Global Smart Irrigation Market Size, Share, Growth Analysis By Component (Controllers, Sensors, Water Flow Meters, Others), By Type (Weather-Based Controller Systems, Sensor-Based Controller Systems), By Type of Enterprise (Large and Small, Medium Enterprise), By Application (Agricultural, Greenhouse, Open Field, Non Agricultural, Residential, Turf and Landscape, Golf Courses, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157502

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

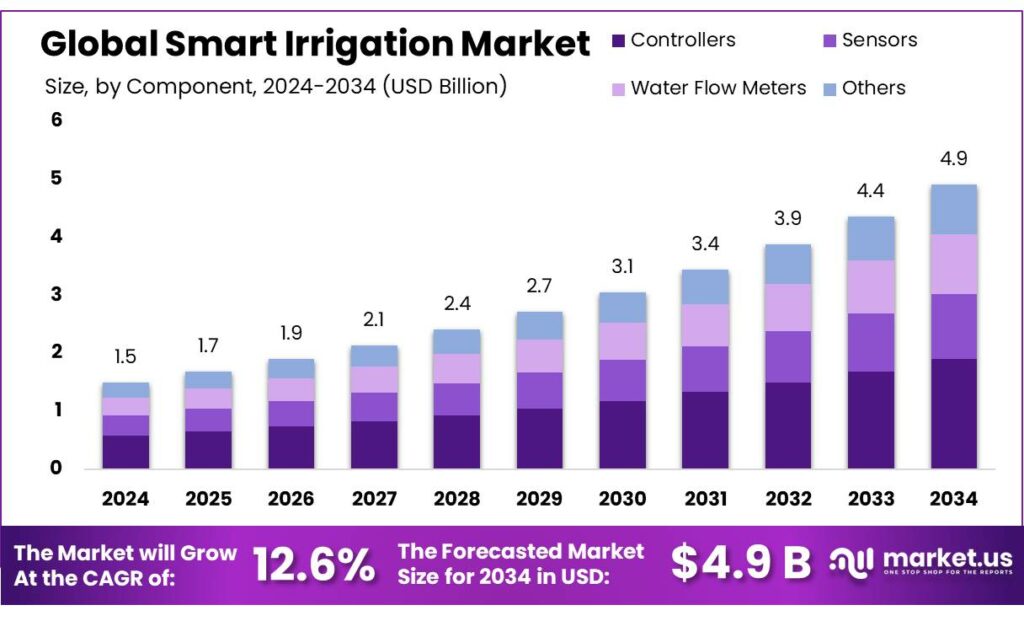

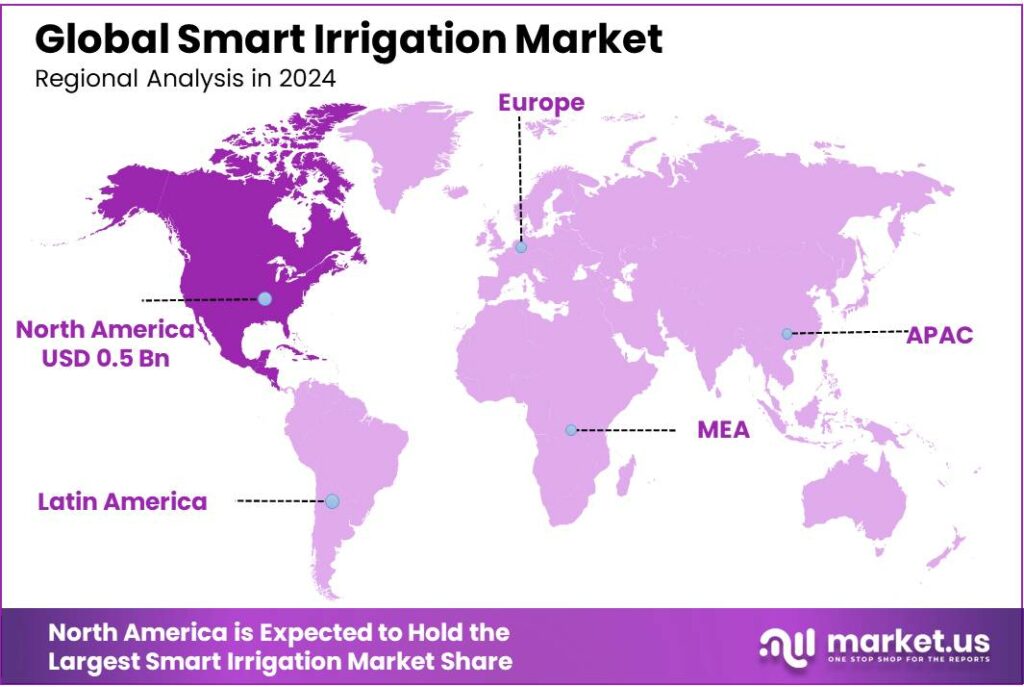

The Global Smart Irrigation Market size is expected to be worth around USD 4.9 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 12.6% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 37.8% share, holding USD 0.5 Billion in revenue.

Smart irrigation has emerged as a pivotal solution in India’s agricultural landscape, addressing critical challenges such as water scarcity, erratic monsoon patterns, and the need for sustainable farming practices. The Indian government has recognized the importance of efficient water management and has implemented several initiatives to promote the adoption of smart irrigation technologies.

Additionally, the National Mission on Micro Irrigation (NMMI) further supports the adoption of drip irrigation systems in India. The government’s commitment to water conservation is also evident in the establishment of the Micro Irrigation Fund (MIF) with an allocation of INR 5,000 crore. This fund aims to bring more land area under micro-irrigation, currently covering only 10 million hectares against a potential of 70 million hectares.

State-level initiatives have also played a significant role in promoting smart irrigation. For instance, Uttar Pradesh has constructed 37,403 farm ponds under the ‘Khet Talab Yojana’ since 2017-18, providing farmers with subsidies to enhance irrigation and water conservation efforts. These ponds have been instrumental in improving agricultural resilience and promoting efficient water use.

Technological advancements have significantly contributed to the adoption of smart irrigation practices. For instance, the Nano Ganesh system allows farmers to remotely control irrigation pumps via mobile phones, facilitating timely irrigation and reducing labor costs.

Key Takeaways

- Smart Irrigation Market size is expected to be worth around USD 4.9 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 12.6%.

- Controllers dominated the smart irrigation market, capturing more than a 38.6% share.

- Weather-based controller systems held a dominant position in the smart irrigation market, capturing more than a 59.1% share.

- Large and small enterprises collectively held a dominant position in the smart irrigation market, capturing more than a 69.8% share.

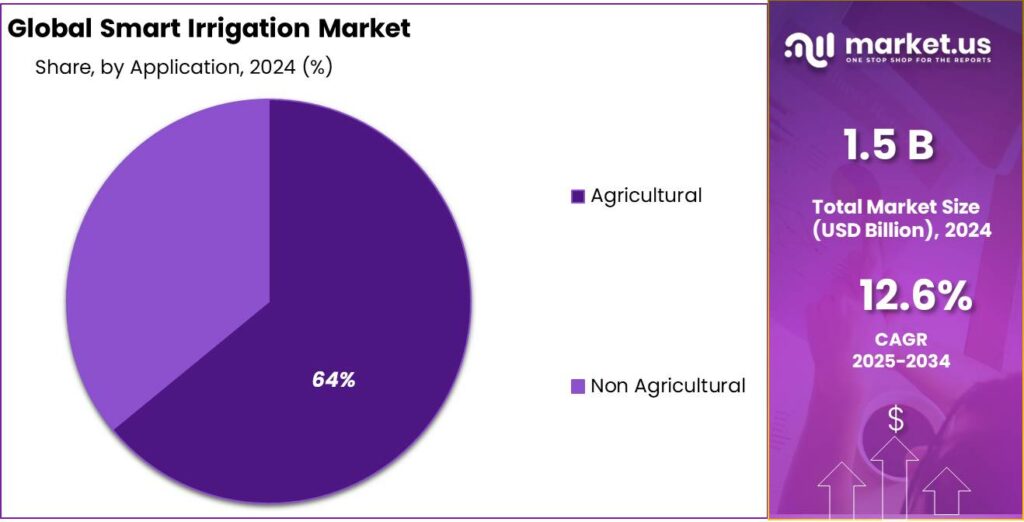

- Agricultural sector dominated the smart irrigation market, capturing more than a 64.2% share.

- North America held a dominant position in the global smart irrigation market, capturing a 37.8% share, valued at approximately USD 0.5 billion.

By Component Analysis

Controllers Lead Smart Irrigation Market with 38.6% Share in 2024

In 2024, controllers dominated the smart irrigation market, capturing more than a 38.6% share. This significant market position is attributed to their pivotal role in automating irrigation systems, thereby enhancing water efficiency and reducing labor costs. Controllers, particularly weather-based and sensor-based types, have become integral components in both agricultural and non-agricultural applications. Their ability to adjust watering schedules based on real-time data ensures optimal water usage, aligning with global sustainability goals.

By Type Analysis

Weather-Based Controller Systems Dominate with 59.1% Share in 2024

In 2024, weather-based controller systems held a dominant position in the smart irrigation market, capturing more than a 59.1% share. This significant market share underscores the growing preference for these systems, which utilize real-time weather data to optimize irrigation schedules. By adjusting watering times based on factors like temperature, humidity, and rainfall, weather-based controllers ensure efficient water usage, making them particularly appealing for both residential and commercial applications.

By Type of Enterprise Analysis

Large and Small Enterprises Dominate Smart Irrigation Market with 69.8% Share in 2024

In 2024, large and small enterprises collectively held a dominant position in the smart irrigation market, capturing more than a 69.8% share. This substantial market share reflects the widespread adoption of smart irrigation solutions across various sectors, including agriculture, landscaping, and municipal applications. The integration of advanced technologies such as IoT, AI, and sensor-based systems has enabled enterprises of all sizes to optimize water usage, reduce costs, and enhance operational efficiency.

By Application Analysis

Agricultural Application Leads Smart Irrigation Market with 64.2% Share in 2024

In 2024, the agricultural sector dominated the smart irrigation market, capturing more than a 64.2% share. This significant market position reflects the increasing adoption of smart irrigation technologies in farming practices worldwide. Farmers are leveraging these systems to optimize water usage, enhance crop yields, and promote sustainable agricultural practices.

Key Market Segments

By Component

- Controllers

- Sensors

- Water Flow Meters

- Others

By Type

- Weather-Based Controller Systems

- Sensor-Based Controller Systems

By Type of Enterprise

- Large and Small

- Medium Enterprise

By Application

- Agricultural

- Greenhouse

- Open Field

- Non Agricultural

- Residential

- Turf and Landscape

- Golf Courses

- Others

Emerging Trends

Integration of Artificial Intelligence (AI) and Internet of Things (IoT) in Smart Irrigation

In recent years, the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into smart irrigation systems has become a significant trend in Indian agriculture. This technological advancement aims to enhance water-use efficiency, reduce costs, and improve crop yields, addressing the challenges posed by water scarcity and climate variability.

The integration of IoT and AI into irrigation systems allows for real-time monitoring and data-driven decision-making. IoT sensors collect data on soil moisture, weather conditions, and crop health, which is then analyzed using AI algorithms to determine optimal irrigation schedules. This approach ensures that water is applied precisely when and where it is needed, minimizing waste and improving water-use efficiency. For example, AI-powered systems can predict irrigation needs based on weather forecasts and soil moisture levels, allowing farmers to adjust irrigation schedules accordingly.

Several states in India have initiated projects to implement AI and IoT-based irrigation systems. In Telangana, the government has launched the Indira Solar Giri Jal Vikasam scheme, which aims to solarize irrigation systems for tribal farmers. The scheme provides a 100% subsidy for the installation of solar-powered irrigation pumps, along with support for drip irrigation and intercropping. This initiative not only promotes sustainable water use but also integrates advanced technologies to enhance irrigation efficiency.

Drivers

Government Support and Subsidies for Smart Irrigation

One of the most significant driving factors propelling the adoption of smart irrigation technologies in India is the robust support provided by the government through various subsidies and initiatives. Recognizing the critical need for efficient water use in agriculture, the Indian government has implemented several schemes aimed at promoting micro-irrigation systems such as drip and sprinkler irrigation.

Under the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), the government offers substantial financial assistance to farmers for installing micro-irrigation systems. Small and marginal farmers receive a 55% subsidy, while other farmers are eligible for a 45% subsidy on the indicative unit cost of the irrigation systems. Additionally, some state governments provide top-up subsidies to further encourage adoption. For instance, Uttar Pradesh has constructed over 37,000 farm ponds under the ‘Khet Talab Yojana’ since 2017-18, with a subsidy of ₹52,000 per pond for farmers maintaining micro-irrigation systems

To facilitate the expansion of micro-irrigation, the government established the Micro Irrigation Fund (MIF) with an initial corpus of ₹5,000 crore, managed by NABARD. This fund provides low-interest loans to state governments for implementing micro-irrigation projects. As of May 2025, loans amounting to ₹4,719 crore have been sanctioned, with ₹3,751 crore released to various states

These financial incentives have led to significant adoption of smart irrigation systems. For example, in Uttar Pradesh, the area under micro-irrigation has increased from 1,730 hectares in 2020-21 to 18,189 hectares in 2024-25, resulting in improved groundwater levels and enhanced crop yields

Restraints

High Initial Investment and Financial Constraints

One of the primary challenges hindering the widespread adoption of smart irrigation technologies in India is the substantial initial investment required for installation and maintenance. Despite the government’s efforts to promote micro-irrigation systems through subsidies, the remaining financial burden often deters small and marginal farmers from embracing these technologies.

For instance, the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) offers a 55% subsidy to small and marginal farmers for installing micro-irrigation systems. However, the remaining 45% cost can still be prohibitive for many, especially when considering the additional expenses for maintenance and operation. Similarly, the PM Kisan Urja Suraksha evam Utthan Mahabhiyan (KUSUM) scheme provides a 60% subsidy for solar irrigation pumps, but the upfront cost remains a significant barrier for farmers with limited financial resources.

The financial constraints are further exacerbated by the fragmented landholding patterns prevalent in India. With an average landholding size of just 1.08 hectares, many farmers find it challenging to justify the investment in smart irrigation systems that require economies of scale to be cost-effective.

Moreover, the lack of access to affordable credit facilities and insurance schemes tailored for smallholder farmers further limits their ability to invest in advanced irrigation technologies. While schemes like the Micro Irrigation Fund (MIF) have been established to provide financial assistance, the accessibility and reach of these funds remain limited, particularly in remote rural areas.

Opportunity

Integration of Smart Irrigation with Solar Energy

One of the most promising avenues for expanding smart irrigation in India is the integration of solar energy with irrigation systems. This combination addresses two critical challenges faced by Indian farmers: unreliable power supply and high energy costs. By harnessing solar energy, farmers can operate irrigation systems independently of the grid, ensuring consistent water supply for their crops.

The Government of India has recognized the potential of solar-powered irrigation and has introduced several initiatives to promote its adoption. Under the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) scheme, farmers are provided with a 60% subsidy for installing solar-powered irrigation pumps.

This initiative aims to reduce farmers’ dependence on diesel and grid electricity, thereby lowering irrigation costs and promoting sustainable farming practices. As of the latest reports, the scheme has been instrumental in solarizing agricultural pumps across various states, contributing to the overall growth of smart irrigation systems in the country.

Additionally, state governments have launched their own programs to support solar-powered irrigation. For instance, the Telangana government has introduced the Indira Solar Giri Jal Vikasam scheme, which targets the solarization of irrigation systems for tribal farmers. With an allocation of ₹12,600 crore, the scheme aims to cover six lakh acres of land over five years, benefiting 2.1 lakh tribal farmers. The initiative provides a 100% subsidy for installing solar pumps, along with support for horticulture development and interim income through intercropping.

Regional Insights

North America Dominates Smart Irrigation Market with 37.8% Share in 2024

In 2024, North America held a dominant position in the global smart irrigation market, capturing a 37.8% share, valued at approximately USD 0.5 billion. This leadership is primarily driven by the United States, which accounted for a substantial portion of the regional market. The adoption of smart irrigation technologies in North America is propelled by factors such as increasing water scarcity, stringent environmental regulations, and a strong emphasis on sustainable agricultural practices.

Technological advancements also play a crucial role in the region’s market expansion. The integration of Internet of Things (IoT) sensors, weather-based controllers, and data analytics into irrigation systems enables precise water management, reducing wastage and enhancing crop yields. Moreover, the growing trend of smart homes and urban landscaping further drives the demand for smart irrigation solutions in residential and commercial applications.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Toro Company, headquartered in Bloomington, Minnesota, is a leading provider of irrigation and outdoor maintenance solutions. With over 11,000 employees and a revenue of $4.58 billion in 2024, Toro offers a range of products including controllers, sensors, and sprinkler nozzles for both agricultural and non-agricultural applications. The company focuses on sustainable water management and has formed strategic partnerships, such as the 10-year collaboration with Sentosa Golf Club, to promote eco-friendly irrigation practices.

Established in 1933 and based in Azusa, California, Rain Bird Corporation is a global leader in irrigation products. The company offers a comprehensive range of smart irrigation solutions, including controllers, sensors, and sprinkler nozzles, catering to agricultural, residential, and commercial sectors. Rain Bird is committed to water conservation and innovation, continuously enhancing its product offerings to meet the evolving needs of the irrigation industry.

HydroPoint, based in the United States, is a leader in smart water management solutions. The company offers advanced irrigation controllers and software that utilize real-time data to optimize water usage in landscapes and agriculture. HydroPoint’s products, such as the WeatherTRAK system, integrate weather data and predictive analytics to reduce water waste and promote sustainability.

Top Key Players Outlook

- The Toro Company

- Rain Bird Corporation

- HUNTER INDUSTRIES INC.

- NETAFIM

- HydroPoint

- Manna Irrigation Ltd.

- Stevens Water Monitoring Systems Inc.

- Galcon

- Rachio inc.

- Weathermatic

Recent Industry Developments

In 2024, The Toro Company, headquartered in Bloomington, Minnesota, reported a revenue of $4.58 billion, marking a 6.5% increase from the previous year.

In 2024, Netafim, a global leader in precision irrigation, achieved a revenue of $7.5 billion. Operating in over 100 countries with more than 4,500 employees, Netafim specializes in drip and micro-irrigation technologies, offering end-to-end solutions from water source to root zone.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 4.9 Bn CAGR (2025-2034) 12.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Controllers, Sensors, Water Flow Meters, Others), By Type (Weather-Based Controller Systems, Sensor-Based Controller Systems), By Type of Enterprise (Large and Small, Medium Enterprise), By Application (Agricultural, Greenhouse, Open Field, Non Agricultural, Residential, Turf and Landscape, Golf Courses, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Toro Company, Rain Bird Corporation, HUNTER INDUSTRIES INC., NETAFIM, HydroPoint, Manna Irrigation Ltd., Stevens Water Monitoring Systems Inc., Galcon, Rachio inc., Weathermatic Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Toro Company

- Rain Bird Corporation

- HUNTER INDUSTRIES INC.

- NETAFIM

- HydroPoint

- Manna Irrigation Ltd.

- Stevens Water Monitoring Systems Inc.

- Galcon

- Rachio inc.

- Weathermatic