of Snack Packaging Machine Market, with a 72.9% share. This substantial dominance reflects the industry’s shift toward high-efficiency, labor-optimized production systems.

Automatic packaging machines deliver consistent output rates and quality standards that manual processes cannot match. They minimize human error while maximizing throughput, making them essential for large-scale snack manufacturers operating in competitive markets.

The technology integration in automatic systems enables real-time monitoring, predictive maintenance, and seamless integration with existing production lines. These capabilities reduce operational costs and improve overall equipment effectiveness.

Semi-automatic systems primarily serving smaller manufacturers and specialized applications where flexibility outweighs pure volume requirements. These systems offer a balanced approach for companies transitioning from manual operations or handling diverse product lines with varying packaging requirements.

The trend toward automation continues accelerating as labor costs rise and efficiency demands increase across the snack packaging industry.

Packaging Material Analysis

Plastic materials dominate with 63.3% due to their versatility and excellent barrier properties.

In 2024, Plastic held a dominant market position in By Packaging Material Analysis segment of Snack Packaging Machine Market, with a 63.3% share. This dominance reflects plastic’s superior performance characteristics and adaptability across diverse snack categories.

Plastic materials provide exceptional moisture and oxygen barrier properties essential for maintaining snack freshness and extending shelf life. Their flexibility enables innovative package designs while offering cost-effective production at scale.

Paper and Paperboard segments continue growing as sustainability concerns drive demand for recyclable and biodegradable packaging solutions. These materials appeal to environmentally conscious consumers and brands seeking to reduce plastic usage.

Metal packaging serves specialized applications requiring maximum barrier protection, particularly for premium products and extended shelf-life requirements. The Others category encompasses emerging sustainable materials and innovative composites.

Despite environmental pressures, plastic’s technical advantages in food safety, product protection, and manufacturing efficiency maintain its market leadership. However, the industry increasingly focuses on developing recyclable plastic solutions and reducing overall material usage to address sustainability concerns.

Application Analysis

Bakery Products dominate with 38.4% due to their widespread consumption and diverse packaging requirements.

In 2024, Bakery Products held a dominant market position in By Application Analysis segment of Snack Packaging Machine Market, with a 38.4% share. This leadership position reflects the massive global consumption of baked goods and their diverse packaging needs across different product categories.

Bakery products require sophisticated packaging solutions to maintain freshness, prevent contamination, and extend shelf life. From individual cookies to multi-pack offerings, this segment demands versatile machinery capable of handling various sizes, shapes, and packaging formats.

Confectionery represents a significant market segment, requiring specialized equipment for delicate products that need protection from moisture and temperature variations. The visual appeal factor in confectionery packaging drives demand for advanced wrapping technologies.

Savory Snacks continue growing rapidly, fueled by changing consumer preferences and snacking habits. This category requires robust packaging solutions for products like chips, crackers, and extruded snacks.

Nuts and Dried Fruits segment benefits from health-conscious consumer trends, requiring packaging that preserves nutritional value and prevents rancidity. The Others category encompasses emerging snack categories and specialty products driving innovation in packaging technology.

Key Market Segments

By Type

- Form-Fill-Seal (FFS) Machines

- Flow Wrapping Machines

- Vacuum Packaging Machines

- Cartoning Machines

- Others

By Packaging Type

- Flexible

- Rigid

By Operation

- Automatic

- Semi-automatic

By Packaging Material

- Plastic

- Paper & Paperboard

- Metal

- Others

By Application

- Bakery Products

- Confectionery

- Savory Snacks

- Nuts & Dried Fruits

- Others

Drivers

Rising Demand for Convenient Snack Products Drives Market Growth

The snack packaging machine market is experiencing strong growth due to several key factors. Modern consumers increasingly prefer ready-to-eat snack products that fit their busy lifestyles. This shift toward convenience foods has created higher demand for efficient packaging machinery that can handle various snack formats quickly and reliably.

Automation is becoming essential in snack packaging operations. Companies are investing in advanced packaging systems that reduce manual labor, increase production speed, and ensure consistent quality. These automated solutions help manufacturers meet growing consumer demand while maintaining cost-effectiveness and operational efficiency.

Environmental consciousness is also shaping the market. Consumers now prefer eco-friendly and sustainable packaging options for their snack purchases. This trend is pushing packaging machine manufacturers to develop equipment that can work with biodegradable materials, recyclable films, and other environmentally responsible packaging solutions.

Restraints

Stringent Regulatory Compliance Creates Market Challenges

The snack packaging machine market faces several significant restraints that impact growth potential. Regulatory compliance requirements for packaging materials have become increasingly strict across different regions. Manufacturers must ensure their equipment meets food safety standards, labeling requirements, and material specifications, which adds complexity and costs to operations.

Raw material price fluctuations present ongoing challenges for the industry. The cost of packaging films, containers, and other materials can vary significantly due to market conditions, affecting overall production costs and profitability for snack manufacturers using these packaging systems.

Small snack brands often struggle with operational challenges in high-volume production environments. Limited resources and smaller production runs make it difficult for these companies to justify investments in advanced packaging machinery, creating barriers to market entry and expansion.

Growth Factors

Integration of Smart Packaging Features Creates New Growth Opportunities

The snack packaging machine market presents exciting growth opportunities through technological advancement and changing consumer preferences. Smart packaging features are becoming increasingly popular, offering enhanced consumer engagement through interactive elements, freshness indicators, and digital connectivity options that provide additional value beyond basic product protection.

Health-conscious consumers are driving demand for specialized packaging solutions. As more people seek nutritious snack alternatives, there’s growing need for packaging machinery that can handle organic, protein-rich, and functional snack products while maintaining their nutritional integrity and shelf life.

Multi-pack snack packaging formats are gaining popularity among consumers who value convenience and portion control. This trend creates opportunities for manufacturers to develop packaging machines that can efficiently create variety packs, family-size portions, and individual serving combinations that meet diverse consumer preferences and shopping habits.

Emerging Trends

Growing Online Snack Sales Drive Packaging Innovation Trends

Several trending factors are reshaping the snack packaging machine market landscape. The explosive growth of online snack sales is driving significant packaging innovation. E-commerce requires packaging solutions that protect products during shipping, create attractive unboxing experiences, and maintain product freshness throughout the delivery process.

Digital technology integration is transforming packaging design approaches. Augmented reality features and interactive digital elements are being incorporated into snack packaging, requiring specialized machinery that can apply these advanced technologies while maintaining production efficiency and cost-effectiveness.

Plant-based and vegan snack options are rapidly gaining market share, creating demand for specialized packaging solutions. These products often require unique barrier properties, extended shelf life capabilities, and specific material compositions that necessitate adapted packaging machinery to handle their distinct requirements effectively.

Regional Analysis

Asia Pacific Dominates the Snack Packaging Machine Market with a Market Share of 47.2%, Valued at USD 8.6 Billion

In 2024, Asia Pacific held a dominant position in the Snack Packaging Machine Market, capturing 47.2% of the market share, valued at USD 8.6 Billion. This dominance is primarily driven by the region’s expanding food processing industries, robust manufacturing capabilities, and increasing demand for packaged snack products across emerging economies such as China and India.

North America Snack Packaging Machine Market Trends

In 2024, North America accounted for a significant share of the Snack Packaging Machine Market. The region’s strong demand for convenience food, coupled with advancements in packaging technologies, has led to continuous market growth. This demand is fueled by the region’s large-scale snack manufacturers and high consumer spending on packaged food products.

Europe Snack Packaging Machine Market Trends

Europe is a prominent market for snack packaging machines, driven by stringent food safety regulations and a growing trend toward sustainable packaging solutions. The region’s established snack industry, combined with consumer demand for eco-friendly packaging, has contributed to steady growth in this segment.

Middle East and Africa Snack Packaging Machine Market Trends

In 2024, the Snack Packaging Machine Market in the Middle East and Africa is expected to experience moderate growth. The region’s expanding snack consumption, coupled with increasing investments in food processing infrastructure, is likely to drive demand for efficient and cost-effective packaging solutions in the coming years.

Latin America Snack Packaging Machine Market Trends

Latin America is anticipated to see steady growth in the Snack Packaging Machine Market, supported by the increasing preference for packaged snacks and the growth of food processing industries in key countries like Brazil and Mexico. However, challenges like economic fluctuations and infrastructure limitations may influence market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Snack Packaging Machine Company Insights

In 2024, Aetna Group is poised to maintain its strong position in the global snack packaging machine market due to its continuous focus on developing innovative solutions that meet the rising demand for high-quality, efficient packaging systems. The company’s emphasis on automation and sustainability positions it as a key player in the evolving packaging industry.

CHLB Pack stands out for its ability to cater to the growing trend of flexible and sustainable snack packaging. Known for its versatile range of packaging machines, CHLB Pack is expected to leverage its expertise in customizing solutions for diverse market needs, providing a competitive edge in the snack packaging sector.

Coesia Group is anticipated to remain a major force in the snack packaging machine market, with its well-established portfolio of advanced packaging technologies. The company’s strong market presence and innovative solutions are driving demand, particularly in industries requiring high-speed packaging and precision.

Fuji Machinery is recognized for its robust packaging machinery designed for flexibility and reliability, offering high-performance solutions tailored to the snack food sector. The company’s focus on automation and technological advancements in packaging machinery ensures its continued relevance in a competitive market.

These companies are expected to dominate the snack packaging machine market by consistently introducing state-of-the-art technology, emphasizing automation, and responding to the evolving demands for sustainability in packaging solutions.

Top Key Players in the Market

- Aetna Group

- CHLB Pack

- Coesia Group

- Fuji Machinery

- IMA Group

- Ishida

- Krones

- Marchesini Group

- MULTIVAC Group

- Nichrome Packaging Solutions

Recent Developments

- In Feb 2025, TIPA unveiled the world’s first advanced metallised high-barrier film designed specifically for snacks, offering enhanced protection and extended shelf life for products.

- In Apr 2024, PepsiCo introduced paper outer bags for Snack A Jacks multipacks, marking a significant step toward sustainable packaging by reducing plastic use.

- In May 2025, KIND launched a fully recyclable paper wrapper, pioneering a new era in snack packaging with an eco-friendly solution aimed at reducing environmental impact.

- In May 2024, ATS announced its decision to acquire Paxiom, a packaging machine provider, enhancing its capabilities and expanding its portfolio in the packaging machinery industry.

- In Jan 2025, Ferrero Group acquired protein snack company Power Crunch, further diversifying its product offerings and solidifying its position in the growing protein snack market.

- In Aug 2024, Pakka Limited successfully raised Rs 2.44 billion in funds, which will be utilized to double the company’s production capacity to meet growing market demands.

Report Scope

Report Features Description Market Value (2024) USD 18.3 Billion Forecast Revenue (2034) USD 28.1 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Form-Fill-Seal (FFS) Machines, Flow Wrapping Machines, Vacuum Packaging Machines, Cartoning Machines, Others), By Packaging Type (Flexible, Rigid), By Operation (Automatic, Semi-automatic), By Packaging Material (Plastic, Paper & Paperboard, Metal, Others), By Application (Bakery Products, Confectionery, Savory Snacks, Nuts & Dried Fruits, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Aetna Group, CHLB Pack, Coesia Group, Fuji Machinery, IMA Group, Ishida, Krones, Marchesini Group, MULTIVAC Group, Nichrome Packaging Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Snack Packaging Machine MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Snack Packaging Machine MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aetna Group

- CHLB Pack

- Coesia Group

- Fuji Machinery

- IMA Group

- Ishida

- Krones

- Marchesini Group

- MULTIVAC Group

- Nichrome Packaging Solutions