Global Small-scale Bioreactors Market By Product Type (Single-use Bioreactors and Reusable Bioreactors), By Capacity (1 L to 3 L, 500 mL to 1 L, 5 mL to 100 mL, 3 L to 5 L, 250 mL to 500 mL and 100 mL to 250 mL), By End-Use (CROs & CMOs, Pharmaceutical & Biopharmaceutical Companies and Academic & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177674

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

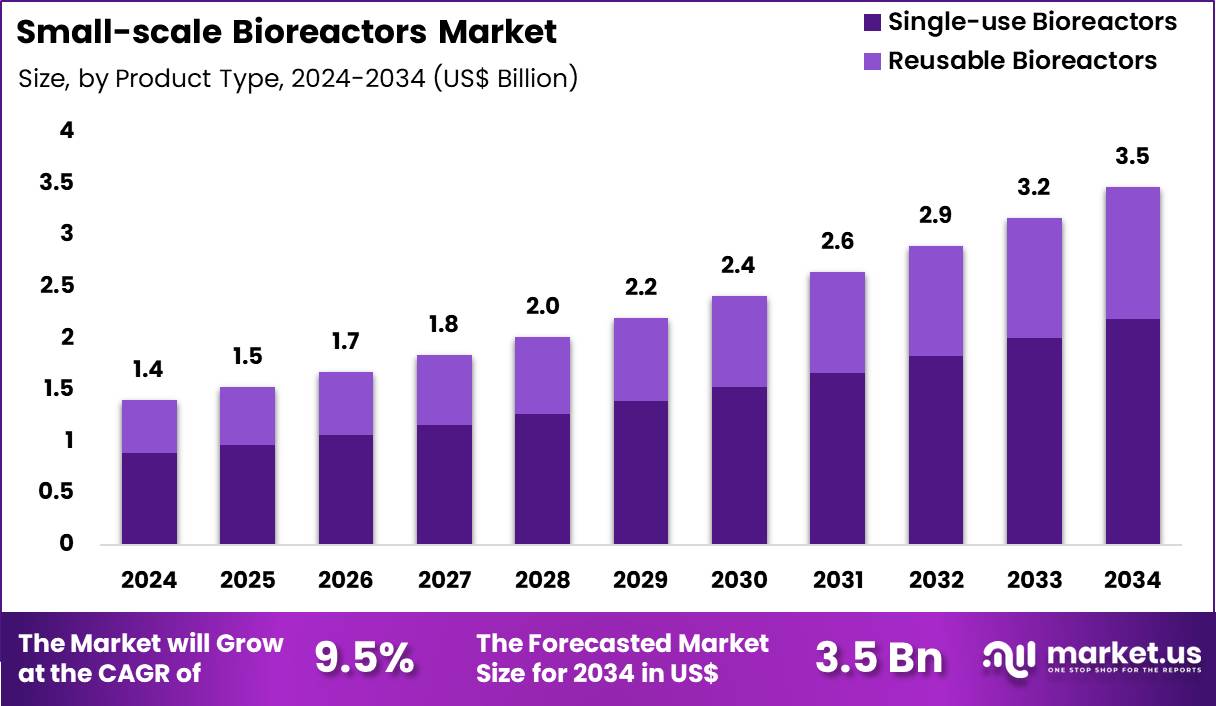

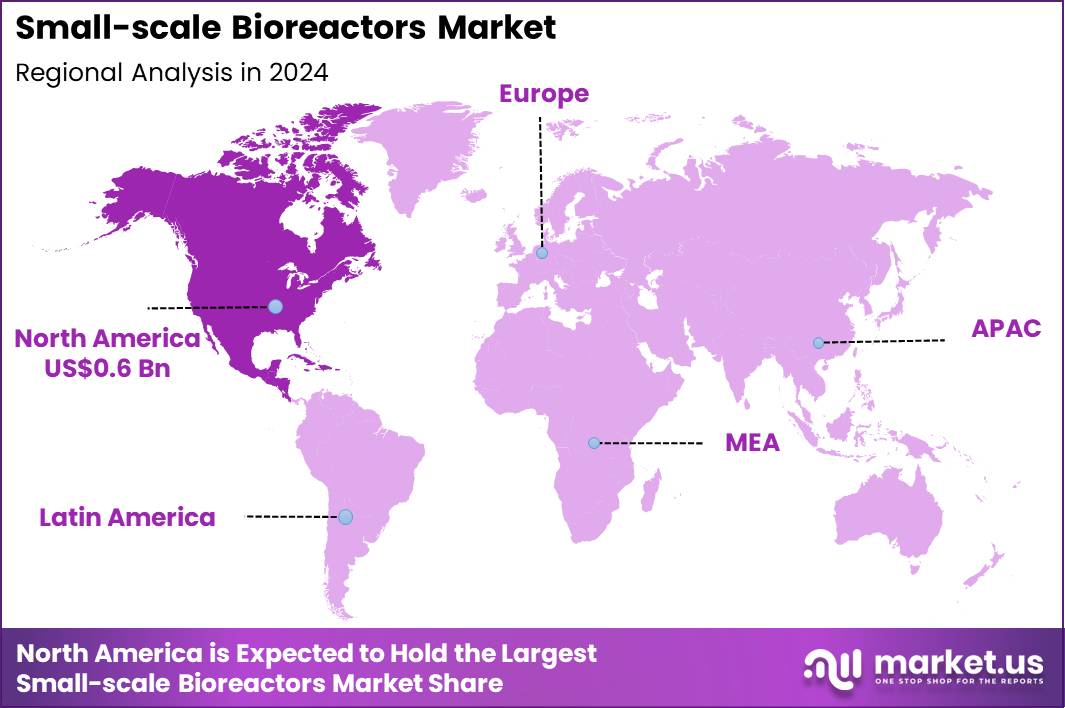

Global Small-scale Bioreactors Market size is expected to be worth around US$ 3.5 Billion by 2034 from US$ 1.4 Billion in 2024, growing at a CAGR of 9.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 44.7% share with a revenue of US$ 0.6 Billion.

Increasing demand for biopharmaceutical research and process optimization accelerates the small-scale bioreactors market as biotechnology firms seek versatile systems that enable rapid experimentation and scale-up predictions. Researchers increasingly utilize benchtop bioreactors for microbial fermentation in antibiotic and enzyme production, controlling parameters like pH, oxygen, and agitation to maximize yields in early-stage development.

These devices support mammalian cell culture for monoclonal antibody generation, where scientists simulate large-scale conditions to refine media formulations and reduce production risks. Academic laboratories apply small-scale bioreactors in stem cell expansion for regenerative therapies, maintaining consistent environments that promote proliferation and differentiation.

Pharmaceutical developers employ these tools in vaccine antigen expression, testing viral vectors under varied conditions to accelerate candidate selection. Tissue engineering teams leverage the equipment for 3D cell constructs, optimizing nutrient delivery and shear stress to mimic physiological settings.

Manufacturers pursue opportunities to integrate automation and sensor technologies that enhance real-time monitoring, expanding applications in personalized medicine where bioreactors customize cell therapies for individual patient profiles.

Developers advance single-use disposable bioreactors that minimize contamination risks, broadening utility in high-throughput screening for drug discovery and metabolic engineering. These innovations facilitate hybrid systems combining bioreactors with microfluidics for organ-on-chip models, supporting toxicity testing and disease modeling.

Opportunities emerge in sustainable designs using recyclable materials, appealing to eco-conscious bioprocessing operations. Companies invest in AI-driven predictive analytics that forecast culture outcomes, streamlining workflows across applications. Recent trends emphasize modular, scalable platforms that bridge lab-to-production gaps, positioning the market for growth in advanced therapeutics and biomanufacturing efficiency.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.4 Billion, with a CAGR of 9.5%, and is expected to reach US$ 3.5 Billion by the year 2034.

- The product type segment is divided into single-use bioreactors and reusable bioreactors, with single-use bioreactors taking the lead with a market share of 63.2%.

- Considering capacity, the market is divided into 1 l to 3 l, 500 ml to 1 l, 5 ml to 100 ml, 3 l to 5 l, 250 ml to 500 ml and 100 ml to 250 ml. Among these, 1 L to 3 L held a significant share of 28.9%.

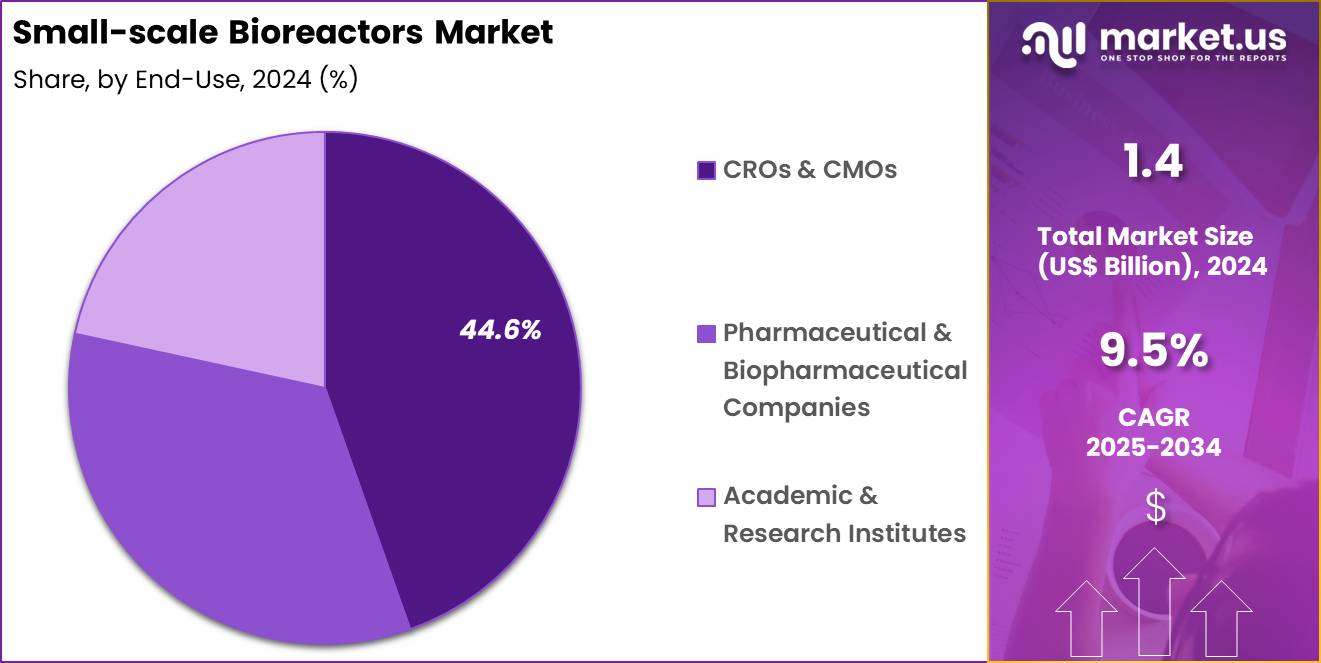

- Furthermore, concerning the end-use segment, the market is segregated into CROs & CMOs, pharmaceutical & biopharmaceutical companies and academic & research institutes. The CROs & CMOs sector stands out as the dominant player, holding the largest revenue share of 44.6% in the market.

- North America led the market by securing a market share of 44.7%.

Product Type Analysis

Single-use bioreactors contributed 63.2% of growth within product type and led the small-scale bioreactors market due to their flexibility, lower contamination risk, and faster turnaround between runs. Bioprocess teams favor disposable systems because they eliminate cleaning and validation steps, which shortens development timelines and reduces operational complexity.

Early-stage process development and cell line screening activities increasingly rely on single-use formats to support rapid iteration. The ability to scale workflows consistently across development stages further strengthens adoption.

Growth accelerates as biologics pipelines expand and process intensification strategies gain priority. Single-use systems support parallel experimentation and quick changeovers, which improves productivity in development labs.

Reduced capital expenditure and lower utility requirements appeal to organizations managing multiple client programs. Supplier innovation improves bag integrity, mixing performance, and sensor integration. The segment is expected to remain dominant as speed, flexibility, and operational efficiency continue to shape small-scale bioprocessing decisions.

Capacity Analysis

The 1 L to 3 L capacity range generated 28.9% of growth within capacity and emerged as the leading segment due to its optimal balance between throughput and experimental control. Process development teams rely on this range to generate representative data for scale-up while maintaining manageable working volumes. The capacity suits fed-batch and perfusion studies during clone selection and media optimization. Compatibility with automated platforms improves reproducibility and data quality.

Growth strengthens as developers aim to de-risk scale-up earlier in the workflow. The 1 L to 3 L range supports extended runs and advanced analytics without excessive resource consumption. CROs and CMOs prefer this capacity to accommodate diverse client requirements across modalities.

Standardization around this volume improves cross-project comparability. The segment is anticipated to sustain leadership as development programs demand scalable, data-rich experimentation.

End-Use Analysis

CROs and CMOs accounted for 44.6% of growth within end-use and dominated the small-scale bioreactors market due to rising outsourcing of bioprocess development and manufacturing services. Sponsors increasingly delegate early development and optimization activities to service providers to accelerate timelines and manage costs.

CROs and CMOs maintain multiple small-scale systems to support parallel client projects, which increases equipment density and utilization. Contracted workflows emphasize flexibility and rapid changeovers, aligning well with small-scale platforms.

Growth continues as biologics portfolios diversify across monoclonal antibodies, cell therapies, and vaccines. Service providers invest in standardized small-scale infrastructure to deliver consistent outcomes across programs.

Long-term partnerships increase recurring demand for capacity expansion. Talent concentration within CROs and CMOs further strengthens adoption. The segment is projected to remain the primary growth driver as outsourcing remains central to biopharmaceutical development strategies.

Key Market Segments

By Product Type

- Single-use Bioreactors

- Reusable Bioreactors

By Capacity

- 1 L to 3 L

- 500 mL to 1 L

- 5 mL to 100 mL

- 3 L to 5 L

- 250 mL to 500 mL

- 100 mL to 250 mL

By End-Use

- CROs & CMOs

- Pharmaceutical & Biopharmaceutical Companies

- Academic & Research Institutes

Drivers

Increasing number of biologic approvals is driving the market.

The growing number of biologic approvals by regulatory authorities has significantly boosted the demand for small-scale bioreactors, as these devices are essential for early-stage development and process optimization in biopharmaceutical research.

Enhanced regulatory pathways and scientific advancements have facilitated more biologics entering the market, requiring efficient small-scale systems for testing and scaling. Healthcare organizations rely on these bioreactors to support the production of monoclonal antibodies and gene therapies approved for various diseases.

The U.S. Food and Drug Administration approved 15 biologics in 2022, 17 in 2023, and 19 in 2024. This upward trend reflects the expanding pipeline of innovative treatments, driving the need for reliable small-scale bioreactors in preclinical phases. Small-scale bioreactors allow for controlled environments to test biologic candidates, ensuring compliance with regulatory standards before larger-scale production.

Government agencies emphasize the importance of robust R&D infrastructure to accelerate approval processes for life-saving biologics. Key manufacturers are responding by innovating bioreactor designs to meet the demands of this approval surge. This driver correlates with global efforts to address unmet medical needs through advanced biotherapeutics. Overall, the rise in approvals sustains market momentum in bioprocessing technologies.

Restraints

High cost of advanced bioreactors is restraining the market.

The elevated pricing of sophisticated small-scale bioreactors equipped with automation and sensors limits their accessibility for smaller research institutions and startups. Manufacturing requirements for precise materials and components contribute to high production expenses, passed on to end-users.

Academic labs often face budget constraints, opting for basic models over advanced systems due to financial limitations. Regulatory compliance for quality assurance adds further costs to development and procurement. In resource-limited settings, these expenses restrict upgrades to existing equipment, slowing innovation adoption.

Providers weigh the benefits against the economic implications when recommending these bioreactors for R&D projects. This restraint impacts market penetration in emerging economies with constrained funding. Industry strategies to introduce modular designs aim to alleviate pricing pressures partially.

Despite performance advantages, the cost factor hinders universal implementation in diverse research applications. Addressing affordability through subsidies is vital for overcoming this market challenge.

Opportunities

Recovery in bioprocess order intake is creating growth opportunities.

The rebound in order intake for bioprocess solutions signals potential for expanded utilization of small-scale bioreactors in pharmaceutical development. Improved market conditions support investments in scalable systems for biologic manufacturing pipelines.

Sartorius reported Bioprocess Solutions order intake of €2,693.1 million in 2024, a 12.0% increase from €2,404.1 million in 2023. This growth reflects renewed demand for equipment that facilitates efficient process optimization in R&D. Partnerships with biopharma firms enable tailored bioreactor solutions for emerging therapies.

The substantial order volumes in developed markets amplify prospects for technology enhancements. Reforms in supply chain management strengthen recovery efforts post-disruptions. Primary corporations pursue expansions to capitalize on this upward trajectory. This opportunity corresponds with initiatives to bolster biomanufacturing resilience. Focused developments can yield notable progress in specialized bioprocessing segments.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions shape the small scale bioreactors market through research funding, biomanufacturing investment, and purchasing discipline across labs and CDMOs. Inflation and higher interest rates tighten capital budgets, which slows equipment upgrades and delays capacity additions for early stage programs.

Geopolitical tensions disrupt supplies of stainless steel, single use components, sensors, and control electronics, increasing lead times and cost variability. Current US tariffs on imported equipment, automation parts, and consumables raise landed costs for manufacturers and buyers, which compresses margins and stretches procurement approvals.

These pressures weigh more heavily on startups and academic labs with limited funding. On the positive side, trade friction encourages domestic manufacturing, local sourcing of single use systems, and supplier diversification.

Continued growth in cell and gene therapy research sustains demand for flexible, benchtop scale production tools. With disciplined sourcing, modular designs, and service support, the market remains positioned for steady and confident growth.

Latest Trends

Integration of artificial intelligence and automation is a recent trend in the market.

In 2024, the adoption of AI-driven controls in small-scale bioreactors has enhanced process monitoring and optimization for biopharmaceutical research. These systems utilize machine learning to predict and adjust parameters in real-time, improving yield consistency. Manufacturers are embedding automation to reduce manual intervention and minimize errors in experimental setups.

Clinical applications benefit from automated data analysis for faster iteration in cell culture development. Sartorius highlighted integrating artificial intelligence and automation as a key technological advance in its 2024 annual report. This innovation addresses challenges in scaling processes from small to large volumes.

Enterprises focus on user-friendly interfaces to support AI integration in diverse lab environments. Regulatory evaluations confirm compliance for automated features in global markets. Sector collaborations refine algorithms for superior predictive capabilities in bioreactor operations. These advancements aim to elevate efficiency while ensuring regulatory adherence in bioprocessing workflows.

Regional Analysis

North America is leading the Small-scale Bioreactors Market

North America accounted for a 44.7% share of the market in 2024, supported by strong demand for flexible upstream systems across biologics, cell therapies, and vaccine development. Biopharma companies increased early phase and scale down experimentation to shorten development timelines and control costs.

Contract manufacturers expanded modular facilities, which raised demand for benchtop and pilot scale systems that support rapid process optimization. Academic labs and translational research centers also increased adoption as they shifted from static culture methods to controlled bioprocessing.

A mature supplier ecosystem ensured fast access to consumables, sensors, and automation tools. Regulatory familiarity and skilled operators further strengthened deployment across the US and Canada.

A clear growth signal came from the US Food and Drug Administration, which reported 55 novel drug approvals through its CDER program in 2023, reflecting sustained biologics activity that relies heavily on small volume bioprocess development.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to show strong expansion during the forecast period as regional governments and manufacturers scale biologics and biosimilar pipelines. Companies across China, India, South Korea, and Southeast Asia increasingly favor compact, single use systems to reduce capital risk and accelerate development cycles.

Academic institutes partner more closely with industry, which drives demand for flexible laboratory scale production platforms. Growing clinical trial activity pushes CROs to invest in process development infrastructure closer to trial sites. Workforce upskilling in bioprocess engineering improves utilization rates across new facilities.

Export focused biologics strategies further support adoption. A supportive indicator is Singapore’s national RIE2025 program, where the government committed SGD 25 billion toward research and innovation, a funding framework that continues to strengthen biomanufacturing and bioprocess capabilities across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the small-scale bioreactors market grow by expanding modular and automated systems that support diverse cell culture and fermentation applications while reducing hands-on time for researchers. They also deepen customer engagement through integrated software packages that enable real-time monitoring, data analytics, and seamless scale-up workflows from benchtop to pilot production.

Firms build strategic collaborations with academic labs and biopharma innovators to embed their solutions in early-stage research programs and strengthen long-term institutional loyalty. Geographic expansion into Asia Pacific and Latin America complements strong penetration in North America and Europe, capturing rising investment in bioprocessing and biologics development.

Sartorius AG exemplifies a leading life sciences technology company with a comprehensive portfolio of bioprocess systems, strong global distribution channels, and coordinated commercial strategies that align product innovation with evolving research demands.

The company advances its competitive position through disciplined R&D investment, targeted acquisitions that broaden capabilities, and a customer-centric service model that translates technical support into sustained market traction.

Top Key Players

- Thermo Fisher Scientific

- Sartorius

- Eppendorf

- Merck KGaA

- Danaher Corporation

- Infors HT

- Applikon Biotechnology

- PBS Biotech

- Cellexus

- Getinge

Recent Developments

- In April 2025, Thermo Fisher Scientific unveiled the DynaDrive 5L single-use bioreactor, a compact benchtop system developed to simplify bioprocess scale expansion. The platform is intended for use across large biopharma organizations, CDMOs, and early-stage biotech companies, supporting a consistent scale pathway from 1 liter through commercial volumes of up to 5,000 liters. Performance data indicate a 27% productivity gain versus conventional glass bioreactors. The system also integrates sustainability-focused materials, including biobased Aegis films and BioTitan retention components, aimed at reducing waste and limiting product losses.

- In November 2024, Lonza achieved initial GMP production at its mammalian manufacturing site in Portsmouth, New Hampshire. The facility incorporates a 2,000-liter single-use bioreactor designed to serve small and mid-scale biologics programs, particularly those supporting rare disease therapies. This addition strengthens the site’s existing manufacturing infrastructure, which includes 6,000-liter and 20,000-liter systems, and enhances Lonza’s ability to support early-stage commercial supply. The site operates with advanced process monitoring tools and optimized manufacturing workflows to ensure consistent output across multiple biologic formats.

Report Scope

Report Features Description Market Value (2024) US$ 1.4 Billion Forecast Revenue (2034) US$ 3.5 Billion CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Single-use Bioreactors and Reusable Bioreactors), By Capacity (1 L to 3 L, 500 mL to 1 L, 5 mL to 100 mL, 3 L to 5 L, 250 mL to 500 mL and 100 mL to 250 mL), By End-Use (CROs & CMOs, Pharmaceutical & Biopharmaceutical Companies and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Sartorius, Eppendorf, Merck KGaA, Danaher Corporation, Infors HT, Applikon Biotechnology, PBS Biotech, Cellexus, Getinge Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Small-scale Bioreactors MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Small-scale Bioreactors MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Sartorius

- Eppendorf

- Merck KGaA

- Danaher Corporation

- Infors HT

- Applikon Biotechnology

- PBS Biotech

- Cellexus

- Getinge