Global Skin Antiseptic Products Market Analysis By Formulation (Alcohol-based, Chlorhexidine gluconate (CHG)-based, Iodophors, Quaternary ammonium compounds, Peroxides and Permanganates, Others), By Product Form (Solutions, Wipes, Swab sticks/Pads, Sprays/Foams, Creams & Gels), By Application (Preoperative skin preparation, Injection/Catheter-site, General skin cleansing & Hygiene, Others), By End-User (Hospitals & clinics, Outpatient facilities, Homecare settings, Others), By Distribution Channel (Drug Stores and pharmacies, E-commerce platforms, Direct sales, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165720

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

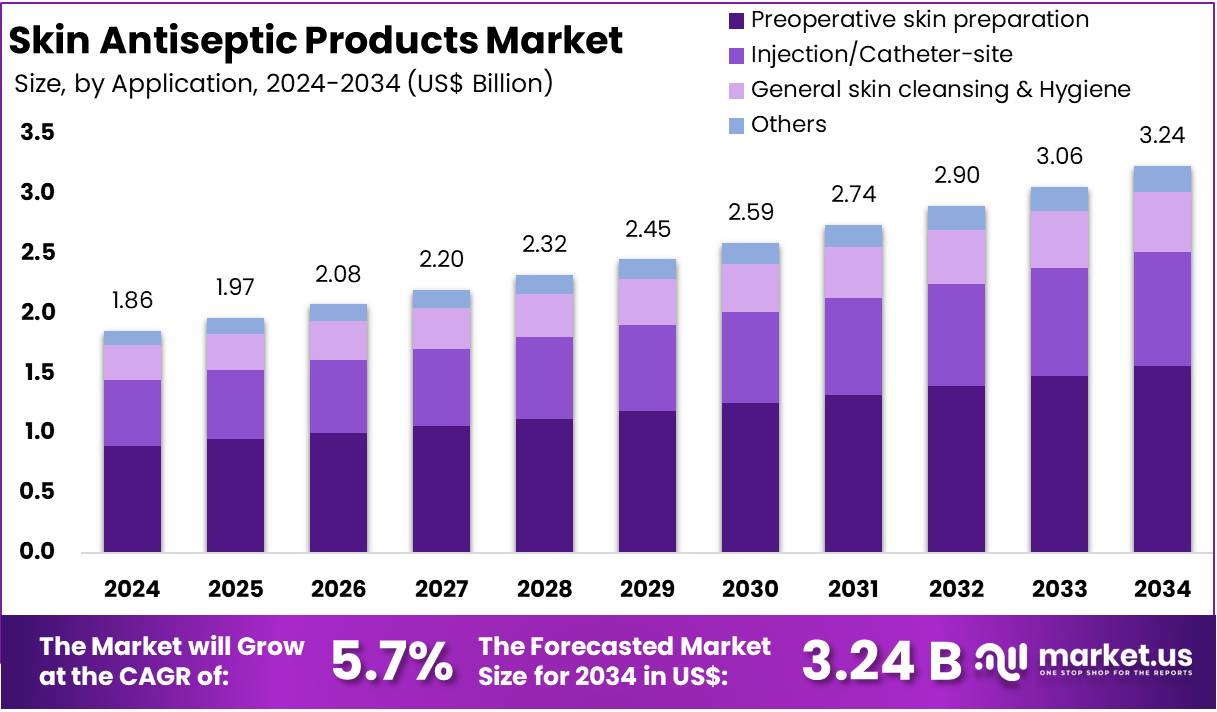

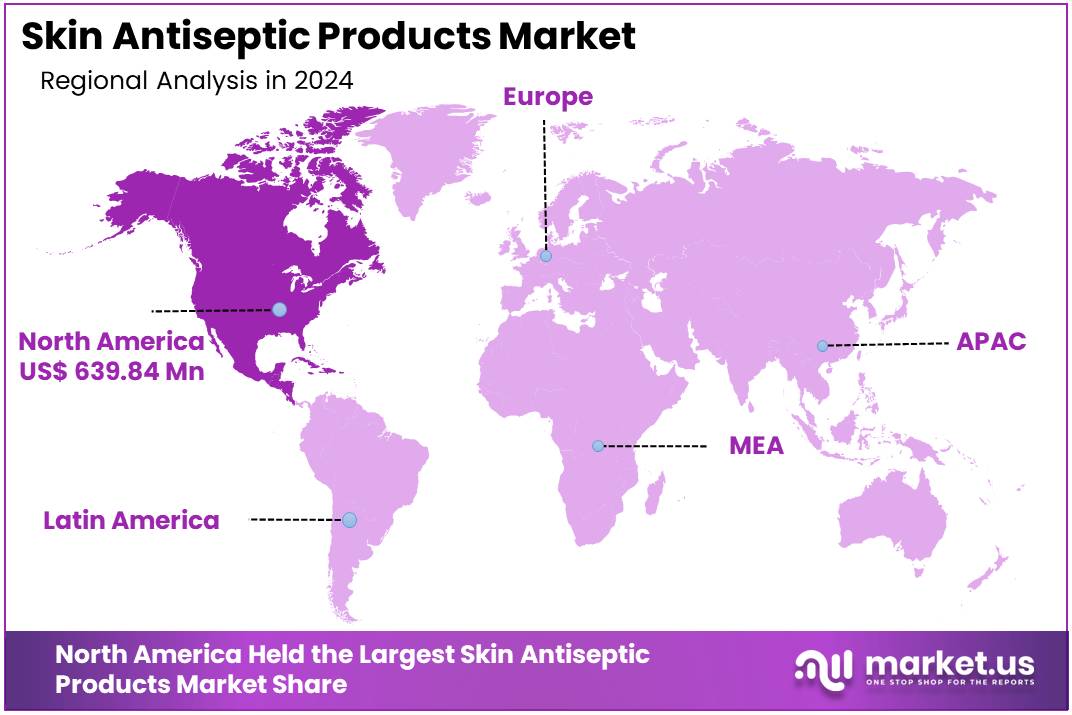

The Global Skin Antiseptic Products Market size is expected to be worth around US$ 3.24 Billion by 2034, from US$ 1.83 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 34.4% share and holds US$ 639.84 Million market value for the year.

The global market for skin antiseptic products has gained strong relevance as healthcare systems prioritize patient safety. These formulations are used to reduce microbial contamination on the skin and support safer clinical outcomes. Their role has expanded due to rising procedural volumes and broader hygiene awareness. According to WHO, these products are essential in surgery, injections and routine care, reinforcing their strategic importance across healthcare settings.

Healthcare-associated infections continue to drive long-term demand. Before citing the scale of the problem, it is essential to highlight that HAIs remain a persistent challenge even in advanced health systems, raising pressure on hospitals to enforce stronger hygiene protocols. Studies by the World Health Organization show that 1 in 10 patients acquires an HAI, and hundreds of millions are affected each year. WHO further notes that effective IPC programmes can prevent up to 70% of infections, strengthening reliance on antiseptic products.

Growing investment in infection-prevention and control frameworks has become another major influence. Many health systems are formalizing national IPC programmes, yet significant implementation gaps remain. These gaps are especially notable in lower-resource regions where hygiene infrastructure is insufficient. According to WHO and UNICEF assessments, 43% of healthcare facilities still lack adequate hand hygiene services. As governments address these deficits, procurement of alcohol-based rubs, sinks and dispensers increases, expanding overall antiseptic product penetration.

Surgical care expansion amplifies market momentum. Surgical procedures require strict skin preparation before incision, and this step remains critical in preventing site infections. As surgical access improves worldwide, the volume of antiseptic use increases proportionally. Global estimates indicate that 234 million surgeries occur each year, representing substantial procedural demand. WHO guidance recommends alcohol-based solutions with chlorhexidine or iodine, encouraging hospitals to prioritize high-performance formulations for consistent clinical outcomes.

Demographic and Regulatory Drivers

Demographic change is reshaping long-term product consumption. Population ageing increases demand because older adults require more medical interventions and wound care. Before considering specific projections, the shift toward a larger elderly population highlights structural increases in clinical needs. According to WHO, people aged 60 years and older will reach 1.4 billion by 2030 and 2.1 billion by 2050, driving consistent use of antiseptic solutions in hospitals, long-term care and home settings.

Chronic diseases intensify reliance on antiseptic products. Conditions such as diabetes increase the risk of ulcers, infections and delayed healing, requiring frequent cleansing and disinfecting routines. This clinical reality explains why antiseptics have become routine components of outpatient and community care. WHO reports that 830 million people live with diabetes, while the International Diabetes Federation notes 589 million adults affected in 2024, with projections rising to 853 million by 2050, reinforcing steady product demand.

Antimicrobial resistance has added urgency to infection-prevention strategies. Public-health bodies emphasize that reducing infections helps limit antibiotic use, which is vital for slowing AMR development. Before citing quantitative data, it is important to note that AMR-focused policies encourage hospitals to strengthen hygiene compliance. WHO’s IPC findings highlight that enhanced skin antisepsis and hand hygiene significantly lower transmission rates, positioning antiseptic products as essential components of national AMR action plans.

Regulatory scrutiny further supports product advancement. Authorities are refining standards for active ingredients to ensure safety and effectiveness, prompting manufacturers to align with stronger evidence requirements. For example, the U.S. FDA has reviewed healthcare antiseptics containing ethyl alcohol, isopropyl alcohol and benzalkonium chloride. In addition, WHO and CDC recommend alcohol concentrations of 60–95% for effective hand hygiene. These guidelines promote the adoption of reliable, high-strength formulations, strengthening market value and product performance expectations.

Key Takeaways

- The global market for skin antiseptic products is projected to reach US$ 3.24 billion by 2034, advancing from US$ 1.83 billion in 2024 at a 5.7% CAGR.

- The alcohol-based formulation segment was observed holding a leading 38.1% share in 2024, reflecting strong adoption across medical and personal hygiene applications.

- The solutions category dominated the product form segment in 2024 with over 40.0% share, indicating preferred usage due to convenience and broad clinical compatibility.

- Preoperative skin preparation accounted for more than 48.3% share in 2024, driven by heightened emphasis on infection prevention protocols in surgical settings.

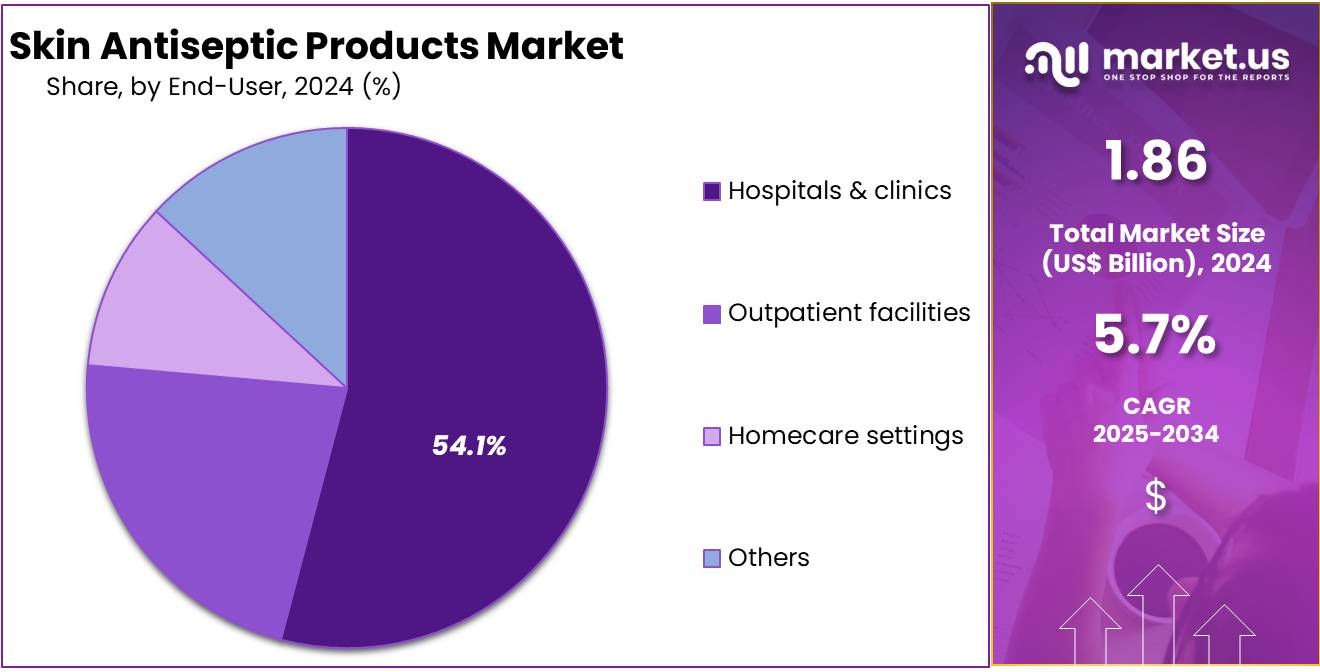

- Hospitals and clinics represented the largest end-user group in 2024 with a 54.1% share, supported by high procedural volumes and standardized antiseptic usage requirements.

- Drug stores and pharmacies captured over 52.2% share in 2024, demonstrating their central role in retail distribution and consumer accessibility for antiseptic products.

- North America led the global market in 2024 with a 34.4% share, representing US$ 639.84 million, supported by advanced healthcare systems and strong infection control practices.

Formulation Analysis

In 2024, the ‘Alcohol-based‘ held a dominant market position in the Formulation Segment of the Skin Antiseptic Products Market and captured more than a 38.1% share. It was observed that strong demand was linked to fast action and broad antimicrobial coverage. Users favored these products in surgical and routine procedures. A third-party review indicated that CHG-based formulations followed due to long-lasting protection. Their continued use in clinical settings supported steady market acceptance.

Industry observers noted that iodophors gained stable traction because they offered strong antiseptic strength with reduced irritation. Their role in pre-operative cleansing supported recurring demand. Quaternary ammonium compounds showed moderate use. They were adopted where balanced antimicrobial action and material safety were required. Their presence in routine skin preparation and surface compatibility activities helped maintain segment relevance. Each formulation displayed distinct strengths that shaped adoption patterns across medical and outpatient settings.

Peroxides and permanganates remained focused on wound and dermatology care. Analysts highlighted that their application was linked to chronic wounds and specific skin conditions. Growth in this group stayed limited due to restricted suitability for surgical preparation. Other formulations formed a niche segment. These included natural or specialty blends aimed at mild use cases. Third-party assessments suggested that consumer interest supported gradual uptake, while clinical usage stayed modest. Overall formulation choices continued to reflect safety needs and antimicrobial performance.

Product Form Analysis

In 2024, the ‘Solutions‘ held a dominant market position in the Product Form Segment of the Skin Antiseptic Products Market, and captured more than a 40.0% share. This position was supported by strong clinical acceptance and consistent use in hospitals. Their rapid action and broad coverage improved adoption. Rising demand for effective preoperative preparation also strengthened growth. Wipes followed as a key product form. Their simple use and single-use format encouraged wide utilization in home care and wound cleansing.

Swab sticks and pads maintained steady demand across clinical environments. Their controlled dosing and quick application increased efficiency in routine procedures. Frequent use in blood collection and catheter insertion supported market presence. Sprays and foams expanded gradually. Their non-contact application reduced contamination risks and improved user convenience. Rising use in emergency care and sports medicine supported this increase. Adoption was further encouraged by broader awareness of easy-to-apply antiseptic formats that improve coverage and reduce procedural time.

Creams and gels held a smaller but meaningful share of the market. Their use was linked to minor wounds, burns, and postoperative care. Longer skin contact time and soothing formulations supported adoption. Demand increased as cases of superficial injuries rose. Across all forms, growth was influenced by strict infection control practices and higher surgical volumes. Healthcare expansion in developing regions supported the market. Broader awareness of hygiene and improved availability of advanced formulations contributed to sustained, steady progress.

Application Analysis

In 2024, the ‘Preoperative skin preparation‘ held a dominant market position in the Application Segment of the Skin Antiseptic Products Market and captured more than a 48.3% share. This outcome was noted by industry observers who highlighted strict surgical protocols. Higher surgical volumes also supported demand. Hospitals favored reliable antiseptic solutions. Injection and catheter-site uses showed steady uptake. Increased chronic conditions influenced usage. Rising adherence to safety rules encouraged continued product adoption across major care settings.

General skin cleansing and hygiene were described as a steadily expanding area. Analysts noted stronger awareness of personal hygiene. Healthcare facilities promoted preventive steps. Outpatient care centers used these products widely. Consumer-grade antiseptic cleansers improved access. The segment showed balanced growth. The ‘Others‘ category covered niche applications. Wound care and minor procedures contributed to demand. Home-based care added support. Gradual adoption patterns were observed across diverse regions. Specialized products gained steady recognition.

Overall market dynamics were outlined by experts who observed broad application-driven demand. Infection control remained a core factor. Hospitals and clinics maintained consistent usage. Consumer awareness increased product circulation. Strict hygiene norms guided procurement decisions. Advances in antiseptic formulations supported wider adoption. Diverse applications ensured stable market progress. Growth prospects were viewed as positive. The shift toward preventive care strengthened long-term potential. The combined influence of these factors shaped a cautiously optimistic outlook.

End-User Analysis

In 2024, the ‘Hospitals & clinics‘ held a dominant market position in the End-User Segment of Skin Antiseptic Products Market, and captured more than a 54.1% share. This trend was observed due to high patient volume and strict infection-control protocols. Frequent surgical procedures increased the use of antiseptic solutions. Routine skin preparation also raised product demand. Industry observers noted that advanced care units further strengthened consumption. Strong adherence to hygiene standards supported the segment’s leadership across multiple clinical environments.

Outpatient facilities were reported to show steady participation in the market. Their demand was influenced by minor surgeries and diagnostic procedures. Ambulatory care centers increased the use of quick-acting antiseptic formulations. Analysts highlighted that same-day medical services encouraged consistent product adoption. Rising patient preference for shorter visits supported overall growth. The shift toward efficient treatment pathways also contributed to the segment’s expansion. These factors created a stable and predictable usage pattern.

Homecare settings demonstrated gradual growth during the period. The rise of home-based wound management increased the need for accessible antiseptic solutions. Ageing populations strengthened this trend. Experts observed that user-friendly products supported adoption in non-clinical spaces. Long-term care centers and emergency units, grouped under Others, reported moderate gains. Awareness of infection risks improved usage across these environments. Preventive care training further elevated demand. Together, these end-user segments contributed to a broader and sustained market outlook.

Distribution Channel Analysis

In 2024, the ‘Drug Stores and Pharmacies‘ held a dominant market position in the Distribution Channel segment of the Skin Antiseptic Products Market, and captured more than a 52.2% share. This leadership was attributed to strong consumer trust and consistent product availability. The presence of trained pharmacists improved guidance and supported safe product use. High retail footfall also strengthened sales. This channel was viewed as the most reliable source for essential antiseptic solutions across regions.

E-commerce platforms were observed as a rapidly growing channel for skin antiseptic products. Their expansion was supported by fast delivery, simple navigation, and clear price comparisons. Consumers also relied on product reviews, which guided quick decisions. Wider digital penetration increased online visibility for major brands. Flexible payment methods and frequent promotional offers encouraged steady adoption. The convenience of purchasing from home played an important role and supported consistent year-on-year growth in this segment.

Direct sales and other offline outlets maintained a smaller yet stable presence in the market. Direct sales benefited from personalized interaction and targeted outreach by healthcare practitioners. The remaining Others category included supermarkets, convenience stores, and specialty retailers. These outlets improved product displays and expanded assortments. Growing awareness of hygiene practices supported gradual increases in demand. Although their share remained modest, these channels continued to supplement overall market accessibility and contributed to broader consumer reach.

Key Market Segments

By Formulation

- Alcohol-based

- Chlorhexidine gluconate (CHG)-based

- Iodophors

- Quaternary ammonium compounds

- Peroxides and Permanganates

- Others

By Product Form

- Solutions

- Wipes

- Swab sticks/Pads

- Sprays/Foams

- Creams & Gels

By Application

- Preoperative skin preparation

- Injection/Catheter-site

- General skin cleansing & Hygiene

- Others

By End-User

- Hospitals & clinics

- Outpatient facilities

- Homecare settings

- Others

By Distribution Channel

- Drug Stores and pharmacies

- E-commerce platforms

- Direct sales

- Others

Drivers

Improved Antiseptic Efficacy as a Key Driver for Skin Antiseptic Products

The growing focus on reducing surgical-site infection risks has strengthened the demand for advanced skin antiseptic products. Hospitals are prioritizing solutions that provide superior microbial eradication and consistent performance during perioperative procedures. This driver has gained momentum as healthcare systems seek products with proven outcomes in high-risk and clean-surgery environments. Rising awareness of the clinical and economic impacts of SSIs has further increased the adoption of high-efficacy antiseptic formulations, as prevention is viewed as a cost-effective strategy that improves patient safety and postoperative recovery.

Enhanced clinical evidence has reinforced confidence in newer antiseptic chemistries with stronger and more sustained bactericidal activity. According to a study by BioMed Central, modern formulations are demonstrating measurable reductions in infection rates, which is encouraging procurement teams to shift from legacy antiseptics toward more reliable alternatives. This preference is driven by the need for uniform performance across diverse surgical conditions. As a result, products with higher residual activity and broader pathogen coverage are becoming central to operating-room protocols.

For instance, a 2022 retrospective study of gastrointestinal cancer surgery patients found that Olanexidine gluconate achieved a marked reduction in SSI incidence. According to BioMed Central analysis, SSI rates declined to 2.7% with OLG compared to 10.3% with Povidone-iodine, with statistical significance (p = 0.02). Such outcomes highlight how switching to improved antiseptics can directly influence surgical recovery metrics. These findings are prompting healthcare facilities to reassess their antiseptic portfolios to ensure alignment with evidence-based infection-control practices.

Further momentum is supported by broader comparative evaluations. A meta-analysis published in 2025 assessed more than 14,000 clean-surgery patients and concluded that alcoholic Chlorhexidine gluconate formulations were top-ranked for SSI prevention. For example, the study reported in Nature a relative risk of approximately 0.49, indicating stronger protective efficacy than alternatives. According to this evidence, CHG-based products are increasingly preferred in standardized surgical preparation routines. These results continue to shape procurement decisions and reinforce the market shift toward high-performance antiseptic solutions.

Restraints

Variability In Clinical Efficacy And Context-Specific Performance Limit Broad Adoption

The market is restrained by the variability in clinical efficacy reported across different healthcare environments. Evidence from comparative studies has shown that the performance of skin antiseptic products changes with patient profiles, procedure types, and implementation protocols. The growth of the market is affected because inconsistent outcomes reduce clinician confidence. This variability limits widespread standardization. Hospitals may hesitate to adopt higher-priced formulations when uniform benefits are not assured. As a result, procurement decisions become conservative, especially in regions with limited evidence-based practice frameworks.

A major concern arises from the limited quality and consistency of existing clinical evidence. According to a referenced meta-analysis, the available trials showed unclear risk of bias and lacked statistically significant findings across multiple study settings. Study by various clinical research groups indicated that inconsistent methodologies reduced the reliability of conclusions. These limitations create uncertainty for policymakers. Procurement committees often rely on robust evidence when evaluating premium antiseptics. When such evidence is weak, the shift toward advanced products becomes gradual rather than widespread.

Regional disparities amplify this restraint. For example, findings from global evaluations highlighted wide differences in antiseptic performance depending on infrastructure conditions and compliance levels. For instance, variations in sterilization workflow, staff training, and wound-care protocols influence final clinical outcomes. The growth of the market is hampered when antiseptic products cannot deliver predictable results across heterogeneous environments. This situation is especially visible where hospitals lack standardized guidelines or have inconsistent monitoring systems.

Contextual challenges in resource-constrained regions further limit adoption. According to Xiahe Publishing, surgical site infections affect up to one-third of patients in many low- and middle-income countries. These high rates are linked to infrastructure gaps and inconsistent antiseptic practices. Study by regional health bodies shows that even effective products underperform when supply chains, training, and sanitation systems are weak. This reduces the likelihood of uniform uptake of premium skin antiseptic products, as outcomes depend heavily on local conditions rather than product efficacy alone.

Opportunities

Emergence of Advanced and Differentiated Skin Antiseptic Products

The emergence of novel antiseptic agents has created a clear opportunity within the skin antiseptic products segment. The demand for enhanced infection-prevention solutions has increased as hospitals seek measurable improvements in clinical outcomes. The opportunity can be attributed to the rising need for formulations that deliver stronger antimicrobial action, improved residual activity, and broader efficacy across surgical and nonsurgical procedures. Product developers are positioned to benefit by introducing advanced solutions designed to support better patient safety and clinical efficiency.

The opportunity is strengthened by the growing preference for differentiated products that help healthcare facilities achieve performance gains. Innovative formulations, such as combination ingredients or sustained-action technologies, are expected to gain acceptance as facilities attempt to reduce surgical site infections. Hospitals increasingly evaluate antiseptic agents not only on cost but also on measurable clinical performance. This shift in purchasing behavior is expected to create sustained demand for next-generation skin-prep solutions.

Evidence from clinical research highlights the potential of these innovations. According to BioMed Central, a study comparing octenidine-based OLG and povidone-iodine (PVP-I) reported a surgical site infection rate of 2.7% for OLG compared with 10.3% for PVP-I. Study by this source demonstrates how differentiated antiseptic technologies may outperform traditional preparations. For instance, products offering faster action and prolonged antimicrobial protection can strengthen their competitive positioning in hospital procurement.

Additional support for innovation is provided by academic evaluations. For example, research published by OUP Academic emphasized that selecting optimal preoperative skin-preparation agents is critical for patient safety. Formulations engineered with enhanced residual effects are likely to gain traction. The findings suggest increased commercial potential for products that offer persistent activity and broader microbial coverage. This environment is expected to encourage manufacturers to invest in novel skin-prep solutions that align with hospital needs for reliable and high-performance antiseptics.

Trends

Guideline-Driven Adoption of Alcohol-Based Chlorhexidine in Surgical Skin Antisepsis

The market has been witnessing a steady transition toward alcohol-based chlorhexidine solutions in surgical skin-preparation protocols. This shift has been driven by the consistent clinical evidence showing improved antimicrobial performance compared with traditional povidone-iodine formulations. Hospital systems have been prioritizing products that lower infection risks and support standardized perioperative workflows. The trend has also been reinforced by procurement teams that now prefer antiseptic solutions aligned with global guidelines emphasizing rapid action, broad coverage, and sustained residual activity.

The growth of alcohol-based chlorhexidine usage has been attributed to stronger SSI-prevention outcomes. According to emerging comparative evaluations, healthcare facilities have increasingly adopted these formulations to enhance surgical safety indicators and reduce postoperative complications. The movement toward optimized antiseptic strategies has strengthened vendor competition within the skin-prep segment. It has encouraged manufacturers to widen product portfolios, improve packaging formats, and introduce more value-driven offerings that meet hospital quality expectations.

Study by an Indian prospective analysis during 2024–25 reported that 2% chlorhexidine gluconate in 70% isopropyl alcohol demonstrated a surgical site infection rate of 3.3%, while 10% povidone-iodine showed 9.6% (p = 0.042). This performance gap has influenced clinical committees to update internal guidelines. For instance, hospitals have increasingly positioned alcohol-based chlorhexidine as the preferred option for major specialties. The findings have also supported strategic procurement shifts toward evidence-backed formulations.

A review highlighted by OUP Academic in 2024 stated that optimal pre-incision antiseptic application significantly reduces SSI risk. For example, the emphasis on enhanced agents has reinforced the perception that legacy PVP-I products offer comparatively limited value. The accumulation of such evidence has been associated with intensified innovation in skin antiseptic portfolios. Vendors have responded by developing formulations with superior drying times, broad-spectrum efficacy, and compliance-friendly delivery formats, strengthening the long-term growth trajectory of this market segment.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 34.4% share and holding a market value of US$ 639.84 million for the year. The region’s strong performance was supported by a well-developed healthcare system and strict hygiene standards across hospitals and clinics. Routine use of antiseptic solutions, wipes, and swabs formed an essential part of daily medical procedures. This consistent demand created a stable environment for market expansion and strengthened the region’s leadership position.

Surgical activity across the United States and Canada also played an important role. A high number of elective and emergency surgeries increased the need for effective pre-operative skin preparation. The expansion of outpatient surgical centers further supported product use, as these facilities rely heavily on infection-prevention protocols. Growth in minimally invasive procedures added to the adoption of skin antiseptic products. These combined factors ensured steady product consumption throughout the year.

Strong awareness regarding infection risks supported the market’s rise. Healthcare-associated infections remained a major concern, encouraging hospitals and long-term care facilities to follow strict guidelines. These guidelines promoted the use of alcohol-based, iodine-based, and chlorhexidine formulations. Regulatory bodies also emphasized compliance with proven disinfection practices. This regulatory support improved product reliability and helped reduce infection rates in clinical settings, strengthening the overall demand base.

The presence of established distribution networks improved product availability across the region. Pharmacies, hospital supply chains, and online platforms ensured easy access to a wide range of antiseptic products. Leading manufacturers also increased investments in product innovation, focusing on convenient packaging and advanced formulations. These improvements supported user confidence and expanded product use beyond hospitals into home-care settings. As a result, the market benefitted from both professional and consumer adoption.

Overall, the dominant position of North America in the Skin Antiseptic Products Market was driven by advanced infrastructure, strict infection-control policies, high surgical volumes, and strong distribution capabilities. Continued innovation in formulations and packaging is expected to support future growth. The region remains well-positioned due to its structured healthcare environment and sustained focus on patient safety, which together reinforce long-term market stability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape has been shaped by continuous innovation in skin antisepsis. Major participants such as Becton Dickinson and Company, 3M, and B. Braun Melsungen AG have strengthened their positions through strong portfolios in pre-operative skin preparation and hand antisepsis. Their strategies have focused on product efficacy, safety, and broad procedural coverage. Growth has been supported by expanding hospital demand, rising surgical volumes, and stricter infection-prevention standards. These companies have maintained long-term partnerships with healthcare facilities, which has reinforced their consistent market presence.

The market has also been influenced by companies with strong consumer and clinical brands. Firms such as Reckitt Benckiser Group plc and Johnson & Johnson have leveraged well-recognized antiseptic formulations. Their offerings have included povidone-iodine and PCMX-based liquids used in wound care and general skin hygiene. Brand trust and wide distribution networks have supported their penetration into primary care environments. Their presence has been reinforced by stable demand for proven antiseptic ingredients across both retail and clinical settings.

Additional competitive momentum has been observed from specialized infection-prevention suppliers. Organizations such as Ecolab Inc., Hartmann Group, Schulke & Mayr GmbH, and Sage Products LLC have expanded portfolios covering hand antisepsis, wound antisepsis, and procedure-ready solutions. Their strategies have emphasized protocol compliance and integrated hygiene programs. Product adoption has been driven by strong efficacy data, user convenience, and alignment with hospital quality-improvement efforts. These companies have maintained relevance across critical care, surgery, and outpatient facilities.

Further contributions to market expansion have originated from regional manufacturers and diversified healthcare suppliers. Firms including Sirmaxo Chemicals, PSK Pharma, Cardinal Health, Smith & Nephew, Avrio Health, and Microgen have provided cost-effective antiseptic solutions tailored to local clinical needs. Their portfolios have focused on chlorhexidine, alcohol-based formulations, and povidone-iodine. Competitive advantage has been supported by affordability, regulatory flexibility, and strong supply networks. These participants have strengthened access to skin antiseptic products in emerging markets and secondary healthcare settings.

Market Key Players

- Becton Dickinson and Company

- 3M Company

- B. Braun Melsungen AG

- Reckitt Benckiser Group plc

- Johnson & Johnson

- Ecolab Inc.

- Hartmann Group

- Sirmaxo Chemicals Pvt. Ltd.

- PSK Pharma Pvt. Ltd.

- Sage Products LLC

- Schulke & Mayr GmbH

- Cardinal Health

- Smith & Nephew

- Avrio Health

- Microgen

Recent Developments

- In May 2024: Opening of N.I.C.O. disinfectant and hygiene products plant in Sempach (Switzerland): B. Braun Medical AG commenced operations at a new production facility for disinfectant and hygiene products at its Swiss headquarters in Sempach. The plant, called N.I.C.O. (New Infection Control Operations), involved an investment of about CHF 75 million and has been designed to double the company’s disinfection production capacity in the medium term.

- In February 2024: BD reported its first-quarter fiscal 2024 results. Within the BD Interventional segment, the Surgery business delivered high-single-digit growth in Infection Prevention, which the company directly attributed to strong demand for ChloraPrep™. The Q1 FY 2024 press release notes that Surgery performance included high-single digit growth in Infection Prevention, driven by strong demand for ChloraPrep™, alongside ongoing adoption of other surgical products.

- In April 2023: 3M Health Care introduced 3M™ SoluPrep™ S Sterile Antiseptic Solution, a new chlorhexidine gluconate 2% w/v + isopropyl alcohol 70% v/v surgical skin prep for presurgical applications. A limited commercial release in the U.S. started on 3 April 2023, with a full commercial launch planned for 2024.

Report Scope

Report Features Description Market Value (2024) US$ 1.86 Billion Forecast Revenue (2034) US$ 3.24 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Formulation (Alcohol-based, Chlorhexidine gluconate (CHG)-based, Iodophors, Quaternary ammonium compounds, Peroxides and Permanganates, Others), By Product Form (Solutions, Wipes, Swab sticks/Pads, Sprays/Foams, Creams & Gels), By Application (Preoperative skin preparation, Injection/Catheter-site, General skin cleansing & Hygiene, Others), By End-User (Hospitals & clinics, Outpatient facilities, Homecare settings, Others), By Distribution Channel (Drug Stores and pharmacies, E-commerce platforms, Direct sales, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Becton Dickinson and Company, 3M Company, B. Braun Melsungen AG, Reckitt Benckiser Group plc, Johnson & Johnson, Ecolab Inc., Hartmann Group, Sirmaxo Chemicals Pvt. Ltd., PSK Pharma Pvt. Ltd., Sage Products LLC, Schulke & Mayr GmbH, Cardinal Health, Smith & Nephew, Avrio Health, Microgen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Skin Antiseptic Products MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Skin Antiseptic Products MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Becton Dickinson and Company

- 3M Company

- B. Braun Melsungen AG

- Reckitt Benckiser Group plc

- Johnson & Johnson

- Ecolab Inc.

- Hartmann Group

- Sirmaxo Chemicals Pvt. Ltd.

- PSK Pharma Pvt. Ltd.

- Sage Products LLC

- Schulke & Mayr GmbH

- Cardinal Health

- Smith & Nephew

- Avrio Health

- Microgen