Global Short-read Sequencing Market By Product (Instruments, Consumables and Services), By Workflow (Pre-Sequencing, Sequencing and Data Analysis), By Application (Whole Genome Sequencing (WGS), Whole Exome Sequencing (WES), Targeted Sequencing & Resequencing and Others), By End-User (Academic & Research Institutes, Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168563

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

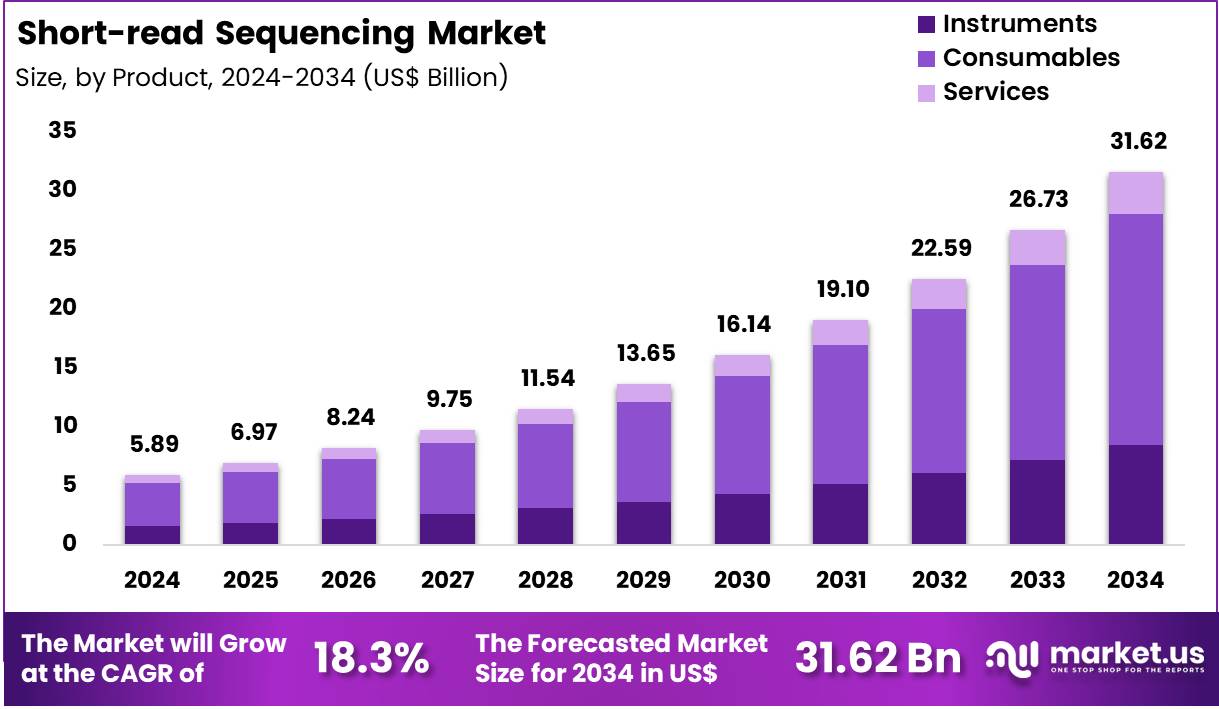

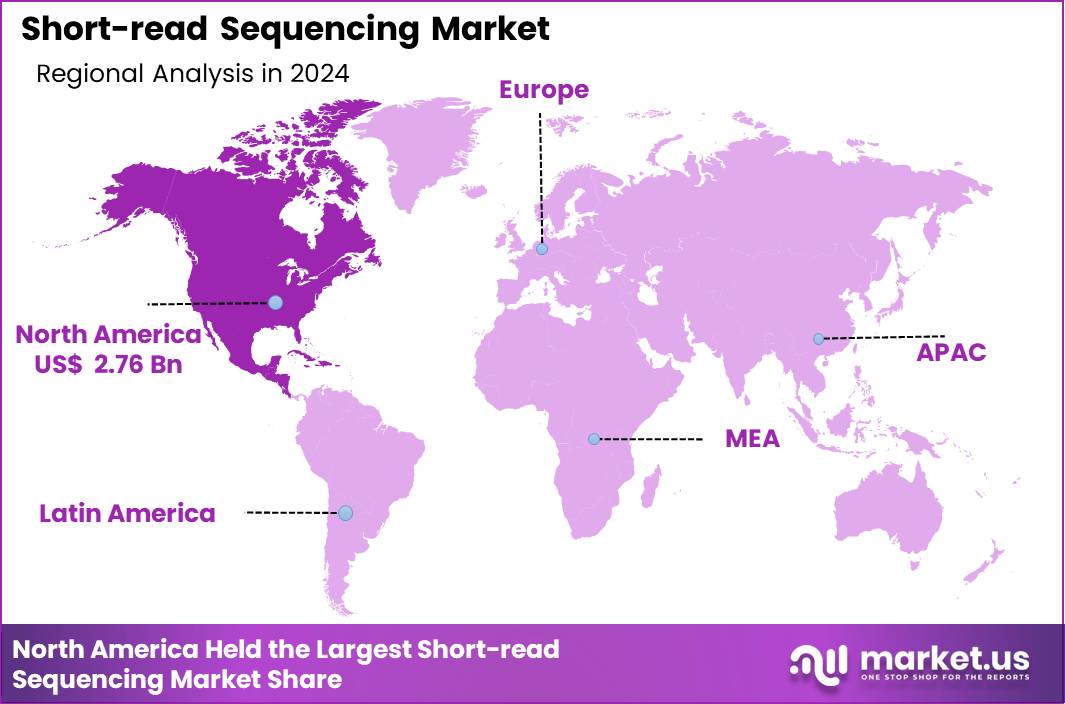

Global Short-read Sequencing Market size is expected to be worth around US$ 31.62 Billion by 2034 from US$ 5.89 Billion in 2024, growing at a CAGR of 18.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 46.8% share with a revenue of US$ 2.76 Billion.

The Short-read Sequencing Market is becoming one of the most influential pillars of modern genomics, enabling high-throughput DNA and RNA sequencing for research, clinical diagnostics, agriculture, and pharmaceutical development. The technology relies on sequencing-by-synthesis and similar chemistries to generate millions to billions of reads cost-effectively, providing unmatched scalability for population-scale genomics and targeted molecular testing.

Short-read sequencing is widely adopted in whole-genome sequencing (WGS), whole-exome sequencing (WES), cancer gene panels, infectious-disease profiling, microbial metagenomics, and transcriptomics. Laboratories, hospitals, and biotech organizations rely on these platforms to analyze genetic variation, identify mutations, understand molecular pathways, and advance precision-medicine initiatives. Rising demand for bioinformatics tools further strengthens the market, as growing genomic datasets require advanced data-analysis workflows and cloud-based computational capabilities.

Increasing global investment in healthcare genomics, agricultural genomics, and molecular biology research continues to accelerate adoption. Population sequencing programs, newborn-screen initiatives, and cancer-risk screening programs across North America, Europe, and Asia further elevate demand for short-read platforms, consumables, and sequencing-as-a-service organizations.

In October 2022, PacBio, a leading provider of high-accuracy sequencing technologies, announced the start of external beta testing for its Onso™ sequencing system. This next-generation benchtop short-read DNA sequencer is designed to deliver exceptional accuracy through PacBio’s proprietary sequencing-by-binding (SBB) technology.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.89 Billion, with a CAGR of 18.3%, and is expected to reach US$ 31.62 Billion by the year 2034.

- The Product segment is divided into Instruments, Consumables, and Services, with Consumables taking the lead in 2024 with a market share of 61.9%

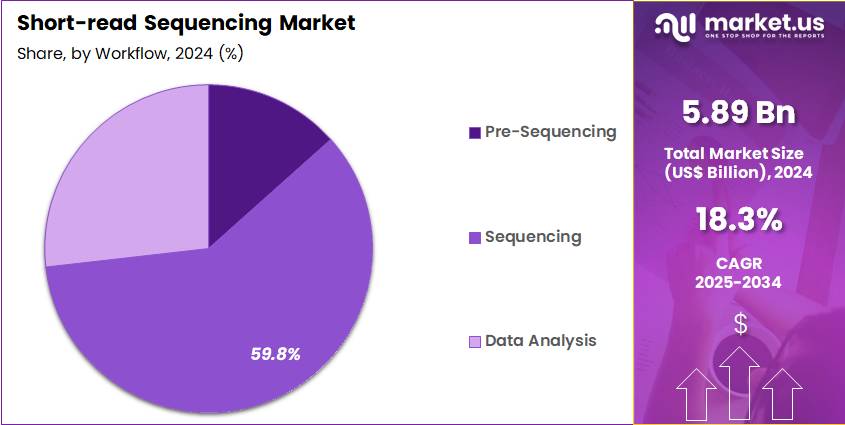

- The Workflow segment is divided into Pre-Sequencing, Sequencing, and Data Analysis, with Sequencing taking the lead in 2024 with a market share of 59.8%

- The Application segment is divided into Whole Genome Sequencing (WGS), Whole Exome Sequencing (WES), Targeted Sequencing & Resequencing, and Others, with Whole Exome Sequencing (WES) taking the lead in 2024 with a market share of 38.1%

- Based on End-User, the market is segmented into Academic & Research Institutes, Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, and Others, with Academic & Research Institutes taking the lead in 2024 with 38.9% market share.

- North America led the market by securing a market share of 46.8% in 2024.

Product Analysis

Consumables held the dominant share of the Short-read Sequencing Market of 61.9% in 2024, supported by continual demand for reagents, flow cells, library-prep kits, and sequencing chemicals. Every sequencing run requires fresh consumables, making this segment highly recurring and revenue-intensive. Growth is supported by the expanding number of sequencing-based diagnostics, oncology panels, and multi-omics workflows.

Laboratories conducting large research projects such as WGS and WES consume high-volume reagent batches, strengthening market concentration within consumables. Instruments are driven by installations across hospitals, research centers, CROs, and pharmaceutical facilities. New generation platforms emphasize higher throughput, reduced turnaround time, and lower cost per base, enabling mid-size and large laboratories to upgrade to automated sequencers.

Workflow Analysis

Sequencing accounts for 59.8% of total workflow spending due to instrumentation, flow-cell usage, and run-cycle consumables. Its central role in any genomics workflow keeps it the largest workflow segment. Growth is supported by the continuous rise in global sequencing throughput, with researchers generating more than 60 petabases of data annually according to the European Nucleotide Archive.

Large-scale programs such as the All of Us Research Program in the US, which targets sequencing over one million genomes, significantly increase demand for sequencing runs and associated consumables. National Genome Japan and GenomeAsia-100K also contribute millions of gigabases of short-read data each year, ensuring sequencing remains the highest-spending workflow segment.

In clinical settings, oncology profiling, newborn screening, and infectious-disease surveillance require frequent sequencing cycles because each sample must be processed at high depth for diagnostic accuracy. Short-read sequencing is widely used for SARS-CoV-2 genomic surveillance, with more than 17 million genomes submitted to GISAID since 2020, reflecting heavy reliance on sequencing workflows.

Application Analysis

Whole Genome Sequencing dominated with 38.1% market share as many application areas because it provides comprehensive coverage of all 3.2 billion bases in the human genome, allowing identification of single nucleotide variants, copy-number variations, structural variants, and mitochondrial DNA changes in a single workflow. Cost reductions have accelerated adoption; the cost per human genome has dropped from USD 10 million in 2007 to approximately USD 600–800, according to the National Human Genome Research Institute.

Countries implementing population genomics, such as the United Kingdom’s 100,000 Genomes Project and the UAE’s Emirati Genome Program, continue to generate vast volumes of whole-genome data, reinforcing demand. WGS also plays a major role in infectious-disease genomics. For example, the US CDC’s PulseNet program utilizes whole-genome sequencing for outbreak detection of foodborne pathogens, enabling faster identification of transmission patterns.

Agriculture and livestock genomics increasingly depend on WGS for breeding optimization, with national dairy and crop-genome improvement programs in New Zealand, Denmark, and China using short-read WGS to accelerate trait-selection cycles. In research settings, more than half of large-scale genetic association studies now incorporate WGS datasets for deeper variant resolution.

End-User Analysis

Academic and research institutes form the largest end-user group accounting for over 38.9% market share because they handle high-volume basic and translational genomic studies across human health, agriculture, microbiology, and evolutionary biology. Universities and publicly funded genome centers generate a majority of the world’s sequencing output.

For example, the European Bioinformatics Institute reports that more than 70% of submitted raw sequence datasets originate from academic laboratories. Global initiatives such as the Human Pangenome Reference Consortium, the Cancer Genome Atlas (TCGA), and the International Cancer Genome Consortium (ICGC) are driven primarily by academic collaborations that collectively sequence tens of thousands of genomes annually.

Research institutes also lead pathogen surveillance; institutes in the US, UK, Brazil, South Africa, and Singapore contributed a large share of SARS-CoV-2 genomes to public repositories, demonstrating their sequencing capacity. Academic groups often run multiple applications, such as WGS, WES, metagenomics, RNA sequencing, and CRISPR off-target analysis, increasing sequencing volume compared to hospitals. Government research grants further fuel adoption. The US NIH allocates billions annually for genomics, while Horizon Europe funds large sequencing projects across cancer, biodiversity, and neurogenomics.

Key Market Segments

By Product

- Instruments

- Consumables

- Services

By Workflow

- Pre-Sequencing

- Sequencing

- Data Analysis

By Application

- Whole Genome Sequencing (WGS)

- Whole Exome Sequencing (WES)

- Targeted Sequencing & Resequencing

- Others

By End-User

- Academic & Research Institutes

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Others

Drivers

Growing adoption of clinical genomics and precision medicine

The Short-read Sequencing Market is strongly driven by the global expansion of precision medicine, oncology diagnostics, and population-scale genomics programs. The National Institutes of Health (NIH) All of Us Program in the US has already enrolled more than 790,000 participants and continues genomic sequencing for population-health analysis.

Similarly, Genomics England completed 100,000 whole genomes, demonstrating the mainstream adoption of short-read sequencing in rare-disease and cancer diagnostics. In oncology, sequencing demand is rising due to widespread use of multi-gene panels, with more than 70% of precision-oncology diagnostics relying on short-read NGS because of its accuracy and cost efficiency.

Infectious disease genomics further boosts installations, as short-read sequencing played a central role in tracking over 14 million SARS-CoV-2 genomes worldwide (source: GISAID), proving its value in real-time outbreak monitoring. Increasing affordability strengthens adoption—Illumina’s short-read sequencing reduced genome cost from US$10 million in 2007 to ~US$600 in 2023, making WGS feasible even in mid-size labs. Clinical adoption accelerates in reproductive health, where NGS-based carrier screening and prenatal panels are becoming routine.

Restraints

Data interpretation complexities and storage limitations

Despite rapid expansion, the Short-read Sequencing Market faces significant operational and technical constraints. One major limitation is incomplete variant resolution—short reads struggle with long repetitive regions, segmental duplications, and large structural variants, which represent up to 70% of genomic variation in some human genome regions (source: Human Genome Structural Variation Consortium). This forces laboratories to combine long- and short-read technologies for comprehensive analysis, raising total testing costs.

Data management remains another challenge; a single whole-genome run generates 80–150 GB of raw data, requiring high-performance servers, cybersecurity infrastructure, and advanced bioinformatics expertise. Many hospitals and mid-size labs lack these resources, slowing clinical adoption. Skilled personnel shortages persist globally; the World Health Organization notes a shortage of ~10 million healthcare professionals, including molecular biologists and bioinformaticians.

High capital expenditure for instruments—ranging from US$50,000 to US$1 million depending on throughput—limits adoption across low-resource regions. Regulatory barriers also slow clinical NGS implementation. For example, molecular diagnostic approvals in Europe slowed temporarily during the transition from IVDD to IVDR, increasing compliance burden for manufacturers and labs.

Opportunities

Expansion of oncology sequencing panels & liquid biopsy workflows

The Short-read Sequencing Market is entering a high-growth opportunity phase driven by the rise of oncology genomics, liquid biopsy innovation, and multi-omics integration. Global cancer incidence is expected to reach 28.4 million cases by 2040 (source: WHO/IARC), massively increasing demand for sequencing-based tumor profiling. Short-read platforms are central to companion diagnostics used with targeted therapies, already approved in multiple markets for genes such as BRCA1/2, EGFR, ALK, and BRAF.

Liquid biopsy presents a major opportunity, as circulating tumor DNA (ctDNA) sequencing adoption expands. Several MRD (minimal residual disease) assays now use short-read sequencing to detect relapse earlier than imaging. In reproductive health, NGS-based carrier screening is increasing rapidly over 60% of US-based obstetric clinics now use NGS for multi-gene panels. Agricultural genomics offers parallel opportunities: short-read sequencing is used for crop breeding, pathogen monitoring, and livestock genomics, aligned with global food-security initiatives.

Sequencing-as-a-service platforms are expanding in Asia, Africa, and the Middle East, offering low-barrier entry for healthcare and research institutions. AI-enabled bioinformatics and cloud-based genome-analysis ecosystems create recurring revenue opportunities through subscription models. Government-led population genomics projects in Qatar, Singapore, China, and Australia, each sequencing 100,000 to 1 million genomes, represent one of the largest growth opportunities for the sector.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the Short-read Sequencing Market by shaping supply chains, investment flows, healthcare budgets, and global research collaboration networks. Economic slowdowns often delay capital purchases such as high-throughput sequencers, which can cost US$ 200,000–US$1 million, making procurement sensitive to institutional funding cycles.

Inflation-driven increases in reagent and semiconductor costs elevate sequencing-run prices, affecting both clinical testing laboratories and research institutions. Geopolitical tensions, particularly US–China trade restrictions, have affected the flow of optical components, chips, and polymerases needed for sequencing instruments, resulting in longer delivery times and sometimes 15–25% cost fluctuations for critical consumables. During the Russia–Ukraine conflict, genomic surveillance programs in Eastern Europe experienced temporary disruptions, showing how political instability can constrain scientific infrastructure.

Global pandemics and public-health emergencies simultaneously create both pressure and opportunity. COVID-19 accelerated sequencing demand for pathogen surveillance, with more than 14 million viral genomes uploaded to global databases, yet also exposed vulnerabilities in cross-border logistics for reagents and sequencing kits. Data-sovereignty regulations such as GDPR, China’s PIPL, and Middle East cloud-security rules restrict how sequencing data can be stored and transferred, complicating multi-country genomic collaborations.

Latest Trends

Growth of cloud-based and AI-driven bioinformatics pipelines

One of the strongest trends is the expansion of hybrid sequencing workflows, where labs combine short-read platforms for high accuracy with long-read technologies for structural variant detection. Increasing automation is another key shift laboratories are adopting robotic liquid handlers and AI-driven QC systems, reducing library-prep time by 40–60% and improving throughput for clinical labs.

Cloud-based genomic analytics is scaling rapidly; more than 50% of global sequencing data is now processed through cloud platforms such as AWS, Google Cloud, and Azure due to increasing computational needs. Another strong trend is the rise of decentralized sequencing, driven by compact benchtop instruments increasingly used in regional hospitals, fertility clinics, and oncology centers.

Wastewater and environmental pathogen surveillance using NGS has expanded significantly since 2020, with short-read sequencing supporting routine monitoring across more than 2,000 municipal sites globally. Multi-omics integration is accelerating, with sequencing used alongside proteomics, metabolomics, and spatial transcriptomics for deeper biological insights. Clinical adoption trends include expansion of NGS for newborn screening, hereditary cancer testing, and infectious-disease AMR profiling.

Regional Analysis

North America is leading the Short-read Sequencing Market

North America maintains the largest share of the market with 46.8% due to strong research spending, established clinical genomics infrastructure, and major sequencing manufacturers headquartered in the region. High adoption of NGS in oncology, reproductive health, and hereditary-disease diagnostics strengthens market leadership. Large federal genomics initiatives, robust insurance coverage improvements, and widespread laboratory automation drive continuous demand.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific demonstrates rapid adoption driven by expanding research output, increasing cancer burden, government-funded genome programs in China, Japan, South Korea, India, and strong growth in biotech manufacturing. Falling sequencing costs and large populations accelerate genomic medicine adoption across the region.

Europe Shows Strong Clinical Adoption

Europe remains a major market due to well-established healthcare systems, strong rare-disease diagnostic capability, and national genomics efforts such as the UK’s Genomics England program. Increasing investments in precision oncology strengthen regional demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Illumina, Inc., Thermo Fisher Scientific, Inc., BGI (BGI / MGI), QIAGEN, Agilent Technologies, Pacific Biosciences of California, Inc., PerkinElmer, Inc., Psomagen, Azenta US, Inc. (GENEWIZ), ProPhase Labs, Inc., F. Hoffmann-La Roche Ltd, Macrogen, Inc. and others.

Illumina dominates the short-read sequencing ecosystem with high-throughput platforms, extensive reagent portfolios, and clinical-grade workflows. Its instruments power global oncology, rare-disease, and population-genomics programs, offering industry-leading accuracy, cost efficiency, and scalability for large sequencing centers and clinical laboratories. Thermo Fisher supports short-read sequencing through Ion Torrent platforms, targeted sequencing panels, and clinical NGS solutions.

Its systems emphasize rapid turnaround, oncology diagnostics, and decentralized testing, supported by strong library-prep chemistries and broad adoption across hospitals, research institutes, and translational genomics programs. BGI advances short-read sequencing through its cost-efficient DNBSEQ platforms, widely used in clinical genomics, infectious-disease surveillance, and population studies. Its technology delivers high throughput at competitive run costs, expanding accessibility across Asia, Europe, and emerging markets seeking scalable genomic solutions.

Top Key Players

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- BGI (BGI / MGI)

- QIAGEN

- Agilent Technologies

- Pacific Biosciences of California, Inc. (PacBio)

- PerkinElmer, Inc.

- Psomagen

- Azenta US, Inc. (GENEWIZ)

- ProPhase Labs, Inc.

- Hoffmann-La Roche Ltd (Roche)

- Macrogen, Inc.

- Other key players

Recent Developments

- In March 2025, Illumina, Inc. outlined a strategic innovation roadmap at the American Society of Human Genetics, highlighting improved short-read sequencing accuracy, faster run-times, integrated methylation analysis, and AI-optimized variant calling pipelines for high-throughput genomic centers.

- In February 2025, Illumina, Inc. released its multi-omic “5-Base Solution,” allowing simultaneous detection of genomic variants and methylation patterns from a single sample using short-read chemistry. The new workflow targets oncology and epigenetic profiling and reduces multi-assay turnaround times for clinical laboratories.

- In January 2025, Illumina, Inc. announced the successful pilot deployment of its new Constellation Mapped Read Technology with GeneDx, enabling improved detection of difficult-to-map variants using short-read NGS. Early evaluations demonstrated enhanced resolution of GC-rich and repetitive genome regions, strengthening clinical applications in rare-disease diagnostics.

Report Scope

Report Features Description Market Value (2024) US$ 5.89 Billion Forecast Revenue (2034) US$ 31.62 Billion CAGR (2025-2034) 18.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Instruments, Consumables and Services), By Workflow (Pre-Sequencing, Sequencing and Data Analysis), By Application (Whole Genome Sequencing (WGS), Whole Exome Sequencing (WES), Targeted Sequencing & Resequencing and Others), By End-User (Academic & Research Institutes, Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Illumina, Inc., Thermo Fisher Scientific, Inc., BGI (BGI / MGI), QIAGEN, Agilent Technologies, Pacific Biosciences of California, Inc., PerkinElmer, Inc., Psomagen, Azenta US, Inc. (GENEWIZ), ProPhase Labs, Inc., F. Hoffmann-La Roche Ltd, Macrogen, Inc. and others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Short-read Sequencing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Short-read Sequencing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- BGI (BGI / MGI)

- QIAGEN

- Agilent Technologies

- Pacific Biosciences of California, Inc. (PacBio)

- PerkinElmer, Inc.

- Psomagen

- Azenta US, Inc. (GENEWIZ)

- ProPhase Labs, Inc.

- Hoffmann-La Roche Ltd (Roche)

- Macrogen, Inc.

- Other key players