Global Smart Lighting Market Size, Share Analysis Report By Component (Hardware,(Lights & Luminaires, Control Systems), Software, Services), By Connectivity Technology(Wired, Wireless), By Application(Indoor Lighting,(Residential, Commercial, Industrial, Others), Outdoor Lighting,(Highway and Roadway Lighting, Architectural Lighting, Others)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 51894

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

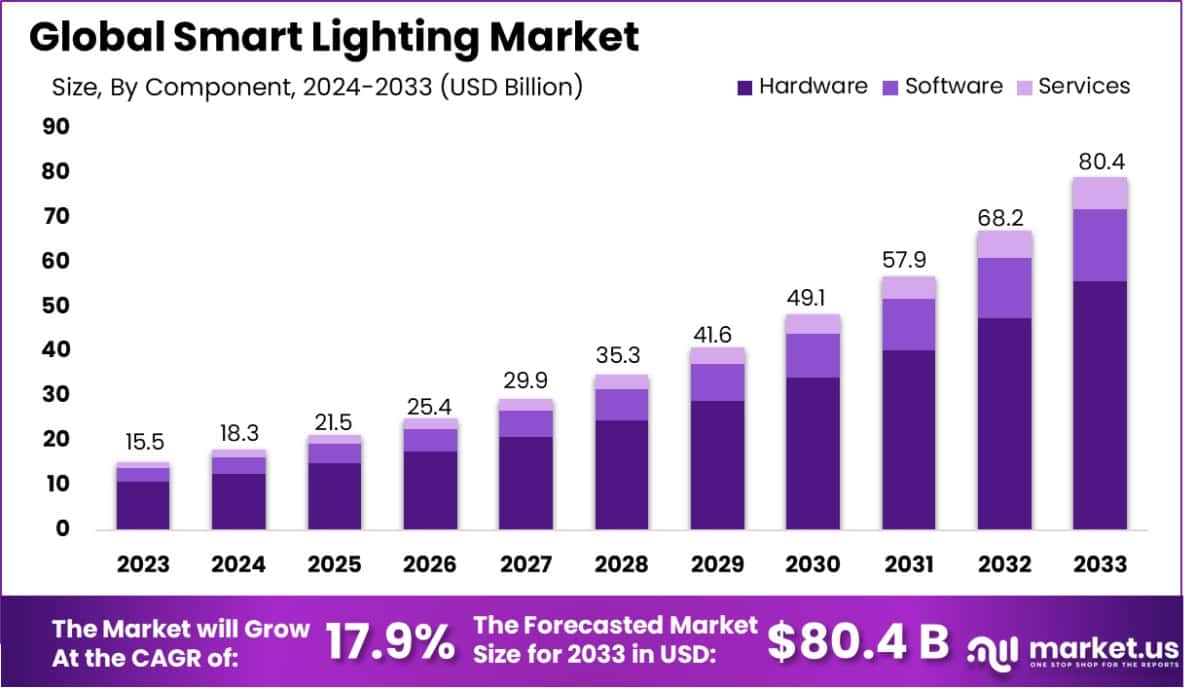

The Global Smart Lighting Market size is expected to be worth around USD 80.4 Billion By 2033, from USD 15.5 Billion in 2023, growing at a CAGR of 17.9% during the forecast period from 2024 to 2033. Europe dominated a 35.8% market share in 2023 and held USD 5.54 Billion in revenue from the Smart Lighting Market.

Smart lighting is an advanced lighting technology that integrates wireless communication to offer enhanced control, convenience, and energy efficiency. It allows users to adjust lighting remotely via apps on smartphones or other connected devices, supporting automation and customization of home and business environments. The key components of smart lighting systems include smart bulbs, control units, sensors, connectivity modules, and user interface software.

The smart lighting market is thriving as residential and commercial users increasingly adopt these systems. This market encompasses a range of products, including bulbs, sensors, networks, and related software used for controlling lighting systems remotely or automatically. The major driving factors for the smart lighting market include the global push for energy efficiency and the rising popularity of smart homes that incorporate IoT technologies for enhanced connectivity and automation.

The lighting industry globally accounts for about 19% of total electricity use and contributes roughly 6% to global greenhouse gas emissions. In contrast, LED smart lights stand out for their efficiency. These lights use up to ~70% less energy compared to traditional lighting and also serve a dual function by connecting to other devices to gather data, which can be used to optimize future energy usage and operational efficiencies.

Market demand for smart lighting is largely fueled by the convenience and advanced features it offers, such as the ability to change color, dim lights remotely, and adjust settings via mobile applications or voice commands. The demand is also driven by the increasing investment in smart city projects where smart lighting plays a crucial role in energy conservation and infrastructure management.

For instance, In June 2024, a report by Cities Today highlighted an impressive achievement by Bellinzona, Switzerland, where the installation of over 2,600 smart streetlights led to a significant 50% reduction in energy consumption. This initiative is part of Bellinzona’s broader commitment to energy efficiency and sustainability. By integrating smart technology into public infrastructure, the city aims to minimize energy waste and reduce operational costs.

Recent technological advancements in smart lighting include the development of more energy-efficient LED bulbs that offer superior connectivity and durability. Innovations in sensor technology have enabled the creation of smarter, more responsive lighting systems that can adjust based on natural light levels, occupancy, and other environmental factors.

Furthermore, the incorporation of mesh networking technologies like Zigbee allows for extended range and reliability in smart lighting systems, making them more adaptable to large scale and complex installations. Significant opportunities in the smart lighting market lie in continuous technological advancements, such as improvements in LED technologies and wireless communication protocols like Zigbee and Bluetooth.

In the United States, the utilization of green bonds for financing climate-aligned infrastructure projects is an exemplar of such transformative initiatives. For instance, Washington, DC, and Seattle have raised substantial funds through green bonds, totaling $350 million and $923 million respectively. These investments are increasingly channeled towards smart street lighting systems, underscoring a robust commitment to sustainable urban development.

Similarly, the Government of India’s UJALA program demonstrates the potential for national-scale transformations in lighting infrastructure. Since its inception in 2015, the program has successfully distributed over 1.15 billion LED bulbs, aiming to retrofit conventional streetlights nationwide. With the ambitious goal of replacing approximately 13.4 million streetlights by early 2020, the projected energy savings are estimated at around 9 billion kWh annually, highlighting substantial economic and environmental benefits.

Moreover, the Smart Street Lighting project in Chennai, funded under India’s Smart City Mission, has replaced traditional sodium-vapor lamps with LEDs, enhancing public safety and reducing energy consumption at a cost of about ₹2.94 crores (around $400,000). This initiative exemplifies the scalability and impact of smart lighting in improving urban landscapes.

Key Takeaways

- The Global Smart Lighting Market size is expected to be worth around USD 80.4 Billion By 2033, from USD 15.5 Billion in 2023, growing at a CAGR of 17.9% during the forecast period from 2024 to 2033.

- In 2023, Hardware held a dominant market position in the By Component segment of the Smart Lighting Market, capturing more than a 69.5% share.

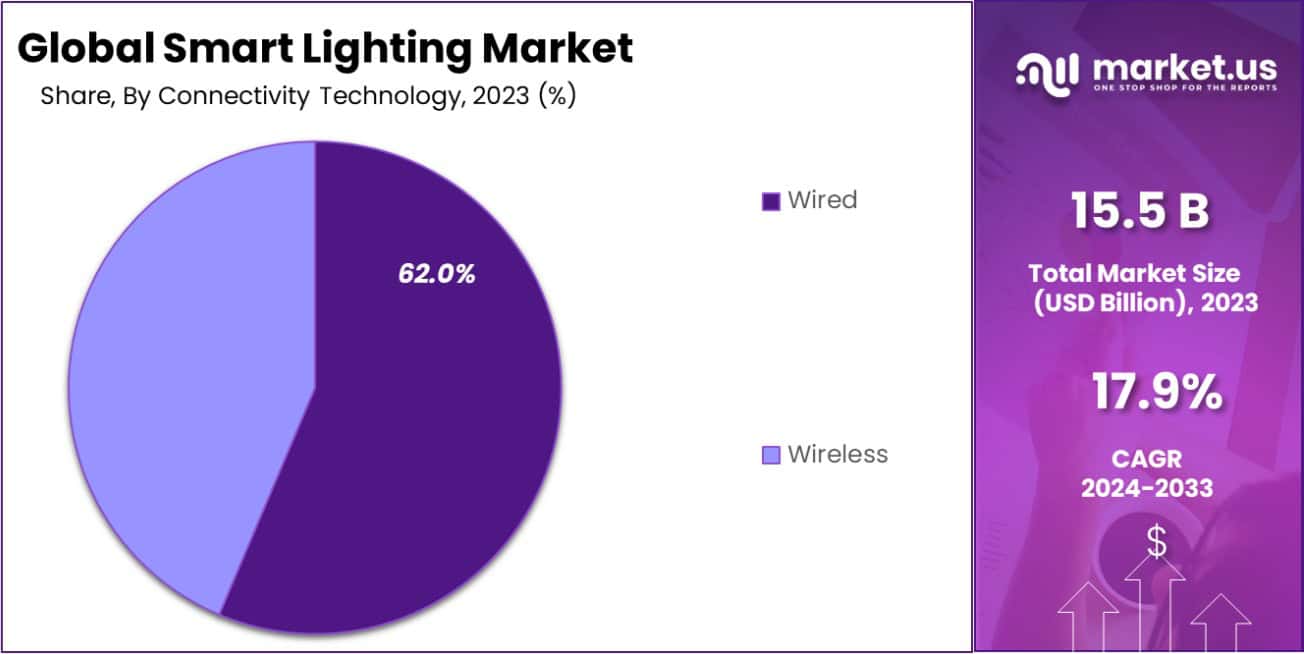

- In 2023, Wired held a dominant market position in the By Connectivity Technology segment of the Smart Lighting Market, capturing more than a 62.0% share.

- In 2023, Indoor Lighting held a dominant market position in the By Application segment of the Smart Lighting Market, capturing more than a 67.4% share.

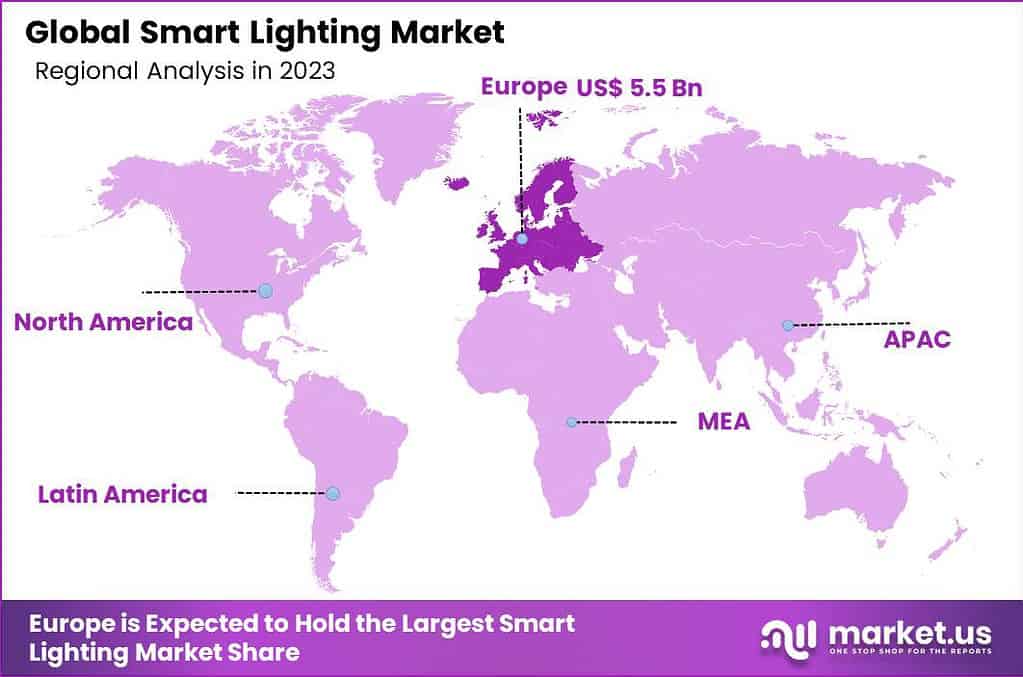

- Europe dominated a 35.8% market share in 2023 and held USD 5.54 Billion in revenue of the Smart Lighting Market.

Europe Smart Lighting Market Size

In 2023, Europe held a dominant market position in the smart lighting market, capturing more than a 35.8% share with revenues amounting to USD 5.54 billion. This leadership is primarily attributed to several key factors that uniquely position Europe at the forefront of the smart lighting industry.

Firstly, the region has seen extensive government initiatives aimed at energy conservation, which promote the adoption of energy-efficient technologies such as smart lighting. European Union regulations and directives that focus on reducing carbon footprints have significantly driven the demand for smart lighting solutions across commercial, industrial, and residential sectors.

Moreover, Europe’s technological advancements and the presence of leading market players who continuously innovate in the smart lighting sphere contribute to its strong market position. These companies not only push the boundaries of what smart lighting can achieve in terms of energy efficiency and intelligent control but also play a crucial role in the integration of these systems with other smart home technologies.

Additionally, Europe has a high penetration rate of smart homes, which incorporate advanced automation and IoT technologies, making smart lighting systems a natural fit for European consumers looking to upgrade their home systems. The increased consumer awareness about the benefits of smart lighting in terms of both convenience and energy savings further stimulates the market in Europe.

The robust infrastructure for research and development in Europe also supports the proliferation of smart lighting technology, ensuring that the market continues to evolve and expand. The combination of supportive regulations, advanced technology, strong market players, and consumer readiness makes Europe a leading region in the global smart lighting market.

Component Analysis

In 2023, the Hardware segment held a dominant market position within the smart lighting industry, capturing more than a 69.5% share. This segment includes both lights & luminaires and control systems, which are fundamental components for any smart lighting solution.

The primary reason for the dominance of the Hardware segment is its integral role in the physical installation and operation of smart lighting systems. Lights and luminaires have undergone significant transformations with the advent of LED technology, offering longer life spans, improved energy efficiency, and better cost-effectiveness than traditional lighting solutions.

Control systems, another critical component under the Hardware umbrella, have been pivotal in advancing the adoption of smart lighting. These systems, which include sensors, dimmers, and networked controls, allow users to adjust lighting based on presence, natural light levels, and other environmental factors.

The ability to integrate these systems seamlessly with other smart home technologies has also greatly contributed to their widespread adoption, making the hardware components the backbone of the smart lighting sector. Additionally, as the market continues to grow, innovations in both lighting technology and control systems are expected to advance.

Innovations such as IoT integration, which enables remote management and data analytics, are making smart lighting solutions increasingly attractive to both residential and commercial consumers. The expansion of smart cities and the global push towards energy efficiency further bolster the demand for robust hardware systems, ensuring their continued market dominance.

Connectivity Technology Analysis

In 2023, the Wired segment held a dominant market position in the smart lighting market, capturing more than a 62.2% share. This substantial market share can be attributed to several key factors that underline the continued preference for wired connectivity in smart lighting solutions.

Wired technology is often perceived as more reliable and secure compared to wireless solutions, offering stable connections without the interference issues that can sometimes plague wireless networks. This reliability is crucial in commercial and industrial settings where consistent performance and network stability are paramount.

Moreover, wired connections are favored for their robustness in large-scale lighting installations, such as those found in urban infrastructure projects, commercial buildings, and industrial complexes. In these environments, the extensive reach and scalability of wired systems play a vital role. The ability of wired systems to handle large volumes of data transfers without latency issues also makes them indispensable in settings requiring real-time control and monitoring.

Additionally, the established nature of wired infrastructure in many buildings facilitates easier integration of smart lighting systems with existing electrical and control systems, reducing initial setup costs and complexity. This ease of integration, combined with the decreasing cost of implementing wired smart lighting solutions due to advancements in technology, continues to drive the preference for wired connectivity.

Furthermore, as smart lighting technology evolves, enhancements in wired connectivity, such as improved energy efficiency and advanced control features, keep it competitive. These developments ensure that the wired segment remains a strong contender in the smart lighting market, even as wireless alternatives continue to emerge and expand.

By Application Analysis

In 2023, the Indoor Lighting segment held a dominant market position within the smart lighting market, capturing more than a 67.4% share. This significant dominance is driven by the diverse applications and high demand for smart lighting solutions across various indoor settings, including residential, commercial, and industrial spaces.

In residential environments, the growing trend towards home automation and the integration of IoT devices have particularly spurred the adoption of smart lighting systems, as they enhance both comfort and energy efficiency. In the commercial sector, smart lighting solutions are increasingly being implemented in office buildings, retail stores, and hospitality venues to reduce energy costs and improve lighting management with automated controls and customizable settings.

This sector benefits significantly from the ability to adjust lighting based on occupancy and time of day, contributing to substantial energy savings and improved operational efficiency. Industrial applications also contribute to the strong performance of the indoor segment, where smart lighting is critical for ensuring worker safety and meeting stringent energy regulations.

Moreover, advancements in LED technology, sensor integration, and networked systems for centralized management have made smart indoor lighting systems more attractive and cost-effective. These technological enhancements have enabled detailed monitoring and control capabilities that appeal to facility managers and property owners looking to optimize their lighting systems for both performance and sustainability.

Key Market Segments

By Component

- Hardware

- Lights & Luminaires

- Control Systems

- Software

- Services

By Connectivity Technology

- Wired

- Wireless

By Application

- Indoor Lighting

• Residential

• Commercial

• Industrial

• Others - Outdoor Lighting

• Highway and Roadway Lighting

• Architectural Lighting

• Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Adoption of Energy-Efficient and Automated Solutions

In 2023, a major driver for the smart lighting market is the escalating demand for energy efficiency and enhanced user convenience across various sectors, including residential, commercial, and industrial spaces. Governments and regulatory bodies worldwide are pushing for reductions in energy consumption, which significantly heightens the appeal of smart lighting systems.

These systems are equipped with technologies such as sensors and automated controls that adjust lighting based on occupancy and ambient light, thereby conserving energy. The integration of smart lighting with IoT devices in smart homes and cities is also propelling market growth, facilitating remote control and monitoring, which adds layers of functionality and user engagement.

Restraint

High Initial Installation Costs and Complexity

A significant restraint in the smart lighting market is the initial cost of installation and the complexity involved in integrating advanced technologies into existing infrastructures. The upfront costs associated with transitioning to smart lighting systems can be prohibitive for some users, particularly in regions with lower economic flexibility.

Moreover, the complexity of installing integrated systems that work harmoniously with different devices and platforms can deter potential adopters who prefer simpler, less disruptive solutions. This complexity extends to maintaining the system, as the integration of various components like sensors, controls, and connectivity technologies requires continuous updates and management to ensure optimal performance.

Opportunity

Expansion into Smart City Projects and IoT Integration

The smart lighting market is presented with substantial opportunities through the expansion of smart city initiatives and further integration with the Internet of Things (IoT). Smart cities around the world are incorporating smart lighting to enhance public safety, improve aesthetics, and reduce energy usage, which aligns with broader goals of sustainability and enhanced urban living.

Furthermore, the advancement of IoT technology allows smart lighting systems to be more interconnected with other city infrastructures, providing comprehensive data analytics that can improve city planning and management. This growing trend towards urban digital transformation represents a fertile ground for the expansion of the smart lighting sector.

Challenge

Interoperability and Standardization Issues

One of the primary challenges facing the smart lighting industry is the lack of standardization and interoperability among different devices and systems. Each manufacturer often develops proprietary protocols, which can hinder the seamless interaction between various smart lighting systems and other smart devices.

This fragmentation in the industry makes it difficult for users to integrate products from different manufacturers, limiting flexibility and choice. Overcoming these interoperability issues is crucial for the industry to move towards broader adoption, requiring collaboration among companies to agree on common standards and protocols that ensure compatibility and ease of use across different platforms.

Growth Factors

The smart lighting market is experiencing rapid growth, driven by a combination of energy-saving initiatives and the global push toward smart cities and homes. As residential and commercial consumers increasingly seek energy-efficient solutions, smart lighting technologies are becoming essential due to their ability to significantly reduce electricity usage.

Additionally, the integration of smart lighting systems with IoT devices is transforming how environments are illuminated, allowing for automated adjustments that further enhance energy efficiency and user convenience. This trend is supported by the rising adoption of LED technologies, known for their low power consumption and long service life, making them ideal for both indoor and outdoor applications.

Emerging Trends

A key trend in the smart lighting market is the deepening integration with smart home ecosystems, where lighting systems are increasingly controlled via smartphone apps or voice commands through platforms like Amazon Alexa or Google Assistant. This integration facilitates not only convenience but also energy management and security enhancements.

Furthermore, advancements in wireless communication technologies are enabling more flexible and scalable installations, particularly in residential settings. Another emerging trend is the customization of lighting experiences, where users can adjust lighting colors and intensities to suit different moods or settings, adding a personal touch to the smart home environment.

Business Benefits

Smart lighting systems offer numerous business benefits, including substantial energy and cost savings, improved employee productivity through better working environments, and enhanced customer experiences in retail settings. In commercial applications, smart lighting can adapt to natural light levels and occupancy, significantly reducing wasted energy.

For retailers, smart lighting can be integrated with sensors and marketing analytics tools to enhance in-store experiences and engage customers more effectively. Additionally, smart lighting contributes to building management systems by improving safety and security, providing a well-rounded investment return for businesses looking to modernize their operations.

Key Players Analysis

Leading players in the outdoor lighting market are employing a range of strategies to strengthen their positions. Key actions include product development, mergers and acquisitions, strategic partnerships, and business expansions. These efforts help them stay competitive and meet evolving market demands.

For instance, in May 2023, Cyclone Lighting, a recognized name in outdoor lighting, introduced a new luminaire called Elencia. This product launch reflects Cyclone’s commitment to innovation, as the company aims to offer cutting-edge solutions that appeal to both functional and aesthetic needs in the lighting sector.

Koninklijke Philips N.V. has been active in enhancing its smart lighting portfolio, launching new LED products that highlight innovation in light quality and energy efficiency. Recently, they introduced a new range of LED retrofit lamps, such as the Philips DimTone BR30 LED, which uniquely adjusts its color temperature during dimming to mimic the warm tones of traditional incandescent bulbs.

OSRAM Licht AG continues to play a significant role in the smart lighting industry by focusing on strategic mergers and acquisitions alongside innovative product development. The company has been integrating advanced technologies into its product offerings, enhancing its capabilities in smart and connected lighting solutions.

Legrand Group has shown robust performance in integrating acquisitions and launching new products to expand its market reach and capabilities in the smart lighting sector. The company’s strategy includes leveraging these acquisitions to foster growth and innovation, particularly in high-value product segments.

Top Key Players in the Market

- Koninklijke Philips N.V.

- OSRAM Licht AG

- Legrand Group

- Acuity Brands, Inc.

- Savant Systems, Inc.

- Honeywell International Inc.

- Lutron Electronics Co., Inc

- Wipro Limited

- RAB Lighting Inc.

- Itron Inc.

- Other Key Players

Recent Developments

- In June 2023, Honeywell International Inc. announced a partnership to integrate their smart lighting products with IoT devices from 5 different tech companies.

- In April 2023, Savant Systems, Inc. secured $50 million in funding to expand its smart home technology offerings, including advanced lighting systems.

- In January 2023, Acuity Brands, Inc. launched a new series of smart lighting solutions, increasing their product line by 20% this year.

Report Scope

Report Features Description Market Value (2023) USD 15.5 Billion Forecast Revenue (2033) USD 80.4 Billion CAGR (2024-2033) 17.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component(Hardware,(Lights & Luminaires, Control Systems), Software, Services), By Connectivity Technology(Wired, Wireless), By Application(Indoor Lighting,(Residential, Commercial, Industrial, Others), Outdoor Lighting,(Highway and Roadway Lighting, Architectural Lighting, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Koninklijke Philips N.V., OSRAM Licht AG, Legrand Group, Acuity Brands, Inc., Savant Systems, Inc., Honeywell International Inc., Lutron Electronics Co., Inc, Wipro Limited, RAB Lighting Inc., Itron Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Koninklijke Philips N.V.

- OSRAM Licht AG

- Legrand Group

- Acuity Brands, Inc.

- Savant Systems, Inc.

- Honeywell International Inc.

- Lutron Electronics Co., Inc

- Wipro Limited

- RAB Lighting Inc.

- Itron Inc.

- Other Key Players