Global SEPP Interconnect Security Market Size, Share Report Analysis By Component (Software, Hardware, Services), By Deployment Mode (On-Premises, Cloud), By Application (Telecommunications, IT and Network Security, Financial Services, Government, Others), By Organization Size (Small and Medium Enterprises, Large Enterprises), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170137

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Component Analysis

- Deployment Mode Analysis

- Application Analysis

- Organization Size Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

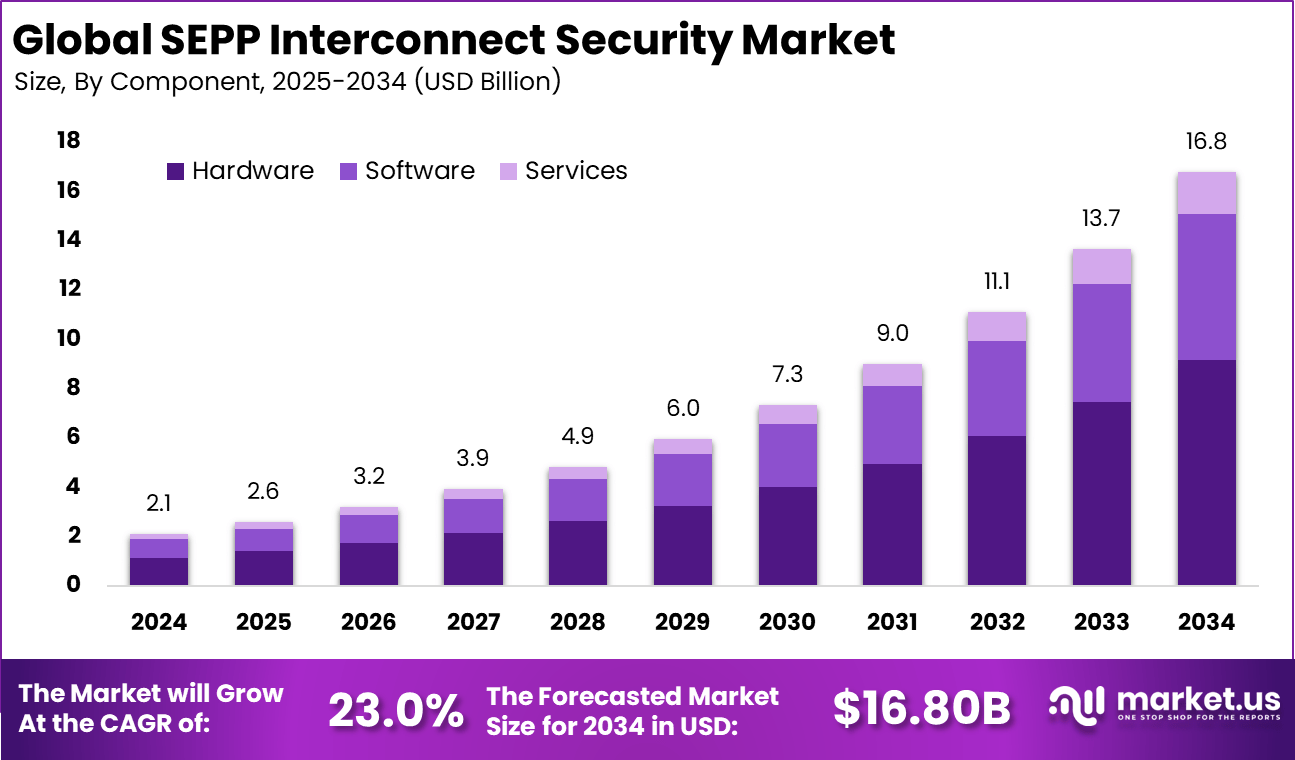

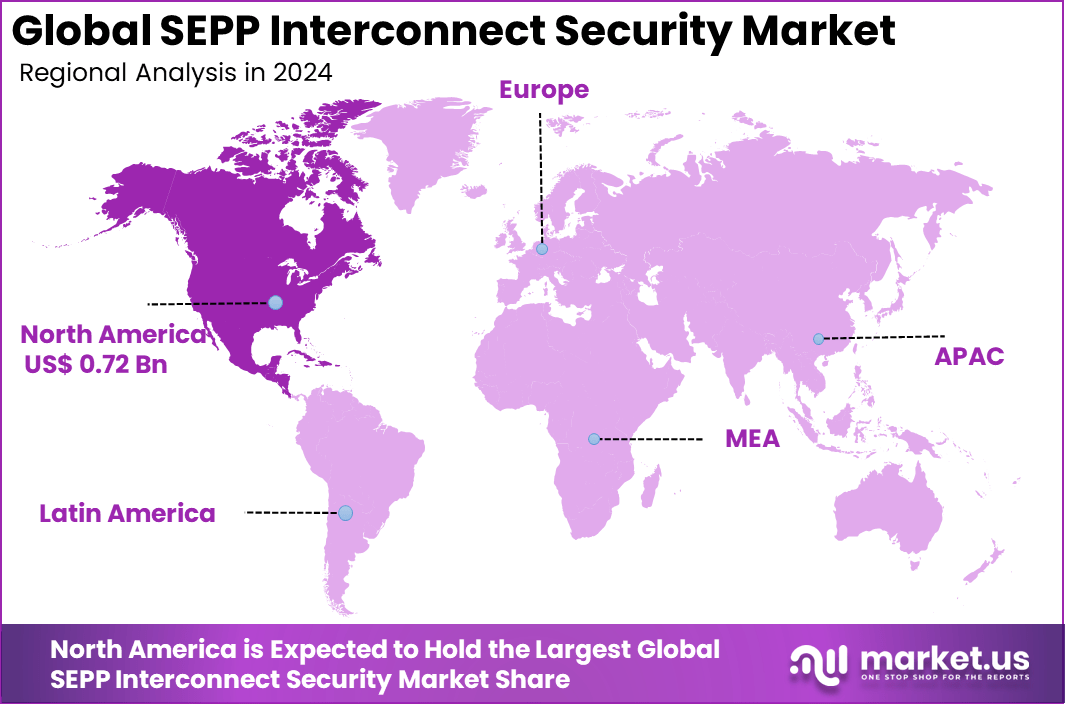

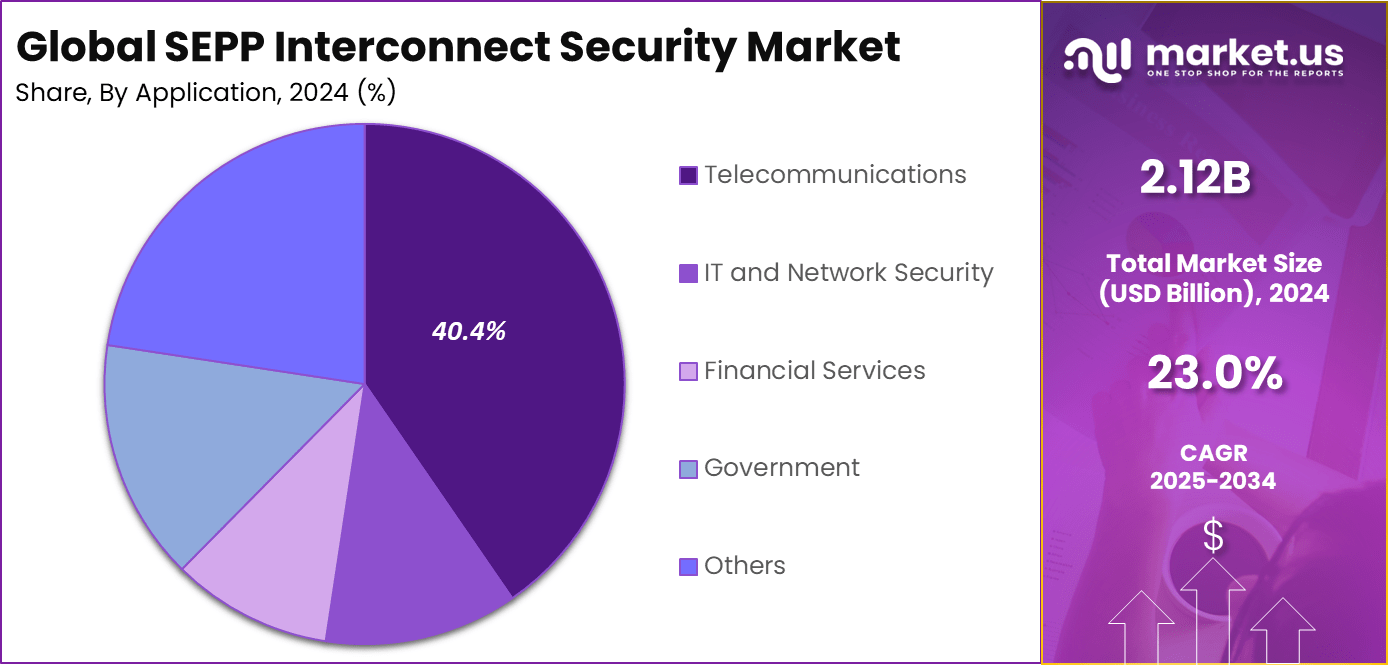

The Global SEPP Interconnect Security Market size is expected to be worth around USD 16.80 billion by 2034, from USD 2.12 billion in 2024, growing at a CAGR of 23.0% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 34.4% share, holding USD 0.72 billion in revenue.

The SEPP Interconnect Security market covers solutions centered on the Security Edge Protection Proxy function that secure network interconnections, especially in 5G roaming and inter operator communication. SEPP protects control plane signaling by ensuring confidentiality and integrity of messages exchanged between networks, preventing unauthorized access and interception of sensitive data across public land mobile networks.

SEPP interconnect security is driven by rising roaming fraud, signaling attacks, and the increasing complexity of 5G networks that connect many operators and devices. Higher signaling volumes, stricter cross border data rules, and national security concerns are pushing telecom providers to adopt standardized edge protection.

The rapid global rollout of 5G is further boosting demand, as expanded infrastructure increases exposure to signaling risks between networks. SEPP solutions secure these links through encryption and integrity checks, with North America and Asia Pacific leading adoption due to strong investments in secure roaming and 5G expansion.

For instance, in September 2025, Marvell Technology Group showed off its interconnect lineup at a major show, focusing on high-speed links for AI data centers. The tech supports secure, low-latency transfers that fit SEPP needs in next-gen networks. With Santa Clara driving innovation, Marvell strengthens North America’s edge in protecting massive data pipes.

Key Takeaway

- Hardware led with 54.7% in 2024, showing strong reliance on dedicated security appliances to safeguard signaling interconnects.

- On-premises deployment captured 60.2%, reflecting the need for strict control, low latency, and compliance-driven security environments.

- The telecommunications sector held 40.4%, driven by rising signaling threats and the expansion of 4G, 5G, and interconnect traffic volumes.

- Large enterprises accounted for 72.8%, confirming that organizations with high network exposure invest the most in SEPP interconnect protection.

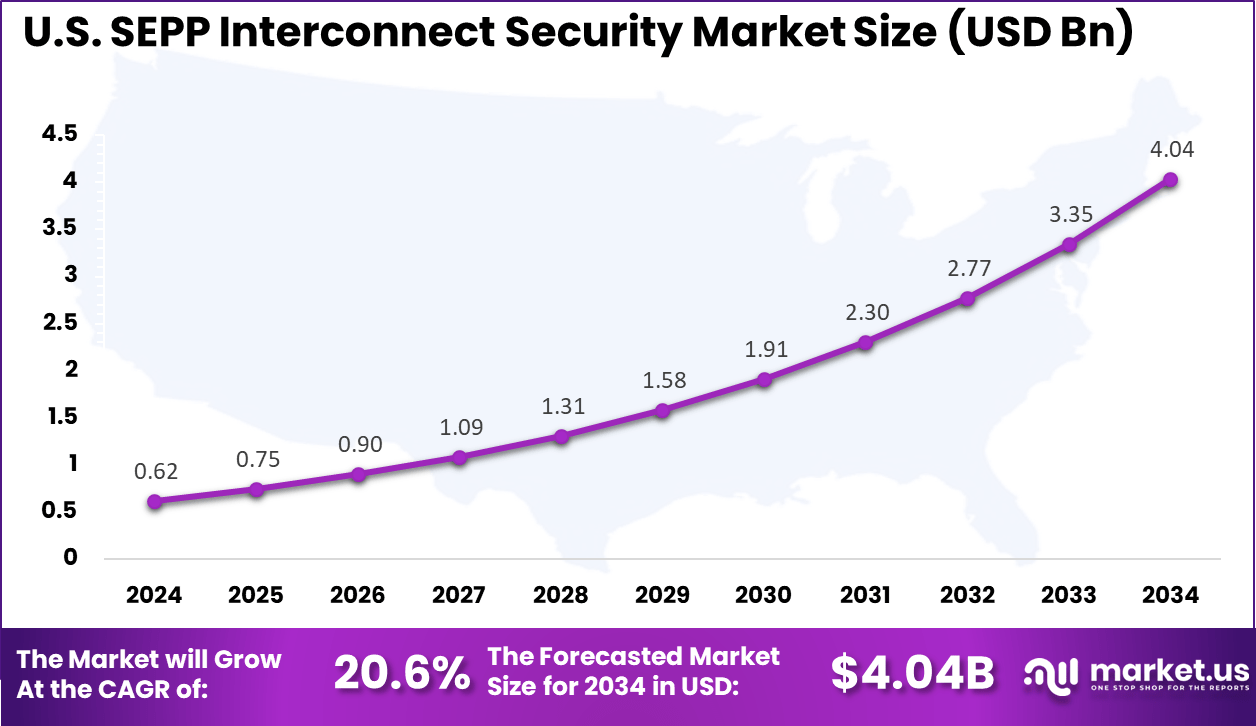

- The U.S. market reached USD 0.62 billion in 2024 with a strong 20.6% CAGR, supported by aggressive telecom security upgrades.

- North America held more than 34.4%, backed by advanced network infrastructure and heightened regulatory focus on signaling security.

Role of Generative AI

Generative AI is changing how SEPP interconnects security and handles threats in 5G environments. It reviews large volumes of signaling data and learns what normal roaming traffic looks like, so it can catch small anomalies that suggest fraud or intrusion. 75% of security teams report growing attack volumes, which makes this level of automated analysis critical for keeping latency low while still enforcing strict security at the network edge.

AI also helps create synthetic attack patterns that stress test SEPP policies before real attackers can exploit gaps. This style of proactive defense is gaining acceptance as operators deal with more complex interconnect topologies. Research shows that generative techniques can improve the detection of unknown threats compared with traditional rule-based tools, which often miss subtle protocol abuses.

Investment and Business Benefits

Investment opportunities around SEPP interconnect security appear across software development, managed security services, cloud platforms, and specialist consulting. Vendors that can offer flexible, standards-compliant SEPP implementations gain room to expand into related functions like firewalls, analytics, and fraud detection for interconnects.

Service providers can create recurring revenue by operating SEPP as a shared security layer for smaller operators that lack in-house teams. There is also space for firms that help carriers design, test, and certify SEPP deployments, especially in regions with evolving regulatory demands. As cyber incidents become more visible, interest from financial investors in telecom security infrastructure continues to rise.

Business benefits from SEPP interconnect security include lower fraud-related losses, fewer outages caused by malicious or malformed traffic, and better efficiency in managing roaming partners. Centralized control of signaling security at the edge reduces manual effort because operators can apply policies consistently instead of configuring multiple systems.

This gives network teams clearer visibility into interconnect flows and makes troubleshooting faster when issues occur. Customers experience more stable roaming with fewer dropped sessions and less exposure to scams, which supports higher satisfaction and loyalty. In competitive markets, strong interconnect security can quietly differentiate an operator as a reliable roaming partner.

U.S. Market Size

The market for SEPP Interconnect Security within the U.S. is growing tremendously and is currently valued at USD 0.62 billion, the market has a projected CAGR of 20.6%. The market is growing due to the rapid rollout of 5G standalone networks by major carriers, which demand robust protection for roaming signaling between operators.

Rising threats like signaling fraud and spoofing push investments in SEPP to encrypt and authenticate interconnect links. Strict federal cybersecurity rules and zero-trust mandates further accelerate adoption as traffic from IoT and mobile users surges.

For instance, In November 2025, Lattice Semiconductor showcased CNSA 2.0 compliant post quantum security features on its MachXO5 NX platform at the OCP Global Summit, strengthening hardware root of trust and firmware security for AI data centers.

In 2024, North America held a dominant market position in the Global SEPP Interconnect Security Market, capturing more than a 34.4% share, holding USD 0.72 billion in revenue. This dominance is due to early adoption of 5G standalone networks by leading carriers, which require strong safeguards for cross-operator roaming and signaling.

High volumes of mobile and IoT traffic heighten the need for encryption against fraud and attacks. Regulatory focus on cybersecurity resilience and data protection also drives operators to deploy SEPP at interconnect borders.

For instance, In October 2025, Texas Instruments strengthened U.S. leadership in secure interconnect technologies by expanding its 300mm wafer fabrication with up to USD 1.6 billion in CHIPS Act funding, supporting production of advanced analog and embedded chips essential for SEPP in 5G networks.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 54.7% share of the Global SEPP Interconnect Security Market. Operators rely on these solid appliances to manage intense signaling traffic in 5G roaming. They provide robust encryption and low latency, which keeps connections smooth between networks.

Engineers value how hardware isolates key security tasks from other systems. This setup cuts down risks in public land mobile network links. Many teams stick with it as a standalone 5G rolls out wider. The preference for hardware grows from real-world needs. It handles heavy loads without slowing down user sessions.

Secure modules inside these units protect against common threats like spoofing. Operators find it easier to integrate with existing gear. This choice also meets strict rules on data handling across borders. As networks scale, hardware proves reliable for core protection duties.

For Instance, in May 2024, Infineon highlighted new secure hardware elements for 5G and IoT devices, focusing on tamper-resistant chips that protect identities and encrypted communications across networks, directly supporting SEPP-type interconnect security use cases where signaling and device trust must be enforced in hardware.

Deployment Mode Analysis

In 2024, the On-Premises segment held a dominant market position, capturing a 60.2% share of the Global SEPP Interconnect Security Market. National rules on data location and lawful access push many to keep these systems in-house, away from shared clouds. Teams integrate them smoothly with firewalls and monitoring tools already in place. This approach lets operators tweak security rules to fit local needs while testing cloud options on smaller scales.

Staying on premises also aligns with compliance demands that vary by country, giving IT groups peace of mind during audits. Maintenance stays straightforward since staff know the hardware and can respond fast to issues. As 5G roaming picks up, these deployments offer predictable performance for voice and data handovers. Operators gradually mix in hybrid models, but on-premises remains the foundation for most critical links.

For instance, in May 2022, Giesecke+Devrient presented secure connectivity solutions for mobile operators, stressing the importance of locally controlled infrastructure and secure elements, which fit on premises SEPP interconnect security, where operators want to keep key encryption and signaling control within their own facilities.

Application Analysis

In 2024, The Telecommunications segment held a dominant market position, capturing a 40.4% share of the Global SEPP Interconnect Security Market. Networks exchange vast message flows that must stay encrypted to stop fraud and spoofing attempts. SEPP acts as a gatekeeper, checking and filtering traffic between operators so subscribers roam without service drops. This focus keeps voice calls and data sessions secure across borders.

Beyond basics, telcos use SEPP to handle new radio features that demand stronger authentication. Rising threats like signaling storms push for better defenses at every interconnect point. Applications extend to enterprise IoT, where devices often move, needing constant protection. Overall, this segment leads as mobile traffic explodes and security stays non-negotiable.

For Instance, in May 2022, IDEMIA and Telefónica España announced collaboration on quantum-safe 5G SIM technology to protect user communications, illustrating how telecom operators are strengthening end-to-end security and preparing for advanced 5G roaming scenarios where SEPP protects signaling between networks.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 72.8% share of the Global SEPP Interconnect Security Market. These groups invest in SEPP to secure complex links that span countries and handle massive data flows. Dedicated security teams integrate it with analytics and policy engines for full oversight. Budgets allow them to deploy at scale, meeting tough governance standards across operations.

Their size brings unique challenges like coordinating with regulators and partners on threat sharing. SEPP helps by standardizing protection on all edges, reducing weak spots. Smaller players watch and adopt later, but big operators set the pace with early rollouts. This lead ensures robust interconnects as 5G ecosystems mature worldwide.

For Instance, in November 2025, Intel pushed Agilex FPGA platforms for 5G with TI for enterprise wireless prototyping. High lane SerDes handles SEPP traffic in complex setups. Large firms deploy them for resilient roaming. Budgets support full-scale integration.

Emerging Trends

Emerging trends within this market are grounded in the accelerating deployment of 5G networks, where secure interconnectivity is regarded as a core requirement. As 5G standalone architectures become more widespread, network operators are increasingly adopting SEPP solutions to comply with international security standards and to manage trust relationships between operators.

This uptake is supported by enhancements in cryptographic protocols and by the introduction of cloud-enabled SEPP deployments that allow flexible and scalable interconnect security. In addition, hosted and service provider-based SEPP models are gaining attention because they allow operators to outsource security functions while retaining policy control.

The market is influenced by the inherent need to counter growing cybersecurity threats that target interconnect signaling paths. With the shift to 5G, legacy vulnerabilities in earlier network generations have highlighted the importance of protecting roaming interfaces and signaling exchanges between operators. SEPP implementations include robust authentication, message integrity validation, and encrypted tunnels that guard against interception and manipulation of traffic.

Growth Factors

Growth factors for SEPP interconnect security solutions include the global rollout of advanced mobile networks and the associated expansion of roaming and cross-operator services. As network operators deploy 5G at scale, the volume of interconnect traffic grows, and securing this traffic becomes a strategic priority.

Regulatory emphasis on privacy and data protection further encourages operators to invest in standardized SEPP solutions to ensure compliance and to reduce exposure to interconnect threats. The trend toward cloud-based security deployments also supports market expansion by enabling service providers to offer flexible, managed security services that align with evolving network architectures.

Key Market Segments

By Component

- Software

- Hardware

- Services

By Deployment Mode

- On-Premises

- Cloud

By Application

- Telecommunications

- IT and Network Security

- Financial Services

- Government

- Others

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

5G Network Expansion

The global rollout of 5G networks is increasing the need for stronger signaling security, positioning SEPP as a critical solution for telecom operators. While 5G enables high speed and low latency communication, it also exposes networks to signaling based cyber risks. SEPP functions as a secure gateway between operators, protecting cross border data exchange and supporting compliance with international security standards.

North America and the Asia Pacific region are leading SEPP adoption as part of broader 5G infrastructure upgrades. Telecom operators in these regions are investing in secure interconnect frameworks to handle rising traffic volumes while preventing signaling threats such as spoofing and interception. Ongoing collaboration between network operators and security vendors highlights SEPP’s role as a core requirement for reliable and secure 5G expansion.

For instance, in November 2025, Infineon rolled out its TEGRION SLC27 security controller at TRUSTECH. This chip handles post-quantum cryptography for safer 5G links. It fits right into growing networks to block future threats. Telecom firms grab it for roaming protection. Operators speed up 5G builds with this secure base.

Restraint

Skilled Worker Shortage

The limited availability of professionals with specialized telecom security expertise is a major barrier to SEPP deployment. Many operators struggle to find engineers skilled in 5G signaling protocols and SEPP integration, which slows implementation and reduces the ability to address emerging threats. Smaller operators are especially affected due to limited access to dedicated training resources.

As network architectures grow more complex, demand for SEPP trained talent continues to outpace supply. Building these skills requires significant time and investment, often diverting resources from other priorities. While managed security services offer some relief, the ongoing talent gap remains a key constraint on the global adoption of SEPP solutions.

For instance, in September 2025, ST invested $60 million in a new chip packaging line amid talent gaps. The plant trains staff on advanced interconnect tech for 5G. Shortages slow full output despite big plans. They partner with schools to build skills. Growth waits on more experts.

Opportunities

Cloud-Based Solutions

Cloud based SEPP solutions are opening new growth opportunities by allowing telecom operators to strengthen signaling security through scalable and flexible architectures. Moving SEPP to the cloud lowers upfront infrastructure costs and reduces deployment time, making adoption easier for emerging networks and operators with limited capital.

In regions such as Asia Pacific, where rapid 5G expansion aligns with strong digital transformation, cloud SEPP platforms support faster integration across complex network environments. Managed cloud based SEPP services further help operators improve compliance and security while minimizing operational overhead, supporting long term efficiency and market growth.

For instance, in October 2025, Broadcom teamed with Comfone for cloud SEPP in 5G roaming. The setup scales fast without heavy hardware buys. Operators test it live in Asia for easy growth. Costs drop as cloud handles peaks. New markets jump in quickly.

Challenges

Tough Rules Across Borders

The lack of uniform security regulations across countries complicates SEPP implementation for global telecom operators. Differences in compliance requirements, data protection laws, and technical standards create operational friction and increase the cost of cross-border signaling security. Companies are often forced to tailor solutions for each regulatory environment, delaying service deployments and straining international partnerships.

Frequent updates to local cybersecurity laws further add to complexity, requiring ongoing adjustments in SEPP configurations and integration practices. Emerging regions face additional delays due to inconsistent enforcement and legacy infrastructure. While international bodies are working toward aligned frameworks, the slow pace of regulatory convergence continues to hinder the seamless and efficient rollout of SEPP solutions globally.

For instance, in December 2025, Qualcomm fixed critical chipset flaws after global alerts hit. Rules vary by region, forcing quick patches across lines. Delays tie up teams on compliance checks. Roaming tests are slow in strict zones. Fines loom without full tweaks.

Key Players Analysis

Infineon Technologies, NXP Semiconductors, STMicroelectronics, Samsung Electronics, and Texas Instruments lead the SEPP interconnect security market with secure elements and cryptographic hardware that protect data exchange and device integrity across telecom and digital services.

Renesas, Broadcom, Microchip, Analog Devices, Qualcomm, Intel, Marvell, and Lattice Semiconductor support the market through secure interconnect controllers and embedded security engines for IoT, automotive, and telecom infrastructure.

IDEMIA, Gemalto, Giesecke+Devrient, Sony Corporation, and other players expand the market with identity modules, secure payment technologies, and credential management platforms. Their offerings ensure strong authentication and key protection for eSIM, digital identity, and financial applications.

Top Key Players in the Market

- Infineon Technologies AG

- NXP Semiconductors

- STMicroelectronics

- Samsung Electronics

- Texas Instruments

- Renesas Electronics Corporation

- Broadcom Inc.

- Microchip Technology Inc.

- Cypress Semiconductor (Infineon)

- Analog Devices, Inc.

- Maxim Integrated (Analog Devices)

- ON Semiconductor

- Qualcomm Incorporated

- Intel Corporation

- Marvell Technology Group

- Lattice Semiconductor

- IDEMIA

- Gemalto (Thales Group)

- Giesecke+Devrient

- Sony Corporation

- Others

Recent Developments

- In August 2025, Broadcom Inc. rolled out agentic AI security updates for VMware Cloud Foundation at VMware Explore, including zero-trust lateral protection and post-quantum encryption tailored for SEPP message flows. These enhancements secure MCP traffic in AI-driven 5G interconnects, adding WAF rules and session persistence to block new attack surfaces. Broadcom’s push here helps operators handle generative AI without compromising roaming integrity.

- In October 2025, Analog Devices, Inc. rolled out secure authentication ICs at SPS with built-in encryption and secure boot features. These chips lock down industrial edge devices from cyber threats right at the hardware level. Factories and grids need this to protect data flows, much like SEPP guards 5G roaming. ADI’s U.S. roots help lead the charge in tamper-proof interconnect tech.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 16.8 Bn CAGR(2025-2034) 23.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Hardware, Services), By Deployment Mode (On-Premises, Cloud), By Application (Telecommunications, IT and Network Security, Financial Services, Government, Others), By Organization Size (Small and Medium Enterprises, Large Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Infineon Technologies AG, NXP Semiconductors, STMicroelectronics, Samsung Electronics, Texas Instruments, Renesas Electronics Corporation, Broadcom Inc., Microchip Technology Inc., Cypress Semiconductor (Infineon), Analog Devices, Inc., Maxim Integrated (Analog Devices), ON Semiconductor, Qualcomm Incorporated, Intel Corporation, Marvell Technology Group, Lattice Semiconductor, IDEMIA, Gemalto (Thales Group), Giesecke+Devrient, Sony Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  SEPP Interconnect Security MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

SEPP Interconnect Security MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Infineon Technologies AG

- NXP Semiconductors

- STMicroelectronics

- Samsung Electronics

- Texas Instruments

- Renesas Electronics Corporation

- Broadcom Inc.

- Microchip Technology Inc.

- Cypress Semiconductor (Infineon)

- Analog Devices, Inc.

- Maxim Integrated (Analog Devices)

- ON Semiconductor

- Qualcomm Incorporated

- Intel Corporation

- Marvell Technology Group

- Lattice Semiconductor

- IDEMIA

- Gemalto (Thales Group)

- Giesecke+Devrient

- Sony Corporation

- Others