Global Smart Grid Data Analytics Market Size, Share, Industry Analysis Report By Component (Software, Services), By Application (Grid Optimization & Asset Management, Advanced Metering Infrastructure (AMI) Analytics, Demand Response & Load Forecasting, Fault Detection & Outage Management, Renewable Energy Integration), By Deployment (Cloud-based, On-premises), By End-User (Utility Companies, Independent System Operators (ISOs), Renewable Energy Generators, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034.

- Published date: Dec. 2025

- Report ID: 171153

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

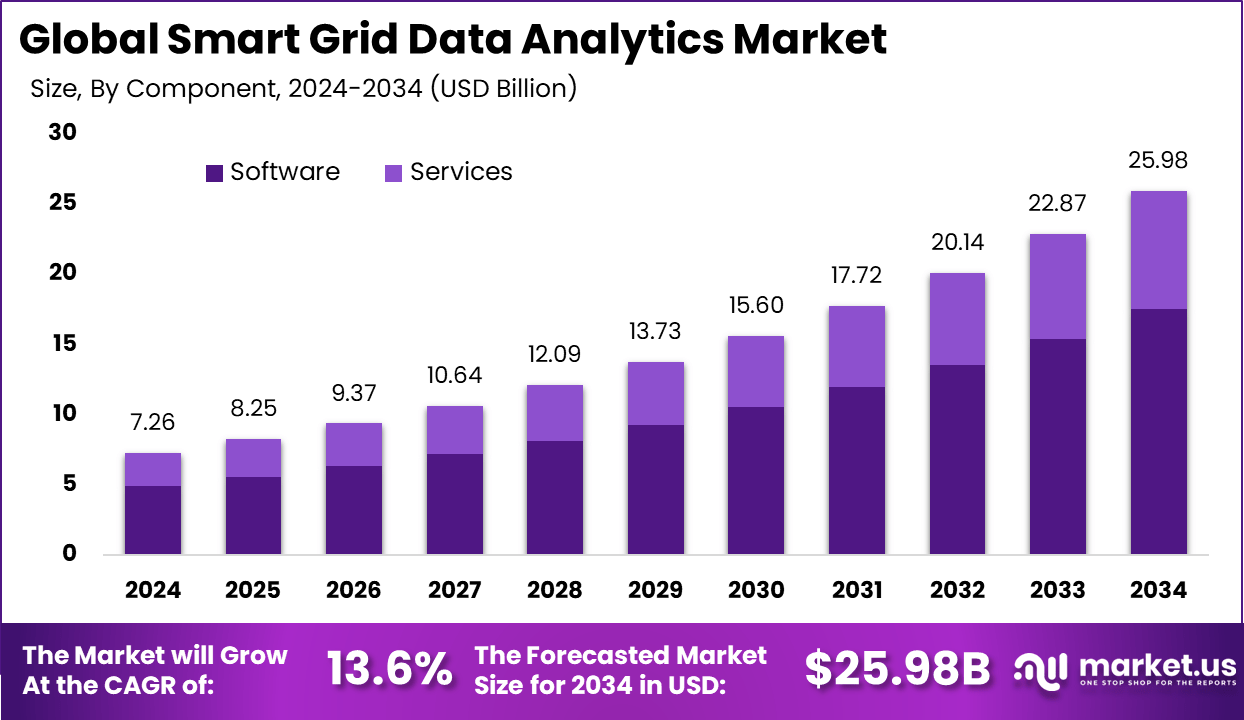

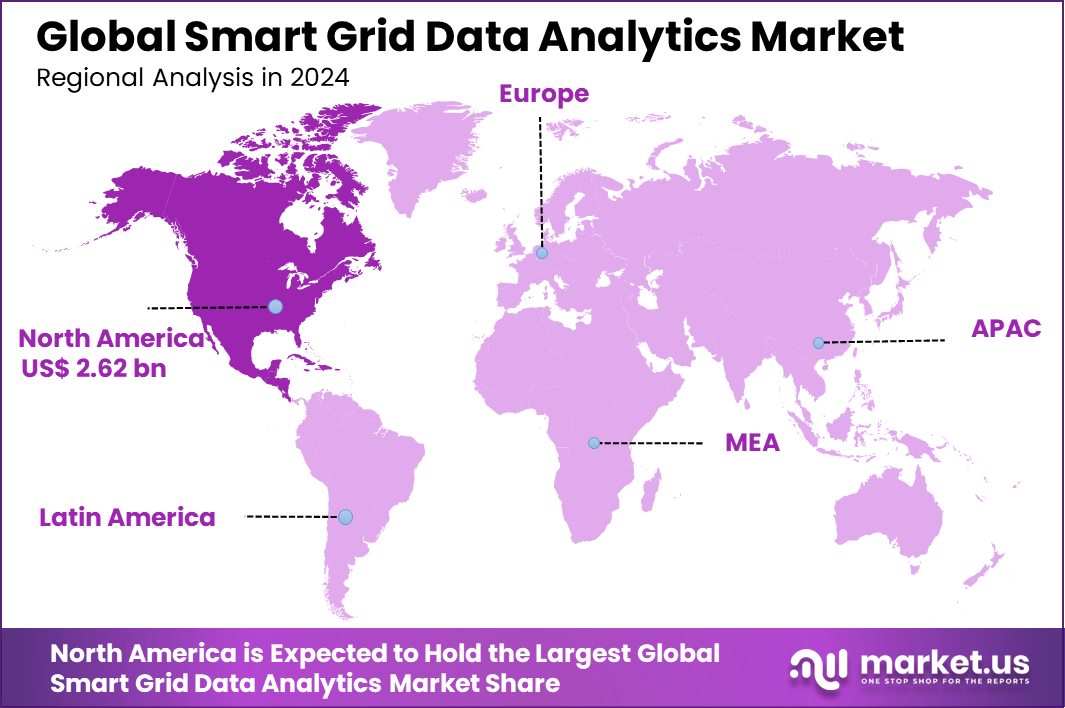

The Global Smart Grid Data Analytics Market size is expected to be worth around USD 25.98 billion by 2034, from USD 7.26 billion in 2024, growing at a CAGR of 13.6% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 36.2% share, holding USD 2.62 billion in revenue.

The smart grid data analytics market includes software platforms and services that collect, process, and analyze data generated across smart grid infrastructure. These solutions interpret large data sets from meters, sensors, substations, grid assets, distributed energy resources, and customer systems to improve grid reliability, efficiency, and service quality. By converting raw data into actionable insights, smart grid analytics support load forecasting, fault detection, energy optimization, and informed decision making across utility operations and energy markets.

This market plays a crucial role in enabling utilities and grid operators to manage complex electrical networks in real time with greater resilience. Smart grid data analytics enhances situational awareness, helps detect anomalies before they escalate into outages, and supports optimal load balancing by analysing usage patterns and grid conditions. These analytics tools also allow integration of renewable energy sources and distributed energy resources while maintaining stability and reliability.

For instance, in April 2025, SAS Institute launched advanced predictive analytics tools tailored for smart grids, linking IT/OT data for automated outage response and demand forecasting. North Carolina-based SAS helps utilities cut operational costs by up to 20% through precise energy management.

Accurate data interpretation contributes to cost savings, improved asset utilisation, and better service quality for electricity consumers. Growth in this market is driven by rapid deployment of smart meters, sensors, and other connected devices, which generate vast amounts of operational and customer data. Increased adoption of advanced metering infrastructure and the digitisation of grid assets have created demand for analytics solutions capable of processing and interpreting this data.

Key Takeaway

- In 2024, the software segment led the market with a strong 67.4% share, supported by rising demand for advanced analytics platforms and real-time grid intelligence.

- Grid optimization and asset management accounted for 31.8%, as utilities focused on improving reliability, reducing outages, and extending asset life.

- Cloud-based deployment captured 58.9%, reflecting a clear shift toward scalable, flexible, and remotely accessible analytics environments.

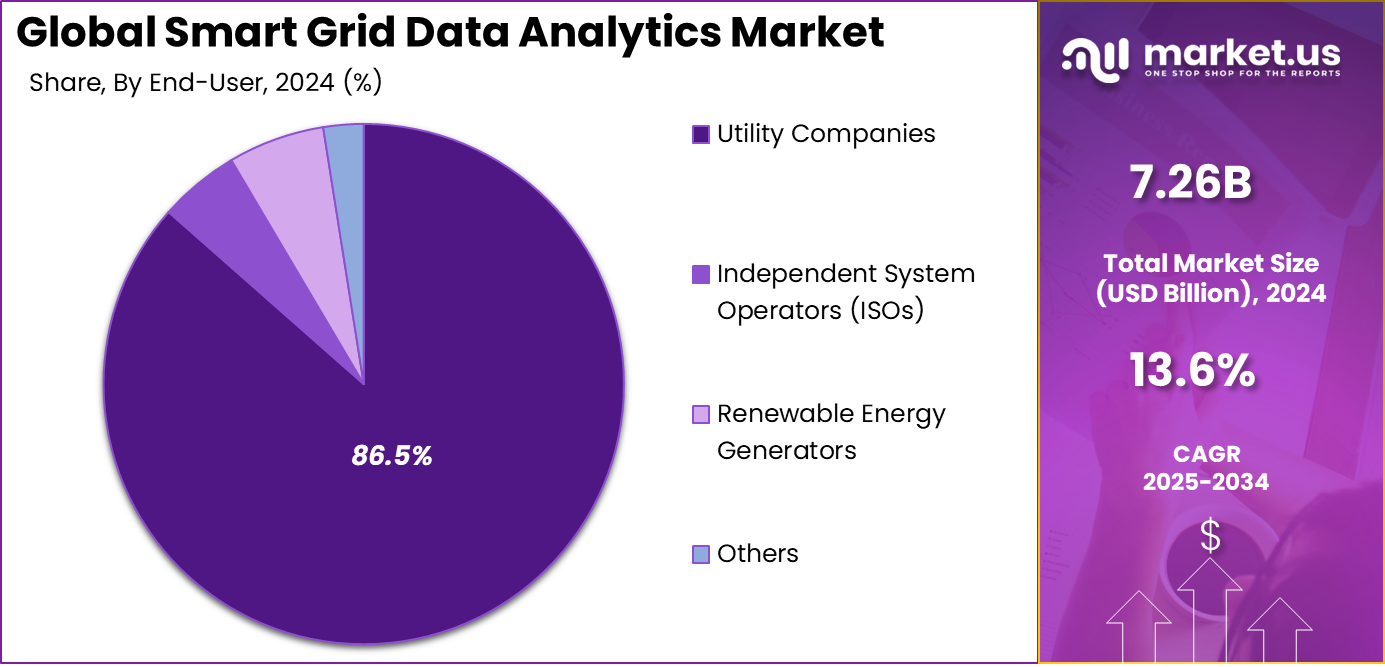

- Utility companies dominated end-user adoption with an 86.5% share, driven by large-scale grid modernization and regulatory compliance needs.

- The U.S. market showed solid growth momentum, supported by continued investments in digital grid infrastructure and data-driven operations.

- North America held over 36.2% share, maintaining its leadership due to early technology adoption and advanced power grid frameworks.

Role of Generative AI

Generative AI opens new doors in smart grid data analytics by building realistic models from sparse real data. Utilities run simulations of grid stress under storms or peak loads to catch problems early. This approach cuts response times as operators train on varied scenarios that match real life.

52.8% of analytics setups now lean on these tools for sharp forecasting and spotting odd patterns in live feeds. Better datasets also strengthen defenses against cyber threats by mimicking rare attacks for training. Grids stand firmer with decisions rooted in these rich, AI-crafted insights that feel close to actual events. Daily operations gain speed and trust from such tech.

Operators weave generative AI into routine checks for smoother cybersecurity and planning. It crafts balanced training data that traditional methods struggle to match, especially for protocol-based hacks. This leads to quicker threat detection and fewer false alarms in busy networks.

Teams report handling complex issues with more confidence thanks to real-time tweaks from AI outputs. Overall, the tech shifts grids toward proactive fixes over reactive patches. Utilities see clearer paths to reliability as these tools handle the growing data flood from meters and sensors without overload. The human touch in oversight keeps it grounded and effective across regions.

U.S. Market Size

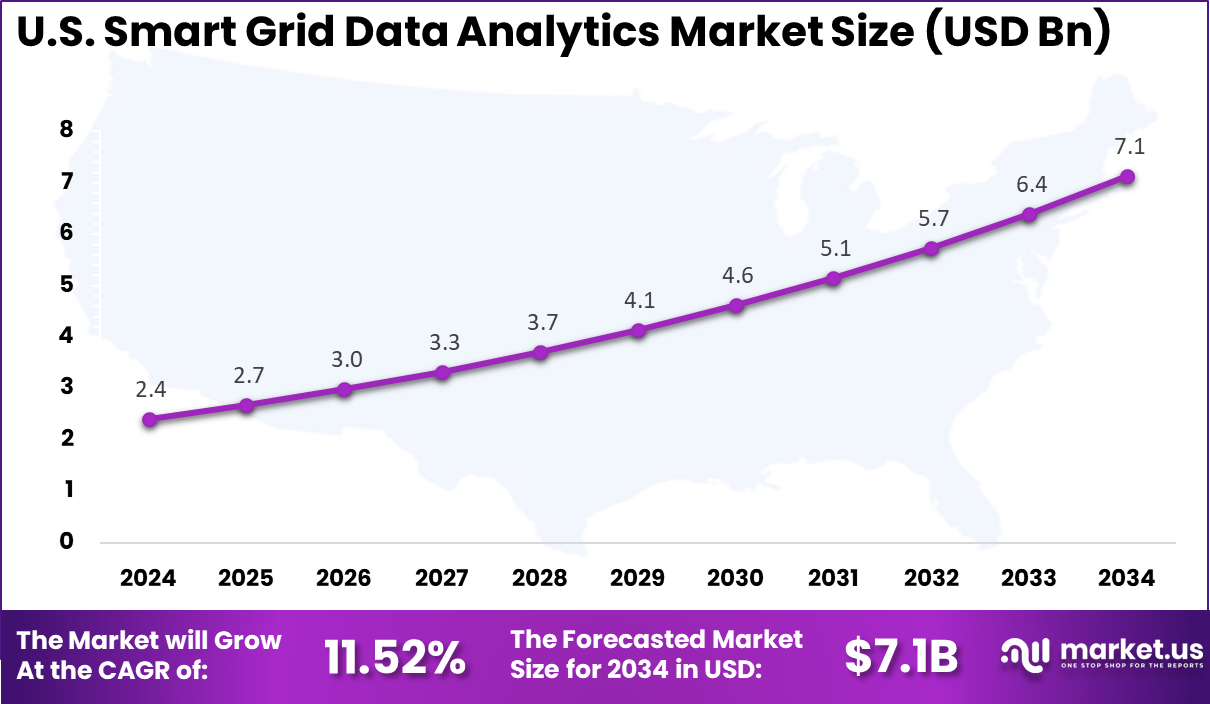

The market for Smart Grid Data Analytics within the U.S. is growing tremendously and is currently valued at USD 2.4 billion, the market has a projected CAGR of 11.52%. The market is growing due to rising demand for grid modernization amid renewable energy integration and electric vehicle adoption. Utilities face pressure to cut outages through real-time data insights, while federal incentives support advanced metering and AI-driven forecasting.

For instance, in June 2025, GE Vernova released whitepapers on AI applications for intelligent grids, addressing challenges like renewable integration and cybersecurity through GridOS Data Fabric for unified data analytics. These solutions enable predictive maintenance, real-time optimization, and enhanced grid resilience, reinforcing U.S. leadership in smart grid data analytics.

In 2024, North America held a dominant market position in the Global Smart Grid Data Analytics Market, capturing more than a 36.2% share, holding USD 2.62 billion in revenue. This dominance is due to advanced infrastructure and heavy investments in smart meters across the US and Canada.

Utilities push analytics to integrate renewables and handle EV loads, cutting outages with real-time data. Federal policies reward grid upgrades, while mature tech adoption speeds cloud tools for forecasting and asset health. Regional focus on resilience against storms solidifies the lead.

For instance, in October 2025, Itron partnered with Microsoft to deploy AI and GenAI at the smart grid edge via Azure OpenAI, integrating with its Meter Data Management System for global rollout in Q2 2025. This advances real-time analytics for metering, network monitoring, and customer usage, bolstering North American grid intelligence.

Component Analysis

In 2024, The Software segment held a dominant market position, capturing a 67.4% share of the Global Smart Grid Data Analytics Market. Utilities rely on these programs to handle huge amounts of data from smart meters and sensors in real time. This setup lets them detect faults quickly and ensure a steady power supply across networks. Tools for operational analytics shine here as they process data from renewable sources and spread-out generation points to improve overall grid reliability.

The rise of software comes from its ability to turn raw data into clear actions. Operators use it to forecast demand shifts and adjust resources on the fly. This reduces waste and supports smoother integration of solar and wind power. As grids grow more complex, software keeps pace by offering updates and new features without major hardware changes. Its flexibility makes it a go-to choice for daily operations.

For Instance, in November 2025, Siemens AG partnered with IFS on a strategic alliance to advance autonomous grid operations. The deal combines Siemens’ Gridscale X grid intelligence with IFS’s Industrial AI platform. This setup helps utilities predict asset failures and optimize investments using software-driven analytics for real-time grid management.

Application Analysis

In 2024, the Grid Optimization & Asset Management segment held a dominant market position, capturing a 31.8% share of the Global Smart Grid Data Analytics Market. These uses help track equipment health and schedule fixes to avoid breakdowns. Data insights allow better load balancing, which cuts energy losses. Utilities save money by stretching the life of transformers and lines through smart predictions. This area thrives as grids face more variable inputs from clean energy.

Operators gain from detailed views of grid performance over time. Analytics spot wear patterns early and guide upgrades where needed most. This leads to fewer outages and lower repair costs. With rising focus on efficiency, these tools help meet peak demands without building extra capacity. They fit perfectly into efforts to build tougher networks for the future.

For instance, in November 2025, ABB supplied synchronous condensers to VoltaGrid for grid stability in data centers. This supports asset management by providing inertia and reactive power control during high-demand events. The tech helps optimize grid performance amid rising AI loads.

Deployment Analysis

In 2024, The Cloud-based segment held a dominant market position, capturing a 58.9% share of the Global Smart Grid Data Analytics Market. They provide quick scaling and access from anywhere without big upfront hardware buys. Utilities value the low maintenance and fast rollouts for new features. This model handles bursts of data from events like storms seamlessly. It supports remote teams in making decisions on the spot.

The cloud edge shows in its cost savings over time. Updates roll out automatically, keeping systems current with the latest tech. Integration with IoT devices happens smoothly for better data flows. Utilities avoid locked-in setups and gain room to grow as needs change. This approach aligns with broader shifts to digital operations in energy sectors.

For Instance, in April 2025, Cisco outlined a clean energy strategy emphasizing cloud-enabled smart grids. Their IoT Control Center manages smart meter data with real-time visibility and APIs. This cloud approach supports utilities in demand forecasting and network diagnostics.

End-User Analysis

In 2024, the Utility Companies segment held a dominant market position, capturing an 86.5% share of the Global Smart Grid Data Analytics Market. They manage massive grids and use analytics to predict issues before they hit customers. Reliability rules push them to adopt these tools for outage prevention. Daily tasks like energy balancing and green source blending rely on sharp data views. Their scale drives most innovation in this field.

These firms focus on long-term gains from better operations. Analytics cut response times to faults and optimize staff routes. They also track compliance with environmental goals easily. As leaders in grid tech, utilities set the pace for wider adoption. Their heavy use ensures tools evolve to handle real-world challenges head-on.

For Instance, in December 2024, Itron released Active Smart Grid Analytics for rapid utility deployment. Built on metering and network data, it delivers dashboards for distribution operations and customer insights. Utilities streamline costs and operations with out-of-the-box tools.

Emerging Trends

In the smart grid data analytics market, a strong trend is the increased use of real time analytics to support operational decision making. Smart meters, intelligent sensors, and distributed energy resources generate large volumes of data that must be analysed instantly to detect anomalies, manage load changes, and optimise power flows.

Real time analytics frameworks are being adopted to enable grid operators to respond quickly to fluctuations in demand and supply, reducing the impact of disruptions and improving overall system stability. Another trend involves the integration of predictive and prescriptive analytics into core grid management functions.

Rather than focusing only on historical performance, grid operators are applying advanced algorithms to forecast equipment failures, predict consumption patterns, and prescribe optimal operational strategies. These capabilities are improving maintenance planning and helping utilities avoid costly breakdowns by identifying potential issues before they occur.

Growth Factors

One key growth factor for smart grid data analytics is the proliferation of smart grid infrastructure that produces vast amounts of real time data. Smart meters, phasor measurement units, and IoT enabled sensors are being deployed widely, creating an increasing need for analytics solutions that can process and interpret this data.

Data analytics enables utilities to extract actionable insights that support efficient energy distribution, demand response, and outage management. Another important factor supporting growth is the increasing complexity of power systems with the rise of renewable energy integration and distributed generation.

Solar panels, wind turbines, and energy storage systems introduce variability in supply that traditional grid management approaches cannot handle effectively. Data analytics solutions help balance these fluctuations by providing utilities with better visibility into generation patterns and load behaviour.

Key Market Segments

By Component

- Software

- Services

By Application

- Grid Optimization & Asset Management

- Advanced Metering Infrastructure (AMI) Analytics

- Demand Response & Load Forecasting

- Fault Detection & Outage Management

- Renewable Energy Integration

By Deployment

- Cloud-based

- On-premises

By End-User

- Utility Companies

- Independent System Operators (ISOs)

- Renewable Energy Generators

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Drivers

Smart meters supported by advanced metering infrastructure are becoming a core element of smart grid modernization by giving utilities real time visibility into energy consumption, voltage levels, and power quality. Continuous data from these meters enables faster operational decisions, improves grid stability, and reduces inefficiencies in power distribution. Large scale deployments in mature markets have demonstrated how data driven monitoring lowers operational waste and enhances system performance.

As renewable energy penetration increases, utilities face greater complexity in balancing supply and demand. Smart meters help detect irregularities early, reduce outage risks, and strengthen service reliability. When integrated with IoT and cloud based analytics platforms, they enable utilities to manage variable generation more effectively and build resilient, sustainable energy systems.

In November 2025, Siemens introduced Gridscale X at DISTRIBUTECH, using AI to process smart meter data for real time grid insights. The platform supports digital grid twins, rapid anomaly detection, and outage reduction, highlighting how advanced analytics unlock greater value from large scale smart meter deployments.

Restraint

Limited understanding among consumers and smaller utilities remains a major barrier to widespread adoption of smart grid analytics. Many users remain unaware of how these technologies can reduce energy bills and enhance supply reliability, leading to hesitation toward smart meter installations. This lack of awareness undermines participation in demand response initiatives that depend on large-scale user engagement.

In emerging markets, smaller utility firms often focus on short-term operational costs rather than long-term benefits. The perceived technical complexity and investment requirements further discourage adoption. Although public campaigns and policy-driven programs are beginning to close the knowledge gap, progress varies by region, leaving some areas behind in advancing their digital grid infrastructure.

For instance, in March 2025, IBM pushed grid modernization talks but noted slow uptake due to unclear benefits among smaller utilities. Their reports highlight how firms overlook analytics gains from meter data amid tight budgets. Education gaps lead to resistance to installs, as seen in uneven adoption rates. IBM’s tools aim to show ROI through demos, yet awareness lags in non-urban areas. Efforts focus on case studies to build trust step by step.

Opportunities

Hybrid cloud architectures are opening new avenues for utilities seeking flexible and secure data analytics solutions. By combining the security of on-premise infrastructure with the scalability of cloud computing, hybrid setups offer a balanced approach to managing sensitive grid data and processing-intensive analytics workloads. This structure allows utilities to handle large data flows efficiently while maintaining control over core assets.

These configurations also enhance system resilience by allocating computing tasks across multiple environments, improving response times and recovery after disruptions. With more utilities modernizing their infrastructure, hybrid models are emerging as a practical bridge toward full digital transformation. Their adaptability fits both large-scale national grids and smaller municipal operations, enabling tailored modernization without full system replacement.

For instance, in November 2025, Siemens advanced cloud-native grid-edge analytics, shifting smart meter data to elastic hybrid processing. Utilities avoid data center costs while running AI models for optimization. The approach bundles applications into secure cloud layers. Integration with 5G backhaul enables low-latency event forwarding. Hybrids balance local control and scalable analytics.

Challenges

The initial expense of implementing smart grid data analytics remains a significant challenge for many utilities. Investments in advanced sensors, network infrastructure, and software platforms are substantial, often stretching the budgets of smaller firms and utilities in developing regions. Beyond hardware, the need for skilled personnel and training adds to the cost burden, delaying system rollouts.

Integration with older grid infrastructure further complicates deployment and raises total expenditure. Additionally, as smart grids become more interconnected, cybersecurity demands intensify, requiring continuous monitoring and defense upgrades. While cloud-based solutions can ease some financial strain, achieving a fully integrated grid data environment remains a long-term endeavor for most utilities.

For instance, in September 2025, Itron partnered with Meralco for smart meter rollout, facing integration hurdles with legacy systems. Upfront costs for hardware and network upgrades strain budgets. Training and cybersecurity layers add to expenses in developing areas. Deployment timelines extend due to complex links. Cloud elements help, but full integration demands years.

Key Players Analysis

Siemens, General Electric, IBM, Oracle, SAS Institute, Schneider Electric, and ABB lead the smart grid data analytics market with platforms that analyze grid performance, demand patterns, and asset health. Their solutions help utilities improve reliability, reduce outages, and optimize energy distribution. These companies focus on real time analytics, AI driven forecasting, and integration with grid management systems. Growing investment in grid modernization continues to reinforce their leadership.

Itron, Landis+Gyr, Open Systems International, Cisco, and Hitachi strengthen the market with analytics tied to smart meters, grid sensors, and control systems. Their technologies support outage management, load balancing, and distributed energy resource integration. These providers emphasize data accuracy, cybersecurity, and scalable deployment. Rising adoption of smart meters and connected grid infrastructure supports wider use.

Accenture, Uptake Technologies, AutoGrid, and other players expand the landscape with cloud based analytics, predictive maintenance, and demand response optimization. Their offerings help utilities gain actionable insights from large data volumes. These companies focus on flexibility, advanced algorithms, and managed services. Increasing penetration of renewable energy and electric vehicles continues to drive steady growth in the smart grid data analytics market.

Top Key Players in the Market

- Siemens AG

- General Electric Company

- IBM Corporation

- Oracle Corporation

- SAS Institute, Inc.

- Schneider Electric SE

- ABB, Ltd.

- Itron, Inc.

- Landis+Gyr

- Open Systems International, Inc. (OSI)

- Cisco Systems, Inc.

- Hitachi, Ltd.

- Accenture plc

- Uptake Technologies, Inc.

- AutoGrid Systems, Inc.

- Others

Recent Developments

- In March 2025, Siemens AG showcased its Gridscale X platform at DISTRIBUTECH 2025, featuring AI-driven digital twins for predictive grid maintenance and real-time DER insights. This open modular software helps utilities handle rising energy demands with better load balancing and anomaly detection, cutting operational complexity while boosting reliability.

- In December 2025, Schneider Electric SE debuted the One Digital Grid Platform with Microsoft Azure integration, delivering AI-powered real-time intelligence to cut outages and speed clean energy adoption. The platform automates grid operations, reducing DER connection times and enhancing resilience for utilities facing growing electrification demands.

Report Scope

Report Features Description Market Value (2024) USD 7.2 Bn Forecast Revenue (2034) USD 25.9 Bn CAGR(2025-2034) 13.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Application (Grid Optimization & Asset Management, Advanced Metering Infrastructure (AMI) Analytics, Demand Response & Load Forecasting, Fault Detection & Outage Management, Renewable Energy Integration), By Deployment (Cloud-based, On-premises), By End-User (Utility Companies, Independent System Operators (ISOs), Renewable Energy Generators, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens AG, General Electric Company, IBM Corporation, Oracle Corporation, SAS Institute, Inc., Schneider Electric SE, ABB, Ltd., Itron, Inc., Landis+Gyr, Open Systems International, Inc. (OSI), Cisco Systems, Inc., Hitachi, Ltd., Accenture plc, Uptake Technologies, Inc., AutoGrid Systems, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Grid Data Analytics MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Grid Data Analytics MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens AG

- General Electric Company

- IBM Corporation

- Oracle Corporation

- SAS Institute, Inc.

- Schneider Electric SE

- ABB, Ltd.

- Itron, Inc.

- Landis+Gyr

- Open Systems International, Inc. (OSI)

- Cisco Systems, Inc.

- Hitachi, Ltd.

- Accenture plc

- Uptake Technologies, Inc.

- AutoGrid Systems, Inc.

- Others