Smart Insulin Pens Market By Product Type (Bluetooth Based and Near Field Communication Based), By Application (Type 2 Diabetes and Type 1 Diabetes), By Distribution Channel (Hospital Pharmacies and Retail & Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 12028

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

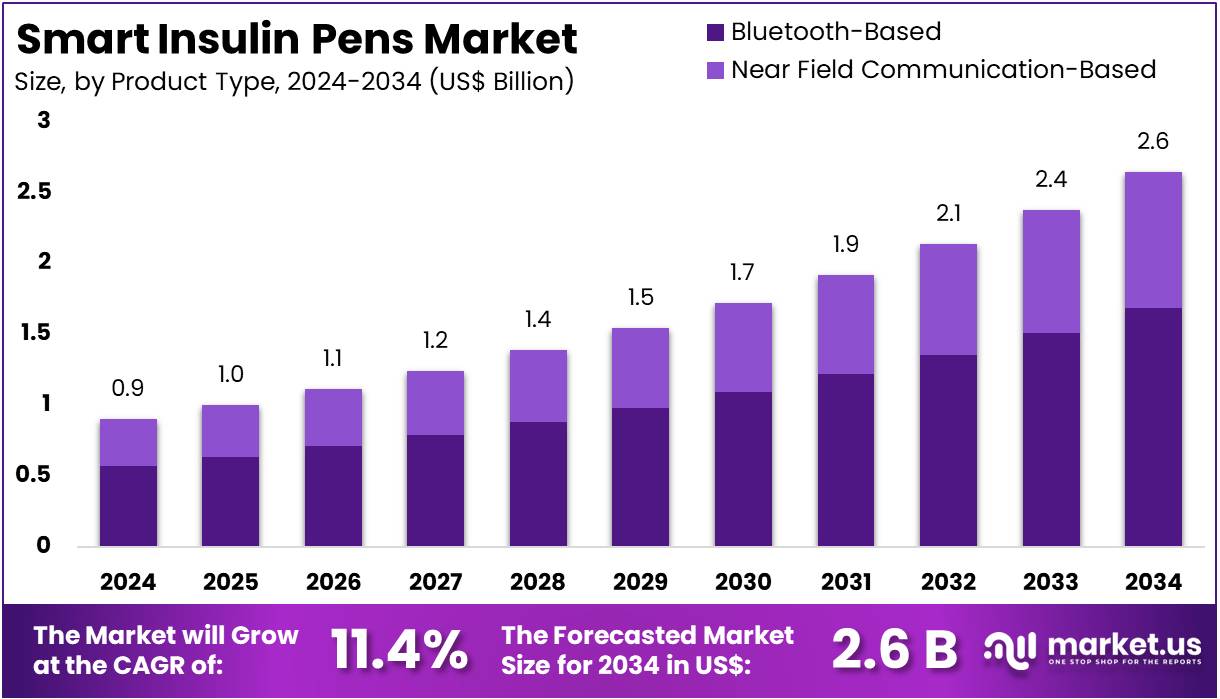

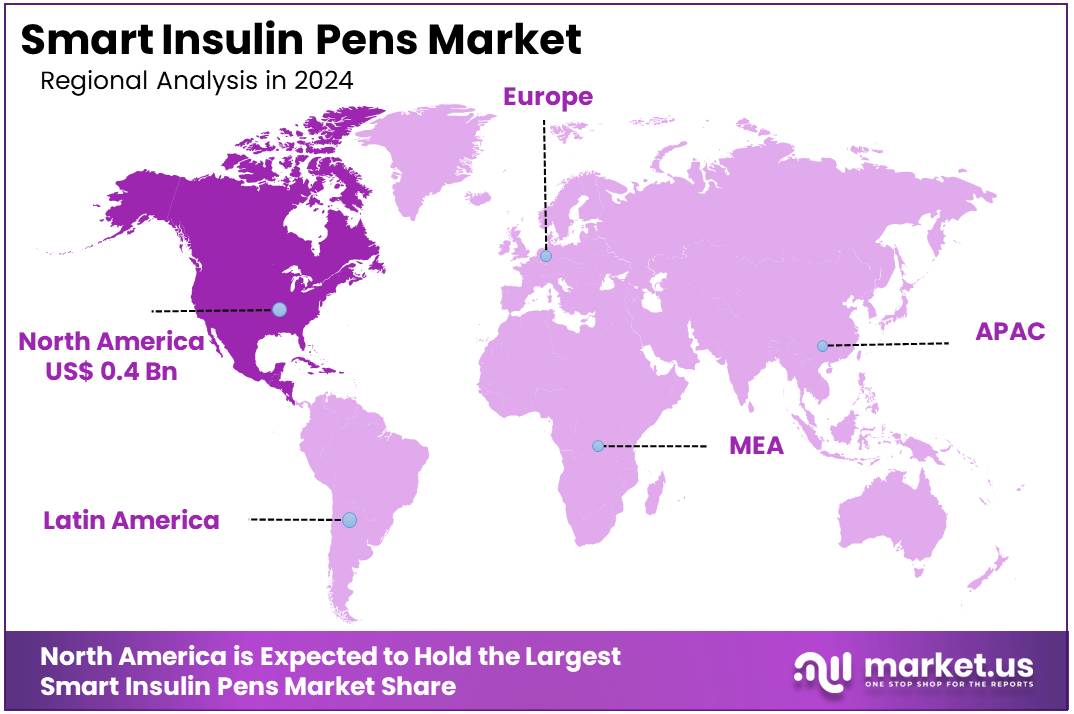

The Smart Insulin Pens Market Size is expected to be worth around US$ 2.6 billion by 2034 from US$ 0.9 billion in 2024, growing at a CAGR of 11.4% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.8% share and holds US$ 0.4 Billion market value for the year.

Increasing prevalence of diabetes and the growing need for more precise and convenient insulin management are driving the expansion of the smart insulin pens market. Smart insulin pens are designed to improve the accuracy and efficiency of insulin delivery, providing real-time data to help individuals with diabetes better manage their condition. These pens allow for the automatic recording of insulin doses, tracking of injection times, and integration with mobile apps for personalized insights, which enhances patient compliance and reduces the risk of dosing errors.

The rising adoption of connected health devices, along with the growing trend toward digital health and remote patient monitoring, is accelerating the use of smart insulin pens. Patients with diabetes increasingly seek solutions that simplify their daily management routines and provide more control over their health.

In October 2022, Novo Nordisk A/S introduced its smart insulin pens, including the NovoPen 6 and NovoPen Echo Plus, to the market in Ireland, aiming to improve insulin delivery and management for individuals living with diabetes. These innovations reflect the growing trend of integrating technology with healthcare, as smart insulin pens can also sync with digital platforms to enable data sharing between patients and healthcare providers.

Recent trends also include the development of pens that offer dose reminders, insulin tracking, and even the ability to adjust dosages automatically based on real-time glucose monitoring. As diabetes care continues to evolve, the smart insulin pens market presents significant opportunities to enhance patient outcomes, improve lifestyle convenience, and reduce long-term complications associated with poor insulin management.

Key Takeaways

- In 2024, the market for smart insulin pens generated a revenue of US$ 0.9 billion, with a CAGR of 11.4%, and is expected to reach US$ 2.6 billion by the year 2034.

- The product type segment is divided into bluetooth based and near field communication based, with bluetooth based taking the lead in 2023 with a market share of 63.5%.

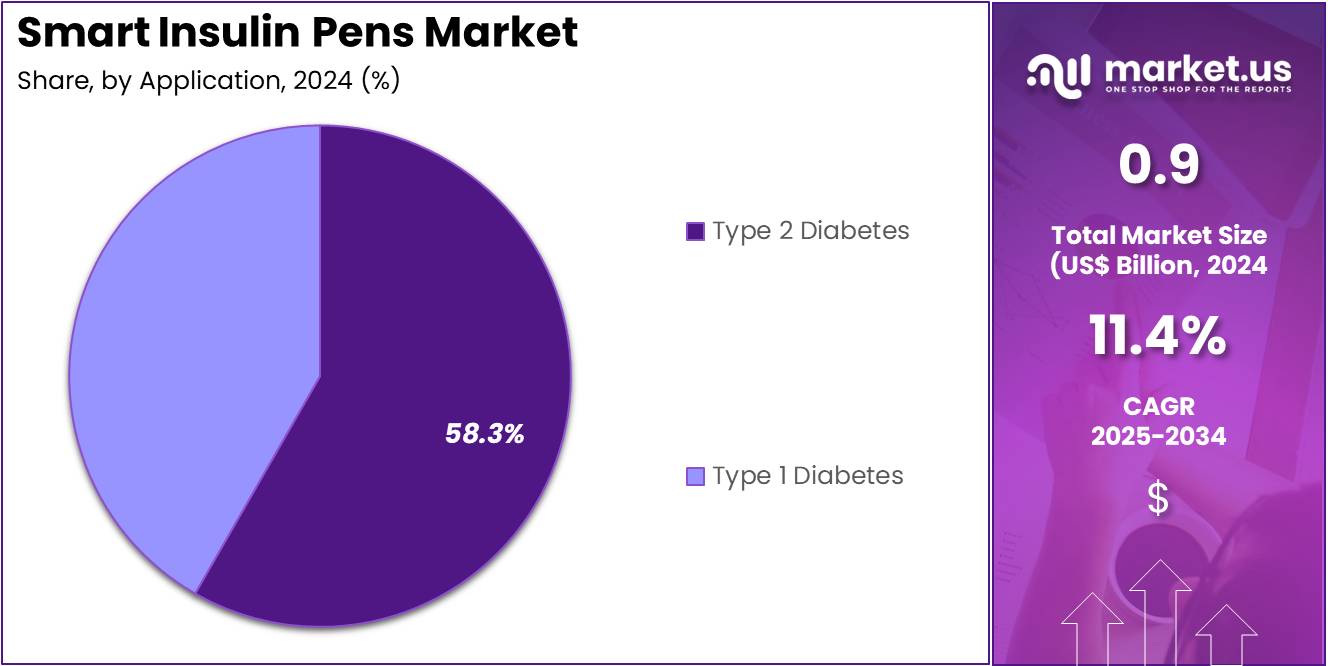

- Considering application, the market is divided into type 2 diabetes and type 1 diabetes. Among these, type 2 diabetes held a significant share of 58.3%.

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacies and retail & online pharmacies. The hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 52.8% in the smart insulin pens market.

- North America led the market by securing a market share of 43.8% in 2023.

Product Type Analysis

Bluetooth-based smart insulin pens hold the largest share of 63.5% in the market. This growth is expected to continue as Bluetooth technology enables seamless data transfer between the insulin pen and connected devices, such as smartphones and glucose meters. This connectivity allows users to track their insulin usage, monitor blood glucose levels, and share data with healthcare providers for more personalized treatment plans. The growing preference for non-invasive, easy-to-use, and user-friendly diabetes management tools is likely to drive demand for Bluetooth-based pens.

As consumers and healthcare providers increasingly adopt digital health solutions for chronic disease management, Bluetooth-based pens are expected to become the preferred choice due to their ability to provide real-time feedback and enhance treatment adherence. The continuous advancements in Bluetooth technology, along with increasing integration with mobile health apps, are expected to further boost the market for Bluetooth-based smart insulin pens in the coming years.

Application Analysis

Type 2 diabetes holds the largest share of 58.3% in the application segment of the smart insulin pens market. This growth is expected to continue as the global prevalence of type 2 diabetes rises due to factors such as aging populations, sedentary lifestyles, and unhealthy diets. Type 2 diabetes is a chronic condition that requires constant monitoring of blood glucose levels and insulin management, making the use of smart insulin pens crucial for effective disease management.

Bluetooth-enabled smart pens are anticipated to become an integral part of managing type 2 diabetes, as they allow patients to track their insulin doses and share data with healthcare professionals for better treatment adjustments.

The increasing awareness of diabetes management tools and the shift towards more personalized healthcare solutions are likely to drive the demand for smart insulin pens, particularly among individuals with type 2 diabetes. Furthermore, as patients seek more efficient, convenient ways to manage their condition, the adoption of smart insulin pens in type 2 diabetes treatment is expected to grow significantly.

Distribution Channel Analysis

Hospital pharmacies represent the largest distribution channel in the smart insulin pens market, holding 52.8% of the market share. This growth is expected to continue as hospitals remain key centers for treating individuals with diabetes, particularly those requiring insulin therapy. Hospital pharmacies are expected to drive the adoption of smart insulin pens as part of their comprehensive diabetes management programs, offering patients a more accurate, efficient, and convenient way to monitor and manage their insulin usage.

The increasing number of patients with diabetes, particularly those with complex treatment regimens, is likely to boost demand for advanced insulin delivery systems. Hospital pharmacies are also investing in digital health solutions that improve patient outcomes, optimize care delivery, and reduce healthcare costs, contributing to the growth of smart insulin pens in these settings. As hospitals continue to focus on improving patient adherence and enhancing overall care, the demand for smart insulin pens in hospital pharmacies is projected to rise, supporting continued growth in this segment.

Key Market Segments

By Product Type

- Bluetooth Based

- Near Field Communication Based

By Application

- Type 2 Diabetes

- Type 1 Diabetes

By Distribution Channel

- Hospital Pharmacies

- Retail & Online Pharmacies

Drivers

Rising Global Prevalence of Diabetes is Driving the Market

The increasing global prevalence of diabetes, particularly type 1 and insulin-dependent type 2 diabetes, is a significant driver propelling the smart insulin pens market. As the number of individuals requiring insulin therapy grows, there is a heightened demand for more accurate, convenient, and data-driven methods of insulin delivery and management. Smart insulin pens address this need by recording dosage, time, and sometimes even integrating with glucose monitoring devices, offering a more precise and personalized approach to diabetes care compared to traditional pens.

The International Diabetes Federation (IDF) Diabetes Atlas 10th edition, updated in December 2021, projected that the number of people with diabetes globally would rise to 643 million by 2030 and 783 million by 2045. While this is a projection, the Centers for Disease Control and Prevention (CDC) reported in its “National Diabetes Statistics Report 2022” that in 2020, 37.3 million Americans (about 1 in 10) had diabetes, and 96 million American adults (about 1 in 3) had prediabetes. These substantial and growing patient populations requiring daily insulin injections create a continuous and expanding market for advanced delivery systems that can improve adherence and glycemic control. The focus on empowering patients with better self-management tools is a key factor in the sustained demand for these innovative devices.

Restraints

High Cost and Limited Insurance Coverage are Restraining the Market

The relatively high cost of smart insulin pens compared to conventional insulin pens, coupled with inconsistent or limited insurance coverage in many regions, represents a considerable restraint on the market. While smart pens offer advanced features, their premium price point can be a significant barrier to adoption for many patients, especially those with high out-of-pocket healthcare expenses or inadequate health insurance.

In many healthcare systems, traditional insulin pens are fully covered, but the “smart” features are often considered an add-on or luxury, requiring patients to pay a larger co-pay or the full cost themselves. A January 2024 report by the American Diabetes Association (ADA) on the cost of diabetes care highlighted that the average medical expenditures for people with diagnosed diabetes were approximately US$13,000 per year, with a significant portion allocated to medications and supplies.

While not specific to smart pens, this illustrates the financial burden on patients. Furthermore, gaining favorable reimbursement status from national health systems and private insurers is a lengthy and complex process for novel medical devices. The lack of widespread, comprehensive coverage limits the accessibility of these devices to a broader patient base, despite their potential clinical benefits, thereby impeding faster market penetration.

Opportunities

Integration with Continuous Glucose Monitoring (CGM) and Digital Health Platforms is Creating Growth Opportunities

The increasing integration of smart insulin pens with Continuous Glucose Monitoring (CGM) systems and broader digital health platforms is creating substantial growth opportunities in the market. This connectivity allows for a seamless flow of data, enabling patients and healthcare providers to gain a more comprehensive understanding of glucose trends in relation to insulin dosing, food intake, and physical activity. This integration facilitates more informed decision-making, personalized insulin titration, and improved glycemic control, moving towards a more holistic diabetes management ecosystem.

The Centers for Medicare & Medicaid Services (CMS) has significantly expanded coverage for CGM devices in recent years, demonstrating increasing recognition of advanced diabetes technology. In January 2023, CMS broadened Medicare coverage for CGMs to include all insulin-treated beneficiaries, regardless of their type of diabetes or frequency of insulin injections, significantly increasing patient access to these integrated systems. This policy change directly benefits the smart insulin pen market by expanding the pool of patients who can utilize the full connectivity features of these devices. The ability of smart pens to fit into a larger, interconnected digital health framework for diabetes care enhances their value proposition, driving adoption and fostering innovation in product development.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and the overall investment climate within the healthcare sector, significantly influence the smart insulin pens market by affecting manufacturing costs and patient affordability. Inflation can increase the expenses for companies producing smart insulin pens, from raw materials and electronic components to labor and distribution, potentially leading to higher product prices. This can be a challenge for patients already burdened by the high costs of insulin itself.

However, governments globally continue to prioritize chronic disease management, recognizing the long-term societal and economic benefits of improved diabetes care. The World Health Organization (WHO) reported in May 2025 that global expenditure on health continued to rise, with many high-income countries allocating over 10% of their GDP to health in 2023. For example, Japan’s health expenditure was 11.43% of GDP in 2022, and Canada’s was 12.23% in 2022, showcasing significant national commitments. Geopolitical stability also plays a role in maintaining stable supply chains for critical electronic components and pharmaceutical-grade plastics. Despite economic fluctuations, the imperative to manage diabetes effectively ensures sustained investment in innovative delivery devices, fostering resilience and continued growth in the smart insulin pens market.

Evolving U.S. trade policies, such as the imposition of tariffs on imported laboratory equipment and electronic components, are reshaping the automated liquid handling technologies market. These policies increase procurement costs and force companies to adjust their supply chain strategies. Automated liquid handler manufacturers depend on complex international supply chains to access specialized components like precision sensors and robotic parts. Since many of these parts are sourced from abroad, tariffs directly raise manufacturing expenses, which can lead to higher prices for laboratories purchasing these systems.

According to the U.S. International Trade Commission (ITC), import duties collected on electrical machinery and equipment totaled US$2.68 billion in 2023, up from US$ 2.05 billion in 2022. This category includes numerous components used in automated liquid handling systems. While the data is not limited to one product type, the increase clearly reflects the financial strain placed on high-tech manufacturing. These costs affect both domestic producers and foreign suppliers aiming to serve the U.S. market. The ripple effects are being felt across research and clinical laboratories that rely on these systems.

In response, companies are revisiting their supply chain models. Strategies such as reshoring or nearshoring are being considered to increase supply chain resilience. However, these shifts often come with higher production costs in the short term. Although such policies are meant to promote domestic production, they add complexity and expense to operations. To protect research efficiency, many organizations are diversifying suppliers and advocating for tariff exemptions on critical scientific tools.

Latest Trends

Growing Emphasis on Personalized Diabetes Management and Remote Monitoring is a Recent Trend

A prominent recent trend shaping the smart insulin pens market in 2024 and continuing into 2025 is the growing emphasis on personalized diabetes management and remote monitoring. Healthcare providers are increasingly recognizing the need for individualized treatment plans that go beyond a “one-size-fits-all” approach, taking into account a patient’s unique lifestyle, glycemic patterns, and preferences.

Smart insulin pens, with their ability to capture precise dosing data and integrate with other health metrics, are central to this personalized approach. Furthermore, the expansion of remote patient monitoring, particularly accelerated by the shift towards telehealth, has made these data-enabled devices invaluable for clinicians to track patient progress, make timely adjustments, and provide proactive support without requiring frequent in-person visits.

The U.S. Health Resources and Services Administration (HRSA) has continuously supported telehealth initiatives, with federal programs and funding allocations, for instance, approximately US$29.5 million was awarded for telehealth-related projects in 2024. This trend empowers patients to take a more active role in their self-management and allows healthcare teams to deliver more efficient and tailored care. The move towards truly individualized diabetes care, facilitated by the data insights from these devices, is driving their increased adoption and further technological evolution.

Regional Analysis

North America is leading the Smart Insulin Pens Market

The smart insulin pens market in North America, holding a significant 43.8% share and 0.4 Billion value, experienced robust growth in 2024. This expansion was primarily driven by the increasing prevalence of diabetes, a growing emphasis on personalized diabetes management, and the rising adoption of digital health technologies that integrate with these devices. The Centers for Disease Control and Prevention (CDC) reported that in 2022, 38.4 million people, or 11.6% of the U.S. population, had diabetes, with 8.7 million adults remaining undiagnosed, highlighting a substantial patient pool requiring effective insulin delivery solutions.

The integration of smart features, such as dose tracking, reminders, and data sharing with healthcare providers, aligns with the broader trend of digital health adoption. Leading pharmaceutical and medical device companies have capitalized on this trend. Novo Nordisk, a major player in diabetes care, reported significant sales growth in its Diabetes and Obesity care segment in 2023, driven by increased demand for its innovative products, including smart insulin delivery devices. Eli Lilly also reported substantial revenue from its diabetes products, with Mounjaro generating US$ 11.54 billion in 2024, demonstrating the market’s dynamism.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The smart insulin pens market in Asia Pacific is expected to grow considerably during the forecast period. This anticipated expansion is primarily fueled by a rapidly increasing diabetes burden, improving healthcare infrastructure, and growing awareness and acceptance of advanced diabetes management solutions. The International Diabetes Federation (IDF) reported that in 2024, Japan had an 8.1% diabetes prevalence, affecting approximately 8.97 million people, indicating a significant patient population.

Countries like China and India also face a high prevalence of diabetes, which will likely drive the adoption of innovative insulin delivery methods. Governments and health organizations across Asia Pacific are increasingly prioritizing diabetes care and promoting digital health initiatives to improve patient outcomes. A narrative review published in February 2025 highlighted that digital health technologies offer promising solutions to bridge gaps in healthcare access and enhance patient engagement in diabetes management across the Asia-Pacific region.

Major pharmaceutical and medical device companies are expanding their presence and product offerings in this dynamic market. Novo Nordisk continues its global rollout of diabetes care products, including advanced insulin delivery systems, while Medtronic’s Diabetes group reported a 6.7% organic revenue increase in the second quarter of fiscal year 2024, reflecting the growing demand for its integrated diabetes management solutions in various geographies, including Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the smart insulin pens market are implementing various strategies to drive growth and enhance patient outcomes. They focus on developing advanced insulin delivery systems that integrate Bluetooth connectivity, enabling real-time data tracking and dose monitoring through mobile applications. Companies are also investing in research and development to create reusable devices that offer cost-effective solutions for long-term diabetes management.

Strategic partnerships with technology firms facilitate the incorporation of artificial intelligence and machine learning algorithms, improving dose accuracy and personalized treatment plans. Expanding distribution channels, including online platforms and retail pharmacies, increases product accessibility to a broader patient base. Additionally, educational initiatives and patient support programs aim to raise awareness and promote the adoption of smart insulin pens among healthcare providers and users.

Emperra GmbH E-Health Technologies, a key player in the market, specializes in the development of smart insulin pens and related digital health solutions. Founded in 2009 and headquartered in Germany, Emperra offers the ESYSTA system, which includes a Bluetooth-enabled insulin pen that syncs with a mobile application to track insulin doses and provide feedback to users.

The company’s commitment to innovation and patient-centered care has positioned it as a significant contributor to the advancement of diabetes management technologies. Emperra continues to collaborate with healthcare providers and research institutions to enhance the functionality and effectiveness of its products, aiming to improve the quality of life for individuals with diabetes.

Top Key Players in the Smart Insulin Pens Market

- Sanofi

- Pendiq

- Novo Nordisk

- Medtronic plc

- Emperra GmbH

- Eli Lilly and Company

- Bigfoot Biomedical

- Berlin-Chemie

Recent Developments

- In June 2023: Novo Nordisk A/S announced plans to acquire Biocorp, a French company specializing in medical devices. This acquisition is intended to combine Biocorp’s innovative technology with Novo Nordisk’s expertise to develop a next-generation connected insulin pen.

- In September 2022: Medtronic PLC partnered with actress Jennifer Stone to raise awareness of advanced medical technologies and promote the InPen, a smart insulin pen designed to help people with type 1 diabetes manage their condition.

Report Scope

Report Features Description Market Value (2024) $ 0.9 billion Forecast Revenue (2034) $ 2.6 billion CAGR (2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bluetooth Based and Near Field Communication Based), By Application (Type 2 Diabetes and Type 1 Diabetes), By Distribution Channel (Hospital Pharmacies and Retail & Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sanofi, Pendiq, Novo Nordisk, Medtronic plc, Emperra GmbH, Eli Lilly and Company, Bigfoot Biomedical, Berlin-Chemie. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sanofi

- Pendiq

- Novo Nordisk

- Medtronic plc

- Emperra GmbH

- Eli Lilly and Company

- Bigfoot Biomedical

- Berlin-Chemie