Global Smartphone Display Market Size, Share, Trends Analysis Report By Display Type (LCD (Liquid Crystal Display), OLED (Organic Light Emitting Diode), AMOLED (Active Matrix OLED), Other Display Types), By Screen Size (Below 5 inches, 5 to 6 inches, Above 6 inches), By Display Resolution (720 x 1280, 1080 x 1920, 1440 x 2560, Other Display Resolutions), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Growth and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132389

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

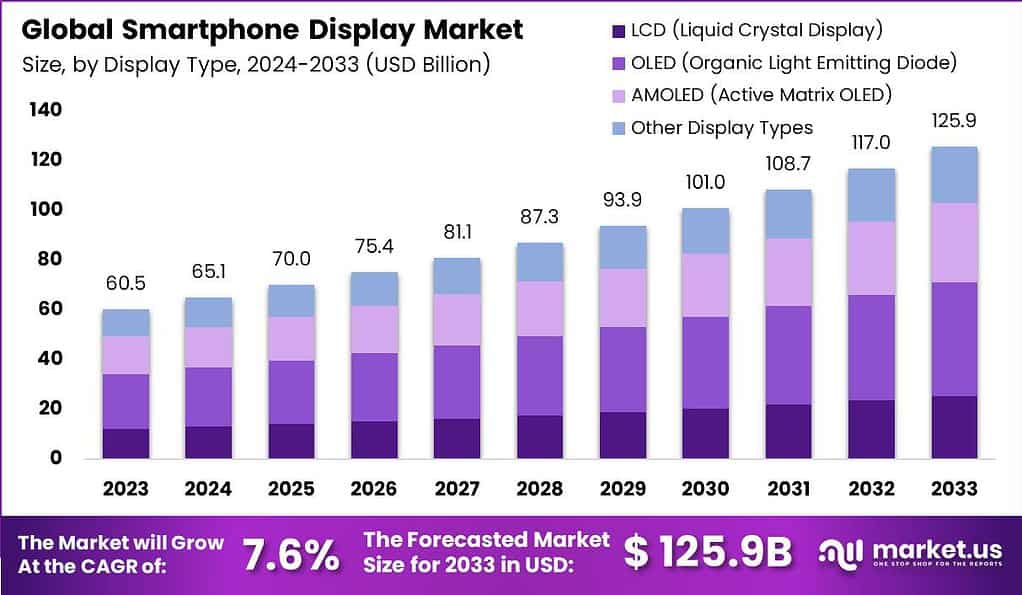

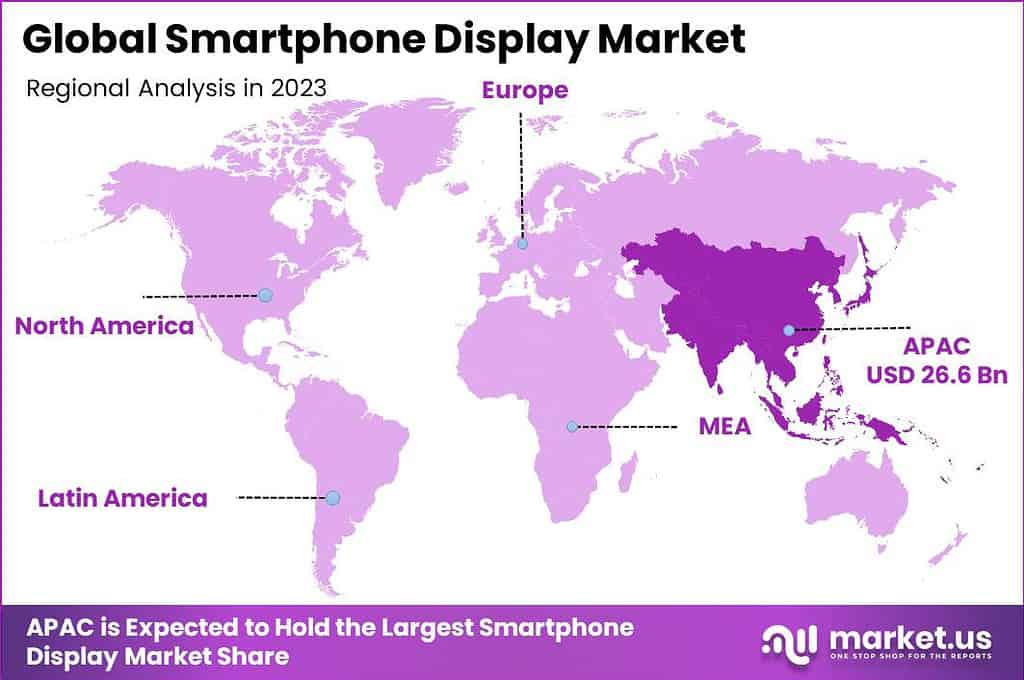

The Global Smartphone Display Market size is expected to be worth around USD 125.9 Billion By 2033, from USD 60.5 Billion in 2023, growing at a CAGR of 7.60% during the forecast period from 2024 to 2033. In 2023, Asia-Pacific led the market, accounting for over 43.9% of the share and generating a substantial revenue of USD 26.6 billion.

A smartphone display is a crucial component of a mobile device, providing the interface through which users interact with their applications and content. These displays are primarily based on two key technologies: OLED and LCD. OLED screens are known for their vibrant colors and deep blacks, to their ability to individually light up pixels, allowing for more dynamic contrast and thinner devices. LCDs, however, are generally more cost-effective and offer more brightness.

The smartphone display market refers to the industry involved in designing, manufacturing, and selling the screens used in smartphones. This market has grown significantly due to the constant demand for smartphones globally. As technology advances, the quality and functionalities of smartphone displays have become major selling points for manufacturers.

The major driving factors of the smartphone display market include the increasing adoption of smartphones worldwide and the consumer demand for higher resolution and larger screens. Additionally, the shift towards OLED and AMOLED displays, which offer better color contrast and are thinner than traditional LCDs, fuels market growth. Innovations in touchscreen technology and energy-efficient displays also play crucial roles in driving this market forward.

The market is propelled by several factors including the adoption of OLED technology, which allows for flexible, thinner, and more energy-efficient screens. Additionally, the rising consumption of multimedia content on mobile devices, such as video streaming and mobile gaming, is pushing the demand for higher quality displays.

Trends like work-from-home and online education have also increased smartphone usage, further boosting the demand for better smartphone displays. The demand for smartphone displays is continuously growing, with particular interest in OLED and foldable technologies which offer superior color reproduction and flexibility for new device form factors.

There is also an increasing interest in adopting low-temperature polycrystalline oxide (LTPO) technology, which allows dynamic screen refresh rates, reducing power consumption while offering high display performance. Technological advancements in the smartphone display sector include the development of foldable and rollable displays, which are set to transform the smartphone form factor entirely.

Innovations in display materials and manufacturing processes are enabling these advancements, alongside improvements in display longevity and energy efficiency. Companies are also exploring the integration of in-display fingerprint sensors and under-display cameras, which could open up new aesthetic and functional possibilities for smartphones.

Key Takeaways

- The Global Smartphone Display Market is expected to reach USD 125.9 billion by 2033, growing from USD 60.5 billion in 2023, at a compound annual growth rate (CAGR) of 7.60% during the forecast period from 2024 to 2033.

- In 2023, the OLED (Organic Light Emitting Diode) segment dominated the smartphone display market, capturing more than 36.5% of the market share.

- The 5 to 6 inches segment held a dominant position in the smartphone display market in 2023, accounting for more than 52.4% of the market share.

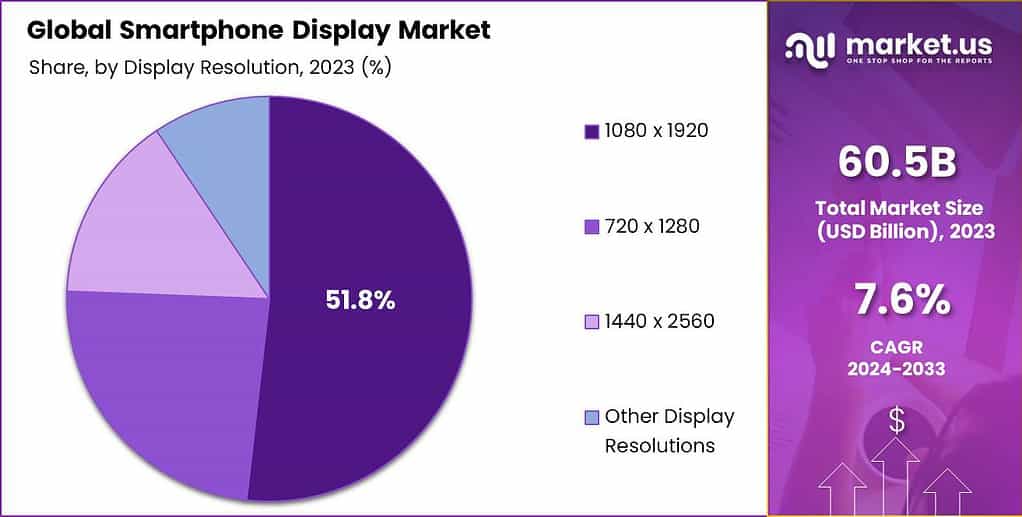

- In 2023, the 1080 x 1920 display resolution segment led the smartphone display market, capturing more than 51.8% of the market share.

- Asia-Pacific held a dominant position in the smartphone display market in 2023, capturing over 43.9% of the market share, with a significant revenue of USD 26.6 billion.

Display Type Analysis

In 2023, the OLED (Organic Light Emitting Diode) segment held a dominant market position in the smartphone display sector, capturing more than a 36.5% share. This dominance can be attributed primarily to the superior display qualities that OLED technology offers, such as deeper blacks, higher contrast ratios, and more vibrant colors compared to other display types.

OLED screens do not require a backlight, which not only helps in making devices slimmer but also enhances their energy efficiency since each pixel emits its own light only when active. The growing consumer preference for better visual experiences on mobile devices has significantly driven the adoption of OLED displays.

High-end smartphones particularly favor OLED for their ability to support advanced display features like true infinite contrast, better viewing angles, and faster refresh rates which are crucial for gaming and high-quality video streaming. These attributes have made OLED displays highly popular among premium smartphones, contributing to their large market share.

Moreover, technological advancements have enabled the development of flexible OLED displays, which are used in the latest foldable and curved smartphones. This innovation has opened new avenues for mobile device design, allowing manufacturers to offer products that stand out in a crowded market. As the technology continues to evolve and scale, the cost of OLED production is gradually decreasing, making it more accessible for mid-range smartphones as well, which is likely to further bolster the growth of this segment in the display market.

Screen Size Analysis

In 2023, the 5 to 6 inches segment held a dominant market position in the smartphone display market, capturing more than a 52.4% share. This segment’s prominence is largely due to the balance these screen sizes offer between usability and portability, which appeals to the widest consumer base.

Screens in this range provide sufficient space for comfortable viewing of videos, gaming, and using apps, without compromising on the ease of handling and carrying the device. This size is ideal for most users looking for a phone that fits easily in the hand or pocket, making it a popular choice for everyday use.

The preference for 5 to 6 inches screens can also be attributed to their compatibility with current design trends and consumer expectations for multifunctional devices. These displays are large enough to allow for immersive media consumption and gaming, yet small enough to not deter extensive daily use, including texting and browsing. The majority of flagship models from leading manufacturers typically fall within this size range, reinforcing its popularity and driving sales.

Furthermore, this segment benefits from the widespread adoption of advanced display technologies like OLED and AMOLED, which are often scaled to this size to optimize visual quality and battery efficiency. As smartphone manufacturers continue to push for bezel-less designs, the 5 to 6 inches displays have become even more prevalent, providing larger usable screen area without increasing the overall size of the phone. This trend supports the continued growth and consumer preference for this segment of the smartphone display market.

Display Resolution Analysis

In 2023, the 1080 x 1920 display resolution segment held a dominant market position in the smartphone display market, capturing more than a 51.8% share. This resolution, also known as Full HD, has become the standard among mid-range to high-end smartphones due to its optimal balance between sharp image quality and power efficiency.

Full HD provides a clear and detailed viewing experience that enhances user interaction with multimedia content, gaming, and reading, making it highly preferred by both consumers and manufacturers. The popularity of 1080 x 1920 resolution is also bolstered by its compatibility with a wide range of media content available online, including streaming videos, games, and digital publications that are typically optimized for this resolution.

This compatibility ensures that users experience minimal scaling issues and get the most out of their device’s multimedia capabilities, which is a key selling point for consumer retention. Moreover, while higher resolutions such as 1440 x 2560 offer more pixels, they also consume more battery life and may require more powerful hardware to run smoothly, which can increase the cost of devices.

In contrast, 1080 x 1920 displays strike an excellent compromise between cost, performance, and battery efficiency, appealing to a broad audience seeking high-quality displays without significant trade-offs. This segment’s strong market presence is supported by its widespread adoption across various smartphone models and price points, driving its substantial market share.

Key Market Segments

By Display Type

- LCD (Liquid Crystal Display)

- OLED (Organic Light Emitting Diode)

- AMOLED (Active Matrix OLED)Other Display Types

By Screen Size

- Below 5 inches

- 5 to 6 inches

- Above 6 inches

By Display Resolution

- 720 x 1280

- 1080 x 1920

- 1440 x 2560

- Other Display Resolutions

Driver

Rising Demand for OLED and Flexible Displays

One major driver of the smartphone display market is the increasing demand for OLED (Organic Light-Emitting Diode) and flexible displays. The rapid evolution of consumer preferences has transformed how smartphone displays are perceived.

Flexible displays have added a new dimension to the market. Foldable smartphones are gaining traction as they offer a blend of portability and large screen sizes, appealing to multitasking users and tech enthusiasts alike. Companies led innovations in this space, sparking a wave of interest and further research and development investment.

Moreover, the demand for high refresh rates, such as 90Hz and 120Hz displays, enhances user interaction by delivering smoother scrolling, gaming, and video playback. As content consumption on smartphones continues to grow, this focus on display quality will drive the adoption of advanced technologies, boosting growth in the display market.

Restraint

Manufacturing Costs and Complexities

Despite the excitement around cutting-edge smartphone displays, one significant restraint is their high manufacturing costs and production complexities. Creating advanced display panels, such as OLED, flexible, or micro-LED displays, requires intricate processes, precision engineering, and costly materials.

Flexible displays, though innovative, further amplify these challenges. The production process must accommodate unique design features like foldability or rollability while maintaining durability, display quality, and consistent performance. Even minor defects in these displays can render entire panels unusable, further increasing wastage and production costs.

Opportunity

Growth in 5G-Enabled Smartphones

The global rollout of 5G networks presents a significant opportunity for the smartphone display market. As the adoption of 5G technology accelerates, consumers are increasingly upgrading their devices to leverage the speed, reliability, and low latency that 5G networks offer.

5G-enabled smartphones necessitate high-resolution displays, faster refresh rates, and low latency to deliver seamless content consumption experiences. This growing demand aligns perfectly with manufacturers’ focus on developing and commercializing advanced displays such as OLED, AMOLED, and high-refresh-rate screens.

Emerging markets are also witnessing a surge in 5G smartphone adoption, creating growth opportunities for display manufacturers targeting different price segments. Affordable yet high-quality display options can appeal to a broader customer base, bridging the gap between premium and budget devices.

Challenge

Environmental Impact and E-Waste Management

One of the pressing challenges faced by the smartphone display market is the environmental impact associated with the disposal and recycling of displays, contributing to e-waste. Modern displays often contain materials like heavy metals, rare earth elements, and hazardous substances that can pose significant environmental risks if not disposed of properly.

Recycling advanced displays is often complicated and cost-intensive. OLED and flexible displays, for instance, consist of multiple layers of organic compounds, adhesives, and protective coatings that are challenging to separate and process for recycling. Additionally, the technology and infrastructure for effectively recycling these materials are still in their nascent stages in many regions, leading to inadequate disposal practices and increased landfill waste.

Emerging Trends

The smartphone display market is undergoing significant transformations, driven by technological advancements and evolving consumer preferences. A notable trend is the widespread adoption of Organic Light-Emitting Diode (OLED) technology. OLED displays offer vibrant colors, deeper blacks, and improved energy efficiency compared to traditional Liquid Crystal Displays (LCDs).

Another emerging trend is the development of foldable and flexible displays. Companies like Huawei have introduced innovative devices such as the Mate XT, the world’s first trifold mobile phone, capturing significant consumer interest despite premium pricing.

High refresh rate displays are also gaining popularity, particularly among gaming enthusiasts. Displays with refresh rates of 90Hz or higher provide smoother visuals, enhancing the gaming and video viewing experience. This trend aligns with the increasing use of smartphones for entertainment purposes.

Business Benefits

Incorporating advanced smartphone displays into business operations offers several advantages. High-resolution and larger screens enhance productivity by providing clearer visuals and more workspace, facilitating tasks such as document editing and data analysis.

Enhanced displays also improve communication and collaboration. Interactive displays allow multiple users to engage simultaneously, fostering teamwork and real-time feedback. This capability is particularly beneficial in remote work settings, where maintaining engagement and connectivity is crucial.

Moreover, advanced displays contribute to better customer service. Mobile technology enables efficient, personalized, and convenient shopping experiences, benefiting retailers’ bottom lines. For example, mobile apps can assist in locating items, providing customer service, and simplifying checkout processes.

The integration of biometric technologies within displays enhances security measures, protecting sensitive business information. Features like in-display fingerprint sensors and facial recognition provide secure access to devices and applications, reducing the risk of unauthorized access.

Regional Analysis

In 2023, Asia-Pacific held a dominant market position, capturing more than a 43.9% share, with a significant revenue of USD 26.6 billion. This leading position is attributed to the region’s strong manufacturing ecosystem, which serves as a global hub for smartphone production and assembly.

Countries like China, South Korea, and Japan have established themselves as key suppliers of advanced display technologies, including OLED and AMOLED screens. Additionally, the region benefits from the presence of major players such as Samsung Display, BOE Technology, and LG Display, who continuously innovate to meet global demand for high-resolution, energy-efficient displays.

Asia-Pacific’s leadership in the smartphone display market is further driven by its rapidly growing consumer base. Emerging markets such as India, Indonesia, and Vietnam have witnessed a surge in smartphone adoption due to increasing disposable incomes and expanding middle-class populations. This has resulted in high demand for budget and mid-range smartphones with premium display features, boosting market growth.

In contrast, North America captured a substantial share of the market, primarily driven by demand for high-end smartphones featuring advanced display technologies such as foldable and 120Hz refresh rate screens. The presence of tech-savvy consumers and leading brands like Apple also plays a significant role in driving innovation.

Europe, with a mature smartphone market, focuses on premium and sustainable display technologies, while Latin America and the Middle East & Africa markets are characterized by increasing smartphone penetration, creating opportunities for mid-range displays to cater to a diverse range of consumer needs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the global smartphone display market, Samsung Electronics Co., Ltd. stands out as a key leader, known for its advanced display technology and innovation. Samsung’s dominance stems from its pioneering work in OLED and AMOLED displays, which are widely used across flagship and premium smartphone models.

LG Display Co., Ltd. is another major player in the smartphone display market, recognized for its expertise in producing high-quality OLED panels. LG Display has played a crucial role in the transition from traditional LCD screens to OLED technology, offering superior contrast, deeper blacks, and energy efficiency.

BOE Technology Group Co., Ltd. has emerged as a significant competitor in the smartphone display market, particularly in recent years. BOE is known for its large-scale production of OLED panels, meeting global demand across. The company has expanded its market share by collaborating with top smartphone brands and continuously improving display performance, including resolution, brightness, and durability.

Top Key Players in the Market

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- Sharp Corporation

- Sony Corporation

- HannStar Display Corporation

- Visionox

- Tianma Microelectronics Co., Ltd.

- Other Key Players

Recent Developments

- January 2024: Visionox began operations at its new flexible AMOLED module production line in Hefei, targeting wearables, mobile devices, IT, and automotive displays, with an annual capacity of 26 million units.

- September 2024: LG Display Co., Ltd. agreed to sell its stake in a large LCD plant in Guangzhou, China, to TCL’s CSOT for approximately $1.54 billion. This move aims to focus LG Display’s efforts on its OLED operations.

- September 2024: Reports indicated that Apple plans to switch to OLED displays for all iPhone models by 2025, which may impact Sharp’s supply of LCDs for iPhones.

- November 2024: BOE and Nubia have unveiled an innovative under-display camera for the Red Magic 10 Pro gaming smartphone. Featuring a 95.3% screen-to-body ratio, the device boasts a 6.85-inch OLED display with a 1220p resolution, branded as a “1.5K true screen.”

Report Scope

Report Features Description Market Value (2023) USD 60.5 Bn Forecast Revenue (2033) USD 125.9 Bn CAGR (2024-2033) 7.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Display Type (LCD (Liquid Crystal Display), OLED (Organic Light Emitting Diode), AMOLED (Active Matrix OLED), Other Display Types), By Screen Size (Below 5 inches, 5 to 6 inches, Above 6 inches), By Display Resolution (720 x 1280, 1080 x 1920, 1440 x 2560, Other Display Resolutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics Co., Ltd., LG Display Co., Ltd., BOE Technology Group Co., Ltd., Sharp Corporation, Sony Corporation, HannStar Display Corporation, Visionox, Tianma Microelectronics Co., Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smartphone Display MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Smartphone Display MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- Sharp Corporation

- Sony Corporation

- HannStar Display Corporation

- Visionox

- Tianma Microelectronics Co., Ltd.

- Other Key Players