Global Smart Greenhouse Insurance Market Size, Share and Analysis Report By Coverage Type (Property & Infrastructure Insurance, Crop & Produce Insurance, Equipment & Technology Breakdown Insurance, Others), By Greenhouse Type (Commercial Hydroponic/Aeroponic Farms, Commercial Traditional Soil-Based Greenhouses, Research & Educational Facilities), By Policy Duration (Annual/Multi-Year Policies, Seasonal/Percrop Cycle Policies), By End-User (Large Commercial Growers, SME & Independent Growers, AgTech Startups & Vertical Farms), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 172490

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- U.S. Market Size

- Coverage Type Analysis

- Greenhouse Type Analysis

- Policy Duration Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

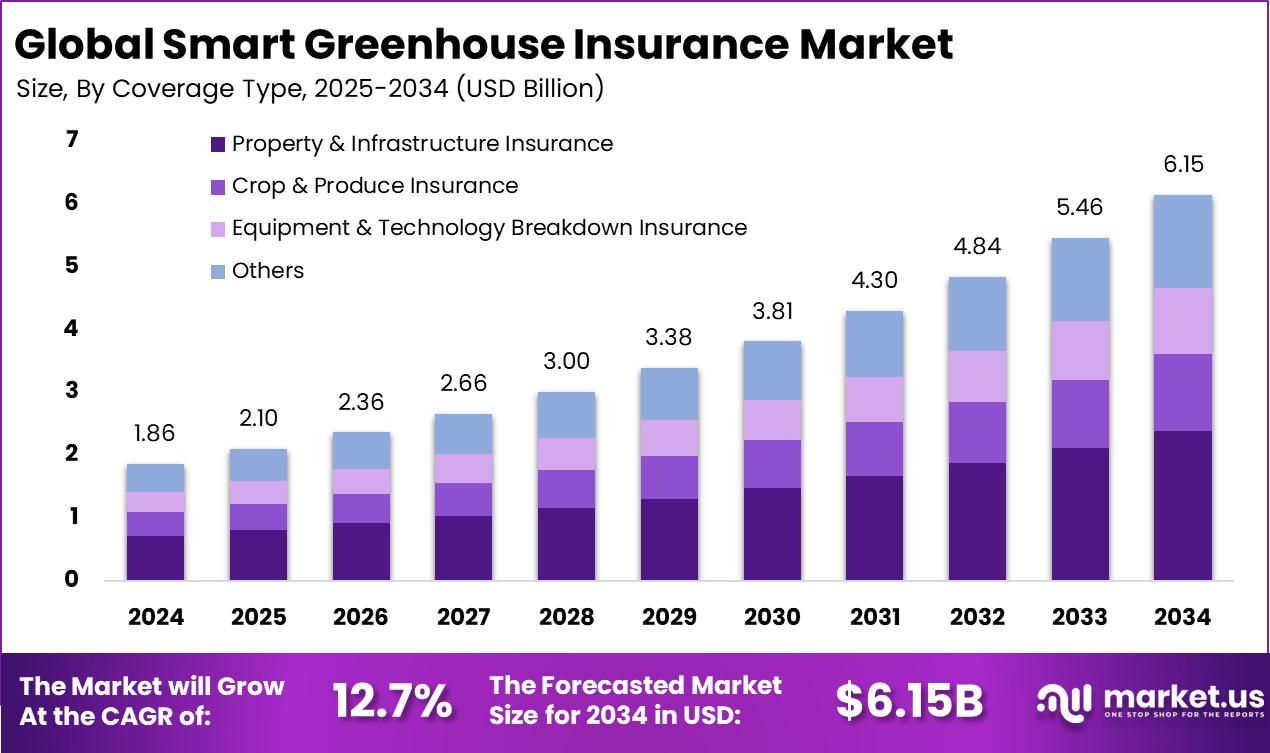

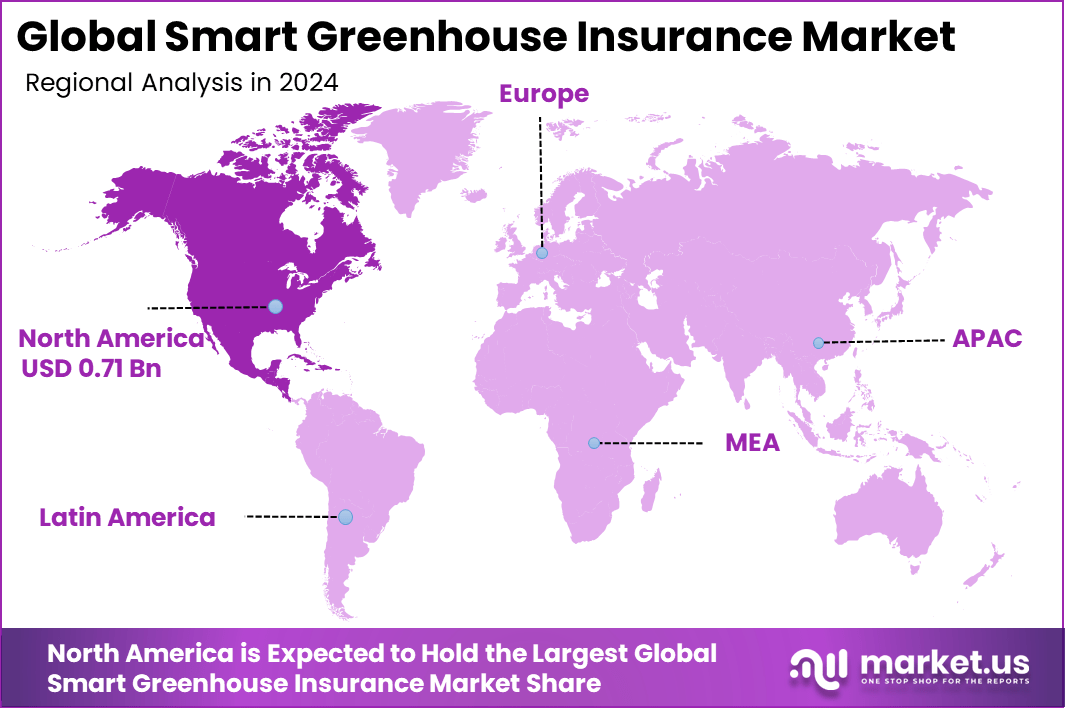

The Global Smart Greenhouse Insurance Market size is expected to be worth around USD 6.15 billion by 2034, from USD 1.86 billion in 2024, growing at a CAGR of 12.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.5% share, holding USD 0.71 billion in revenue.

The Smart Greenhouse Insurance Market refers to insurance solutions designed to protect technologically advanced greenhouse operations. Smart greenhouses use automated climate control, sensors, data analytics, and connected systems to manage crop production. These systems increase productivity but also introduce new operational and financial risks. Insurance products in this market are structured to cover greenhouse structures, equipment, crops, and business interruptions.

As greenhouse farming becomes more technology-driven, traditional agricultural insurance models are often insufficient. Smart greenhouse insurance addresses risks related to automation failures, environmental control breakdowns, and extreme weather events. Coverage supports controlled-environment agriculture where production is continuous and capital-intensive. This market plays a key role in supporting modern and sustainable food production systems.

For instance, in June 2025, The Hartford Financial Services Group partnered with research groups on climate modeling tools that feed into smart greenhouse policies, predicting risks like extreme heat or floods for controlled environments. This boosts their inland marine endorsements for high-value crops, giving growers reliable coverage that matches real-time data from greenhouse systems.

Demand for smart greenhouse insurance is increasing due to rising investments in controlled-environment agriculture. Greenhouse operators rely heavily on technology to maintain optimal growing conditions. Any system failure can quickly lead to crop loss or production delays. Insurance is therefore viewed as an essential risk management tool.

Smart greenhouse insurance adoption is closely linked to the use of sensors, automation, and data platforms. These technologies monitor temperature, humidity, lighting, and irrigation in real time. Data generated by these systems helps insurers better understand operational risks. This supports more accurate underwriting and tailored coverage.

Remote monitoring and connectivity also influence insurance models. Insurers increasingly consider system reliability and data availability when assessing risk. Technology-enabled greenhouses allow faster damage assessment and claims validation. This improves efficiency for both insurers and greenhouse operators.

Key Takeaway

- In 2024, property and infrastructure insurance led the smart greenhouse insurance market with a 38.7% share, driven by the need to protect high-value structures, climate systems, and automation equipment.

- Commercial hydroponic and aeroponic farms dominated with 52.4%, reflecting higher insurance demand from technology-intensive and capital-heavy farming operations.

- Annual and multi-year policies accounted for 83.5%, showing strong preference for long-term coverage aligned with crop cycles and investment planning.

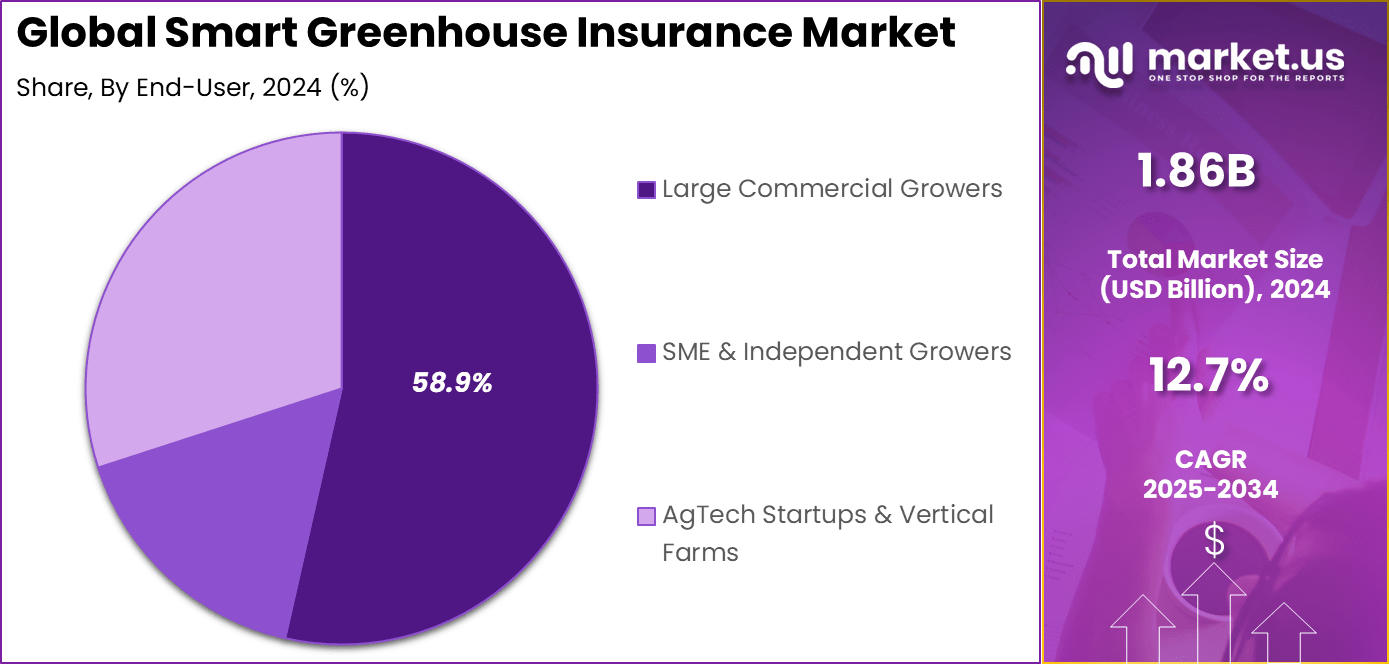

- Large commercial growers captured 58.9%, as scale, asset concentration, and operational risk increase the need for comprehensive insurance solutions.

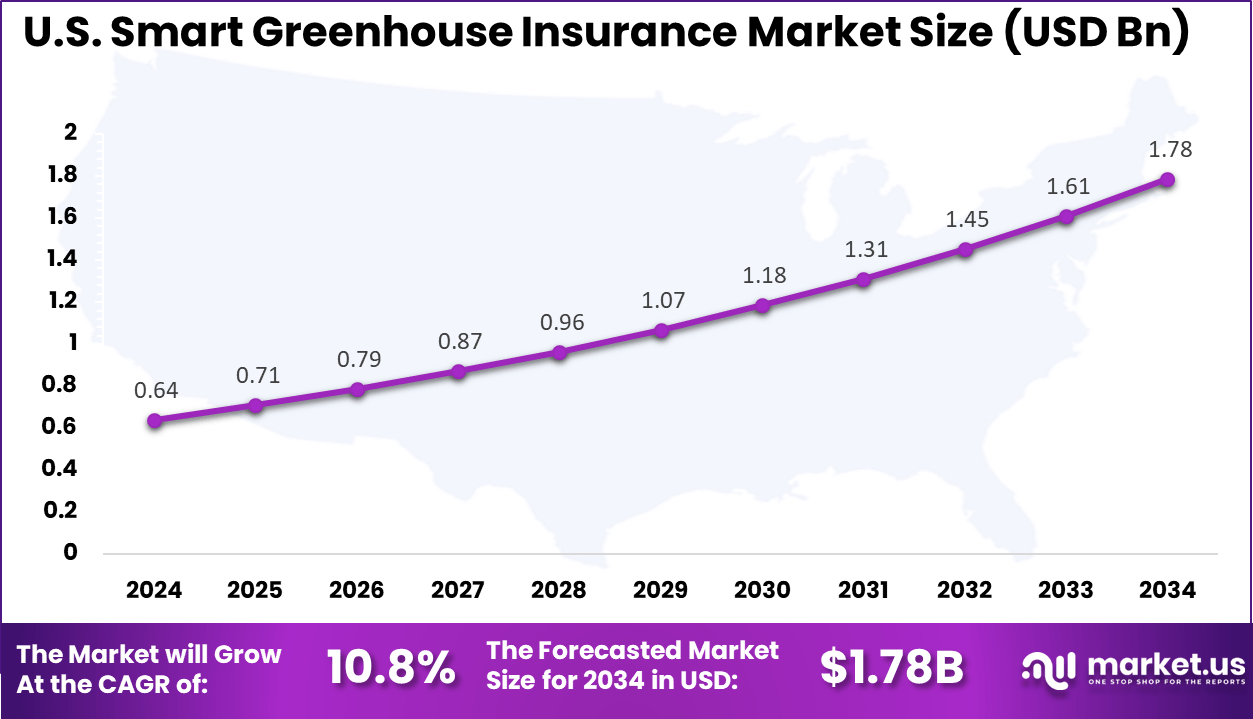

- The U.S. smart greenhouse insurance market reached USD 0.64 billion in 2024 and is expanding at a 10.8% CAGR, supported by growth in controlled-environment agriculture.

- North America held over 38.5% share globally, backed by advanced greenhouse adoption, strong insurer presence, and rising focus on climate-resilient farming systems.

U.S. Market Size

The United States reached USD 0.64 Billion with a CAGR of 10.8%, reflecting consistent expansion. Growth is driven by investment in controlled-environment agriculture. Growers seek financial protection for modern farming systems. Insurance adoption continues to rise. Market outlook remains positive.

For instance, in January 2025, FM Global emphasized AI models for predicting greenhouse losses from climate hazards, fires, and equipment failures in its 2025 outlook. Proprietary data analytics enable precise underwriting for smart facilities. FM Global’s engineering expertise reinforces U.S. dominance in commercial property insurance for advanced agriculture.

In 2024, North America held a dominant market position in the Global Smart Greenhouse Insurance Market, capturing more than a 38.5% share, holding USD 0.71 billion in revenue. This dominance stems from widespread adoption of advanced greenhouse automation, strong risk management frameworks, and increasing climate unpredictability across the region.

Farmers in the U.S. and Canada are investing in insurance to protect high-value infrastructure and digital tools from extreme weather events. Supportive government policies, a mature insurance ecosystem, and rapid expansion of commercial hydroponic and aeroponic farms further reinforced the region’s leadership.

For instance, in November 2025, Chubb Ltd. launched an AI-powered embedded insurance engine, enhancing real-time risk assessment for agriculture, including smart greenhouses. This innovation supports precision monitoring and climate-resilient farming. Chubb’s advanced tools underscore North America’s leadership in technology-driven crop and greenhouse insurance solutions.

Coverage Type Analysis

In 2024, Property and infrastructure insurance accounts for 38.7%, showing its importance in protecting smart greenhouse assets. This coverage focuses on greenhouse structures, climate control systems, sensors, and irrigation equipment. Smart greenhouses rely on advanced infrastructure that involves high capital investment. Damage or failure of equipment can disrupt crop production. Insurance coverage helps reduce financial risk.

The strong adoption of this coverage type is driven by increasing automation in greenhouse operations. Growers seek protection against fire, storms, and equipment breakdown. Insurance policies help ensure business continuity after unexpected events. Infrastructure protection is also required by lenders and investors. This sustains steady demand for property-based coverage.

For Instance, in October 2025, FM Global expanded its engineering-based property insurance for advanced agricultural facilities, focusing on resilience against equipment breakdowns. The update includes assessments for greenhouse frames and roofing under extreme weather. This approach helps owners maintain operations by preventing costly repairs to vital infrastructure.

Greenhouse Type Analysis

In 2024, the Commercial hydroponic and aeroponic farms represent 52.4%, making them the dominant greenhouse type insured. These farms use technology-intensive growing systems that depend on controlled environments. Any system failure can lead to rapid crop loss. Insurance coverage helps manage operational risk. Advanced farming models increase the need for protection.

Adoption in this segment is driven by expansion of soilless farming methods. Commercial operators invest heavily in equipment and automation. Insurance supports risk management for high-value crops. Coverage also improves financial planning and stability. This supports continued adoption among modern farms.

For instance, in October 2025, Zurich introduced modular insurance for agrivoltaic systems that overlap with hydroponic greenhouses, covering crop damage from shared tech failures. The policy protects sensors, pumps, and nutrient systems in soilless farms from power outages or contamination. It supports year-round production in these high-tech environments.

Policy Duration Analysis

In 2024, Annual and multi-year policies account for 83.5%, reflecting preference for long-term coverage. Smart greenhouse operations require continuous protection throughout growing cycles. Long-duration policies align with farming timelines and investment horizons. They reduce the need for frequent renewals. Predictable coverage supports operational planning.

The dominance of longer policy durations is driven by stability and convenience. Growers prefer consistent coverage without gaps. Multi-year policies also help manage premium costs over time. Insurers and policyholders benefit from long-term agreements. This makes extended coverage the standard choice.

For Instance, in April 2025, Munich Re enhanced its parametric reinsurance for multi-year agricultural policies, linking payouts to weather data over extended cycles. This suits annual renewals in greenhouses by stabilizing premiums for long-term crop protection. It reduces renewal hassles for consistent coverage.

End-User Analysis

In 2024, The Large commercial growers hold 58.9%, highlighting their significant role in the market. These growers operate large-scale greenhouse facilities with high production volumes. Insurance is essential to protect assets and revenue streams. Large operations face higher exposure to financial loss. Risk management is a priority.

Adoption among large growers is driven by scale and investment levels. Insurance supports compliance with financing and partnership requirements. Coverage helps manage operational uncertainty. Large growers also seek tailored policies. This sustains strong demand from this user group.

For Instance, in November 2025, Allianz advanced claims handling for commercial growers via data-driven policies covering downtime in large automated greenhouses. Focus on renewables integration helps protect high-output facilities from breakdowns. This aids major players in maintaining steady production flows.

Emerging Trends

One emerging trend in the Smart Greenhouse Insurance Market is the growing use of real time data to support risk assessment and loss prevention. Insurers are increasingly aligning policy terms with sensor based monitoring of temperature, humidity, power supply, and ventilation systems. This trend reflects a shift from reactive claims handling toward proactive risk management. As a result, insurance is being positioned as a continuous support mechanism rather than a standalone financial product.

Another important trend is the gradual move toward customized and modular insurance coverage. Greenhouse operators are seeking policies that reflect crop type, growth stage, and technology intensity rather than standard agricultural classifications. This has encouraged insurers to design flexible coverage structures that can be adjusted as operations scale or diversify. Such customization improves relevance and reduces coverage gaps in complex greenhouse environments.

Growth Factors

One key growth factor for the Smart Greenhouse Insurance Market is the increasing value concentration within greenhouse operations. Modern greenhouses house high value crops, automated systems, and specialized infrastructure that require strong financial protection. As capital investment per facility increases, the need for insurance coverage becomes more critical. This directly supports steady growth in insurance adoption across commercial greenhouse operators.

Another major growth factor is the rising frequency and unpredictability of weather related events. Storms, heatwaves, cold snaps, and flooding can severely impact greenhouse structures and internal systems. These risks increase financial exposure even in controlled environments, driving demand for insurance solutions that address both physical damage and operational interruption. Insurance is therefore viewed as an essential safeguard rather than a discretionary expense.

Key Market Segments

By Coverage Type

- Property & Infrastructure Insurance

- Crop & Produce Insurance

- Equipment & Technology Breakdown Insurance

- Others

By Greenhouse Type

- Commercial Hydroponic/Aeroponic Farms

- Commercial Traditional Soil-Based Greenhouses

- Research & Educational Facilities

By Policy Duration

- Annual/Multi-Year Policies

- Seasonal/Percrop Cycle Policies

By End-User

- Large Commercial Growers

- SME & Independent Growers

- AgTech Startups & Vertical Farms

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A key driver of the Smart Greenhouse Insurance market is the rising exposure to climate variability. Greenhouse structures remain vulnerable to storms, heat stress, flooding, and snow loads despite being controlled environments. These risks can cause sudden damage to crops, equipment, and structures, leading to significant financial loss. Insurance demand increases as growers seek protection against unpredictable climate conditions.

Another driver is the growing capital intensity of modern greenhouse operations. Advanced climate control systems, automation tools, and high value crops increase the financial stakes of operational failure. Even a short disruption can result in crop loss and revenue decline. This pushes greenhouse operators to adopt specialized insurance that reflects the true cost of downtime and system failure.

Restraint Analysis

One major restraint is the complexity involved in assessing greenhouse specific risks. Loss outcomes depend on many factors including crop type, growth stage, equipment performance, and external weather conditions. This makes underwriting more difficult compared to traditional property insurance. Higher complexity can translate into higher premiums, which may limit adoption among smaller growers.

Another restraint relates to data reliability and infrastructure readiness. Smart insurance models rely heavily on accurate sensor data and stable digital systems. Inconsistent data collection or system outages can weaken trust in technology based coverage models. This can slow adoption in regions where digital infrastructure or technical expertise is still developing.

Opportunity Analysis

A strong opportunity lies in combining insurance with greenhouse management technologies. Insurers can partner with technology providers to offer bundled solutions that include monitoring, alerts, and risk coverage. This integrated approach supports loss prevention rather than only loss compensation. It also creates value for growers by improving both operational efficiency and financial protection.

Another opportunity is the expansion of controlled environment agriculture to new regions and crop types. As food security and year round production become priorities, greenhouse farming continues to expand. New entrants often require insurance to secure financing and long term contracts. This creates steady demand for tailored insurance products designed for modern greenhouse systems.

Challenge Analysis

One key challenge is aligning expectations between insurers and greenhouse operators. Growers often expect fast and predictable payouts during loss events. Traditional insurance processes may involve inspections and documentation that delay settlement. Educating policyholders on new models such as trigger based coverage is essential to reduce misunderstanding.

Another challenge is adapting insurance frameworks to evolving regulations and standards. Innovative insurance structures may face regulatory uncertainty in some regions. At the same time, data sharing between growers, technology providers, and insurers must comply with privacy and compliance rules. These factors can slow product innovation and market adoption if not managed carefully.

Key Players Analysis

Chubb, Ltd., AXA SA, Zurich Insurance Group, and Allianz SE lead the smart greenhouse insurance market by offering tailored coverage for climate controlled farming operations. Their policies address risks related to crop loss, equipment failure, cyber incidents, and extreme weather events. These insurers focus on risk modeling, sensor based monitoring alignment, and global underwriting expertise. Rising adoption of high value smart greenhouse infrastructure continues to reinforce their leadership.

American Financial Group, Tokio Marine Holdings, Sompo Holdings, Munich Re, and Swiss Re strengthen the market through specialized agricultural insurance and reinsurance support. Their offerings help manage exposure from operational downtime, technology malfunctions, and yield volatility. These providers emphasize data driven underwriting and loss prevention advisory. Growing investment in precision agriculture supports wider adoption.

Farmers Insurance Group, The Hartford Financial Services Group, QBE Insurance Group, RSA Insurance Group, and FM Global, along with others, expand the landscape with flexible policies for small and mid sized greenhouse operators. Their coverage supports property, liability, and business interruption risks. These companies focus on customization and cost efficiency. Increasing use of smart farming technologies continues to drive steady growth in smart greenhouse insurance.

Top Key Players in the Market

- Chubb, Ltd.

- AXA SA

- Zurich Insurance Group, Ltd.

- Allianz SE

- American Financial Group, Inc.

- Tokio Marine Holdings, Inc.

- Sompo Holdings, Inc.

- Munich Re

- Swiss Re, Ltd.

- ICAT

- Farmers Insurance Group

- The Hartford Financial Services Group, Inc.

- QBE Insurance Group, Ltd.

- RSA Insurance Group plc

- FM Global

- Others

Recent Developments

- In July 2025, Chubb, Ltd. strengthened its agribusiness arm with expanded precision coverage for smart farm tech, including greenhouse sensors and automated climate controls. Building on their farm/ranch expertise, Chubb now offers tailored protection against equipment failure in IoT-enabled greenhouses, helping operators avoid costly downtime from tech glitches or weather hits.

- In June 2025, The Hartford Financial Services Group partnered with research groups on climate modeling tools that feed into smart greenhouse policies, predicting risks like extreme heat or floods for controlled environments. This boosts their inland marine endorsements for high-value crops, giving growers reliable coverage that matches real-time data from greenhouse systems.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Bn Forecast Revenue (2034) USD 6.1 Bn CAGR(2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Property & Infrastructure Insurance, Crop & Produce Insurance, Equipment & Technology Breakdown Insurance, Others), By Greenhouse Type (Commercial Hydroponic/Aeroponic Farms, Commercial Traditional Soil-Based Greenhouses, Research & Educational Facilities), By Policy Duration (Annual/Multi-Year Policies, Seasonal/Percrop Cycle Policies), By End-User (Large Commercial Growers, SME & Independent Growers, AgTech Startups & Vertical Farms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Chubb, Ltd., AXA SA, Zurich Insurance Group, Ltd., Allianz SE, American Financial Group, Inc., Tokio Marine Holdings, Inc., Sompo Holdings, Inc., Munich Re, Swiss Re, Ltd., ICAT, Farmers Insurance Group, The Hartford Financial Services Group, Inc., QBE Insurance Group, Ltd., RSA Insurance Group plc, FM Global, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Greenhouse Insurance MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Greenhouse Insurance MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Chubb, Ltd.

- AXA SA

- Zurich Insurance Group, Ltd.

- Allianz SE

- American Financial Group, Inc.

- Tokio Marine Holdings, Inc.

- Sompo Holdings, Inc.

- Munich Re

- Swiss Re, Ltd.

- ICAT

- Farmers Insurance Group

- The Hartford Financial Services Group, Inc.

- QBE Insurance Group, Ltd.

- RSA Insurance Group plc

- FM Global

- Others