Global Skin Microbiome Market By Product Type (Skin Care Products, Medical Devices, Dietary Supplements and Diagnostic Tests), By Skin Type (Normal, Dry, Oily and Combination), By Disease (Acne Vulgaris, Psoriasis Vulgaris, Atopic Dermatitis and Rosacea), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177684

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

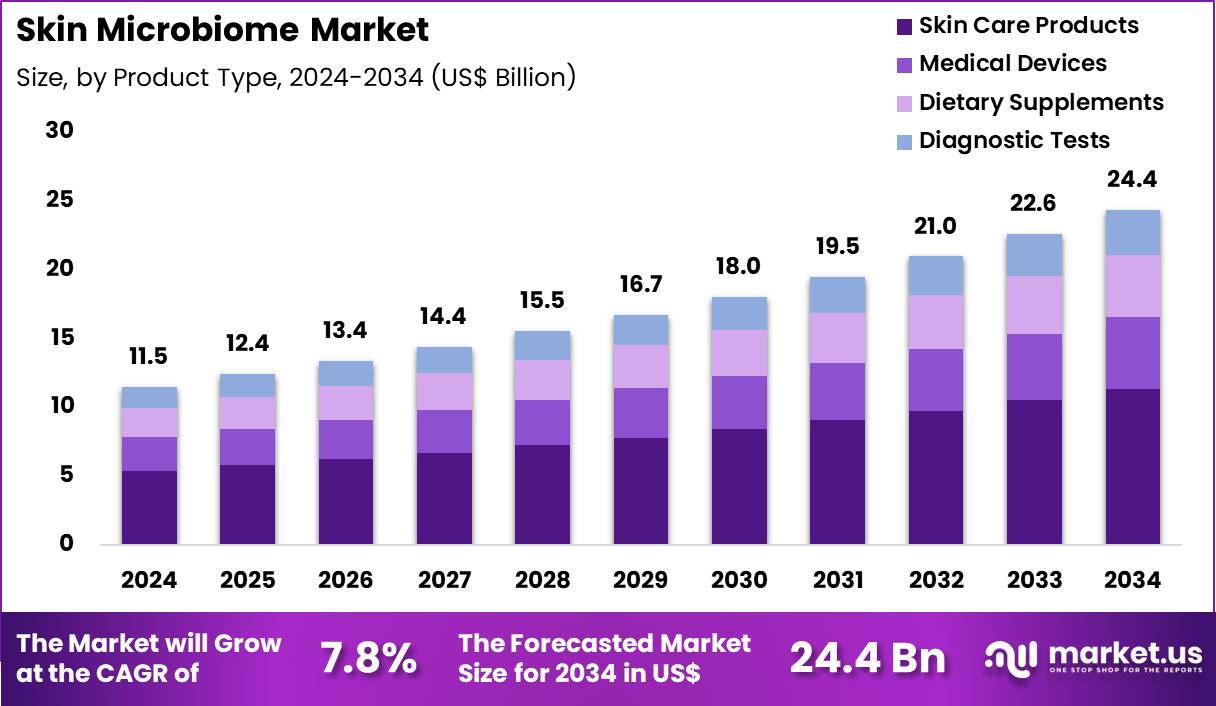

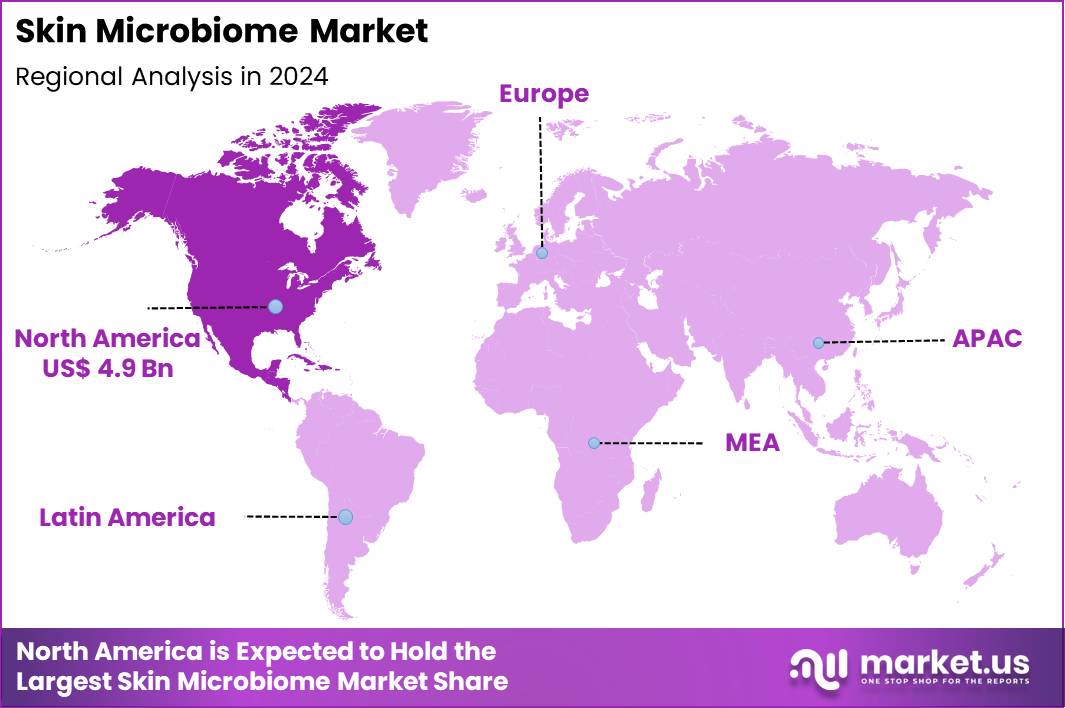

The Global Skin Microbiome Market size is expected to be worth around US$ 24.4 Billion by 2034 from US$ 11.5 Billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.4% share with a revenue of US$ 4.9 Billion.

Increasing consumer interest in microbiome-based skincare solutions drives the skin microbiome market as individuals seek natural alternatives to traditional cosmetics that restore microbial balance and enhance barrier function. Dermatologists increasingly prescribe topical probiotics to treat acne vulgaris, where beneficial bacteria outcompete pathogenic strains and reduce inflammation in sebaceous glands.

These applications extend to eczema management, where prebiotic formulations nourish commensal microbes to alleviate itching and dryness in atopic dermatitis patients. Cosmetic brands utilize microbiome-friendly serums for anti-aging regimens, promoting collagen production and hydration by modulating microbial diversity on facial skin.

Wound care specialists apply microbiome-modulating dressings to chronic ulcers, accelerating healing by fostering protective biofilms that inhibit infection. Personal care products incorporate microbiome boosters for scalp health, addressing dandruff and hair loss through balanced follicular ecosystems.

Manufacturers pursue opportunities to develop personalized microbiome kits that analyze individual skin profiles via swab sampling, enabling tailored treatments for conditions like rosacea and psoriasis. Developers advance fermented extract blends that harness microbial metabolites for barrier repair, expanding utility in sensitive skin therapies.

These innovations facilitate integration with wearable sensors that monitor microbial shifts in real time for proactive interventions. Opportunities emerge in eco-friendly, plant-derived prebiotics that support sustainable formulations without synthetic preservatives.

Companies invest in clinical trials validating microbiome claims, building credibility for novel applications in post-procedure recovery and environmental stress protection. Recent trends emphasize multi-strain probiotic complexes and AI-driven formulation design, positioning the market for growth in holistic skin health management.

Key Takeaways

- In 2024, the market generated a revenue of US$ 11.5 Billion, with a CAGR of 7.8%, and is expected to reach US$ 24.4 Billion by the year 2034.

- The product type segment is divided into skin care products, medical devices, dietary supplements and diagnostic tests, with skin care products taking the lead with a market share of 46.5%.

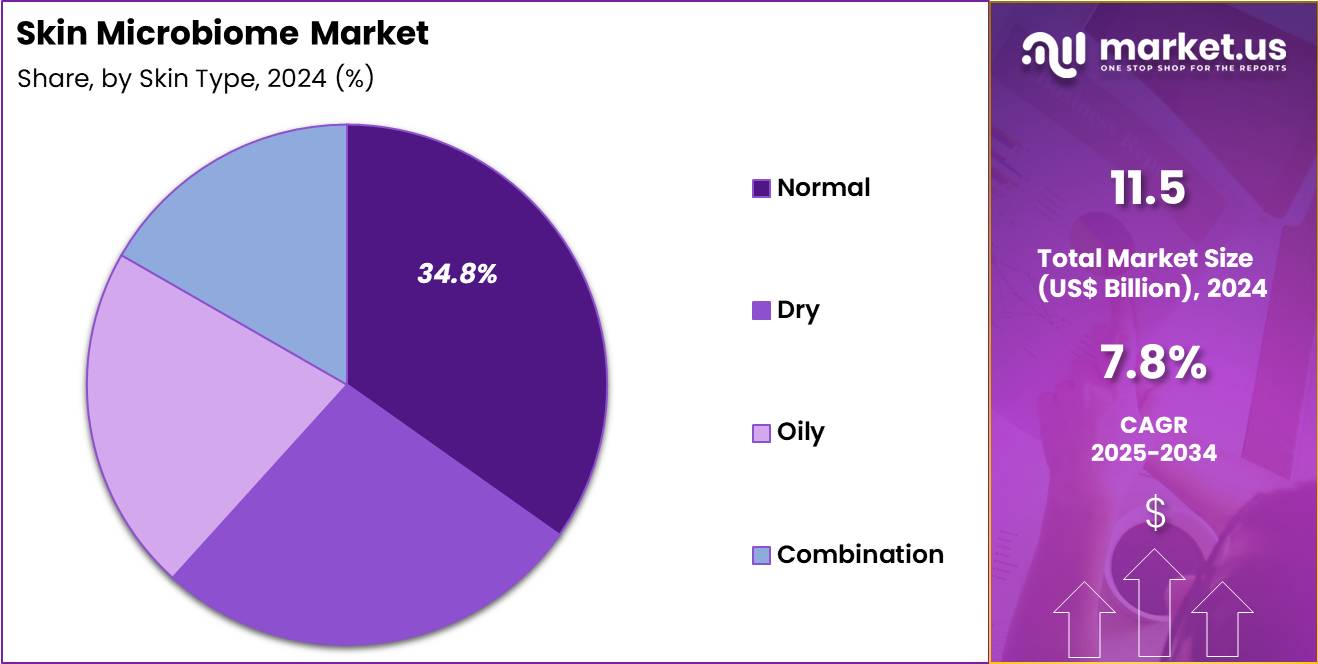

- Considering skin type, the market is divided into normal, dry, oily and combination. Among these, normal held a significant share of 34.8%.

- Furthermore, concerning the disease segment, the market is segregated into acne vulgaris, psoriasis vulgaris, atopic dermatitis and rosacea. The acne vulgaris sector stands out as the dominant player, holding the largest revenue share of 39.6% in the market.

- North America led the market by securing a market share of 42.2%.

Product Type Analysis

Skin care products contributed 46.5% of growth within product type and led the skin microbiome market due to strong consumer demand for daily-use formulations that support microbial balance. Brands increasingly develop cleansers, serums, and moisturizers with prebiotics, probiotics, and postbiotics to protect the skin barrier and reduce irritation.

Consumers prefer topical products because they integrate easily into existing routines and deliver visible benefits over time. Dermatology recommendations and growing awareness of microbiome science reinforce adoption across mass and premium segments.

Growth strengthens as personalization trends encourage microbiome-friendly formulations for specific concerns. Continuous product innovation expands use cases from basic hydration to acne control and sensitive skin care.

Retail and e-commerce distribution improve accessibility and trial. Regulatory acceptance of cosmetic microbiome claims further supports launches. The segment is expected to remain dominant as daily skincare continues to serve as the primary interface for microbiome modulation.

Skin Type Analysis

Normal skin accounted for 34.8% of growth within skin type and dominated the skin microbiome market due to its large addressable population and preventive care focus. Consumers with normal skin increasingly adopt microbiome-supporting products to maintain balance and prevent future issues.

Preventive skincare aligns with wellness-oriented lifestyles and long-term skin health goals. Brands position microbiome solutions as maintenance products, which increases repeat usage among this group.

Growth accelerates as education highlights the role of microbial diversity even in healthy skin. Product lines tailored for maintenance rather than correction attract consistent demand. Normal-skin consumers show higher experimentation with new formulations, supporting product trial rates. Subscription and routine-based purchasing models further increase volume. The segment is anticipated to sustain leadership as prevention-focused skincare gains traction globally.

Disease Analysis

Acne vulgaris generated 39.6% of growth within disease and emerged as the leading segment due to its high prevalence and strong link to microbiome imbalance. Research increasingly connects acne severity to disruptions in Cutibacterium acnes strains and skin microbial diversity.

Consumers seek microbiome-based alternatives to harsh treatments that cause irritation or resistance. Dermatologists recommend microbiome-friendly regimens to support long-term acne management and barrier repair.

Growth strengthens as adolescent and adult acne incidence rises across regions. Combination therapies that include microbiome-supporting products increase treatment duration and product usage. Social media awareness accelerates adoption among younger consumers. Clinical validation of microbiome approaches improves confidence and uptake. The segment is projected to remain dominant as acne management continues to shift toward gentler, biology-aligned solutions.

Key Market Segments

By Product Type

- Skin Care Products

- Medical Devices

- Dietary Supplements

- Diagnostic Tests

By Skin Type

- Normal

- Dry

- Oily

- Combimation

By Disease

- Acne Vulgaris

- Psoriasis Vulgaris

- Atopic Dermatitis

- Rosacea

Drivers

Increasing focus on dermatological research including microbiome is driving the market.

The emphasis on dermatological advancements incorporating microbiome studies has significantly propelled the skin microbiome market by enabling innovative skincare solutions for conditions like acne and rosacea. Key players are investing in scientific territories such as the microbiome to address skin health challenges through evidence-based products. This research focus supports the development of therapies that balance microbial communities for improved cutaneous homeostasis.

Healthcare partnerships enhance the translation of microbiome insights into practical applications for consumer use. The correlation between microbiome alterations and inflammatory diseases underscores the need for targeted interventions.

Government health bodies recognize the potential of microbiome modulation in preventive dermatology. L’Oréal’s Dermatological Beauty Division achieved sales of €7 billion in 2024, reflecting a 9.8% like-for-like growth. This financial performance highlights the market’s response to microbiome-integrated skincare lines.

Overall, the research drive fosters collaboration between industry and academia for sustained market expansion. This driver aligns with global trends toward personalized and efficacious dermatological care.

Restraints

Absence of regulatory standards is restraining the market.

The lack of standardized regulations for microbiome-based products poses challenges to product efficacy validation and market entry for developers. Variations in microbial compositions require consistent guidelines to ensure safety and reproducibility in skincare formulations. Regulatory gaps lead to hesitancy among manufacturers in scaling production due to potential compliance risks.

Smaller biotech firms struggle with navigating undefined approval pathways for microbiome therapeutics. The inability to standardize product performance hinders consumer trust and widespread adoption. Oversight bodies are yet to establish universal protocols for microbiome claims in cosmetics. This restraint affects investment in research for novel microbial applications in dermatology.

Industry advocacy seeks harmonized standards to facilitate innovation while protecting public health. Despite therapeutic potential, regulatory uncertainties delay commercialization timelines. Addressing these standards is crucial for mitigating market limitations and enabling growth.

Opportunities

Strong growth in dermatological beauty revenues is creating growth opportunities.

The robust expansion in dermatological beauty sales presents avenues for integrating skin microbiome products into premium skincare portfolios. Increased consumer demand for science-backed solutions supports the incorporation of microbiome-friendly formulations in diverse product lines. Strategic investments in microbiome research enable the creation of targeted therapies for skin barrier enhancement.

Partnerships with healthcare professionals facilitate the promotion of microbiome-based products in clinical settings. The large market for anti-aging and acne treatments amplifies opportunities for microbiome modulation innovations. Policy advancements in cosmetic regulations bolster product development in high-potential regions.

L’Oréal’s Dermatological Beauty Division reported a 9.3% reported growth in 2024, surpassing the global dermocosmetics market. This performance indicates untapped potential for microbiome-specific lines within established brands. Key corporations are leveraging this growth to diversify offerings beyond traditional skincare. Overall, revenue momentum aligns with efforts to meet evolving consumer needs in skin health.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the skin microbiome market through consumer spending, clinical research budgets, and brand investment decisions across beauty and healthcare. Inflation and higher interest rates reduce discretionary spend on premium skincare and slow funding for early stage microbiome programs.

Geopolitical tensions disrupt supplies of probiotics, fermentation inputs, packaging materials, and cold chain logistics, increasing cost volatility and delivery risk. Current US tariffs on imported ingredients, laboratory equipment, and finished products raise landed costs, which pressures margins and pricing strategies. These factors challenge smaller brands and delay product launches in price sensitive channels.

On the positive side, trade pressure encourages local fermentation, ingredient traceability, and regional manufacturing partnerships. Rising awareness of skin health, acne, and inflammatory conditions sustains demand for microbiome based solutions. With science backed formulations, omnichannel reach, and disciplined sourcing, the market remains positioned for steady and confident growth.

Latest Trends

Launch of investment programs for skin health research is a recent trend in the market.

In 2024, major players initiated funding programs to advance microbiome research for dermatological applications. These investments focus on improving access to skin health solutions through microbiome studies on conditions like psoriasis. Collaborative forums emphasize the role of microbiome in developing inclusive dermatology products.

Regulatory adaptations support the integration of microbiome data in product efficacy claims. Industry leaders are prioritizing long-term commitments to microbiome innovation for sustainable skincare. L’Oréal launched a €20 million five-year investment program in 2024 for global skin health access. This initiative includes funding for scientific publications and epidemiological studies on diverse skin types.

Partnerships enhance knowledge sharing on microbiome dynamics in various populations. These developments aim to bridge gaps in microbiome-based therapeutic options. The trend positions investment as key to future advancements in personalized dermatology.

Regional Analysis

North America is leading the Skin Microbiome Market

North America holds a 42.2% share of the global Skin Microbiome market, experiencing substantial expansion in 2024 due to escalating consumer preference for natural, microbiome-balanced formulations that address inflammatory conditions like rosacea and dermatitis through enhanced barrier function.

Leading companies such as Johnson & Johnson and Procter & Gamble have invested in proprietary bacterial strains and postbiotic ingredients, delivering targeted therapies that restore microbial diversity and reduce irritation in sensitive skin types. The region’s vibrant cosmetics industry has capitalized on e-commerce channels to promote education on skin flora’s role in overall wellness, driving demand among millennials seeking clean beauty options.

Academic collaborations with institutions like Harvard Medical School have accelerated clinical validations of topical probiotics, supporting evidence-based claims for efficacy in wound healing. Regulatory advancements from the FDA have clarified guidelines for live biotherapeutic claims, facilitating faster product launches and market penetration.

Heightened focus on holistic health post-pandemic has spurred integrations with wearable tech for real-time microbiome monitoring, personalizing regimens for urban dwellers exposed to pollutants. Moreover, philanthropy from organizations like the Bill & Melinda Gates Foundation has supplemented studies on diverse ethnic skin microbiomes, broadening inclusivity in formulations.

The Federal Government of the U.S. spent USD 903 million on microbiome research and development in 2022, catalyzing innovations in dermatological applications.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts project notable progression in the cutaneous flora sector across Asia Pacific over the forecast period, as authorities bolster incentives for biotech firms to engineer region-specific probiotic creams suited to humid climates.

Enterprises in Singapore and Thailand cultivate indigenous strains that counteract pollution-induced imbalances, while dermatologists in the Philippines prescribe prebiotic serums to fortify defenses against tropical infections. Healthcare providers in Cambodia establish clinics that dispense affordable postbiotic lotions, aiming to alleviate widespread atopic issues among youth.

Backers in Laos finance cooperatives producing herbal-infused balms that nurture beneficial communities, offsetting dietary deficiencies in agrarian societies. Officials in Brunei subsidize importation of advanced sequencing kits, empowering labs to tailor solutions for genetic predispositions.

Practitioners in Bhutan conduct outreach programs distributing microbial toners, educating nomads on hygiene practices amid altitude variations. Manufacturers in Fiji adapt enzyme-based masks for oceanic exposures, enhancing resilience against saltwater aggressors. Biotechnology startups in Asia secure nearly $ 3.5 billion in investments over the 2022-2024 period, marking a 140% increase driven by government support.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the skin microbiome market pursue growth by developing targeted formulations that balance microbial communities and address specific dermatological needs such as acne, sensitivity, and aging, which helps differentiate their offerings in a crowded skincare landscape. They also invest in clinical studies and published evidence that validate product benefits, strengthening trust among dermatologists, estheticians, and informed consumers.

Firms expand distribution through omnichannel strategies that combine direct-to-consumer e-commerce with partnerships across pharmacies, specialty beauty retailers, and professional clinics to broaden reach and repeat purchase potential. Strategic alliances with research institutions and microbiology labs help them access emerging science and accelerate innovation pipelines.

DSM-Firmenich exemplifies a global leader with deep expertise in microbial science and skin health, a diversified portfolio spanning active ingredients and finished products, and a coordinated commercialization strategy that aligns formulation strength with brand partner needs. The company steers growth through disciplined R&D investment, cross-sector collaborations, and a customer-focused approach that translates scientific insight into market-relevant solutions.

Top Key Players

- L’Oréal

- Unilever

- Johnson & Johnson

- Nestlé Skin Health

- Gallinée

- S-Biomedic

- AOBiome

- Seed Health

- Evolva

- La Roche-Posay

Recent Developments

- In February 2025, Phyla, backed by Ryan Reynolds, introduced a novel acne treatment based on bacteriophage technology. The Acne Phage Serum, priced at USD 70, is designed to selectively target Cutibacterium acnes, addressing the root bacterial cause of acne through a natural, highly specific mechanism. Early consumer feedback has highlighted visible improvements in skin clarity.

- In December 2024, French skincare brand Gallinée launched an Anti-Ageing Face Recovery Mask developed with a microbiome-supportive formulation. Enriched with prebiotics and probiotics, the product aims to strengthen the skin barrier while improving hydration and overall skin luminosity.

Report Scope

Report Features Description Market Value (2024) US$ 11.5 Billion Forecast Revenue (2034) US$ 24.4 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Skin Care Products, Medical Devices, Dietary Supplements and Diagnostic Tests), By Skin Type (Normal, Dry, Oily and Combination), By Disease (Acne Vulgaris, Psoriasis Vulgaris, Atopic Dermatitis and Rosacea) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape L’Oréal, Unilever, Johnson & Johnson, Nestlé Skin Health, Gallinée, S-Biomedic, AOBiome, Seed Health, Evolva, La Roche-Posay Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- L’Oréal

- Unilever

- Johnson & Johnson

- Nestlé Skin Health

- Gallinée

- S-Biomedic

- AOBiome

- Seed Health

- Evolva

- La Roche-Posay