Global Smart Peephole Camera Market Size, Share and Analysis Report By Connectivity (Wi-Fi, Bluetooth), By Resolution (1080p Full HD, 2K / 4K Ultra HD), By Application (Residential Apartments & Homes, Hotel & Hospitality Rooms, Short-term Rentals (Airbnb, Vrbo), By Sales Channel (Online Retail, Offline Retail), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177221

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insights Summary

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- By Connectivity

- By Resolution

- By Application

- By Sales Channel

- Regional Perspective

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Trends and Disruptions Impacting Customers

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

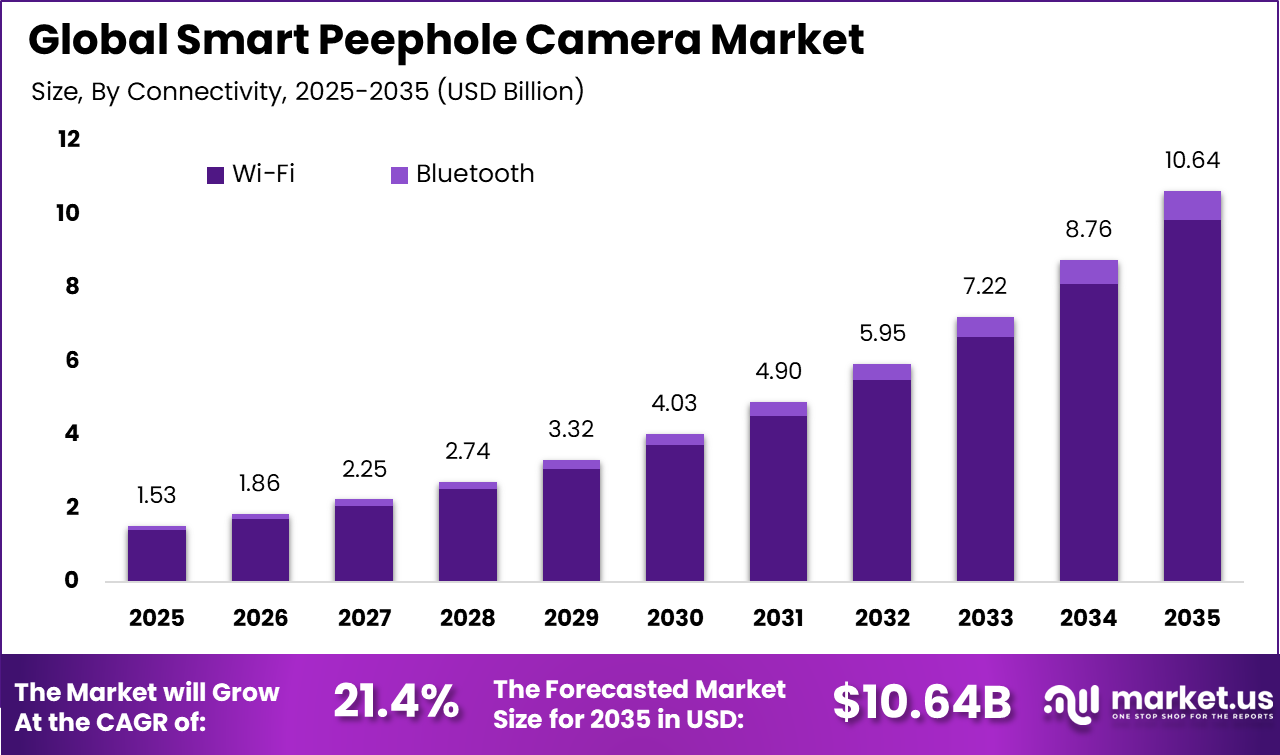

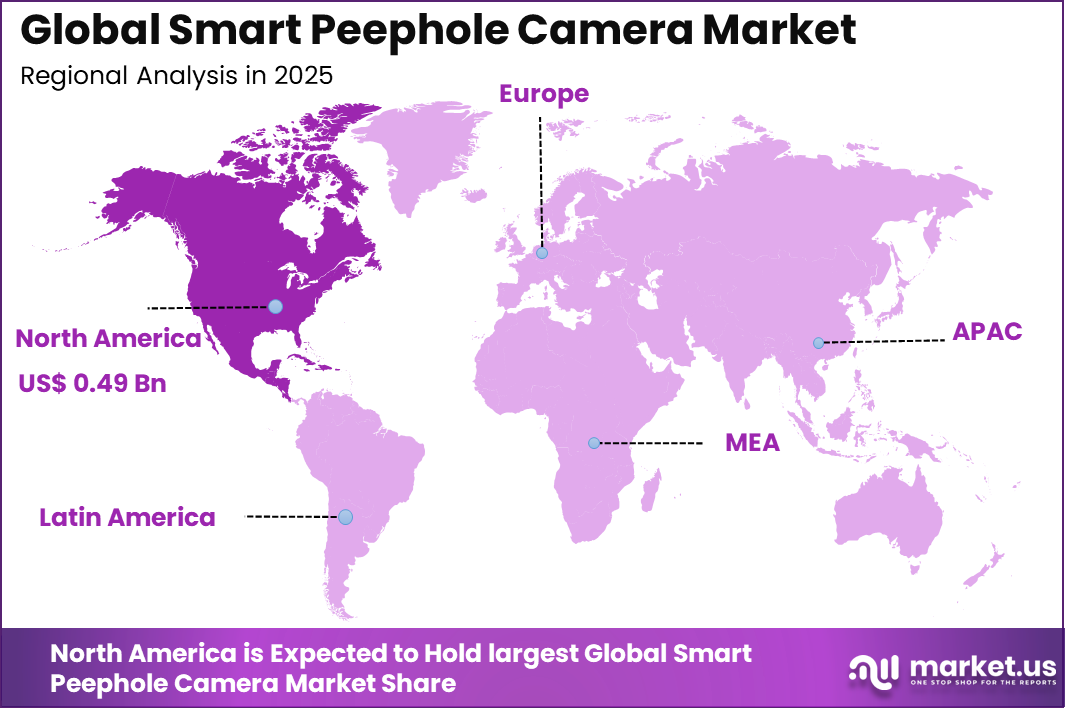

The Global Smart Peephole Camera Market size is expected to be worth around USD 10.64 billion by 2035, from USD 1.53 billion in 2025, growing at a CAGR of 21.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 32.5% share, holding USD 0.49 billion in revenue.

The Smart Peephole Camera Market refers to compact digital door viewing devices that replace or enhance traditional door peepholes with cameras, displays, and connected features. These devices allow occupants to view visitors through an internal screen or connected mobile application without opening the door. Smart peephole cameras are designed primarily for apartments, residential buildings, and rental properties where full doorbell camera installation may not be feasible.

The market has gained relevance due to rising concerns around doorstep security and visitor verification. Smart peephole cameras combine discreet hardware design with basic smart security functionality. Unlike conventional surveillance cameras, they are installed within existing peephole openings, minimizing structural changes. Industry observations indicate that more than 55% of urban apartment residents prefer non intrusive security upgrades, supporting adoption of peephole based solutions.

One of the main driving factors is increasing concern over unauthorized access, doorstep theft, and visitor related security incidents. Residents want to verify visitors before opening doors, especially in high density housing environments. Traditional peepholes offer limited visibility and are ineffective in low light conditions. Smart peephole cameras address these limitations through digital viewing and image capture.

Demand for smart peephole cameras is increasing among urban households and senior residents. These devices offer a simple way to enhance personal safety without complex installation. Studies indicate that visual verification reduces doorstep related incidents by more than 25% in multi unit residential settings. This safety benefit drives consumer interest.

For instance, in May 2025, Arlo Technologies rolled out Secure 6 AI service with fire detection, audio alerts for screams or glass breaks, and smart video search. Subscriber base topped 5 million, showing strong demand for advanced peephole-integrated security.

Key Takeaway

- By connectivity, Wi-Fi based devices dominated the Smart Peephole Camera Market with a 92.6% share, supported by easy installation and remote access features.

- By resolution, 1080p Full HD models led adoption with a 71.5% share, reflecting strong demand for clear and detailed video output.

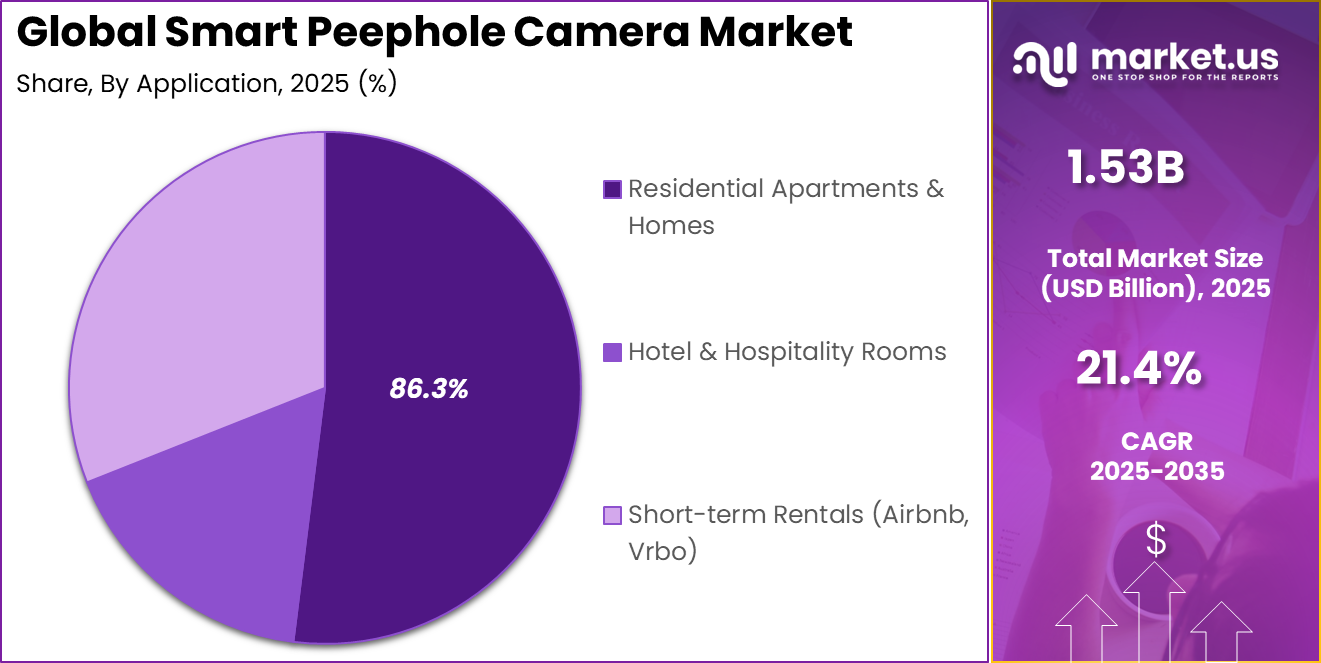

- By application, residential apartments and homes accounted for 86.3% of total usage, driven by rising focus on household security.

- By sales channel, online retail held a 68.7% share, supported by wider product availability and direct to consumer purchasing.

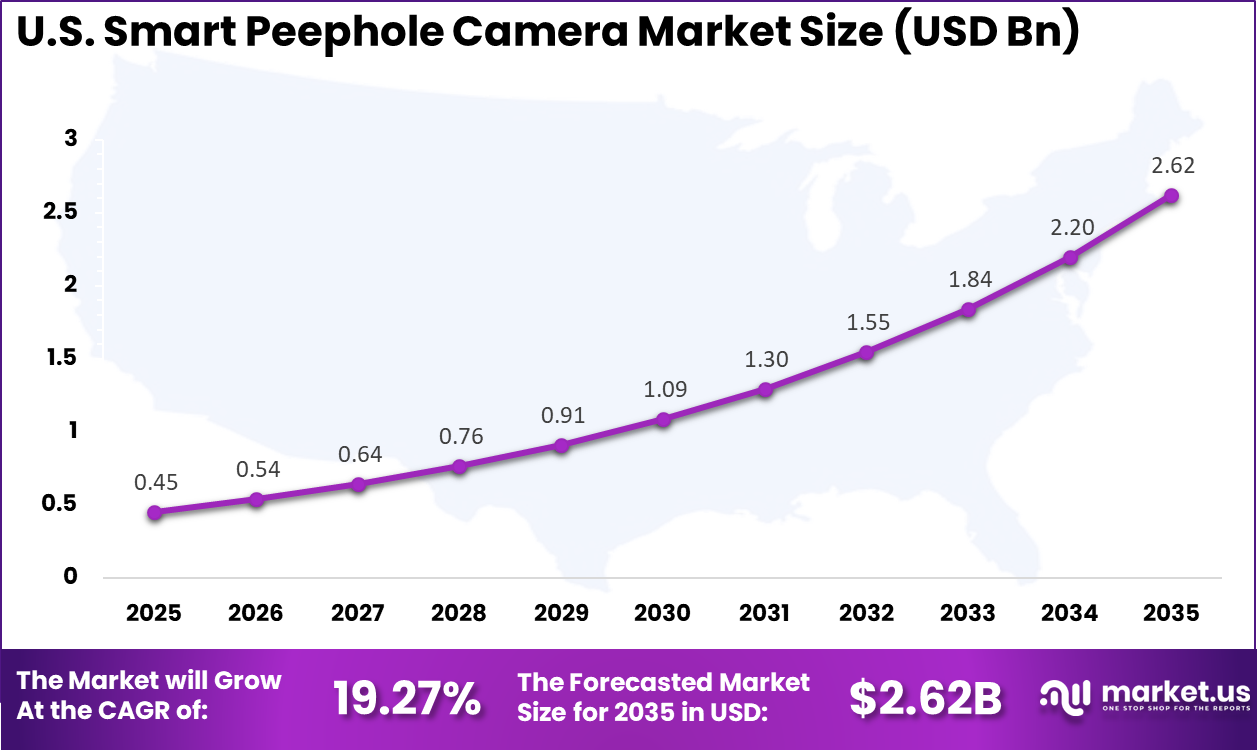

- Regionally, North America represented 32.5% of the market, with the US valued at USD 0.45 billion and recording a CAGR of 19.27%, supported by high smart home adoption.

Key Insights Summary

- General household penetration reached about 30% of US internet households, with ownership of at least one smart camera or video doorbell.

- In the US, adoption of video based home security systems increased from 42% in 2023 to 52% in 2024, while video doorbells alone reached 45% adoption among homeowners.

- In the UK, nearly 29% of individuals had installed a smart doorbell or home security camera by May 2025, with an additional 19% planning a purchase within the same year.

- Adoption levels were notably higher among younger homeowners, with 72% of Millennials and 69% of Gen Z using security cameras, compared with 30% of Baby Boomers.

- Households using smart cameras or video doorbells owned an average of 2.21 devices, indicating strong multi device usage for wider coverage.

- Around 35% of users installed a security system following a package theft incident.

- Ease of installation influenced purchasing decisions, with 67% of users selecting wireless peephole systems for simple DIY setup.

- Real time monitoring and two way audio were key usage features, supporting instant visitor verification and remote package handling.

- Integration with smart home ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit was increasingly preferred to enable hands free control and unified alerts.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rising demand for home security and visitor monitoring +5.2% Global Short to medium term Growth of apartment living and rental housing +4.4% Asia Pacific, Europe Medium term Increasing adoption of smart home ecosystems +4.0% North America, Europe Medium term Rising concerns around doorstep theft and unauthorized access +3.9% Global Short term Expansion of e-commerce deliveries to residential buildings +3.9% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Privacy concerns related to video surveillance -3.4% Europe, North America Medium term Dependence on stable Wi-Fi and power supply -2.9% Global Medium term Price sensitivity in cost-conscious residential segments -2.6% Emerging Markets Short to medium term Limited awareness in older housing stock -2.1% Asia Pacific, Latin America Medium term Installation compatibility issues with legacy doors -1.8% Global Medium to long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Smart home security device manufacturers Very High Medium Global Strong product-driven growth Consumer electronics brands High Medium North America, Asia Pacific Portfolio expansion opportunity Residential security service providers Medium Low to Medium Global Bundled service offerings Private equity firms Medium Medium North America, Europe Brand scaling and consolidation Venture capital investors High High North America Innovation-led hardware and AI features Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline HD cameras with night vision and wide-angle lenses +5.1% Clear visitor identification Global Short term Mobile app integration with real-time alerts +4.5% Remote monitoring Global Medium term AI-based motion detection and person recognition +3.8% Reduced false alerts North America, Europe Medium term Cloud-based video storage and playback +3.3% Event review and evidence Global Medium to long term Battery optimization and low-power chipsets +2.7% Extended device lifespan Global Long term By Connectivity

Wi Fi connectivity accounts for 92.6% of overall adoption in the Smart Peephole Camera Market. This dominance reflects strong demand for real time video access and remote monitoring through mobile devices. Homeowners value the ability to view visitors and receive alerts without physical proximity.

The preference for Wi Fi is also driven by ease of installation and integration with home networks. Wireless connectivity removes the need for complex wiring. This supports faster deployment across apartments and residential buildings.

Reliability improvements in home internet infrastructure further support adoption. Stable connectivity enables consistent video streaming and cloud access. These factors sustain Wi Fi as the primary connectivity choice.

For Instance, in January 2026, Ring LLC enhanced its Peephole Cam with improved Wi-Fi stability for better app connectivity. The update ensures reliable streaming even in crowded networks, helping apartment dwellers get instant alerts without drops. Users praise the seamless link to Alexa, making it a top pick for wireless home security setups.

By Resolution

1080p Full HD resolution represents 71.5% of total adoption by resolution type. High definition video quality is essential for clear identification of visitors and recording details. Consumers prioritize sharp visuals to enhance security effectiveness.

The dominance of Full HD resolution is also linked to affordability and performance balance. 1080p cameras provide sufficient clarity without significantly increasing storage or bandwidth requirements. This makes them suitable for residential use.

Improved image sensors and low light performance further enhance Full HD adoption. Clear visuals during different lighting conditions increase user confidence. These advantages reinforce the leadership of 1080p resolution.

For instance, in January 2026, Eufy launched a 1080p HD peephole viewer in its Spring lineup. The model offers crisp night vision through existing doors, ideal for dim hallways. Buyers love the clear faces in footage, shared easily on phones. This reinforces 1080p as the sweet spot for quality without heavy data drain.

By Application

Residential apartments and homes account for 86.3% of application based demand. Urban living environments with shared entryways increase the need for discreet security solutions. Smart peephole cameras offer monitoring without altering door structure. Homeowners and tenants value added safety without intrusive installation.

Peephole cameras preserve door aesthetics while enhancing security. This convenience drives strong residential adoption. The growth of rental housing and apartment living further supports this segment. Portable and non permanent installations are preferred. These factors sustain high demand in residential applications.

For Instance, in September 2025, August Home, Inc. announced smart lock integrations for peephole cams in residential settings. Their systems work inside apartments, linking video with keyless entry for homes. Renters gain remote access control, fueling growth in everyday housing security.

By Sales Channel

Online retail accounts for 68.7% of total sales channel activity. Consumers increasingly prefer online platforms for researching and purchasing smart security devices. Product comparisons and user reviews influence purchasing decisions. The dominance of online retail is also supported by competitive pricing and home delivery options.

Easy access to installation guides and support materials enhances buyer confidence. This strengthens online channel preference. Direct to consumer sales through digital platforms improve brand reach. Manufacturers benefit from faster market access. These conditions maintain the leadership of online retail channels.

For Instance, in January 2026, Zmodo (Xiamen Huaxia Technology Co., Ltd.) boosted its online store with free shipping on peephole-compatible cams. Buyers grab bundles with 3-year warranties and 30-day returns easily. The platform’s app previews drive impulse buys, simplifying online security shopping.

Regional Perspective

North America holds a significant position in the Smart Peephole Camera Market, accounting for 32.5% of total activity. The region benefits from high awareness of residential security technologies and widespread smart home adoption.

Consumers actively invest in connected safety solutions. Urbanization and apartment living patterns further support demand. Security remains a priority in residential planning. These factors reinforce North America’s strong regional role.

For instance, in September 2025, Ring LLC (Santa Monica, California, USA) unveiled its first 4K security cameras powered by Retinal Vision technology, including advanced doorbells with AI features like Alexa+ Greetings and Familiar Faces recognition. These developments showcase North America’s dominance in smart peephole cameras through superior video clarity and intelligent automation for enhanced neighborhood security.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 0.45 Bn and a growth rate of 19.27% CAGR. Expansion is supported by rising demand for affordable home security devices and increased e commerce penetration. Smart peephole cameras are viewed as practical security upgrades.

Adoption in the U.S. is influenced by convenience and privacy considerations. Non invasive installation appeals to renters and homeowners alike. These dynamics collectively support strong growth in the U.S. market segment.

For instance, in May 2025, Arlo Technologies, Inc. launched Arlo Secure 6, an AI-powered smart home security service featuring fire detection, advanced audio detection, detailed video descriptions, and powerful video search capabilities. This innovation enhances Arlo doorbell and camera systems with intelligent threat recognition, reinforcing U.S. leadership in smart peephole camera technology by delivering deeper insights for proactive home protection.

Emerging Trends Analysis

An emerging trend in the smart peephole camera market is the use of artificial intelligence for motion detection and visitor recognition. AI based alerts help reduce false notifications caused by irrelevant movement. Intelligent filtering improves user experience and device efficiency. AI driven features are becoming increasingly common.

Another trend is growth in display enabled peephole cameras. Some models include internal screens that allow viewing without a smartphone. This appeals to users who prefer standalone operation. Display integration expands usability across age groups.

Growth Factors Analysis

One of the key growth factors for the smart peephole camera market is increasing urbanization and apartment living. Residents in shared buildings require security solutions suited to limited space and installation restrictions. Smart peephole cameras align well with these living conditions. Urban housing trends support long term demand.

Another growth factor is rising consumer acceptance of smart security devices. As smart cameras and connected security become mainstream, users are more comfortable adopting niche devices. Familiarity with mobile monitoring and alerts encourages adoption. This behavioral shift reinforces market expansion.

Opportunity Analysis

A significant opportunity in the smart peephole camera market lies in integration with broader smart home ecosystems. Connecting peephole cameras with smart locks, alarms, and mobile assistants can create a more comprehensive security experience. Integration enhances functionality such as remote access control and automated alerts. This ecosystem alignment increases perceived value.

Another opportunity is rising demand from rental and multi family housing segments. Property managers and tenants seek security solutions that do not damage property or require permanent installation. Smart peephole cameras meet these requirements while improving resident safety. Expansion in urban rental housing supports adoption.

Challenge Analysis

A major challenge for the smart peephole camera market is balancing compact design with image quality. Limited space restricts sensor size and optical components. Maintaining clear video performance in low light conditions can be difficult. Technical optimization is required to meet user expectations.

Another challenge is privacy management in shared living environments. Cameras positioned at doors may capture neighboring activity. Ensuring responsible use and compliance with privacy guidelines is essential. Clear user controls and transparency are important to maintain trust.

Trends and Disruptions Impacting Customers

The Smart Peephole Camera Market is expanding as consumers and businesses seek enhanced door security and real-time visibility into visitors. These devices replace traditional door peepholes with digital cameras that provide clear video feeds, motion detection alerts, and mobile access.

Rising concerns about doorstep safety have contributed to wider adoption, with many households reporting that visible security devices reduce perceived risk. As a result, smart peephole solutions are increasingly viewed as practical tools that strengthen entry point monitoring without requiring complex installation.

Customer expectations are influenced by demand for connectivity and convenience features. Many users prefer devices that offer two way audio, night vision, and integration with home automation systems, which allows live viewing from smartphones or tablets. Industry surveys indicate that over 50% of smart security buyers prioritize remote access and app alerts when choosing door monitoring devices.

At the same time, concerns about data protection and device security have led a significant portion of buyers to evaluate products based on encryption standards and software update support. These preferences are shaping product designs and purchase behavior in the smart peephole camera market.

Key Market Segments

By Connectivity

- Wi-Fi

- Bluetooth

By Resolution

- 1080p Full HD

- 2K / 4K Ultra HD

By Application

- Residential Apartments & Homes

- Hotel & Hospitality Rooms

- Short-term Rentals (Airbnb, Vrbo)

By Sales Channel

- Online Retail

- Offline Retail

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading smart home security brands such as Ring LLC, Arlo Technologies, Inc., and Google LLC hold strong positions in the smart peephole camera market. Their products integrate HD video, motion detection, night vision, and mobile alerts. Seamless app ecosystems and cloud connectivity enhance user experience. These companies benefit from strong brand recognition and wide retail distribution. Demand is driven by rising apartment living and the need for discreet front-door surveillance.

Mid-range and value-focused players such as Eufy, Reolink Digital Technology Co., Ltd., and August Home, Inc. emphasize easy installation and privacy-focused features. Remo+ DoorCam and DoorBird address apartment-specific and premium smart entry use cases. These players focus on battery efficiency, local storage options, and compatibility with existing door hardware. Adoption is supported by growing DIY smart security trends.

Emerging and regional brands such as Kangaroo, Inc., Zmodo, and HeimVision expand product availability across price tiers. Konke, Icsee, and Smonet support regional demand with localized offerings. Other vendors increase competition and innovation, supporting steady adoption of smart peephole cameras in residential security markets.

Top Key Players in the Market

- Ring LLC

- Eufy

- Reolink Digital Technology Co., Ltd.

- Arlo Technologies, Inc.

- Google LLC (Nest Hello)

- August Home, Inc.

- Remo+ DoorCam

- Kangaroo, Inc.

- DoorBird (an Alarm.com company)

- Zmodo (Xiamen Huaxia Technology Co., Ltd.)

- HeimVision

- Maximus, Inc.

- Smonet

- Konke

- Icsee

- Others

Recent Developments

- In January 2026, Ring LLC enhanced its peephole offerings with the Ring Peephole Cam, featuring 1080p HD video and a 155° field of view, perfect for apartments. Battery-powered with a 6-12-month life, it integrates seamlessly with Alexa for two-way talk and motion alerts.

- In January 2025, DoorBird (Alarm.com) debuted a wide-angle peephole expansion camera at BAU 2025, compatible with PoE/Wi-Fi and smart home systems. It boosts entrance visibility for better security, highlighting Bird’s innovation in professional-grade peephole intercoms.

Report Scope

Report Features Description Market Value (2025) USD 1.5 Bn Forecast Revenue (2035) USD 10.6 Bn CAGR(2026-2035) 21.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Connectivity (Wi-Fi, Bluetooth), By Resolution (1080p Full HD, 2K / 4K Ultra HD), By Application (Residential Apartments & Homes, Hotel & Hospitality Rooms, Short-term Rentals (Airbnb, Vrbo), By Sales Channel (Online Retail, Offline Retail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ring LLC, Eufy, Reolink Digital Technology Co., Ltd., Arlo Technologies, Inc., Google LLC (Nest Hello), August Home, Inc., Remo+ DoorCam, Kangaroo, Inc., DoorBird (an Alarm.com company), Zmodo (Xiamen Huaxia Technology Co., Ltd.), HeimVision, Maximus, Inc., Smonet, Konke, Icsee, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Peephole Camera MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Smart Peephole Camera MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Ring LLC

- Eufy

- Reolink Digital Technology Co., Ltd.

- Arlo Technologies, Inc.

- Google LLC (Nest Hello)

- August Home, Inc.

- Remo+ DoorCam

- Kangaroo, Inc.

- DoorBird (an Alarm.com company)

- Zmodo (Xiamen Huaxia Technology Co., Ltd.)

- HeimVision

- Maximus, Inc.

- Smonet

- Konke

- Icsee

- Others