Global Smart Wearable and Non-Wearable Devices Market By Device Type (Wearable, and Non-wearable), By Technology (Motion Sensor, Pressure Sensor, Temperature Sensor, and Other Technologies), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 105765

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

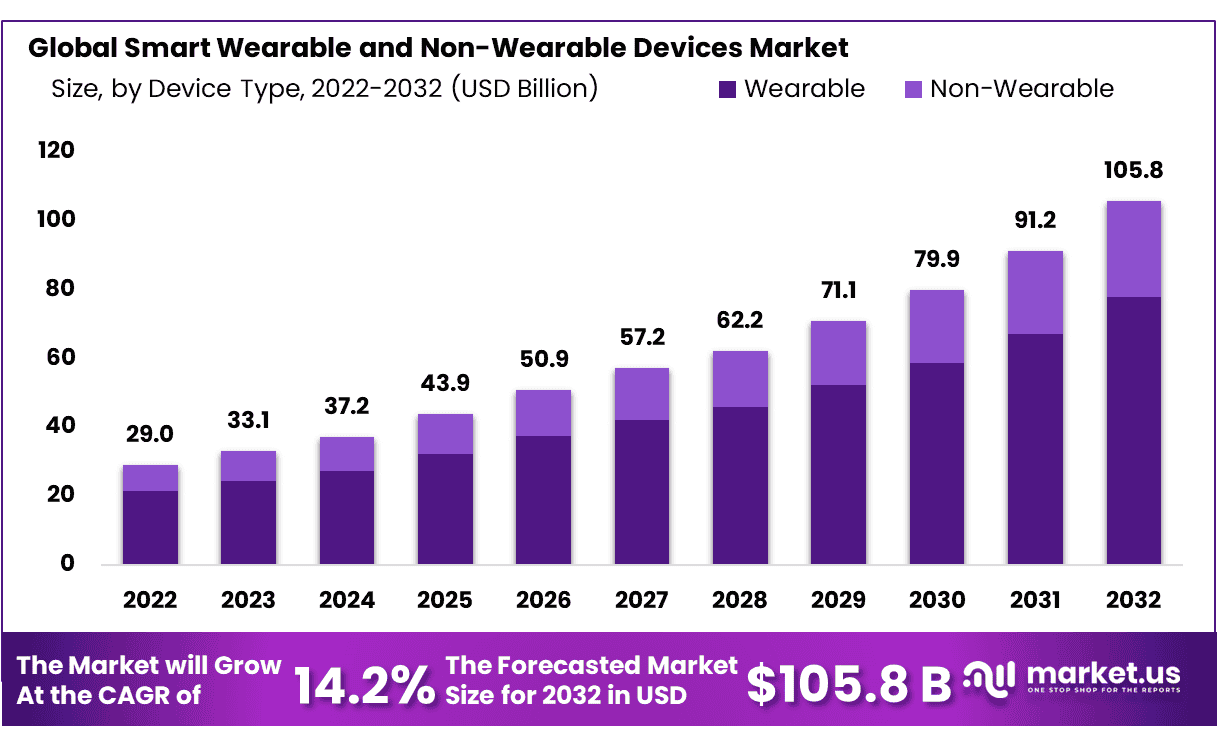

According to a recent report by Market.us, the Global Smart Wearable, And Non-Wearable Devices Market size is expected to be worth around USD 105.8 Billion by 2032 from USD 29.0 Billion in 2022, growing at a CAGR of 14.2% during the forecast period from 2023 to 2032.

Smart wearable devices are technology-infused devices designed to be worn or carried by individuals that can record, analyze, and transmit physiological data. They have sensors to monitor specific health and wellness parameters and wireless connectivity to sync with other smart devices or cloud-based platforms for data storage and analysis.

Smart wearables are typically designed for functions such as tracking health metrics like heart rate, blood pressure, body temperature, glucose levels, steps walked, user’s physical activity, vital signs, sleep patterns, and more, providing GPS location data, enabling communication, or even offering entertainment features like music streaming. Their appeal lies in their convenience and unobtrusive presence, enabling continuous monitoring or access to digital tools without disrupting daily activities. The rise of these devices has significantly enhanced self-health monitoring, promoting a more proactive approach to personal health and well-being.

On the other hand, non-wearable smart devices are not worn on the body but are used to monitor, track, or improve health and wellness. These devices can be used in various environments, such as homes, hospitals, or clinics, and leverage the power of connectivity and data analysis to provide insights or support health management. The global rise in chronic conditions such as diabetes, heart disease, and obesity has increased the need for constant health monitoring and management. Health smart devices offer an effective solution for tracking these conditions in real-time, alerting users to potential health issues, and aiding in disease management, thus driving their market demand.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Wearable Categories: Smart wearables can fall into many different categories, from smartwatches and fitness trackers to clothing featuring AR glasses or jewelry connected with Bluetooth technology – each category providing specific functions, including health monitoring, communication or fitness benefits.

- Health and Fitness Tracking: Fitness trackers and smartwatches have become popular devices used for tracking physical activity, heart rate, sleep patterns and other important indicators that indicate overall well-being and fitness goals. Their data provides users with valuable insight into their wellbeing as they set goals to enhance wellness and fitness goals.

- Healthcare Applications: Wearable devices have quickly become indispensable resources in healthcare environments for monitoring patients remotely, managing chronic disease conditions and medication adherence – offering potential to both increase outcomes for patients while decreasing healthcare costs.

- Evolving Designs: Wearable designs continue to develop to become increasingly stylish, comfortable and unobtrusive – features that contribute to consumer adoption such as aesthetic appeal and ergonomic design.

- Privacy and Data Security: With wearable devices collecting sensitive health and personal data, privacy concerns have significantly risen. Manufacturers and regulators alike are paying careful attention to data protection compliance regulations in their efforts for data security protection compliance regulations compliance.

Driving Factors

Healthcare Cost Reduction to Surge Market Growth

Health smart devices can potentially reduce healthcare costs by allowing for early detection and management of health issues, thus preventing expensive treatments and hospitalizations. They also facilitate telehealth, which can reduce the cost associated with in-person doctor visits.

Remote Patient Monitoring and Telehealth drives the market growth

The COVID-19 pandemic has accelerated the adoption of remote patient monitoring and telehealth solutions. Health smart devices enable healthcare providers to remotely monitor patients’ vital signs, symptoms, and progress, reducing the need for in-person visits. The convenience and accessibility of remote patient monitoring and telehealth are driving the demand for smart health devices in delivering healthcare services.

Restraining Factors

Privacy and Data Security Concerns to impede market growth

The collection, storage, and transmission of personal health data through smart devices raise privacy and data security concerns. Users are increasingly concerned about the security and confidentiality of their health information. Any breaches or mishandling of sensitive data can erode trust and hinder the widespread adoption of smart health devices.

Limited Battery Life and Charging Requirements to hamper the market growth

Battery life remains a limitation for many healthy smart wearable devices. Users may find it inconvenient to frequently recharge their devices, especially if they are used for continuous monitoring or during extended periods of use. Improvements in battery technology and the development of more power-efficient devices are necessary to address this constraint.

By Device Type Analysis

The wearable segment accounted as the dominant segment in global smart wearable and non-wearable devices market in 2022

Based on device type, the market for smart wearable and non-wearable devices is segmented into wearable and non-wearable devices. Among these devices, the wearable segment held the largest revenue share of 73.6% % in 2022. Wearable segment is further sub-divided into smart health watches, fitness trackers, biosensors, wearable ECG monitors. Out of these, the smart health watches held the largest share of 40.5%. These devices offer the tracking features with advanced monitoring capabilities.

They track heart rate, sleep, and workouts and provide features like ECG (electrocardiogram) measurement, blood oxygen saturation monitoring, and fall detection. For instance, the Apple Watch Series 6 not only tracks physical activities and heart rate but also offers an ECG app and a Blood Oxygen app to measure blood oxygen levels. The Samsung Galaxy Watch 3, on the other hand, offers features such as automatic sleep tracking, blood oxygen (SpO2) readings, and VO2 max reporting (a metric for overall fitness).

By Technology Analysis

Motion sensor technology dominated the market in 2022

On the basis of technology, the market is divided into motion sensor, pressure sensor, temperature sensor, and other technologies. Among these technologies, the motion sensor segment held the largest revenue share of 45.4% in 2022. Motion sensors provide a wide range of functionalities that cater to various applications. They can detect and measure movement, orientation, acceleration, and even gestures. This versatility allows them to be integrated into a diverse array of devices, from fitness trackers to smartwatches to virtual reality headsets.

By Distribution Channel Analysis

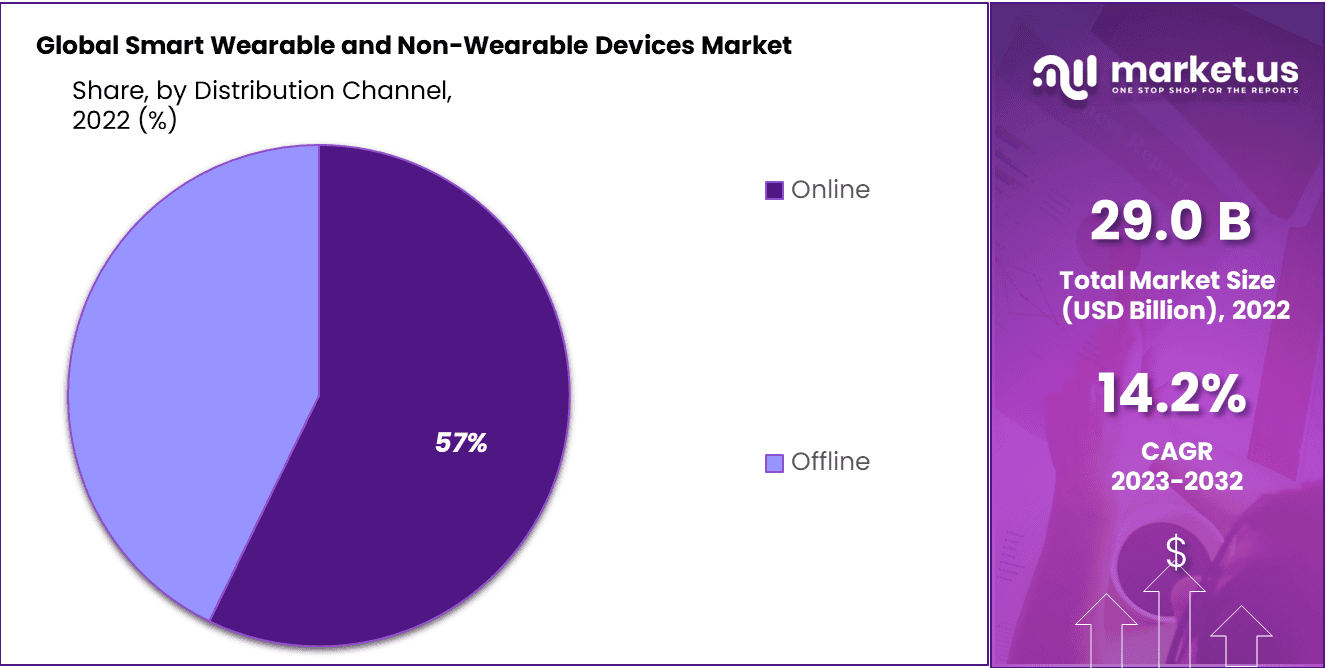

Based on distribution channel, the global wearable and non-wearable devices market is bifurcated into online and offline channels. Among these segments, the online distribution channel dominated the market with highest revenue share of 57.2%. Online distribution allows manufacturers and retailers to reach a global audience without the limitations of physical store locations. This is especially important for a technologically driven market like wearable and non-wearable devices, where consumers worldwide seek the latest innovations.

Moreover, consumers can browse and purchase products from the comfort of their homes or on-the-go, eliminating the need to travel to physical stores. This drives the growth of online segment in the global and US smart wearable and non-wearable devices market.

Key Market Segments

By Device Type

- Wearable

- Fitness Trackers

- Wearable ECG Monitors

- Smart Health Watches

- Biosensors

- Non-wearable

- Smart Scales

- Blood Pressure Monitors

- Muscle Stimulation Devices

- Other Non-Wearables

By Technology

- Motion Sensor

- Pressure Sensor

- Temperature Sensor

- Other Technologies

By Distribution Channel

- Online

- Offline

Growth Opportunity

Wearable Biosensors for Continuous Monitoring to offer numerous growth opportunities

Advances in biosensor technology offer opportunities for continuous health monitoring. Wearable biosensors embedded in smart devices can capture real-time data on various health parameters, including glucose levels, oxygen saturation, and hormonal levels as well. Continuous monitoring can lead to early detection of health issues, personalized interventions, and improved patient outcomes.

Partnerships with Healthcare Providers and Insurance Companies create significant opportunities

Collaborations with healthcare providers and insurance companies can lead to wider adoption of these devices. For instance, insurance companies may provide incentives or discounts to customers who use such devices, and healthcare providers can use the data from these devices to deliver better patient care.

Latest Trends

Integration with IoT and AI.

As technology advances, smart health devices are likely to integrate more with the Internet of Things (IoT) and artificial intelligence (AI). This will enable more sophisticated health tracking and personalized health insights, as well as better interconnectivity among devices.

Focus on Mental Health and Well-being

There is a growing focus on mental health and well-being in the health smart device market. Devices incorporate features such as stress tracking, guided meditation, mindfulness exercises, and sleep quality analysis to address mental health concerns. The integration of mental health features reflects the increasing recognition of the importance of holistic well-being.

Regional Analysis

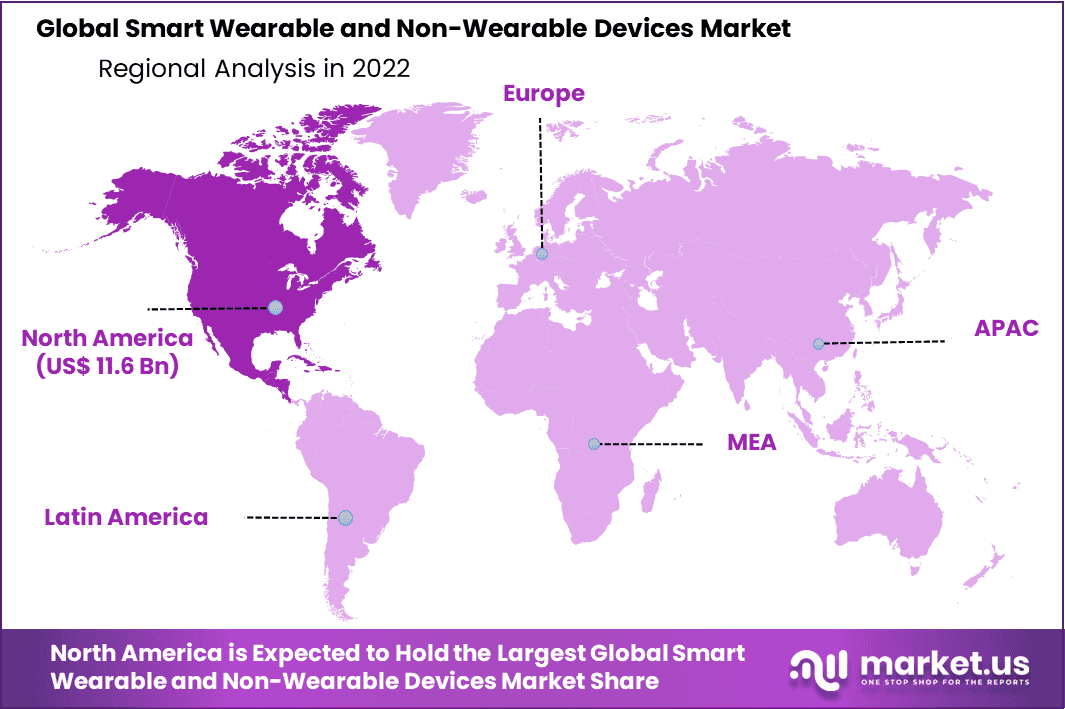

North America dominated the global smart wearable and non-wearable devices market with revenue share of 40.2%

Based on region, the global smart wearable and non-wearable devices market is divided into North America, Europe, Asia Pacific, Latin America, And Middle East & Africa. Among these regions, North America accounted for the highest revenue share of 40.2% in 2022. This significant share is gained due to early adoption of smart technologies in this region. In addition, the growth of this region can be attributed to the relatively high disposable income of consumers in this region who can afford to buy the latest smart devices as soon as they are released.

The Asia-Pacific accounted as the second dominating region with a revenue share of 23.5% in global smart wearable and non-wearable devices market

The market of Asia-Pacific is witnessing significant growth due the countries in APAC, such as China, India, and Southeast Asian countries, witnessing rapid urbanization. Moreover, china in particular is a global manufacturing hub for electronics. This means that many wearables and smart devices are actually produced in the region, leading to potentially lower prices and quicker market availability.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players in the market are highly investing in R&D for introduction of innovative products. In addition, they are focused on implementing strategic growth policies to increase their market presence. Moreover, they are involved in partnerships, collaborations, and mergers & acquisitions as well as new product launch. This forms the competitive landscape in the market, thereby propelling the market growth.

Top Key Players

- Apple, Inc.

- Alphabet Inc.

- Samsung Electronics Co. Ltd.

- Huawei Technologies Co. Ltd.

- Xiaomi Corp.

- Koninklijke Philips NV

- OMRON Corp.

- Garmin Ltd.

- Other Key Players

Recent Developments

- In March 2023, Garmin International launched the Forerunner 265 series and Forerunner 965 GPS-running smartwatches with vibrant AMOLED displays.

- In September 2022, the company released Venu Sq 2 series smartwatches in the US.

Report Scope

Report Features Description Market Value (2022) USD 29.0 Billion Forecast Revenue (2032) USD 105.8 Billion CAGR (2023-2032) 14.2% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Device Type – Wearable, and Non-wearable; By Technology – Motion Sensor, Pressure Sensor, Temperature Sensor, and Other Technologies; and By Distribution Channel Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Apple, Inc., Alphabet Inc., Samsung Electronics Co. Ltd., Huawei Technologies Co. Ltd. Xiaomi Corp., Koninklijke Philips NV, OMRON Corp., Garmin Ltd., Withings, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are smart wearable and non-wearable devices?Smart wearable devices are electronic gadgets that can be worn on the body, like smartwatches and fitness trackers. Non-wearable devices include smart home appliances and gadgets like thermostats and voice-activated speakers.

How big is the Smart Wearable and Non-Wearable Devices Market?The global Smart Wearable and Non-Wearable Devices Market size was estimated at USD 29.0 billion in 2022 and is expected to reach USD 105.8 billion in 2032.

What is the Smart Wearable and Non-Wearable Devices Market growth?The global Smart Wearable and Non-Wearable Devices Market is expected to grow at a compound annual growth rate of 14.2%.

Who are the key companies/players in the Smart Wearable and Non-Wearable Devices Market?Some of the key players in the Smart Wearable and Non-Wearable Devices Markets are Apple, Inc., Alphabet Inc., Samsung Electronics Co. Ltd., Huawei Technologies Co. Ltd., Xiaomi Corp., Koninklijke Philips NV, OMRON Corp., Garmin Ltd., Other Key Players

Why are smart devices becoming so popular?Smart devices offer convenience, connectivity, and functionality, enhancing our daily lives by automating tasks and providing information at our fingertips.

What are some common examples of smart wearables?Common examples include smartwatches, fitness trackers, and augmented reality glasses that provide features like fitness monitoring, notifications, and hands-free navigation.

Smart Wearable and Non-Wearable Devices MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Smart Wearable and Non-Wearable Devices MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple, Inc.

- Alphabet Inc.

- Samsung Electronics Co. Ltd.

- Huawei Technologies Co. Ltd.

- Xiaomi Corp.

- Koninklijke Philips NV

- OMRON Corp.

- Garmin Ltd.

- Other Key Players