Global Smart Food Bin Market by Food Type (Raw, Cooked, and Processed), By Operation (Automatic, Semi-automatic), By Compartment, By Distribution Channel, By End-user, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct. 2023

- Report ID: 103650

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Driving Factors

- Restraining Factors

- By Food Type Analysis

- By Operation Analysis

- By Compartment Analysis

- By Distribution Channel Analysis

- By End-User Analysis

- Key Market Segments

- Opportunity

- Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

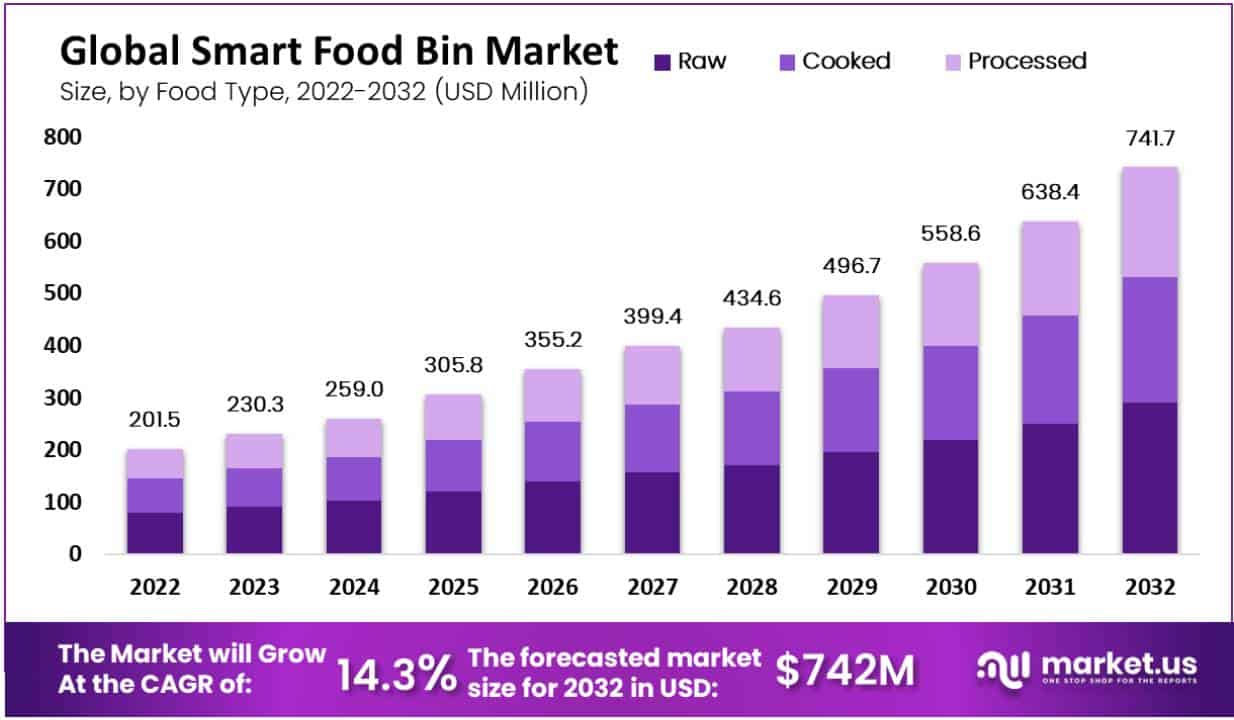

In 2022, the global Smart Food Bin Market was valued at US$ 201.5 million and will reach US$ 741.7 million by 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 14.3%.

Food that is prepared for human consumption but is most frequently never consumed is referred to as food waste. This comprises of food that is lost or damaged in transit, or, food that is not consumed in commercial and residential kitchens, and unfinished leftovers. Depending on the type of food, it is estimated that between 25 and 40 percent of the food produced in the US is wasted.

Reducing wastage of food has an immediate clear, and widespread advantage. Therefore, most nations are looking into different solutions to the issue of food waste in order to lessen the amount of food wasted in various regions of the world due to the very high rate at which food is wasted globally. Here Smart Food Bin Market can solve the problem. Consumers may help reduce food waste by using smart food bins, which are innovative food waste bins. The job of taking pictures of the food being thrown away is done by a Smart Food Bin. Then it weighs the food that is being thrown away and sends the information to a computer.

Note: Actual Numbers Might Vary In The Final Report

Artificial intelligence (AI) is used by the computer that receives the data to advise the user about the kind of food that has been wasted. The smart food bin can identify and separate various types of food waste, enabling food outlets to adjust their food output as necessary. Restaurants and food businesses may benefit from this by improving their food production, which will aid the Smart Food Bin market’s expansion throughout the projection period.

Key Takeaways

- The Smart Food Bin Market is anticipated to reach a value of US$ 741.7 million by 2032, with an estimated CAGR of 14.3% from 2023 to 2032.

- Developing regions, particularly in Asia Pacific and the Middle East, present significant opportunities for market growth, as they grapple with high levels of food waste and increasing environmental concerns.

- Food waste is a critical issue globally, with the US alone wasting over 60 million tonnes of food annually, accounting for roughly 40% of the country’s food supply.

- Rapid urbanization has contributed significantly to the escalating food waste issue, especially in developing regions where a lack of awareness and infrastructure exacerbates the problem.

- Governments are increasingly focused on implementing measures to reduce food waste, aligning with the UN’s Sustainable Development Goal-12 to halve global per capita food waste by 2030.

- The market is hindered by the high cost of smart food bins, availability of alternative solutions, and technical challenges related to wireless technology and data processing.

- North America leads the market, with the US generating about 40 million tons of food waste annually. Europe and the Asia-Pacific regions are expected to witness substantial growth due to increased awareness and initiatives to combat food waste.

- Major industry players include Winnow Solutions Limited, Orbisk, Kitro SA, Leanpath Inc., Lumitics, and Wybone Limited, among others, who are driving innovation in the smart food bin space.

Driving Factors

Growing Urbanization

Urbanization has been accelerating around the world in recent years. For example, according to the World Bank, in 2021 about 5% of the world’s population lived in urban areas. Urbanization is directly correlated with waste generation due to the high consumption rate of packaged and processed products. Urbanization has a greater impact on developing regions than on developed regions. In developing regions, a significant portion of waste is openly dumped due to lack of awareness and necessary infrastructure.

For example, the World Bank predicts that total waste generation will more than double by 2050 in the fastest growing countries such as sub-Saharan Africa, South Asia, the Middle East and North Africa. increase. Given the significant environmental impact of uncontrolled landfill waste, demand for innovative waste management solutions. Smart Food Bin Market is expected to grow in these regions.

Rise in food waste around the globe

Food waste is both a growing problem as well as an opportunity to be explored. The United States wastes more food than any other nation in the world: over 60 million tonnes (or 120 billion pounds) of food annually, as opposed to the world’s 2.5 billion tonnes. This amounts to 325 pounds of trash per person and is roughly 40% of the food supply in the US.

In fact, with 22 percent of municipal solid waste (MSW) being food, it occupies the most space in US landfills. The estimated worth of all the food that is wasted in America is close to $218 billion, or around 130 billion meals. Thus, reducing the extent of food wastage has become a huge priority for most nations around the globe. This is expected to accelerate the demand for smart food bins and accelerate market size expansion during the forecast period.

Demand to Comply with the UN Sustainable Development Goals on Food Waste

Many countries are focusing on implementing crucial measures to reduce the extent of food waste, as over the years, food waste has become a global problem. According to the United Nations Environment Programme, food waste costs around $990 billion annually. Through its Sustainable Development Goal-12 (SDG 12), the UN has set national targets for reducing food wastage.

This goal aims to reduce reducing per capita food waste globally at both retail and consumer levels by half by the year 2030. It also states the emphasis on responsible food consumption and production by countries, and thus promotes sustainable consumption and production patterns. It is expected to drive the demand for smart food bins and drive the growth of the Smart Food Bin Market over the estimated time period.

Rising Awareness among individuals regarding food waste

Numerous countries from all around the globe have begun educating their local populations about the need to prevent food waste. Food waste prevention is important from both an economic and environmental perspective, since it could result in the depletion of renewable natural resources and a shortage of those resources in the environment. At least 88 million tonnes of food are lost every year across the supply chain, according to a project started in the European Union by STREFOWA to minimize and manage food waste in the Europe.

Food loss and waste can occur at various stages of the food value chain, including farming, post-harvest, processing, and other stages. Governments around the world have made various efforts to prevent food waste. The UK government has pledged her £15m financing package to reduce food waste. The UK government is working with businesses and other charities to reduce the amount of edible surplus food that is thrown away each year. Such supportive government initiatives are likely to drive the market growth during the forecast period.

Restraining Factors

High cost of smart food bins

A significantly high cost of smart food bins is a major factor which may hamper the growth of the Smart Food Bin Market. The smart food bin is a technologically enhanced product. These bins comprise of sensors, cameras, and screens, which makes the technology integration costly. As smart food bin is a new concept in the market, the majority of end users do not fully understand the benefits of these bins. Moreover, end-users in developing regions refrain from investing in these high-end products, thereby restraining the growth of the smart food bin market.

Availability of alternatives

The spontaneous availability of various alternative smart trash bins and other solutions across the globe are expected to pose major impediments to the growth of the smart food bin market. These trash bins may be used by small-scale food service providers and as these smart trash bins offer smart technology to segregate and distinguish food waste. Thus, a presence of alternative solutions is likely to limit market growth over the forecast period.

Technical issues

Smart food bins utilize wireless technology, and it can have short ranges and slow data speeds. Also, its operation requires a sensor node with a short memory size. These technical issues may lead to a decrease in efficiency of smart food bins in case of large scale operations which requires higher efficiency and productivity for effective food waste management. Therefore, these technical issues are expected to negatively affect the growth of the Smart Food Bin Market during the estimated time period.

By Food Type Analysis

The raw segment is expected to lead the Smart Food Bin Market

Raw food consists of food and fruit leftovers, inedible vegetable parts, fruit peels, potatoes, plantains and large amounts of the latter and vegetable waste. This waste is generally inedible and, most of which are disposed of as garbage.

Adding some creativity to your cooking can help minimize raw food waste. For example, watermelon skins can be pickled for a crunchy, hearty snack, and collard fibrous stalks can also be chopped for sautéing. These methods can reduce the generation of raw food waste, but the lack of information about innovative cooking methods among individuals hinders their application and supports the growth of the segment.

Also, the processed food segment is likely to grow at a high rate during the forecast period. The growth of the segment can be attributed to rise in consumption of processed food over the globe. Processed foods such as cooked meats and poultry, vegetables and dishes with cold sauces, fried rice is very popular especially in smart cities because it is intended for direct consumption. Today’s lifestyles of many people have led to great demand for such convenient foods. This has led to rise in extent of food waste, and therefore, it is likely to promote the demand for advanced technology like smart food bins over the projected time period.

By Operation Analysis

Automatic smart food bins are witnessing high demand

The automatic segment leads the Smart Food Bin Market with a major revenue share of 65% in 2022. Automatic smart food bins are gaining high popularity among a wide range of food service utilities due to key benefits offered by them such as, greater efficiency, high productivity, and ability to effectively manage large amount of food waste. Thus, key benefits offered by automatic smart food bins is a major factor which is expected to drive the growth of the segment over the forecast period.

On the other hand, the semi-automatic segment is anticipated to witness high growth due to high demand for cost-effective food waste management systems in developing and underdeveloped nations, which is offered by semi-automatic smart food bins.

By Compartment Analysis

Multi-compartment model is highly preferred

The multi-compartment segment shows highest growth in the market with a revenue share of 55.4% in 2022. Waste disposal methods known as multi-compartment bins are created with distinct compartments to gather various types of food waste.

The presence of sensors in these bins often helps to identify the type of waste being disposed and further sort it into the proper compartment. The demand for high quality waste management in case of different types of food waste is expected to fuel the demand for multi-compartment models.

Also, the single compartment model is likely to witness significant growth during the forecast period. Single compartment bins contain one section for all food waste types. These bins often feature sensors that may immediately start the compaction process when garbage is added, which reduces the amount of space needed. This is a key factor driving the growth of the segment.

By Distribution Channel Analysis

Online sales channel shows largest growth

The offline sales channel dominated the Smart Food Bin Market for smart food bins, by accounting for a 51% share of the global revenue in 2022. Perception issues related to online sales channels, and the availability of advanced products like smart food bins through wholesale stores, specialty stores, etc. are key factors driving the growth of the segment.

Moreover, the online segment is likely to grow at the fastest rate during the projected time period. Increasing internet penetration, quicker delivery from online forums, as well as the presence of wide-range of options are some of the key benefits which are contributing to the growth of the segment.

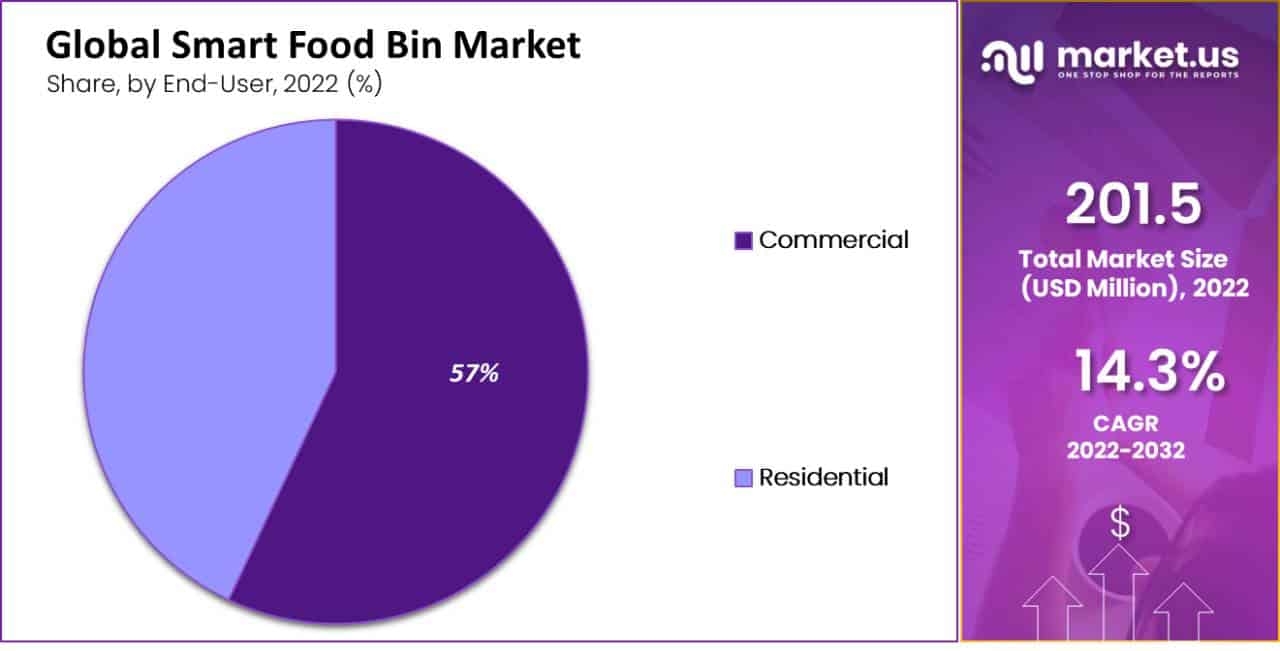

By End-User Analysis

The Commercial segment is witnessing highest growth

The commercial segment is expected to lead the end-user segment by accounting the largest revenue share of 57% in 2022. The high growth of the segment is driven by significant rise in commercial food chains like restaurant and grocery store establishments around the world. Nowadays, most consumers around the world consistently refuse to eat some of the food delivered to them at their table. Therefore, grocers have to deal with large amounts of food waste.

According to Rethink Food Waste (ReFED), restaurant sector in the US generates food waste valuing around 11.4 million tons every year. Limited-service restaurants generate approximately 4.1 million tons of waste while, full-service restaurants generate approximately 7.3 million tons. The cost of food wastage was estimated over $25 billion. Also, annually, a potential profit of $620 million could be generated annually by large hotels or restaurants by using solutions such as waste tracking and analytics that help address the food waste problem. Thus, rise in commercial food chains is likely to positively impact the growth of the segment during the forecast period.

Note: Actual Numbers Might Vary In The Final Report

Also, the residential segment is projected to grow at a high rate during the estimated time period, due to the implementation of advanced technological solutions, as well as the utilization of smart strategies to reduce food wastage and promote efficient waste management in residential settings.

Key Market Segments

By Food Type

- Raw

- Cooked

- Processed

By Operation

- Automatic

- Semi-Automatic

By Compartment

- Single Compartment

- Multi-compartment

By Distribution Channel

- Online

- Offline

By End-User

- Residential

- Commercial

Opportunity

Potential in emerging nations

Countries in developing regions such as Asia Pacific, Middle East and Africa create lucrative opportunities for Smart Food Bin Market players due to the large number of hotels, restaurants and pantries in these regions. These nations have large populations, and so does the amount of food that is wasted.

Market participants can develop products that meet the needs of customers in these regions. Additionally, several governments have taken initiatives to reduce food waste as it contributes to the generation of greenhouse gases. And when food is disposed of in landfills, the bacteria that decompose food waste produce methane, which has an atmospheric warming potential 21 times that of carbon dioxide. To reduce methane production, the HORECA industry is deploying smart food bins, creating lucrative opportunities for major players operating in the Smart Food Bin Market.

Trends

Role of smart food bins in environmental conservation

People in all parts of the world are emphasizing on the importance of avoiding wasting edible food. A large number of people handle food on a regular basis, and the use of smart food bins offers great benefits to them, as it can optimize the amount of food they prepare for various occasions. This can also contribute towards reducing greenhouse gas emissions to a significant extent.

According to the Food and Agriculture Organization (FAO) estimates, the release of at least 4.4 gigatons of greenhouse gases each year due to food loss and wastage. Thus, rise in environmental awareness is likely to positively impact the adoption of smart products like smart food bins in the upcoming years, and therefore, it can be considered as an emerging trend.

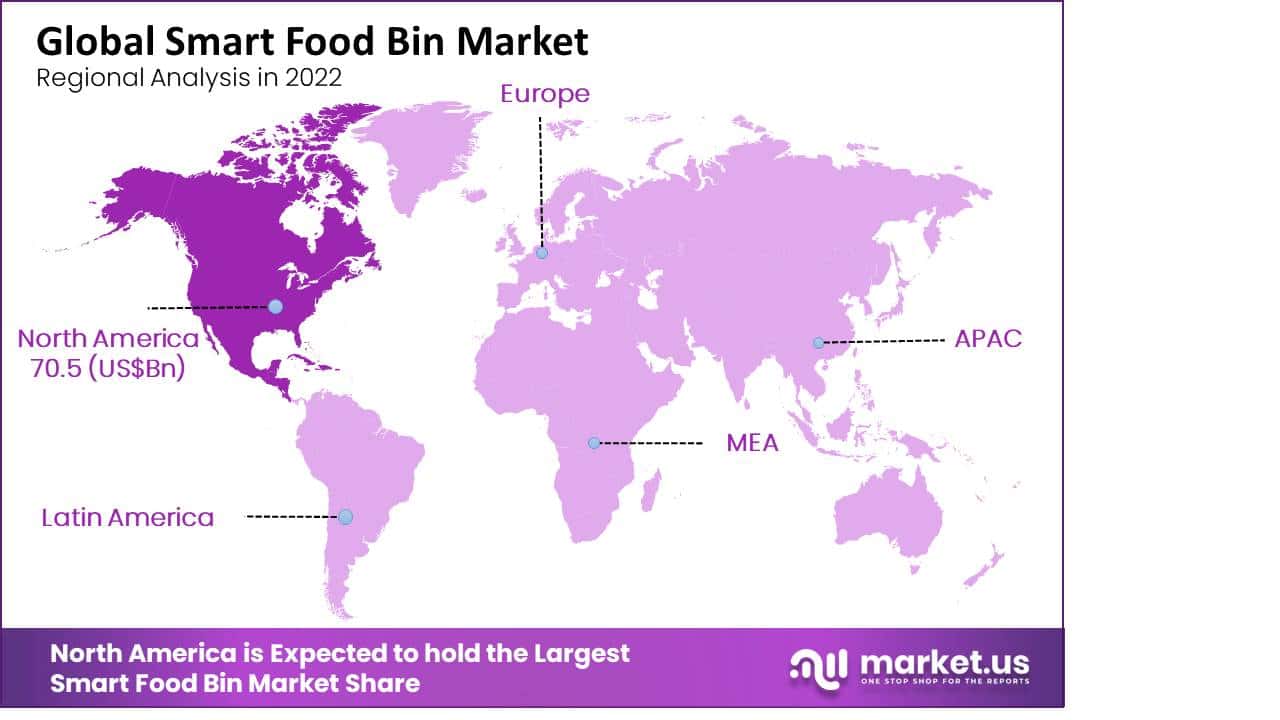

Regional Analysis

The North America region is expected to hold the highest share in the Smart Food Bin Market with a major of 35% and a revenue of 70.5 million during the forecast period, owing to increasing consumer awareness of food waste. Each year, the United States throws out about 40 million tons of food, or 219 pounds of garbage per person.

According to the non-profit organization Feeding America, Americans waste about $218 billion on food each year, with dairy being the most common. American food is plentiful and affordable compared to other parts of the world. Several states are taking steps to reduce food waste and improve food utilization.

People in this region are implementing innovative solutions to reduce the amount of waste that ends up in landfills. Smart food bin is gaining popularity in the region as consumers tend to produce zero food waste and earn higher per capita incomes, thus supporting the growth of the Smart Food Bin Market in the region.

Note: Actual Numbers Might Vary In The Final Report

The Europe region is anticipated to witness high growth over the forecast period, due to the presence of prominent market players in the region. Major European countries such as France, Germany, the UK, and Spain produce large of extent of food waste in the region. It is likely to drive the demand for smart food bins. Also, people in the region are striving to eliminate excess food waste and applying innovative solutions that turn food waste into composite materials. It is expected to boost the expansion of the market in the region.

The Asia-Pacific region is expected to witness significant growth due to high food waste generated by several developing countries in the region. China, India, Australia, Malaysia, Indonesia and Pakistan, among other nations are the main sources of food waste in the region. Most countries in the region are in the development stage and are investing heavily in expanding their overall infrastructure. Per capita income in this region is lower than in Western countries. As the concept of smart bins is new and expanding its roots in developed regions, the development of the Smart Food Bin Market in this region will progress slowly.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global smart food bin market is reasonably competitive. The market is growing gradually due to the increasing implementation for smart food waste management initiatives across the globe. High adoption of advanced technology, such as automated technologies for efficient food waste management, is one of the main factors boosting competition among key industry players. Additionally, technologically advanced product launches solutions are likely to have a positive impact on market expansion.

Top Key Players in Smart Food Bin Market

- Winnow Solutions Limited

- Orbisk

- Kitro SA

- Leanpath Inc.

- Lumitics

- Wybone Limited

- Enevo Inc.

- Other Key Players

Recent Developments

- Jan ’23: Lumitics has raised seed funding to track food waste generated by F&B shops and restaurants in Singapore. The company raised around $557,000 in an oversubscribed seed funding round the hospitality veteran Franck Courmont and ReadyVentures.

- November ’22: With the addition of asset tracking devices for 4,500 smart food bins transferring chicken between farms and distribution centers, the Australian grocery operator Coles made its first push into digitization.

Report Scope

Report Features Description Market Value (2022) USD 201.5 Mn Forecast Revenue (2032) USD 742 Mn CAGR (2023-2032) 14.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Food Type- Raw, Cooked, Processed, By Operation -Automatic, Semi-automatic, By Compartment- Single Compartment, Multi-compartment, By Distribution Channel- Online, Offline, By End-user- Residential, Commercial Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Winnow Solutions Limited, Orbisk, Kitro SA, Leanpath Inc. Lumitics, Wybone Limited, Enevo, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is global Smart Food Bin Market?The global Smart Food Bin Market was valued at US$ 201.5 million in 2022 and is projected to reach US$ 741.7 million by 2032.

What is Smart Food Bin Market?Smart food bins are innovative waste bins that use technology to address food waste. These bins capture images and weigh the food being discarded, sending the information to a computer.

What are the driving factors for the growth of the Smart Food Bin Market?Growing urbanization, rise in food waste worldwide, the demand to comply with UN Sustainable Development Goals on food waste, and increasing awareness among individuals regarding food waste are some of the driving factors for the growth of the Smart Food Bin Market.

What are the key segments in the smart food bin market based on food type?The key segments based on food type in the smart food bin market include raw, cooked, and processed food.

What are the different operation types available in the smart food bin market?The smart food bin market offers two operation types: automatic and semi-automatic.

How are smart food bins categorized based on compartments?Smart food bins can be categorized as single compartment or multi-compartment bins.

Who are some of the key players in the smart food bin market?The key players in the smart food bin market include Winnow Solutions Limited, Orbisk, Kitro SA, Leanpath Inc., Lumitics, Wybone Limited, Enevo Inc., and other key players.

What are the advantages of using smart food bins?Smart food bins offer benefits such as efficient food waste management, reduced environmental impact, improved hygiene, and cost savings through optimized waste disposal.

-

-

- Winnow Solutions Limited

- Orbisk

- Kitro SA

- Leanpath Inc.

- Lumitics

- Wybone Limited

- Enevo Inc.