Global Sexually Transmitted Diseases Diagnostics Market By Test Type (Syphilis Testing, HIV Testing, HPV Testing, HSV Testing and Others), By Technology (Immunoassay-based Methods, Biosensor / Microfluidics, Molecular Diagnostics and Next-Generation Sequencing), By Location of Testing (Central & Hospital Laboratories, Over-the-Counter / Home Self-Testing and Rapid Point-of-Care Platforms), By End-user (Hospitals & Clinics, Home Care / OTC Users and Diagnostic Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171234

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

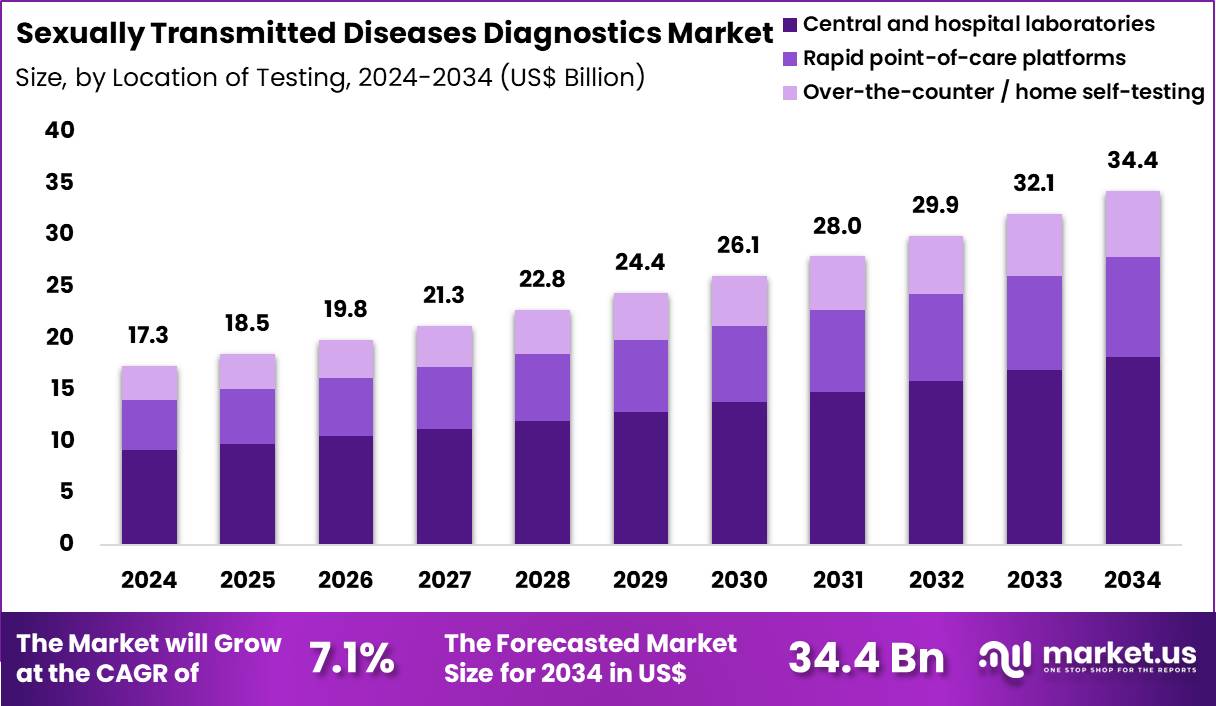

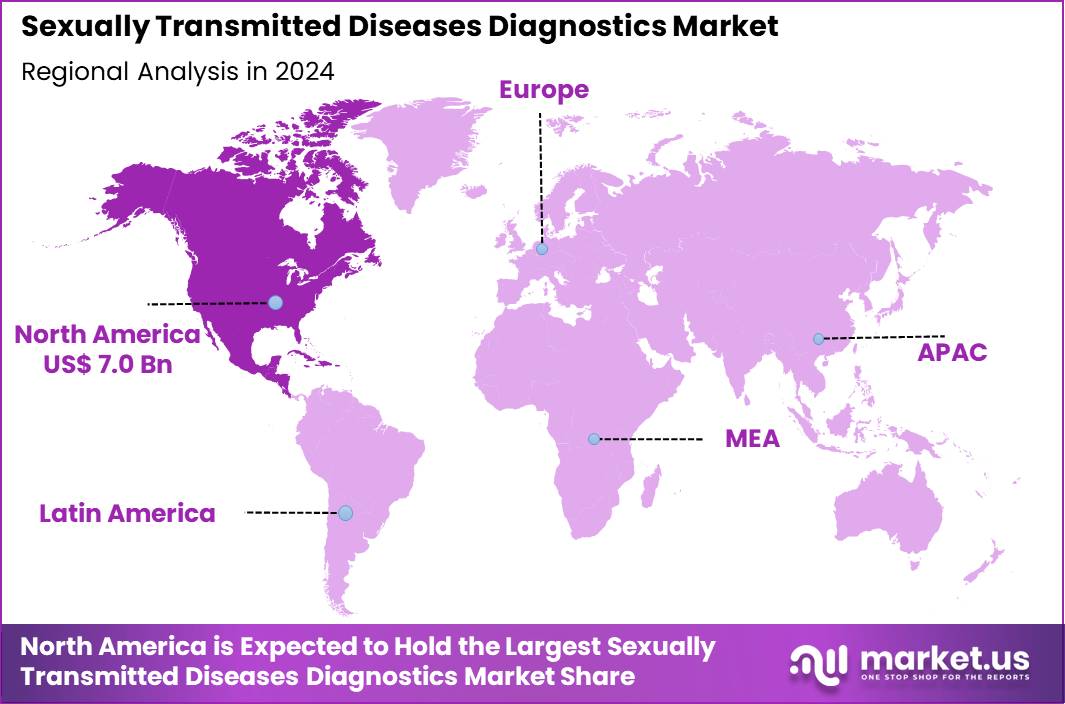

The Global Sexually Transmitted Diseases Diagnostics Market size is expected to be worth around US$ 34.4 Billion by 2034 from US$ 17.3 Billion in 2024, growing at a CAGR of 7.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.5% share with a revenue of US$ 7.0 Billion.

Increasing prevalence of sexually transmitted infections propels the Sexually Transmitted Diseases Diagnostics market, as public health authorities and clinicians intensify efforts to curb transmission through accurate, early identification. Diagnostic manufacturers develop multiplex nucleic acid amplification tests that detect Chlamydia trachomatis, Neisseria gonorrhoeae, and Trichomonas vaginalis from a single specimen.

These assays enable routine screening in family planning clinics to guide antibiotic selection, asymptomatic partner testing for contact tracing, prenatal evaluations to prevent congenital syphilis or neonatal herpes, and emergency department assessments for pelvic inflammatory disease risk. Point-of-care innovations create opportunities for immediate treatment initiation and reduced loss to follow-up.

In February 2023, Mylab launched rapid diagnostic products featuring easy operation and room-temperature stability, empowering resource-limited settings and enhancing blood bank safety through efficient detection of transfusion-transmissible infections. This development directly expands access to reliable diagnostics and strengthens infection control across diverse healthcare scenarios.

Growing adoption of self-sampling kits accelerates the Sexually Transmitted Diseases Diagnostics market, as individuals prefer discreet, mail-in options that bypass clinic visits while maintaining laboratory-grade accuracy. Biotechnology firms engineer vaginal swabs and urine collection devices compatible with centralized molecular platforms.

Applications encompass online sexual health services for comprehensive STI panels, college campus wellness programs offering anonymous testing, LGBTQ+ community outreach with tailored HIV/syphilis dual assays, and correctional facility intake protocols to interrupt institutional spread.

Home-based models open avenues for subscription services that combine testing with telehealth consultations and prescription delivery. Pharmaceutical companies increasingly integrate these diagnostics into PrEP adherence monitoring to ensure concurrent STI management. This consumer-centric shift drives equitable access and supports proactive sexual health maintenance.

Rising integration of antimicrobial resistance profiling invigorates the Sexually Transmitted Diseases Diagnostics market, as laboratories incorporate genotypic assays to guide targeted therapy amid rising gonococcal resistance. Technology providers launch sequencing-enabled panels that identify macrolide or cephalosporin resistance markers alongside pathogen confirmation.

These advanced tools support outpatient management of recurrent gonorrhea with culture-independent susceptibility prediction, public health surveillance for emerging resistant clones, therapeutic decision-making in extragenital infections like pharyngeal gonorrhea, and clinical trials evaluating novel antimicrobial candidates.

Resistance-aware diagnostics create opportunities for stewardship programs that preserve last-line antibiotics. Global networks actively standardize reporting to inform treatment guidelines and vaccine development priorities. This precision approach positions diagnostics as essential guardians of effective STI treatment in an era of escalating resistance.

Key Takeaways

- In 2024, the market generated a revenue of US$ 17.3 Billion, with a CAGR of 7.1%, and is expected to reach US$ 34.4 Billion by the year 2034.

- The test type segment is divided into syphilis testing, hiv testing, hpv testing, hsv testing and others, with syphilis testing taking the lead in 2024 with a market share of 34.6%.

- Considering technology, the market is divided into immunoassay-based methods, biosensor / microfluidics, molecular diagnostics and next-generation sequencing. Among these, immunoassay-based methods held a significant share of 41.8%.

- Furthermore, concerning the location of testing segment, the market is segregated into central & hospital laboratories, over-the-counter / home self-testing and rapid point-of-care platforms. The central & hospital laboratories sector stands out as the dominant player, holding the largest revenue share of 52.9% in the market.

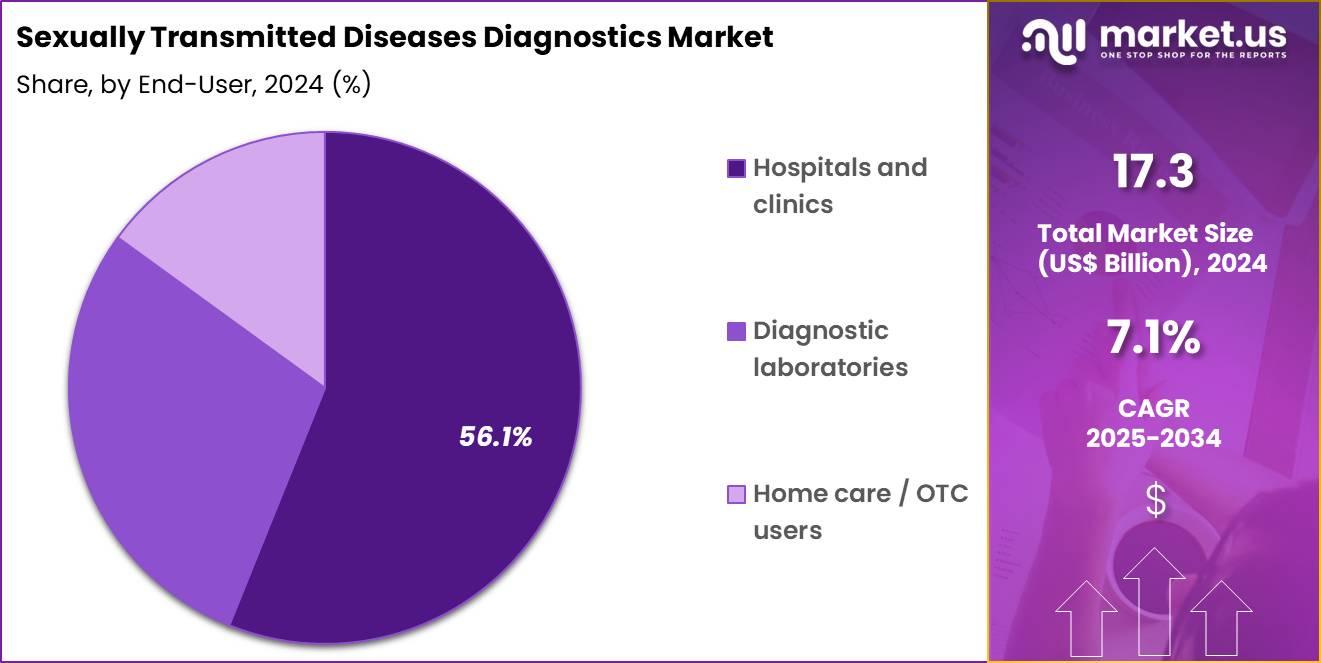

- The end-user segment is segregated into hospitals & clinics, home care / otc users and diagnostic laboratories, with the hospitals & clinics segment leading the market, holding a revenue share of 56.1%.

- North America led the market by securing a market share of 40.5% in 2024.

Test Type Analysis

Syphilis testing, holding 34.6%, is expected to dominate because syphilis cases continue rising across many regions, driving stronger screening initiatives. Public health programs promote early diagnosis to prevent severe complications, including neurological damage and congenital transmission. Prenatal care protocols increasingly include mandatory syphilis testing, expanding testing demand in clinical settings.

Rapid immunochromatographic tests support point-of-care use, speeding up diagnosis in high-burden areas. Travel and behavioral risk factors influence transmission rates, motivating frequent screening among at-risk populations. Technological improvements support high-sensitivity testing, especially for asymptomatic individuals. These factors keep syphilis testing anticipated to lead the test type segment.

Technology Analysis

Immunoassay-based methods, holding 41.8%, are anticipated to dominate because they deliver high-volume testing capability with simplified workflows suitable for routine STD screening. Hospitals and diagnostic labs prefer immunoassays for their strong specificity in identifying viral and bacterial antigens or antibodies. Continuous automation upgrades increase test throughput and laboratory efficiency.

Affordable pricing makes immunoassays accessible across both developed and resource-limited regions. Wider test menu availability, from HIV to syphilis and HPV, strengthens reliance on this technology. These drivers keep immunoassay-based methods projected to remain the most widely adopted technology.

Location of Testing Analysis

Central and hospital laboratories, holding 52.9%, are expected to maintain dominance as they remain responsible for confirmatory STD testing requiring strict clinical interpretation. These facilities handle complex cases when rapid tests require validation using higher-sensitivity technologies. Government-funded screening programs depend on hospital labs to support surveillance and disease reporting.

Hospitals also cater to symptomatic patients seeking comprehensive care and diagnostic certainty. Increasing laboratory automation improves turnaround time and supports mass-scale screening drives during disease outbreaks. These dynamics keep central and hospital laboratories anticipated to lead testing locations.

End-User Analysis

Hospitals and clinics, holding 56.1%, are projected to dominate because most STD-suspected individuals initially seek care from clinical professionals for evaluation and treatment. Hospitals maintain strong infrastructure for laboratory testing, counseling, and immediate clinical intervention. Rising patient awareness encourages earlier visits for sexual health concerns, expanding diagnostic volume.

Antenatal care and pre-surgical testing protocols routinely include STD screening, reinforcing hospital demand. Integration of advanced platforms such as automated immunoassay analyzers strengthens diagnostic accuracy within clinical environments. These factors keep hospitals and clinics expected to remain the leading end-user segment in this market.

Key Market Segments

By Test Type

- Syphilis Testing

- HIV Testing

- HPV Testing

- HSV Testing

- Others

By Technology

- Immunoassay-based Methods

- Biosensor / Microfluidics

- Molecular Diagnostics

- Next-Generation Sequencing

By Location of Testing

- Central & Hospital Laboratories

- Over-the-Counter / Home Self-Testing

- Rapid Point-of-Care Platforms

By End-user

- Hospitals & Clinics

- Home Care / OTC Users

- Diagnostic Laboratories

Drivers

Escalating global incidence of curable STIs is driving the market

The surge in sexually transmitted infections worldwide has heightened the imperative for robust diagnostic solutions to curb transmission and mitigate long-term health consequences. According to the World Health Organization, new cases of syphilis among adults in age group 15-49 years reached 8 million in 2022, marking an increase of over 1 million from 2020 levels. This escalation underscores the urgent need for scalable testing platforms to identify asymptomatic carriers effectively.

In parallel, the Centers for Disease Control and Prevention reported over 2.4 million cases of chlamydia, gonorrhea, and syphilis in the United States in 2023. Such statistics reflect disrupted screening during the pandemic, amplifying diagnostic demands in primary care and public health settings. Enhanced awareness campaigns by governmental bodies promote routine screening, bolstering market penetration for innovative assays.

Multiplex technologies that detect multiple pathogens simultaneously align with this driver, optimizing resource utilization in overburdened facilities. The economic burden of untreated STIs, including infertility and neonatal complications, incentivizes healthcare investments in early detection. Regional hotspots, particularly in the Americas and Africa, necessitate tailored diagnostic strategies to address localized surges. Collectively, this driver propels the evolution of STD diagnostics toward more accessible and efficient modalities.

Restraints

Persistent stigma and access barriers in underserved populations is restraining the market

Social stigma surrounding sexually transmitted diseases continues to deter individuals from seeking timely testing, perpetuating undetected infections and hindering diagnostic uptake. Privacy concerns and fear of judgment exacerbate avoidance, particularly among adolescents and marginalized communities where cultural taboos prevail. Infrastructural limitations, such as limited clinic hours and transportation challenges, compound these issues in rural and low-income areas.

The World Health Organization highlights that the majority of curable STIs remain asymptomatic, complicating self-identification and voluntary screening efforts. During the COVID-19 era, disruptions in routine services led to a surge in maternal syphilis, with 1.1 million adult cases reported amid access constraints. In the United States, racial and ethnic minorities often face systemic distrust in healthcare, further impeding engagement with diagnostic services.

Financial barriers, including copayments and insurance gaps, restrict affordability for at-risk groups reliant on public funding. Inadequate provider training on sensitive counseling perpetuates discomfort, reducing referral rates for confirmatory testing. These multifaceted restraints result in suboptimal test volumes, constraining economies of scale for manufacturers. Ultimately, addressing this restraint requires integrated stigma-reduction initiatives to unlock broader market potential.

Opportunities

Proliferation of point-of-care molecular assays is creating growth opportunities

The advent of point-of-care molecular diagnostics enables rapid, on-site detection of sexually transmitted pathogens, revolutionizing access in resource-limited environments. These assays deliver results within 30 minutes, facilitating immediate treatment and contact tracing to interrupt transmission cycles. Alignment with decentralized healthcare models expands opportunities for integration into community clinics and mobile units.

The U.S. Food and Drug Administration’s endorsements for such technologies validate their efficacy, encouraging adoption in primary care workflows. Multiplex capabilities allow simultaneous screening for chlamydia, gonorrhea, and trichomoniasis, enhancing cost-effectiveness and patient throughput. Collaborative frameworks between regulatory bodies and developers accelerate validation for low- and middle-income countries. This shift reduces reliance on centralized laboratories, mitigating delays in high-burden settings.

Educational programs for non-specialist users further democratize deployment, targeting underserved demographics. Synergies with digital health platforms enable remote result sharing, supporting follow-up care. In totality, these opportunities herald a paradigm shift toward proactive, equitable STD management.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends energize the sexually transmitted diseases diagnostics market as rising healthcare budgets and heightened awareness of public health risks propel clinics and labs to integrate advanced rapid tests for HIV, chlamydia, and syphilis detection. Manufacturers aggressively develop point-of-care kits and multiplex platforms, capitalizing on the surge in preventive screening programs and telemedicine adoption to reach underserved populations.

Persistent inflation and uneven economic growth, however, tighten funding for diagnostic services, forcing providers to cut back on non-urgent testing and extend the use of existing equipment in budget-strapped settings. Geopolitical tensions, including U.S.-China trade disputes and supply disruptions from global conflicts, repeatedly halt shipments of key reagents and biosensors, creating production delays and cost volatility for suppliers reliant on international networks.

Current U.S. tariffs impose significant duties on imported diagnostic kits and components, driving up procurement costs for American healthcare facilities and challenging market accessibility for smaller operators. These tariffs trigger retaliatory measures in foreign markets that restrict U.S. exports of innovative tests and complicate cross-border collaborations on disease surveillance. Nevertheless, the policies spur investments in domestic manufacturing and localized R&D initiatives, building resilient supply chains that will foster greater innovation and long-term market expansion.

Latest Trends

FDA authorization of the first over-the-counter at-home syphilis test is a recent trend

In August 2024, the U.S. Food and Drug Administration granted marketing authorization to NOWDiagnostics for the First To Know Syphilis Test, marking the inaugural over-the-counter at-home diagnostic for syphilis antibody detection. This innovation employs a fingerstick blood sample to yield results in 15 minutes, empowering users to initiate confirmatory clinical evaluation promptly.

Reviewed via the De Novo pathway, the test establishes special controls for performance and labeling to ensure reliability. It addresses gaps in traditional screening by promoting self-initiated testing amid rising syphilis incidence. Availability without prescription enhances privacy, particularly for populations hesitant to visit healthcare facilities. This trend complements prior authorizations, such as at-home collection kits for other STIs, fostering a continuum of consumer-led diagnostics.

Public health advocates anticipate increased case detection, aligning with national elimination goals. Integration into retail channels broadens dissemination, with educational inserts guiding users on next steps. Early post-authorization monitoring underscores its role in reducing diagnostic delays. This 2024 milestone exemplifies regulatory agility in adapting to evolving STI surveillance needs.

Regional Analysis

North America is leading the Sexually Transmitted Diseases Diagnostics Market

In 2024, North America commanded a 40.5% share of the global sexually transmitted diseases diagnostics market, driven by heightened public health imperatives and technological advancements. Healthcare authorities and providers increasingly prioritize early detection amid persistent infection trends, fostering demand for innovative testing solutions like point-of-care assays and multiplex panels that deliver rapid, accurate results.

Regulatory frameworks from bodies such as the U.S. Food and Drug Administration expedite approvals for next-generation diagnostics, enabling broader integration into primary care and telehealth platforms. Rising awareness campaigns, bolstered by collaborations between government agencies and private entities, encourage proactive screening among at-risk populations, including adolescents and men who have sex with men. Urbanization and migration patterns exacerbate transmission risks in densely populated areas, compelling investments in scalable diagnostic infrastructure.

Moreover, the integration of artificial intelligence in result interpretation enhances efficiency, reducing turnaround times and supporting epidemiological surveillance. Pharmaceutical giants and diagnostic firms expand their portfolios with user-friendly home-testing kits, aligning with consumer preferences for privacy and convenience. These dynamics collectively propel market expansion, underscoring a commitment to curbing disease burdens through accessible diagnostics.

According to the Centers for Disease Control and Prevention, the United States reported more than 2.5 million cases of chlamydia, gonorrhea, and syphilis in 2022, highlighting the ongoing need for robust testing measures.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Key stakeholders anticipate robust expansion of the sexually transmitted diseases diagnostics sector in Asia Pacific throughout the forecast period, propelled by surging healthcare investments and epidemiological pressures. Governments in nations like India and China allocate substantial budgets to infectious disease control, spurring adoption of affordable, high-throughput testing technologies in both urban clinics and rural outposts.

Demographic shifts, including a burgeoning young adult population, amplify infection vulnerabilities, prompting ministries of health to roll out nationwide screening initiatives integrated with digital health records. Local manufacturers innovate cost-effective molecular diagnostics, bridging accessibility gaps in underserved regions while complying with international quality standards.

International aid organizations partner with regional bodies to train personnel and distribute multiplex kits, enhancing capacity for syphilis and gonorrhea detection amid rising congenital cases. Urban professionals and migrant workers, facing lifestyle-induced risks, increasingly seek discreet testing options through mobile apps and community pharmacies.

Pharmaceutical leaders introduce multiplex platforms tailored to prevalent strains, optimizing sensitivity for diverse genetic profiles. These concerted efforts position the region for sustained growth, fortifying defenses against escalating transmission threats. The World Health Organization estimates 86 million new cases of four curable sexually transmitted infections in the Western Pacific Region in 2020, a figure that underscores the imperative for diagnostic proliferation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in sexually transmitted disease diagnostics focus on developing multiplex molecular assays and point-of-care platforms that enable fast, simultaneous detection of multiple pathogens, strengthening adoption in urgent-care and community settings. They expand market access by partnering with public-health agencies, telehealth providers, and pharmacy networks to support wider screening of underserved populations.

Product teams emphasize automation and integrated data connectivity to help laboratories scale volumes while improving accuracy and reporting efficiency. Commercial leaders position their testing solutions within broader sexual-health programs that include education, counseling, and repeat screening, which encourages recurring demand.

They also pursue approvals for self-collection kits to address privacy concerns and improve patient compliance. One strong example, Roche Diagnostics, leverages its global footprint, extensive molecular-testing portfolio, and established relationships with infectious-disease providers to deliver high-quality STD diagnostic solutions that support both clinical expansion and public-health priorities.

Top Key Players

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers AG

- Hologic, Inc.

- Cepheid (Danaher Corporation)

- Becton, Dickinson & Co.

- Bio-Rad Laboratories, Inc.

- QuidelOrtho Corporation

Recent Developments

- In March 2025, bioLytical Laboratories Inc. launched the INSTI HIV-1/2 Syphilis Test in Australia. The combined test is able to produce a result in about a minute, allowing clinicians to rapidly screen for both infections and move patients into appropriate care pathways much faster.

- In January 2025, OraSure Technologies, Inc. received FDA approval from CBER for an expanded label on the OraQuick HIV Self-Test. The revision lowers the minimum age of use to 14 years, improving screening access for adolescents who were previously excluded from at-home HIV testing options.

Report Scope

Report Features Description Market Value (2024) US$ 17.3 Billion Forecast Revenue (2034) US$ 34.4 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (Syphilis Testing, HIV Testing, HPV Testing, HSV Testing and Others), By Technology (Immunoassay-based Methods, Biosensor / Microfluidics, Molecular Diagnostics and Next-Generation Sequencing), By Location of Testing (Central & Hospital Laboratories, Over-the-Counter / Home Self-Testing and Rapid Point-of-Care Platforms), By End-user (Hospitals & Clinics, Home Care / OTC Users and Diagnostic Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Roche Diagnostics, Siemens Healthineers AG, Hologic, Inc., Cepheid (Danaher Corporation), Becton, Dickinson & Co., Bio-Rad Laboratories, Inc., QuidelOrtho Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sexually Transmitted Diseases Diagnostics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Sexually Transmitted Diseases Diagnostics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers AG

- Hologic, Inc.

- Cepheid (Danaher Corporation)

- Becton, Dickinson & Co.

- Bio-Rad Laboratories, Inc.

- QuidelOrtho Corporation