Global Server Operating System Market Size, Industry Analysis Report Analysis By Operating System (Windows, Linux, UNIX, Others), By Virtualization (Virtual Machine, Physical), By Deployment (On-premise, Cloud), By Enterprise Type (Large Enterprise, Small & Medium Enterprises) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157856

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Role of Generative AI

- U.S. Market Revenue

- Investment and Business Benefits

- Emerging Trends

- Operating System Analysis

- Virtualization Analysis

- Deployment Analysis

- Enterprise Type Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

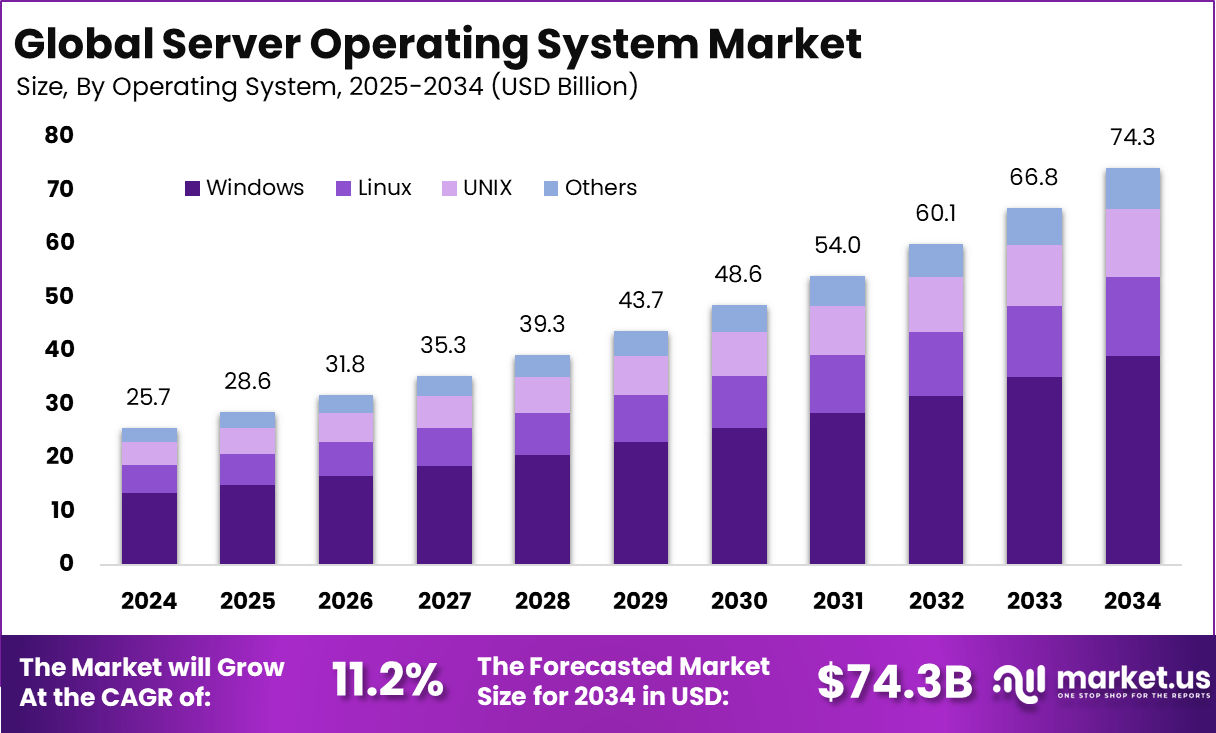

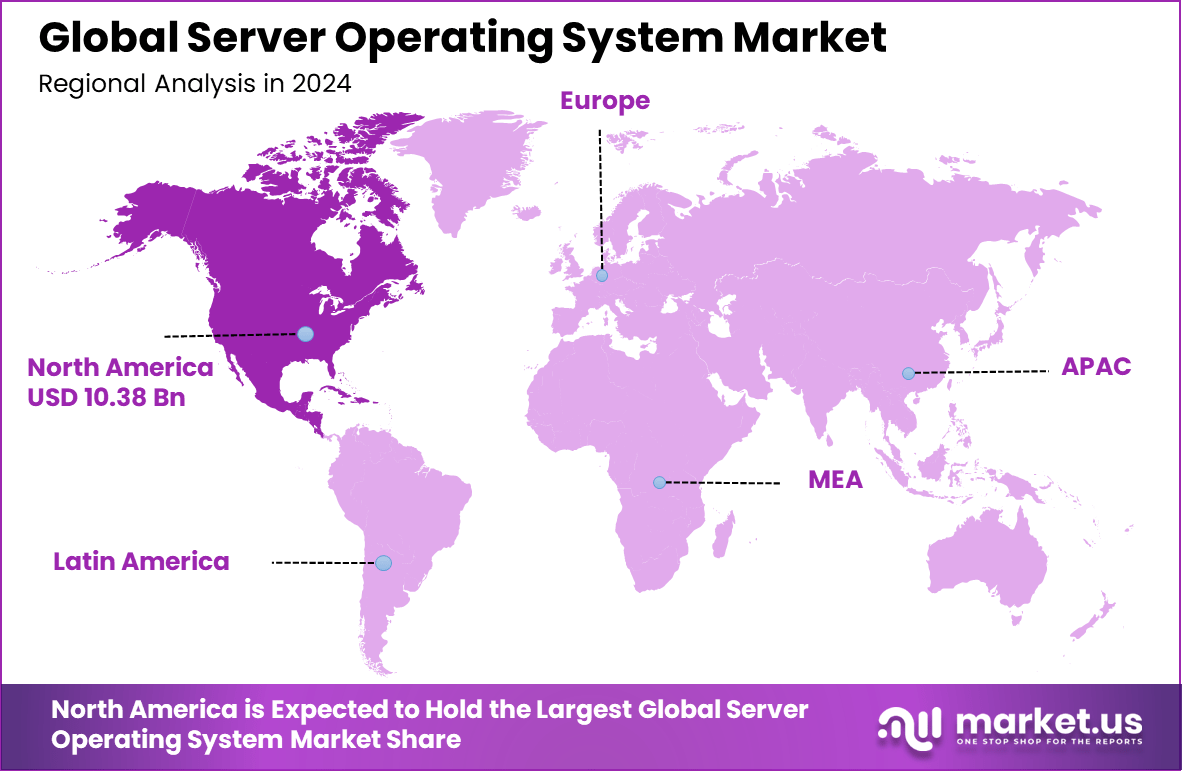

The Global Server Operating System Market size is expected to be worth around USD 74.3 billion by 2034, from USD 25.7 billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.4% share, holding USD 10.38 billion in revenue.

The Server Operating System (OS) Market refers to the industry involved in the development, deployment, and management of operating systems designed for server environments. Server operating systems are software platforms that enable servers to function effectively, manage hardware resources, run applications, and support communication between servers and client devices.

These systems are critical for data centers, cloud services, enterprise IT infrastructure, and web hosting. Popular server OS products include Microsoft Windows Server, Linux distributions, and Unix-based systems. The growth of the server operating system market is driven by the increasing demand for data centers, cloud computing services, and enterprise-grade applications.

According to sci-tech-today, As of February 2025, Android continues to lead the global operating system market with a 45.53% share, followed by Windows at 25.36% and iOS at 18.25%. In the desktop segment, Windows dominates with a 70.62% share, while macOS accounts for 15.74% and Linux 3.81%. The adoption of Windows 11 has accelerated, reaching 31.63% of the Windows market by August 2024.

By 2023, 2.8 billion people were using Android OS, and in 2024, about 71.74% of smartphones worldwide operated on Android. According to statistics from December 2024, Windows XP still held a 0.64% share despite being obsolete, while Windows as a whole retained 73% of the desktop and laptop market. User satisfaction remains high across platforms: 93% of Android users reported being satisfied, 92% said they would recommend it, and 93% stated it meets their needs

Key Insight Summary

- In 2024, Windows led the market by OS type, holding 52.6% share.

- The Virtual Machine segment dominated by workload type, capturing 56.3% share.

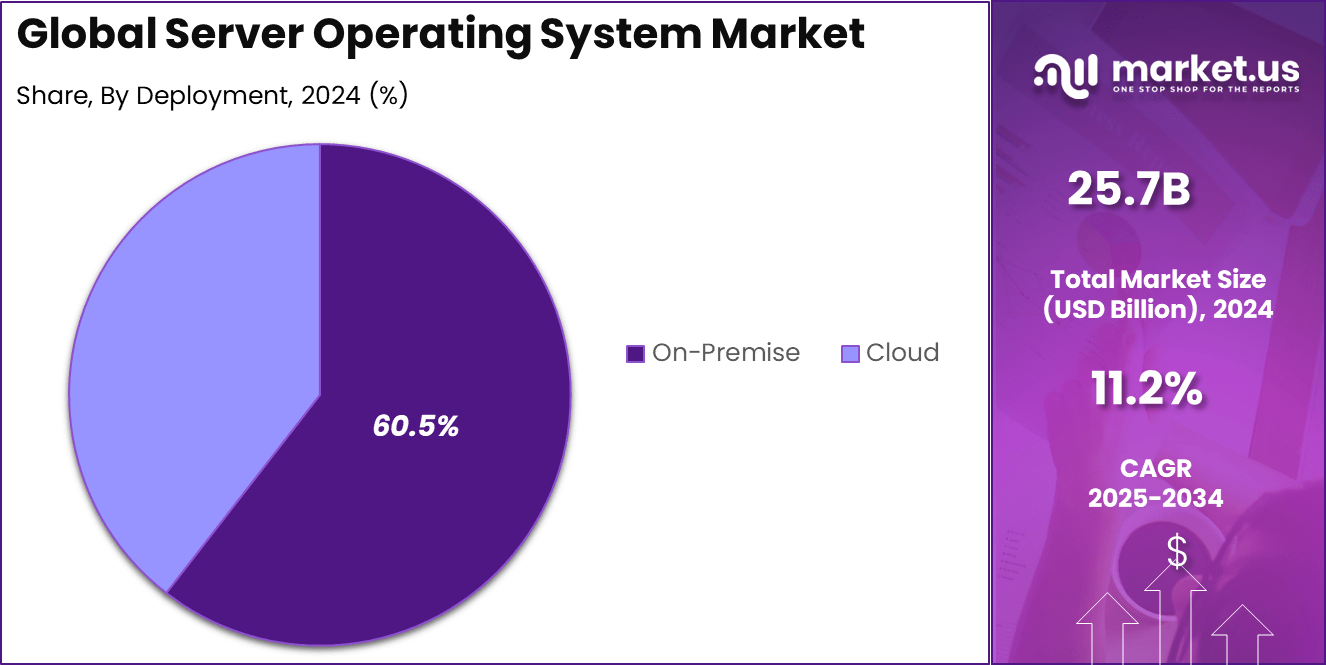

- By deployment, On-premise solutions accounted for 60.5% share in 2024.

- Large Enterprises were the leading adopters, representing 65.7% share.

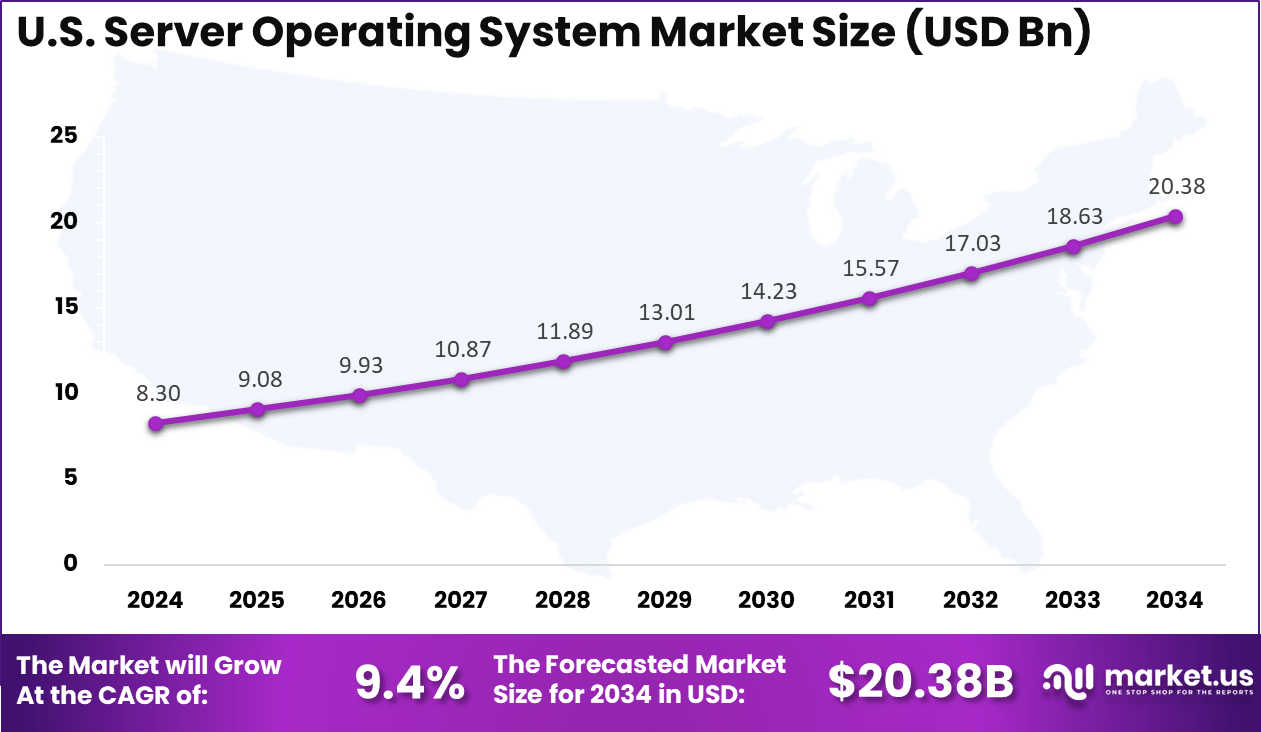

- The U.S. market reached USD 8.30 Billion in 2024, growing at a robust 9.4% CAGR.

- Regionally, North America led the global market, securing 40.4% share.

Analysts’ Viewpoint

Several driving factors are shaping this market. Chief among them is the surge in adoption of cloud computing, which demands operating systems capable of seamless integration and resource management across both on-premises and cloud-based data centers.

The rapid proliferation of containerization technologies such as Docker and Kubernetes, along with the rising importance of AI and machine learning workloads, requires organizations to choose flexible and scalable server OS solutions that can handle complex distributed environments efficiently.

Demand continues to rise as IT teams look for operating systems that can provide advanced security, automate routine tasks, and enable risk mitigation. Cybersecurity threats are increasingly pushing organizations to adopt server operating systems featuring robust encryption, access controls, and auditing capabilities.

Technologies seeing increased adoption include containerized environments, microservices architectures, and lightweight server OS solutions for edge computing. The expansion of 5G and the growth of the Internet of Things are further accelerating investments in server OS infrastructure that can operate across both centralized data centers and edge devices.

Role of Generative AI

Key Role Description Enhanced IT Automation Generative AI enables IT automation by producing scripts, predictive analytics, and automating system monitoring. Proactive Issue Resolution AI models can predict server issues and suggest or execute pre-emptive actions, optimizing uptime and performance. Intelligent Documentation Generative AI produces operational content (SOPs, reports) from live system data, streamlining IT administration. Adaptive Resource Allocation AI-driven systems dynamically allocate server resources based on real-time workload and predictive demand modeling. Security & Threat Detection Generative AI analyzes network/anomaly data to detect and counteract zero-day threats within server environments. U.S. Market Revenue

The market for Server Operating systems within the U.S. is growing tremendously and is currently valued at USD 8.30 billion, the market has a projected CAGR of 9.4%. The market is growing due to the rapid rise of cloud computing, digital transformation, and the growing dependence on data centers. As businesses embrace hybrid and multi-cloud models, the demand for secure, scalable, and efficient server OS solutions has increased.

For instance, in April 2025, IBM announced the launch of enhanced IT support services for its IBM Z17, a powerful server platform designed to optimize enterprise workloads. This move reflects the ongoing U.S. dominance in the server operating system market, with IBM continuing to lead in high-performance computing and mainframe solutions.

In 2024, North America held a dominant market position in the Global Server Operating System Market, capturing more than a 40.4% share, holding USD 10.38 billion in revenue. This dominance is due to the region’s advanced technological infrastructure, widespread adoption of cloud computing, and a strong focus on digital transformation.

The presence of key players like Microsoft, IBM, and Oracle, along with substantial investments in sectors such as healthcare, finance, and IT, has further accelerated the demand for secure and scalable server OS solutions. Additionally, the region’s early adoption of emerging technologies like AI, edge computing, and automation contributed to its market leadership.

For instance, in July 2025, AWS announced an enhancement to its platform, enabling customers to operate BYOL (Bring Your Own License) Windows Server workloads more effectively on AWS. This initiative further underscores North America’s dominance in the server operating system market, with major cloud providers like AWS driving innovation in hybrid cloud solutions.

Investment and Business Benefits

There are growing investment opportunities in cloud-based server operating systems, particularly those designed for containerized environments and hybrid cloud setups. The increasing shift to cloud-native applications and microservices creates demand for OS solutions that can integrate with modern cloud platforms and DevOps workflows.

Companies focused on creating lightweight, secure, and scalable server OS solutions for edge computing and IoT applications are also attracting attention. Additionally, investment in open-source server OS technologies, especially Linux and related distributions, presents opportunities for businesses targeting cost-sensitive markets.

Server operating systems offer significant business benefits, including improved IT efficiency, reduced downtime, enhanced security, and lower operational costs. By automating resource management, OS platforms help organizations allocate computing power effectively, ensuring that servers are used optimally without unnecessary overprovisioning.

Centralized management tools available in modern server OS solutions streamline administration, while enhanced security features protect against data breaches and cyber threats. These systems also support the smooth operation of mission-critical applications and ensure high availability, which is essential for maintaining business continuity.

Emerging Trends

Key Trends Description Cloud Computing Expansion Hybrid and multi-cloud deployments are driving rapid adoption of cloud-ready OS platforms for seamless integration. Virtualization & Containers Widespread virtualization, containerization, and Kubernetes are transforming server management and scalability. AI & Automation Integrations AI/ML-powered tools enhance system management, performance optimization, and reduce manual intervention. Edge & IoT Deployments Need for localized, lightweight server OS grows as edge computing and IoT adoption accelerates globally. Operating System Analysis

In 2024, the Windows segment held a dominant market position, capturing a 52.6% share of the Global Server Operating System Market. This dominance is due to Windows Server’s robust integration with enterprise environments, strong support for various business applications, and its user-friendly interface.

Additionally, its widespread adoption in both on-premise and hybrid cloud infrastructures, coupled with comprehensive security features and ongoing updates from Microsoft, has solidified Windows Server’s leadership in meeting the needs of large-scale enterprises across diverse industries.

For Instance, in July 2025, AWS introduced new enhancements for operating BYOL (Bring Your Own License) Windows Server workloads more effectively on AWS. This update enables organizations to leverage their existing Windows Server licenses while benefiting from the scalability, security, and flexibility of the AWS cloud infrastructure.

Virtualization Analysis

In 2024, the Virtual Machine segment held a dominant market position, capturing a 56.3% share of the Global Server Operating System Market. Virtual machines allow businesses to make better use of physical server hardware by hosting multiple independent server environments on a single device.

The strong adoption of virtual machines stems from their flexibility and ease of management. Enterprises can quickly deploy, move, or replicate server workloads across different physical machines or cloud platforms, supporting business continuity and rapid scaling when needed. This versatility explains the sustained demand for virtual machine-based solutions within enterprise IT environments.

For instance, in August 2025, Microsoft previewed a new tool designed to simplify the conversion of virtual machines from VMware to Hyper-V, enhancing integration with its server operating systems. This tool allows organizations to seamlessly migrate VMware-based workloads to Microsoft’s Hyper-V, providing greater flexibility and cost efficiency in virtualized environments.

Deployment Analysis

In 2024, the On-premise segment held a dominant market position, capturing a 60.5% share of the Global Server Operating System Market. This dominance is due to the growing demand for resource optimization, flexibility, and scalability in IT environments.

Virtual machines allow businesses to run multiple OS instances on a single physical server, reducing hardware costs and improving efficiency. The increasing adoption of cloud computing and the need for improved workload management further drive the popularity of virtualization technologies in enterprise infrastructures.

For Instance, in July 2021, AWS introduced the Application Migration Service to help organizations efficiently migrate on-premises workloads to the AWS cloud. This service simplifies the process of moving applications, databases, and server operating systems from on-premise environments to the cloud with minimal disruption.

Enterprise Type Analysis

In 2024, the Large Enterprise segment held a dominant market position, capturing a 65.7% share of the Global Server Operating System Market. This dominance is due to the increased demand for scalable, secure, and high-performance server OS solutions to support complex, large-scale operations.

Large enterprises often require robust IT infrastructure to manage extensive workloads, data, and applications across multiple locations. Additionally, their substantial investments in cloud computing, digital transformation, and advanced technologies further fuel the adoption of sophisticated server OS platforms.

For Instance, in August 2025, Ubiquiti introduced its new UniFi OS Server, enabling large enterprises to run UniFi OS on their own Windows, macOS, or Linux hardware. This solution provides businesses with greater flexibility and control over their network management by allowing them to utilize existing infrastructure while still benefiting from UniFi’s powerful networking capabilities.

Key Market Segments

By Operating System

- Windows

- Linux

- UNIX

- Others

By Virtualization

- Virtual Machine

- Physical

By Deployment

- On-premise

- Cloud

By Enterprise Type

- Large Enterprise

- Small & Medium Enterprises

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Cloud Computing

The increasing adoption of cloud computing is a major driver for the server OS market. As businesses transition to cloud-based infrastructures, they require reliable, scalable server operating systems to support virtualized environments and enhance operational efficiency.

Cloud providers demand OS solutions that optimize resource management, improve uptime, and reduce costs. This shift toward the cloud emphasizes the need for advanced, flexible, and high-performance server operating systems to manage the complexities of virtualized workloads and dynamic cloud environments.

For instance, in September 2025, Duke Energy proposed the development of new data centers to meet the increasing demand for AI and cloud computing services. This expansion is driven by the growing need for scalable, secure, and high-performance infrastructures that can support the rapid rise of cloud-based applications and AI technologies.

Restraint

High Cost of Server Operating Systems and Implementation

One significant restraint faced by the server operating system market is the high cost associated with purchasing licenses and implementing these systems. Enterprise-grade server OS solutions often come with expensive licensing fees and subscription costs that can pose a barrier for small and medium-sized businesses.

This high cost factor also impacts the ability of companies to hire skilled IT personnel needed to manage and maintain these server systems effectively. Smaller businesses may find it challenging to justify or afford such investments, which can slow down the penetration of advanced server operating systems in certain markets.

Opportunities

Growth in Hybrid Cloud Environments

As more organizations adopt hybrid cloud models, there’s a significant opportunity for server OS providers to offer integrated solutions that blend on-premise and cloud resources. These solutions help organizations achieve greater flexibility, scalability, and optimized resource management, providing seamless performance across both environments.

Hybrid cloud environments demand server OS platforms capable of integrating diverse infrastructures while ensuring data consistency, security, and minimal latency. This growing trend offers a strong market opportunity for innovative server OS solutions tailored to hybrid needs.

For instance, in April 2025, IBM announced its acquisition of HashiCorp, a move aimed at enhancing its hybrid cloud platform. This acquisition will enable IBM to offer a more comprehensive end-to-end solution for businesses transitioning to hybrid and multi-cloud environments.

Challenges

Security Risks and Vulnerabilities

Server operating systems are prime targets for cyberattacks due to their central role in managing critical infrastructure. Vulnerabilities in OS software can expose servers to risks like data breaches, ransomware, and malware. These threats can severely compromise business operations and data integrity.

To mitigate these risks, continuous updates, patches, and vigilant security measures are essential. Organizations must prioritize regular maintenance and adopt proactive security strategies to safeguard their systems against evolving cyber threats and ensure data protection.

For instance, in March 2025, IBM’s AIX server operating system faced significant security vulnerabilities that put enterprise systems at risk. These flaws exposed servers to potential cyberattacks, including data breaches and ransomware. As a result, IBM issued critical patches to address the weaknesses.

Key Players Analysis

In the server operating system market, Microsoft, IBM, Oracle, and Cisco Systems hold strong positions due to their long-standing presence and enterprise-grade solutions. Their products are widely adopted by large organizations for critical workloads. Strong integration with hardware and cloud environments gives them an advantage.

Amazon Web Services, NEC Corporation, and Unisys expand the market with specialized offerings. AWS dominates cloud-based server OS deployments, offering scalability and flexibility for businesses of all sizes. NEC and Unisys provide customized enterprise solutions, focusing on reliability and mission-critical performance. Their presence is significant in regions with high demand for secure and efficient IT infrastructure.

Canonical Ltd. (Ubuntu) leads in open-source server operating systems, supported by its cost efficiency and strong community base. Its adoption is high in cloud-native, developer-focused, and start-up ecosystems. Ubuntu’s role in containerization and edge computing adds to its appeal.

Top Key Players in the Market

- Cisco Systems, Inc.

- IBM Corporation

- Oracle

- Amazon Web Services

- NEC Corporation

- Microsoft Corporation

- Unisys

- Canonical Ltd. (Ubuntu)

- Others

Recent Developments

- In March 2025, Unisys selected Radisys’ Engage Media Server to enhance its voicemail offerings for Tier 1 mobile network operators, showcasing its focus on next-generation communication solutions.

- In August 2025, Microsoft released Windows Server 2025, focusing on virtualization, containerization, and microservice innovations with Azure Stack HCI and Windows containers.

Report Scope

Report Features Description Market Value (2024) USD 25.7 Bn Forecast Revenue (2034) USD 74.3 Bn CAGR(2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Operating System (Windows, Linux, UNIX, Others), By Virtualization (Virtual Machine, Physical), By Deployment (On-premise, Cloud), By Enterprise Type (Large Enterprise, Small & Medium Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Inc., IBM Corporation, Oracle, Amazon Web Services, NEC Corporation, Microsoft Corporation, Unisys, Canonical Ltd. (Ubuntu), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Server Operating System MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Server Operating System MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- IBM Corporation

- Oracle

- Amazon Web Services

- NEC Corporation

- Microsoft Corporation

- Unisys

- Canonical Ltd. (Ubuntu)

- Others