Global Short-Term Vacation Rental Market By Accommodation Type (Home, Apartments, Resort and Condominium, Others), By Booking Mode (Online and Platform-based, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139474

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

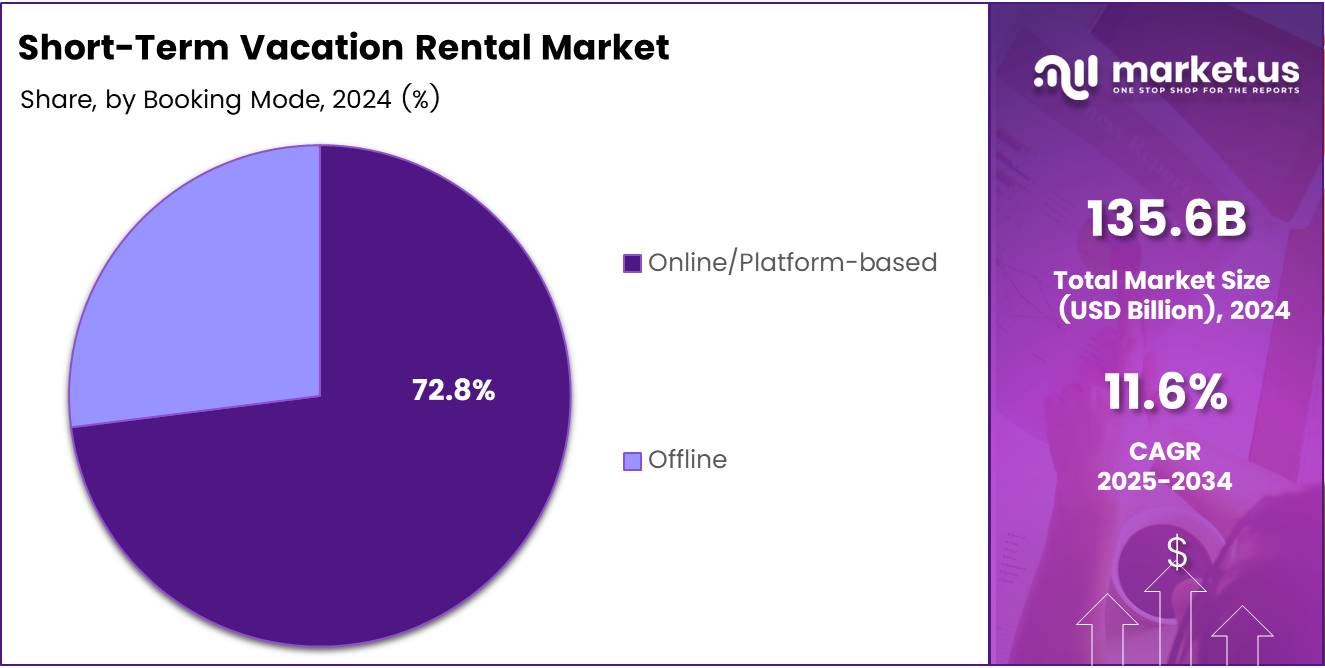

The Global Short-Term Vacation Rental Market size is expected to be worth around USD 406.4 Billion by 2034, from USD 135.6 Billion in 2024, growing at a CAGR of 11.6% during the forecast period from 2025 to 2034.

Short-term vacation rental market has emerged as a dynamic and increasingly popular sector within the global tourism and real estate industries. This market involves property owners or managers listing their properties for short-term stays, typically through online platforms such as Airbnb, Vrbo, and Booking. The sector has experienced significant growth, driven by the rise of digital platforms that allow travelers to book unique accommodations at competitive prices.

The primary attractions for both guests and hosts are affordability, flexibility, and the opportunity for immersive local experiences, differentiating vacation rentals from traditional hotel offerings. According to AirDNA, as of 2023, there were over 2.4 million vacation rental listings and 785,000 hosts in the United States alone, illustrating the scale of this rapidly expanding market.

Despite its expansion, the short-term vacation rental market has faced challenges in terms of regulatory scrutiny, market saturation, and fluctuating occupancy rates.

As of 2024, the adjusted paid occupancy rate for short-term rentals in the U.S. from January through August was 47%, reflecting a slight decline from 50% in 2023 and 54% in 2022, according to KeyData Dashboard. Nevertheless, the outlook remains positive, with U.S. occupancy rates for short-term rentals projected to rebound to 54.9% by the end of 2025, as reported by Hotel News Resource.

The short-term vacation rental market continues to demonstrate robust growth, underpinned by rising consumer demand for flexible, unique, and cost-effective travel options. North America alone had over 4.5 million short-term rental units listed online as of October 2024, according to MyLighthouse. This surge presents ample growth opportunities for property owners, particularly in high-demand urban and vacation destination areas.

Additionally, short-term rentals provide substantial economic benefits to local economies. According to Rent Responsibly, 94.5% of short-term rental operators support locally owned and operated businesses through purchases and referrals, fostering a symbiotic relationship with surrounding communities.

Government regulations and investments are increasingly shaping the future of the market. Cities across the world are implementing stricter rules to control the growth of short-term rentals and maintain affordable housing availability. These regulations range from registration requirements to outright bans in certain areas.

As governments aim to strike a balance between encouraging tourism and addressing housing shortages, these regulatory frameworks will significantly impact market dynamics. Simultaneously, government investments in tourism infrastructure and local economies will continue to support the growth of the market, ensuring it remains an integral component of the global tourism landscape.

Key Takeaways

- The global short-term vacation rental market is projected to reach USD 406.4 billion by 2034, growing at a CAGR of 11.6%.

- Home rentals dominate the accommodation type segment with a 41.9% market share in 2024.

- Online/platform-based bookings lead the market, accounting for 72.8% of the booking mode segment in 2024.

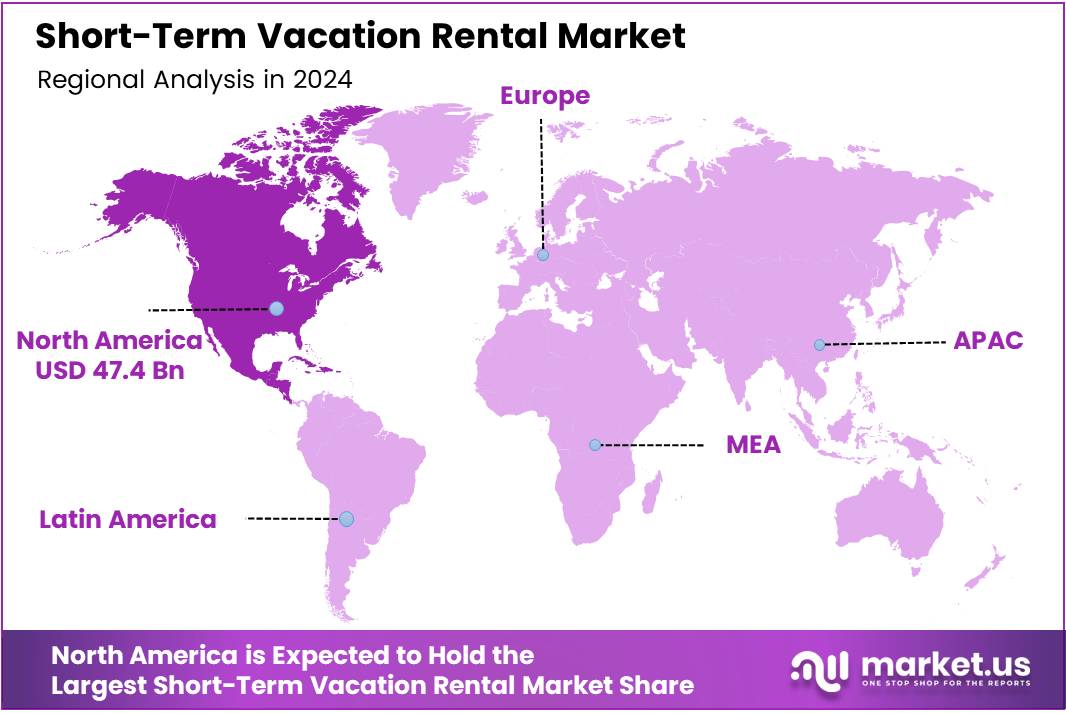

- North America holds the largest market share at 35.1%, valued at USD 47.4 billion in 2024.

Accommodation Type Analysis

Home Rentals Lead Short-Term Vacation Market with 41.9% Share in 2024

In 2024, Home rentals secured a dominant position in the By Accommodation Type segment of the Short-Term Vacation Rental Market, capturing a significant 41.9% market share.

This growth can be attributed to the increasing demand for unique, personalized experiences that traditional hotel accommodations often fail to deliver. Home rentals offer travelers a home-like atmosphere with the added benefit of privacy and flexibility, appealing to a broad range of customers, including families, groups, and long-term stayers.

Apartments, while still popular, held a smaller share due to the preference for homes that provide more space and amenities. Resorts and condominiums also saw steady growth, attracting tourists seeking luxury and convenience, but they remain a niche offering compared to the widespread appeal of private homes.

Other accommodation types, such as hostels and boutique properties, made up a minor portion of the market, primarily catering to budget-conscious or adventure-seeking travelers.

As home rentals continue to dominate, driven by platforms like Airbnb and Vrbo, this segment is expected to maintain its leading role in the short-term vacation rental market for the foreseeable future, reflecting changing consumer preferences for authenticity and autonomy during travel.

Booking Mode Analysis

Online/Platform-Based Bookings Dominate with 72.8% Share in Short-Term Vacation Rental Market in 2024

In 2024, Online/Platform-based booking methods led the By Booking Mode segment of the Short-Term Vacation Rental Market, holding a substantial 72.8% share. This dominance reflects the growing reliance on digital platforms like Airbnb, Vrbo, and Booking.com, which have revolutionized the way consumers book vacation accommodations.

The convenience, transparency, and extensive selection of properties available on these platforms make them the preferred choice for most travelers, especially those seeking ease of access and user-friendly experiences. Additionally, these platforms offer a level of trust and security, often featuring reviews, ratings, and payment protections that traditional offline methods lack.

In contrast, Offline bookings, while still prevalent in certain regions or among specific demographic groups, have seen a steady decline. Many travelers now prefer the speed and accessibility of online bookings, leaving offline methods—such as direct bookings with property owners or through travel agents—accounting for only a smaller share of the market.

Although offline channels continue to serve niche markets or last-minute bookings, their relative market share is expected to shrink as the convenience of online booking platforms continues to drive consumer behavior.

With the rapid digital transformation of the travel industry, Online/Platform-based booking is poised to maintain its commanding market position in the coming years.

Key Market Segments

By Accommodation Type

- Home

- Apartments

- Resort/Condominium

- Others

By Booking Mode

- Online/Platform-based

- Offline

Drivers

Increased Global Tourism Fuels Demand for Short-Term Vacation Rentals

The short-term vacation rental market is seeing strong growth driven by several key factors. One major driver is the rising number of global travelers, as more people opt for vacation rentals over traditional hotel accommodations. Platforms like Airbnb and Vrbo have made it easier for travelers to find and book diverse lodging options, whether for a weekend getaway or an extended stay.

The flexibility in booking dates and check-in/check-out times appeals to a wide range of customers, including families, solo travelers, and business professionals. Additionally, the growing trend of remote work and digital nomadism has led to increased demand for long-term vacation rentals, as people seek alternative living arrangements while maintaining their work routines.

These properties often cater to extended stays, offering the comfort of home with the convenience of travel. Moreover, the variety of rental options available—from apartments and houses to unique stays like treehouses and yurts—gives travelers a wide range of choices depending on their preferences and the type of experience they are seeking. As these factors converge, the short-term vacation rental market continues to grow, offering both investors and travelers exciting opportunities.

Restraints

High Operational Costs and Regulatory Challenges Impact Short-Term Vacation Rentals

While the short-term vacation rental market is growing, it also faces significant restraints that could limit its expansion. One of the major challenges for hosts is the high operational costs involved in maintaining a property for short-term stays.

Expenses related to cleaning, property upkeep, utilities, and platform fees can quickly add up, cutting into profits. Many hosts find themselves balancing the need to maintain high-quality accommodations with the financial burden of these recurring costs.

Additionally, regulatory and legal issues present another major hurdle. In many cities and regions, local governments have introduced strict regulations on short-term rentals, often requiring hosts to obtain special licenses or pay higher taxes. In some cases, entire cities have imposed bans on short-term rentals altogether, which limits the availability of these properties in popular tourist destinations.

These regulations vary widely depending on location, creating confusion for both hosts and guests, and potentially driving up operational costs for property owners. As a result, while short-term vacation rentals offer flexibility and convenience, the financial and legal challenges may deter potential hosts from entering the market and could limit growth in the future.

Growth Factors

Expansion into Underserved Areas Presents Growth Opportunities for Short-Term Vacation Rentals

The short-term vacation rental market has several exciting growth opportunities that could drive its expansion in the coming years. One of the key opportunities is the untapped potential in underserved regions, such as rural or less-traveled areas.

As travelers look for new, off-the-beaten-path destinations, property owners can capitalize on these regions by offering short-term rentals that cater to the growing demand for unique travel experiences. Another growth avenue is the luxury and niche markets.

Upscale vacation rentals and properties with specialized features, like pet-friendly accommodations, eco-friendly homes, or wellness retreats, are attracting a niche but growing segment of travelers looking for more personalized and unique stays.

Additionally, integrating short-term vacation rentals into travel packages with airlines, tour operators, or travel agencies could expand the market’s reach by offering more comprehensive and attractive options to vacationers.

Lastly, the increasing demand for flexible, home-like accommodations among business travelers presents an excellent opportunity. As more companies embrace remote work and corporate travel continues to grow, offering short-term rentals as alternatives to traditional hotels can cater to the changing needs of business professionals seeking comfort and convenience during their travels.

These growth opportunities provide significant avenues for property owners, platforms, and investors to explore, helping drive the market forward.

Emerging Trends

Sustainability and Mobile Booking Trends Shape the Future of Short-Term Vacation Rentals

Several trending factors are driving the evolution of the short-term vacation rental market. One of the most notable trends is the growing demand for sustainability and eco-consciousness. More travelers are prioritizing eco-friendly properties that use renewable energy, reduce waste, and implement sustainable practices. This shift is pushing property owners to adapt and incorporate green initiatives to appeal to environmentally-minded guests.

Another key trend is the growth of mobile booking. With the increasing use of smartphones, apps have made it easier than ever for travelers to find and book short-term rentals on-the-go, enhancing convenience and expanding the market’s reach.

Health and safety protocols also remain a major trend, as the impact of COVID-19 still influences traveler expectations. Cleanliness, sanitation, and health measures are now a top priority for many guests, leading to increased pressure on hosts to maintain high standards of hygiene and provide transparency about their safety protocols.

Finally, the demand for flexibility, particularly with cancellation policies, is growing. As uncertainty continues to affect travel plans, many travelers are seeking accommodations that offer more lenient cancellation options, ensuring they are not penalized if their plans change unexpectedly.

These trends highlight how the market is adapting to shifting consumer preferences, with sustainability, mobile accessibility, safety, and flexibility taking center stage.

Regional Analysis

North America Leads Short-Term Vacation Rental Market with 35.1% Share and USD 47.4 Billion Driven by Strong Travel Culture and High Disposable Income

The short-term vacation rental market is experiencing substantial growth across multiple regions, driven by evolving travel trends, technological advancements, and shifting consumer preferences.

North America dominates the global market, accounting for approximately 35.1% of the market share, valued at USD 47.4 billion. This dominance is largely attributed to the increasing popularity of platforms like Airbnb and Vrbo, along with high disposable income and a well-established travel culture. Additionally, the region benefits from robust tourism infrastructure, coupled with rising demand for flexible, personalized accommodations in both urban and rural destinations.

Regional Mentions:

Europe holds a significant portion of the market as well global market share. Countries such as France, Spain, and Italy remain top destinations for short-term rentals due to their rich cultural heritage, scenic landscapes, and vibrant tourism sectors. The rise of ‘staycations’ and the flexibility provided by remote work have further fueled demand for vacation rentals. The European market is also witnessing strong growth in Eastern European countries, which are emerging as attractive alternatives to traditional tourist hotspots.

Asia Pacific is witnessing the fastest growth. This growth is driven by the rising middle class, increasing international travel, and the expanding acceptance of vacation rentals. Popular destinations like Japan, Australia, and India are contributing to the region’s expanding market share, though challenges such as regulatory hurdles and limited digital penetration in some countries are factors to consider.

Latin America and Middle East & Africa also show promise, albeit with a smaller market share. In Latin America, countries like Brazil and Mexico are seeing increasing vacation rental activity, bolstered by the region’s growing tourism industry. The Middle East, led by the UAE, is becoming a hub for luxury short-term rentals, appealing to affluent travelers from around the globe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global short-term vacation rental market continues to experience rapid growth in 2024, driven by shifting travel preferences and increasing consumer demand for unique, localized lodging options. The key players in this space, such as Airbnb, Inc., Oravel Stays Private Limited (OYO), and Expedia Group, Inc., are leveraging technology, data analytics, and diverse business models to maintain their competitive edge.

Airbnb remains the dominant player, thanks to its robust global reach and broad appeal to travelers seeking distinctive, personalized accommodations. With continued innovation in user experience, such as enhanced booking features and tailored recommendations, Airbnb is reinforcing its position as the market leader. Its focus on “Airbnb Experiences” is also diversifying its service offerings, strengthening its appeal to both hosts and guests.

OYO, on the other hand, has taken a more aggressive approach by focusing on budget-friendly accommodations and an expansive global footprint, especially in emerging markets. With a substantial increase in partnerships and an optimized pricing strategy, OYO continues to capitalize on the growing demand for affordable, flexible lodging options.

Booking Holdings Inc. and Expedia Group, Inc. have also solidified their positions by incorporating short-term rentals into their expansive travel ecosystems. Their platforms, which encompass everything from hotels to flights, are capitalizing on consumer preferences for bundled services and convenience.

Smaller but significant players like Hotelplan Management AG and NOVASOL A/S cater to niche markets, focusing on premium vacation rentals and specialized regional offerings. Their emphasis on high-end properties and personalized travel experiences allows them to capture discerning customers.

Top Key Players in the Market

- Airbnb, Inc.

- Oravel Stays Private Limited

- Tripadvisor, Inc.

- Booking Holdings Inc.

- Expedia Group, Inc.

- Hotelplan Management AG

- MakeMyTrip Pvt. Ltd.

- NOVASOL A/S

- Wyndham Destinations, Inc.

Recent Developments

- In Jan 2025, HomeToGo announced the acquisition of Interhome, a leading European vacation rental management company, to expand its portfolio and strengthen its position in the European market. This move aims to enhance HomeToGo’s offerings and broaden its reach to a wider customer base.

- In Jan 2025, Casago, a vacation rental management company, acquired Vacasa, a major player in the property management industry, to consolidate its position and diversify its services across multiple markets. The acquisition is expected to accelerate growth and improve operational efficiency for both companies.

- In Feb 2024, Guesty acquired Rentals United, a leading property management platform, to enhance its capabilities in managing short-term rental properties. This strategic acquisition aims to offer property managers more integrated and scalable solutions, improving the efficiency of managing multiple listings.

- In Sep 2024, the vacation home rental startup ELIVAAS secured $5 million in funding to scale its operations and expand its reach in the growing short-term rental market. This investment will help ELIVAAS enhance its technology platform and provide better services to property owners and travelers.

Report Scope

Report Features Description Market Value (2024) USD 135.6 Billion Forecast Revenue (2034) USD 406.4 Billion CAGR (2025-2034) 11.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Accommodation Type (Home, Apartments, Resort and Condominium, Others), By Booking Mode (Online and Platform-based, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airbnb, Inc., Oravel Stays Private Limited, Tripadvisor, Inc., Booking Holdings Inc., Expedia Group, Inc., Hotelplan Management AG, MakeMyTrip Pvt. Ltd., NOVASOL A/S, Wyndham Destinations, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Short-Term Vacation Rental MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Short-Term Vacation Rental MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Airbnb, Inc.

- Oravel Stays Private Limited

- Tripadvisor, Inc.

- Booking Holdings Inc.

- Expedia Group, Inc.

- Hotelplan Management AG

- MakeMyTrip Pvt. Ltd.

- NOVASOL A/S

- Wyndham Destinations, Inc.