Global Ski Vacation Market Size, Share, Growth Analysis By Type (Family ski holiday, Advanced Skiing, Beginners skiing, Group ski holiday, Luxury ski holiday, All-inclusive holiday), By Booking Channel (Online Booking, Phone Booking, In Person Booking), By Tourist Type (International, Domestic), By Tour Type (Tour Group, Package Traveller, Independent Traveller), By Consumer Orientation (Men, Women), By Age Group (15-25 Years, 26-35 Years, 36-45 Years, 46-55 Years, 66-75 Years), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153836

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

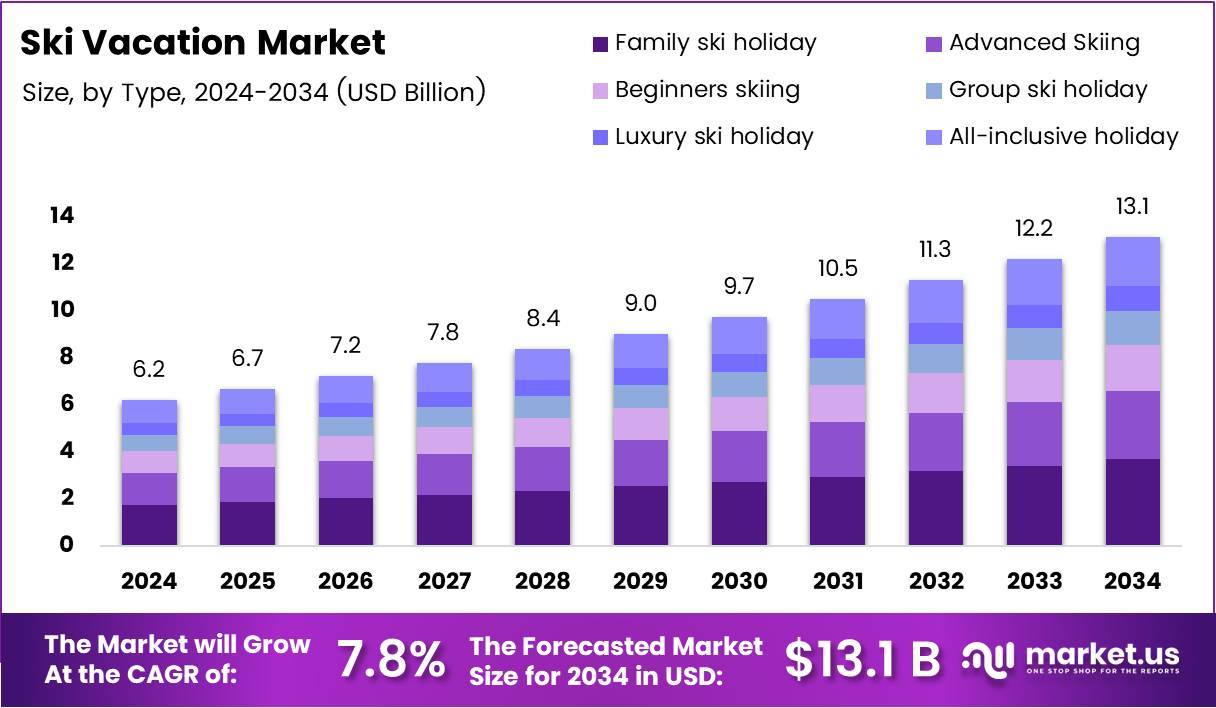

The Global Ski Vacation Market size is expected to be worth around USD 13.1 Billion by 2034, from USD 6.2 Billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034.

The ski vacation market represents a niche yet steadily growing segment within the global travel and leisure industry. It revolves around consumers seeking mountain resorts and winter experiences, primarily for skiing, snowboarding, and après-ski culture. From luxury chalets to budget lodges, the market spans a diverse demographic profile of both casual tourists and dedicated winter sports enthusiasts.

Ski vacations continue to gain popularity, driven by evolving travel preferences and rising disposable incomes. Notably, according to Smithsonianmag, American ski resorts recorded a record-setting 64.7 million visits during the 2022–23 season, showcasing a robust demand post-pandemic and indicating strong market recovery.

Globally, ski infrastructure is expansive. As per FamilySkiTrips, the planet now hosts over 6,000 ski areas, pointing to the breadth of opportunity across North America, Europe, and Asia. This extensive network supports a broad customer base, enabling tour operators to offer tailored packages across regions and budgets.

Meanwhile, Europe remains a major hub. According to Kaggle, the continent alone houses over 1,000 ski resorts, reinforcing its central role in the global ski tourism economy. These established destinations attract travelers seeking alpine adventure, cultural experiences, and well-developed snow sport infrastructure.

Tourism behavior is evolving too. StyleAltitude notes a sharp increase in solo ski holidays, rising to 18 percent in 2024, up from 13 percent in 2023. This shift reflects changing social dynamics and growing independence among travelers. Still, family ski holidays remain dominant, comprising 60 percent of the market, despite a modest decline.

Governments are also stepping in to promote the ski industry. Investments in eco-friendly transport, snow sustainability projects, and climate adaptation measures are increasingly seen across alpine countries. These policies aim to secure long-term growth while addressing environmental concerns impacting snow reliability.

Furthermore, several nations have introduced safety regulations and environmental codes for ski resorts, especially in high-altitude zones. This encourages responsible tourism while building consumer trust and ensuring operational stability for stakeholders in the ski vacation market.

Consumer trends are driving innovation. The rise in digital booking platforms, dynamic pricing, and flexible travel plans all contribute to enhanced customer experiences. Additionally, wellness and luxury elements are being integrated, creating premium ski vacation offerings for high-value travelers.

Key Takeaways

- The Global Ski Vacation Market is projected to reach USD 13.1 Billion by 2034, growing from USD 6.2 Billion in 2024 at a CAGR of 7.8%.

- In 2024, Family ski holidays led the market by type with a 25.9% share, driven by demand for multi-generational travel and family-friendly amenities.

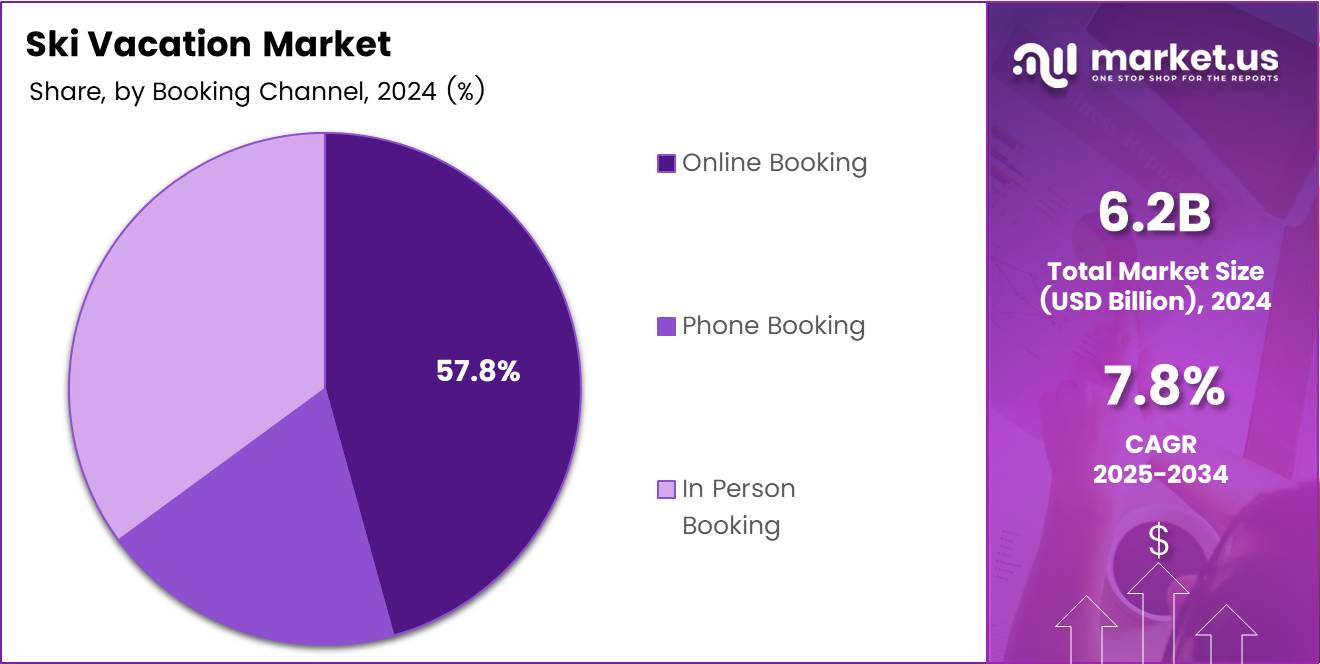

- Online Booking dominated booking channels in 2024 with a 57.8% share, highlighting the trend toward digital convenience and customization.

- International tourists made up 63.7% of the market in 2024, driven by cross-border travel, better flight connectivity, and relaxed visa norms.

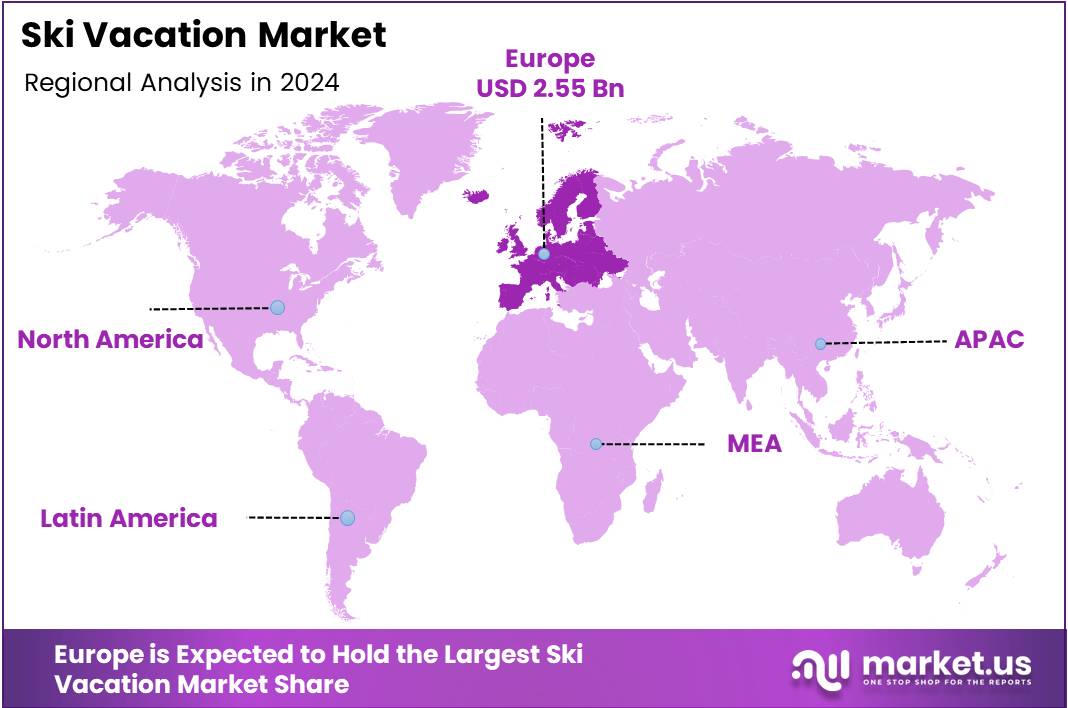

- Europe led the regional market with a 41.2% share and generated approximately USD 2.55 Billion, supported by strong infrastructure and high tourist inflow in alpine regions.

Type Analysis

Family ski holiday leads with 25.9% as the preferred choice for winter travel enthusiasts.

In 2024, Family ski holiday held a dominant market position in By Type Analysis segment of Ski Vacation Market, with a 25.9% share. This growth reflects the rising demand for family-friendly destinations and amenities that cater to multi-generational travel experiences. Resorts offering childcare, ski schools, and inclusive packages have especially driven demand.

Advanced Skiing remained a strong sub-segment, as experienced skiers sought challenging slopes and off-piste experiences. This category is appealing to repeat visitors who prioritize terrain diversity and technical difficulty.

Beginners skiing continued to attract new participants, bolstered by the availability of introductory packages and guided lessons. Accessibility and safety-focused environments helped maintain its relevance.

Group ski holiday gained popularity among friends and corporate retreats, as social travel continues to be a growing trend.

Luxury ski holiday attracted affluent travelers with high-end accommodations and exclusive services, contributing to the premium market growth.

All-inclusive holiday also held significant appeal due to convenience and cost certainty, particularly among budget-conscious travelers.

Booking Channel Analysis

Online Booking dominates with 57.8% due to convenience and mobile accessibility.

In 2024, Online Booking held a dominant market position in By Booking Channel Analysis segment of Ski Vacation Market, with a 57.8% share. This leadership reflects the increasing consumer preference for digital platforms that offer ease, customization, and instant confirmations.

The growing integration of AI-powered booking engines and mobile-friendly websites contributed significantly to this channel’s expansion. Personalized package options and loyalty discounts further enhanced its popularity.

Phone Booking continued to serve travelers who prefer human interaction, especially for more complex itineraries or last-minute changes. While not leading, this channel maintained a steady customer base among older demographics.

In Person Booking saw reduced demand due to limited flexibility and increased reliance on digital tools. However, it still plays a role in niche markets, including bespoke travel services and local tourism offices.

Tourist Type Analysis

International tourists dominate with 63.7% as global travel rebounds post-pandemic.

In 2024, International held a dominant market position in By Tourist Type Analysis segment of Ski Vacation Market, with a 63.7% share. This strong presence is driven by the resurgence of cross-border leisure travel, fueled by increased flight connectivity, relaxed visa norms, and attractive international ski packages.

Destinations in Europe, North America, and Japan saw heightened interest from global travelers seeking unique winter landscapes and cultural experiences. Upscale resorts that market to overseas clients saw significant gains.

Domestic tourism also remained relevant, supported by regional promotions and travelers opting for nearby, cost-effective holidays. This segment often reflects spontaneous trips and short stays during peak snow seasons.

As international travel continues to stabilize and grow, its dominance in the ski vacation market is expected to remain robust, with more travelers prioritizing immersive and exotic alpine getaways.

Key Market Segments

By Type

- Family ski holiday

- Advanced Skiing

- Beginners skiing

- Group ski holiday

- Luxury ski holiday

- All-inclusive holiday

By Booking Channel

- Online Booking

- Phone Booking

- In Person Booking

By Tourist Type

- International

- Domestic

By Tour Type

- Tour Group

- Package Traveller

- Independent Traveller

By Consumer Orientation

- Men

- Women

By Age Group

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 66-75 Years

Drivers

Increasing Popularity of Winter Sports Among Millennials and Gen Z Drives Market Growth

Millennials and Gen Z travelers are showing a rising interest in winter sports, significantly driving demand for ski vacations. Social media trends and influencers are helping younger audiences discover the thrill of skiing, snowboarding, and other mountain activities, making ski resorts popular destinations for group and solo travel.

Luxury ski resorts are expanding in emerging markets like Eastern Europe and Asia. These destinations are developing modern amenities to attract high-income tourists, creating new business opportunities in the ski vacation industry and helping spread tourism beyond traditional regions like the Alps and Rockies.

Governments in mountain-rich countries are promoting ski tourism through campaigns and infrastructure improvements. Investments in roads, transport, and public-private partnerships support growth, especially in regions that were previously underdeveloped or overlooked by international tourists.

In areas with low natural snowfall, resorts are adopting advanced snowmaking technologies to ensure consistent ski conditions. This innovation allows ski resorts to extend their operating seasons and offer reliable experiences, regardless of weather patterns caused by climate change.

Restraints

High Cost of Ski Equipment and Accessories Limits Market Accessibility

One major challenge in the ski vacation market is the high cost of ski equipment and gear. From skis to boots and thermal clothing, the expense can be a barrier for many travelers, especially families or first-time skiers, limiting the market’s inclusivity.

Environmental concerns also pose a restraint. Building and expanding ski resorts often affects mountain ecosystems. Deforestation, water use for artificial snow, and increased foot traffic can damage local flora and fauna, leading to stricter regulations and opposition from conservation groups.

Ski tourism remains heavily seasonal, which affects resorts’ ability to generate consistent revenue year-round. Peak seasons offer good income, but long off-seasons can create financial instability for smaller resorts and related businesses like hotels and equipment rentals.

Remote mountain areas often have limited accessibility due to poor road conditions or limited public transport. This makes it harder for tourists to reach resorts, especially in developing regions, and restricts market expansion into more isolated but scenic locations.

Growth Factors

Rise in Adventure Tourism Among International Travelers Creates Growth Opportunities

Adventure tourism is rising among global travelers seeking thrilling, outdoor experiences, and skiing fits perfectly into this trend. International tourists are increasingly choosing ski vacations as part of their travel plans, boosting demand for ski resorts worldwide.

All-inclusive ski packages are gaining popularity. These packages cover lodging, meals, gear rentals, lessons, and lift passes, offering a hassle-free experience that attracts both beginners and families. Such offerings help resorts attract more first-time skiers and simplify travel planning.

Virtual reality (VR) is emerging as a tool for training and trip previews. Resorts use VR to provide virtual ski tours and skill simulations, allowing potential visitors to explore and build confidence before booking. This tech-savvy approach appeals to younger and cautious travelers.

To improve off-season revenue, resorts are adding activities like hiking, biking, and festivals during spring and summer. These offerings make ski destinations attractive year-round, opening new revenue streams and appealing to a broader range of travelers.

Emerging Trends

Surge in Demand for Eco-Friendly and Sustainable Ski Resorts Influences Market Trends

Sustainability has become a key factor in travelers’ decisions. Many ski resorts are adopting eco-friendly practices such as solar power, waste reduction, and sustainable snow production. These efforts resonate with environmentally conscious tourists and help improve brand reputation.

Social media influencers play a growing role in destination marketing. Ski resorts collaborate with influencers who showcase their experiences online, creating buzz and attracting younger audiences eager to visit trending and visually appealing locations.

Customization is another trend shaping the market. Tourists now look for personalized ski experiences like themed events, private guides, and family-specific packages. These customized offers create memorable experiences and help resorts stand out in a competitive market.

Wellness has merged with ski vacations as more resorts offer spa services, yoga classes, and wellness retreats alongside skiing. This combination appeals to travelers looking for both adventure and relaxation, adding value to ski vacation packages.

Regional Analysis

Europe Dominates the Ski Vacation Market with a Market Share of 41.2%, Valued at USD 2.55 Billion

Europe leads the global ski vacation market, accounting for a dominant 41.2% share and generating revenues of approximately USD 2.55 Billion. The region benefits from a well-established ski tourism infrastructure, diverse alpine resorts, and strong seasonal tourist inflows. High participation from both domestic and international tourists continues to drive steady market growth across key destinations in the Alps and other mountainous regions.

North America Ski Vacation Market Trends

North America follows as a major contributor to the ski vacation market, supported by a high number of ski resorts, technological enhancements in lift systems, and growing interest in winter recreational activities. The U.S. and Canada host several internationally renowned resorts that attract both regional and global tourists, particularly during the peak winter months.

Asia Pacific Ski Vacation Market Trends

Asia Pacific is witnessing rapid growth in ski tourism, driven by increasing disposable incomes, the emergence of new ski destinations, and rising interest among younger demographics. Countries like Japan, China, and South Korea are investing in ski infrastructure and winter sports promotion, further fueling regional demand.

Middle East and Africa Ski Vacation Market Trends

While still nascent, the Middle East and Africa are gradually making inroads into the ski vacation market through innovative indoor skiing facilities and premium travel experiences. Although constrained by climatic limitations, countries like the UAE are leveraging technology and tourism diversification to attract ski enthusiasts.

Latin America Ski Vacation Market Trends

Latin America’s ski tourism market is primarily supported by seasonal resorts in countries like Argentina and Chile. The region caters to both local and international travelers during the Southern Hemisphere’s winter season, with opportunities for expansion hinging on improved connectivity and targeted promotion of ski destinations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Ski Vacation Company Insights

In 2024, the global ski vacation market continues to expand as travelers seek premium, adventure-based winter experiences. Among the key players driving this growth are several specialized ski travel companies offering tailored services to affluent and mid-range clientele.

Ski has maintained its dominance by leveraging a vast portfolio of ski resorts and integrating technology for seamless booking experiences. Its strength lies in scalable solutions that appeal to both beginners and seasoned skiers globally.

Ski Trip Advisors stands out with its curated review-based model, empowering travelers with real-time feedback and personalized recommendations. Its customer-first approach builds trust, making it a go-to platform for planning comprehensive ski holidays.

Ski Solutions excels in providing luxury and bespoke ski packages, especially for European destinations. Their deep-rooted partnerships with upscale resorts and chalets enhance exclusivity and high customer satisfaction.

SNO Holidays differentiates itself through competitive pricing and a strong online presence, capturing budget-conscious travelers without compromising service quality. Their agile marketing strategy continues to attract a younger demographic looking for value-driven options.

These companies collectively shape the competitive landscape of the ski vacation market, each bringing a unique value proposition to a diverse and evolving customer base. As consumer expectations rise, these key players are expected to lead innovation in personalization, sustainability, and digital integration.

Top Key Players in the Market

- Ski Trip Advisors

- Ski Solutions

- SNO Holidays

- Ski Travels

- Lumi Experiences

- Mogul Ski Worlds

- Prime Travels

- Travel Experiences

Recent Developments

- In Jul 2024, Heidi, a rapidly expanding online tour operator focusing on flexible ski holidays, successfully raised £5.6 million in a funding round. The investment was led by Mercia Ventures, aimed at fueling growth and platform development.

- In Apr 2025, MCP committed over $15 million to ski resort upgrades following a record-breaking winter season. The improvements span multiple properties, targeting enhanced guest experiences and infrastructure modernization.

- In Jul 2025, a small Colorado mountain town with a population of about 1,500 revealed its plan to acquire a popular ski resort. The resort is currently under corporate ownership, and the move signals a shift toward local control and sustainable tourism.

Report Scope

Report Features Description Market Value (2024) USD 6.2 Billion Forecast Revenue (2034) USD 13.1 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Family ski holiday, Advanced Skiing, Beginners skiing, Group ski holiday, Luxury ski holiday, All-inclusive holiday), By Booking Channel (Online Booking, Phone Booking, In Person Booking), By Tourist Type (International, Domestic), By Tour Type (Tour Group, Package Traveller, Independent Traveller), By Consumer Orientation (Men, Women), By Age Group (15-25 Years, 26-35 Years, 36-45 Years, 46-55 Years, 66-75 Years) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ski Trip Advisors, Ski Solutions, SNO Holidays, Ski Travels, Lumi Experiences, Mogul Ski Worlds, Prime Travels, Travel Experiences Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ski Trip Advisors

- Ski Solutions

- SNO Holidays

- Ski Travels

- Lumi Experiences

- Mogul Ski Worlds

- Prime Travels

- Travel Experiences