Global Smart Contracts In Trade Finance Market Size, Share, Industry Analysis Report By Component (Platform / Middleware, Services), By Application (Letters of Credit (LC), Bills of Lading (BoL), Invoice Financing, Payment Settlement, Trade Document Verification, Customs & Compliance, Others), By Organization Size (Large Enterprises, SMEs), By End User / Industry (Banks & Financial Institutions, Exporters / Importers, Shipping & Logistics, Customs Authorities & Governments, Trade Finance Platforms & Fintechs, Others), By Deployment Mode (Public Blockchain, Private / Permissioned Blockchain), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165500

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Smart Contract Statistics

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Component Analysis

- Application Analysis

- Organization Size Analysis

- End User / Industry Analysis

- Deployment Mode Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

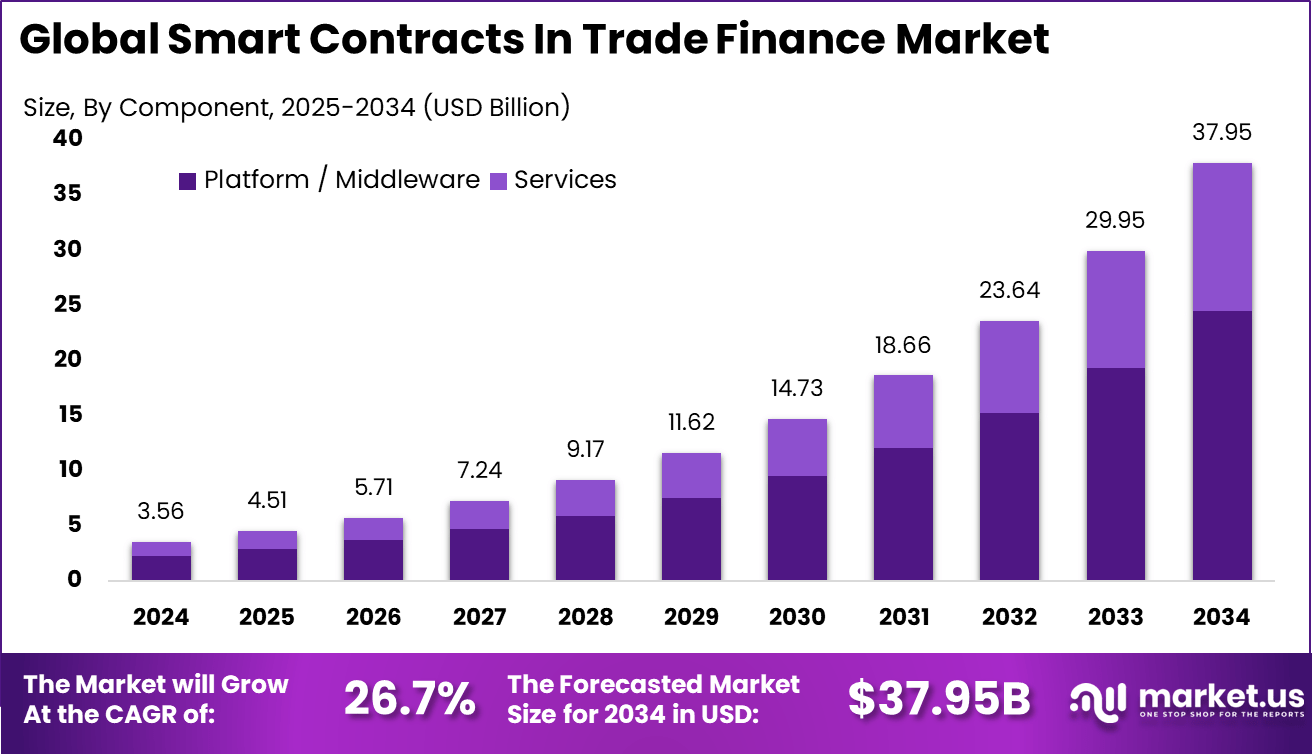

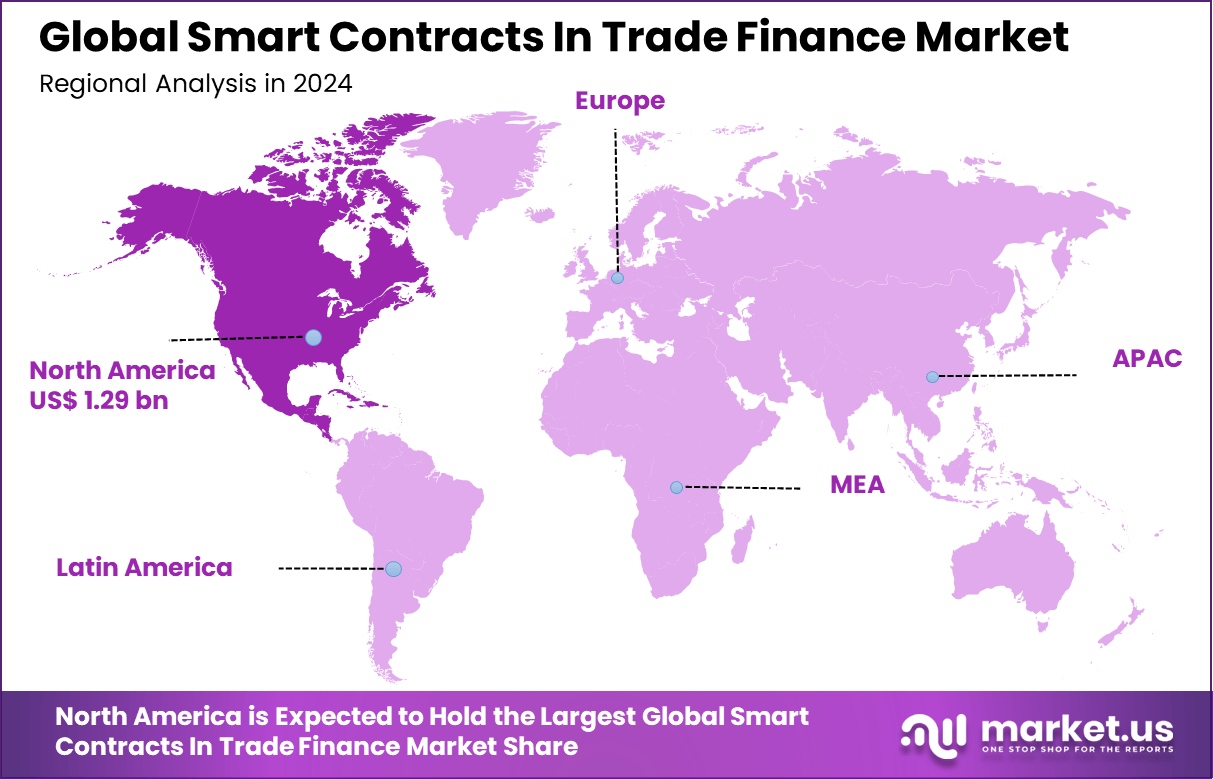

The Global Smart Contracts in Trade Finance Market size is expected to be worth around USD 37.95 billion by 2034, from USD 3.56 billion in 2024, growing at a CAGR of 26.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 36.4% share, holding USD 1.29 billion in revenue.

Smart contracts in trade finance are digital agreements that automatically execute when predetermined conditions are met. These contracts are typically written in code and run on blockchain platforms, ensuring transparency, security, and immutability. By automating processes such as payment releases or document verification, smart contracts eliminate the need for intermediaries and reduce delays. They offer greater accuracy and reduce human errors, improving efficiency across trade finance lifecycles.

A key factor driving the adoption of smart contracts in trade finance is the growing demand for faster and more secure transactions. Increasing global trade volume makes traditional paper-based and manual processes slow and prone to fraud and errors. Smart contracts address these issues by providing a single source of truth visible to all parties, which enhances trust.

According to Market.us, The global AI in trade finance market is projected to reach USD 38.9 billion by 2033, increasing from USD 9.2 billion in 2023. The market is estimated to grow at a 15.5% CAGR during the period from 2024 to 2033. The market for smart contracts in trade finance is driven by the need to automate and streamline complex trade processes.

Automation through smart contracts reduces manual intervention, cutting operational costs and minimizing delays by ensuring payments and document verifications happen automatically once contract conditions are met. This increases efficiency, accuracy, and transparency, which are crucial in global trade where risks and errors have traditionally been high.

Demand for smart contracts in trade finance is rising due to the ongoing digital transformation in the sector and growing awareness of benefits like automation and fraud reduction. Businesses increasingly seek solutions that enhance transparency and reduce settlement times, with smart contracts reducing invoice approval times by up to 70%.

For instance, in May 2025, R3’s Corda platform confirmed its market leadership in tokenized real-world assets, managing over $10 billion in on-chain assets. R3 has continued to expand partnerships to modernize payments, including CBDCs, and improve interoperability solutions for digital and financial markets, reinforcing its deep footprint in trade finance smart contracts.

Key Takeaway

- The Platform or Middleware segment led the market in 2024 with a strong 64.6% share, showing its central role in enabling automated, secure, and interoperable trade finance workflows.

- Letters of Credit (LC) remained the leading application area, capturing 32.2%, supported by rising demand for faster, tamper-proof, and transparent cross-border settlement.

- Large Enterprises held a dominant 75.5% share, reflecting their higher transaction volumes and stronger adoption of blockchain-enabled smart contract systems.

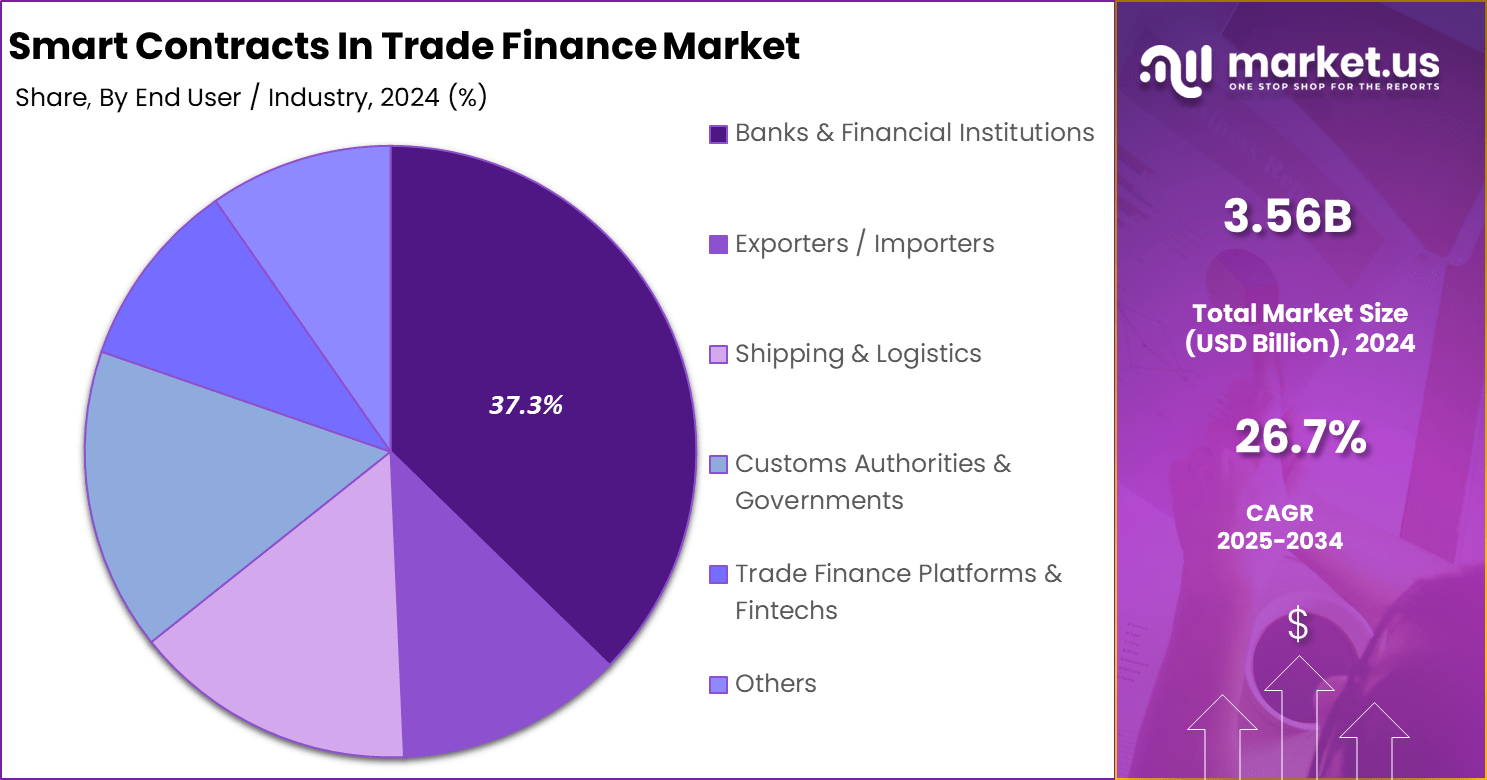

- The Banks and Financial Institutions segment accounted for 37.3%, as these organizations continue modernizing trade processes through digital verification and automated compliance.

- Public Blockchain platforms led with 55.5%, driven by the need for openness, traceability, and decentralized verification in global trade operations.

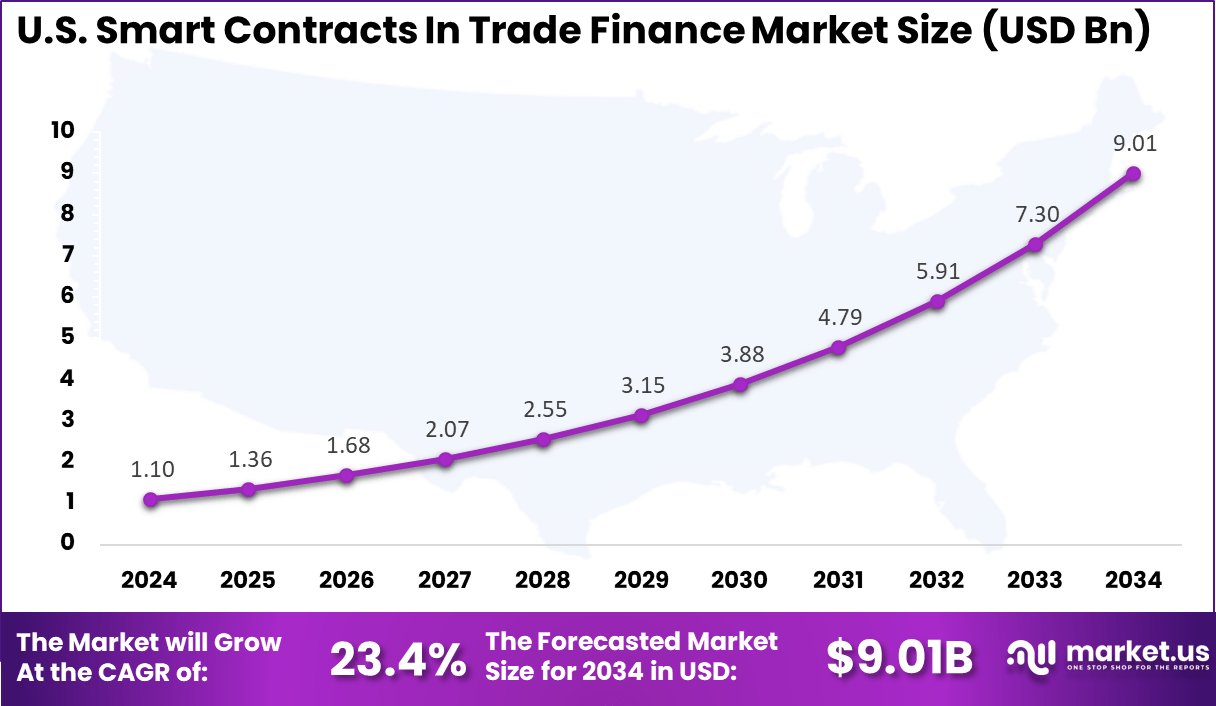

- The U.S. market reached USD 1.10 billion in 2024, expanding at a 23.4% CAGR, supported by rapid digitization of trade logistics and strong fintech participation.

- North America dominated globally with a 36.4% share, anchored by regulatory clarity, advanced digital infrastructure, and high blockchain adoption across financial institutions.

Smart Contract Statistics

Efficiency and Cost Reduction

- Reduced processing times: Smart contracts have significantly shortened transaction processing cycles. In many use cases, processing times have decreased by up to 92%, shifting workflows from days or weeks to hours or minutes. One example is a blockchain-enabled letter of credit that cut approval time from five days to under 24 hours.

- Lower transaction costs: The removal of intermediaries in international trade has reduced transaction costs by as much as 40%. Automation in pilot programs has also lowered documentation expenses by more than 80%, creating substantial savings in paper-heavy processes.

- Operational cost savings: Automated smart contract platforms helped financial institutions save an estimated USD 10 billion in operational costs in 2024, due to lower manual processing and fewer reconciliation requirements.

Fraud Reduction and Security

- Decreased fraud: Blockchain-based smart contract systems have been highly effective in reducing fraud. Pilot studies show that documentary fraud fell by more than 80%, while an IBM–Maersk platform case study recorded a 60% reduction in fraud incidents.

- Enhanced security: The immutability of blockchain ensures that once a contract is executed, it cannot be altered. This reduces risks related to data tampering, unauthorized edits, or duplicate financing.

- Improved transparency: Smart contracts create a single shared ledger that is accessible to authorized parties. This improves transparency across all participants and simplifies compliance and regulatory reporting.

Role of Generative AI

Generative AI is transforming smart contracts in trade finance by enabling advanced data analysis and predictive capabilities. It helps identify patterns and discrepancies in documents, speeding up compliance checks and reducing human errors. Around 90% of trade finance processes could benefit from AI-driven automation, improving decision-making and transparency in transactions. This allows businesses to process transactions more efficiently while maintaining regulatory standards.

By using generative AI, smart contracts become capable of adapting and updating based on new data inputs, which enhances the reliability of trade finance operations. This integration supports fraud detection, improves risk management, and accelerates transaction settlements. Despite challenges such as data privacy and ethical considerations, generative AI remains a key driver of innovation in the trade finance ecosystem, promoting faster and more accurate contract execution.

Investment and Business Benefits

The rise in smart contract adoption in trade finance opens multiple investment avenues, especially in blockchain infrastructure, AI integration, and fintech startups creating smart-contract-based platforms. Investors look to fund projects that improve the scalability and security of these contracts, as well as solutions that facilitate interoperability among various blockchain systems.

Tokenization initiatives also create access to new asset classes and financing models. With trade volumes expected to grow, investment in technologies enabling trade digitization provides long-term opportunities in transforming global commerce and financial services. Businesses benefit from smart contracts in trade finance through faster transaction settlements, reduced fraud risk, and lowered operational costs.

The automation of trade documentation and payments streamlines workflows, saving time and resources. Improved transparency and auditability foster stronger business relationships and reduce reconciliation efforts. Enhanced accuracy and real-time tracking ensure compliance with regulations and reduce errors. These advantages lead to improved cash flow management and increased revenue potential by accelerating the trade cycle and reducing financing costs.

U.S. Market Size

The market for Smart Contracts In Trade Finance within the U.S. is growing tremendously and is currently valued at USD 1.10 billion, the market has a projected CAGR of 23.4%. This growth is largely driven by the rising adoption of blockchain technology that enables automated, secure, and transparent contract execution. Smart contracts reduce reliance on intermediaries, significantly cutting delays, risks, and costs involved in trade finance operations.

Additionally, the U.S. benefits from a mature technological infrastructure, skilled workforce, and favorable regulatory environment encouraging digital innovation. Large enterprises and financial institutions increasingly deploy smart contracts to improve efficiency, compliance, and payment automation. Growing investments and startup activity in blockchain also fuel market expansion, making the U.S. a key hub for smart contract-driven trade finance modernization.

For instance, in October 2025, IBM announced a new collaboration with Deloitte to deliver AI-led and blockchain-powered services aimed at transforming trade finance processes. The partnership focuses on integrating smart contracts with AI solutions to boost automation, enhance transparency, and reduce costs in cross-border trade finance. This move reinforces IBM’s lead in advancing digital trade finance in the U.S. and North America.

In 2024, North America held a dominant market position in the Global Smart Contracts In Trade Finance Market, capturing more than a 36.4% share, holding USD 1.29 billion in revenue. This strong position is driven by the region’s advanced technological infrastructure and early adoption of blockchain technology. North America benefits from a supportive ecosystem with skilled professionals and numerous startups focusing on smart contract innovation.

Government initiatives and favorable regulations in the region have further encouraged blockchain integration in trade finance. The presence of leading financial institutions and large enterprises investing in smart contracts boosts operational efficiency, transparency, and security in trade transactions. These factors combine to maintain North America’s leadership in the global market.

For instance, in March 2025. R3 Corda, a leader in blockchain for trade finance, reported the successful completion of two prototypes with over 15 consortium member banks using distributed ledger technology for smart contracts. These implementations aim to accelerate digital transformation in trade finance, enabling faster settlement, lower risks, and increased trust among participants in North America and globally.

Component Analysis

In 2024, the Platform / Middleware segment held a dominant market position, capturing a 64.6% share of the Global Smart Contracts In Trade Finance Market. This dominance is due to the platforms’ ability to provide the underlying infrastructure for creating, deploying, and managing smart contracts across trade finance applications.

These platforms allow seamless automation and integration of various trade finance processes, reducing manual work and the time needed for transactions. The middleware further acts as a connector between blockchain protocols and existing financial systems, enabling smoother operation.

This segment’s leadership indicates that foundational technology investments in platforms and middleware remain a priority for organizations aiming to streamline trade finance workflows. The ability to automate processes using these platforms helps companies reduce operational costs and improve overall speed and accuracy within trade finance transactions.

For Instance, In October 2025, CargoX was noted for improving trade finance processes through blockchain and smart contracts. Its platform supports automated exchange of electronic trade documents and letters of credit, which helps lower risks, reduce delays, and control costs. This progress reflects the rising emphasis on platform and middleware technologies that enable secure smart contract execution in trade finance.

Application Analysis

In 2024, the Letters of Credit (LC) segment held a dominant market position, capturing a 32.2% share of the Global Smart Contracts In Trade Finance Market. This reflects how smart contract technology is transforming a core trade finance instrument by automating key steps like issuance, verification, and settlement. Smart contracts within letters of credit can trigger payments automatically once the predefined conditions are met, eliminating lengthy manual checks and intermediaries.

The shift to smart contracts in the letters of credit space addresses traditional pain points such as delays and fraud risk. The automation improves efficiency and trust across buyers, sellers, and banks, reducing processing time and costs. This application growth shows how blockchain solutions improve longstanding trade finance products by adding transparency and speed.

For instance, in October 2025, CargoX further demonstrated leadership by providing fast, secure solutions for electronic trade documents such as bills of lading and letters of credit. This enhances trust and boosts transparency across trade finance workflows, proving the practical benefits of smart contracts in real-world applications.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 75.5% share of the Global Smart Contracts In Trade Finance Market. These organizations have the scale, financial capacity, and technological readiness to implement advanced blockchain solutions. Large companies benefit from smart contracts by automating complex and high-value trade processes, thereby cutting down risks of errors and fraud.

Their lead adoption also stems from their need for compliance, reporting accuracy, and faster settlements in cross-border trade. Large enterprises’ focus on operational efficiency drives continuous investments in smart contract platforms. Their share indicates that enterprise-scale solutions are central to driving smart contract penetration in trade finance markets today.

For Instance, In August 2024, Wipro partnered with Traydstream to support automated trade finance processing for banks and corporates. The collaboration focuses on digitizing trade documents, automating rule checks, and improving compliance through blockchain-based smart contract applications. This partnership shows how technology providers are helping modernize trade finance for large enterprise users.

End User / Industry Analysis

In 2024, the Banks & Financial Institutions segment held a dominant market position, capturing a 37.3% share of the Global Smart Contracts In Trade Finance Market. They use smart contracts primarily to automate loan issuance, payment settlements, and document verification in trade finance transactions. This adoption helps reduce paperwork, processing times, and fraud risks, which are common in traditional trade finance methods.

The banking sector’s large share highlights its critical role in digitally transforming international trade through blockchain. Financial institutions increasingly rely on smart contracts to enhance transparency and trust among multiple trading parties, accelerating transaction cycles and lowering operational costs in their trade finance offerings.

For Instance, in August 2024, Wipro entered a strategic partnership with Traydstream to deliver end-to-end trade finance automation solutions. This collaboration focuses on digitalizing and streamlining trade finance processes for banks and large enterprises. Wipro’s involvement reflects the strong adoption of smart contracts among large organizations aiming to digitize document verification, compliance checks, and rule enforcement in trade finance.

Deployment Mode Analysis

In 2024, The Public Blockchain segment held a dominant market position, capturing a 55.5% share of the Global Smart Contracts In Trade Finance Market. Public blockchains offer a decentralized, transparent, and immutable environment, which is suitable for ensuring trust and auditability in multi-party trade finance transactions across borders. Their openness attracts various stakeholders, fostering greater acceptance and collaboration.

This preference for public blockchains marks the trade finance sector’s focus on transparency and interoperability. While private and consortium blockchains also have use cases, the dominance of public blockchains underlines the push for standardization and open networks that support widespread adoption of smart contract automation within global trade.

For Instance, in July 2025, XDC Network is leveraging smart contracts to enable the secure exchange of funds and asset ownership within trade finance. Its network supports regulatory compliance automation and end-to-end transaction functionality, reducing complexities in trade finance processes. This highlights the growing role of public blockchains in supporting trade finance ecosystems with smart contract capabilities.

Emerging trends

One key trend is the surge in adoption of smart contract templates for trade finance, which has increased by about 50% by 2025. These templates simplify processes like letters of credit, supporting faster and more secure transactions. Also, escrow agreements now represent roughly 20% of smart contract use cases, ensuring safer fund transfers in global trade.

This adoption is part of a broader move towards digital platforms and blockchain integration to enhance transparency and reduce fraud. Additionally, the rise of hybrid blockchains shows about 40% growth, combining the security of private chains with the openness of public networks.

The focus on ESG compliance and collaboration with fintech companies is reshaping trade finance, enabling smarter risk assessments and real-time supply chain analytics. These trends highlight how smart contracts are central to creating a more resilient and efficient trade finance environment.

Growth Factors

The primary growth driver is the increasing reliance on blockchain technology to automate and secure transactions. This technology reduces the need for intermediaries, cutting transaction costs and processing times significantly. Over 60% of smart contracts now operate on public blockchains, which provide immutable and transparent records, fostering greater trust among trade parties.

Another growth factor is regulatory advancements encouraging digital trade solutions. Governments and industry bodies are pushing for frameworks that support AI and blockchain interoperability in trade finance. This regulatory support, combined with the growing need to minimize fraud and payment risks, fuels wider smart contract adoption. These factors help businesses reduce delays and operational risks while increasing efficiency.

Key Market Segments

By Component

- Platform / Middleware

- Services

- Integration & deployment

- Auditing & compliance

- Consulting and advisory

By Application

- Letters of Credit (LC)

- Bills of Lading (BoL)

- Invoice Financing

- Payment Settlement

- Trade Document Verification

- Customs & Compliance

- Others

By Organization Size

- Large Enterprises

- SMEs

By End User/Industry

- Banks & Financial Institutions

- Exporters / Importers

- Shipping & Logistics

- Customs Authorities & Governments

- Trade Finance Platforms & Fintechs

- Others

By Deployment Mode

- Public Blockchain

- Private / Permissioned Blockchain

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Automation Reduces Cost and Delays

Smart contracts’ automated execution of trade finance agreements cuts down the need for manual intervention, significantly reducing operational costs and preventing payment delays. By triggering payments only when contract conditions are met, these contracts streamline workflows, reduce paperwork, and eliminate middlemen, helping firms process transactions faster and more economically. This efficiency drives adoption as businesses look to optimize cash flows and minimize errors.

This automation also enhances accuracy and speeds up verification processes, making trade finance much more transparent and reliable. The reduction in delays and errors positively impacts the overall trade ecosystem by lowering risks for all parties involved. This direct connection of contract terms to automated execution is a major factor encouraging the use of smart contracts in trade finance today.

For instance, in October 2025, CargoX announced the rapid growth of its platform for creating and exchanging electronic trade documents. This development highlights how CargoX leverages blockchain to automate trade finance processes, reducing delays and lowering costs through its secure, digital document solutions. This automation directly supports the driver of cost reduction and faster transaction processing in trade finance.

Restraint

Legal and Regulatory Uncertainty

The adoption of smart contracts in trade finance faces significant restraints due to unclear legal and regulatory frameworks globally. Different jurisdictions have varying laws about the enforceability of coded contracts, creating uncertainty around dispute resolution and contract modification. Without standardized guidelines and international legal recognition, companies remain hesitant to fully trust or invest in smart contract solutions.

This lack of a consistent legal framework also complicates compliance and can increase operational risks, especially in cross-border trade where multiple legal systems intersect. Until regulations become clearer and more harmonized, the scope for wide-scale implementation of smart contracts in trade finance will remain limited.

For instance, in August 2024, Wipro partnered with Traydstream to offer automated trade finance solutions to banks and corporates. Despite the promise of digitization, this partnership also reflects the restraint caused by slow adoption due to regulatory and operational uncertainties. The need to integrate new systems within existing legal frameworks remains a hurdle for many firms.

Opportunities

Enhanced Transparency and Reduced Fraud

Smart contracts embedded on blockchain technology offer a unique opportunity to increase transparency and reduce fraud in trade finance. Transactions recorded on immutable ledgers enable real-time tracking and verification of trade documents, making it harder to commit fraud or manipulate data. This transparency builds trust among trading partners and financial institutions, paving the way for wider acceptance of blockchain-powered trade finance.

Furthermore, automated verification reduces human error and ensures compliance with agreed terms, simplifying audit trails and dispute handling. This opens doors for smaller enterprises and new market entrants to access trade finance more securely and efficiently than traditional methods allowed.

For instance, in July 2025, XDC Network advanced its trade finance capabilities significantly by acquiring Contour, a platform backed by major financial institutions. This strategic move focused on digitizing trade processes and tokenizing trade documents, enhancing transparency and reducing fraud risks, especially for small and mid-sized enterprises.

Challenges

Integration with Legacy Systems

A key challenge for smart contracts in trade finance is their integration with existing legacy banking and enterprise systems. Many institutions still rely on traditional, paper-based processes and siloed IT infrastructure, which are difficult to connect with blockchain platforms. This integration complexity slows down digital transformation initiatives as companies face technical and operational hurdles.

The challenge also includes aligning multiple stakeholders and updating existing workflows to accommodate automated smart contracts. Overcoming entrenched manual processes and convincing all parties to adopt new digital solutions requires time and investment, presenting a major barrier to scaling smart contract deployment in trade finance.

For instance, in May 2025, R3 Corda reported progress with multiple global banks building trade finance applications on its platform. While the technology supports faster transactions, the challenge of integrating these new smart contract tools with legacy banking systems remains.

Key Players Analysis

The Smart Contracts in Trade Finance Market is shaped by global technology leaders such as International Business Machines Corporation, Wipro, and R3 Corda. Their blockchain frameworks support automated settlements, document authentication, and real-time transaction validation. Adoption is rising as banks and logistics operators seek to reduce delays, increase transparency, and limit manual intervention across cross-border trade processes.

Specialized blockchain platforms including XDC Network, CargoX, Spydra, and Debut Infotech focus on digitizing bills of lading, multi-party approvals, and tokenized trade documents. Their systems allow smart contracts to trigger payments and compliance checks automatically. These providers support interoperability with existing trade finance systems while enhancing traceability across global supply chains.

Additional contributors such as DP World, PerfectionGeeks Technologies, and other major players integrate smart contract tools into port operations, cargo tracking, and customs processes. Their solutions improve transaction accuracy and reduce operational risk through automated workflows. The market continues to expand as organizations prioritize secure, verifiable, and efficient trade execution supported by blockchain-based smart contracting.

Top Key Players in the Market

- CargoX

- International Business Machines Corporation

- Wipro

- XDC Network

- R3 Corda

- DP World

- Debut Infotech

- PerfectionGeeks Technologies

- Spydra

- Other Major Players

Recent Developments

- In July 2025, XDC Network marked significant progress with institutional adoption and regulatory clarity. It launched the XDC Exchange-Traded Product (ETP) listed in Europe, enabling regulated exposure to its blockchain. It also advanced technical capabilities with cross-chain integration, boosting liquidity and interoperability across major blockchains. These milestones strengthen XDC’s role in tokenizing trade finance assets and expanding decentralized finance opportunities.

- In July 2025, DP World Trade Finance surpassed the milestone of facilitating more than $1 billion in working capital for businesses in emerging markets. Their platform integrates logistics expertise with tailored financial solutions, supported by partnerships with over 30 financial institutions, to enable faster lending decisions and improve supply chain visibility. This marks DP World as a major enabler in closing trade finance gaps globally.

Report Scope

Report Features Description Market Value (2024) USD 3.5 Bn Forecast Revenue (2034) USD 37.9 Bn CAGR(2025-2034) 26.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Platform / Middleware, Services), By Application (Letters of Credit (LC), Bills of Lading (BoL), Invoice Financing, Payment Settlement, Trade Document Verification, Customs & Compliance, Others), By Organization Size (Large Enterprises, SMEs), By End User / Industry (Banks & Financial Institutions, Exporters / Importers, Shipping & Logistics, Customs Authorities & Governments, Trade Finance Platforms & Fintechs, Others), By Deployment Mode (Public Blockchain, Private / Permissioned Blockchain) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CargoX, International Business Machines Corporation, Wipro, XDC Network, R3 Corda, DP World, Debut Infotech, PerfectionGeeks Technologies, Spydra, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Contracts In Trade Finance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Contracts In Trade Finance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- CargoX

- International Business Machines Corporation

- Wipro

- XDC Network

- R3 Corda

- DP World

- Debut Infotech

- PerfectionGeeks Technologies

- Spydra

- Other Major Players