Global Smartphone App Developers Market Size, Share, Industry Analysis Report By Platform (Android, iOS), By App Store (Google Play Store, Apple App Store), By Application Type (Gaming, Media & Entertainment, E-commerce, Banking & Finance (BFSI), Health & Fitness, Education, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158442

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Government-Led Investments

- Investment and Business benefits

- By Platform

- By App Store

- By Application Type

- Key Trends

- Growth Drivers

- Key Market Segments

- By Region: Asia Pacific

- By Country: China

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

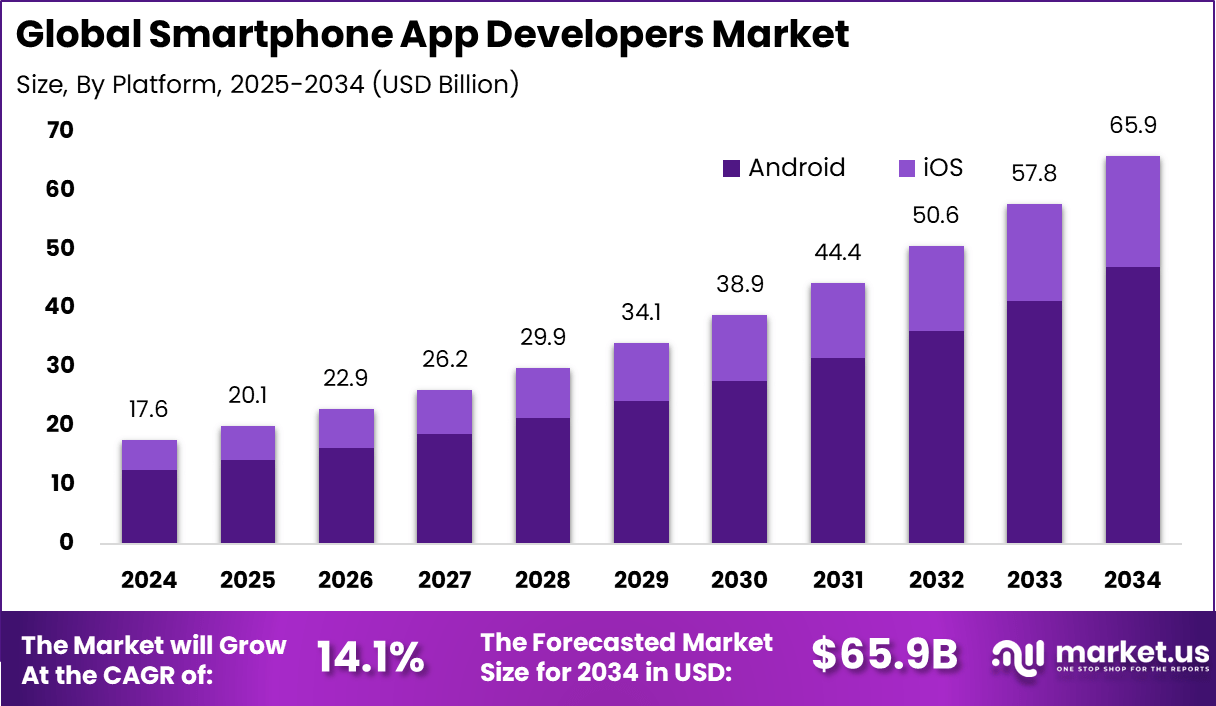

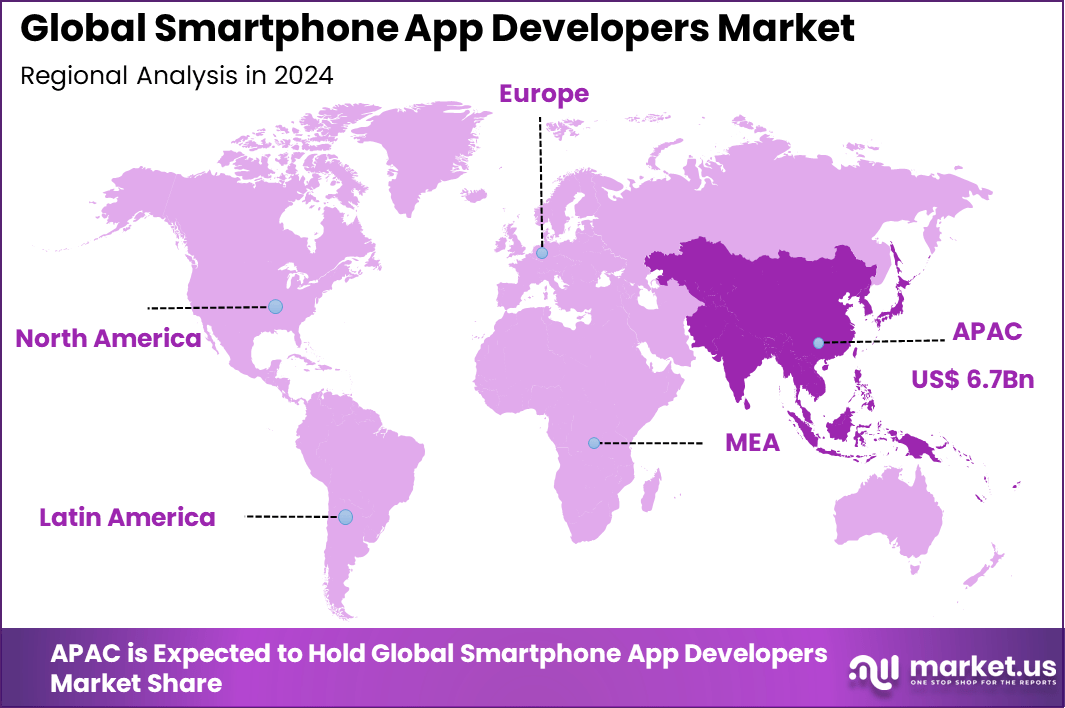

The Global Smartphone App Developers Market size is expected to be worth around USD 65.9 Billion By 2034, from USD 17.6 billion in 2024, growing at a CAGR of 14.1% during the forecast period from 2025 to 2034. In 2024, APAC held a dominan market position, capturing more than a 38.41% share, holding USD 6.7 Billion revenue.

The smartphone app developers market is growing rapidly due to the widespread use of mobile devices and increasing internet penetration. In 2024, the world had nearly 4.9 billion smartphone users, and by early 2025, there were over 2 million apps available globally. Users spend about 90% of their mobile time within applications, mostly on social media, gaming, and creative tools.

Top driving factors include the rise in smartphone adoption worldwide, especially in emerging economies where affordable devices and data plans are making internet access easier. The growth of e-commerce, digital payments, and online services fuels app downloads since consumers prefer quick and smooth online experiences. Also, the availability of cross-platform development tools lowers barriers, enabling faster and more cost-efficient app creation.

According to Market.us, The AI in Mobile Apps Market is projected to reach USD 354.09 billion by 2034, rising from USD 21.23 billion in 2024 at a CAGR of 32.5% (2025–2034). In 2024, APAC led the market with over 55.34% share, generating USD 11.73 billion in revenue.

Demand is high across both consumer-facing and enterprise applications. Social media, gaming, and entertainment apps remain dominant in consumer markets, while enterprise demand focuses on mobile solutions for workforce productivity, collaboration, and customer relationship management. E-commerce and fintech applications are experiencing rapid growth as consumers increasingly shop and make payments via smartphones.

Key Insight Summary

- By platform, Android dominated the market, accounting for 71.4% share, reflecting its widespread global adoption.

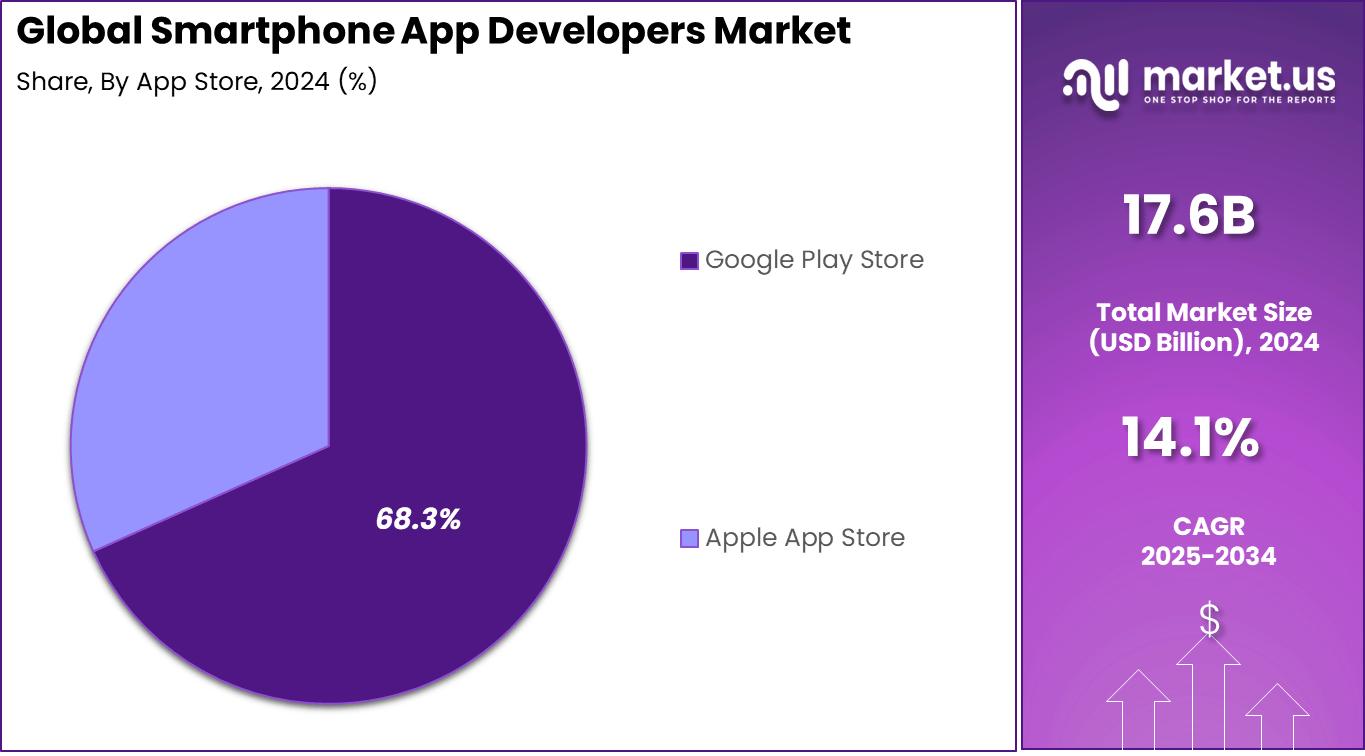

- By app store, the Google Play Store led with 68.3% share, supported by its vast developer ecosystem and user base.

- By application type, Gaming apps captured the largest share at 45.8%, driven by strong consumer demand and in-app monetization models.

- Regionally, Asia Pacific held the leading position with 38.41% share, supported by large-scale smartphone adoption and app development activity.

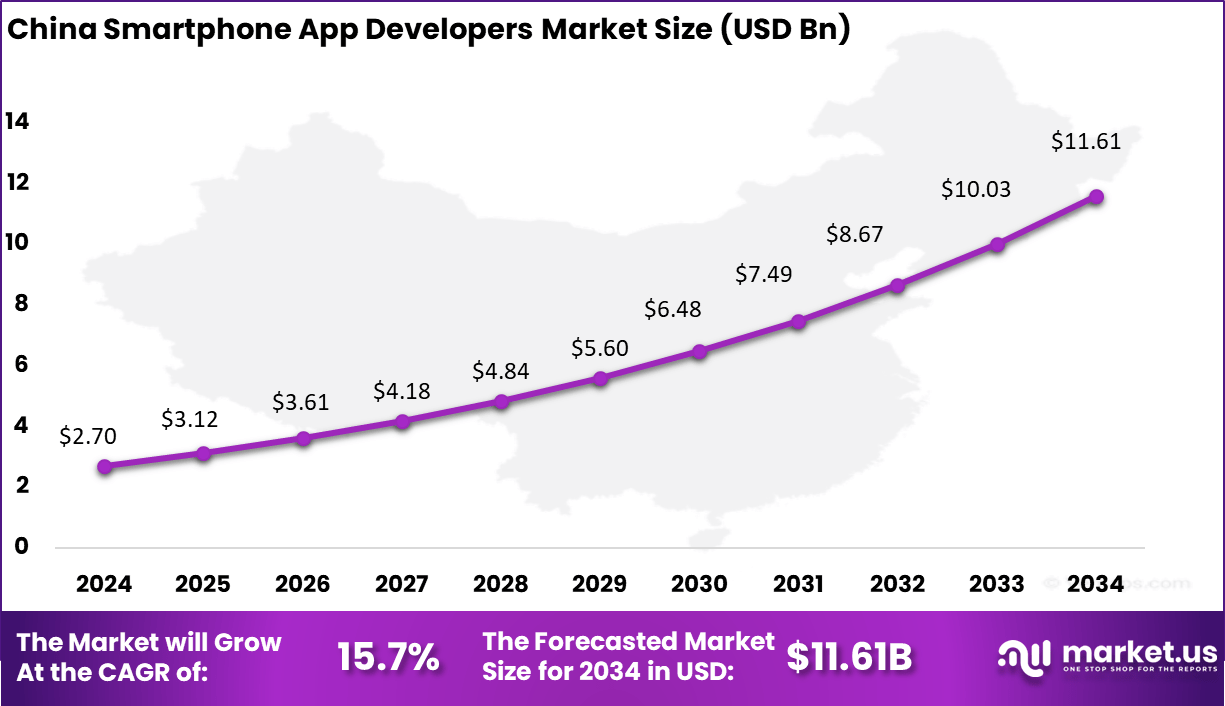

- Within Asia Pacific, China stood out with a market size of USD 2.70 Billion in 2024, expanding at a strong CAGR of 15.7%.

Analysts’ Viewpoint

Increasing adoption of technologies such as 5G, AI, machine learning, augmented reality, and blockchain is reshaping app development. For example, 5G promises faster speeds and lower latency, allowing for real-time features in gaming and streaming apps.

AI enhances personalization and automation in apps, while AR technologies create interactive experiences for shopping and education. Key reasons for adopting these technologies include improving the app’s speed, reliability, and user experience.

Studies indicate that apps with excellent user interfaces can boost conversion rates by around 200% and improve return on investment significantly. Performance expecting fast loading times is critical, with nearly 30% of users expecting apps to load within seconds, or they may uninstall.

Government-Led Investments

Governments worldwide are investing heavily in digital infrastructure and innovation ecosystems, recognizing app development as a critical growth area. For instance, India’s government initiatives have helped increase internet penetration and digital literacy, leading to 28 billion app downloads in 2023 alone.

Funding for app startups and technology incubation hubs has surged, supported by policies aiming at $70-80 billion app and software product industry targets. Such public investments foster a vibrant developer ecosystem and prepare economies for the digital future, underpinned by advances in 5G rollouts, AI capabilities, and IoT expansion.

Investment and Business benefits

Investment opportunities in the smartphone app developer market are substantial, fueled by investor interest in scalable and innovative apps. Startups that validate their ideas by showing early user traction, clear growth strategies, and unique value propositions tend to attract funding. Investors value apps that target large or niche markets with clear demand.

Mobile app startups often secure funding through various rounds, including seed and venture capital stages, aiming to enhance features continuously and expand user bases. These investments help accelerate development cycles and market entry. Business benefits of investing in app development include broader market reach, improved customer engagement, and higher revenue potential.

Android apps, in particular, offer cost-effective development options due to open-source tools and compatibility with diverse devices. App businesses can leverage mobile platforms to deliver personalized experiences, reduce marketing costs, and build stronger customer relationships. For developers, the return on investment can be higher given the extensive user base, provided apps meet quality and performance standards that users demand.

By Platform

In 2024, Android holds a commanding 71.4% share in the smartphone app development market. Its appeal is rooted in the platform’s openness, which allows developers to experiment and build without restrictive approval processes. The affordability of Android-powered devices also ensures that developers can reach a much larger audience compared to closed-platform ecosystems.

Another factor that drives its dominance is the variety of distribution options. Developers can deploy apps on the Google Play Store or alternative marketplaces, providing flexibility in strategy and monetization. This combination of reach, cost efficiency, and freedom of innovation has made Android the central platform for app development around the globe.

By App Store

In 2024, the Google Play Store accounts for 68.3% of app distribution, reinforcing its leadership as the go-to marketplace for developers. The store provides easy onboarding, global accessibility, and faster publishing cycles, which significantly attract developers trying to scale their apps quickly. With its integration on almost all Android devices, it ensures maximum reach.

Beyond distribution, the app store also enables a steady revenue stream through in-app billing, subscriptions, and ad placements. These revenue models are critical to sustaining the developer community. The Play Store’s ecosystem has evolved into more than just a marketplace; it is a foundation for global visibility and monetization.

By Application Type

In 2024, Gaming apps lead the development market, capturing 45.8% share. The surge is powered by changing consumer behavior, where entertainment now fits into smaller pockets of daily routines. Developers have tapped into trends such as hyper-casual titles and social interaction features to keep users engaged for longer durations.

The revenue potential in gaming is unrivaled, partly because of in-app purchases and immersive features that create recurring income streams. Mobile gaming has bridged the gap for both hardcore and casual users, making it appealing to a broad range of players. This inclusivity continues to anchor gaming as the central force in app development.

Key Trends

Developers are increasingly integrating advanced technologies such as artificial intelligence and machine learning to create smarter, personalized app experiences. AI-driven capabilities like chatbots and predictive analytics enhance usability, with approximately 60% of B2B and 42% of B2C companies adopting AI chatbots.

The rollout of 5G is transforming app performance, offering up to 100 times faster speeds and drastically reduced latency, empowering developers to embed richer features like real-time streaming, augmented reality, and IoT connectivity. Apps designed for wearable devices are also accelerating, with tens of thousands becoming available directly on smartwatches, reflecting steady growth in wearable penetration.

Growth Drivers

The demand for mobile apps is driven by growing smartphone penetration, expanding internet access, and evolving digital behaviors. India, for example, is a key market, with mobile app revenue expected to reach nearly $4 billion in 2025, supported by government initiatives like Digital India and Startup India focused on enhancing digital infrastructure and entrepreneurship.

The rise of foldable smartphones adds complexity and opportunity for developers who must optimize app designs to adapt to varying screen sizes. Furthermore, the cloud computing market supporting mobile backend services is projected to grow at over 21% CAGR, enabling developers to build scalable and efficient apps.

Key Market Segments

By Platform

- Android

- iOS

By App Store

- Google Play Store

- Apple App Store

By Application Type

- Gaming

- Media & Entertainment

- E-commerce

- Banking & Finance (BFSI)

- Health & Fitness

- Education

- Others

By Region: Asia Pacific

Asia Pacific holds a dominant 38.41% share of the global market. The region’s large user base, coupled with increasing affordability of mobile devices and rising penetration of 4G and 5G networks, creates a thriving environment for app developers. The widespread adoption of mobile wallets and entertainment apps also deepens user reliance on digital services.

Developers in the region are innovating faster to cater to local needs, including apps in regional languages and services tailored to local culture. The scale of opportunities in Asia Pacific is not limited to urban centers but also in fast-digitizing rural populations where smartphone penetration is accelerating.

By Country: China

China stands out as one of the fastest-growing markets in the segment with a 15.7% CAGR growth trajectory. The country’s strong mobile-first culture means users are highly dependent on smartphones for essential and entertainment needs. This naturally creates high incentives for developers to focus on building optimized applications targeted to Chinese habits and preferences.

In addition to scale, China provides developers with a competitive advantage in experimenting with innovative app features such as mini-programs and advanced mobile payment integrations. This push toward highly interactive and multifunctional apps continues to strengthen China’s leadership position in smartphone-based digital ecosystems.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Smartphone Adoption and Internet Penetration

The rapid increase in smartphone users worldwide is a major market driver. In 2025, over 6.9 billion people use smartphones, and more than 60% of the global population has internet access. This expanding user base creates a large audience for app developers, pushing demand for new and varied applications.

For instance, sectors like ecommerce and fintech are rapidly adopting mobile-first strategies, fueling continuous growth. The convenience offered by mobile apps for shopping, payments, and social connectivity is driving users to spend more time and money on apps, encouraging developers to innovate and meet this growing demand.

This driver directly benefits developers by expanding their potential market reach. The surge in mobile traffic and usage motivates businesses to invest heavily in mobile solutions, increasing opportunities to monetize apps through ads, subscriptions, and in-app purchases. For example, social media and gaming apps remain the most downloaded categories, supported by extensive smartphone penetration.

Restraint Analysis

Market Saturation and Competition

The smartphone app development market faces strong restraint due to increasing saturation. With over 2 million apps available on major app stores and new apps flooding the market daily, it becomes harder for new apps to stand out and attract users. Many apps fail to gain traction because they offer similar features or fail to meet unique user needs.

For instance, many startups struggle with user acquisition due to fierce competition from well-established apps that dominate user attention and spending. This saturation challenges developers by requiring significant investment in marketing and innovation to differentiate their apps.

Limited user attention spans mean even well-designed apps can go unnoticed without strong promotion. As a result, many new apps do not reach profitability, limiting developer sustainability. This restraint forces developers to carefully study target user needs and competitors before launching, adding costs and slowing time to market.

Opportunity Analysis

AI and Automation in App Development

Artificial intelligence and automation offer a significant opportunity for smartphone app developers in 2025. AI-driven tools are increasingly used to speed up development, improve app personalization, automate testing, and forecast user behavior.

For instance, AI assists developers by generating code snippets, improving app performance, and enabling predictive analytics to enhance user experiences. This reduces development time and cost while increasing app quality and relevance.

Developers can leverage AI not only during coding but also for ongoing app updates and user engagement strategies. For example, AI-powered chatbots and recommendation engines improve customer interaction and retention, providing a competitive edge. The growing availability of low-code and no-code platforms integrated with AI further lowers entry barriers and expands opportunities for smaller developers.

Challenge Analysis

Understanding User Needs and Regulatory Compliance

One of the biggest challenges for smartphone app developers is accurately understanding and meeting diverse user needs across different regions and demographics. Developers must invest substantial effort in market research and user testing to create apps that offer clear value. Failure to do so leads to apps that users ignore or uninstall quickly.

In addition to user needs, regulatory compliance presents a growing challenge. Developers must navigate privacy laws and data protection regulations such as GDPR and CCPA, which add complexity to app design and operation. Ensuring apps handle user data securely while providing transparent privacy policies increases development time and cost.

Competitive Analysis

In the smartphone app developers market, firms such as LeewayHertz, Rightpoint Consulting, IT Craft, and Quy Technology stand out for their strong capabilities in delivering custom mobile applications. These companies specialize in enterprise-grade apps, user-focused design, and scalable solutions across industries.

Mid-sized players including Utility Inc., Miquido, Hedgehog Lab, N-iX, and GeekyAnts expand the market with innovative design and development services. They focus on delivering cross-platform applications with strong user interfaces and seamless functionality. Their agile development models allow them to cater to start-ups as well as established enterprises.

Other firms such as MentorMate, Yalantis, Brainvire Infotech, Algoworks Technologies, SumatoSoft, and BuildFire add value by offering specialized and niche services. Their strengths include app prototyping, cloud integration, and end-to-end mobility solutions for sectors such as healthcare, finance, and retail.

Top Key Players in the Market

- Leewayhertz Technologies Private Limited

- Rightpoint Consulting, LLC

- IT Craft

- Quy Technology Private Limited

- Utility, Inc.

- Miquido

- Hedgehog Lab Limited

- N-iX Ltd

- GeekyAnts India Pvt Ltd

- MentorMate, LLC

- Yalantis Limited

- Brainvire Infotech Private Limited

- Algoworks Technologies Private Limited

- SumatoSoft LLC

- BuildFire, Inc.

- Other Major Players

Recent Developments

- In 2025 (Q1), Synopsys completed a major acquisition of ANSYS valued at $35 billion, which impacts software development broadly, including app development sectors focused on simulation and AI-driven tools. This acquisition is expected to bring advanced AI and machine learning capabilities that could trickle down to enhance mobile app development environments and tools for smarter apps.

Report Scope

Report Features Description Market Value (2024) USD 17.6 Bn Forecast Revenue (2034) USD 65.9 Bn CAGR(2025-2034) 14.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform (Android, iOS), By App Store (Google Play Store, Apple App Store), By Application Type (Gaming, Media & Entertainment, E-commerce, Banking & Finance (BFSI), Health & Fitness, Education, Others), Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Leewayhertz Technologies Private Limited, Rightpoint Consulting, LLC, IT Craft, Quy Technology Private Limited, Utility, Inc., Miquido, Hedgehog Lab Limited, N-iX Ltd, GeekyAnts India Pvt Ltd, MentorMate, LLC, Yalantis Limited, Brainvire Infotech Private Limited, Algoworks Technologies Private Limited, SumatoSoft LLC, BuildFire, Inc., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smartphone App Developers MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Smartphone App Developers MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Leewayhertz Technologies Private Limited

- Rightpoint Consulting, LLC

- IT Craft

- Quy Technology Private Limited

- Utility, Inc.

- Miquido

- Hedgehog Lab Limited

- N-iX Ltd

- GeekyAnts India Pvt Ltd

- MentorMate, LLC

- Yalantis Limited

- Brainvire Infotech Private Limited

- Algoworks Technologies Private Limited

- SumatoSoft LLC

- BuildFire, Inc.

- Other Major Players