Global Sinus Dilation Devices Market Analysis By Product (Balloon Sinus Dilation Devices, Endoscopes, Functional Endoscopic Sinus Surgery (FESS) Instruments Set, Sinus Stents/Implants, Other Products), By Procedure (Standalone, Hybrid), By Application (Adult, Pediatric), By End-use (Hospitals, ENT Clinics/In-office, Ambulatory Surgical Centers (ASCs)) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 18871

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

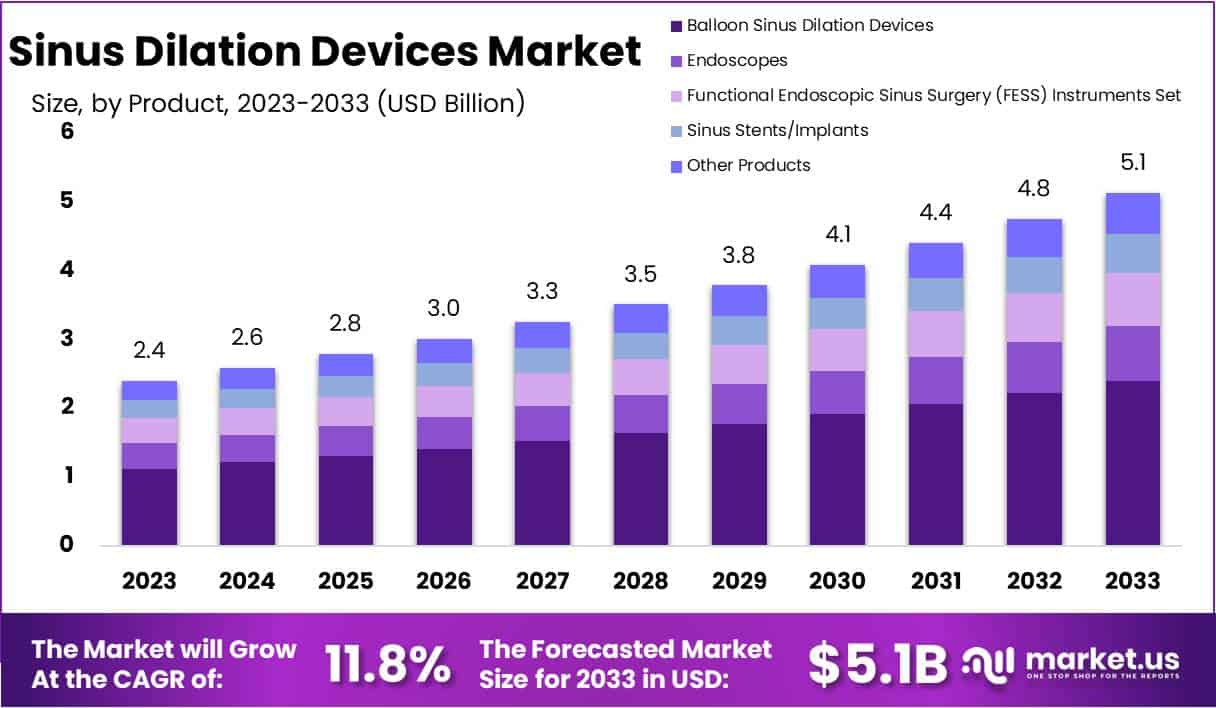

The Sinus Dilation Devices Market Size is anticipated to reach approximately USD 5.1 billion by 2033, marking a significant increase from the 2023 valuation of USD 2.4 billion. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 11.8% throughout the forecast period spanning from 2024 to 2033.

Sinus dilation devices are innovative medical tools designed to address sinusitis, an inflammatory condition affecting the sinuses. These devices offer a less invasive alternative to conventional sinus surgery and are specifically engineered to open and widen sinus passages, ultimately enhancing airflow and drainage.

One prevalent type is the Balloon Sinuplasty, where a flexible balloon catheter is introduced into the sinuses and inflated, gently expanding the openings. This method compresses surrounding tissues, effectively restoring normal drainage. Alternatively, mechanical dilation devices, such as microdebriders and suction tools, may be employed to remove tissue and mucus, aiding in the dilation process.

The sinus dilation devices market is influenced by a confluence of factors driving innovation and adoption in the field of sinusitis treatment. Marked by a competitive landscape, companies specializing in these devices continually strive to meet the increasing demand for minimally invasive solutions. The rise in sinusitis cases, both acute and chronic, underscores the importance of effective treatment options.

Sinus dilation devices, such as balloon systems and stents, offer a less invasive alternative, aligning with the prevailing preference for procedures with quicker recovery times. Ongoing technological advancements, coupled with heightened awareness and educational initiatives, further contribute to the growth of this market. Regulatory approvals, especially from bodies like the FDA, remain critical for market penetration and the introduction of new, advanced products.

Key Takeaways

- Market Size and Growth: Projected market size of USD 5.1 billion by 2033, growing at a CAGR of 11.8% from 2024 to 2033.

- Product Dominance: Balloon Sinus Dilation Devices held a commanding 46.8% market share in 2023, showcasing widespread adoption.

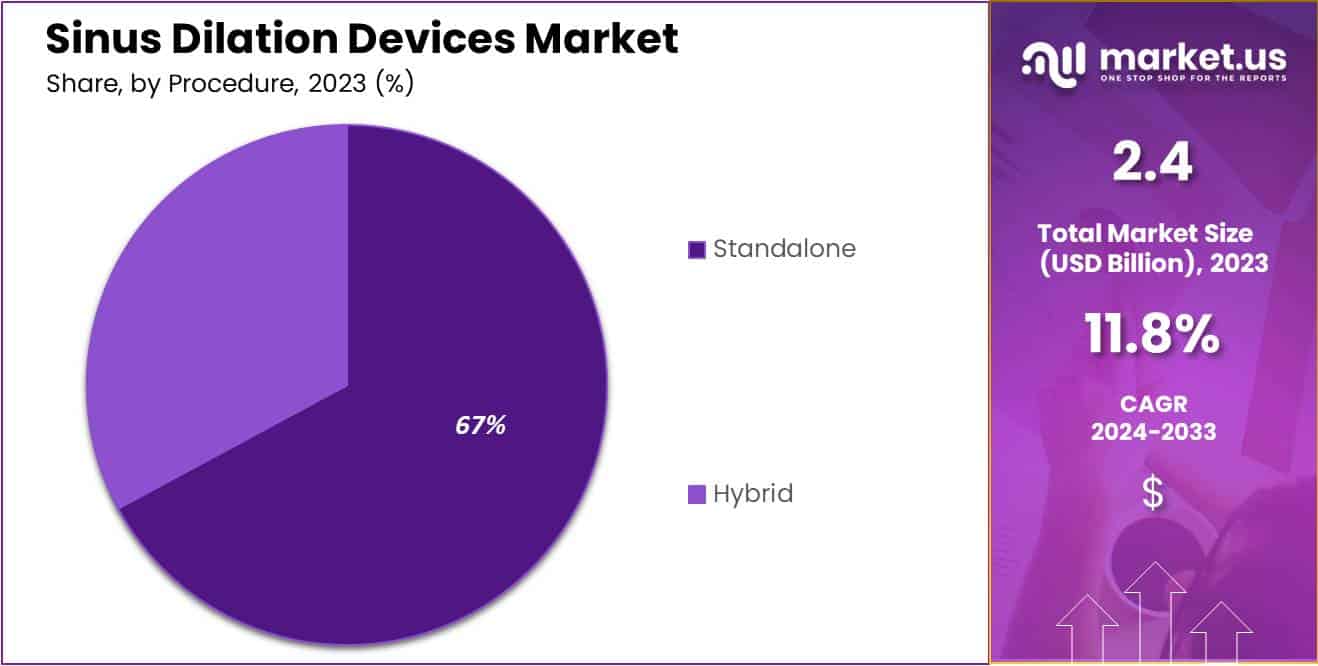

- Procedure Preference: Standalone procedures dominated with a robust 67.4% market share in 2023, indicating a preference for streamlined approaches.

- Target Demographics: The adult segment commanded a significant 67.9% market share in 2023, reflecting the prevalence of sinus issues in adults.

- End-Use Leadership: Hospitals led the market with a dominant 53.1% share in 2023, highlighting their comprehensive healthcare services.

- Market Drivers: Global rise in chronic sinusitis cases drives demand, while technological advancements and awareness contribute to a growing market.

- Market Restraints: High procedural costs and stringent regulatory processes act as barriers, impacting market accessibility and growth.

- Opportunities for Growth: Expanding the geriatric population and developing healthcare infrastructure in emerging markets offer significant growth prospects.

- Key Trends: Balloon sinuplasty gains prominence, and collaborations for collective expertise in product development are observed trends in the market.

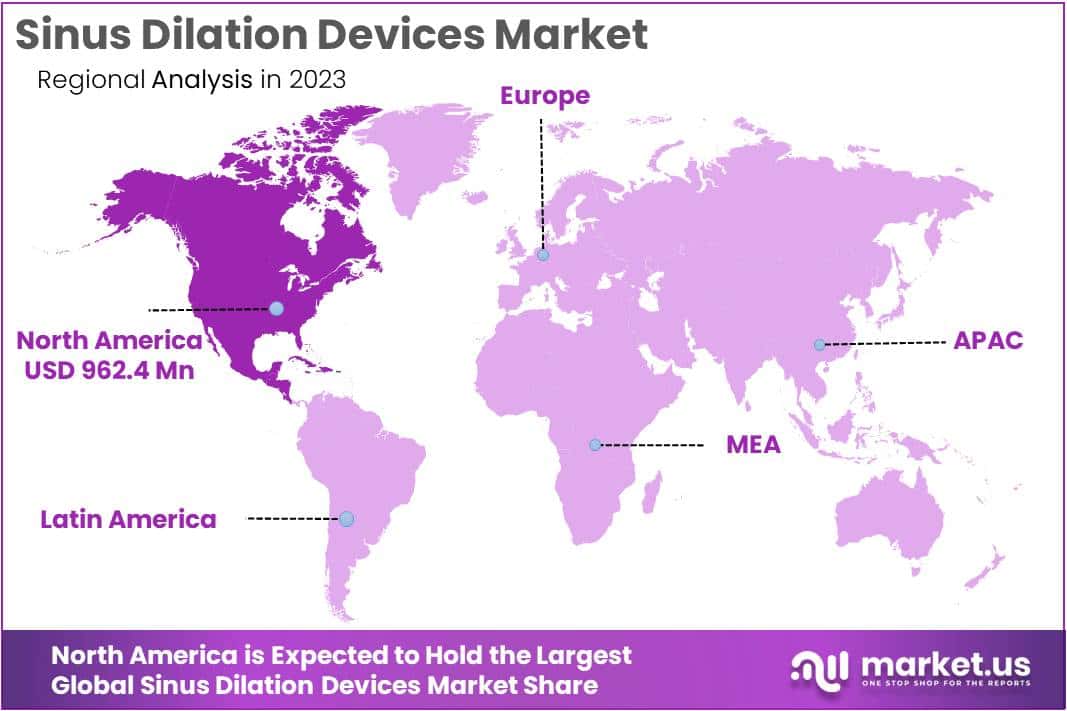

- Regional Dominance (North America): North America secured over 40.1% market share in 2023, driven by factors like chronic sinusitis prevalence and advanced healthcare infrastructure.

Product Analysis

In 2023, the Balloon Sinus Dilation Devices segment segment held a dominant market position in the Sinus Dilation Devices Market, securing a robust market position with an impressive 46.8% share. This signifies a noteworthy dominance in the industry, showcasing the preference and widespread adoption of balloon-based devices for sinus dilation procedures.

Endoscopes, another key player in the market, contributed significantly to the sinus dilation landscape. These devices, facilitating visual exploration and navigation within the sinus cavities, held a substantial market share, reflecting the crucial role they play in enhancing procedural precision and effectiveness.

Functional Endoscopic Sinus Surgery (FESS) Instruments Set also made a substantial impact on the market in 2023. As an integral component of sinus surgery, these specialized instrument sets garnered notable attention, emphasizing their significance in ensuring successful and minimally invasive procedures.

The Sinus Stents/Implants segment emerged as a notable player, demonstrating a growing acceptance within the market. These implants, designed to maintain sinus patency and support healing, gained traction due to their efficacy in promoting favorable surgical outcomes.

Complementing these primary segments, other products in the Sinus Dilation Devices market played a pivotal role. This diverse category encompasses various tools and technologies contributing collectively to the market dynamics, catering to the evolving needs of healthcare professionals and patients alike.

Overall, the Sinus Dilation Devices market in 2023 reflects a dynamic landscape with Balloon Sinus Dilation Devices taking the lead, while Endoscopes, FESS Instruments Set, Sinus Stents/Implants, and other products contribute synergistically to the growth and innovation in sinus dilation procedures.

Procedure Analysis

In 2023, the Standalone segment held a dominant market position in the Sinus Dilation Devices Market, boasting a robust market share of over 67.4%. This signifies a dominant position, showcasing the widespread preference for standalone procedures in the sinus dilation domain.

Standalone procedures in sinus dilation refer to those interventions that operate independently, without the integration of additional techniques or approaches. The significant market share captured by the Standalone segment reflects a clear inclination towards streamlined and singular procedures, highlighting their effectiveness and acceptance among healthcare practitioners and patients alike.

On the other hand, Hybrid procedures, which combine multiple techniques or approaches, constituted a substantial but comparatively smaller portion of the market in 2023. Despite their efficacy in certain cases, the Standalone segment’s dominance underscores a prevailing confidence in the standalone procedures’ efficiency and outcomes.

Factors contributing to the Standalone segment’s prominence include its simplicity, reduced procedural complexities, and potentially quicker recovery times for patients. This trend suggests a current market landscape where healthcare providers and patients prioritize straightforward and effective solutions in the realm of sinus dilation.

As the sinus dilation devices market evolves, the dynamics between Standalone and Hybrid procedures will continue to shape the industry landscape. The observed dominance of the Standalone segment in 2023 sets a noteworthy baseline for market trends, providing valuable insights for stakeholders and industry players navigating the sinus dilation devices market.

Application Analysis

In 2023, the Sinus Dilation Devices market witnessed a noteworthy trend in segment distribution, with the Adult segment securing a dominant market position. Adult patients accounted for a substantial 67.9% share, showcasing a robust presence in the sinus dilation landscape.

This commanding market position of the Adult segment can be attributed to the widespread prevalence of sinus-related issues among the adult population. The demand for sinus dilation devices in addressing adult-specific sinus conditions has fueled the growth of this segment.

On the other hand, the Pediatric segment, while contributing significantly to the overall market, held a slightly lesser share at 32.1% in 2023. This reflects the specialized nature of pediatric sinus cases and the unique considerations involved in catering to this demographic.

Factors such as the rising awareness of sinus-related problems in adults and the effectiveness of dilation devices in addressing these issues have propelled the Adult segment to the forefront. However, the Pediatric segment remains a crucial component of the market, underscoring the importance of tailored solutions for younger patients.

The Sinus Dilation Devices market in 2023 is characterized by the dominance of the Adult segment, showcasing the prevalence of sinus issues in the adult population. The coexistence of a substantial Pediatric segment emphasizes the need for diverse solutions to cater to varying age groups and their specific medical requirements.

End-Use Analysis

In 2023, the Sinus Dilation Devices market showcased a robust landscape, with distinct segments playing pivotal roles in shaping its dynamics. Among these, the Hospitals segment emerged as the frontrunner, firmly securing a dominant market position by capturing more than a 53.1% share.

Hospitals, being the primary healthcare hubs, witnessed a substantial adoption of sinus dilation devices due to their comprehensive healthcare services. The reliability and extensive facilities provided by hospitals contributed significantly to the segment’s commanding market share.

Following closely is the ENT Clinics/In-office segment, which carved out a noteworthy niche in the Sinus Dilation Devices market. This segment demonstrated a commendable growth trajectory, driven by the convenience offered to patients seeking specialized care for sinus-related issues. The accessibility and focused expertise of ENT clinics and in-office settings made them attractive alternatives for individuals requiring sinus dilation procedures.

Ambulatory Surgical Centers (ASCs) emerged as another vital player in the Sinus Dilation Devices market. In 2023, ASCs showcased a substantial market presence, offering a balance between specialized care and outpatient convenience. The flexibility and efficiency of ambulatory surgical centers attracted patients seeking sinus dilation procedures in a more streamlined and time-efficient manner.

The Sinus Dilation Devices market in 2023 displayed a diverse landscape, with Hospitals taking the lead in market share. However, the ENT Clinics/In-office and Ambulatory Surgical Centers segments played pivotal roles, showcasing the evolving dynamics of healthcare delivery and patient preferences in the sinus dilation domain. The market’s growth was shaped by a harmonious interplay between these segments, each contributing to the overall advancement of sinus dilation procedures.

Key Market Segments

Product

- Balloon Sinus Dilation Devices

- Endoscopes

- Functional Endoscopic Sinus Surgery (FESS) Instruments Set

- Sinus Stents/Implants

- Other Products

Procedure

- Standalone

- Hybrid

Application

- Adult

- Pediatric

End-use

- Hospitals

- ENT Clinics/In-office

- Ambulatory Surgical Centers (ASCs)

Drivers

Increasing Prevalence of Chronic Sinusitis

The rising incidence of chronic sinusitis worldwide is a major driver for the sinus dilation devices market. As the global population ages and environmental factors contribute to sinus-related issues, the demand for effective treatment options, including dilation devices, is on the rise.

Technological Advancements in Sinus Dilation Techniques

Continuous advancements in medical technology, particularly in the field of sinus dilation procedures, are driving market growth. Innovative devices that offer minimally invasive solutions, reduced recovery times, and improved patient outcomes contribute to the increasing adoption of sinus dilation procedures.

Growing Preference for Minimally Invasive Procedures

Patients and healthcare providers are increasingly favoring minimally invasive procedures over traditional surgical interventions. Sinus dilation devices, which offer less pain, shorter recovery periods, and reduced risk of complications compared to traditional surgeries, are thus gaining popularity.

Rising Awareness and Education Initiatives

Increased awareness about sinusitis, its symptoms, and the availability of advanced treatment options is positively impacting market growth. Educational initiatives by healthcare organizations and manufacturers to inform both patients and healthcare professionals about the benefits of sinus dilation devices contribute to market expansion.

Restraints

High Costs Associated with Sinus Dilation Procedures

The cost of sinus dilation procedures, including the devices and related healthcare services, can be a significant barrier to adoption. High procedural costs may limit access to these treatments, particularly in regions with limited healthcare resources.

Stringent Regulatory Approval Processes

The sinus dilation devices market is subject to rigorous regulatory approval processes. Stringent regulatory requirements can result in delays in product launches and increased development costs, impacting market growth.

Limited Reimbursement Policies

In some regions, limited or inadequate reimbursement policies for sinus dilation procedures may hinder market growth. Patients and healthcare providers may face financial challenges, affecting the adoption of these devices.

Lack of Skilled Healthcare Professionals

The successful use of sinus dilation devices requires specialized skills and training. The shortage of skilled healthcare professionals proficient in these procedures can act as a restraining factor, limiting the widespread adoption of sinus dilation devices.

Opportunities

Expanding Geriatric Population

The aging global population is a significant growth opportunity for the sinus dilation devices market. Older individuals are more prone to sinus-related issues, and the demographic shift toward an aging population is expected to drive demand for effective sinusitis treatments.

Increasing Healthcare Infrastructure in Emerging Markets

The growth of healthcare infrastructure in emerging markets presents an opportunity for market expansion. As these regions develop and invest in healthcare facilities, there is a potential for increased adoption of advanced sinus dilation devices.

R&D Investments for Product Innovation

Ongoing research and development activities aimed at innovating and improving sinus dilation devices create growth opportunities. Companies investing in novel technologies and product enhancements may gain a competitive edge in the market.

Rising Patient Demand for Outpatient Procedures

The trend towards outpatient procedures, driven by patient preference for convenience and cost-effectiveness, presents a growth opportunity for sinus dilation devices. Devices that facilitate outpatient sinus dilation procedures may gain traction in the market.

Trends

Shift Toward Balloon Sinuplasty

Balloon sinuplasty has emerged as a prominent trend in the sinus dilation devices market. This technique, which uses balloon catheters to dilate sinus passages, is gaining popularity due to its minimally invasive nature and favorable patient outcomes.

Collaborations and Partnerships

Collaborations and partnerships between healthcare organizations, manufacturers, and research institutions are a prevailing trend. Such collaborations aim to leverage collective expertise for product development, research initiatives, and market expansion strategies.

Customization of Sinus Dilation Devices

There is a trend toward the customization of sinus dilation devices to cater to individual patient needs. Customizable devices allow healthcare professionals to tailor treatments based on the specific anatomy and requirements of each patient.

Integration of Digital Technologies

The integration of digital technologies, such as imaging and navigation systems, into sinus dilation procedures is a notable trend. This integration enhances precision during procedures, contributing to improved outcomes and patient satisfaction.

Regional Analysis

In 2023, North America emerged as the leading region in the Sinus Dilation Devices Market, securing a dominant market position by capturing more than a 40.1% share. The region’s sinus dilation devices market exhibited robust growth, reaching a market value of USD 1.3 billion for the year. This significant market share and value can be attributed to several key factors that highlight the region’s prominence in the sinus dilation devices sector.

The high prevalence of chronic sinusitis in North America has been a driving force behind the substantial market share. A growing patient pool suffering from chronic sinus conditions has led to an increased demand for advanced and effective sinus dilation devices, boosting market growth.

North America has been at the forefront of technological advancements in the medical field. The region’s healthcare infrastructure has readily adopted minimally invasive procedures, including sinus dilation, contributing to the widespread adoption of sinus dilation devices. The preference for less invasive treatments among both healthcare providers and patients has propelled market expansion.

The region benefits from well-established healthcare reimbursement policies, facilitating easier access to sinus dilation procedures and devices. This has encouraged healthcare providers and patients to opt for advanced sinus dilation solutions, positively impacting market growth.

The sinus dilation devices market in North America has witnessed numerous collaborations and partnerships between healthcare institutions, research organizations, and market players. These collaborations aim to enhance product development, research, and distribution networks, fostering market dominance.

Increased awareness about sinus-related disorders and the availability of advanced treatment options have been promoted through educational initiatives and awareness campaigns. This has contributed to a higher rate of diagnosis and treatment, driving the demand for sinus dilation devices in the region.

North America boasts a well-established and advanced healthcare infrastructure, with state-of-the-art medical facilities and skilled healthcare professionals. This facilitates the seamless adoption of new medical technologies, including sinus dilation devices.

The competitive landscape in North America is characterized by the presence of key market players investing in research and development activities to introduce innovative sinus dilation devices. This intense competition has spurred technological advancements and product differentiation, further propelling market growth.

North America’s dominant market position in the Sinus Dilation Devices Market in 2023 can be attributed to a combination of factors, including the high prevalence of chronic sinusitis, technological advancements, favorable reimbursement policies, strategic collaborations, awareness initiatives, and a robust healthcare infrastructure. As the region continues to lead in these aspects, it is poised to maintain its significant share in the global sinus dilation devices market in the coming years.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

- Accurate Surgical & Scientific Instruments Corporation

- B. BRAUN MELSUNGEN AG

- Olympus Corporation

- Johnson & Johnson

- Medtronic Plc.

- Stryker Corporation

- Smith & Nephew Plc.

- Sinusys Corporation

- Sklar Surgical Instruments

- Intersect Inc.

Market Key Players

The collaborative efforts of market key players contribute to the overall growth and dynamism of the Sinus Dilation Devices industry. Their strategic initiatives, research investments, and commitment to quality position them as pivotal influencers in shaping the trajectory of this evolving healthcare segment. As the market continues to witness advancements, these key players remain integral to driving innovation and meeting the evolving needs of healthcare practitioners and patients alike.

The Sinus Dilation Devices Market is propelled by key players such as B. Braun Melsungen AG, Olympus Corporation, Johnson & Johnson, and Medtronic Plc., alongside other significant contributors. These industry leaders play a pivotal role in shaping the market landscape.

B. Braun Melsungen AG, with its innovative sinus dilation devices, contributes to market growth through a focus on advanced technology and patient-centric solutions. Their commitment to research and development fosters a competitive edge in the industry.

Olympus Corporation, renowned for its expertise in medical technology, brings forth cutting-edge sinus dilation devices. The company’s dedication to precision and imaging technologies enhances the effectiveness of sinus procedures, catering to the evolving demands of healthcare professionals.

Johnson & Johnson, a stalwart in the healthcare sector, adds substantial value to the Sinus Dilation Devices Market. The company’s diversified portfolio and global presence bolster market expansion, offering a range of solutions for sinus-related conditions.

Medtronic Plc., a key player in medical technology, is a driving force in the sinus dilation market. Their comprehensive suite of products addresses diverse patient needs, reflecting a commitment to improving outcomes in sinus interventions.

Recent Developments

- In October 2023, Medtronic, a renowned player in medical technology, made headlines by acquiring RhinoSensis, a company specializing in innovative sinus dilation devices. Although the financial details of the deal remain undisclosed, the move is poised to enhance Medtronic’s Ear, Nose, and Throat (ENT) portfolio, offering new and improved treatment options for individuals dealing with chronic sinusitis.

- In September 2023, Stryker, a prominent name in the medical device manufacturing sector, introduced a new solution. The SinuFx Balloon Sinuplasty System is their latest offering designed to provide a less invasive treatment choice for those grappling with chronic sinusitis.

- In August 2023, Envista Therapeutics achieved a significant milestone, as the clinical-stage biopharmaceutical company secured FDA Breakthrough Designation for its Envista Nasal Sinus Implant. This implant represents a promising biodegradable alternative to conventional sinus surgery.

- In July 2023, Collaborating to pioneer advancements in sinus dilation devices, Boston Scientific and Sylexis joined forces. Boston Scientific, a global leader in medical technology, partnered with Sylexis, an innovative developer of bioresorbable polymers. Together, they aim to create novel sinus dilation devices that surpass the effectiveness of traditional options while minimizing invasiveness.

Report Scope

Report Features Description Market Value (2023) USD 2.4 Bn Forecast Revenue (2033) USD 5.1 Bn CAGR (2024-2033) 11.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Balloon Sinus Dilation Devices, Endoscopes, Functional Endoscopic Sinus Surgery (FESS) Instruments Set, Sinus Stents/Implants, Other Products), By Procedure (Standalone, Hybrid), By Application (Adult, Pediatric), By End-use (Hospitals, ENT Clinics/In-office, Ambulatory Surgical Centers (ASCs)) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Accurate Surgical & Scientific Instruments Corporation, B. BRAUN MELSUNGEN AG, Olympus Corporation, Johnson & Johnson, Medtronic Plc., Stryker Corporation, Smith & Nephew Plc., Sinusys Corporation, Sklar Surgical Instruments, Intersect Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the sinus dilation devices market in 2023?The sinus dilation devices market size is USD 2.4 billion in 2023.

What is the projected CAGR at which the sinus dilation devices market is expected to grow at?The sinus dilation devices market is expected to grow at a CAGR of 11.8% (2024-2033).

List the segments encompassed in this report on the sinus dilation devices market?Market.US has segmented the sinus dilation devices market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product the market has been segmented into Balloon Sinus Dilation Devices, Endoscopes, Functional Endoscopic Sinus Surgery (FESS) Instruments Set, Sinus Stents/Implants, and Other Products. By Procedure the market has been segmented into Standalone, and Hybrid segments. By Application the market has been segmented into Adult, and Pediatric section. By End-use the market has been segmented into Hospitals, ENT Clinics/In-office, and Ambulatory Surgical Centers (ASCs).

List the key industry players of the sinus dilation devices market?Accurate Surgical & Scientific Instruments Corporation, B. BRAUN MELSUNGEN AG, Olympus Corporation, Johnson & Johnson, Medtronic Plc., Stryker Corporation, Smith & Nephew Plc., Sinusys Corporation, Sklar Surgical Instruments, Intersect Inc. and Others

Which region is more appealing for vendors employed in the sinus dilation devices market?North America is expected to account for the highest revenue share of 40.1% and boasting an impressive market value of USD 962.4 million. Therefore, the sinus dilation devices industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for sinus dilation devices?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the sinus dilation devices Market.

Sinus Dilation Devices MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Sinus Dilation Devices MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Accurate Surgical & Scientific Instruments Corporation

- B. BRAUN MELSUNGEN AG

- Olympus Corporation

- Johnson & Johnson

- Medtronic Plc.

- Stryker Corporation

- Smith & Nephew Plc.

- Sinusys Corporation

- Sklar Surgical Instruments

- Intersect Inc.